Good afternoon, dear readers! At one of my Forex seminars, I asked the audience whether they believed in omens. Most of the audience was skeptical and convinced me that modern people do not believe in such nonsense. It is no coincidence that I started this article this way.

Today I will prove to you that without knowing certain signs a trader cannot be successful. Their essence combines Forex technical analysis, and today I will tell you what it is and why it is so important for traders. We will analyze the basic tools of technical analysis and learn how to use them in practice.

What is technical analysis and why is it needed?

One of the features of the Forex currency market is the ability to always make money on it, regardless of changes in currency quotes. The most important thing for us is to understand where the price is moving and make the appropriate transaction - buy or sell. Technical analysis is a tool for analyzing price movements on Forex.

This analysis is based on the principle that, under certain conditions, price movements naturally repeat. Knowledge of such patterns will allow you to predict the direction of the price chart in the future without analyzing the reasons that led to this.

Brief history of appearance

Technical analysis is a relatively young science.

But traders have been trying to predict how the price will behave throughout the existence of exchange trading, i.e. several centuries. There are two schools of technical analysis: Western - it originated in the 19th century. in the USA and ancient Japanese, which arose as a result of observations of the rice trade. Both are reflected in Forex, and they have a lot in common. Hurry up to take advantage of the doubling of the tax deduction until December 31, 2022.

The main postulates of technical analysis were defined in the 19th century. American journalist Charles Dow. In Wall Street magazine, he published assumptions that he believed were operating in the market. According to them, forecasting is based on an analysis of changes in indices associated with stock prices.

At that time, his position had not yet been formed into a clear theory, but this did not stop traders from using it and trading on the basis of these assumptions to this day. The Dow Theory is just the beginning of technical analysis. There are many other equally important things in it.

What does TA study?

All technical analysis comes down to answering the question when to buy and when to sell on Forex. To do this, just look at the chart. The arsenal of technical analysis includes tools such as lines, levels, channels, volumes, indicators, patterns and much more. When used skillfully, they can be used to make a fairly accurate forecast of price movements on Forex.

Does technical analysis work or not?

This question worries all traders. Some have become ardent fans of technical analysis and rely exclusively on its methods in their work, while others, on the contrary, deny it. The fact is that to answer it it is important to understand how technical analysis works. It is based on quote information. Correct interpretation of this information will make it possible to predict their movement on Forex with a high degree of probability.

Price is the result of the expectations of all Forex traders. If it grows, they open purchase transactions, thereby provoking its further growth, or a bullish trend. If it falls, then bears prevail in Forex and the downward trend continues. Those. in similar circumstances, people almost always behave the same way. This can be repeated, but not with 100% accuracy. This pattern underlies technical analysis.

Confidence

Forex has given rise to a large number of communities, scammers, people posing as successful traders, but who are not. There is a lot of embellished advertising and custom-made flattering reviews of brokerage firms. Often, even an experienced trader can get confused about what is true and what is not.

There are rules to reduce the consequences of an error:

- The first time after coming to Forex, do not subscribe to any paid courses or send signals, do not buy advisors. Gain experience so you don't blindly rush into advertising.

- "Do not make yourself an idol". On forums you often meet people who give out a ton of advice on trading, but do not know how to trade profitably.

- Start with a demo account. Or with a real one, but with an amount that you won’t be afraid to lose.

- Do not rush to give large sums of money to the trading robot. Test it first on a real account with some money. The robot behaves differently on a real account than on a demo account and in the strategy tester.

An important addition: if one person says that a certain strategy does not work and only brings losses, and the second one claims that he has been trading it profitably for a long time, this does not necessarily mean that one of them is lying. They can both tell the truth. This is often observed in Forex: even with strict adherence to the rules, people interpret signal readings differently, which leads to different results. Even dispassionate two equally configured advisors can give different results if, for example, they trade with different brokers or were launched at different times.

Why is TA so popular among traders?

Technical analysis has been used in trading for hundreds of years. During this time, he proved his effectiveness. Its effectiveness is not one hundred percent, but it is regularly updated with new methods and tools. The ability to use them correctly has enriched millions of people working in Forex and beyond.

Advantages and disadvantages

Technical analysis cannot be called a universal method. Like anything else, it has its pros and cons.

Advantages:

- Technical analysis is suitable for any market, especially foreign exchange. It is very popular in Forex.

- Using technical analysis, you can work on any timeframe.

- Mastering technical analysis does not require special knowledge and is accessible even to beginners.

Flaws:

- Technical analysis is based on probability, not an exact forecast, so there is a risk of statistical errors.

- Subjectivity of assessment: two traders, when analyzing the same chart technically, can draw different conclusions.

Risks when working on Forex

The daily volume of transactions on the foreign exchange exchange exceeds $5 trillion. These are huge funds. Many people are looking for ways to make money on Forex. This is possible, but the risk of losing your investment is very high.

This is due to:

- Availability of DCs practicing internal clearing.

- Lack of knowledge and experience.

- An imperfect trading strategy.

- Inability to manage capital and a number of other reasons.

The peculiarities of the Forex market exclude the possibility of stable earnings without a systematic approach to trading.

Temporary successes of beginners, as a rule, remain temporary. Knowing the risks and controlling them allows you to achieve success in trading.

Basic principles of TA

The main idea of technical analysis is cyclicality and repetition. Look at the chart of any currency pair on Forex, and you will see that price fluctuations are repeated at certain intervals and after similar events. Let us examine the three main principles of technical analysis, on which its entire philosophy is built.

The price takes everything into account

The price (market) is influenced by various factors. This includes the political situation in the world, the economy, and even the psychological mood of traders. All these factors are a priori taken into account by the price, so they are no longer needed to assess its movement. She herself will give us all the necessary information to assess her movement.

Prices move by trends

The movement of quotes goes in a strict direction, which is called a trend. There are only 3 such trends in Forex: upward (bullish), downward (bearish) and sideways. Quotes are not characterized by chaotic fluctuations - if the price moves in a certain direction, then significant events must occur for it to change.

History always repeats itself

The situation on the Forex market is constantly changing, unlike the laws of physics, economics and psychology. These laws will always apply, which means history will always repeat itself.

Cluster analysis of the Forex market – volumes indicating the activity of players

The foreign exchange market is dynamic and volatile. The effectiveness of certain approaches to forecasting price trends is declining, forcing analysts to look for new patterns.

Relatively recently, in 2004, graphical analysis of the Forex market was supplemented with another tool. Traders now have access to information about volume accumulations, which, in turn, form price levels.

This made it possible to take into account the real volumes of current transactions and see those traded in the past.

Special computer programs were created that make it possible to observe how trading volumes are formed inside bars and evaluate the activity of players in certain places at a given time.

Forex cluster analysis (a new approach) made it possible to more objectively assess the market situation. Since all other TA methods are based on the market price, their effectiveness is approximately the same.

They always speak about the current moment, while volumes allow you to predict with a greater degree of confidence future price movements relative to the current moment and strong key points where volume has accumulated.

A horizontal histogram (market profile) is a powerful tool for analyzing the market situation and its development. An indicator of the strength of levels and an interesting tool for large players. Absolutely indispensable for a trader.

The market profile displays the traded volume, allows you to determine the levels of asset accumulation (position acquisition by large players) and the places where the trend begins and where it weakens.

Accurate volumes are assessed using special variations of the market profile display, which make it possible to determine accumulations in chart segments.

Also, such places can be determined using clusters - price bars divided into levels. They display the traded volume at the point through which the bar passes.

Cluster analysis tools have made it possible to create new profitable trading strategies in the Forex market.

Technical analysis methods (graphical and mathematical)

Technical analysis specialists are conventionally divided into two groups: technical analysts and graphicists. The first ones rely on computer technologies and statistical methods in their work. The latter are more interested in the appearance of the graph - based on it they make their forecasts. There is no clear answer as to which technical analysis method is better, so their combination is the key to success for any Forex participant.

Classic graphic technical analysis

Forex quotes move vertically and to the right, taking a standard step each time. Each such step is recorded on the graph by a new point. The essence of classical technical analysis is to draw lines and levels of support and resistance, channels and patterns on a chart, allowing one to predict the situation on Forex. Below we will look at all these tools in more detail.

Japanese candlestick analysis

Candlesticks are a product of the ancient Japanese school of technical analysis. The basis of this analysis is to study the combinations of candles relative to each other. You can highlight individual candles, which by their position and shape will provide a lot of valuable information about the direction of the trend in Forex.

Indicator analysis

The essence of this method is to add indicators and oscillators to the chart, showing the direction of the main trend in Forex. They can confirm it or signal a change in trend direction.

Elliott wave analysis

Elliott wave theory is widely used in technical analysis. According to it, price fluctuations on Forex resemble the ebb and flow of the sea. The main trend goes through 3 phases:

- The accumulation phase, when the most informed participants in the Forex market engage in trading.

- Continuation phase – other astute investors enter the game.

- The fading phase, in which the “crowd” comes to the market and large investors begin to take profits.

In these phases there are 5 waves, each of which consists of three more sub-waves. This is a shorthand representation of Elliott's theory. To get acquainted with its positions and properties of each wave, you will need a separate article.

Volume Analysis

This summary method is widely popular. It is easy to use and reliable. Volumes indicate the number of transactions concluded on Forex. An increase or decrease in price on the chart is always accompanied by an increase or decrease in trading volumes. Moreover, volumes often outpace prices. For example, if the chart is moving up, but trading volumes have fallen, this is a clear signal from technical analysis to conclude a sell transaction.

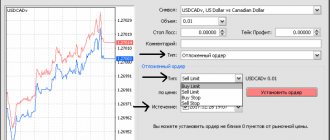

Glass

The order book allows you to track the positions of large Forex investors that influence changes in quotes. This technical analysis tool can be found on every Forex trading platform. It is a table that displays orders from all participants in the foreign exchange market. The method allows you to identify the largest contracts and open positions according to them.

Forex market volatility and its impact on the effectiveness of trading strategies

Trading currency pairs has a number of features. The Forex market is volatile and this requires a constant search for new patterns and analytical tools.

The deeper the understanding of the processes taking place on the stock exchange, the higher the likelihood of making a profit. Therefore, trading involves constant learning and searching for new approaches to trading.

Each of the existing analytical tools is honed over years of work by specialists and acquires many subtleties.

Understanding them allows you to create successful trading strategies, but on Forex they cannot bring profit constantly.

The currency exchange operates 24 hours a day. East trading zones are active at the beginning of the day. When Europe joins in, market activity increases, and when the East falls asleep, America takes over the baton.

Availability makes the market difficult to predict. Only knowledge of all the nuances of the functioning of the exchange makes it possible to make money on Forex.

Do you want to successfully trade in financial markets? Click on the button