Cryptocurrency is not the usual ruble or dollar (so-called fiat, or fiduciary money). It is not part of the banking system, so it has its own characteristics. Crypto money on the Internet cannot be controlled; it runs on open source software, using cryptography and a peer-to-peer network. The difference between cryptocurrencies and real money lies precisely in the decentralized system. The data operates using a distributed network; it is based on the principle of equality of each participant. To ensure the immutability of the transaction block base, participants use cryptography (for example, a digital signature).

Thanks to the increased demand for Bitcoin and its open source code, clones have been created. What new cryptocurrencies emerged in 2017? We will answer this question and note that a significant role in the market belongs to altcoins - alternatives to Bitcoin that appeared after the creation of the first cryptocurrency.

#1 Bitcoin

The first position is rightfully occupied by Bitcoin, a cryptocurrency that has remained the most popular since the first days of its existence. Today it is considered the most popular in the world and is used as a synonym for the word “cryptocurrency”. Bitcoins benefit from the following indicators: they are anonymous, not controlled by any state, not subject to inflation, etc. All kinds of cafes and restaurants, as well as online stores, use bitcoin to pay for goods and services, which makes the currency universal, because it can perform most functions , familiar to ordinary money.

Is it worth starting mining in 2022 and how do you make money?

To understand whether the game is worth the candle, you need to understand what is currently happening in the world of mining. At the beginning of 2022, there was a boom in this method of earning money. Everyone was eager to buy the best video cards and literally swept them off store shelves or bought them online. Their prices soared, but the income still covered the costs.

Towards the middle of 2022, there were more and more people wanting to earn money and start mining. And the most interesting thing is that their expectations were justified. Almost everyone remained in the black and earned a lot of money from their farms. But, as you know, where there is potentially high and stable income, there are also investors, and very large ones at that.

Is it worth starting mining in 2022 and how do you make money?

Entire companies or private investors, funds purchased countless numbers of video cards and built their farms. They could not be compared with those that an ordinary user tried to make at home. Therefore, a lot of large competitors appeared on the market - investors with their farms, who took the lion's share of the profits from mining for themselves.

And this trend continues today. If you are interested in cryptocurrency mining 2022, where to start is by studying the market, trends and number of competitors. In general, you can’t do without analysis. There is no point in thoughtlessly purchasing equipment and spending money on very expensive video cards. All risks and possible profits should be calculated in advance. Further in the article we will help you figure out how to do this correctly and where to start.

How is income distributed in mining, how much can you get in 2017 and 2018

How is income distributed in mining, how much can you get in 2017 and 2018

How much can you earn from mining in 2022 with a farm of any size? The answer to this question is very simple, without even going into detail about how much was invested in the equipment. To do this, let’s look at the very scheme of calculating rewards from the system for a successfully processed and mined block:

- Quite a lot of users with different equipment are involved in mining, processing and adding a new block.

- When adding a new block, the reward from the system for this is fixed.

- The reward is distributed among all participants (users) who took part in the mining and processing of one block.

- As a rule, money is distributed in proportion to who spent how many resources to process the block.

- The more participants mine a block from their computers, the less each of them will earn. Simply put, the income is distributed among a large number of users. Previously, a much smaller number of people took part in mining, and therefore their profits were higher.

- The more popular mining becomes among users, investors, and companies, the less each of these players will earn in the future and in 2022. If someone just wants to start such a business, then it will be much more difficult for them.

The number of miners in 2022 has increased

If earlier mining was extremely profitable, now it can be called simply profitable. It is not yet unprofitable or a way of earning money that does not bring money. Just in 2017 and next year you can still make a profit from mining.

How to get higher income in a “pool” with other miners

Smart market participants realized that it was better to join forces to earn more bitcoins or other cryptocurrencies. And they still need to simultaneously confront giants - investors or companies with powerful farms. For these purposes, ordinary users simply join groups called pools. Together they mine 1 block and distribute the profits among themselves. More precisely, this is done by the system itself or the platform on which they registered.

How to get higher income in a “pool” with other miners, where to start in 2017

If you analyze all these facts and “moves”, it is clear that mining in 2022 and subsequent years has no longer become just a type of income. This is an investment in which you need to analyze, build strategies, take risks, team up and even play. And the most interesting thing: it will be more difficult further, and only the largest players will “survive”. To compete with them, you will need to properly invest your money in mining, in the technology itself, and in cryptocurrency. How to do this correctly is described below.

#3 Litecoin

This is a currency that has proven itself to be one of the best alternatives to Bitcoin. Litecoin is one of the first currencies to follow in the footsteps of Bitcoin, and therefore they are similar in many ways. Its main, but not the only, feature is the high speed of transactions.

In addition, the currency has a number of less remarkable characteristics:

- provides anonymity in the system;

- has decentralized management;

- limited emissions.

How to buy new cryptocurrencies

For beginners, it is advisable to use the Dollar Cost Averaging (DCA) strategy. This is an acquisition of an asset for a small amount; it is recommended to do everything in parts. The advantage of the strategy is that you don’t need to follow the news about what’s happening with Bitcoin. With long-term investments, the average entry amount will fluctuate evenly.

The main goal of the DCA system is to reduce risks. This method is far from the most profitable, but we use it to start shopping, since it is difficult for beginners to predict the course of market development. Purchasing in parts at different times helps protect against fluctuations.

To choose a profitable cryptocurrency for yourself, you need to constantly study promising projects. Without conducting high-quality analytics, you can lose all your investments, because trading is associated with high risks.

#10 Zcash

The ranking is completed by a decentralized open-source currency. The youngest on the list, was released in 2016. Zcash offers its users to use a new cryptographic method of information encryption, which was developed by the company for conducting “shielded” transactions.

Each of the currencies presented in the TOP-10 rating has its own characteristics. Not a single cryptocurrency, even Bitcoin, can do everything at once. Some focus on anonymity, others on security, while others offer a system with a strong encryption algorithm, transparent transactions or a presentable exchange rate.

Where to look for new cryptocurrencies

A lot of useful information is posted in thematic Telegram chats. It is convenient to post data for viewing there, as well as publish ratings and selections of assets.

New cryptocurrencies

Information about new cryptocurrencies in 2022 is also posted on websites. To search, just enter a query into Google.

The latest information is also available on analytical portals for traders. The choice is wide - the novice investor himself must find a suitable site, based on his own preferences, as well as planned earnings.

Polygon (MATIC)

- Current rate: $1.12

- Market capitalization: $11.184 billion

- Rating position: 21

Polygon is a platform designed to develop the Ethereum infrastructure and scale it into a multichain. In other words, it helps connect blockchains that are compatible with Ethereum. The project started in 2022, it has a native token - MATIC.

The global blockchain summit will take place in Dubai from October 13 to 14. One of the speakers will be Polygon co-founder Sandeep Nailwal.

MATIC has been trading inside a descending wedge since September 5th. The price rebounded from the support line formed by the lower border of the wedge at $1.06. This happened on September 21st. Then a double bottom appeared on the charts, and now the price is trying to make a breakout.

In this case, the nearest resistance is at $1.48.

TradingView Chart

Bitcoin (BTC)

Rank: №1

Current price: & nbsp; $65,300

Market capitalization: $1.23 trillion

Year of launch: 2009

Bitcoin is the longest-running cryptocurrency on the market, has the highest price and market capitalization, and its closest competitor has just over 1/3 of Bitcoin's market capitalization. The global cryptocurrency market is hugely impacted by any price changes in Bitcoin, given its 45% market dominance. It is a peer-to-peer digital currency that is already accepted by thousands of merchants and websites, including Visa, Mastercard, Tesla, JP Morgan and many other global banks. The adoption of Bitcoin in El Salvador has become an iconic example demonstrating the potential of BTC as an alternative payment solution to the existing fiat system.

October was an exciting month for Bitcoin as the first BTC ETF went public on the New York Stock Exchange. Consequently, on October 20, BTC prices skyrocketed to a new ATH of $66,930 (from a low of $47,045 in October). In October alone, the price increased by more than 42%. The coin is still basking in ETF glory and is expected to continue its upward trend next month after stabilizing around $60,000 after rising.

Since the launch of the ETF, a total of $1.5 billion has been recorded as inflows from crypto funds, fueling the growth of the entire crypto economy. Another important development is that the Australian government has given the green signal to Bitcoin and Ethereum ETFs, paving the way for BTC even further. &Nbsp; & nbsp;

Bitcoin could become a viable investment this November, an extended boom period since October. It is necessary to understand the volatility associated with BTC and consider it as a long-term investment direction.

Cardano (ADA)

Rank: #6

Current price: $2.13

Market capitalization: $70.80 billion

Launch year: 2022

Cardano, one of the first Proof-of-Stake blockchain platforms, enables faster and cheaper transactions and requires comparatively less energy to complete a transaction. It strives to be more adaptable and secure.

ADA is used by agricultural companies, educational institutions and supply chain management companies to improve the efficiency and transparency of their businesses. In September, Cardano went through an Alonzo hard fork, bringing the smart contracts feature into its purview. Within 24 hours of launch, more than 100 smart contracts were deployed.

The announcement of the launch of a hard fork led to a 116% increase in Cardano prices. It has been missing its ATH of $3.10 for some time and has been tracking a downward move for many days. However, the downtrend appears to be strong and we can expect Cardano to reverse this trend in November. As investors, you can profit from the “buy low, sell high” mantra by investing in ADA.

Mining on a processor: progress of settings

Almost all types of cryptocurrency can be mined on a processor.

However, this will not be beneficial in every case. If you choose this method, you should choose the best cryptocurrency for mining on the processor.

Important: mining requires a powerful processor. In addition, the cryptocurrency mining program heavily loads the computer, so it’s unlikely to work in parallel.

Difficult choice... One of the recommended options in this case is Primecoin.

In practice, mining such a cryptocurrency will look like this.

- Installing a primecoin wallet. You need to download the appropriate software and get your wallet address.

- Downloading the miner.

- Generating a bat file to launch the program (more on this below).

- Save the document and launch.

After completing all these steps, the mining process will start.

back to menu ↑

What types of mining can a beginner master in 2022, where to start with a small budget

Cloud mining in 2017

If you don’t have enough capacity to independently mine cryptocurrency and process blocks, then it’s better to team up with other participants in the system. This association is called a “pool”. Then the commission is distributed proportionally among the wallets of all pool participants, based on the capacity and costs that they put into processing the block. There are special services and platforms for mining in pools.

Another way to earn money is also suitable - cloud mining. These are services where you can rent equipment if you have your own Internet. Of course, a fee must be paid for such rent. If there is no capital for mining, then in 2022 it is better to start with its cloud version or work in pools. There are also faucets - sites where only Satoshi are awarded for basic online work, for example, entering a captcha. But this is a “completely different story” with much lower profitability.

Join our group on VKontakte

IOTA (IOT)

The specialization of this cryptocurrency is secure communication and payments between Internet of Things gadgets. IOTA emerged in 2015, and in a short time it has gained a lot of followers.

Unfortunately, it is not possible to mine IOTA. There are exactly 2,779,530,283 coins and their number remains constant. Cryptocurrency can be purchased on various exchanges, and this will be a good investment. After all, since the start of trading in July 2022, its price has increased from $0.63 to a peak value of $5.4 by the beginning of December 2022, demonstrating an almost 9-fold increase in less than six months. At the same time, there are prospects for further increases in price, as Volkswagen, Samsung, Cisco, Bosch and many other large corporations are showing interest in IOTA.

Preparing to launch the miner

So, let's go back to creating the bat file. The text document must reflect:

- The name of the miner that will be launched on the computer (for example, primeminer_xexe).

- Pool address (poolip=176.34.128.129).

- Pool port (poolport=1337).

- User identification number (pooluser=ХХХХХХХХХХХХХХХХ).

- The number of processor cores that will be used by the miner. In order to be able to work on your computer in parallel with the mining process, you should limit the number of cores (genproclimit=3).

- The amount of deductions as a percentage of the funds received is assigned voluntarily (poolfee=5).

When the text document is ready, it needs to be saved and renamed (ХХХХ.bat).

It is placed in the same folder where the miner is located. All that remains is to run the file on the processor.

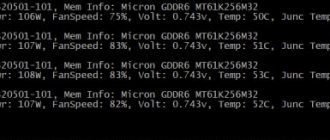

If all the data is entered correctly, the program will start working and a black window will appear on the screen.

Is it possible to mine cryptocurrency on a video card? Actually, yes.

If we talk about the ratio of performance and cost, the best option would be Radeons 5870, 7870, R9 270X.

To achieve better performance, it is better to give preference to the Radeon R9 280X option.

back to menu ↑

Segment analysis

In the segment of the 100 leading cryptocurrency projects, applications have the largest decline in overall market capitalization. As of August 29, the total market value of digital coin projects reached $1,192.8 billion, down 0.73%. The average market value of digital coin projects reached $23.8 billion, down 0.73%.

The total market value of platform projects reached $581.7 billion, an increase of 0.52%. The average market capitalization of platform projects reached $24.2 billion, an increase of 0.52%. The total market value of application class projects reached US$198.4 billion, down 0.89%. The average market capitalization of application class projects reached $8.34 billion, an increase of 2.64%. The total market value of asset-backed token projects reached $66.9 billion, an increase of 1.38%. The average market value of asset-backed token projects reached $33.4 billion, an increase of 1.38%.

Figure 1. 4: Capitalization of the market segment of the TOP-100 cryptocurrencies

*in billion US dollars

Figure 1.5: Average market capitalization of the TOP100 Cryptocurrency segment

*in billion US dollars

The distribution by market segment among the top 100 cryptocurrencies remained stable. As of August 29, among the top 100 projects, the number of coin class projects, platform class projects, asset-backed token class projects and the number of application projects remained the same. The largest overall market capitalization by segment continued to be held by coin projects, which accounted for 58.47% of the total market capitalization of the top 100 projects.

Figure 1.6: Coefficient of the TOP-100 cryptocurrency segment

Figure 1.7: Market share of the TOP-100 cryptocurrency segment

Where to start in mining in 2022 and how to get super profits: all strategies

Most people imagine classic mining as the extraction of cryptocurrency on their farm with a certain number of video cards. You connect the program, start the equipment and wait for the bitcoins to start pouring in. Yes, this was true before, and users even made big profits without doing much of anything. The costs of equipment and video cards paid for themselves very quickly. But now the income has decreased significantly, as described above. So, what is next? Mine cryptocurrency again and immediately sell it?

Where to start in mining in 2022 and how to get super profits

Of course not. Now simply mining and immediately selling bitcoins is considered a thankless and not particularly profitable task. Profitability is not the same as before, and by the end of 2022 and at the beginning of 2022 it will generally decrease even more. So what to do with your farm and purchased video cards? But you just need to “brain it out” and “start putting your eggs in different baskets.” This principle applies to investments, finance, and, of course, mining. To do this, you should invest savings in all types of mining and more.

Choosing the right mining strategy in 2022 and in 2022: example with calculations

How to invest your money if you like cryptocurrency mining 2022 where to start for an ordinary user? And you need to invest your money in several directions. More precisely, mining should be perceived not only as creating blocks on your farm, but also as a completely different way of mining bitcoins and, accordingly, money:

- We begin to forecast our possible income and expenses, and analyze different options.

- Let’s say for $2,000 a user can purchase equipment to make money from mining. But for the same money he can buy a certain number of coins. Let's denote them as “x coins” (x bitcoin coins).

- Next, the user must predict and calculate how many coins he will earn on his equipment purchased for the same money - $ 2,000. Let's say he calculates that in a year he will have 1.8*x coins or 1.8x coins. This is 1.8 times more than if he simply bought $2,000 of the same coins. After all, when purchasing, he would receive x coins, and when mining after six months - 1.8 x coins.

- The situation can also turn out the other way around, when buying will be more profitable than mining. But we should always consider both cases with the same initial capital. In our case it is 2000 dollars.

We choose the right mining strategy in 2022 and in 2022, we carry out calculations

So, the user realized that when mining he would receive 1.8 more coins than when purchasing them. He rejoices and agrees to simply mine and create blocks on his farm. But what mistake did he make? He did not take into account:

- Your associated costs: variable and fixed costs. It is clear that the constant costs will be the cost of electricity and, possibly, the purchase of more powerful, new video cards and chips. Variable costs can be anything, for example, purchasing a new keyboard, spare parts, etc. You need to sum up all these expenses and subtract from the possible profit - from 1.8x coins. Perhaps, given this, he will receive from mining in 2022, if he has just started earning, only 1.5x coins.

- And if in six months there will be one and a half, two or even 3 times more market participants. Then their total profit will become the same number of times less. Here the user has two forecasting options. The first is to buy new, more powerful equipment to generate more or at least the same amount of income. But this is another additional cost. This means that something else needs to be subtracted from 1.5x coins, and, for example, you will get 1.2x coins at the end of 2017. The second option for unfolding events is to simply go with the flow and continue mining with old equipment. But with a larger number of participants in the system, earnings will be less, and can also be equal to the same 1.2x coins, or even less.

- Force majeure, external factors, new global trends, cryptocurrency rate collapses, etc. They will also take a certain amount of coins, which is why the earnings will drop to the same x coins. It turns out that the user would earn the same amount, and maybe even less, if he simply bought the cryptocurrency for those $2,000.

Should the calculations given above be considered correct? No, these are just forecasts. Perhaps in 2022, those who have just decided to start will be able to earn more by mining than by buying cryptocurrency and its subsequent sale. There may be such a forecast. What to do then, where to start? And you need to start with calculations and analytics: determining cost items, possible profits (profitability), risks and more. A detailed example is given below.

In which mining areas should you start investing money in 2022 and not go broke?

In which mining areas should you start investing money in 2022 and not go broke?

How to “put your eggs in different baskets” in order to minimize risks and make a profit. If you like cryptocurrency mining 2017, where to start then? You need to invest money in different areas:

- We spend part of the money on buying equipment and mining on it.

- We spend part of the funds on buying bitcoins. We are waiting for the rate to increase and “merge” all or part of the coins.

- If desired, we invest part of the money in new projects related to cryptocurrency and the technology itself. For example, these are “ICOs”.

- If you have the skills of a trader, then we try to deposit a small amount on one of the cryptocurrency exchanges to start trading bitcoins.

The last two methods are risky and require special knowledge and careful fundamental and technical analysis. But if you are interested in only one direction from the four above, then you should not go against your will and invest start-up capital in all options. Then it is important to calculate everything in only one direction, make an analysis, forecast and start working in 2022.

We calculate all the risks in 2017-2018 before starting mining

Calculating risks is also an important step before starting mining in 2022 and 2022. You need to understand that it will not always be possible to receive the same level of income. Someday it will be smaller, someday it will be larger. These are the very investment and financial risks. But for those who decided to start mining in 2017, the risks were practically avoided. Perhaps they were, but this did not prevent them from making a profit, and sometimes quite a lot.

The higher the stakes and risk, the higher the profit and, accordingly, the profitability of mining in the future. But at the same time it is necessary to invest as much as possible. In other words, the more equipment, chips and video cards you buy, and, most importantly, productive ones, the more money you can get.

We calculate all the risks in 2017-2018 before starting mining

In mining in 2022, these rules still apply. But you shouldn’t forget about risks either, they are always present. If something happens, one incident can affect income and significantly reduce it. Since there is no insurance in this business and type of income, you can lose a lot of invested capital or even all of it. To prevent this from happening, you need to competently build an investment strategy, that is, correctly “put your eggs in baskets, and not leave them all in one.” How to do this was described in detail above.

Therefore, there are two types of earnings in this area:

- Efficient mining.

- Effective investing in cryptocurrencies.

If you combine both of these directions, you can achieve great heights in earnings on bitcoins and blockchain. If you like cryptocurrency mining 2022, where to start this year, what equipment is best to purchase is described below. But you definitely can’t do without the above strategy and several areas of investment. If previously users received acceptable fees from mining blocks alone, now this is not enough. Something more is needed, and it consists of investing in several areas related to cryptocurrency at once.