Passive income is always appropriate: most Russians add it to their salary in order to live a better and brighter life, or save it for a rainy day. And if the additional income is significant, you can quit your job altogether - this is what successful investors do over time. But how can you organize extra budget revenues? In this article, Bankiros.ru tells you where to invest money to receive monthly income.

Brokerage account

Open an account

The main rules for a profitable investment

To receive income from investing capital, follow several rules:

- Don't invest with borrowed funds.

- Invest only free money . Do not use amounts intended to pay for utilities, treatment, education, or current expenses for maintaining a family for investment.

- The profitability of the proposal is half the success; carefully study the obvious and hidden risks of the chosen investment scheme. Do not get involved in programs that offer significantly more than others similar to it on the market. In such situations, the probability of losing everything is much greater than receiving the promised income.

- Diversify your investment portfolio . In simple words, this means - distribute your own capital into programs of different profitability and risks. Allocate a certain amount of money to high-yield instruments and strategies, and another to less low-risk investments. This approach, in the event of failure of one of the directions, will allow you to save the remaining funds, and not lose everything at once.

The main conditions by which each investment strategy is assessed:

- profitability;

- minimum amount to start investing;

- risk;

- payback period of the investment.

To create your own profitable investment plan for investing your money, diversify your portfolio. We will consider the TOP 10 profitable options for investing money with monthly or future income in 2022 below.

Savings accounts

At their core, savings accounts are very similar to deposits, but they provide savers with a number of advantages. The investor can replenish such an account at any time or withdraw the required amount of money. The initial capital for the deposit is minimal. It could be only a few hundred rubles.

The disadvantage of savings accounts is that they have a lower rate of return than deposits. The sole purpose of savings accounts is to accumulate capital with the potential to earn a little extra income. This approach is suitable for the most conservative investors.

Bank deposits

The most famous way of passive income is a bank deposit. Read about how this works and which option to choose in a separate article. But let’s repeat a reminder about what to pay attention to:

- The deposit amount in one bank that participates in the insurance system is no more than 1.4 million rubles. If there is more money, then it is better to distribute it among several banks. Check the information about the participation of the company with which you will be making a deposit in advance on the SSV website.

- Study additional terms and conditions for deposits. Is there a preferential option for early termination of the contract, the ability to replenish or partially withdraw money?

- A bank deposit is a democratic investment option. You can start with 1000 rubles.

- Most banks offer the opportunity to make a deposit online in your personal account without additional visits to the office, which increases their popularity.

The most significant disadvantage of the deposit is the low interest rates of 5-7% per annum, that is, about 0.5% per month. From a deposit of 100,000 rubles at 6% per annum with monthly interest withdrawals, you will receive 500 rubles per month. Rates on foreign currency deposits are even lower, so they may not be profitable for investing.

This option is suitable if:

- Minimum risk is the main goal. Make a deposit in a large bank, the likelihood of license revocation is minimal. For example, Sberbank, Tinkoff, Alfa-Bank, Gazprombank, other leaders or systemically important banks of the Russian Federation.

- The company is pursuing an adequate policy taking into account the key rate of the Central Bank of the Russian Federation. That is, the bank does not increase the rate compared to the key rate, but also does not lower the interest rate below the market average.

- The main goal is not so much to increase funds as to preserve them and protect them from inflation.

For those who like to count and manage a budget rationally, another scheme will be interesting. It is somewhat similar to a traditional deposit, but it is a different banking product. We are talking about savings accounts or debit cards with a high interest rate on the balance in the account. Such bank programs can be much more profitable than deposits, but at the same time the money is up to 1.4 million rubles. are also protected by the insurance system.

Sushi Master franchise business - invest money profitably

Owning your own business from scratch is a rather risky undertaking. This requires solid start-up capital, an original idea and well-thought-out business technology. But there is an alternative option - to use a ready-made commercial model with a predetermined payback period and guaranteed profitability.

The chain of Japanese cuisine restaurants Sushi Master has its representative offices in Russia, China, Ukraine, Lithuania, Hungary, Kazakhstan and other countries. The main share of business comes from the Russian market.

Franchising is one of the leading activities of the Sushi Master company. The company's promoted product is a predictable business with a proven and effective structure.

The owners transfer the finished model to their partners, the latter can only comply with the established standards with the partners, the latter can only comply with the established standards in cooking and marketing, and also maintain the appropriate level of service.

Franchise payback period: 5-18 months depending on the region of location, the chosen format and other objective factors.

The algorithm for opening a Sushi Master franchise branch is as follows:

- Submit an application on the official website of the company.

- You pay a lump sum fee - at the time of writing this amount is equal to 400,000 rubles.

- Take a training course at a training center in Krasnodar.

- You receive the right to open a point under the SUSHI MASTER brand, an official contract, production technologies, original recipes.

- Together with the franchise owners, you choose a location for the restaurant, calculate the return on investment, and receive the support of the start-up team.

- You open a restaurant.

- Together with your team, bring the project to a stable profit.

You and your team will calculate the total starting investment individually. Cost range: from 1.3 to 4.5 million rubles. The opening period of the restaurant is from 3 months.

The advantage of this model is that it is guaranteed to work. All possible problems and obstacles that may arise at the launch stage have a proven elimination algorithm. You do not work alone, but become a participant in a successful business, which has already paid off more than 100 times, brought and is still bringing profit to its owners.

Co-owner of the company Alex Yanovsky is the founder of his own School “Business Behind Glass”, a successful entrepreneur whom I know personally. I have not the slightest doubt about his honesty, as well as about the profitability of the franchise.

The risks are minimal, and the support of the training center under the leadership of Alex Yanovsky is continuous and constant. At your disposal is the experience of successful businessmen, professional equipment, and proven marketing technologies.

The market niche that you will occupy is now on the rise: there is an outflow of visitors from expensive restaurants to cheaper ones. Catering establishments in street format or “island” format are in demand and popular - these are the options we offer to our partners.

Real estate

Real estate as an investment object is a popular and sought-after method. An undeniable plus is that the apartment or house is the property of the investor; it can be rented out or sold at any time.

| Advantages | Flaws |

| High liquidity of real estate. Despite periods of recession, housing is always in demand, especially in large cities. | Large costs at the first stage. If the living space was not inherited or given as a gift, you will need to buy it first. |

| There is minimal risk if you work through a real estate agency and conduct a preliminary legal check of the property. | You will still have to study the basic rules of supply, demand, periods of market decline and growth. Otherwise, you can get burned big time. |

| No special skills are required to manage such an asset. | When renting out your home, you will have to monitor the condition of the property and carry out repairs yourself. If there are a lot of rental properties, then this turns into work, which requires a lot of effort and ceases to be passive income. |

Real estate investment options:

- Purchase of old living space, renovation and sale . Suitable for megacities and large cities. Allows you to earn from 20 to 35% per annual turnover.

- Purchasing an apartment in a multi-storey building at the excavation stage , with subsequent sale after completion of construction. Allows you to get from 100 to 250% profit, investment period from 4 to 7 years. In addition, there is a risk of construction being suspended, the developer going bankrupt, or the project turning into a long-term construction project.

- Purchasing housing for the purpose of renting it out . Allows you to receive passive income of 6-10% per year for a long time. If you independently search for tenants and carry out repairs after a change of tenants, then this type of investment can become time-consuming.

- Building a house for sale or rent is the most difficult type of investment in this area. You need knowledge in several areas or the involvement of experts - to select a site, connect communications, and prepare documents. When building near a metropolis, you can get up to 100-200% profit. Investment period is at least 3-5 years. The risks are similar to the second option.

A stable monthly income will only come from renting an apartment or house; other options are not suitable.

Where is the best place to invest money in 2022?

The only sure option for this year is real estate. But before investing, it’s worth taking a good look at those cities and countries where it has seriously fallen in price due to the pandemic, but before that there were no sharp fluctuations in value for 50 years.

This is complex analytical work that is carried out by real estate and investment specialists. You can also obtain such data yourself, but there is a possibility of making a mistake. Therefore, for advice, you should contact an expert who specializes in real estate in a particular country or region.

When choosing an investment object, countries and cities where prices have fallen more are especially attractive. But if there have been crisis periods there before, when prices rolled down, you should not focus on such an unstable market. An investor will not be able to enter it as a safe haven and gain confidence in preserving and increasing his own funds.

Automobile

To obtain monthly passive income, not only housing, which is in great demand among tenants, is suitable, but also a car. Personal cars are actively donated to the following services:

- Taxi;

- delivery;

- carsharing - a service for providing cars with per-minute payment in a geographical accessibility area;

- cargo transportation, if you have a suitable type of transport.

This type is suitable for owners of several cars that are not used or were purchased for rental. The disadvantage is that considerable funds are required for the initial purchase of vehicles. In addition, when renting, in some cases it is difficult to verify the tenant, especially if there is no formal contract. Another disadvantage is that the car wears out and loses its original value, and it also needs to be regularly repaired and maintained.

Is it possible to invest if you have little money?

Let's say you have 30, 20 or even 10 thousand free and you want to invest it profitably.

A logical question arises: where and whether this can be done at all. Not all investment options are available with such amounts. For example, it is obvious that investing in real estate and renting it out will not work. However, this does not mean that you should say goodbye to the idea. Such amounts are called micro-investments or nano-investments. The attitude of financial institutions towards them is extremely skeptical. And in vain, because often the path of great investors begins with such amounts.

Igor Fainman

Financial Consultant

If you invest 10 thousand and stop there, you are unlikely to get rich. But if this is just the beginning of building your investment portfolio, there is definitely a chance for success.

Stocks, bonds and currencies

Investing money to generate income from securities is carried out according to two schemes:

- Individual investment account (IIA). You can conduct transactions with assets yourself or entrust this to a Management Company (MC), which will handle all operations on the stock exchanges on your behalf.

- Trading on the stock exchange . In this case, your profit is based on the difference in price between the purchase and sale of the asset.

Bonds

The most stable and low-risk way to invest capital in this investment option is bonds from the state or large corporations. Reliability is high, like that of a bank deposit, but the profit is higher - up to 9-15% per annum. If you find more “profitable” offers of 18-25%, then you should not give in to temptation, most likely there is a high proportion of hidden risk. Know that when you apply for and return a tax deduction of 13% and work with IIS for longer than 3 years, you will automatically increase the profitability of investing in IIS.

Investments in bonds are suitable even with a small amount of free money, because the entry threshold is 10,000 rubles and above. Even with a small initial capital, you can begin to master trading in the stock markets. In addition, this is the most secure and safe option that beginners should start with.

To receive monthly stable income, buy several different types of bonds with different payment periods, then the flow will be continuous. For example, on government bonds, income is received once every six months. For a number of corporate bonds - once a quarter or month.

Coupons, or in other words, income on bonds are paid once a year, half a year, quarterly or monthly. If you need income every month, carefully draw up an investment strategy before you start investing

Promotions and participation in trading

Company shares are a riskier investment option for the inexperienced trader than bonds. At the initial stage, only shares of well-known Russian brands are suitable. To invest in international assets like Apple, you will need to obtain financier status and open an account with a balance of at least 6 million rubles.

However, you can earn from 6 to 10% on dividend shares, if, for example, judging by the payments of such companies as Surgutneft, M-video or MTS. In addition, if the company's profits grow, so do your dividends. Although in the short term the price of shares can fall by two or three times. It will be difficult for an inexperienced investor to understand at the initial stage when to make a transaction and not panic during any market fluctuations.

The main disadvantage of this type of investment is the lack of stability in income. The highest dividend payments from companies occur in the second quarter. And the payment period is not monthly, but once every six months. In addition, market instability can lead to a sharp drop in stock prices, which will lead to an untimely sale of the asset and a resulting loss on the investment. It is better to consider stocks as a long-term investment option aimed at long-term profits. Securities of large and simultaneously growing companies are suitable for this.

trading on the stock exchange is accessible to everyone, successful investing here will also require special knowledge. Most brokers offer novice investors paid or free training. To enter the market you will need to open a brokerage account. The minimum amount for entry is 500 rubles. But to get a tangible profit, you will need to put into circulation at least 100 thousand rubles. This is a riskier way to make money on your own capital, but also with greater profit.

The expected return in this sector is 25-50% per annum. Even if you follow a conservative strategy, you can get up to 30% profit. But it is important to undergo training, make decisions without emotions and based on sober calculations.

Trust management

In investing, risk and return are related. The higher the profit, the riskier your investment. Returns on stocks and bonds are not guaranteed. Investments are not insured by DIA.

If you don't want to think through strategies yourself and analyze the stock market, pay attention to transferring money to trust management. In Russia it is:

- Mutual investment funds - we will talk about them in more detail below.

- Individual investment account (IIA) with trust management. The management company (MC) invites the investor to open an account and choose one of the ready-made strategies. The management company itself manages funds in IIS within the framework of a specific strategy. This option has the advantage of tax benefits.

Investments in mutual funds

A fairly common method of investing, which has been gaining particular popularity in Russia over the last 3 years. The main advantage is that you can completely entrust management and not waste time and effort on studying the principles of operation of stock exchanges. Investment objects are the assets listed in the previous paragraph - stocks, bonds, securities, as well as real estate and precious metals. But the strategy and placement are handled by the Management Company (MC), which buys mutual investment funds on your behalf - mutual funds.

There are several types of mutual funds available:

- venture;

- mortgage;

- rental and others.

Most often, mutual funds are ready-made diversified portfolios with different percentages of profitability and share of risk. At the same time, it is recommended to invest in stock mutual funds for at least 3 years, and in bond mutual funds for at least a year. The initial investment amount is from 1,000 to 15,000 rubles. Increase in asset value by 15-40% of the amount. The main risk is that the management company may also operate at a loss, so in the end the share will cost less than at the investment stage. But compared to independent trading on the stock exchange without knowledge and experience, this risk is several times less.

You can receive monthly income only if you invest simultaneously in several different mutual funds with different payout dates.

Precious metals

Another common way to invest money is to buy precious metals. These include palladium, platinum, gold and silver. Choose this method of investing if you want to make a profit in the future.

Investments in precious metals are long-term. It is also important to note that if you have owned precious metals for less than 3 years and sell them, the gain will be taxable. If the assets are owned for more than three years, there is no need to declare profits and pay personal income tax.

You can also open an impersonal metal account. In this case, there is no need to buy precious metals. The investor deposits a certain amount into the account. It is converted to grams. You are not trading precious metals, so you are not required to pay income taxes. The profitability of investments is directly related to the increase in the cost of precious metals.

Investments in precious metals and jewelry

Investments in precious metals and jewelry are considered promising investments, but not on a short-term basis. It is not possible to get a high monthly income in this sector.

| Advantages | Flaws |

| You can invest in metals in different ways - bars, coins, an impersonal metal account (UMA) and even ready-made jewelry. | Access to passive savings is provided only by compulsory medical insurance, in other options there is a permanent income. There will be profit, but only in the delayed future. |

| All investment options in precious metals, except compulsory medical insurance, allow you to obtain a certain part of the metal for personal ownership. | All transactions with precious metals should be carried out only through banks and trusted exchanges, otherwise there is a risk of contacting scammers. |

| Reserves of precious metals in the bowels of the earth are depleting, which means that their prices will certainly rise. | Without carefully studying the market and drawing up a strategy, it is difficult to make a lot of money on precious metals. |

Investing in gold, silver or platinum is not very effective for making quick money. Also investing in jewelry. For them to increase in price, you will need to initially buy an expensive vintage item, which will become even more expensive over the years. Therefore, the strategy is suitable for diversification in favor of heirs rather than oneself.

An area close to precious metals is investing in art objects. Be careful when making this investment. Here it is very easy to become a victim of scammers and be left without money, but with “exclusive” rubbish. Only experts and very rich people who are not afraid of losing money for the sake of aesthetic tastes and the illusory prospect of an increase in the price of a masterpiece can invest in this segment. This option is not suitable for monthly income.

Where to invest for a novice investor

To answer this question, it is important to estimate your net worth. If you have 1000 euros on hand, you shouldn’t invest, it doesn’t make sense. You need to save the amount, and think about investing when you have at least 100 thousand euros in your hands.

“If you don’t own a home, that’s what you need to buy first,” notes Anna Stukkert. - But only liquid, which is easily sold. If you have housing, you can split your portfolio: invest 10% in Bitcoin, the stock market and give it a try.”

A beginner cannot handle this job alone. Here we need mentors, guides who will tell you what right steps to take. But it is impossible to give general recommendations on investments: despite the presence of hundreds of books on investing and accessible educational programs, including from leading Russian banks, such recommendations simply do not exist.

“Be prepared to lose this money,” the expert continues. — In the world of stocks, cryptocurrencies and the like, there are no guarantees. There is a chance of not losing, there is a chance of earning. But precisely because of the high risks, no more than 10% of your own funds should be invested in this type of investment.”

The remainder needs to be distributed. For example, to obtain a profitable loan in your country. The expert calls a loan with a rate of no more than 6% per annum profitable, and ideally 1-2%. If the rate is above 6%, it is not worth taking a loan; it is a priori unprofitable.

Part can be invested in gold, part in a proven business franchise. But buying stocks during a pandemic is risky. The exception is the titans of the market, for example, online retailers and large online stores, which are still on top today.

pixabay.com/Gerd Altmann

Investing in microfinance organizations

Investing in microfinance organizations was discussed in detail in another material from the Brobank service. It describes in detail the scheme and methods for implementing a profitable investment of a large amount of money. But let us repeat the main points, limitations, as well as the pros and cons of this type of passive income:

| Advantages | Flaws |

| High interest rates on investments ranging from 12 to 25%. The rate depends on the term and individual conditions of the MFO. | Invested funds are not insured, so if an MFO goes bankrupt, it is difficult for the investor to return the investment without going to court. |

| The ability to independently choose how long to invest and how often to receive interest. You can choose a monthly payment, semi-annually, annually, with or without interest capitalization. | If the terms of the contract do not stipulate the conditions for early termination, then the microfinance organizations will not release the funds before the end of the term. Or they will only return the amount that exceeds the amount of 1.5 million rubles. |

| An absolutely passive type of income that does not require investor participation. | High entry threshold - from 1.5 million rubles for one individual. |

| The ability to choose a short-term investment program and withdraw all your money after the end of the term. | The risk of investing money in an unreliable microloan company. But this can be easily avoided if you carefully study the information on how to check microfinance organizations and identify those whose licenses have been revoked. |

In addition, income received from investing in microfinance organizations is subject to taxation. If the microloan company does not automatically send 13% when paying interest, then you will need to independently submit a declaration to the Federal Tax Service and pay personal income tax.

This option is suitable if:

- the amount of free money is more than 1.5 million rubles;

- passive income without the participation of the investor is the main goal;

- there is no time or desire to study a lot of additional information on risks and asset management.

To minimize risks, invest in well-known MFCs, such as MoneyMen, Zaimer, MigCredit or Bystrodengi, which have been operating in the market for a long time and have a strong position. But in any case, study the current situation in the company before investing: rating, news in the media and the validity period of the Bank of Russia license.

Top 10 options for investing small amounts

I have made a selection of 10 ways in which you can invest small amounts in Russia so that they work and generate income. All that remains is to decide on the size of this small amount. Statistics for July 2022 suggested that the average salary in Russia was 50.145 thousand rubles. Naturally, not all of this money can be used for investment. But about 10% is quite enough, i.e. approximately 5 thousand rubles.

However, the average hospital temperature does not reflect the real picture in the country. In Moscow it is 98.93 thousand rubles, in the Ivanovo region - 27.981 thousand rubles. Someone might argue that a monthly investment of 1 thousand rubles will not allow you to create substantial capital. And I will agree or refute if I know the purpose of the accumulation.

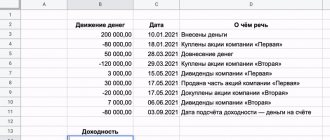

Let's look at the numbers to see what we can accumulate in 20, 30 and 40 years if we invest 1,000 and 10,000 rubles in investments every month. Let's take a conservative rate, which is easy to get, for example, on the stock exchange - 10% per annum. I used a standard investment compound interest calculator:

| Monthly investment amount | Investment term | ||

| 20 years | 30 years | 40 years | |

| 1 000 ₽ | 725 528,74 ₽ | 2 081 849,39 ₽ | 5 599 795,83 ₽ |

| 10 000 ₽ | 7 255 287,44 ₽ | 20 818 493,87 ₽ | 55 997 958,29 ₽ |

Play with your numbers. Some will have a larger initial or monthly amount, others will consider a shorter or longer term, etc.

In the first 5–7 years, the increase will seem insignificant. But then the snowball begins to grow at an impressive rate. The main thing is not to change your strategy and regularly top up your account. Compound interest will do the rest for you.

Complete information about current strategies that have already brought millions of passive income to investors

The amount of income received largely depends on the choice of investment instrument. Let's consider where it is better to invest your money to make money. Some methods are quite risky, others are low-income, and others allow you to maintain a balance between risk and profitability. The choice is yours.

Education

Education is the only tool that I can recommend not only to a novice investor, but to any person. Investing in your development is one of the most profitable and risk-free investments.

But education is different. I can say this as an expert, because I have been teaching at the university for 20 years. Students are divided into 3 categories:

- Those who have made a conscious choice of direction and try to get the most from their studies and teachers. Such people quickly find work after graduating from a technical school or university, and grow not only on the career ladder, but also in income.

- Those who were guided by their parents, making a choice for them. They rarely attend classes, studying “for show” or to reassure their relatives. They rarely work in their specialty. And if they work, they hate their job.

- Those who already work in their favorite specialty, but for further growth they need an education diploma. Moreover, such a student may be more experienced and theoretically more knowledgeable than the teacher. Therefore, it is not easy to interest him in studying. My advice is not to interfere. Let him receive his diploma and achieve his goals.

This concerns education, which will be your source of active income. But successful investing to generate passive income will require special knowledge. Their sources can be:

- books on financial literacy and investing;

- paid and free courses to improve financial literacy;

- investment courses.

You need to take the choice of courses very seriously. Behind beautiful promises of quick earnings of 100% per month, scammers or organizers of financial pyramids often hide.

More than 100 cool lessons, tests and exercises for brain development

Start developing

It is difficult to estimate in rubles or percentage the profitability that you will receive from investing in self-education. But it definitely exists. Some, after gaining new knowledge, radically change their lives. In any case, this is always a new, higher step on the ladder to financial independence.

2. Deposits

Deposits are one of the most favorite instruments of Russians. But not a single practicing investor would call the process of storing money in a bank an investment. Look at the statistics of the Central Bank of the Russian Federation at the end of September 2022 - the maximum interest rate on deposits in the country's 10 largest banks was 4.396%.

With such numbers, you can only count on capital preservation. We are not talking about any profitability. Why then, according to the Central Bank, as of September 1, 2020, are 32.437 trillion rubles stored on the deposits of Russians? I see the reason in one thing – low financial literacy. People don’t know, and in most cases, don’t want to learn about other savings opportunities.

If you have chosen deposits as a place to store your money, remember the maximum amount for which the state insures deposits is 1.4 million rubles. Perhaps this is the only argument that can be accepted as an explanation for the popularity of banks with their low rates. People are afraid of losing everything, so they want guarantees.

3. Bonds

Bonds are securities, the purchase of which makes you a creditor of the one who issued these securities (the state represented by the Ministry of Finance, regional authorities, commercial enterprises).

Let's compare it to a bank. You go for a loan, the bank gives it to you, but requires you to pay for allowing you to use your money. In this case, you are the borrower. It's the same with bonds. Only the roles change. The issuer of the bonds becomes the borrower. He pays you coupons (interest on the face value of the security) for using your money, and at the end of the security’s validity period he also repays the debt.

In terms of reliability, bonds are often compared to a deposit. But paper is different from paper. If you buy OFZ (federal loan bonds), then the state is the guarantor of money back. The only way you won't get your debt back is if it goes bankrupt. What is possible in our country, but still unlikely. The yield on OFZ is higher than on bank deposits: from 4 to 6.5% per annum.

For municipal and corporate securities, the yield is higher (5–10%), but the risk of bankruptcy is also greater. Therefore, you should take the choice of such bonds seriously in your portfolio. But you must agree that the bankruptcy of Gazprom, Sberbank or Rosseti is unlikely to happen in the coming decades, only if together with the country.

The nominal value of the bonds is 1,000 rubles. But they are sold at a market price, which can be either higher or lower than the nominal price. In any case, you will need a small capital to replenish your portfolio with these securities every month. For example:

- OFZ-26212-PD with a maturity date in January 2028 costs 1,098 rubles, the effective yield to maturity is 5.72%;

- KHMAO-Yugra-35001-ob with a maturity date in December 2023 costs 1,040.5 rubles, the effective yield to maturity is 6.59%;

- Gazprom Neft-003P-02R with a maturity date in December 2029 costs RUB 1,052.2, the effective yield to maturity is 6.62%.

4. Promotions

Shares are securities that make you the owner of part of the business. This means that you can count on the profits this business makes. Investors use different investment strategies:

- Long-term with dividends. The profitability consists of the increase in the value of the security and the dividends received.

- Long-term without dividends. Not all joint stock companies distribute part of their profits to shareholders. In this case, investors only count on the growth in the value of the company's shares in the future.

- Short-term or speculative. Earnings come only due to the growth of quotes (buy cheaper, sell more expensive).

Investing in stocks is not without risk. If you buy a security into your portfolio based solely on its popularity, you risk holding an asset for many years that shows little or no growth in value. You need to select stocks based on at least a basic analysis of the company and the market.

But there is no ceiling on profitability with this method of investing. For example, a Sberbank share at the beginning of 2009 cost approximately 7.5 rubles. Today – 198 ₽. Over 11 years - an increase of 26.4 times. Plus, the company regularly pays high dividends. For 2022, the dividend yield was more than 9%.

Even with 1,000 ₽ you can buy shares monthly. For example:

- NCSP (Novorossiysk Commercial Sea Port) – 836 ₽ per 1 lot (100 shares). Dividend stability index – 0.57. Dividend yield for 2022 is 12.68%.

- LSR Group (the largest construction company in Russia) – 861.8 rubles per 1 lot (1 share). Dividend stability index – 1 (maximum value). Dividend yield for 2022 is 11.01%.

- Severstal – 1011.2 ₽ per 1 lot (1 share). Dividend stability index – 0.5. Dividend yield for 2022 is 11.49%.

- Tatneft (preferred shares) – 436.4 ₽ per 1 lot (1 share). Dividend stability index – 0.57. Dividend yield for 2022 is 9.12%.

- Rostelecom (preferred shares) – 861 RUR per 1 lot (10 shares). Dividend stability index – 0.5. Dividend yield for 2022 is 5.76%.

ETFs and mutual funds

If you don’t want to understand multipliers, read stock market news and generally devote time to analyzing companies, then you can invest money in index funds: ETFs and mutual funds. They are a basket in which shares of many companies are collected. They follow the index. For example, the RTS or S&P 500 index. An investor buys a share of such a basket and becomes the owner of all issuers included in it. To create a fund you will have to pay a commission to the manager.

If you bought all the shares included in the fund yourself, you would not be reading this article. The fact is that the management company includes dozens and hundreds of companies in its basket. An investor would need millions of rubles to replicate the fund structure, and a lot of free time to monitor changes in the index.

Shares of ETFs and mutual funds are inexpensive. Here are just a few examples:

- FXRU (index fund of corporate Russian bonds, which includes Eurobonds of Gazprom, Rosneft, Norilsk Nickel and other largest Russian companies) - 970 rubles per share. Profitability for 3 years – 47.33%.

- VTBH (exchange-traded mutual fund from VTB, includes US corporate bonds) – 805.33 rubles. The average annual return in dollars is 5.4%. You can buy it for rubles.

- FXGD for those who want to invest in gold – 1,004 RUR. Profitability for 3 years – 83.49%.

Another instrument, very similar to the previous one, is a mutual fund. It differs in that it is not traded on the stock exchange, does not follow the index and is formed at the discretion of the manager. Buyers of mutual fund shares will pay significantly more commissions compared to owners of index funds. The cost of a share can be significantly less than 1,000 rubles.

The top 5 mutual funds for September 2022 look like this:

Precious metals

Investments in precious metals have always played a protective role. The cost of gold, silver, platinum and palladium is growing slowly (the exception is 2022, because in a crisis people try to buy what has been valuable for thousands of years), but in the long run the investor will always be in the black. For a period of less than 20 years, such an asset is not even worth considering.

Options for investing small amounts:

- Ingots. You can buy from 1 g. For example, the selling price of a gold bar weighing 1 g is 6,378 ₽, a silver bar weighing 5 g is 4,253 ₽.

- Investment or commemorative coins. The first ones are issued solely for investment purposes and do not have any special historical or artistic value. The second ones are associated with memorable dates. Gold coins are not suitable for small investments. But silver ones are fine. There are options from 2,500 ₽. For example, the investment coin “St. George the Victorious” (silver) costs about 2,650 rubles.

- Anonymized metal account (UMA). You will not hold the bullion in your hands, it will remain as an amount in the account. As the price of the precious metal changes, so does your account. Purchase is possible from 0.1 g. For example, at the time of writing, 1 g of gold on the Sberbank website cost 4,566 rubles. When purchasing 0.1 g you will spend only 456.6 RUR.

- ETF or mutual fund for gold. Today there are 3 gold funds: from FinEx, VTB and Tinkoff. The cost of the 1st is 1,004 ₽, the 2nd is $0.016, the 3rd is $0.08.

Crowdlending platforms

Crowdlending platforms are platforms for raising money to finance small and medium-sized businesses and startups. Considered to be a very risky investment. No one will ever be able to tell you which idea will not bring even a ruble of profit, and which will turn into another Google or Amazon.

To reduce risk, it is better to invest in several projects at once. Burn out on one, rise on another. Among the Russian sites the following are known:

- Penenza. The minimum investment amount is RUB 5,000. This is an investment in short-term business loans at a high interest rate.

- The Potok investment platform is a partner of Alfa-Bank. The minimum investment amount is RUB 10,000. Offers to finance small businesses using 3 types of loans: classic, factoring and tender.

- Lemon. Promises to pay a 5% return on invested money even if the borrower defaults. The minimum contribution is RUB 1,000.

It is better to choose from the register of investment platforms compiled by the Central Bank of the Russian Federation.

Cryptocurrency

Investing in cryptocurrency is not for beginners. It is necessary to study the market and all the risks associated with it, a specific asset, choose a strategy and not change it, constantly monitor the situation. It can't be called a cheap way either. For example, the popular Bitcoin costs $11,370 (as of 10/13/2020). But you can buy only part of it or find cheaper cryptocurrency. The top five by capitalization today looks like this:

9. PAMM accounts

Another type of high-risk investment is PAMM accounts. They are based on currency trading in the Forex market. The bottom line is that the investor links his account to the account of the manager, who makes all transactions. Naturally, he takes a rather large percentage of income for this (sometimes up to 50%). There is practically no need for initial capital for this method of investing; it is enough to have $10.

Profitability is measured in percentages per month and can reach several hundred. The risk of losing all invested capital grows in proportion to it. Experts advise investing money not in one, but in 5-10 accounts. On the website of the largest broker Alpari, which provides access to Forex, the rating of PAMM accounts looks like this:

But you cannot select accounts only by rating. You need to carefully study:

- account age;

- trading strategy;

- the amount of the manager's capital;

- the maximum drawdown value;

- number of participants;

- history of the manager on the market (how many accounts he opened, how many he closed).

Internet projects

On the Internet you can not only play or study, but also invest. I don’t mean the online purchase of securities, currency and other assets (although this is also possible), but rather investments in various Internet projects: websites, groups on social networks, applications, games, etc. The main thing is that they bring profit.

Several options are possible:

- Creating your own website/channel and bringing it to monetization. Expensive, time consuming and without any guarantee of success.

- Investments in someone else's website. Profitability will depend entirely on the professionalism of its creator.

- Purchasing sites/groups that have reached monetization for the purpose of their further exploitation and receiving passive income. But to maintain the achieved level, you will also have to work, which may require time and money.

Participation in private lending

If you have a sufficient amount of free money, then you can use it for private lending. In this case, loans are issued and issued online on special exchanges or electronic money systems. For example, this is how lending through WebMoney works. Whether to lend or not - each lender decides independently. Short-term lending from a few days to a couple of months. You can also find offers up to a year, but they are not very popular with either borrowers or lenders. Interest rates from 70 to 100% per annum.

This method is suitable for active users. If you choose this investment method, first study the useful information. For example, about how to identify an unscrupulous borrower, as well as what signs of an account or behavior should be monitored before lending. But even such information and positive experience at the initial stage will not protect against possible risks in each individual lending case.

In most cases, a private lender does not even know the passport details of the person who is lending. Therefore, the main rule works: the higher the profitability, the higher the risk. Think about how much of your savings you are really willing to lose without significant damage to your investment portfolio, and only then lend.

Where to start investing for a beginner

Even if you understand the right direction, investing without any experience or knowledge is risky and difficult. Of course, there are chances to make a profit, but there is a much higher chance of being left without anything at all. Therefore, Anna Stukkert first advises trying to understand the issue, and only then getting out your hard-earned savings. Then investing will feel less like roulette.

“I recommend, at a minimum, reading open sources and the works of investment specialists,” the expert comments. — Unlike educational theorists who teach at economic universities, experts are people who have bought and sold a lot in real life. They don't teach theory, they pass on experience. But I don’t recommend taking paid courses. I signed up for them several times, but did not receive anything valuable. Just general phrases, pure water.”

You can find useful information yourself. Yes, you will have to try: crawl through a lot of sites, read a large number of articles, and not just skim through them, but understand them, delve into them. It is important to gain experience and try to bring different proposals to a deal.

The best way to understand the intricacies of real estate transactions is to try working as an agent yourself. Communicate with sellers and buyers, listen to recommendations and arguments, participate in negotiations and transactions. And even if the deal doesn’t go through, you will still have invaluable practical experience, and you will a priori be head and shoulders above other novice investors.

pixabay.com/geralt

Business investing

Not all businessmen can invest their own money in the business, so they attract investors. In order to become a successful investor of your free capital and not go broke, you will need to simultaneously fulfill two conditions - luck and the ability to choose a startup. If it is difficult to influence the first, then you can try the second. Invest money if:

- the strategy is clear and familiar to the target audience;

- demand for the product has been identified and a viable business model has been developed;

- You have extensive experience in auditing and financial consulting, or you have an expert who has deep knowledge of this area.

In the future, you can achieve passive income and, over time, receive monthly profits from it, but this will not happen immediately. Only if you become an investor in an already operating business, money will arrive regularly after a short period.

The main disadvantage of this method is that only really large investments can provide tangible profits. We are talking about amounts of more than 1-2 million rubles. In addition, it is difficult to objectively assess risks in this area, especially without special knowledge and experience.

You can often hear advice that it is best to invest money in projects of friends or good acquaintances. But the optimism and enthusiasm of a loved one can reduce your objectivity. Excessive emotionality and the desire to help in the implementation of the project will lead to an incorrect assessment of risks and can cause large financial losses.

Formation of an investment portfolio

If an investor decides to invest money on his own, he needs to create an effective investment portfolio. Depending on the level of risk, it can be:

- conservative;

- balanced;

- aggressive.

The main problem of small capital is the need to build a portfolio gradually. The investor's task is to invest money regularly until he creates a portfolio of the right size with the right level of risk and sufficient potential return.

Investments in vending

One of the most attractive, but also costly types of investment at the initial stage is vending. This term refers to any transaction performed by a vending machine on a paid basis - a package of chips, a chocolate bar, coffee or topping up a mobile phone balance. The need for vending machines is constantly growing, and the method is especially beneficial in the financial services industry. You don’t have to deal with financial transactions—accepting payments, transfers—but trade in piece goods.

The project can be either a start-up or an addition to an existing business. There will be passive income only if you only invest in it, as in the previous option. If you engage in vending yourself, there will be additional costs for servicing terminals, purchasing assortment and other related expenses. This type of investment is profitable and brings a stable monthly income, but under one condition that the business works smoothly and efficiently.

A similar example of earning money in one of the developing areas is given to make it clear that there is somewhere to invest, but it is better not to do this without a strategy.

Where you shouldn't invest money so as not to burn out

You should not invest money in obviously losing enterprises - financial pyramids, casinos, illegal and morally unacceptable projects.

These include criminal types of business: trafficking in drugs, weapons, contract goods, the organization of brothels, front companies that launder money, as well as fraudulent schemes in the real estate sector (corruption in construction, eviction of lonely old people and re-registration of housing).

To live in peace, engage in honest and socially acceptable ways of earning money, then you will gain not only financial freedom, but also spiritual harmony.

Summary

The main advice for diversifying an investment portfolio is as follows:

- Focus 50% on conservative strategies - bonds, deposits, individual investment insurance, real estate, compulsory medical insurance;

- Place 30% of your capital in options with an average level of risk - trading, business, stocks, brokerage accounts.

- and allocate no more than 20% of your free capital to strategies with increased risk, but with a return of no higher than 50%; anything higher can be a financial pyramid or fraud.

Whether you follow such recommendations or not is up to you to decide. When investing in high-risk instruments, remember not to invest more than you are willing to lose without harming your other instruments.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Eugene

01/09/2022 at 12:59 You can dial me Evgeniy +7917*

Reply ↓ Olga Pikhotskaya

01/09/2022 at 13:36Evgeniy, good afternoon. You can ask questions of interest in the comments.

Reply ↓

Where to find money for investment

The most common objection from those who do not invest: “I don’t earn that much, I have nowhere to get money from, I live from paycheck to paycheck!” And so on in the same spirit. Let me try to find money for investment for you?

I’ll show you using the example of a friend of mine. Every morning she runs into her favorite coffee shop for a cup of aromatic coffee that costs 220 rubles. I don’t encourage you to give up the little joys of life (everyone has their own). But I propose to set aside exactly the same amount for investments. That is, for a month it will be: 220 * 30 days = 6,600 ₽.

And do this every time you spend money on optional but enjoyable purchases. For example, did you buy a new scarf to match the color of your shoes? Chips for a child? Enrich your investment portfolio.

If you have already read my articles about the family budget, you should know where money for investment can appear. With proper distribution of income and optimization of expenses, you can get at least 1,000 rubles per month. I am 100% sure that everyone has absolutely useless expenses that are easy to refuse.

Any income other than basic income can be allocated to the portfolio. For example, we sold something on Avito, received cashback on the card or an income tax refund.

Determine the percentage that you will allocate to investments from your main income. I assure you, if you can live on 40,000 rubles a month, you can live on 36,000 rubles, and 10% will go into capital. Imagine that you increased the cost of utilities or public transport by 10%. Will you not use the services? Of course you will. Then why are you denying yourself the creation of capital?

If you think that such small amounts are of no use, you are mistaken. First, you will develop the habit of saving money for investments. Secondly, you will get a taste of it when you receive your first coupons or dividends and think about investing on a larger scale. Thirdly, it is easy to learn and make mistakes with small amounts. As long as you change your financial thinking, these pennies will already start working for you.

31.12.2019

5 634

Where to invest a million rubles: available tools, strategies and investment rules

Hello, friends! If you have a question about where to invest a million...