They may not be a salvation from the economic crisis, but they look more than attractive as an alternative to regular money. In particular, the difference between cryptocurrencies and fiat money is their decentralization. At least, the most popular crypto coins have this property. But the list of existing cryptocurrencies is constantly expanding. Every year hundreds of new coins appear on the market. True, most of them are not competitive and quickly burst, but there are coins that become hits and only grow in price every year.

Today, if we consider the list of all cryptocurrencies, we can count about one and a half thousand, 900 of which are in stable, albeit not always high, demand. Don’t be surprised, but in addition to Bitcoin, the developers have released many more coins for payments on the Internet. At first, in real life, new money has practically no weight, but as interest in it grows, the currency can be exchanged in special exchangers, receiving benefits.

When considering what cryptocurrencies exist, we can highlight several general rules:

- Decentralized, that is, not controlled by anyone;

- Centralized ones, which, as a rule, burn out quickly;

- Gaming, used for calculations in online games and more.

The list could take a long time, since each newly appeared virtual coin has its own peculiarity. Of course, sometimes almost complete clones of popular coins appear on the market, but these do not last long. And users have warmly accepted the changes in the financial world, which has contributed to the need for a more thorough review of virtual money.

Cryptocurrency market overview

New types of cryptocurrencies appear almost every day. The total number of cryptocurrencies in the world is more than 1,300 and is constantly growing, so it is quite difficult to calculate how many cryptocurrencies there are. But, as already mentioned, they are classified. Classifications may vary. Considering the economic situation of these coins, the following types of cryptocurrencies can be distinguished:

- The first ones are the gaming ones. There are the most of them, since they are used in games to pay for player actions, as a reward for in-game achievements, and for internal use in the game. In particular, these coins can be used to buy equipment, additional lives, etc. As a rule, this type of coin is not used by a wide audience and does not have a high price;

- Commercial or market. These are the most popular cryptocurrencies at the moment. Their appearance is associated with speculation on stock exchanges, and that is precisely why they were created. Their main goal is to take the place of Bitcoin. Although this has not yet happened, some attempts have been quite successful;

- Money tied to the platform. Also popular coins on the electronic money market. They may well become leaders, but still give way to commercial options.

Their popularity also depends on the characteristics of cryptocurrencies. For example, there are groups where the number of coins is:

- Limited;

- Not limited.

The first is Bitcoin.

Its monetization is limited, although the principles of such resource distribution depend on many factors, in particular on the desire of the developer. But when reviewing cryptocurrencies, bitcoins are not singled out as a separate category. The fact is that this is the first digital currency, and thanks to a high-quality system for increasing demand, it will most likely not be supplanted by any other financial unit. Even taking into account the high rate of generation of new products. A review of cryptocurrencies today, at the end of 2022, shows that this market will no longer be able to close. Coins appear at a catastrophic rate. Some occupy a place next to the leader for a long time, while others disappear after a couple of months, or even days. But in any case, we will discuss the list of leaders today, because we need to sum up the results of 2022 in the world of digital money.

Official cryptocurrencies

The legal status of cryptocurrencies depends on the specific legislation of each country. In a number of states, they are an official investment asset or commodity, and therefore are subject to taxation. For example, in Japan and Germany, Bitcoin is a current payment instrument on a par with bank cards and cash.

A number of other countries have legal restrictions on cryptocurrencies. In China, transactions with cryptocurrencies can only be carried out by individuals; this is prohibited for companies, including banks.

At the same time, in Russia the status of Bitcoin is not fully regulated. There is no concept of “cryptocurrency” in the legal field. However, in 2022, changes occurred in the Civil Code - the term “digital assets” was introduced. Meanwhile, the most anticipated law “On Digital Financial Assets,” which was supposed to determine the status of cryptocurrencies in Russia, was never adopted.

Bitcoin - BTC

When considering the main cryptocurrencies, one cannot ignore the most famous of the known cryptocurrencies. It’s probably not hard to guess that we’re talking about bitcoin (btc). So, let's look at the features of this coin, because it is not only the first digital financial unit, but also the only coin that managed to achieve such tremendous success.

- Bitcoin is a peer-to-peer payment system. Simply put, neither the state nor any economic structures can influence it;

- Bitcoin is open source, which makes the system unique because it can track all actions - from the first to the last. By the way, almost all modern digital coins operate on the basis of the same open code;

- The system has a limited number of coins. You won't believe it, but the leader of the world cryptocurrency has only 21 million coins. In order to obtain the status of a currency, or rather, to have the right to be called one, it was decided to divide each Bitcoin into Satoshi. So, one satoshi is 10−8 bitcoins. This fragmentation system made it possible to significantly expand the number of monetary units and make the system more stable;

- In the blockchain system, despite its complete openness, anonymity is maintained. Users store their data as if in transparent boxes, but only the person who has the access code to their box knows who owns it;

- Transactions in the system are irrevocable. That is, if a transaction is confirmed by at least one block of the blockchain, it will be impossible to revoke it. If the transaction is not confirmed, there is an opportunity to return your bitcoins. But you will have to check whether the transaction is stuck on the network, because sooner or later it will be carried out when its initiator no longer wants to send money;

Bitcoins can be transferred within the network, without the use of intermediate servers or other auxiliary tools. That is why such transactions are as safe as possible, of course, if both parties are confident in each other.

In order to become the owner of the Bitcoin cryptocurrency, you just need to follow a few simple steps in the Matby online exchanger. The entire purchasing process will take no more than 10-15 minutes. For a more detailed explanation, the project owners have prepared detailed video instructions. After purchasing cryptocurrency, it can be left for storage in Matbi, or sent to another cryptocurrency wallet. In addition to Bitcoin, you can buy Litecoin, Dash and Zcash in Matbi.

The following advantages can be identified in the work of the Matbi service:

- 24/7 customer service support,

- instant processing of applications,

- favorable rate,

- multi-currency service,

- high level of security, since confirmation of all actions is carried out via SMS, Google Authenticator and PIN code,

- ability to track transactions and their current status,

- a wide range of methods for depositing and withdrawing funds,

- built-in wallet for storing cryptocurrencies in secure “cold” storage.

In general, it is not surprising that the popularity of Bitcoin as a cryptocurrency is only growing in the world. Today the rate fluctuates around 17 thousand dollars, and this is an almost unattainable mark for most other currencies. In addition, it should be replaced that Bitcoin is constantly updated. The year 2022 has become a real breakthrough for the coin.

- The rate has increased. If the year began with a rate that barely reached a thousand dollars, today it is 17 thousand. This is a colossal leap.

- The latest version of Bitcoin 0.15.1 has been released. This happened in November of this year, when the coin’s exchange rate began to rise sharply.

- In August of this year, developers changed the structure of Bitcoin, resulting in a fork of Bitcoin called Bitcoin Cash. That is, this coin developed together with bitcoins until August, but after the fork it became a separate unit with an incompatible structure.

Brief historical background

The term “cryptocurrency” began to be actively used after the advent of the Bitcoin payment system.

The very first such platforms appeared in the last century. For example, David Chom's DigiCash system was founded in 1990. It was centralized, i.e., based on 1 device, which made it vulnerable to external attacks.

On August 18, 2008, Satoshi Nakamoto (still unknown, perhaps a group of people) published the “Bitcoin Manifesto” - a document that described the basics of blockchain technology and the new currency that functions with it - bitcoin.

Blockchain is a database that stores information about all operations of each participant in the system in the form of a chain of blocks. Any blockchain user has access to the list. In this case, everyone acts as a collective notary, i.e., confirms the truth of the transaction. Thus, information is decentralized - stored on many computers. This ensures reliable operation of the system.

In January 2009, the first 50 coins of the Bitcoin system were mined and Satoshi Nakamoto made the first transaction of 10 bitcoins. The rate gradually grew: during 2009, the price fluctuated between 700 and 1600 bitcoins per 1 US dollar. In 2010, the first exchangers began to appear for buying and selling bitcoins for classical money.

In 2011, the first altcoins (from the English altcoin, alternative coin) appeared - all cryptocurrencies after Bitcoin. The pioneers were Litecoin and Namecoin. The developers wanted to overcome a number of problems that classic Bitcoin had. For example, Litecoin has a higher transaction speed, and Namecoin was created to develop alternative secure DNS servers.

Ethereum - ETH

Russia has its own type of cryptocurrency called Ethereum.

This financial unit was proposed by Vitalik Buterin in 2013, but the currency finally entered the market in 2015. Ethereum is not only a cryptocurrency, but also a platform created to implement decentralized online services based on the blockchain. Peculiarities:

- The basis of the current principle of implementing cryptocurrency works on the basis of smart contracts. This is its main difference from the Bitcoin blockchain base. Moreover, it is much more profitable, since it allows you to speed up data transfer, which is a problem in the Bitcoin network;

- Ethereum has its own fractional parts. They are called: 1/1000 - finney, 1/106 - szabo and 1/1018 - wei;

- The author did not limit cryptocurrency solely to payments. Rather, they are something of a nice bonus, while the main purpose of Ethereum is to act as a means of exchanging resources;

- The current adoption of the cryptocurrency itself is quite positive. In particular, today the rate is $650 and continues to grow;

- According to the description of the founder of this cryptocurrency, mining for this coin is not so important. It's easier to buy;

- In terms of capitalization, Ethereum is in second place after Bitcoin;

- The Ethereum rate changes much more actively than the rate of other cryptocurrencies, which makes this financial unit an excellent option for working on exchanges, giving the opportunity to make money on fluctuations in this rate;

- October 2022 was significant for Ethereum, as this month Sberbank entered into a non-profit alliance with the Enterprise Ethereum Alliance (EEA), which significantly increased the stability of the currency. And interest in it from users has increased;

- The peculiarity of Ethereum is the large number of applications and platforms that significantly expand the functionality of the system. In particular, there is a decentralized and investment fund, FreeMyVunk (a platform that is used to monetize ratings in games).

Ethereum is on the list of the main types of cryptocurrencies that are in stable demand. It occupies the second or third position in the list of the most popular virtual coins, which is a very good indicator, considering the short-lived

history of the coin. This indicates her excellent prospects.

Of course, the system has vulnerabilities, which provoked the emergence of a new separate cryptocurrency, Ethereum Classic. It appeared as a way to solve the problems that had arisen and now leads a completely successful separate existence.

List of cryptocurrencies with chart and description

List of cryptocurrencies

A lot has already been said about the largest and “oldest” cryptocurrencies - Bitcoin and Ethereum, so it is worth paying attention to other promising coins that are popular among the crypto community.

Ripple (XRP)

Unlike other cryptocurrencies, XRP cannot be mined. The coin is used as an exchange currency when sending international payments when currency conversion is necessary. Many large banks became interested in this. Currently, more than 100 international financial companies are collaborating with Ripple.

As we can see in the chart, in 2022 there was literally an “explosive” growth in XRP. It happened due to the fact that the company had already entered the Asian markets by that time. The growth in value was also influenced by cooperation with the English bank Santander and the Canadian bank Royal Bank of Canada.

History of the development of the XRP cryptocurrency, 2013 – 2022.

☝️

Read the full review of Ripple (XRP) cryptocurrency

TRON (TRX)

TRX is the internal cryptocurrency of a distributed open network where users can share entertainment content freely and without censorship. Mining of this cryptocurrency is impossible, since the company conducted a one-time issue of 100 billion coins. Users can receive TRX for active actions on the platform: likes, reposts, posting content, etc.

The growth of this cryptocurrency was mainly provoked by the team’s marketing campaign and the hype around the personality of the founder Justin Sun.

History of the development of the TRON cryptocurrency, 2022 – 2022

☝️

Read the full review of Tron (XRP) cryptocurrency

Litecoin (LTC)

This cryptocurrency is a fork of Bitcoin. Initially, Litecoin was created as a “backup” version of Bitcoin, which at that time did not yet have analogues. Then changes were made to the code regarding mining, the number of coins and the speed of transactions. This contributed to the fact that the coin was able to develop into an independent project and already in 2013 took 2nd place in market capitalization.

In December 2022, LTC reached its maximum value - over $320. The cryptocurrency boom of 2018 coincided with the announcement by the founder of Litecoin, Charles Lee, that he was going to completely sell all the coins he owned. Then the rate began to adjust, like other cryptocurrencies.

History of the development of the Litecoin cryptocurrency, 2013 – 2022.

☝️

Read the full review of the Litecoin cryptocurrency

Monero (XMR)

Anonymous cryptocurrency Monero

is considered the best coin for online casinos and darknet platforms, providing impeccable anonymity and security due to the lack of information about the owner of the wallet. Even large transactions can go unnoticed. The coin works on the principle of ring signatures, and there is also improved protection against transaction analysis.

As you can see from the graph, Monero is seeing steady growth in 2022. This may be due not only to an interest in anonymity, but also to improved performance of the blockchain network, which allows transactions to be carried out faster and cheaper.

History of the development of the Monero cryptocurrency, 2014 – 2022.

☝️

Read the full review of the Monero (XMR) cryptocurrency

Ethereum Classic - ETC

Ethereum Classic is one of the most controversial cryptocurrencies in the world. Its story began with the discovery of an error in the code of The DAO of regular Ethereum in 2016. The developers chose a way to solve it and changed the block chain. Many people did not like the hard fork. But the stolen funds amounting to, at the then exchange rate, $50 million were returned to their rightful place. After this decision, the first branch of Ethereum was formed - Ethereum Classic.

A description of the distinctive features of this type of cryptocurrency is as follows:

- The newly minted Ethereum Classic continues to operate as The DAO project, while the parent project does not. This is the most important difference between these cryptocurrencies;

The capitalization of Ethereum Classic in April 2022 was $456 million. A month later, that is, in May 2022, this figure exceeded $1.5 billion. And by the end of the year, capitalization amounted to $2.72 billion;- The currency peaked at $33 at the end of November 2022. But the first significant jump in the value of the coin occurred in the spring of the same year, when the rate was $5;

- The Ethereum Classic community is not very large, but is actively expanding;

- Investing in classic Ethereum is profitable, since the rate is constantly growing, and its fluctuations also allow you to make good money on it;

- The functional characteristics of Ethereum Classic and Ethereum are practically no different, however, developers are actively trying to make updates to the system, making the currency even more reliable and promising.

Ethereum Classic is not only a coin that is included in the list of the most famous cryptocurrencies. In fact, this is the same classic Ethereum as it was developed at the very beginning, and not a fork. It’s just that, as already mentioned, changes in regular Ethereum were made without the opinion of all users. They decided to follow the standard coin operation scheme, and Ethereum followed its new course. That is why this coin is called classic Ethereum.

Experts say that this currency has a great future, since the problems that were associated with the error have already been eliminated, and all the advantages of the crypto coin remain with it. The rate is already trending upward, even if it is currently only $28. But there is every reason to believe that money will increase in value in the new year.

Promising new cryptocurrencies

The list of cryptocurrencies and blockchain platforms is updated every year.

TON

The top project is Telegram Open Network (TON). This is a blockchain platform developed under the leadership of Pavel Durov. It has already raised $2 billion from investors in a private token sale. The platform will allow you to place any type of smart contracts: from classic payments to large contracts for the purchase and sale of any assets. Has an internal currency GRAM.

The main feature of the currency is the fast speed of transactions. Bitcoin can only carry out 7 transactions per second, ether - 15. At the same time, the speed of GRAM is projected to be up to 10 million transactions per second, which is comparable to the power of Visa and Mastercard. Mining will be impossible - 100% of the shares will be in circulation. Estimated launch: 2022

Libra

Blockchain platform for implementing smart contracts, developed by Facebook.

The main features of the platform are:

- Scalability. There can be up to a billion accounts here, which will result in high transaction throughput, i.e. low latency and high speed of each transaction.

- High security, which is guaranteed by the project partners.

- Power. The platform must enable the implementation of both current smart contracts and more complex ones that will appear in the future.

- Good potential for growth. The number of Facebook users who will be able to use the currency has exceeded 1 billion.

Partners include Mastercard, PayPal, Visa, eBay, Uber.

The platform has an internal Libra token of the same name. The exact launch date is still unknown.

Litecoin - LTC

Litecoin is on the list of the most popular cryptocurrencies in the world. This coin is a fork of Bitcoin, created second after Namecoin and released into the public domain in 2011. Among the world's crypto coins, this coin occupies a leading position. Let's discuss the features and characteristics of this digital currency.

- We know that this financial unit was developed by former Google employee Charlie Lee. He tried to create an improved version of Bitcoin in this way, and to some extent he succeeded, because the coin took a place on the list of leaders in the cryptocurrency world;

- This currency, according to various sources, ranks second or fourth in global volume. In particular, the system is designed for 84 million coins, which is several times more than Bitcoin;

- As for the speed of payment confirmation, this process takes noticeably less time. The transaction is 4 times faster than in the case of Bitcoin, and there is no problem of payment freezing in the network, which has worried users of the Bitcoin blockchain recently, when the number of transfers has increased;

- The Scrypt algorithm is used. It is noticeably more memory intensive than the Bitcoin algorithm. Thanks to this, the process of mining coins is simplified;

- And the biggest advantage of the existence of cryptocurrency is that it can be mined even on a regular computer, but with other popular coins this has long been impossible or difficult to do. Nevertheless, Litecoin mining goes through all the standard stages of its development. In particular, it was possible to mine on a CPU, then on a GPU, and finally on an ASIC. And adjustments to the difficulty of production are made at intervals of three minutes. So calculating blocks and conducting transactions is easier and faster than in the case of classic Bitcoin;

- The current exchange rate of the currency in question is more than $300. Moreover, a significant increase occurred precisely in December. In November 2022, the rate was only $97, and from December it rose first to $150, and then to almost $350. Now there is a slight drop in the exchange rate, but it is minimal;

- Litecoin's market capitalization is over $10 billion.

The peculiarity of this type of cryptocurrency is its variability and versatility. The developer wanted to make them like this, and he succeeded. But the system also has its drawbacks. For example:

- As with almost all cryptocurrencies, if the wallet is lost, it will be impossible to get the money back;

- Despite the rapid and rapid growth of the coin over the past month, its rate remains quite unstable, which forces one to be careful when working with it;

- Even though it is a fork of Bitcoin, compared to its parent coin, the turnover of this digital currency is too low to pose a serious threat to Bitcoin;

- Due to the fact that block generation occurs so quickly, double spending often occurs on the network. This is unacceptable for a trusted digital currency.

Types by appearance

If we take technical features as a basis, primarily blockchain technology, then we will get 3 types of cryptocurrencies: bitcoin, altcoins and tokens. Each of them has its own strengths and weaknesses, as well as representatives in the coinmarketcap capitalization rating and other independent sources. Let's take a closer look at each type of digital asset.

Bitcoin

Perhaps the most famous among the entire digital asset market. It is the quotes of the BTC coin that continue to be the main indicator of the state of the crypto industry. The increase in the value of Bitcoin leads to an increase in the price of almost all tokens, which directly indicates the importance of this project for the entire direction of digital assets. Let us consider in detail how to use it, the circumstances of its appearance, as well as what features cryptocurrency has.

History of cryptocurrencies

The first information appeared in 2008, when a certain Satoshi Nakamoto launched the Bitcoin project and also published its detailed description. As it later became known, this is not a real name, but only a pseudonym for the developer, who continues to remain anonymous to this day. At the project’s inception stage, he did not yet suspect that the emergence of Bitcoin would become the starting point of such a large-scale technological movement. However, this is exactly what happened. The emergence of BTC marked the beginning of a new era.

During the first few years, crypto was used primarily by criminals to trade illegal goods and illicit services on the Darknet. Surely you have heard the big story about “SilkRoad”, when an entire business empire was built around Bitcoin, based on the sale of stolen bank details, pornography, drugs, weapons, etc. Unfortunately, there were several similar examples. This harmed the reputation of digital assets.

The period 2013-2014 was marked by strong growth in Bitcoin. Then the dynamics of the upward movement of quotes gradually subsided. However, after 3 years, growth resumed with even greater force. Already in December 2022, absolutely everyone learned about Bitcoin, since the cost of one coin reached $20,000. People who had 50 BTC in their account became millionaires.

What it is

Bitcoin is a digital means of payment. You can use cryptocurrency to pay for purchased goods or services, or simply send it to other users. Satoshi Nakamoto's idea was to create a decentralized analogue to fiat currencies. The performance of the network does not depend on banks, financial corporations or government regulators. Major decisions are made by ordinary people by voting.

Bitcoin is a peer-to-peer network because transactions are carried out directly between users without the participation of intermediaries. The implementation of this principle became possible thanks to the use of blockchain technology. Network participants have the opportunity to remain anonymous. The exclusion of the third party automatically eliminated the need for identification and also made transfers cheaper.

Principle of operation

Transaction details, including information about sending and receiving coins, are recorded in a decentralized blockchain database. The information is encrypted, so confidentiality is guaranteed. Only the owner of specific coins will be able to decipher information about transfers. Each owner receives a private key that allows them to decrypt bitcoin.

Some people worry about network security: is there a guarantee of reliability if no one processes or verifies transactions. Absolutely all payments are checked and confirmed, but this is not done by banks or specific structures, but by ordinary people - miners. They run special software using their computer's processing power to confirm the transaction. In return, they receive a reward - BTC coins. This approach allows us to maintain decentralization.

Altcoin

Today, the crypto industry includes over 1000 digital currencies, but most of them are 99% copies of Bitcoin with minor changes in the code. This is precisely the reason for the name of this group. Altcoins are alternative coins. However, not every altecoin is an alternative to Bitcoin. Some coins do have many differences regarding their purposes and tasks.

Some developers launch a cryptocurrency based on the Bitcoin blockchain, but at the same time use completely different algorithms for achieving consensus, which significantly modifies the principle of the network’s operation. A striking example of these words is the Factom project, which uses a PoS algorithm. This is the same altcoin, but without mining. Together with users who mine coins and confirm transactions, so-called stakers are used - they also confirm payments, but do not do so at speed, which allows them to reduce the level of load on the computer, as well as the amount of electricity consumed. Moreover, there is only one staker in each block.

Therefore, it is not entirely correct to say that absolutely all coins are a copy of Bitcoin. We must not forget that there is also Ethereum and NEO, which are not digital currencies at all. Rather, these are decentralized platforms on the basis of which you can create various applications for working with blockchain. It was Ether that opened up a completely new direction - the era of smart contracts, which allow you to activate actions programmed in advance.

Smart contracts have become a laconic continuation of the innovation that the creator of Bitcoin promoted - this is the rejection of intermediaries. If the BTC network is a peer-to-peer network that allows you to carry out transactions without the participation of banks and commercial companies, then smart contracts allow you to expand this idea to other actions: buying/selling real estate, trading in stock and financial markets, the relationship between the consumer and the electricity producer or any other resource.

Without exaggeration, we can say that almost any cryptocurrency allows you to fight intermediaries. Since their participation in transactions leads to an increase in the cost of a product or service, excessive centralization of absolutely any area. Therefore, the emergence of smart contracts also gave new impetus to the continued development of digital assets. The Ethereum and NEO platforms allow you to tokenize real things and then integrate them into the blockchain database.

Token

The final item on the list is the token. Partially this topic has already been touched upon earlier. The uniqueness of tokens lies in the absence of their own Blockchain base. Instead, special decentralized applications are used, created by developers on the Ethereum, NEO, etc. platforms. Such projects include the use of smart contracts in their work, so tokens are also part of the network.

Tokens can have a physical expression: a product, a service, real estate, that is, absolutely anything. However, in some cases they retain a digital expression, for example, purchasing something online. Tokens can provide a discount on the purchase of a product/service or act as a fee for voting. Tokens have value and can be sold or bought. For example, some users use them to enter into speculative transactions: first they buy at a lower price and then sell at a higher price.

Within platforms built on the basis of blockchain technology, for example Ethereum or NEO, special nodes are responsible for verifying transactions. Transaction fees are paid using Ether or NEO. This means that in order to conduct transactions within the network of a decentralized application, you need to have NEO, ETH or another altcoin in your wallet, the blockchain of which is used. It is with these assets that commissions are paid. These are the key groups that exist today.

Zcash - ZEC

Today it is no longer easy to calculate how many cryptocurrencies exist in the world, but Zcash definitely stands out among them.

It was developed by Zerocoin Electric Coin Company, with an emphasis on open source code. This ensures maximum confidentiality and selective transparency of transactions. Let's take a closer look at what this cryptocurrency is:

- First of all, it should be pointed out that this is the world's first digital currency that works on a cryptographic zero-knowledge proof protocol. This protocol provides for complete trust between the parties to the transaction, even if they have no idea about each other. This works in such a way that the other party to the transaction shows that he knows some information, but this information itself is not disclosed. That is, it is this virtual currency that can provide complete anonymity;

- The minimum transferable financial unit of this cryptocurrency is called zatoshi; in size it is equal to satoshi for bitcoin;

- Zcash has the same fixed volume of financial units as Bitcoin, and it is 21 million coins;

- Blocks are formed quite quickly: the system spends about two or two and a half minutes on one formed block, which is much faster than Bitcoin;

- Another distinctive feature of the coin in question is that the Zcash protocol does not store data about who made the transaction and to whom. Only the fact of the transaction itself is indicated. There is not even information about the amount of transfers made. But in the blockchain, this information can be opened at the request of the user. This is very convenient and is an original feature of Zcash;

- Coins on the network are interchangeable. It does not matter how and when they were received, because all transactions are completely anonymous and confidential, even for the parties themselves;

- If there is a need to prove fraud or deception, it will be impossible to do so. There that the system is one of the most popular for money laundering and other criminal activities;

- Transactions cannot be traced. That is why the name of the new cryptocurrency was immediately learned by people who became interested in untraceable transactions. All that is available is the time when the transaction occurred. And all this thanks to the zk-SNARK protocol;

- The coin rate is $392.61, which is a very good result;

- Zcash capitalization is more than $908 million.

Naturally, they couldn’t help but become interested in such a coin. In particular, donations can be sent to WikiLeaks in Zcash. As for individuals, Edward Snowden singled out this coin from the thousands of cryptocurrencies existing today and called it the most promising replacement, or, more precisely, an alternative to Bitcoin. And this is taking into account the fact that Zcash appeared only in 2016.

How to buy the top cryptocurrency from the rating

To buy cryptocurrency from the rating, you need to use the following methods:

- Buying, selling and trading cryptocurrency on an online exchange. List of crypto exchanges: Binance, Currency.com, EXMO, Cex.io, BitMEX, Huobi and others. On the EXMO trading platform you can buy: Bitcoin, Ethereum, Waves, Ripple, Litecoin, Zcash, Dash, Bitcoin cash, Ethereum classic, Dogecoin for fiat money - dollars, euros, rubles, hryvnia. You can buy or sell bitcoins on the Localbitcoins exchange.

- Buying/selling in crypto exchangers. They present all the most popular and major coins by capitalization: Bitcoin, Ethereum, Dash, Litecoin, Zcash, Tether, Ethereum Classic, Bitcoin cash, Dogecoin, Monero. Reliable and proven exchangers for buying cryptocurrency: ProstoCash, 60cek, Ramon-cash, Kassa, Platov, Xchange. Large selection of cryptocurrencies at Baksman: EOS, Stellar, Cardano, Neo, NEM, TRON. To make an exchange, you need to indicate the currency being given or received, the amount, wallet address and other information if necessary. After payment for the application and confirmation of the transaction in the blockchain network, the cryptocurrency will be sent to the cryptocurrency wallet. Detailed instructions can be obtained when completing the transaction.

Monero - XMR

The existence of cryptocurrencies no longer surprises anyone, although few can foresee which existing coins will be popular in the future.

But there is still an expert opinion that Monero will definitely be on this list. This currency is a fork of ByteCoin (this is not Bitcoin, just similar names). At first the coin was called BitMonero, but the Bit prefix was removed. Interestingly, shortly after its first block was generated in 2014, hackers began attacking the coin. The first strong attack occurred in early autumn 2014, and Monero successfully survived it, even without significant damage to itself. But this attack showed that the hackers knew very well the source code of the coin and how the cryptocurrency algorithm works, which is different from other types of cryptocurrencies. Therefore, there was a danger. The developers have taken several very effective measures to minimize damage and make the system even more secure.

In principle, it is not surprising that the coin was of interest to attackers, because at the beginning it did not even have a normal interface, wallets, etc. This was confusing, because actions had to be performed through the command line.

But let's discuss other features of the system:

- Of course, the main feature of the currency is the use of ring signatures. Thanks to this operating mechanism, it is almost impossible to track transactions, since they are mixed so much that even the most powerful computer cannot calculate who made the transaction and who its recipient is;

In addition, this currency is based on the CryptoNote protocol, and in order to finally convince users of its effectiveness, the developers also added the CryptoNight algorithm;- Considering what cryptocurrencies there are, we can definitely say that Monero will stand out, despite the fact that it works, like many others, according to the Proof of work principle. That is, it provides evidence that the work has been completed;

- The source code of this currency is open source;

- The issue of the coin is 18 million 400 thousand. According to the developers’ calculations, it should take no more than eight years and be completed in 2022. But so that miners do not lose interest in the currency, a decision is being made to receive 0.6 monero for each block;

- The coin price is about 300 dollars. It began to show rapid growth in 2016. It was then that the money, for which they did not give even a dollar, rose to 50 dollars. And by the end of 2017, they cost as much as $300 and could cost even more, given the positive dynamics. After all, compared to other types of cryptocurrency, their rate is more than good for professionals, not to mention beginners who are just learning to understand this area;

- The currency capitalization is $764 million.

For some reason, there is an opinion that Monero is used exclusively on the black market. Actually this is not true. Monero is often used for payments in games, online casinos and other Internet payments.

How to buy Ethereum

Just like when buying Bitcoin, in order to purchase Ethereum, you need to use a cryptocurrency exchange or exchange.

In the exchanger, you need to select the direction of exchange, the amount, and indicate the wallet address to receive ether.

For example, in the ProstoCash exchanger you can buy Ethereum for rubles, electronic money - Yandex, Qiwi, for other cryptocurrencies, from a Visa and MasterCard of any Russian bank and in many other ways.

You must carefully enter all other data and the Ethereum wallet address:

In the article from the cryptocurrency rating, we examined in detail only Bitcoin and Ethereum. The review will be updated soon.

All cryptocurrencies in one table

The list of cryptocurrencies is already quite large: there are more than 1,300 coins. Every year this list of cryptocurrencies will only expand. And in order not to get lost in this diversity, it is advisable to have a complete list of cryptocurrencies before your eyes. Then you can decrypt cryptocurrencies at any time and see which cryptocurrencies are suitable for mining at that moment.

The list of cryptocurrencies, of course, is a very convenient device that helps you understand the types of cryptocurrencies, their details, etc. The table of cryptocurrencies usually includes the following information:

The name of all types of cryptocurrency that are currently in demand in the coin market. Moreover, all current names are indicated - both abbreviated tickers, which are used on cryptocurrency exchanges, and full names, as users are accustomed to calling them. This makes it very easy to find coins, because there are too many of them to remember all the abbreviated names;- In addition, the cryptocurrency comparison table involves the use of coin price data. This is one of the main indicators that a user interested in virtual money pays attention to. Moreover, the rate is indicated in dollars, but if necessary, the initial currency can be taken;

- Among other things, the cryptocurrency directory often displays market capitalization information. This indicator is one of the most important for a currency, as it shows its position in the market. The higher the market capitalization, the better for the coin;

- Also, the graph sometimes shows the number of cryptocurrencies in the world—those that have already been mined, and those that are yet to be mined. True, there are crypto coins that do not provide for the presence of a final, and there are those for which the number of units has long been provided for. For example, the latter includes Bitcoin. So this indicator depends on how many types of cryptocurrencies were used in the table;

- Transaction volume for 24 hours. This is one of the main indicators that are used when creating a table with cryptocurrency. Let’s take Bitcoin’s performance as an example. Its 24-hour trading volume is $12.5 billion with a market capitalization of $288 billion;

- To compare price increases by currency for all cryptocurrencies in the list, the exchange rate in bitcoins is entered. This helps a lot in the exchange, and just assessing how much other coins lag behind their progenitor is quite interesting;

- And to check where the rate is moving, you can look at the statistics of changes. Typically, the table shows changes that occurred in a day and changes that can be observed over a week or longer. To help coin owners navigate whether to sell or buy money.

In general, tables as miner and trader tools are very useful. And thanks to them, cryptocurrency producers and knowing the details of their coin can view the rating of their financial unit in the world of virtual digital money.

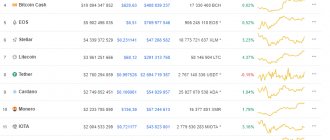

The table looks like this: You can see how it works in practice here.

| Name | Ticker | Price in USD | Market cap. | Volume (24 hours) | Volume (%) | Price in BTC | Change over 7 days (%) | |

| 1 | Bitcoin | BTC | 16.887,0 | $288.71B | $12.61B | 55,07% | 1 | +49,69% |

| 2 | Ethereum | ETH | 676,58 | $45.98B | $1.47B | 6,40% | 0,0276026 | +2,53% |

| 3 | Bitcoin Cash | BCH | 1.566,20 | $24.01B | $951.42M | 4,16% | 0,0823458 | -7,89% |

| 4 | IOTA | MIOTA | 4,26770 | $12.24B | $456.94M | 2,00% | 0,00025456 | +59,28% |

| 5 | Litecoin | LTC | 341,020 | $10.60B | $2.12B | 9,25% | 0,0113507 | +92,58% |

| 6 | Ripple | XRP | 0,43870 | $9.70B | $178.64M | 0,78% | 0,00001454 | -0,42% |

| 7 | Dash | DASH | 877,97 | $5.79B | $184.78M | 0,81% | 0,0434372 | -2,25% |

| 8 | Bitcoin Gold | BTG | 275,75 | $4.26B | $261.34M | 1,14% | 0,0147364 | -21,15% |

| 9 | Monero | XMR | 304,50 | $4.22B | $147.03M | 0,64% | 0,0158475 | +32,26% |

| 10 | NEM | XEM | 0,51439 | $4.19B | $68.91M | 0,30% | 0,00002705 | +67,09% |

| 11 | Cardano | ADA | 0,135593 | $3.10B | $38.88M | 0,17% | 0,00000692 | -10,80% |

| 12 | Ethereum Classic | ETC | 29,5000 | $2.72B | $450.72M | 1,97% | 0,00160198 | -8,13% |

| 13 | Stellar Lumens | XLM | 0,147400 | $2.53B | $117.65M | 0,51% | 0,00000825 | +50,69% |

| 14 | EOS | EOS | 6,44000 | $2.33B | $146.96M | 0,64% | 0,00025333 | +13,60% |

| 15 | NEO | NEO | 42,760 | $2.29B | $78.77M | 0,34% | 0,00203516 | -14,34% |

| 16 | BitConnect | BCC | 326,30 | $1.87B | $40.03M | 0,17% | 0,0226545 | +20,31% |

| 17 | Populous | PPT | 37,6780 | $1.19B | $4.02M | 0,02% | 0,00167293 | +118,28% |

| 18 | Waves | WAVES | 13,6116 | $1.12B | $75.37M | 0,33% | 0,00064589 | +70,27% |

| 19 | Stratis | STRAT | 9,7400 | $1.06B | $68.62M | 0,30% | 0,00062331 | +47,89% |

| 20 | Qtum | QTUM | 14,8169 | $985.81M | $217.56M | 0,95% | 0,00077319 | -2,55% |

Other types of digital coins: comparison table

We've looked at the blue chips of the digital asset market, now it's worth getting acquainted with the lesser-known types of coins. Each of the projects presented in this table also deserves attention from investors. Many of these cryptocurrencies are in their infancy, so they may rise significantly in price in the near future.

| Coin | When did it appear | Consensus algorithm | Hash algorithm | Emission |

| Monero | April 18, 2014 (ByteCoin fork) | PoW | CryptoNote | 17.6 million |

| Dash | January 2014 | PoW | X11 | 18.9 million |

| Zcash | October 28, 2016 | PoW | Equihash | 21 million |

| Primecoin | July 7, 2013 | PoW | SHA-256 | floating |

| Peercoin | August 12, 2012 | PoW | SHA-256 | floating |

| Namecoin | September 16, 2009 | PoW | SHA512 | floating |

| VertCoin | January 11, 2014 | PoS | Scrypt-Adaptive-Nfactor | 84 million |

| BitShares | July 19, 2014 | Delegated_Proof-of-stake | SHA-256 | 3.6 billion |

| Factom | 2014 | Raft | SHA-256 | floating |

| NEM | March 31, 2015 | Proof-of-Importance | SHA-256+RIPEMD160 | 8.9 billion |

| Dogecoin | December 6, 2013 | PoW | Scrypt | floating |

| MaidSafeCoin | year 2014 | Proof Of Resource | SHA-256 | 452 million |

| Digibyte | year 2014 | PoW | Skein | 21 billion |

| Decred | February 7, 2016 | PoW and PoS | Blake-256 | 21 million |

What is the future of crypto money?

All cryptocurrencies have a future. For some it is good, for others it is not so good. In particular, it is no secret that many coins simply disappeared over time, failing to attract sufficient interest from miners or buyers. But how many cryptocurrency coins have managed to achieve success and are now worth several hundred dollars, and their value continues to grow steadily? There is a pattern that the higher the rate, the greater the chance that the coin will remain with us. And the quotation depends on the following indicators:

- Frequencies of use;

- Generation speeds;

- Cryptocurrency coin numbers;

- System algorithm;

- The ability to exchange for other coins and fiat money;

- The lifespan of a financial unit.

Different cryptocurrencies were perceived differently. For example, Bitcoin was not taken seriously for a long time. Again, I remember the story of two pizzas that were bought for 10,000 bitcoins. Coins that appeared later were easier in this regard. But the high level of competition in the crypto world forces us to come up with unique coins.

Most digital money was created as a means of speculation. They do not have a limited number of units, like Bitcoin. This really poses a threat to the economies of countries that do nothing. The development of virtual finance cannot be stopped. They are anonymous, complex and decentralized.

Considering what cryptocurrencies exist today, we can already say that at least a thousand coins have a future. Which one exactly depends on the users. But the most optimistic forecasts say that even if Bitcoin disappears, the development of cryptofinance cannot be stopped. Everyone will have them sooner or later. True, it is necessary to simplify the system of their storage and expand the scope of use of money to the real world, providing safe, fast and convenient ways of converting, for example, bitcoins into fiat money.

How to buy Bitcoin cryptocurrency

The fastest way to get bitcoins is to use e-currency exchangers. There are a huge number of them on the Internet, so the main thing is to choose a reliable and safe one.

The process of buying bitcoins itself consists of the following steps:

- Payment with cryptocurrency and transfer of money to the exchanger’s account.

- Transfer of Bitcoin by the exchanger to the address that was specified after receipt of money.

Everything is very simple and fast. As soon as the operation is confirmed on the network, bitcoins will be credited to the wallet.

We recommend a reliable exchanger - ProstoCash. He works without breaks and weekends. After registration there is a discount of 0.05%.

Feedback from monitoring is positive:

The Bitcoin exchanger carries out exchanges in the most popular directions: Yandex.Money, Sberbank, Qiwi, VTB 24, AdvaCash, Perfect Money, Payeer, Visa and MasterCard cards; codes of cryptocurrency exchanges EXMO, Livecoin, WEX and other options.

To buy cryptocurrency, you need to fill out a form indicating the currency you are giving and receiving. In our example, exchange Qiwi for Bitcoin:

Then indicate the remaining details of the operation: wallet number, email address and address for receiving bitcoins.

The second way to buy bitcoins for rubles is through exchanges. The registration process on the EXMO exchange, where you can sell and exchange cryptocurrency, was described above.

You need to go to the EXMO website and top up your account balance in the “Wallet” section. You can deposit cryptocurrency or top up your account with regular money (fiat).

On the EXMO exchange you can either trade or simply exchange fiat money for cryptocurrency. For example, exchanging bitcoins for rubles:

Cryptoruble 2022. Buy Cryptoruble at Sberbank. Cryptoruble from Sberbank release date

In Internet search engines, indicators for queries have increased: where to buy cryptoruble, buy cryptoruble 2022, crypto exchanges with rubles, cryptoruble dates. Note that these requests are somewhat premature.

The Bank of Russia has not yet made a decision on issuing a digital ruble. The creation of a prototype platform for it is scheduled for December 2021, and in January 2022 it is planned to begin developing changes to the legislation necessary to launch the project. Testing of the project itself is scheduled for 2022. Based on its results, a “road map” for the implementation of the digital ruble platform will be formed.

At the same time, Sberbank of Russia in January 2022 submitted an application to the Central Bank of the Russian Federation to register a blockchain platform for issuing its own cryptocurrency.

There is no information yet explaining how the coin will be purchased. It is assumed, based on the fact that the owner of Qiwi is a participant in all discussions of the cryptographic ruble, that sales will be carried out by the Qiwi payment system and Sberbank.

Central Bank cryptoruble: pros and cons

The advantages of the digital ruble, like any cryptocurrency, include the absence of intermediaries in money transfers and a high level of protection.

The absence of intermediaries in cryptography will allow you to significantly save on money transfers: no bank commissions, and payment systems will not take their 10 - 15% for the operation; everything will happen at the expense of the users who participate in this system.

A high level of cryptographic protection will not allow attackers to influence the transaction and receive other people's money.

The main disadvantage of the crypto ruble is government regulation. The issue of regulating the circulation of cryptocurrency is very acute. Government regulators understand that uncontrolled payments help to evade taxes, finance terrorism and launder illicit proceeds.

It is also important to note that the cryptoruble concept does not have a model for the functioning of anonymous wallets. Wallets will be opened on a platform created by the Central Bank and under its control.

The need to link a wallet to a specific person (legal or individual) means that the Central Bank delegates the control function to commercial banks and gives commercial banks responsibility for identifying individuals.

What does the cryptocurrency rate depend on?

The main reasons on which the ratio of supply and demand for a particular digital currency depends:

- The influence of large players buying or selling a large amount of cryptocurrency at once.

- Cross-influence of courses. The most striking example is that the Bitcoin rate always pulls with it the cost of most altcoins.

- Economic and political factors regarding the ban or, conversely, approval of cryptocurrencies in countries around the world.

- News background regarding the crypto market in general or a specific coin.

Due to the variety and instability of factors, the cryptocurrency market is extremely volatile. This simultaneously causes difficulties for investing/trading and makes it possible to make significant money on a jump in the exchange rate.

Binance Coin cryptocurrency rate

BNB is considered one of the most successful tokens from crypto exchanges. Binance has managed to turn its functionality token into a successful financial asset. At one point, the capitalization of the coin reached 176 million USD. The Binance Coin rate today is $23,291.

Stellar Lumen cryptocurrency rate

The fork and one of Ripple's main competitors initially had a price of just $0.06 per unit. After that, the price rose and fell more than once and was subject to correction. It is worth noting that there are few news channels around the cryptocurrency, which does not provide prerequisites for either growth or decline. As of April 26, 2022, the Stellar Lumen rate is $0.0979.