Many of those who are familiar with the concept of cryptocurrency are divided into people who are confident that this “soap bubble” is about to burst or, conversely, who consider digital money as a real opportunity to secure their financial future. If you are reading this article, it means that you have already either heard about cryptocurrency and are trying to understand this issue, or have already somehow come into contact with virtual money and want to choose the most promising one for investment. It is for those who consider cryptocurrency as an alternative opportunity to make a profit that the Big Rating Magazine has compiled a rating of cryptocurrencies based on their prospects at the end of 2022.

The number of cryptocurrencies has long since exceeded eight hundred, but not every one of them is as promising at the moment as, for example, Bitcoin. Therefore, we are primarily interested in the top ten digital currencies, the most popular among exchange players, the most expensive at the moment and having a solid market capitalization. So, we present the most promising cryptocurrencies of 2022 that can become a good source of capital in 2022.

NEM

- Year of creation: 2015

- Symbol: XEM

- Approximate capitalization: $2,186,603,999

The NEM altcoin was developed by the Japanese company NemProject 2 as a fork of Nxt and stands for New Economy Movement. The purpose of creating a crypt is to bring the speed of transactions and the level of security of banking operations to a new level.

What the user should know about NEM:

- it is a peer-to-peer cryptocurrency platform based on Javascript and Java;

- contains an integrated system for exchanging encrypted data;

- uses multi-signature and Eigentrust++ system;

- blockchain technology is complemented by the Proof-of-Importance consent protocol;

- can be purchased for cash, electronic money or exchanged for another crypt;

- transaction speed is 3,000 per second.

NEM has a strong foothold in the Japanese market, but is gradually penetrating cryptocurrency exchanges in other countries. Since January 2022, the cost of one digital coin has increased from 0.3 cents to $1.48. This cryptocurrency attracts mainly experienced traders who focus on the long term.

Latest Cryptocurrencies

It is impossible to say what the newest cryptocurrency of 2022 is called. This is due to the active, continuous emergence of new cyber money. The process of creating virtual money does not stop for a moment, and it is becoming increasingly difficult for potential miners and investors to choose the most profitable investment or mining option. But such selection and fierce competition lead to the fact that most unreliable currencies disappear a short time after their appearance, and the most stable ones undergo instant automatic quality checks.

NEO

- Year of creation: 2014

- Symbol: NEO

- Approximate capitalization: $2,449,843,500

Although the Chinese cryptocurrency NEO joined the market only in 2017, it would be difficult to call it new, since it is a rebranded Antshares digital asset platform. Technical documentation, social media, the official website were updated, and the stock ticker was changed. In addition, the platform has successfully transitioned to the NEO 2.0 smart contract system.

What the user should know about NEO:

- is the Chinese version of Ethereum, but with an improved platform;

- coin owners have a say in blockchain reform;

- allows you to carry out multiple transactions simultaneously;

- operations last on average seconds;

- supports traditional programming language;

The currency is extremely popular in China and Asian countries, and developers are seeking official status for NEO. This will turn digital currency into a full-fledged and legal system for making payments. According to experts, in three years NEO will become an official part of the Chinese economy.

Cryptocurrency and ICO market overview for 2022

Information as of 01/03/2018

Authors of the study:

- Dmitry Kornilov , Doctor of Economics, Academician of the Russian Academy of Natural Sciences, leading analyst at ICOBox

- Dmitry Zaitsev , Candidate of Economic Sciences, Head of the International Public Relations Service and Business Analytics Department at ICOBox

- Nikolay Evdokimov , co-founder of ICOBox company

- Mikhail Raitsin , co-founder of ICOBox company

- Anar Babaev , co-founder of ICOBox company

- Daria Generalova , co-founder of ICOBox company

The study presents data on the dynamics of the cryptocurrency market and the ICO market in 2022.

General analysis of the cryptocurrency and asset market (for the quarter, year). Market dynamics in 2022

1.1. General analysis of the cryptocurrency and asset markets

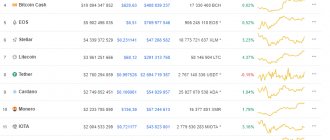

Table 1.1. Quarterly dynamics of the crypto market and the top 10 cryptocurrencies by capitalization from 01/01/2017 to 01/01/2018.

Over the past 2022, the total market capitalization of cryptocurrencies (Total Market Capitalization) increased by almost 600 billion US dollars, from 17.7 to 612.9 billion US dollars, i.e. 34.6 times (as of January 1, 2022 00:00 UTC; see Table 1.1). In Fig. Figure 1 shows the evolution of the crypto market in 2017.

The most intensive growth in the capitalization of the crypto market was in November-December 2022, and on December 21, the capitalization exceeded 650 billion US dollars, followed by a slight correction. The overall increase was mainly due to an increase in the capitalization of Bitcoin by approximately 220 billion US dollars, from 15.5 to 236.7 billion US dollars, in addition, the capitalization of altcoins increased by 374 billion US dollars, from 2.2 to 376.2 billion US dollars. At the same time, the total number of types of cryptocurrencies and cryptoassets on the exchange over the year increased from 617 to 1,335 units (according to coinmarketcap.com), i.e. more than 2 times. Due to the emergence of a large number of competing altcoins, the share of the main cryptocurrency, Bitcoin, on the market decreased quite significantly over the year - from 87.5% to 38.6%. In Fig. Figures 2 and 3 show the structure of the crypto market in terms of capitalization (USDbillion) and dominance (%) at the beginning of 2022 and 2018.

The structure of the crypto market changed rapidly during 2022, although Bitcoin always remained the leader in capitalization. The second, third and fourth places were most often occupied by the main altcoins: Ethereum, Ripple and Bitcoin Cash, which appeared as a result of the Bitcoin hard fork on August 1. Thus, the share of the Ethereum cryptocurrency, which was 3.9% at the beginning of 2022, reached 27.3 by July 1 %, but by the end of the year it dropped to 11.9%, as a result of which the second place in terms of capitalization was taken by Ripple, whose rate has increased significantly in 2022 (Fig. 6).

In turn, the Bitcoin rate in 2022 increased more than 14 times, from $964 to $14,112. In Fig. Figure 4 shows the dynamics of this growth.

In Fig. Figure 4 shows how actively the crypto market responded to the news about the start of trading in Bitcoin futures on the Cboe Global Markets (12/10/2017) and CME Group (12/18/2017) exchanges. Immediately before the start of futures trading on Cboe, the Bitcoin rate exceeded several threshold values at once. In just two weeks (from 11/26 to 12/08/2017) it doubled, from $9,000 to $18,000. However, in the next two days there was a correction, and by the beginning of trading on Cboe (12/10/2017) the rate had decreased up to $13,300 – 15,500.

Similarly, before the start of futures trading on the world’s largest commodity exchange, CME Group, the Bitcoin rate recovered within a week and exceeded $20,000 (12/17/2017), but just a day before the start of trading, by 12/18/2017, a small correction to $18,500-19,000. After the CME Group launched trading in Bitcoin futures, its rate even dropped to $12,000 in four days (December 22, 2017), but gradually recovered and until the end of December, BTC was trading in the range from $12,300 to $16 800.

It can be assumed that immediately before the start of trading in Bitcoin futures (one or two weeks in advance), a sufficiently large amount of cryptocurrency was purchased to ensure that its rate could be adjusted in the future. Obviously, the fact that Bitcoin was recognized as a valuable financial asset and the emergence of futures had a positive impact on the crypto market as a whole and attracted additional attention to this currency, and, consequently, caused additional demand for it.

The above data indicates the high liquidity of the crypto market and the willingness of traders to extract additional profits through short-term changes in rates. At the same time, there are many individual traders and quite a few large institutional players in the crypto market. However, if such players arrive, the economy of the crypto market may undergo significant changes associated with the emergence of new mechanisms for hedging risks (futures contracts), the emergence of high-frequency robots that make transactions in microseconds based on developed trading algorithms, and an increase in the influence of financial funds. As you know, Goldman Sachs, one of the largest financial and investment companies, already helps its clients buy and sell Bitcoin futures contracts. In the future, the number of financial derivatives on the crypto market will increase, which will attract large funds and require the introduction of clearer rules for its regulation.

To analyze trading activity on crypto exchanges in 2022, below is the quarterly dynamics of the rates of cryptocurrencies included in the top 10 by capitalization size (Fig. 5).

In Fig. Figure 5 shows that the fourth quarter of 2022 was the most successful for the crypto market and significantly affected the rates of major cryptocurrencies. The rate of the following cryptocurrencies increased especially noticeably in the period from October 1, 2022 to January 1, 2022:

- Cardano – from $0.022 to $0.72 (more than 32 times)

- Stellar – from $0.0135 to $0.36 (more than 25 times)

- Ripple – from $0.198 to $2.30 (more than 10 times)

In table Table 1.2 presents the results of calculations of the quarterly dynamics of the crypto market and the top 10 cryptocurrencies by capitalization size from 01/01/2017 to 01/01/2018 in percentage. The values in USD from the table are taken as a basis. 1.1.

Table 1.2. Quarterly dynamics of the crypto market and the top 10 cryptocurrencies by capitalization from 01/01/2017 to 01/01/2018 (in%)

Many media outlets have repeatedly called 2022 the year of cryptocurrencies. And, indeed, the growth in the rates of the top 10 cryptocurrencies by capitalization in 2022 was truly record-breaking (see Fig. 6). For example, the Ripple rate increased by 35,160% over the year, from $0.006523 to $2.30, i.e. 352.6 times.

The growth in exchange rates for the fourth quarter of 2022 is presented in Fig. 7.

In table Table 1.3 presents the key events of 2022 that influenced the course of the dominant cryptocurrencies and the crypto market as a whole, indicating the nature and direction of their influence.

Table 1.3. Key events that influenced the crypto market in 2022

In table Table 1.4 presents a list of events, information about which can affect both the rate of individual cryptocurrencies and the market as a whole.

Table 1.4. Events that may affect the rate of cryptocurrencies (cryptomarket) in 2022

General analysis of the ICO market for 2022

2.1. Brief overview of the market (important events in 2017)

- 01/08/2017 – 2016: The Year Blockchain ICOs Disrupted Venture Capital

- 01/24/2017 – Watch Out – The ICOs Are Coming

- 03/01/2017 – CoinDesk Research: Speculation Driving Boom in Blockchain 'ICOs'

- 03/10/2017 – Investment Firm Blockchain Capital is Launching a $10 Million ICO

- 04/16/2017 – Blockchain Capital Raises $10 Million ICO for VC Startup Fund

- 04/25/2017 – ICO Insanity? $300 Million Gnosis Valuation Sparks Market Reaction

- 05/06/2017 – Blockchain Asset Fund TaaS Raises $7.7 Million Through ICO

- 05/18/2017 – Ethereum-Based Aragon Raises $25 Million Under 15 Minutes in Record ICO

- 06/01/2017 – Investors Rush and Crush to Buy $36 Million Ethereum-Based BAT ICO

- 06/29/2017 – Pantera Capital to Raise $100 Million for ICO Fund

- 07/17/2017 – $7 Million Lost in CoinDash ICO Hack

- 07/21/2017 – ICO Mania: $1.2 Billion Raised in 2022, $600 Million in the Last 30 Days

- 08/04/2017 – Before entering the ICO, the startup Filecoin raised $52 million

- 08/22/2017 – Estonia is preparing to hold the world’s first state ICO

- 09/08/2017 – The Filecoin platform set a new record for ICO – $257 million

- 09.27.2017 – Kik completed ICO with $98.8 million in investments

- 10/07/2017 – Vitalik Buterin is Against Many Open-Source Ethereum Scaling Projects Conducting ICOs

- 10/27/2017 – Billionaire Warren Buffett: Bitcoin is a “real bubble”

- 11/17/2017 – Tezos investors made another attempt to return funds through the court

- 11/29/2017 – Tokenized Fund-of-Funds to Raise $100 Million Via ICO

- 12/04/2017 – The SEC accused the organizers of the ICO PlexCoin of fraud

- 12/22/2017 – Belarus legalizes mining and operations with cryptocurrencies

2.2. Integrated indicators of the dynamics and efficiency of the market for past (completed) ICOs

To assess the dynamics and efficiency of the market for successfully completed and/or listed ICOs, a set of tools is proposed (see Table 2.1).

Table 2.1. Tools for assessing the efficiency of the market for successfully completed and/or listed ICOs

Table 2.2. Integrated indicators of the dynamics and efficiency of the market for completed ( completed ) ICOs in 2022

Data from the beginning of 2022 have been adjusted to take into account the availability of more complete information on past ICOs. As a result, the total amount of funds raised for 2022 amounted to more than 6 billion US dollars (the volume of funds raised from 382 ICOs was taken into account). Over the past fourth quarter of 2022, ICO collections exceeded $3.1 billion. This amount consists of the results of the 196 most successful completed ICOs, with the largest amount raised being approximately US$258 million (ICO Hdac). The average amount of funds raised per project is US$16 million. More detailed data on the main ICOs of the past year are presented in table. 2.3.

2.3. Quantitative analysis of the ICO market

1. Number of funds raised and number of ICOs

Table 2.3. Number of funds raised and number of ICOs

Table 2.3 shows that the largest amount of ICO funds was raised in June and December 2022.

2. Quarterly analysis of the top ICOs of 2017

Table 2.4. Top 10 ICOs by volume of funds raised, first quarter of 2022

In table 2.4 presents the top 10 ICOs successfully completed in the first quarter of 2022.

At the moment, according to the “Efficiency” indicator (Token Performance), all projects from the top 10 have values from 0.73x to 101.85x. One of the most successful ICOs in terms of the volume of funds raised was the ChronoBank project, and in terms of the process of entering the stock exchange - the Augmentors project, because This particular project has a Current Token Price to Token Sale Price ratio of 101.85x. When considering this indicator, one should take into account the completion date of Augmentors ICO (February 2022), i.e. an increase of 101.85 times occurred in about 10 months.

In Fig. 2.2 presents the ten largest ICOs completed from January to March 2022.

Table 2.5. Top 10 ICOs by volume of funds raised, Q2 2022

In table 2.5 presents the top 10 ICOs successfully completed in the second quarter of 2022.

The leader in terms of the volume of funds raised was the EOS project. The highest value for the “Efficiency” indicator (Token Performance), i.e. the best ratio of Current Token Price to Token Sale Price is 16.25x and belongs to ICO Status. Its market capitalization currently stands at around $2 billion.

In Fig. 2.3 presents the ten largest ICOs completed from April to June 2022.

Table 2.6. Top 10 ICOs by volume of funds raised, Q3 2022

In table 2.6 presents the top 10 ICOs successfully completed in the third quarter of 2022.

The leader in terms of the volume of funds raised was the Filecoin project. The highest value in terms of the “Efficiency” indicator (Token Performance), i.e. the best ratio of Current Token Price to Token Sale Price is 62.14x and belongs to ICO ICON. Its market capitalization currently stands at approximately $2.7 billion.

In Fig. 2.4 presents the ten largest ICOs completed from July to September 2022.

Table 2.7. Top 10 ICOs by volume of funds raised, Q4 2022

In table 2.7 presents the top 10 ICOs successfully completed in the fourth quarter of 2022.

The Hdac project turned out to be the leader in terms of the volume of funds raised and the most successful over the entire period of the ICO. It collected $1 million more than the above-mentioned Filecoin project, which until that moment held first place in terms of collections.

Hdac is an acronym for Hyundai Digital Asset Currency. This is a hybrid project that creates a gigantic, constantly evolving information platform based on blockchain and the Internet of Things (IoT). This project offers an ecosystem with public and private keys for interacting with the devices around you, the number of which will constantly grow (smart home, smart car, smartphone, smart watch, TV, refrigerator, stove, kettle, etc.) .d.). The Hdac configuration creates a reliable, confidential, holistic and controlled communication system, which will allow for fast transactions and increase the convenience of all types of payments: taxes, settlements with customers, investments, loans, etc.

In Fig. 2.5 presents the ten largest ICOs completed from November to December 2022.

3. Top ICO since the beginning of 2017

In table Figure 2.8 shows the top 10 largest ICOs by volume of funds raised in 2022, the main part of which falls into the Infrastructure category.

Table 2.8. Top 10 ICOs by volume of funds raised in 2022

Over the past 2022, 382 projects successfully completed ICOs, each of which raised more than $100 thousand, with the total amount of funds raised amounting to at least $6 billion. The leader of the year was the Hdac project ($258 million).

Glossary

| Key Concepts | Definition |

| Initial coin offering , ICO (initial coin offering, initial coin offering) | A form of collective support for innovative technology projects, a type of pre-sale and attraction of new supporters through an initial offering of coins to future holders in the form of blockchain-based cryptocurrencies (tokens) and crypto-assets. |

| Market capitalization ( market capitalization) | The cost of the object, calculated based on the current market (exchange) price. This financial indicator is used to assess the total value of market instruments, entities and markets. [Wikipedia]. |

| Cryptocurrency market capitalization | The total market value of cryptocurrencies traded on the market. |

| Total cryptocurrency market capitalization | Market capitalization of cryptocurrencies and assets, i.e. the total market value of cryptocurrencies and assets traded on the market. |

| Token reward | Efficiency of the token (current price of the token / price of the token at the time of the ICO), i.e. reward for one US dollar invested in a token. |

| Dominance | Market share, i.e. the ratio of the capitalization of a cryptocurrency (token) to the total market capitalization. Expressed as a percentage. |

| Token sale price Current token price | The price of the token at the time of the ICO. Current token price. |

| Not Minable | The coin is not mined (from the English mining). Used in relation to cryptocurrencies (tokens) that do not have a mining function or are not released during the mining process. |

| Premined | Pre-mining coin. Used to refer to cryptocurrencies (tokens) that are produced through the mining process, but a certain number of coins (tokens) were created and distributed among certain users when the project was launched. |

| The rate of market increase (in % to the beginning of the year) | Market growth rate (in % compared to the beginning of the year), i.e. By what percentage has market capitalization increased compared to the beginning of the year? |

| The growth rate of the market (in % to the beginning of the year) | Market growth rates (in % compared to the beginning of the year), i.e. How many times has the market capitalization changed compared to the beginning of the year? |

| Increase in market capitalization (in USD million compared to previous period) | Growth in market capitalization of cryptocurrencies and assets (in millions of US dollars compared to the previous period), i.e. by how many million US dollars the market capitalization changed during the period. |

| The rate of market increase (in % compared to previous period) | Market growth rate (in% of the previous period), i.e. By what % did market capitalization increase over the period? |

| The market growth rate (in % compared to previous period ) | Market growth rates (in% of the previous period), i.e. How many times has the market capitalization increased compared to the previous period? |

| Number of cryptocurrencies and digital assets | Number of cryptocurrencies and assets. At the time of the glossary’s formation, more than 1,070 types of cryptocurrencies and assets were circulating on the market. |

| Average market capitalization | Average market capitalization, i.e. the ratio of the market capitalization of all cryptocurrencies and assets to their number. |

| Token return | An indicator of the efficiency of funds spent on the acquisition of tokens, or the ratio of the current price of a token and the sale price of a token, i.e. the effectiveness of investing one US dollar in tokens at the stage of selling tokens, subject to their subsequent sale on a crypto exchange for US dollars. |

| ETH reward – current dollar value of $1 spent on buying tokens during the token sale | An alternative indicator of the effectiveness of funds spent on the acquisition of tokens during the ICO period, or the ratio of the current ETH rate to its rate at the time of the start of the sale of ICO tokens, i.e. if one US dollar were invested not in ICO, but in ETH at its rate at the start of the token sale, and then sold at the current ETH rate. |

| BTC reward– current dollar value of $1 spent on buying tokens during the token sale | Similar to the previous one: An alternative indicator of the efficiency of funds spent on acquiring tokens during the ICO period, if one US dollar was invested in BTC at the rate at the time of the start of the ICO, and then sold at the current BTC rate. |

| Token /ETH reward | The ratio of economic benefits/losses of a market participant in connection with the purchase of tokens at the ICO stage to the possibility of investing in ETH. If the value is > 1, then the market participant has achieved greater efficiency in investing the funds spent on tokens than if he had invested in the ETH cryptocurrency. |

| Token /BTC reward | The ratio of economic benefits/losses of a market participant in connection with the purchase of tokens at the ICO stage to the possibility of investing in BTC. If the value is > 1, then the market participant has achieved greater efficiency in investing the funds spent on tokens than if he had invested in the BTC cryptocurrency. |

| ZAK-n Crypto index | The index is calculated as a percentage and represents the ratio of trading volumes (transactions) on a cryptocurrency exchange per day (Volume 24h) by n dominant cryptocurrencies to the amount of their market capitalization. When calculating the ZAK-4 Crypto Index, the four dominant cryptocurrencies with the largest market capitalization are taken into account - Bitcoin, Ethereum, Bitcoin Cash and Ripple. When calculating the ZAK-8 Crypto Index, the trading volume and market capitalization of eight cryptocurrencies are taken into account: Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, DASH, Cardano and IOTA. |

Disclaimer

Although the information contained herein is believed to be reliable, ICOBox makes no representations or warranties, express or implied, as to its completeness or accuracy. The information provided herein may include certain statements, estimates and forecasts. Such statements, estimates and forecasts reflect ICOBox's assumptions about expected trends, which may or may not materialize. ICOBox refrains from making any representations regarding the accuracy of such statements, estimates or forecasts, and actual performance may differ materially from those referred to in such statements, estimates or forecasts.

Expected financial results may be affected by changes in economic and political conditions and other future events that cannot be predicted. ICOBox makes no representations or warranties regarding the feasibility of forecasts or the data, information and assumptions contained herein. Statements and estimates represent our opinions as of the date of this report and are subject to change without notice. This document is for informational purposes only and does not constitute an offer to sell securities, cryptocurrencies or tokens, nor does it contain any recommendations or advice regarding investment in any specific company or assets.

ICOBox disclaims any liability for any statements, express or implied, contained or omitted herein. ICOBox is a SaaS solution provider for companies looking to sell their product through a token sale (ICO). ICOBox has or seeks to partner with companies mentioned in its research reports and has acquired or seeks to acquire their assets.

Source

Monero

- Year of creation: 2014

- Symbol: XMR

- Approximate capitalization: $2,991,665,251

Monero is another product of 2014. The cryptocurrency is designed to provide monetary transactions with increased anonymity, for which it uses the Cryptonote algorithm. In the fall of the same year, there was a hacker attack on Monero, but although the hackers were well versed in the crypt code and the Merkle Tree, they were unable to destroy the currency. In January 2022, the developers conducted a hard fork.

What the user should know about Monero:

- is a decentralized system;

- has open source code;

- uses the Proof-of-work principle;

- protected from mining on individual devices;

- Crypto is mined in exchangers and stock exchanges;

- automatic mixing of transactions in the network;

- emissions are not limited.

Since May 2022, Monero has been among the top ten cryptocurrencies with a solid capitalization and is characterized by rapid growth in value. One of the reasons for its popularity is the ability to use Monero in online games and virtual casinos.

Bytecoin

Bytecoin (BCN), not to be confused with Bitcoin, is a darknet cryptocurrency. That is, a network that cannot be accessed using a regular browser, and which is not controlled by law enforcement agencies. This token was created in 2012. Its main difference from the most popular cryptocurrency is that it cannot be tracked. Using the Cryptonote protocol, only the fact of the transaction is revealed. Its amount, and especially the participants in the transaction, remain unknown.

Cryptocurrency, which originated in the world of the darknet, is now becoming popular beyond its borders. Thanks to open source, developers can introduce new features. You can get Bytecoin by regular mining using a processor and video card. An important feature of BCN is that it is possible to mine cryptocurrency even on weak computers. And although its popularity is still weak, there are objective prerequisites for the development of this “digital” money.

Ethereum Classic (classic ether)

- Year of creation: 2016

- Symbol: ETS

- Approximate capitalization: $3,119,102,673

A hard fork of Ethereum – Ethereum Classic is a blockchain platform for developing applications based on smart contracts. The crypt was created after a hacker hack of the previous ETH platform The DAO, when a third of all Ethereum worth $50 million was leaked to ChildDAO accounts.

What the user should know about Ethereum Classic:

- is a decentralized system;

- works on the Ethereum algorithm;

- can be transferred from one participant to another;

- Bitcoin is easier to mine;

- serves to create tokens on the Ethereum Classic blockchain.

Crypto traders and investors see the prospects of Ethereum Classic in a balanced monetary policy and the support of such major crypto enthusiasts as the head of the Digital Currency Group, Barry Silbert.

general information

| Name | OpenDAO |

| Ticker | SOS |

| Year of appearance | 2021 |

| Token type | ERC-20 |

| Blockchain | Ethereum |

| Reviewers | https://etherscan.io/token/ https://ethplorer.io/address/ |

| Maximum emission | 100,000,000,000,000 SOS |

| In circulation as of 12/26/21 | 36 515 202 063 178 SOS |

| Rate as of 12/26/21 | 0,00000827 $ |

| Capitalization as of 12/26/21 | 301 969 506 $ |

| Official site | https://www.theopendao.com/ |

| Contract | 0x3b484b82567a09e2588a13d54d032153f0c0aee0 |

| Social media | https://twitter.com/The_OpenDAO https://discord.com/invite/zzzKhejARz |

| Exchanges | Bybit, OKEx, MEXC, Gate.io, KuCoin, Uniswap, DODO, Sushiswap |

IOTA (ticker MIOTA)

- Year of creation: 2014

- Symbol: IOTA

- Approximate capitalization: $4,188,668,750

The popularity of the IOTA cryptocurrency is largely due to its uniqueness: it is based on the unique Tangle consensus method (no miners). Digital money became available for transactions only in 2022 and quickly rose up the ranking table.

What the user should know about IOTA:

- decentralization of the system;

- no transaction fees;

- transactions are carried out by mutual confirmation of network nodes;

- the ability to make payments in the system without commission;

- coins cannot be mined;

- the main concentration of tokens is the Hong Kong exchange Bitfinex;

- has a high level of security.

The value of cryptocurrency has strong prospects, as evidenced by impressive capitalization volumes. Because IOTA was created as a global exchange network for the Internet of Things (a kind of “crypto token” for payment), it has high throughput. According to experts, by the end of the next decade it will be able to connect more than 50 billion different devices with its network.

Cardano (ADA)

This is a new promising next-generation decentralized cryptocurrency that appeared in October 2022. It is based on research. Cordano is a networking project that creates an intelligent protocol with significantly more complex features than other protocols. Cryptocurrency is open source. Code developers are engineers and researchers. Cordano ranks 11th in the cryptocurrency rankings and has a low exchange rate of $0.099687 per coin.

Digital Cash (dash)

- Year of creation: 2014

- Symbol: DASH

- Approximate capitalization: $5,035,002,494

Dash gained fame thanks to a revolutionary idea and a special algorithm for creating x11. Developer Evan Duffield sought to increase the anonymity of users of the new currency compared to BTS. This crypt has an official website and company.

What the user should know about Dash:

- until 2015 it was called Darkcoin;

- decentralized management;

- due to high anonymity (PrivateSend service), it is almost impossible to track transactions on the network;

- emissions require lower costs than military-technical cooperation;

- uses several cryptographic algorithms;

- The system operates an instant transaction service – InstantSend.

Digital Cash is essentially an improved version of Bitcoin with greater user anonymity and simplified mining. Actively developing and conquering new markets, Dash has managed to increase in price from $9 to $625 since the beginning of 2022.

Dash

The Dash cryptocurrency was developed by Evan Duffield in 2012. He also tried to solve Bitcoin's problems with transaction anonymity. But when the creators of the first cryptocurrency did not use Evan’s improvements, he wrote an algorithm for a new cryptocurrency overnight. This is how XCoin was born, later renamed Darkcoin. But this name did not last long. And for two years now, Duffield’s brainchild has been called Dash.

Unlike Bitcoin, Dash allows you to transfer cryptocurrency completely anonymously and securely. Several algorithms are responsible for this. Today, the project has acquired a whole team of programmers and has transformed from an ordinary cryptocurrency into an international payment system.

Litecoin (lightcoin)

- Year of creation: 2011

- Symbol: LTC

- Approximate capitalization: $5,369,938,216

Litecoin was originally developed by Coinbase CTO Charlie Lee as a “clone” fork of BTC. Despite this, digital currencies have some differences. For example, the emission of Litecoin is higher than Bitcoin and amounts to 84 million LTC, and the transaction occurs in 2.5 minutes, which is 4 times faster than that of BTC.

What the user should know about Litecoin:

- popular, stable and among the top ten cryptocurrencies by capitalization;

- has a production method similar to military-technical cooperation;

- decentralized management;

- LTC emission is limited;

- mining and faucets are used to obtain new coins;

- coins are stored in a special wallet that is part of the general system;

- inability to cancel a transaction;

- user anonymity;

- can be purchased and exchanged on the stock exchange or at an exchange office;

- the growth of currency value is abrupt.

The digital currency Litecoin is very dependent on BTC. As long as the latter is in price, Litecoin will be in demand. Over the past year, the Litecoin rate has increased 17 times.

Siacoin (SC)

Siacoin is a cloud storage platform that is decentralized. Anyone can provide storage space on their computer and receive a reward for doing so. Typically, cloud storage services are centralized and data is stored on a third-party server. However, in Siacoin, users contribute to a decentralized storage with their own share of resources.

Siacoin currently ranks in the top 40 of all coins based on market capitalization, which it has at $174 million. Factors influencing Siacon's valuation include limited storage and coin supply.

Ripple

- Year of creation: 2013

- Symbol: XRP

- Approximate capitalization: $10,892,576,404

The Ripple cryptocurrency, like Ethereum, is one of the oldest digital payment systems, which allows it to be used for financial transactions of any size and in any national currency.

What the user should know about Ripple:

- software scripts are provided free of charge;

- the support of large Western banks provides cryptocurrency with a good airbag;

- the use of distribution registries in the system provides complete protection against hacking;

- possibility of canceling the operation;

- lack of mining capabilities.

Ripple is widely used for financial transactions by Santander, UBS, Mitsubishi UFJ, BBVA, Fidor, UniCredit, Union b, Mizuho, Westrn and the Commonwealth Bank of Australia. This cryptocurrency represents a link between traditional banking methods and new technologies, and therefore can be a serious competitor to most digital units. Ripple is not afraid of panics on regular cryptocurrency exchanges, and some enthusiasts predict its role as an alternative to SWIFT.

Reasons for the emergence of new cryptocurrencies

Speaking about the reasons for the emergence of various cybermoney, it should be noted that they can be very diverse. But, if we ignore minor nuances and unique, special cases, all possible options can be divided into several large groups:

- the most common motive is the banal desire to make money on a popular idea (even cases of fraud are possible);

- A slightly less common reason is the desire of certain companies or associations to create their own unique financial product (this is how currencies associated with certain people, industries, and firms appeared);

- The most important and promising task of cyber finance is the development and promotion of new technologies (blockchain, which is now actively used by payment systems and banks, is the most important legacy of cryptocurrencies).

It is worth noting that the most promising cryptomoney is associated with new technologies, since very often they are supported by large international corporations that are interested in their development.

Bitcoin Cash (bitcoin cash)

- Year of creation: 2017

- Symbol: BCH

- Approximate capitalization: $26,869,290,293

This cryptocurrency was the result of the division of the military-technical cooperation into two new currencies due to problems of a significant slowdown in transactions of the main digital unit.

What the user should know about Bitcoin Cash:

- is more protected from possible problems with transaction speed;

- in the future it may become more convenient as a means of payment than Bitcoin.

Although, immediately after its appearance on the exchanges, Bitcoin Cash, thanks to its solid capitalization, was able to surpass such popular currencies as Litecoin and Ripple in the ratings. Although today the number of transactions and price growth are not particularly impressive, Bitcoin Cash does not lose its popularity, continuing to remain at the top.

Ways to make money on cryptocurrency

- Mining. Mining is the extraction of cryptocurrencies. To do this, you need to buy a video card and other components, install a program for generating hashes on your PC. An alternative option is cloud mining. To earn this kind of money, you need to register on one of the services and purchase a tariff. This is reminiscent of buying hosting, but in this case the hardware is used for mining cryptocurrencies.

- Earning money on the cryptocurrency exchange. The approach is similar to making money using Forex: you need to register on an exchange, for example, Poloniex, buy currency and start trading (the goal is to buy cheaper, sell more expensive).

- Video content creation. There are a lot of video bloggers on Youtube talking about how to build a farm and what programs to use, reviewing exchanges, market news, etc. You can create a channel and post content about cryptocurrency on it or add videos about mining to the main channel, which has long been you lead.

- Creation of exchangers or exchanges. For depositing/withdrawing funds, you pay a certain percentage of the commission to the exchange; the same services include payment services that convert virtual currency into real money, and currency exchangers. Anyone can theoretically become an intermediary in the provision of these services.

- Technical support, service and maintenance. Video card manufacturers, sellers or equipment suppliers also have the opportunity to earn money; they can also create and maintain mining farms. Manufacturing companies have already begun producing components for cryptocurrency mining. Tech-savvy specialists have the opportunity to charge a fee for assembling such designs (since cryptocurrency miners usually have a lot of problems with overclocking, cooling and firmware, such a service would be relevant).

Ethereum (etherium)

- Year of creation: 2015

- Symbol: ETH

- Approximate capitalization: $46,389,457,409

Ethereum is far from the first altcoin to be created, but it was the one that was able to become the main competitor of Bitcoin when its capitalization exceeded the billion dollar limit in 2016. Ethereum developer Vitalik Buterin has created an entire decentralized virtual machine on the basis of which startups or software can be created.

What the user should know about Ethereum:

- the possibility of using ETN as a means of payment;

- smart contract system;

- features an energy-efficient emission method - POS (proof of stake);

- is an open platform for guaranteed computing.

The popularity of Ethereum is growing day by day, and the crypt can already be found on almost all cryptocurrency exchanges and online exchangers along with BTS. To date, Ethereum has attracted the attention of such well-known companies as Microsoft, Acronis, IBM and Sberbank. Since Ethereum has shown phenomenal growth rates over the past year, most statisticians predict that Ethereum will soon overtake Bitcoin completely.

Investments in cryptocurrency 2022: final result

For every $1 invested equally in the 15 listed cryptocurrencies, the investor would receive $121 after one year. It should be noted that 2022 turned out to be an extremely successful year for most coins. The market recovered from the fall of the end of 2013, and money from private investors poured into crypto exchanges in a rapid flow. The positive news background also contributed to the increase in capitalization. The names of large companies investing in the development of blockchain technology began to appear in media reports, and government officials and politicians began to talk seriously about the development of the digital economy.

It is noteworthy that the growth of cryptocurrency was not smooth. Several large waves are clearly visible on the chart of Ethereum and many other altcoins, the most powerful of which occurred in the spring of 2022. Periods of rapid growth are inevitably followed by serious pullbacks - an important pattern that all novice investors should remember. Investments in cryptocurrency today can lead not only to enrichment, but also to the loss of a significant part of the funds in the short term.

Considering the above events, it is not worth projecting a 121-fold increase in cryptocurrencies for 2022. The cryptocurrency market capitalization is $634 billion, while at the beginning of the year it was measured in only hundreds of millions of dollars. In this regard, the coming months may bring a significant correction. Let's figure out how to act in such a situation.

Bitcoin (bitcoin)

- Year of creation: 2009

- Symbol: BTC

- Approximate capitalization: $182,264,019,568

The undisputed leader of any list of promising cryptocurrencies is Bitcoin. The official “father” of Bitcoin is considered to be Satoshi Nakamoto, although most users of this crypt remain confident that this name is a collective pseudonym for a whole group of talented programmers.

What the user should know about Bitcoin:

- decentralization of the system, providing all users with equal rights and opportunities;

- transparency of payments, allowing you to monitor all transactions;

- lack of control by any organization or government entity;

- anonymity of the user’s identity due to the lack of verification;

- limited coin circulation of 21 million BTC;

- sending money anywhere in the world;

- According to preliminary forecasts, 1 BTC will grow from $4 to $40 thousand in a couple of years;

- Oligarchs invest in Bitcoin.

Bitcoins have all the transaction features of fiat money. Bitcoin is open source, which allows other programmers to create new types of cryptocurrency.

If after reading the article you still have questions, we recommend reading the article about the best exchangers and the most promising exchanges for cryptocurrencies. And a popular resource among crypto enthusiasts – Coinmarketcap – will help you keep your finger on the pulse of the latest changes in the digital cash market.

New promising cryptocurrencies for 2021

It is not yet possible to name the best cyber money of 2022, since they either have not appeared yet or have not yet had time to prove themselves. But you can easily identify new cryptocurrencies of 2022 for mining and investment, which have already shown their best side. These include:

- Bitcoin Cash;

- Bitcoin Gold;

- NEO;

- OmiseGo

- Monaco;

- IOTA.

All of the listed cyberfinances have striking distinctive features that help them stand out from the colossal number of analogues and competitors.

Thus, many famous personalities were involved in the emergence of OmiseGo, including the creator of Ethereum. IOTA is notable for its unique approach to financial transactions. Its creators decided to combine the identities of users and validators, which made transactions fast and completely free.

The emergence of Bitcoin Cash cannot be ignored. This cybermoney arose immediately after the Bitcoin hard fork, becoming a reliable help for those who did not agree with the changes being introduced.

NEO is also attractive for purchase. So far, this currency is in demand in Japan and Southeast Asia, but in the future it will definitely spread throughout the planet.

In short, the year that is ending turned out to be extremely rich in events and ideas. Some of them turned out to be extremely successful and successful, which is confirmed by the existing level of capitalization of individual crypto-finances and the demand for them. It could not do without mistakes, but in creative activity, which is the creation and development of cyber money, mistakes cannot be avoided.

Risk management for a cryptocurrency investor in 2022

During 2022, the total capitalization of cryptocurrencies increased several hundred times. Such growth may indicate both an initial underestimation of blockchain technology and a possible overbought of assets. Despite many optimistic estimates, the factor of a possible fall in 2022 should not be discounted.

To mitigate the risk of a possible fall and get additional profit on subsequent growth, you can divide your capital in a 50/50 ratio and invest only one of these parts in cryptocurrencies. If the growth phase continues, the investor will receive a good profit, and in the event of a deep fall, he will be able to buy additional coins at favorable prices.