An online cryptocurrency exchange with withdrawal in rubles is a great way to attract investors who are ready to manage their funds as freely as possible, avoiding exchange transactions outside the platform. Anyone can become a cryptocurrency trader, regardless of their level of knowledge or size of investment. Using their own or borrowed capital, participants in online platforms analyze rates, receive signals, sell and exchange popular assets. They earn very real money, withdraw funds to a card or wallet in rubles.

Spot exchanges

Cryptocurrency spot exchanges are more suitable for beginners and novice traders. The peculiarity of spot trading is that for each transaction, settlements are made at the same moment as it was completed.

Spot platforms support two main types of trading orders, market (market) and limit. Market is suitable for instant purchase or sale at the currently available rate. The limit one allows you to set your own price, as a result of which the order will be closed only when a counter order appears at a similar price.

Creating a limit order on the Binance cryptocurrency exchange

The market is formed by makers and takers. In short, a maker is the one who creates limit orders, and a taker is the one who closes it by creating a market order. Since the maker plays a key role in shaping the market, trading commissions for him are usually an order of magnitude lower or even zero.

Popular spot cryptocurrency exchanges:

- Binance.com

- Coinbase.com

- Kraken.com

- Yobit.com

FAQ

Is it allowed to trade cryptocurrency in Russia?

Yes, subject to payment of personal income tax.

What are the characteristics of crypto exchanges for Russia?

They support working with rubles (purchases for rubles) and have a Russian-language interface. They often require account verification to comply with regulatory requirements.

Which crypto exchanges are the most popular in the Russian Federation?

Binance, OKEx, EXMO, FTX, etc.

Is it possible to buy cryptocurrency with a bank card?

In most cases, yes, if the exchange is equipped with a fiat gateway.

Is it possible to withdraw rubles to a card or e-wallet?

Depends on the exchange. There are platforms that allow withdrawal to a card, Qiwi, Advcash, Payeer wallets.

What are p2p exchanges?

They are characterized by the fact that users trade directly with each other with little or no third party involvement. The market is formed on the basis of offers for exchange rates and payment methods that are set by users.

What to look for when choosing an exchange in Russia?

The need to pass KYC/AML verification, commission fees, interface convenience, additional functionality, market reputation, liquidity and trading volume.

Exchanges for trading futures (options)

A derivative is a contract, in order to fulfill the terms of which one user undertakes to transfer cryptocurrency to another within a certain period and at a certain price. When trading derivatives, traders do not own the underlying asset itself, but make money on changes in its market rate and provide risk hedging.

Contract trading interface on the BitMEX exchange

Most often, when trading contracts, leverage is used, which can significantly increase possible earnings, but in the event of an unsuccessful transaction, losses also increase significantly.

Futures are contracts for the sale/purchase of an asset in the future at an agreed price. Futures can also be perpetual, meaning they can be sold at any time. Options differ from futures in that they do not oblige the trader to buy a specified asset, but give the right to do so.

Examples of cryptocurrency futures exchanges:

Get a 10% discount on trading fees on Binance using the code “ CRYPTOSLIVA ” or by registering using this link

- Binance Futures

- FTX.COM

- Deribit

Instructions for choosing a crypto exchange

Below is a list of criteria based on which everyone can choose a reliable cryptocurrency exchange. We will evaluate your reputation, trading conditions, and comfort of working with the exchange.

Reputation and reliability

Complex question, when solving it, do the following:

- Assess the operating life of the cryptocurrency exchange and its reputation . It is desirable that there are no hacks in the history, and if there were, then that clients receive compensation.

- Find out the jurisdiction in which the site operates. The tougher it is, the lower the likelihood of deception and disregard for the client.

- Evaluate the openness of information about offices and teams.

- Trading volume – the higher it is, the better.

- Study reviews , various ratings, for example, on coinmarketcap com. They cannot be the decisive criterion for choosing, but they will indicate the public’s attitude towards the cryptocurrency exchange.

Ideally, the exchange should operate for several years, have no hacks, and have a high rating in the ratings.

I also recommend reading:

IEO on the stock exchange - what is it in simple words? What is the difference from ICO?

The ICO boom occurred in 2022, thousands of new projects successfully sold coins, but most token sales had only […]

Working conditions

Here you will have to take into account not only the conditions of the cryptocurrency exchange itself, but also the expected style of work:

- Verification – it is advisable that the exchange does not force clients to go through it immediately. Basic functionality should be available immediately.

- Fiat currency support.

- Geographical restrictions.

- If you plan to implement advanced strategies, for example, calendar spread trading, then you need platforms that support crypto futures. If you plan to simply speculate on cryptocurrency rates, then a regular exchange will do.

- For margin trading, leverage is required; not all crypto exchanges provide it.

- Commissions – the lower the better. You will feel the influence of this factor as the speed increases.

- Number of supported crypto pairs . For example, Payeer is a good exchange, but it is not suitable for active traders. It simply does not have the abundance of altcoins that, for example, Binance offers.

- Restrictions on replenishment/withdrawal of funds . For example, on the BTCAlpha crypto exchange there is a limit on the withdrawal of funds for unverified traders of $5 thousand per day, but for most traders this limit will not be an obstacle.

Be sure to compare the working conditions with your own requirements.

Trading terminal and work comfort

Here the requirements are:

- There must be a live chart, all indicators and graphical analysis tools are available.

- It is desirable that limit orders and buy stop orders be available.

- Terminal freezing is unacceptable.

- High speed of order execution is desirable.

- The advantage will be the ability to customize the terminal (setting the location of individual elements).

Comfort in general is also important. The location of individual elements should be intuitive; unspoken standards have already been established for their placement.

Bitfinex exchange trading terminal

Additional requirements

We include:

- The possibility of passive income – the availability of staking will be an advantage when choosing a crypto exchange.

- Earn money by lending to other users.

- Having your own Visa or MasterCard.

- Scenarios for using the internal token.

- Incubators for blockchain projects.

- Adequacy of technical support work.

- Full translation of the site into Russian.

None of the above points are considered decisive. But if both exchanges are approximately equal in other indicators, then you will have to compare them according to additional indicators.

I also recommend reading:

The Cup with Handle pattern is a reliable pattern for trend trading

The Cup & Handle pattern is a trend continuation pattern. First used in trade in the 80s […]

Cryptocurrency exchanges with margin trading

Margin trading involves issuing a loan to a trader for a certain amount secured by the funds he has on his balance sheet. This credit can only be used for trading on the same exchange. Leverage increases purchasing power and can multiply profits on a successful transaction. Due to the high risk component, margin trading of cryptocurrencies is suitable for professionals and is not recommended for beginners.

On some crypto exchanges, to trade with leverage, you need to separately transfer money from your spot account to your margin account.

Some exchanges require you to first transfer money to a separate margin account before using lending

The loan can be issued either directly from funds belonging to the exchange, or (more often) from the funds of other users, who thereby earn money by investing their money at interest.

Examples of crypto exchanges with margin trading:

- Binance Futures

- PrimeXBT

- Poloniex

Rules and Tips for Trading Cryptocurrency

The cryptocurrency market is extremely volatile. It is especially difficult for newcomers to “survive” despite the growing trend. Let's look at tips that will be useful for new and more experienced traders.

7.1. Trade only with your own money

Since the cryptocurrency market is a high-risk trade, you should only carry out transactions with your own money, which you can afford to lose. Trading with borrowed funds will be a risky move.

Plus time has a strong influence. Everything will grow over time, you just have to wait.

7.2. Don't try to find the bottom or top of the market

Greed destroys not only “fraters”, but traders. Everyone knows this and still tries to guess the bottom and top of the market. Although absolutely no one knows exactly how much the cryptocurrency will rise or fall.

It is better to act according to the circumstances and facts. For example, when Ethereum grew from $7 to $420, according to classical analysis it would have been overbought a hundred times. All indicators said that it should be sold, but it grew and grew further. Many traders went out at $40, at $90, thinking that they were great, and then bit their elbows as the price went higher and higher. And all because they were looking for the top of the market.

As a result, half opened positions much more expensive at $350, $400 and then sat in a drawdown for six months. If they had acted according to the situation, the loss would have been avoided.

7.3. Always view the graph on a global scale

When studying a chart, you should always look at it on a global scale. Short-term trends in cryptocurrencies matter little.

Look at the global chart and volumes. Only they show the true price movement.

7.4. Don't take the shoulder

When trading cryptocurrency, it is advisable to refrain from using leverage. With fluctuations of 20-40% per day, this can greatly “reduce” the deposit in case of unfavorable circumstances.

And where are the leverages? The vibrations are already too strong.

7.5. Risk diversification

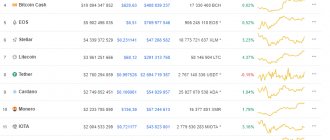

Do not invest all your funds in one cryptocurrency. Spread out among several promising ones: Bitcoin, EOS, Ethereum, Tron, Dash, Ripple, Binance Coin, Litecoin

It is unknown what will happen to each coin, so it is better to play it safe and diversify the risks. Create a good investment portfolio of promising cryptocurrencies. Some small part (10-15%) can be invested in risky assets (tokens are something that has just appeared on the market).

- Portfolio diversification rules;

- How to create an investment portfolio;

7.6. Don't read stock chats

There are chats on the stock exchange that contain a lot of negativity, false rumors, and off-topic comments. All this slag only causes problems. Therefore, it’s better not to read this, so as not to confuse yourself from your own goal.

It’s not for nothing that professionals don’t read newspapers, don’t watch forecasts, and generally don’t watch TV.

7.7. Don't play short without a stop.

Some crypto exchanges allow short trading. Since cryptocurrencies are in a growing trend globally, trading without a short stop is extremely risky.

7.8. Don't enter with your entire briefcase at once

Do not enter into a trade with your entire portfolio at once. Separate inputs in batches. For example, the percentage of the first entry into a trade from the portfolio: 10%, then another 30% and the remaining 60%.

As trading practice shows, you can always buy something better and cheaper. So it is better to do this with the maximum possible capital available.

7.9. Sometimes you need to record losses

All people make mistakes. And even super-experienced professional traders make mistakes. Sometimes you have to come to terms with it and record the loss in order to stop incurring even greater losses.

There is nothing wrong with recording losses if it is truly justified.

Withdrawal of cryptocurrency into rubles through payment systems

Some payment systems allow you to use several accounts at once within one account and seamlessly and instantly transfer funds from one to another. In this case, the calculation takes place at the market rate.

EPS that support conversion between cryptocurrency and Russian ruble:

- Payeer. Fiat accounts – RUB, USD, EUR. Cryptocurrencies – BTC, ETH, BCH, LTC, DASH, USDT, XRP.

- Advcash. Fiat accounts – RUB, USD, EUR, GBP, UAH, TRY, BRL, KZT. Cryptocurrencies – BTC, ETH, BCH, LTC, XRP, ZEC.

- Capitalist. Fiat accounts – RUB, USD, EUR. Cryptocurrencies – BTC, USDT.

Wallet Capitalist

Why do you need a demo account?

It is best to start with a demo account for those who are just getting acquainted with the world of crypto trading. It is advisable to work with it longer and make as many mistakes as possible in order to get a feel for how the market works and understand all the potential risks.

By the time he switches to a regular account, the user has already developed a certain strategy that he finds most effective. Subsequently, you can check it “live”. However, you should know that real trading still has some differences from demo trading. First of all, this is a psychological aspect. As long as a person perceives trading as a computer game where it is impossible to lose, he does not feel a threat to his money. When switching to a real account, many people fail because they constantly feel emotional pressure due to the risk of losing money.

Therefore, when leaving a demo account, you should start trading with minimal amounts of cryptocurrency that you don’t mind losing. Of course, you won’t be able to earn much from them either, but it will help achieve consistency in trading and reduce psychological pressure. The main goal is to double your first deposit. When you manage to do this, you can raise the rates.

What is a demo account

A test account is a type of account funded using an artificial cryptocurrency. Allows a potential user to experiment with the functionality before creating a real account and funding it. This method is used by some popular trading platforms and has already proven its usefulness.

Demo accounts are also relevant among traders who are accustomed to one asset, but want to try themselves with others. For example, a person who has been trading cryptocurrencies for a long time may want to practice before getting started with futures or options. After all, these markets are subject to different influence factors, allow different types of orders and have different trading conditions.

Bybit

Opening a test account is carried out by the usual registration on a separate portal for demo accounts testnet.bybit.com

In this mode, the player can master all the intricacies of working with the platform, study the location of information windows, customizing them at his discretion.

Trading on a demo account replaces many of the most detailed books on trading. After all, nothing more expensive than practice has yet been invented.

Go to the website and register