The best cryptocurrencies are the coins that show the highest daily trading volume and maximum ROI. Naturally, the TOP 10 mainly includes market titans: Bitcoin, Ethereum, Ripple, Litecoin and other well-known coins. The top ten leaders can change very dramatically, for example, due to the discovery of technical errors in the network or due to a hard fork.

According to CoinMarkerCap, there are more than 2,000 cryptocurrencies in the world. Their total capitalization as of July 24 of this year reached $285 billion. Because of such huge numbers, a newcomer to the digital asset market can easily become confused. To avoid this, find out which crypto coins deserve the most attention.

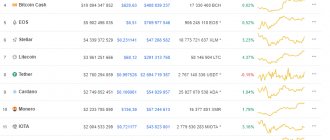

Rating of popular cryptocurrencies

To choose the best cryptocurrency, we suggest paying attention to the daily trading volume. Data collected from most major cryptocurrency exchanges using the CoinMarketCap service. Based on this information, we will identify the most popular crypto coins. This way we will find out which asset on the cryptocurrency market has the greatest liquidity.

| Place | Name | Daily trading volume as of 07/24/20 |

| 1 | Bitcoin | $18 299 314 656 |

| 2 | Ethereum | $10 007 193 336 |

| 3 | Litecoin | $1 794 944 744 |

| 4 | Ripple | $1 734 669 285 |

| 5 | EOS | $1 403 953 615 |

| 6 | Bitcoin SV | $1 333 053 663 |

| 7 | Bitcoin Cash | $1 316 979 102 |

| 8 | Chainlink | $663 041 452 |

| 9 | Ethereum Classic | $619 554 194 |

| 10 | TRON | $407 118 482 |

As of July 24, the highest daily trading volume was recorded for Tether (USDT). Since this cryptocurrency is an analogue of the dollar and has a relatively stable exchange rate of 1 to 1, it is not attractive for investors. Therefore, the USDT token was not included in the list of the most sought-after digital assets.

#1 – Bitcoin

- Ticker: BTC

- Capitalization: $175,281,444,698

- Maximum number of coins: 21,000,000

- Current number of coins: 18,440,937

- Rate: $9,516.06

- Release date: January 3, 2009

- Algorithm: SHA-256

Bitcoin is the first cryptocurrency created by the mysterious Satoshi Nakamoto. Since its inception until today, it has been ranked number one on many lists, spawning an entire industry, which is why BTC is in the spotlight of many media outlets. Bitcoin continues to evolve, gaining even more attention thanks to SegWit and Lightning NetWork technologies.

#2 – Ethereum

- Ticker: ETH

- Capitalization: $30,220,655,212

- Maximum number of coins: unlimited

- Coins issued: 111,889,355

- Rate: $270.1

- Release date: July 30, 2015

- Algorithm: EtHash

Ethereum appeared in 2015, and its founder is Vitalik Buterin. He became interested in cryptocurrency back in 2011. Then he founded Bitcoin Magazine. His project has long been ranked second among the most popular digital assets and is the main competitor to Bitcoin.

Ethereum has become more than just a cryptocurrency. Vitalik Buterin managed to create a platform for implementing decentralized online services based on blockchain using smart contracts. Subsequently, his network began to be actively used to create their own cryptocurrencies, which led to the ICO boom. However, despite the technological superiority over Bitcoin in some aspects, Ethereum is noticeably inferior to the first cryptocurrency in terms of capitalization.

#3 – Litecoin

- Ticker: LTC

- Capitalization: $2,887,727,366

- Maximum number of coins: 84,000,000

- Coins issued: 65,099,729

- Rate: $44.36

- Release date: October 13, 2011

- Algorithm: scrypt

The top three in the top 10 is completed by Litecoin. This cryptocurrency is a fork of Bitcoin and appeared in 2011. Charlie Lee, the founder of Litecoin, envisioned his network as a faster alternative to Bitcoin. If today the majority considers BTC as digital gold, then LTC is silver.

Litecoin retains all the advantages of Bitcoin, but at the same time the altcoin has higher throughput. Creating a new block takes not 10 minutes, but 2.5. It works according to the same rules, so every 840,000 blocks the reward for miners decreases. More than 65 million coins were issued in 2020.

#4 – Ripple

- Ticker: XRP

- Capitalization: $9,175,455,568

- Maximum number of coins: 100,000,000,000

- Coins issued: 44,848,773,395

- Rate: $0.204587

- Release date: 2012

- Algorithm: ECDSA

Ripple was conceived as a cryptocurrency platform for payment systems that would be used for currency exchange without chargebacks. In simple terms, the creators of XRP wanted to provide banks with a cheap way to transact large amounts anywhere in the world. In technical terms, Ripple is superior to centralized money transfer systems - SWIFT and Western Union.

Unlike most other cryptocurrencies, Ripple is a centralized platform that is owned by the company of the same name. She is responsible for issuing coins and leading the further development of the technology. She is actively developing her brainchild, collaborating with the largest banks: Akbank, Canadian Imperial Bank of Commerce, CGI Group, Mitsubishi UFJ Financial Group, Deloitte, UniCredit Group and others.

#5 – EOS

- Ticker: EOS

- Capitalization: $2,415,653,374

- Maximum number of coins: unlimited

- Coins issued: 934,595,602

- Rate: $2.60

- Release date: January 31, 2018

- Algorithm: DPoS

This cryptocurrency appeared relatively recently. However, within 2 years, EOS quickly entered the top and secured its place in 5th place. The author of the network was Dan Larrimer, who previously developed BitShares and Steemit. To launch his own network, he conducted an ICO based on Ethereum, which later became one of the most successful cryptocurrency startups, collecting 651,902 ETH - $170 million at the time of fundraising.

Like Ethereum, EOS is a decentralized platform using smart contracts that is designed for building blockchain-based applications. It is also used for conducting ICOs. Because of this, EOS is considered one of the main competitors of Ethereum. In 2022, the project was criticized by the independent firm Whiteblock. After the tests, experts came to the following conclusions:

- EOS throughput is lower than stated during the ICO;

- the network does not operate on the basis of a blockchain, but through a homogeneous database management system, so transactions in EOS are not subject to cryptographic verification;

- the developers provided the cloud service without full transparency.

Essentially, EOS is not a decentralized platform, and Dan Larrimer's promises have not been fully implemented. However, this did not prevent the cryptocurrency from taking its place in the sun in our ranking.

#6 – Bitcoin SV

- Ticker: BSV

- Capitalization: $3,333,620,359

- Maximum number of coins: 21,000,000

- Coins issued: 18,469,327

- Rate: $180.49

- Release date: November 15, 2018

- Algorithm: SHA-256

Bitcoin SV was created as a result of the Bitcoin Cash hard fork. Abbreviations SV stands for "satoshi vision". Thus, the author of the network tried to implement a replacement for the first cryptocurrency. The man behind BSV is Craig Wright. Before the hard fork, he had already tried to impersonate Satoshi Nakamoto, but he never managed to deceive the community.

Among the main features of the new crypto coin, one can highlight the scalability solution. To achieve this, Craig Wright increased the block size to 2 GB. This made transactions faster and cheaper than the original network. However, his actions were criticized, for example, Changpeng Zhao, the head of the cryptocurrency exchange Binance, expressed his dissatisfaction with Craig Wright's attempt to impersonate Satoshi Nakamoto. The Kraken exchange also decided to stop supporting Bitcoin SV. After conducting the survey “Is Bitcoin SV necessary?” about 70% of users stated that cryptocurrency is unprofitable.

The people have spoken. Kraken is delisting BitcoinSV: https://t.co/8lSUfEYUYr#delistBSV

— Kraken Exchange (@krakenfx) April 16, 2019

The lack of support from some major exchanges initially had a negative impact on Bitcoin SV. In a few days, the cryptocurrency fell in price by $15. The sites that helped BSV survive were HitBTC, Bittrex, Okex, Bitfinex and a number of other large platforms where you can still purchase this cryptocurrency.

#7 – Bitcoin Cash

- Ticker: BCH

- Capitalization: $4,339,701,419

- Maximum number of coins: 21,000,000

- Coins issued: 18,470,538

- Course: $234.95

- Release date: August 1, 2017

- Algorithm: SHA-256

Bitcoin Cash is one of the best cryptocurrencies that appeared as a result of a fork of the Bitcoin network on August 1, 2022. The scalability of the main crypto coin has again proven to be a reason to split the community. To solve the problem, the SegWit protocol was developed and implemented, which increased the block size in Bitcoin from 1 MB to 2 MB and allowed some information to be stored outside the blockchain.

Adding the ability to store data outside the blockchain did not suit all network participants. A group of developers led by Amaury Sechet eventually carried out a hard fork and simply increased the block size to 8 MB - and thus a new coin called Bitcoin Cash was born. It was supported by such large exchanges as Kraken, Bitfinex exchange and Poloniex.

#8 – Chainlink

- Ticker: LINK

- Capitalization: $2,688,411,635

- Maximum number of coins: 1,000,000,000

- Coins issued: 350,000,000

- Rate: $7.68

- Release date: 2017

- Algorithm: ERC-20

Chainlink is another platform focused on working with smart contracts. The main idea of the developers was that smart contracts could interact with services that are located outside the blockchain. In other words, any centralized external system can be connected to the Chainlink blockchain via the API. The result is a blockchain and an external add-on to which third-party applications can connect.

The external part of the network has already been connected to Ethereum, Bitcoin and Hyperledger. In the future, developers are going to integrate the block chains of other cryptocurrencies. Google Cloud has become interested in a similar solution. On June 13, 2022, an article appeared on the site about creating a hybrid network using Chainlink. As a result, investors and traders became interested in cryptocurrency, and its price began to rise rapidly.

#9 – Ethereum Classic

- Ticker: ETC

- Capitalization: $727,736,191

- Maximum number of coins: 210,700,000

- Coins issued: 116,313,299

- Rate: $6.26

- Release date: 2016

- Algorithm: Dagger-Hashimoto

Ethereum Classic is a hard fork of the original Ethereum that occurred in 2016. The reason was the hacking of the investment platform The DAO. Then hackers illegally took possession of cryptocurrency worth $50 million. As a result, the reputation of the Ethereum network itself was under threat, and the ETH rate fell from 22 to 12 dollars. To rectify the situation, they carried out a hard fork with a rollback of blocks and returned the stolen funds to investors. This is the first hard fork in history to return stolen funds.

As a result, two blockchains were formed: in the first (Ethereum) there was never a hack and investors got their money back, and in the second (Ethereum Classic) the blockchain continued to exist without changes and the scammers were able to keep the cryptocurrency for themselves. The problem was that not everyone agreed with the rollback of the network, since the underlying concepts and standards of the blockchain were violated, leaving decentralization in question.

#10 – TRON

- Ticker: TRX

- Capitalization: $1,270,865,651

- Maximum number of coins: 100,850,743,812

- Coins issued: 71,659,657,369

- Rate: $0.017735

- Release date: 2017

- Algorithm: DPoS

TRON is a decentralized entertainment content platform that operates on a blockchain and uses the TRX cryptocurrency for internal payments. Network options include the ability to create and run your own applications. The author of the platform is an entrepreneur from China, Justin Sun. From the very beginning, his project attracted huge attention from traders and investors.

First of all, TRON is known for one of the largest ICOs. During the fundraising process from August 31 to September 2, 2017, the team managed to raise $70 million. Initially, the platform operated as an ERC-20 token based on Ethereum, but in the summer of 2022 TRON switched to its own blockchain.

Tether (USDT)

Tether cryptocurrency

Tether cryptocurrency is a coin that became the first stablecoin to gain popularity in the crypto world. This coin was started by the Realcoin project, launched in July 2014 by the vice president of the world famous company Starbucks. The idea was to create a cryptocurrency whose price would be tied to the dollar exchange rate. However, this cryptocurrency was not in demand, and therefore a complete rebranding was carried out after a couple of months. Immediately after this, Tether was added to one of the largest exchanges, Bitfinex.

Tether is one of the most controversial cryptocurrencies in the entire crypto world. The coin earned this reputation from the very beginning. The creators said that Tether and the Bitfinex crypto exchange were in no way connected, but later documents from the Paradise Papers surfaced, which confirmed the connection between the companies.

Another scandal is related to the fact that Tether Limited could not prove the security of tokens with fiat assets, since it never conducted open audits. And in the spring of 2022, information surfaced online that some of the coins were backed by Bitcoin.

Tether is a completely centralized cryptocurrency. The emission of tokens and verification of payments is carried out by Tether Limited, and to work with tokens you need to undergo verification.

However, despite all the shortcomings described above and the presence of promising competitors in the form of younger stablecoins, Tether still remains the leader in this category of cryptocurrencies. At the time of writing, the cost of one token is the required $1, with a capitalization of almost $3.4 billion. However, over the entire history of the coin’s existence, its value has varied between $0.91 and $1.06.

Tether (USDT) rate for its entire existence

// Source: Coinmarketcap

What are the biggest pumps that have happened over the past six months?

High trading volume does not ensure stable growth in asset values. Thus, from May 1 to July 24, bitcoins are traded in the range of $9,000-11,000. It is difficult to make money on such fluctuations, especially for beginners. You must have technical analysis, composure and the ability to place orders. To find out which asset is experiencing the greatest growth, we suggest paying attention to less popular coins that have surprised the community with rapid growth.

| № | Name | Min. in 2020 | Max. in 2020 | Profitability |

| 1 | Aave | $0.015209 | $0.442615 | +2810 % |

| 2 | Streamr | $0.005915 | $0.091738 | +1450 % |

| 3 | Swipe | $0.163598 | $1.87 | +1043 % |

| 4 | Synthetix Network Token | $0.360629 | $4.10 | +1037 % |

| 5 | Cyber Network | $0.184525 | $1.87 | +913 % |

| 6 | Hedera Hashgraph | $0.010187 | $0.076831 | +654 % |

| 7 | Numeraire | $4.65 | $34.43 | +640 % |

| 8 | Crypto.com Coin | $0.030243 | $0.147085 | +386 % |

| 9 | DxChain Token | $0.000884 | $0.002603 | +194 % |

| 10 | Dogecoin | $0.002136 | $0.005600 | +153 % |

#1 – Aave (+2810%)

- Ticker: LEND

- Capitalization: $374,660,300

- Maximum number of coins: unlimited

- Coins issued: 1,299,999,942

- Rate: $0.288200

- Release date: 2017

The Aave cryptocurrency operates on the Ethereum blockchain. It is used as a decentralized lending system. Through smart contracts, network participants can provide or take out loans. To ensure payment guarantee, users can leave ETH or LEND cryptocurrency as collateral, which will be paid to the lender in case of refusal to repay the loan. In the future, the developers plan to add new functions that will improve the scope of lending within the system:

- placement of ready-made proposals from creditors; crowd lending – several lenders can issue one loan within the framework of one smart contract;

- formation of a database for assessing lending risks based on artificial intelligence;

- building a reputation among community members.

The key was the USDT support that Aave announced in March. The stablecoin quickly became one of the most popular on the platform, with USDT loans exceeding 3 million in a matter of days. Rapid growth and the attraction of new users allowed the LEND token to set a new all-time high of $0.442615 in July.

No. 2 – Streamr (+1450%)

- Ticker: DATA

- Capitalization: $36,394,997

- Maximum number of coins: 987,154,514

- Coins issued: 683,943,835

- Rate: $0.053213

- Release date: 2017

Streamr Network is a scalable system for secure real-time data exchange. With its help, you can create an ecosystem of applications and services, combining your home computer, smartphone, smart home and car. Now the network operates on the Ethereum blockchain and developers continue to actively develop it.

In March, the value of the token was $0.005915, but already in May it reached $0.091738. In two months, the coin’s growth was +1450%. Such a strong jump occurred after the announcement of a partnership with the Binance cryptocurrency exchange in April. Note that the historical maximum of $0.338995 is still far away, so the token retains good potential for further growth.

#3 – Swipe (+1043%)

- Ticker: SXP

- Capitalization: $121,166,712

- Maximum number of coins: 299,969,953

- Coins issued: 65,982,752

- Rate: $1.84

- Release date: 2019

Swipe is a mobile application that allows you to buy, sell and spend cryptocurrency. Now the service allows you to manage 30 of the most popular digital assets, buy and sell coins using bank cards, and instantly convert funds. You can download the application from the Apple Store and Google Play.

In mid-March, the SXP cryptocurrency could be purchased for $0.163598. Later, the Binance exchange became interested in the project. On July 7, information appeared that the cryptocurrency trading platform was bought by Swipe and listed the token. After that, its price began to increase sharply and on July 24 reached $1.87. The most successful traders managed to earn +1043% on the transaction.

No. 4 – Synthetix Network Token (+1037%)

- Ticker: SNX

- Capitalization: $295,034,992

- Maximum number of coins: 194,959,122

- Coins issued: 89,036,116

- Rate: $3.31

- Release date: 2017

Synthetix Network Token is a protocol for providing liquidity for derivatives based on Ethereum. The platform allows you to create derivatives of fiat currencies, other cryptocurrencies, commodities and stock indices. The platform itself supports various trading functions: binary options, futures, etc. The project was launched back in 2017 and was originally called Havven (HAV).

In March, one SNX coin was valued at $0.360629. As tokens found use as collateral in derivatives trading, a “liquidity crisis” arose in the market. A similar situation occurs when no one wants to sell their cryptocurrency. Increasing demand and limited supply have led to the rapid growth of SNX. As a result, its price increased by 1037% and on July 20 reached $4.10 on some exchanges.

No. 5 – Kyber Network (+913%)

- Ticker: KNC

- Capitalization: $309,411,717

- Maximum number of coins: 210,506,801

- Coins issued: 194,948,959

- Rate: $1.59

- Release date: 2017

Kyber Network is a platform based on the Ethereum blockchain, which allows you to instantly convert digital assets - BTC, ETH and others. In other words, it is a decentralized exchange with high liquidity. For example, a user wants to pay for a hotel room with cryptocurrency and he only has ETH. The hotel only accepts currency in BTC. Through Kyber Network, the user will be able to make an instant conversion to the merchant's account and pay for the service.

At the beginning of the year, the KNC token was worth $0.184525. Gradually the price increased, but the key moment before the pump took place on July 7th. Then a network update called Katalyst was released, adding the KyberDAO platform. It allowed token owners to take part in the further development of the network, and the attractiveness of the coin increased significantly. As a result, the KNC rate rose to $1.87, and the growth of the token over six months was +913%.

#6 – Hedera Hashgraph (+654%)

- Ticker: HBAR

- Capitalization: $206,229,423

- Maximum number of coins: 50,000,000,000

- Coins issued: 4,942,186,082

- Rate: $0.041728

- Release date: 2018

Hedera Hashgraph is a decentralized ledger that was introduced by Lemon Baird in 2022. During the fundraising process, the project managed to raise $100 million. In September 2022, the HBAR token was listed on some exchanges and on average the cryptocurrency was purchased for $0.026605. However, investors began to quickly sell coins, which is why on September 25, 2019, the rate dropped to $0.026605.

In 2022, the minimum token price was $0.010187. However, already in February the price jumped by 654% and reached $0.076831. Increased interest in cryptocurrency began to be shown after developers announced a partnership with Google Cloud.

#7 – Numeraire (+640%)

- Ticker: NMR

- Capitalization: $54,055,777

- Maximum number of coins: 10,979,518

- Coins issued: 2,747,800

- Rate: $19.67

- Release date: 2017

Numeraire is an Ethereum-based platform designed to make stock market forecasts. The special feature is the integration of machine learning and the provision of simple tools to create your own algorithm. Forecasts are published publicly and can be backed by the NMR token. Leaderboards will help you quickly find the best trader.

In March, you could buy NMR for $4.65. However, at the end of the month, the digital asset began to rapidly increase in price. This is due to the emergence of the Erasure Bay platform - on the platform, participants could request information from other users, and ratings ensured trust in counterparties while maintaining anonymity. As a result, in May the Numeraire rate reached $34.43.

No. 8 – Crypto.com Coin (+386%)

- Ticker: CRO

- Capitalization: $2,884,072,886

- Maximum number of coins: 100,000,000,000

- Coins issued: 18,422,374,429

- Rate: $0.156553

- Release date: 2018

Crypto.com is a platform that allows you to pay with cryptocurrency for any goods and services anywhere. She offers to connect a cryptocurrency wallet to a bank card, providing instant conversion. The application for iOS and Android supports more than 55 digital assets and offers to pay with them without commissions or extra charges.

The peculiarity of this coin is that it ranks 9th on the list among digital assets by capitalization. Unlike other digital assets in our rating, the value of Crypto.com Coin increased gradually. If in March you could buy a token for $0.030243, then in July it is sold above $0.14. Gradual growth is no longer about increasing trading volume, but about delivering real value.

More than 23,000 users have rated the Crypto.com Android application. Mostly users leave positive reviews.

#9 – DxChain Token (+194%)

- Ticker: DX

- Capitalization: $142,265,878

- Maximum number of coins: 100,000,000,000

- Coins issued: 50,000,000,000

- Rate: $0.002845

- Release date: 2018

DxChain Token is based on Ethereum. It is a decentralized data processing and computing network that also supports machine learning. Beta testing began in 2022. Over time, developers added API and SDK libraries, integrated smart contracts, created an interface for programming on the blockchain, etc.

This year, the project experienced several important events. On March 1, the developers announced the launch of a trial version of DxChain Mainnet. Then investors paid attention to the project. On May 24, an article from Forbes about increasing blockchain spending mentioned the DxChain project. As a result, the cryptocurrency managed to set a new historical maximum of $0.002603.

#10 – Dogecoin (+140%)

- Ticker: DOGE

- Capitalization: $404,323,610

- Maximum number of coins: unlimited

- Coins issued: 125,569,414,697

- Rate: $0.003220

- Release date: 2013

The media started talking massively about the Dogecoin cryptocurrency after the price of the coin sharply increased by 140% in early July and reached $0.0056 on some trading platforms. All thanks to a video on the TikTok platform, in which the author urged people to buy DOGE in order to make money on its growth. As a result, the video collected more than 58 thousand likes and 4 thousand comments.

The initiative of one blogger grew into a real challenge - #DogecoinTiktokChallenge. TikTok users set a goal to reach $1 and urged people not to sell cryptocurrency. However, the market had its own plans. As a result, on July 17, the Dogecoin price dropped to $0.002995. The easiest and fastest way to buy dogecoin is to use instant exchanges

Summarizing

Today, the cryptocurrency market is actively developing. The positions of old players are strengthening, the scope of application is expanding, and new products are appearing every year.

Until 2013, the software of all altcoins was based on data from the open source code of the Bitcoin system. In July 2013, new blockchain platforms appeared with various functions - from online stores to stock trading programs. The list of areas in which blockchain is used is gradually expanding. For example, there are platforms for online trading or information support for production.

Cryptocurrencies and the blockchain system are the path of the global economy not only to complete security, but also to new technologies and transformation of daily operations.

Conclusion

After reviewing two different ratings, we can come to the following conclusions:

- With an increase in daily trading volume, it is more difficult for cryptocurrencies to demonstrate a sharp increase in value, however, such assets are characterized by increased confidence on the part of investors and traders and are better suited for long-term investment and storage.

- The value of tokens is constantly changing. Among the important growth factors are:

- Entering into partnerships with large companies can increase the value of digital assets several times. This is what happened to the Streamr Network token after the announcement of a partnership with Binance.

- Large-scale updates aimed at expanding functionality and attracting new audiences. A striking example is Aave, which with the support of USDT alone was able to significantly increase the amount of loans.

- Hype – mentions in the media or on social networks often unreasonably influenced the value of the cryptocurrency, artificially increasing demand. This year, the Dogecoin story served as an example. After a sharp increase in price due to TikTok videos, the value of the asset expectedly fell.

Ethereum (ETH)

The average market rate is about $300. Market capitalization is more than $28.6 billion.

Ethereum (or ether) was proposed by the founder of Bitcoin Magazine, Russian-Canadian Vitalik Buterin at the end of 2013.

It is an open software platform based, like Bitcoin, on blockchain technology (a chain containing all transactions). With its help, developers receive tools for creating a variety of decentralized applications without intermediaries. Examples can be seen here.

They are based on so-called smart contracts: applications operate in strict accordance with the initially established rules and algorithms.

This cryptocurrency is one of the most popular among miners today.

BitShares (BTS)

The average market rate is $0.27. Market capitalization: $708 million.

BitShares is an electronic crypto trading platform, a decentralized cryptocurrency market based on blockchain technology. BTS is the platform's built-in payment tool.

The network operates based on proof of stake rather than proof of transaction, as is the case with Bitcoin. The processes occurring on BitShares are controlled by the algorithm for launching decentralized autonomous companies (DAC - Decentralized Autonomous Companies).

A special feature of the platform is the absence of the usual risks for such trading platforms: theft, blocking of funds in the account, closure of the site, and so on.

Where to store altcoins?

If you decide to invest your funds in altcoins, you should take care in advance about the safe storage of your investments. Here are the main storage methods:

- Storing altcoins on a cryptocurrency exchange wallet. This opportunity is available on almost all exchanges. We do not recommend this option, as it may be unsafe, because the exchange may suddenly close or be subject to a hacker attack. In this case, it will be almost impossible to return the funds. The exchange is more suitable for short-term storage or trading.

- Storing altcoins in a crypto wallet. At the moment, there is a large selection of wallets for the most popular cryptocurrencies. For your convenience, you can choose one of the options: web wallets, mobile wallets, desktop wallets, browser extensions and hardware (cold) wallets.

You can read our reviews of cryptocurrency wallets:

- wallets for Bitcoin,

- multi-currency wallets with support for a large number of tokens.

Many of the wallets listed in the reviews are multi-currency and support dozens of different cryptocurrencies.

NEM (XEM)

The average market rate is $0.17. Market capitalization: $1.55 billion.

NEM (New Economy Movement) was developed in Japan using its own open source code and with the support of the operator of the largest Japanese cryptocurrency exchange, ZAIF. NEM is a cryptocurrency and technology platform.

A special feature of NEM is the use of the POI (Proof of Importance) algorithm. Determining the user who will generate the next block depends not only on its share (as is the case with other cryptocurrencies), but also on activity - the number of transactions completed. In this way, developers discourage hoarding and encourage the use of NEM as a currency.

The process of mining - creating blocks - is called harvesting (from harvesting - harvesting). The developers have set the minimum wallet size for faucets to 10,000 XEM.

The number of XEM coins is limited to 9 billion. The developers do not plan to conduct an additional issue.

Litecoin (LTC)

The average market rate is about $40. Market capitalization is more than $2 billion.

Litecoin is a cryptocurrency created by former Google employee Charlie Lee in October 2011 as an “evolution” of Bitcoin and based on its open source code.

The maximum amount of Litecoin that can be mined is 84 million (there are currently over 51.7 million units). The mining algorithm for this cryptocurrency is similar to Bitcoin. However, blocks for which rewards are paid are formed four times faster in Litecoin.

What do you need to know before investing in altcoins?

An inexperienced investor can easily become overwhelmed by the wealth of alternative cryptocurrencies to choose from. As a result, he will either invest money in some scam project, or will not pay attention to alts at all, investing everything in Bitcoin.

In the first case, he will simply lose money. And in the second, not wanting to buy an altcoin that will soon rise in price, he may miss the maximum benefit and wait a very long time for the price of digital gold to soar.

However, the second option is not at all hopeless, the cost of the BTC cryptocurrency will increase, but by successfully investing in alts, you can earn more and much faster. In this case, you should pay attention to the following criteria:

- Goals of creating cryptocurrency and technical parameters. If you want to invest in a particular project, read the white paper and roadmap, evaluate the prospects.

- The reputation of the founders and partners of the project.

- Liquidity of the coin on exchanges.

- Reviews on social networks and comments from recognized experts.

And most importantly, weigh the risks and do not go into debt, counting on quick profits. Invest exactly as much as you are afraid of losing.

IOTA (MIOTA)

The average market rate is $0.38. Market capitalization is more than $1 billion.

This is a new project different from other cryptocurrencies: the creation of an exchange network for the Internet of Things (Internet of Things - a computing network of physical objects with built-in technologies). IOTA appeared on exchanges a few weeks ago.

The basis of cryptocurrency is not a traditional blockchain (in this case there are no blocks as such), but Tangle technology, which allows you to make transactions without payments.

The peculiarity of cryptocurrency is that the user cannot carry out a transaction without checking the two previous ones. Thus, it helps to increase network security.

The emphasis in this scheme is on conducting micro- and even nanotransactions without any commissions (which, as is known, can be more than the transfer itself). The incentive in this case is the use of the network itself: the more often the user does this, the more checks occur and, accordingly, the higher its efficiency.

It is stated that IBM and Qualcomm Inc. actively studying and testing solutions based on IOTA.

How to assess the prospects of investing in a specific altcoin?

The cryptocurrency market is very unstable. All this is because the first coins appeared only recently and simply did not have time to stabilize. In addition, most coins are not backed by anything, just like their progenitor - Bitcoin. But the market is emerging, and people are increasingly thinking about investing fiat money in digital money.

But it should be remembered that a wrong investment can cost the investor huge losses. Even Bitcoin, the most stable cryptocurrency at the moment, has problems with price fluctuations. However, the high volatility of altcoins is their main distinguishing feature. You can play on this to make money, which is what traders do.

Although, by studying certain trends, it is possible to identify altcoins that are more or less stable. To make the right choice, the following factors must be taken into account:

- Market capitalization . If a coin has a low price, the altcoin is more subject to speculative influences, so the rate can often jump. With Bitcoin, it is much more difficult to speculatively carry out an artificial price jump due to its record high capitalization. But we are not saying that this is impossible. Today, fluctuations in the Bitcoin exchange rate are a common occurrence, and cryptocurrencies with large capitalization may be subject to exchange rate fluctuations, as they are affected by other factors;

- Availability of large coin holders . If someone has 1% or more of the total number of altcoin crypto coins, he can really influence the rate. That is, if an altcoin has many wealthy cryptocurrency holders - “Whales”, they can have a significant influence on trading platforms. The way it works is that when “Whales” buy a lot of coins, they create a hype around the currency and its price rises. And when the rate soars, the “Whales” sell a large number of coins, due to which their price falls, and the “Whales” make a profit. This is how the Pump and Dump of the cryptocurrency rate are formed;

- Possibility of long-term investment . To avoid the risk of Pump and Dump, you can look for coins that are favorable for long-term investments. That is, they must demonstrate a positive trend in the market for a long time. Of course, this is very risky because cryptocurrencies are generally unstable, but it is possible to find alts with positive dynamics;

- Community . It is desirable for a cryptocurrency to have a large community that can influence the decisions made by developers;

- High liquidity on exchanges . The more and more actively exchanges work with altcoins, the better;

- Developers . Of course, all cryptocurrencies have developers, but now we are not talking about their actual presence, but about the actions of developers to improve the functionality of coins.

In addition, when investing in cryptocurrencies, you need to know a few rules:

- Avoid hype that is promoted by some communities.

- Investments should only be made in coins that are familiar to you. If you don't understand what an altcoin is, investing in it is unwise.

- Never make an investment if you can't afford it. Be smart about how much you can invest so you don't lose all your money.

- If possible, invest in multiple currencies.

Where to buy altcoins?

To purchase altcoins, you need to register on a cryptocurrency exchange and top up your balance using bank cards or an electronic payment system.

The most reliable exchanges with the highest cash turnover; for several years now, the largest cryptocurrency exchange in the world has been Binance. The Binance platform is the most popular crypto exchange in the CIS, as it has maximum trading volumes and supports transfers in rubles from Visa/MasterCard bank cards and payment systems QIWI, Advcash, Payeer.

Especially for newcomers to the cryptocurrency market, we have prepared a detailed guide: How to buy Bitcoin on a crypto exchange for rubles?

Rating of TOP 5 cryptocurrency exchanges for 2022

| # | Cryptocurrency exchange | Official site | Site assessment |

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.5 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | Yobit | https://yobit.net | 6.3 |

| 5 | OKEx | https://okex.com | 6.1 |

The criteria by which the rating is given in our rating of crypto exchanges:

- Reliability of operation

- stable access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the period of operation on the market and daily trading volume. - Commissions – the amount of commission for trading operations within the platform and withdrawal of assets.

- Reviews and support – we analyze user reviews and the quality of technical support.

- Interface convenience – we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Features of the platform are the presence of additional features - futures, options, staking, etc.

- The final score is the average number of points for all indicators, determines the place in the ranking.

What is Altcoin?

In simple words, alcoins are all cryptocurrencies except Bitcoin. The first virtual coin Bitcoin, created in 2008 by the legendary Satoshi Nakamoto, remains unique and inimitable, but progress cannot be stopped and, inspired by the success of the first blockchain project, cryptographers began to develop alternative payment networks. They strive to make cryptocurrency payments even faster and more reliable, introduce innovative technologies into all spheres of life, and transfer the global economy to cyberspace.

This is how modified digital coins appeared, having different purposes. They use their own unique blockchain networks for their work, and are not copies of the first cryptocurrency. Of course, there are virtual coins that arose as a result of a branch of the main Bitcoin chain, that is, modified copies, or as they are also called hard forks, but this is still a separate category. We are now talking about completely new resources created on an individual basis.

Formally, altcoins do not depend on the state of affairs of the main cryptocurrency BTC; their value is regulated by the law of supply and demand. But this rule partially works for well-known and well-promoted blockchain projects. Young cryptocurrencies and underdeveloped systems that have failed to withstand competition and occupy a worthy niche in cyberspace react harshly to fluctuations in the exchange rate of digital gold - Bitcoin. However, to one degree or another, Bitcoin volatility affects the entire cryptocurrency market.