The best cryptocurrencies are the coins that show the highest daily trading volume and maximum ROI. Naturally, the TOP 10 mainly includes market titans: Bitcoin, Ethereum, Ripple, Litecoin and other well-known coins. The top ten leaders can change very dramatically, for example, due to the discovery of technical errors in the network or due to a hard fork.

According to CoinMarkerCap, there are more than 2,000 cryptocurrencies in the world. Their total capitalization as of July 24 of this year reached $285 billion. Because of such huge numbers, a newcomer to the digital asset market can easily become confused. To avoid this, find out which crypto coins deserve the most attention.

Bitcoin (BTC)

The average market rate is about $2,600. Market capitalization (the value of all existing Bitcoins) is $41.8 billion.

This is what essentially started the cryptocurrency boom. The Bitcoin network (bit - unit of information, coin - coin) was launched in January 2009, when Satoshi Nakamoto (Satoshi Nakamoto - the pseudonym of one or more programmers) published client program code for a new decentralized payment system.

The maximum number of coins in the Bitcoin system is 21 million. Currently, more than 16.4 million Bitcoins have been mined. According to forecasts, the issue of new coins will be completed by 2140.

Before August 2010, Bitcoin was worth virtually nothing. Then its price began to rise: from 0.06 to almost $3,000. Today it is the most expensive and difficult to obtain cryptocurrency.

In May 2010, the first exchange of bitcoins for goods took place: two pizzas were sold for 10 thousand units of this cryptocurrency.

At the end of June 2022, one of the Moscow restaurants became the first Russian establishment to accept payment in bitcoins.

Conclusion

After reviewing two different ratings, we can come to the following conclusions:

- With an increase in daily trading volume, it is more difficult for cryptocurrencies to demonstrate a sharp increase in value, however, such assets are characterized by increased confidence on the part of investors and traders and are better suited for long-term investment and storage.

- The value of tokens is constantly changing. Among the important growth factors are:

- Entering into partnerships with large companies can increase the value of digital assets several times. This is what happened to the Streamr Network token after the announcement of a partnership with Binance.

- Large-scale updates aimed at expanding functionality and attracting new audiences. A striking example is Aave, which with the support of USDT alone was able to significantly increase the amount of loans.

- Hype – mentions in the media or on social networks often unreasonably influenced the value of the cryptocurrency, artificially increasing demand. This year, the Dogecoin story served as an example. After a sharp increase in price due to TikTok videos, the value of the asset expectedly fell.

Ethereum (ETH)

The average market rate is about $300. Market capitalization is more than $28.6 billion.

Ethereum (or ether) was proposed by the founder of Bitcoin Magazine, Russian-Canadian Vitalik Buterin at the end of 2013.

It is an open software platform based, like Bitcoin, on blockchain technology (a chain containing all transactions). With its help, developers receive tools for creating a variety of decentralized applications without intermediaries. Examples can be seen here.

They are based on so-called smart contracts: applications operate in strict accordance with the initially established rules and algorithms.

This cryptocurrency is one of the most popular among miners today.

Cardano (ADA)

The Cardano project was launched in 2015, and the cryptocurrency is called ADA. Like Ethereum, this platform is designed to work with smart contracts.

ADA mining is carried out using the Proof-of-Stake algorithm. This means that new coins are randomly awarded to one of the active participants in the network. The choice is made taking into account the size of the share - the more ADA in your account, the higher the chance of receiving a reward.

The ADA rate remained stable until the end of November 2022. After this, the price of the cryptocurrency began to grow rapidly, and by mid-December it increased from the initial 2 to 57 cents per coin. Overall, the coin has great potential, but it will have to get rid of bottlenecks (such as low transaction speeds) and win the trust of large players.

Ripple (XRP)

The average market rate is $0.278. Market capitalization is about $10.5 billion.

Ripple is an open-source cryptocurrency and distributed payment system. It was launched in 2012 to provide instant, secure and virtually free (with a meager commission that is destroyed) financial transactions of any size.

At its core, XRP is similar to Bitcoin: this cryptocurrency is based on mathematical formulas, it is decentralized, each wallet in the system contains the history of all transactions.

But there are also differences. Ripple does not use a traditional blockchain, as is the case with Bitcoin. It is impossible to mine this currency: all coins have already been created. They can be bought at exchange offices or on stock exchanges.

XRP is recognized by a number of major banks. Some venture funds have invested in this cryptocurrency.

Bitcoin Cash (bitcoin cash)

- Year of creation: 2017

- Symbol: BCH

- Approximate capitalization: $26,869,290,293

This cryptocurrency was the result of the division of the military-technical cooperation into two new currencies due to problems of a significant slowdown in transactions of the main digital unit.

What the user should know about Bitcoin Cash:

- is more protected from possible problems with transaction speed;

- in the future it may become more convenient as a means of payment than Bitcoin.

Although, immediately after its appearance on the exchanges, Bitcoin Cash, thanks to its solid capitalization, was able to surpass such popular currencies as Litecoin and Ripple in the ratings. Although today the number of transactions and price growth are not particularly impressive, Bitcoin Cash does not lose its popularity, continuing to remain at the top.

Litecoin (LTC)

The average market rate is about $40. Market capitalization is more than $2 billion.

Litecoin is a cryptocurrency created by former Google employee Charlie Lee in October 2011 as an “evolution” of Bitcoin and based on its open source code.

The maximum amount of Litecoin that can be mined is 84 million (there are currently over 51.7 million units). The mining algorithm for this cryptocurrency is similar to Bitcoin. However, blocks for which rewards are paid are formed four times faster in Litecoin.

Ethereum Classic (ETC)

The average market rate is about $18. Market capitalization is about $1.8 billion.

Ethereum Classic is the younger brother of Ether. This cryptocurrency has all the same features, including smart contract functions. It was created in the summer of 2016 as a result of a hard fork (a rigid change in the rules in the operating protocol) of the Ethereum network.

The reason for this was a hacker attack on The DAO, a decentralized venture capital fund created for cryptocurrency-related projects. In 28 days, The DAO collected a lot of ether through crowdfunding - $168 million. But a vulnerability was discovered in the smart contract. The hacker who found it managed to withdraw about 3.6 million ether (at that time approximately $50 million).

To return what was stolen, it was decided to hard fork the Ethereum blockchain, resulting in the formation of a new chain of transaction blocks.

NEM (XEM)

The average market rate is $0.17. Market capitalization: $1.55 billion.

NEM (New Economy Movement) was developed in Japan using its own open source code and with the support of the operator of the largest Japanese cryptocurrency exchange, ZAIF. NEM is a cryptocurrency and technology platform.

A special feature of NEM is the use of the POI (Proof of Importance) algorithm. Determining the user who will generate the next block depends not only on its share (as is the case with other cryptocurrencies), but also on activity - the number of transactions completed. In this way, developers discourage hoarding and encourage the use of NEM as a currency.

The process of mining - creating blocks - is called harvesting (from harvesting - harvesting). The developers have set the minimum wallet size for faucets to 10,000 XEM.

The number of XEM coins is limited to 9 billion. The developers do not plan to conduct an additional issue.

Dash (DASH)

The average market rate is about $180. Market capitalization is more than $1.3 billion.

At the time of launch (January 2014), this cryptocurrency was called Xcoin, and a little later - Darkcoin.

Dash is a cryptocurrency and an open-source, decentralized international payment system.

Its peculiarity is the ability to make anonymous transactions, which is provided by a mechanism called DarkSend. Dash also has decentralized governance. The decision on any changes in the operation of the network is made by all its participants: they can put any issue to a vote for a small fee.

In June 2022, the developers intend to launch Dash Evolution, a decentralized platform for cryptocurrency payments with minimal commissions for merchants and zero for clients.

Monero (XMR)

This cryptocurrency takes an honorable 10th place in the top 10. It appeared as a result of the Bytecoin (not Bitcoin) fork on April 18, 2014. What distinguishes Monero from previous cryptocurrencies is the anonymity of transactions and the absence of restrictions on total emission.

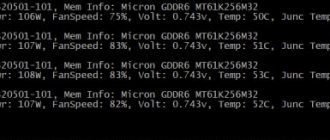

Monero mining is carried out on video cards. To date, there are no ASIC devices capable of working using the CryptoNight algorithm, so the difficulty of mining this cryptocurrency is not growing so much. The same cannot be said about the price, which in 2022 made a dizzying jump from $9.59 in January to $470 in December.

The anonymity of transactions in Monero makes it very popular. The promotion of cryptocurrency is also facilitated by the high activity of the community.

IOTA (MIOTA)

The average market rate is $0.38. Market capitalization is more than $1 billion.

This is a new project different from other cryptocurrencies: the creation of an exchange network for the Internet of Things (Internet of Things - a computing network of physical objects with built-in technologies). IOTA appeared on exchanges a few weeks ago.

The basis of cryptocurrency is not a traditional blockchain (in this case there are no blocks as such), but Tangle technology, which allows you to make transactions without payments.

The peculiarity of cryptocurrency is that the user cannot carry out a transaction without checking the two previous ones. Thus, it helps to increase network security.

The emphasis in this scheme is on conducting micro- and even nanotransactions without any commissions (which, as is known, can be more than the transfer itself). The incentive in this case is the use of the network itself: the more often the user does this, the more checks occur and, accordingly, the higher its efficiency.

It is stated that IBM and Qualcomm Inc. actively studying and testing solutions based on IOTA.

Top 10 most popular cryptocurrencies

08/15/2017 Alex Kondratyuk

#Coinmarketcap#Ethereum (ETH)#Bitcoin#capitalization#cryptocurrencies

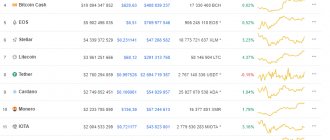

The analytical service Coinmarketcap is extremely popular among crypto enthusiasts around the world. This is evidenced by the dynamics of growth in traffic to this resource, growing from month to month.

The Coinmarketcap service collects all cryptocurrencies that are listed on at least one exchange and that have a blockchain and open source code. At the time of writing this review, the service offers over 800 digital assets, sorted by capitalization. The latter is the product of the current price of a cryptocurrency and the volume of its supply on the market.

The digital currencies represented in the top ten of the Coinmarketcap rating are in greatest demand among traders and crypto investors. This is due to various factors, and the most important among them are high liquidity, stable exchange rate growth, prospects for further development of the ecosystem and the reputation of the developers.

It is also worth noting that in the world of cryptocurrencies everything is changing very rapidly. However, at the time of writing this review, the total capitalization of the first ten cryptocurrencies in the Coinmarketcap rating is $122.4 billion. If this number is compared with the total value of all cryptocurrencies ($138.8 billion) presented on this service, it turns out that the market share of the ten most popular digital currencies will account for 88%.

1. Bitcoin (stock ticker - BTC, sometimes - XBT). The first ever and most popular cryptocurrency in the world. Created at the turn of 2008-2009. Despite such a “venerable age”, the cryptocurrency is actively developing; developments are being carried out on the basis of the Bitcoin blockchain and various solutions are being implemented to improve it. It was the emergence of Bitcoin that was the reason for such a rapid development of the cryptocurrency market and the regular appearance of a wide variety of digital assets. Bitcoin is based on the revolutionary blockchain technology, which has been actively researched and developed by the world’s largest companies for several years now, and is also used in many industries.

The current capitalization of Bitcoin is $71 billion, which exceeds the value of many large world-famous companies. The supply of the first digital currency is strictly limited to 21 million BTC. On the Coinmarketcap website you can see the current volume of Bitcoin supply on the market - 16,506,412 BTC, the daily exchange trading volume, as well as various useful links to official sources of information, social media, block explorers, exchanges where this cryptocurrency is presented, etc.

2. Ethereum (ETH). It is a digital currency platform for creating decentralized blockchain-based online services (Dapps) powered by smart contracts. If Bitcoin is often called “digital gold” (due to the complexity of its production, limited supply and excellent investment qualities), then Ethereum is sometimes called the “digital analogue of oil.” This is because the ETH cryptocurrency is a kind of “fuel” for smart contracts and Dapps created on their basis.

There is ongoing debate in the crypto community about which investment object is more attractive: Bitcoin or Ethereum. Despite the relatively young age of the latter (the Ethereum network was launched on July 30, 2015), “ether” is preferred by fairly well-known personalities in the world of cryptocurrencies. They are convinced that the popularity of Ethereum will soon eclipse Bitcoin.

The rapid growth in popularity of Ethereum is evidenced by the following graph, which reflects the share of the most popular cryptocurrencies on the market:

Data: Coinmarketcap

So far, the market capitalization of “digital oil” ($28 billion) is approximately two and a half times less than the corresponding figure for Bitcoin.

At the same time, Ethereum's potential is high and attracts the attention of major software developers such as Microsoft and IBM. There are many ICOs (Initial Coin Offerings) conducted on the Ethereum platform, and many crypto tokens are created based on the underlying ERC-20 standard.

3. Ripple (XRP). This cryptocurrency is used in the real-time gross settlement system, as well as for currency exchange and money transfers. The Ripple protocol launched in 2012. Its goal is to provide "secure, instant and nearly free global financial transactions of any size with no chargebacks." According to some crypto enthusiasts, the Ripple payment system may in the future become an “alternative to SWIFT”.

The largest companies and banks in the world cooperate with Ripple, including BBVA, Mizuho, Mitsubishi UFJ, UniCredit, UBS and Santander. Ripple investors include names such as Accenture, Andreessen Horowitz, Google Ventures and Seagate.

The rapid rise in the price of Ripple (XRP) occurred in the first half of this year and allowed the cryptocurrency to confidently gain a foothold in the top three of the Coinmarketcap rating. Currently, the capitalization of the XRP cryptocurrency is approaching 7 billion. There have been times when the capitalization of Ripple exceeded the total market value of the digital currency Ethereum.

4. Bitcoin Cash is an “alternative to Bitcoin” that emerged as a result of a hard fork. So, on August 1, the Bitcoin blockchain split into two chains and a new digital asset appeared - Bitcoin Cash (sometimes - Bcash), which has a common history with Bitcoin, but is traded under a different ticker - BCC (less often - BCH).

After the hard fork, many exchanges and wallets gave holders of “digital gold” an excellent opportunity - to receive a certain amount of Bitcoin Cash tokens, which should correspond to the balance of Bitcoin in a 1:1 ratio. For example, if a user has 1 BTC in his wallet, then he receives 1 BCC after the hard fork.

Immediately after its appearance on the exchanges, the new cryptocurrency found itself in third place in terms of capitalization, leaving behind such market “veterans” as Litecoin and Ripple. However, shortly after exchanges made Bitcoin Cash deposits and withdrawals available, the “alternative to Bitcoin” began to plummet in price. So, if on August 2 the BCC price reached 0.485 BTC (approximately $1300) on the Bittrex exchange, then two days later its weighted average price slightly exceeded $250.

Not everything is going well with the new cryptocurrency. Bitcoin Cash is not as attractive for mining as “regular” Bitcoin, and its network experiences various problems every now and then. Apparently, the new cryptocurrency so far owes its capitalization of $4.8 billion only to the popularity of Bitcoin, nothing more.

5. IOTA. Cryptocurrency exchange network project for the Internet of Things. It is based on the unique Tangle consensus method. The main feature of the latter is the absence of miners. In addition, there are no transaction fees on the network - the latter are mutually confirmed by network nodes.

IOTA is also unique in that network participants are not divided into users and transaction validators. Each node both sends and confirms transactions that are not packaged into blocks (which distinguishes IOTA tokens from the vast majority of other digital currencies). The throughput of the IOTA network is proportional to the number of nodes and their activity.

IOTA tokens are traded primarily on the popular Hong Kong exchange Bitfinex. It is noteworthy that other trading platforms are not yet in a hurry to list this innovative cryptocurrency. On the other hand, IOTA is gradually gaining universal recognition. So, last month, the SatoshiPay service specializing in micropayments announced its intention to abandon the use of Bitcoin in favor of the IOTA cryptocurrency.

If we consider the global prospects of the new cryptocurrency, they seem quite interesting. Thus, according to research by TechNavio, from 2022 to 2022. the cumulative average annual growth rate of the global Internet of Things (IoT) market will be 4%. This means that the global IoT market will reach $1.37 billion by 2021, with 81% of the market growth coming from a variety of electronic gadgets.

Recently, the IOTA cryptocurrency has been showing strong growth and the price of one token has reached $0.88. IOTA market capitalization has crossed the $2 billion mark.

6. Litecoin (LTC). A popular fork of Bitcoin, often referred to as “digital silver.” Litecoin was one of the first to activate support for the SegWit protocol. However, even before the activation of Segregated Witness, Litecoin had a significantly faster transaction confirmation time than the same Bitcoin. Currently, the project continues to actively develop under the leadership of its famous creator Charlie Lee.

For several years, Litecoin was “in the shadow” of Bitcoin and other cryptocurrencies, trading around $3-4 per coin. In March of this year, on the eve of the implementation of SegWit, the price of “digital gold” began to rise rapidly. Now the price of Litecoin is approaching $50 per coin and, according to many analysts, this is far from the limit. Cryptocurrency is available on most exchanges and exchange platforms, and is also accepted by many companies as a means of payment.

The maximum supply of Litecoin is limited to 84 million tokens and there are currently 52.4 million LTC in circulation on the market.

7.NEO. The NEO digital asset platform (formerly known as Antshares) is often referred to as the “Chinese Ethereum.” Recently, project representatives completed the complete rebranding. In particular, the Chinese startup announced an upgrade of blockchain nodes, an update of technical documentation, social media, the official website, a change in the stock ticker, as well as a successful transition to the NEO 2.0 smart contract system.

The NEO coin has been demonstrating impressive growth for a long time, which allowed the cryptocurrency to take 7th place in the Coinmarketcap rating in a short period of time. In just the last three months, the price of the cryptocurrency has increased approximately 20 times and NEO is now trading around $45. The supply volume of NEO is fixed and limited to one hundred million tokens, of which 50 million coins are in circulation on the market. The market capitalization of “Chinese Ethereum” exceeds $2 billion.

It is also worth noting that the project is developing very actively and has already established cooperation with well-known blockchain startups, including Bancor, Coindash and Agrello. Chinese blockchain startup Red Pulse announced the creation of a platform for financial research, which will be built on the NEO 2.0 smart contract system. Also, in collaboration with the NEO project, a blockchain operating system called Elastos is being developed. According to the developers, it is intended to “explore the technological value of using blockchain applications in new Internet operating systems and further develop Smart Economy.”

8. NEM (XEM). This digital currency gained popularity in early 2015. It is distinguished from many other digital currencies by its original open source code and a number of interesting innovations. For example, the XEM cryptocurrency is based on the POI (Proof Of Importance) algorithm, a “proof-of-stake” modification. However, unlike PoS, in POI, in addition to proof of storage of a certain amount of funds, the user’s activity is also taken into account - the number of transactions he has made. Receiving a block reward on the NEM network is called “harvesting”.

A major update called Catapult is expected this year, during which NEM will switch from Java to C++. The new version of the private network has been tested for stable operation at speeds of up to 3000 transactions per second. The update will take place first on the private Mijin blockchain and then on the public NEM chain.

Also based on NEM, a new platform, COMSA, is being developed, which is designed to support projects in conducting transparent and orderly ICOs. According to project representatives, the new solution will significantly optimize the process of attracting investments in digital currency.

XEM's capitalization exceeds $2 billion. The coin is popular not only in its native Japan, but is also actively traded on a number of major exchanges, including Poloniex and Bittrex.

9. Dash. The launch of the cryptocurrency, which at that time was called Xcoin, occurred on January 18, 2014. From January 28, 2014 to March 25, 2015, the cryptocurrency was called Darkcoin.

Main features of the Dash cryptocurrency:

— transactions are anonymized thanks to the Darksend mechanism; — a combination of several cryptographic algorithms is used; — mining Dash requires less energy than Bitcoin; — decisions on the development of the system are made not by individual programmers, but by all members of the Dash network through a decentralized control mechanism.

The DASH network operates so-called masternodes - special nodes that ensure the operation of the PrivateSend transaction mixing mechanism. To stimulate the work of masternodes, a reward is provided, which is 50% of the miner’s reward for the found block. The DASH system also implements the InstantSend instant transaction service. Another feature of DASH is the use of the X11 hashing algorithm.

The DASH cryptocurrency has many supporters. Since its inception, the price of the cryptocurrency has increased several hundred times and Digital Cash is currently trading around $200.

10. Ethereum Classic (ETC). Appeared in 2016 as a result of the “twin brother” hard fork of Ethereum (ETH). In other words, this cryptocurrency is the same Ethereum before the hard fork. The goal of the project is to keep the original Ethereum decentralized, immutable, and uncensorable.

A year ago, many considered Ethereum Classic to be “stillborn,” but this turned out to be far from the case. ETC is still in the list of top 10 cryptocurrencies by market capitalization. An ardent supporter of Ethereum Classic is world-famous crypto enthusiast and head of the Digital Currency Group, Barry Silbert. Largely thanks to his efforts, the ETC cryptocurrency appeared in the professional computer system Bloomberg Terminal.

In general, the growth of Ethereum Classic greatly intensified in the spring of 2017, after the launch of the Ethereum Classic Investment Trust. The further growth of Ethereum Classic expects to be stable, at least thanks to the project’s balanced monetary policy, which provides for limiting emissions and reducing the block reward. In particular, the total number of coins will be approximately 210 million, but not more than 230 million; As for the reward for the mined block, it will be reduced by 20% after block number 5,000,000 and will be reduced by 20% in the future after each subsequent 5 million blocks.

Alexander Kondratyuk

Found an error in the text? Select it and press CTRL+ENTER

BitShares (BTS)

The average market rate is $0.27. Market capitalization: $708 million.

BitShares is an electronic crypto trading platform, a decentralized cryptocurrency market based on blockchain technology. BTS is the platform's built-in payment tool.

The network operates based on proof of stake rather than proof of transaction, as is the case with Bitcoin. The processes occurring on BitShares are controlled by the algorithm for launching decentralized autonomous companies (DAC - Decentralized Autonomous Companies).

A special feature of the platform is the absence of the usual risks for such trading platforms: theft, blocking of funds in the account, closure of the site, and so on.

Stratis

This project is based on blockchain for enterprises. Its developers have created simple solutions for testing and developing blockchain applications written in C#. Already today, many financial institutions use the Stratis blockchain to work with cryptocurrencies, not Bitcoin, as you might think.

But the main competitor of this system is not Bitcoin, but Ethereum. This platform for creating applications on the Blockchain largely copies the brainchild of Vitalik Buterin. But, as often happens in the cryptocurrency market today, the system that came out later has better technology. Therefore, the future of Stratus, devoid of problems, is quite promising.

Promising cryptocurrencies

The cryptocurrencies listed below are some of the most expensive on the market.

Zcash (ZEC)

The average market rate is $342. Market capitalization: $532 thousand.

The peculiarity of this cryptocurrency is confidentiality and selective transparency of transactions. Payment information is published on a public blockchain. However, Zcash uses a zero-knowledge proof protocol: the sender, recipient, and transaction amount remain hidden.

The developers believe that this is an improved blockchain.

Byteball (GBYTE)

The average market rate is $816. Market capitalization: $208.4 million.

Byteball is called a new generation cryptocurrency. It does not have the usual blockchain, it works on the basis of DAG (each new transaction refers to previous “parent” transfers, forming a kind of “tree”). There is no mining in Byteball: transactions are confirmed by trusted users.

The developer, Anton Churyumov, used an unusual method of distributing cryptocurrency: he distributed it free of charge to all Bitcoin owners who confirmed their wallet on the Byteball network.

Digital Cash (dash)

- Year of creation: 2014

- Symbol: DASH

- Approximate capitalization: $5,035,002,494

Dash gained fame thanks to a revolutionary idea and a special algorithm for creating x11. Developer Evan Duffield sought to increase the anonymity of users of the new currency compared to BTS. This crypt has an official website and company.

What the user should know about Dash:

- until 2015 it was called Darkcoin;

- decentralized management;

- due to high anonymity (PrivateSend service), it is almost impossible to track transactions on the network;

- emissions require lower costs than military-technical cooperation;

- uses several cryptographic algorithms;

- The system operates an instant transaction service – InstantSend.

Digital Cash is essentially an improved version of Bitcoin with greater user anonymity and simplified mining. Actively developing and conquering new markets, Dash has managed to increase in price from $9 to $625 since the beginning of 2022.