Cryptocurrency is a type of digital currency, the peculiarity of which is a decentralized payment system with complete anonymity of participants. Neither the platform nor its participants can track transaction data. Classic currencies, such as the ruble, have regulators in the form of the Central Bank and the Tax Service, which control all types of transactions and have information about them: they know the transfer amount, date, recipient and sender. All cryptocurrencies have advantages such as security and reliability of transfers.

Brief historical background

The term “cryptocurrency” began to be actively used after the advent of the Bitcoin payment system.

The very first such platforms appeared in the last century. For example, David Chom's DigiCash system was founded in 1990. It was centralized, i.e., based on 1 device, which made it vulnerable to external attacks.

On August 18, 2008, Satoshi Nakamoto (still unknown, perhaps a group of people) published the “Bitcoin Manifesto” - a document that described the basics of blockchain technology and the new currency that functions with it - bitcoin.

Blockchain is a database that stores information about all operations of each participant in the system in the form of a chain of blocks. Any blockchain user has access to the list. In this case, everyone acts as a collective notary, i.e., confirms the truth of the transaction. Thus, information is decentralized - stored on many computers. This ensures reliable operation of the system.

In January 2009, the first 50 coins of the Bitcoin system were mined and Satoshi Nakamoto made the first transaction of 10 bitcoins. The rate gradually grew: during 2009, the price fluctuated between 700 and 1600 bitcoins per 1 US dollar. In 2010, the first exchangers began to appear for buying and selling bitcoins for classical money.

In 2011, the first altcoins (from the English altcoin, alternative coin) appeared - all cryptocurrencies after Bitcoin. The pioneers were Litecoin and Namecoin. The developers wanted to overcome a number of problems that classic Bitcoin had. For example, Litecoin has a higher transaction speed, and Namecoin was created to develop alternative secure DNS servers.

Channel

Sometimes prices fluctuate in a corridor limited by two parallel lines. One trend line, the other line is drawn parallel to the trend line.

If you can identify the channel lines, this can help in the technical analysis of the cryptocurrency chart.

How can channel lines help in trading or investing?

- You can buy on the pullback and sell on the approach to the channel line. Or, on the contrary, open short positions on the upper line of the channel and close on a rollback to the trend line.

- If the trend does not reach one of the channel lines, or breaks through it, you record a change in the nature of the movement of the analyzed cryptocurrency and monitor the new movement more closely.

- A breakthrough of the upper line of the channel during an uptrend usually indicates the strength of the trend and can serve as a signal to buy or expand a position. And vice versa for shorts. A breakthrough of the lower level of the channel indicates strong weakness of the cryptocurrency.

Official cryptocurrencies

The legal status of cryptocurrencies depends on the specific legislation of each country. In a number of states, they are an official investment asset or commodity, and therefore are subject to taxation. For example, in Japan and Germany, Bitcoin is a current payment instrument on a par with bank cards and cash.

A number of other countries have legal restrictions on cryptocurrencies. In China, transactions with cryptocurrencies can only be carried out by individuals; this is prohibited for companies, including banks.

At the same time, in Russia the status of Bitcoin is not fully regulated. There is no concept of “cryptocurrency” in the legal field. However, in 2022, changes occurred in the Civil Code - the term “digital assets” was introduced. Meanwhile, the most anticipated law “On Digital Financial Assets,” which was supposed to determine the status of cryptocurrencies in Russia, was never adopted.

Types of charts

There are several types of charts that can be used to perform technical analysis of cryptocurrencies:

- Bars (BAR)

- Candles (CANDLESTICK)

- Linear (LINE)

We will always analyze the candlestick chart, it is the most common. Also on it, together with technical analysis, you can conduct candlestick analysis of cryptocurrency, about which we will soon write the same manual. Combining these two schools of chart analysis (European and Japanese) gives amazing results in analyzing price dynamics.

Line (Linear), Bar (bars), Candle (candlestick) charts

To invest and trade in Bitcoin and other cryptocurrencies, register on the Binance exchange (-10% on commissions using our link).

Rating of the 10 best cryptocurrencies

Bitcoin

Bitcoin is the first popular cryptocurrency. It is not tied to either physical assets or “traditional” currencies, and its price is regulated solely by the state of the market, i.e. it is influenced only by the level of supply and demand.

Bitcoin can be mined (from the English mine - mined). The number of issued Bitcoin cryptocurrency coins as of January 2020 is 18 million, and the maximum possible number that can be mined is 21 million.

This is the leader in terms of influence on the cryptocurrency industry. Tops the rating of tokens by capitalization.

Ethereum

Ethereum is an open-source blockchain platform for creating smart contracts in applications or services. Created in 2015 by Vitalik Buterin. It was a kind of revolution for the world of cryptocurrencies.

The main difference from Bitcoin is that Ethereum can record internal data not only like a traditional cryptocurrency, but also as smart contracts - contracts that are written using code and stored on the blockchain.

Ether allows you to use it not only as a means of payment, but also as a way to record a transaction - it acts as a tool for developing a smart contract. For this reason, developers buy it to create decentralized applications based on this platform.

Binance Coin

This is a cryptocurrency based on the Ethereum platform. Allows you to receive discounts on services on Binance, an exchange for trading cryptocurrency. In the future, it is planned to transform into a platform for trading any types of digital assets.

Using Binance Coin, you can pay for a discount of up to 50% on trading on the exchange.

XRP

Another name is Ripple. A major player among blockchain platforms. The most popular resource for ensuring the functioning of payment systems. The main task is to carry out currency exchange transactions, while there is no possibility of chargebacks. The service was launched in 2012.

The Ripple network can be considered a public database for sharing. It has a kind of online ledger that allows you to track your accounts and their balances. At any time, anyone can examine the ledger and see a record of all activities on the Ripple network.

There is a currency called XRP within the Ripple system. It is in 3rd place in terms of total capitalization and is inferior to Bitcoin and Ethereum.

EOS

EOS is a platform created for the development of decentralized applications on the blockchain. It is a platform on which sites and services can place their smart contracts. Ethereum's main competitor. According to the creators, the site has the highest transaction processing speed - up to 100,000 per second.

The internal EOS token allows it to be used both for payments outside the system and for internal transactions, for example, to purchase space to host a smart contract on the blockchain.

Litecoin

One of the first altcoins. It was launched in October 2011. Based on the principles and program code of the Bitcoin system.

“Litecoin” differs from “Bitcoin” in 2 ways:

- The speed of formation of new blocks is higher (2.5 minutes instead of 10 for Bitcoin).

- For mining, a new adaptive cryptographic key generation function (scrypt) is used.

Bitcoin Cash

The volume of one block in Bitcoin can reach a maximum of 1 MB. When the number of transactions on the network began to increase, this led to a decrease in the speed of all transactions - buying, selling and transferring.

There were two possible solutions: increasing the block size or moving some of the information off the blockchain to make room for new operations. A group of developers led by former Facebook engineer Amaury Sechet implemented the extension idea. On August 1, 2017, Bitcoin Cash was launched.

Differences from classic Bitcoin:

- The block size has increased 8 times - up to 8 MB.

- The difficulty change scheme does not change every 6 blocks, like Bitcoin, but every 2016.

Tether

A cryptocurrency whose rate is tied to fiat, i.e., classical currencies (euro, dollar, yen). The issue is handled by Tether Limited. Through its blockchain platform, Tether enables users to store, send and receive digital tokens.

Cardano

It is a decentralized platform for creating smart contracts. Built in the highly secure Haskell language. The company's mission is to help organizations quickly, inexpensively and securely create contracts and decentralized applications. The platform uses the Cardano (ADA) cryptocurrency.

Stellar

Stellar is a financial platform for trading cryptocurrency. The goal of the creators is to reduce costs and commissions when buying and selling any currencies, assets or tokens. The platform has its own token, Stellar Lumens (XLM). Launched in 2014

Stellar Lumens coins cannot be mined because 100% of the cryptocurrency is in circulation.

Types of cryptocurrencies depending on generation: Blockchain 1.0, 2.0 or 3.0

Blockchain of cryptocurrencies

At the moment, there are three generations of cryptocurrencies, which are created on different blockchains, and thus form different types of cryptocurrencies. Let's briefly look at how they differ from each other, what their advantages and disadvantages are.

Blockchain 1.0

This blockchain technology appeared in 2009, it was launched by an anonymous person under the pseudonym “Satoshi Nakamoto”. In essence, this is a virtual cryptocurrency, where Bitcoin became the “pioneer”. Despite its primacy, the Bitcoin blockchain has a number of limitations: it is difficult to integrate with external systems, and it has low throughput.

In Blockchain 1.0, all transactions are made publicly, they are interconnected, and network participants confirm them in a decentralized manner. This blockchain ensures the integrity of transactions, and there are rewards for calculations. However, high mining costs reduce the profitability of Bitcoin. As a result, more advanced technologies began to emerge to overcome Bitcoin's technical shortcomings.

Bitcoin is not the only coin that runs on the first generation blockchain. Litecoin and DASH can also join this list.

Blockchain 2.0

In 2013, Vitalik Buterin, having gathered a group of experts and programmers, launched the Ethereum network. A significant improvement was the emergence of decentralized applications and the possibility of practical use of smart contracts, which completely changed all processes.

Smart contracts made it possible to carry out the ICO procedure (initial fundraising) without any regulatory restrictions, promptly and with minimal legal formalities. However, the second generation blockchain also has its drawbacks, such as scalability problems. This results in network congestion, which leads to higher transaction fees.

The Ethereum blockchain runs BAT tokens from the Brave browser, Augur (REP) and ICON (ICX).

Blockchain 3.0

Blockchain 3.0 is a combination of cloud technologies, applications and software products with which blockchain can be easily integrated into the real world, without the participation of financial or payment systems. This new type of blockchain radically changes the cryptocurrency trend, which promotes mass adoption of cryptocurrencies.

Blockchain 3.0 combines all the best from its predecessors (bitcoin and ether), implementing the circulation of cryptocurrencies and smart contracts. Also, the third generation blockchain is characterized by the use of DAG (Directed Acyclic Graph) - a direct acyclic graph with a changing structure, presented in the form of DAG blocks and chains.

Blockchain 3.0 works without miners and blocks, so transactions are confirmed in almost real time and at the lowest cost. In addition, in DAG networks, transactions are confirmed multiple times, which avoids “double spending.”

Blockchains 3.0 include cryptocurrencies such as IOTA, Cardano and EOS.

Promising new cryptocurrencies

The list of cryptocurrencies and blockchain platforms is updated every year.

TON

The top project is Telegram Open Network (TON). This is a blockchain platform developed under the leadership of Pavel Durov. It has already raised $2 billion from investors in a private token sale. The platform will allow you to place any type of smart contracts: from classic payments to large contracts for the purchase and sale of any assets. Has an internal currency GRAM.

The main feature of the currency is the fast speed of transactions. Bitcoin can only carry out 7 transactions per second, ether - 15. At the same time, the speed of GRAM is projected to be up to 10 million transactions per second, which is comparable to the power of Visa and Mastercard. Mining will be impossible - 100% of the shares will be in circulation. Estimated launch: 2022

Libra

Blockchain platform for implementing smart contracts, developed by Facebook.

The main features of the platform are:

- Scalability. There can be up to a billion accounts here, which will result in high transaction throughput, i.e. low latency and high speed of each transaction.

- High security, which is guaranteed by the project partners.

- Power. The platform must enable the implementation of both current smart contracts and more complex ones that will appear in the future.

- Good potential for growth. The number of Facebook users who will be able to use the currency has exceeded 1 billion.

Partners include Mastercard, PayPal, Visa, eBay, Uber.

The platform has an internal Libra token of the same name. The exact launch date is still unknown.

Trend line

The trend line is one of the main tools in the technical analysis of cryptocurrencies. To plot a trend line on a chart, you need at least two points. Moreover, these points must be either increasing or decreasing.

Uptrend trend line built using 2 points ETH (1H)

The uptrend line is drawn along the retracement points.

Trend line in an uptrend. A good example of the fact that trends do not always touch the line exactly and bounce off it can be a price error. Next, let's see what to do with this.

Downward trend line constructed from 2 peaks

The downward trend line is drawn along the peak points.

If you correctly learn how to work with a trend line in conjunction with levels, you can work miracles in predicting prices in the technical analysis of cryptocurrencies.

The line is both a support line and a resistance line. In which cases we will now consider with you.

How to use a trend line

As you remember, one of the fundamental principles states that a trend that is in its development stage will tend to continue its movement.

What does a trend line help us with...

Determining pullback or adjustment prices to enter a position

You can use a trendline as a definition of the lower or upper points of a correction or retracement. If the trend is up, you can predict prices to buy from a pullback. If the trend is downward, you can determine prices to sell from a pullback.

How to use a trend line

Please note that growth and retracement in a trend are always approximately similar, so you can build expectations on where to buy and where to sell cryptocurrency.

Using the example of the chart above, you can buy in zones 2 and 3, and sell at the upper points of the movement, where the trend turns into a pullback. If you start building such lines, you will see that the movements are very similar, sometimes they are identical in length.

The zones on the feet were measured according to significant movements.

How to Determine a Significant Movement for a Cryptocurrency

Significant Movements

We determine significant movements on the timeframe on which we analyze. We take the movements that cryptocurrency most often uses. They are highlighted in the screenshot at point 1. The stop order is placed approximately at this distance in this example.

Determining signs of the end of a trend to exit a position in a timely manner

The trend line is an indicator of the possible end of the trend. When a trend line breaks, this is the first sign that the trend is breaking or changing the angle and speed of movement. More on this later. As a result, a decision may be made to exit positions.

Sign of end of trend

This chart clearly shows that after the third touch of the trend line, Ethereum broke through the trend line and did not return immediately, this is a sign that the downward trend is beginning to break. And the final confirmation was a retest of the trend line and a turning point. Let's talk about figures or patterns of technical analysis of cryptocurrencies further.

Trend lines change places

After a trend line is broken, it often becomes a support line during correction and testing of this breakout.

The trend line becomes support when a downtrend reverses

From the previous figure, we see how ETH broke through the trend line on the fourth touch, and subsequently the trend line served as a support line before the trend broke. This is quite common.

How to adjust a trend line?

Often the trend changes its angle and has to be adjusted. This is normal. The movement is accelerating, the nature of the cryptocurrency’s course and the angle of the trend are changing.

Trend line angles

Based on the break of each trend line, you can draw appropriate conclusions and build new expectations.

Table of existing cryptocurrencies with characteristics and rates

The table contains an overview of information about cryptocurrencies with the largest capitalization. Information is current as of 01/19/2020.

| № | Name | Price for 1 coin | Capitalization | Change in 24 hours |

| 1 | Bitcoin (BTC) | $ 9038,45 | $164bln | + 2,0% |

| 2 | Ethereum (ETH) | $ 174,89 | $19bln | + 3,5% |

| 3 | XRP (XRP) | $ 0,24 | $10bln | + 3,7% |

| 4 | Bitcoin Cash (BCH) | $ 350,66 | $6bln | — 4,7% |

| 5 | Bitcoin SV (BSV) | $ 261,04 | $4bln | — 0,4% |

| 6 | Tether (USDT) | $ 1,00 | $4bln | 0,0% |

| 7 | Litecoin (LTC) | $ 60,49 | $3 bln | + 1,4% |

| 8 | EOS (EOS) | $ 3,81 | $3 bln | — 0,8% |

| 9 | Binance Coin (BNB) | $ 17,92 | $2bln | + 0,8% |

| 10 | Cardano (ADA) | $ 0,05 | $1 bln | + 2,6% |

| 11 | Stellar (XLM) | $ 0,06 | $1 bln | + 2,7% |

| 12 | TRON (TRX) | $ 0,02 | $1 bln | + 2,4% |

| 13 | Monero (XMR) | $ 68,14 | $1 bln | — 2,3% |

| 14 | Ethereum Classic (ETC) | $ 9,09 | $1 bln | — 1,2% |

| 15 | Tezos (XTZ) | $ 1,51 | $1 bln | + 3,8% |

| 16 | ChainLink (LINK) | $ 2,76 | $1 bln | + 2,3% |

| 17 | Dash (DASH) | $ 104,35 | $969 mln | — 0,5% |

| 18 | LEO Token (LEO) | $ 0,91 | $893 mln | + 1,6% |

| 19 | Cosmos (ATOM) | $ 4,72 | $891 mln | — 0,8% |

Percentage of correction in trend movement

The smaller the correction of the main movement, the more likely it is that the trend will continue. A correction of more than 50% may already indicate that this is a strong pullback and we may not see a recovery in the trend in the near future.

A correction of 30% is considered the most optimal, indicating the strength of the trend.

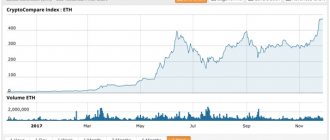

Ethereum chart pullback (1D)

An example of a 60% rollback on Ethereum. After such a rollback, Ethereum was in the rollback stage for 3 months.

Below is a detailed description of the patterns; spot trading is an excellent option for using patterns in trading.

Summarizing

Today, the cryptocurrency market is actively developing. The positions of old players are strengthening, the scope of application is expanding, and new products are appearing every year.

Until 2013, the software of all altcoins was based on data from the open source code of the Bitcoin system. In July 2013, new blockchain platforms appeared with various functions - from online stores to stock trading programs. The list of areas in which blockchain is used is gradually expanding. For example, there are platforms for online trading or information support for production.

Cryptocurrencies and the blockchain system are the path of the global economy not only to complete security, but also to new technologies and transformation of daily operations.

Timeframes or time intervals for analysis. What timeframe to analyze charts on?

Technical analysis of cryptocurrency charts can be carried out on all timeframes.

Investors use the daily (D) and weekly (W) charts to assess the overall picture, and the hourly (1H) and 15-minute (15min) charts to find the best entry prices.

Traders use 5 minutes (5M), 15 minutes (15M), hourly (1H), daily (D) to assess the overall picture, and one minute (1m) and (5m) to enter and implement trading tactics.

We will look at figures and patterns on the 15 minute (15M), hourly (1H) and daily (1D) time frames.

How to mine ERGO

ERGO is the youngest coin on our list. An unpretentious mining algorithm allows you to mine even cards with only 3 GB of video memory.

Miner Ergo

This coin was able to quickly attract almost a quarter of the miners from the ETC algorithm - mainly cards with 3 GB and 4 GB of video memory.

Ergo price chart for the year

- Mining algorithm: Autolykos2 (Cold ❄️)

- Minimum video card memory size: 3 GB

- Block reward: 67.5 ERG

- Average block time: 140 seconds.

- Traded on exchanges: Gate, KuCoin, CoinEx, HotBit and others.

- Place in the cryptocurrency ranking: 198.

This coin is mined worldwide by 20 to 30 thousand miners or 200-300 thousand cards. Estimates vary greatly due to the significant difference in the types of cards used in the algorithm.

Ergo mining profitability on Nvidia RTX 3080 Ti

A ready-made bat file for mining can always be found on the “How to start” page of the ERGO pool. For Nvidia, take T-rex.

t-rex.exe -a autolykos2 -o stratum+tcp://erg.2miners.com:8888 -u YOUR_WALLET_ADDRESS -w RIG_ID -px pause

For AMD - Team Red Miner.

teamredminer.exe -a autolykos2 -o stratum+tcp://erg.2miners.com:8888 -u YOUR_WALLET_ADDRESS.RIG_ID -px pause

Read the Ergo mining guide here.

Why is everyone mining Ethereum?

The vast majority of miners currently mine the Ethereum cryptocurrency, as it occupies a leading position in terms of profitability on most video cards. You can easily verify this by opening the 2CryptoCalc mining profitability calculator.

The most profitable cryptocurrencies for mining

Despite the fact that this cryptocurrency is very demanding on the amount of internal memory of video cards and requires 8 MB more every 3-4 days, many beginners with one card try to mine it, and then suffer from too high commissions when receiving their payment. The 2Miners pool has created a unique payment system that allows you to receive your mined money daily and without commissions. Read more in this article.

Ethereum mining and Bitcoin reward