In Forex trading, support/resistance levels are very important. They are worth paying attention to regardless of what strategy you are trading with, be it Price Action or any other trading system. Levels will help improve your trading many times over. In this lesson we will talk about what support/resistance levels are, how to build them, what levels you should pay attention to and, most importantly, how we can apply them in our own trading on the Forex currency market.

Support/resistance levels in Forex

What is a level?

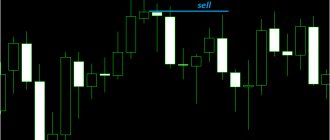

The level is the point where the trend breaks or “trades”. There is some kind of struggle between sellers and buyers, the outcome of which determines whether the price will continue the initial movement or turn around and go in the other direction. A support/resistance level is any previous peak or trough. Let's look at this clearly on a theoretical price chart.

Let's imagine that we now have a chart with an uptrend.

Let's mark the levels on this chart.

I have highlighted them with red lines:

Also, at the end of our chart, you can notice that the price is at the same level and constantly rests on something. This is called pro-trading.

It can be considered a level, so let’s also mark it with a red line:

Thus, we have found all levels on the chart.

I would like to say right away that a level is not a straight line that coincides point by point with a certain price on the chart, but a zone that includes some space around it:

In this chart, you could immediately see that some local maxima and minima lie on the same straight line. But at the same time, there is one that lies slightly lower than the others. This is normal, because it is still in the area of our marked level.

So, a level is a point of a possible price reversal or, in other words, a place where traders’ activity increases. You probably have a question: “Why is this place so attractive to traders?” A similar market reaction is caused by the accumulation of limit orders from sellers and buyers. Why do they place their limit orders? The answer will be very simple. This is because it is obvious to them where to place the stop loss. This is a feature of human perception, because not only robots, but also people trade in the market.

And besides, I note that robots are programmed by people who realize that people trade in the market. They understand that instead of entering into an unclear space where it is unclear how to set a stop loss, the human brain will look for something to grab onto. He tends to enter the market at such breaks.

A level is a collection of limit orders from sellers or buyers. Since there is high activity of traders at the levels, the levels are a possible place for a price reversal or an increase in its activity.

How to find levels and plot them on a chart?

Before we start marking levels on the chart, first of all we must pay attention to the extremes, that is, the extreme points: the maximums and minimums of the chart.

As a rule, levels are usually marked on the chart with a red line, which is available in the MetaTrader 4 toolbar:

We draw levels at the extreme points of the candles, while trying to draw them through the zone of maximum density of bars. What does this mean? For example, on the chart we have an extremum point.

She stands out with her tail:

It would seem that you need to build a level along its tail, but if you look at the chart carefully, you can see that the price fought back several times from the obstacle that prevented it from going up. It is for this reason that we need to move the level just below the tail:

On the one hand, it is closest to the highest point, but at the same time passes through areas with the maximum density of candles. This gives a more optimal picture.

And I remind you once again that a level is not a line, but a zone. We look at the line, but remember that in reality it can have approximately this area of influence on the chart:

Let me note that the price does not have to reach our line point by point. It can turn around and go in the opposite direction without reaching the level we built. Therefore, imagine a certain zone and work within it.

Dow Theory: Basic Principles

The Dow Theory is based on 6 principles:

✳️ The market takes everything into account!

This means that any event that affects supply and demand is reflected on the trading chart in the price of the corresponding asset.

✳️ There are only three types of trends on the market.

According to Dow Theory, the market moves in three types of trends:

☝️ Main trend (long-term). Duration from 1 to 3 years. This is the strongest trend.

☝️ Secondary trend (medium term). Duration from 3 weeks to 3 months. Usually this is a correction of the main trend, that is, a movement within it, but in the opposite direction.

☝️ Minor trend (short-term). Duration less than 3 weeks. Correction of the secondary trend.

The main trends are divided into 3 phases

☝️ Bullish or uptrend: accumulation phase - participation phase - accumulation phase.

☝️ Bearish trend: accumulation phase – participation phase – implementation phase.

Source: CFD IBEX 35, weekly chart, MT5 Admiral Markets. Data Range: February 12, 2022 to March 3, 2022 Prepared March 3, 2022 Please note that the past data we present does not guarantee future results.

The following principles:

✳️ Trading volume must confirm the trend:

✴️ Uptrend: If the price goes up, the volume should increase. If the price goes down, the volume should go down.

✴️ Downtrend: the opposite will happen. If the price goes up, the volume must go down. If the price decreases, volume must increase.

✳️ Confirmation of the Dow Jones Transportation and Industrial Index:

Dow Theory tells us that the existing trend must be confirmed by these two indices (they must follow the same trend). If not, it could be a sign of a weakening or reversal in the trend.

✳️ Duration of the current trend before the change is demonstrated

How to find levels if you are a beginner?

It can be difficult for beginners to see peaks and troughs on a chart. This is because they don't have enough experience. In this case, switching the graph to linear mode can help you.

At first, it will be better to use it.

In the future, you will be able to do this on a regular chart with candles or bars. I will say right away that it is very important to learn how to work with a regular chart, because it displays the extreme price points, tails and shadows of candles, and the constructed levels without them will be, to put it mildly, inaccurate.

You can also use the ZigZag indicator to practice building levels:

It will help you mark levels on the chart:

But I recommend that you do not use indicators, but find levels manually.

How to choose significant levels?

Once all the peaks and troughs are marked on the chart, it may seem that there are too many levels on the chart.

And if you rewind the chart and mark all the levels there, you will end up with a chart drawn with horizontal lines. And there will be nothing left on it except levels. What to do and what to do about it? First, you must understand that not all levels deserve your attention. First of all, don't look too far. There is no need to rewind the chart back a few years.

You must understand that traders are looking at the current screen. Simply put, you need to look at what fits into the monitor, and this is about 200 candles. Therefore, the distance that we need to pay attention to when finding levels on the chart is approximately 200 points or one screen. If there was a strong minimum or maximum near the screen limits, then it should be taken into account when arranging levels.

For example, it is worth noting the extreme value of Frank:

Since such extremes stand out strongly on the chart, traders will remember them for a long time, so they should not be forgotten.

Try to mark clear levels that are visible to the naked eye. The largest number of traders pay attention to them. If we go into technical details a little deeper, then first we note the extremes; they are most important during a price reversal. Next, we mark the levels formed by long tails - this is nothing more than collecting stop losses. The price moved, enriching the market makers. Traders remember these levels and use them in trading in the future.

In addition, it is necessary to note the levels from which the impulse movement occurred with the breakdown of local minimums and maximums. And, of course, we mark levels where there was strong prolonged trading, when the price was not allowed to go up or down.

Now that I've given you information about what levels you should pay attention to, let's edit them in our example.

This is what our chart looked like with the levels previously marked on it:

Let's start editing from the bottom, from left to right. The lowest level was the extreme. After it, a price movement occurred that broke through local highs, that is, it gave us a new high point.

From this we conclude that we leave this level.

The next level gave us approximately the same information as the previous one, but here there was a trade. The price was not allowed to go lower for a long time. There is a certain power to it. They buy some large positions from him.

Therefore, we also leave it:

There is consolidation on it and the price is not allowed to go below a certain level.

We marked the next level based on the long tail of the candle. But it did not give a good downward movement, so we remove this level:

There was no movement here that would give us new local minima. If the price went down from this pin bar, then the level would have taken place. But since there was no movement, it means there was no result.

The next level must be set carefully so that it passes through the local minimum and at the same time captures the candles behind it. This level gave us a new high point, so we leave it.

Next, we drew a level, since the price touched it three times and subsequently gave a new high:

This means that we are leaving him.

For the next level, it may seem like the price takes it into account. But there were no new local minimums and maximums compared to the previous one, so we delete it:

It is very easy to notice on the chart. It stands out, which means we will leave the level drawn through it. It will attract traders and perhaps benefit us. And the last level is at the very top. At the moment it is carried out at the extreme. Therefore, it remains on the chart. This is how we edited our chart and cleared it of unnecessary levels.

In this article we are looking at support and resistance levels. I usually just call them levels. But if we distinguish between these concepts, it turns out that support levels are levels that prevent the price from going lower. And resistance levels are levels at the top that prevent the price from going higher.

Our last drawn level will be resistance for the price for some time. He will resist its further upward movement.

History tends to repeat itself

And Dow has mentioned this more than once, since it is possible to search for repeating patterns of price movement. We find the same patterns on the working timeframes of the “Sniper” strategy in the form of certain graphical structures for a reversal or a breakout of a continuation of movement.

8. Percentage price reversal criterion

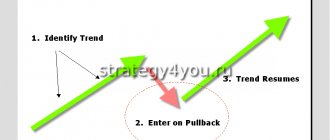

The price never goes in one direction - sooner or later periods of price pullbacks occur. Using a percentage measured from previous values, we identify three types of turning points.

According to the Dow Theory, a price reversal occurs after moving up or down 33%, 50% or 66% of the last movement.

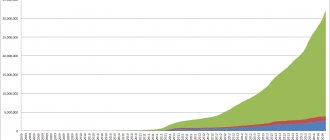

Technical analysis constantly adapts and changes along with the non-linear market, but the basis always remains the same. The Dow theory is over 100 years old and its main theses remain relevant to this day. On these basic principles, you can build your own rules, search for new patterns of technical analysis, which will work out with some success over a long trading period of time.

Remember that without understanding these principles, successful Forex trading is impossible.

Reversing the roles of support and resistance

And as you might have already guessed, support can become resistance after the level has been broken down.

For example, this level has been support for a long time. After it was broken through, it became resistance for a while:

When the price broke through it upward, it again became a support level. Remember, if the price is above the level, then it is support, and if on the contrary, then it is resistance. Changing the roles of levels on a chart is normal.

The price takes everything into account

The current price is the result of all factors acting on the market: financial, economic, political. It reflects the market “opinion” on a trading asset and takes into account the impact of various events and news, comments, forecasts and even some probability of force majeure. This statement of the Dow theory is quite consistent with the market efficiency hypothesis.

At each moment of time, the market provides the trader with actual data on price ( Open, Close, High, Low ), volume ( Volume and Open Interest ), statistics, and supply/demand indicators. It is this information that indicators use to assess the likelihood of further movement. As a result, technical analysis of the Dow always lags behind the real market, since it studies only “past” data (price history). To get possible options for further actions, and if you’re lucky, to be one step ahead, you need a fundamental analysis. For now, let's move on.

How to understand that the level has been broken?

Sometimes there is a zigzag price movement on the chart. Because of this, it can be confusing which level belongs to what. The price zigzags and breaks through it back and forth.

Therefore, there is a very simple criterion for levels. To understand that the level has been broken, you need to look at the two closing prices of the candles at the level. If the level was broken for the first time, and then it was broken again, this means that the level was broken. There is nothing complicated about this, the main thing is to carefully follow the schedule.

The Doe Theory - Who was Charles Doe?

Charles Dow was the son of a farmer and was born in Stirling in 1851. His father died when Charles was only 6 years old, so the boy had to leave school and start working to support his family.

Charles Dow later began a career as a journalist, and in 1889 he founded. This company was the first to publish an index designed to reflect the movement of the stock market. This index eventually became known as the Dow Jones.

How to use levels in Forex trading?

To begin with, it’s worth remembering that levels are a fulcrum. If you have a buy signal somewhere and you see that the price is at the level, then this means that the signal has a foothold. You can take it with more confidence.

For example, we had a buy signal at this point in the middle of the chart:

It has no pivot, so it is less significant than the next signal at the support level in the blue box.

In addition, levels are used to determine stop losses and profit taking targets. As for the goals, I think everything will be clear to you. The target is the nearest level.

Stop losses are placed just below the level if it acted as a support. Let's imagine that we entered the market somewhere in the area marked with a blue rectangle:

We would set the stop loss just below the level, giving some freedom to the price:

This is all determined by eye. There are no clear criteria for this.

Dow Theory: Cascade of Lows

Source: CFD DAX 30, chart H1, MT5 Admiral Markets. Data Range: January 15, 2022 to February 7, 2022 Prepared March 3, 2022 Please note that the past data we present does not guarantee future results.

The chart above shows how the price consistently breaks through different lows, and we get a clear downward trend in the DAX30 CDF.

What are the advantages of this method?

➢ This type of Forex signals is available to everyone, allows you to take advantage of all market opportunities and is ideal for a trending market with little pullback.

➢ Very often it requires a larger stop loss, which affects the profit/loss ratio for each position.

Are there any disadvantages?

➢ This is a rather aggressive way to enter the market, so the strategy needs to be tested first.