Bitcoin halving reduces the number of new coins created and earned by miners by half. This happens approximately every four years and helps control the distribution of BTC, curb inflation and perform other important functions that are integral to the philosophy of the cryptocurrency world.

Sponsored Sponsored

If you're new to the world of cryptocurrencies but want to learn more, it's worth first understanding how the Bitcoin blockchain works. There are many important concepts and nuances here that are worth learning. However, Bitcoin halving is perhaps one of the most innovative concepts to emerge along with blockchain and cryptocurrencies.

What is cryptocurrency halving and how does it happen?

- The idea of halving has existed since the very beginning of Bitcoin. It is reflected in the project documentation - the so-called white paper - published by the mysterious creator of the digital coin, Satoshi Nakamoto, on October 31, 2008. This is the document that first outlined the concept of a digital currency, which later became known as Bitcoin (BTC).

- The White Paper explains the essence of digital currency and the principles of its functioning. In addition to Bitcoin, the document also presented blockchain technology, on which all existing cryptocurrencies are based.

- Bitcoin halving has become one of the basic concepts of the new technology. It controls inflation and the distribution of new coins. This concept is closely related to the concept of cryptocurrency mining, in which miners use their computing power to solve complex mathematical equations and find blocks in the Bitcoin blockchain. Each block represents a group of transactions. When a block is found, these transactions are confirmed and added to the digital ledger as a separate entry.

- For their work, miners receive a reward in the form of new bitcoins. However, to prevent inflation on the network, the reward amount is gradually being reduced.

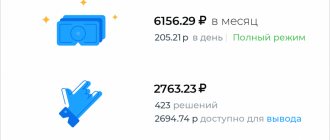

Income of Bitcoin miners. Data: blockchain.com

- In other words, halving occurs (halving). This mechanism is built into the Bitcoin source code and is triggered every 210,000 blocks. And it divides the amount of reward miners receive by half. In this way, the number of new coins put into circulation is gradually reduced, which leads to higher prices and helps to avoid a sharp increase in the number of coins on the market.

- At the same time, this provides an incentive for miners to work for an extended period until 21 million coins are mined.

A graph that reflects the volume of bitcoins already mined as of the end of November 2022. Data: blockchain.com

Preface, or What is Bitcoin?

Bitcoin is a digital currency that can be transferred to another person or paid for a product or service. The main ideology of cryptocurrency is the impossibility of control and management.

Bitcoin is decentralized - there is no regulator. An example in the classical economic scheme is a bank that controls the issue and circulation of fiat.

BTC (bitcoin) exists as a peer-to-peer network, which includes a huge amount of computing power, with an installed client program. The result is that the network is run by the cryptocurrency users themselves.

The total number of bitcoins is limited, the issue is 21 million coins. BTC is generated according to a code that involves a gradual decrease in the reward to miners for finding a block.

Why does halving happen?

As mentioned earlier, the Bitcoin halving serves several functions:

Sponsored

Sponsored

- Prevents inflation

- Stimulates the growth of Bitcoin exchange rate

- Gives the industry time to develop

Let's take a deeper look at each of these points and see how they helped the coin reach its current status.

Prevents inflation

Bitcoin emerged in response to the financial crisis that hit the world in 2008. Then banks proved once again that centralized systems are unreliable, and that they are willing to abuse their power to enrich themselves.

As a result, Nakamoto created his own decentralized system, and tried to eliminate the main problems typical of the traditional financial industry. One such problem is inflation: if the government runs out of money, it simply prints more to cover its expenses.

Obviously, the influx of new money into circulation reduces its value, and then the entire financial industry suffers. History has many examples of currency depreciation. To prevent this, Satoshi decided that the volume of Bitcoin emission would be limited - only 21 million coins. This is the absolute maximum; it is simply impossible to mine more bitcoins.

Bitcoin information: emission volume, current number of coins in circulation and price, as of November 30, 2022. Data: CoinMarketCap

At the same time, he understood that it was necessary to create a mechanism that would evenly distribute the flow of new coins into the system. This will help motivate miners, who will receive a certain amount of bitcoins for confirming transactions. In addition, the system needs time to establish and develop, so Satoshi decided that the size of the reward would be reduced, delaying the moment of mining the last coin.

Thus, with each halving, miners will receive half as much money. If the initial reward was 50 BTC per block, then after the first halving the reward dropped to 25 BTC per block. The second halving reduced it to 12.5 BTC and so on.

Stimulates the growth of cryptocurrency rates

Naturally, Satoshi could not predict when the Bitcoin rate would take off and what heights it would reach. But he had no doubt that the cryptocurrency would rise in price. The first price of the coin appeared shortly after its launch.

As you know, today there is no real asset that would provide the value of Bitcoin. Essentially, it is determined by the utility of the decentralized coin. Satoshi showed that the value of the coin is not subject to the control of central authorities, which was a revelation for users.

Bitcoin price chart. Data: CoinMarketCap

People realized that they could do without banks, which could freeze their accounts at any time; they do not need to be trusted, who can abuse their power over money; and most importantly, they will no longer have to pay huge commissions for money transfers.

These advantages attract the attention of users to Bitcoin. And the more actively it is used, the higher its value. Thus, the value of Bitcoin varies depending on how investors perceive its utility and reliability.

However, Satoshi was well aware that it would take time for people to get used to the idea of a new currency, as well as for the idea to become widespread. Most likely, he also assumed that the authorities would try to intervene to prevent the mass distribution of Bitcoin.

This means that Bitcoin should be a rare asset and not concentrated in the hands of early adopters. This will ensure the price rises as demand picks up, which is another reason why halvings occur from time to time. With each halving, the influx of new coins into circulation is reduced, which, in turn, leads to an increase in price - supply decreases, and demand continues to increase. In other words, Satoshi was right, and up until this point everything had worked exactly as planned.

Gives the industry time to develop

As mentioned above, mining cryptocurrencies is not a cheap pleasure, since the process of mining coins requires considerable computer power, expensive equipment and consumes a lot of electricity. Due to the nature of Bitcoin, it can be mined by one miner or by a million. Satoshi made this possible by creating the concept of mining difficulty - an algorithm that reduces or increases the level of difficulty depending on the number of miners and the amount of computer power involved.

Thanks to this function, it takes on average about 10 minutes to find each block, regardless of the amount of power involved. Otherwise, with an increase in the number of miners, computer power would also increase, and an increase in the amount of resources, in turn, would lead to an acceleration of the block mining process. In this case, 21 million bitcoins would have been mined much faster.

Bitcoin hashrate and cryptocurrency mining difficulty graph. Data: btc.com

But then no one would engage in mining just to keep the Bitcoin network functioning, especially at the beginning of the cryptocurrency, when few people used the coin to make transactions.

Thus, halving fulfills one more task - it maintains the interest of miners while Bitcoin develops and attracts new users. Once all the coins have been mined, miners will receive a profit for their efforts and will earn from transaction fees instead of mining new coins. But for this process to be profitable, Bitcoin must reach mainstream status and be used around the world.

Some forecasts of famous people and experts

John McAfee, founder of the famous antivirus software company McAfee, plans to keep his bitcoins until at least 2022. According to his calculations, the profit will definitely be no less than 100% and can reach a maximum of 2400%. In addition, John believes that by the time the last Bitcoin is mined, its value will be in the hundreds of millions of dollars.

Another expert and crypto investor, Petros Anagnostou, founder of the consulting agency Crypto Solutions and the ICO Timeline information portal, believes that Bitcoin is in for an incredible jump: by the end of 2022, you can expect a price from $50,000 to $100,000 per Bitcoin.

Another forecast comes from Bobby Lee, stating that Bitcoin could rise to $60,000 in 2020.

Are you planning to hold your Bitcoins? Do it right! Read how you can quickly and safely increase their number in the article:

ApiTrade – automated Bitcoin trading

Halving schedule: when was the last halving

There is less than a month left until the next Bitcoin halving. Two halvings have already taken place before this.

Due to the relatively stable process of finding blocks, we can roughly predict the date of the next halving, which takes place once every four years - it is during this period of time that 20 thousand blocks are mined as part of a continuous process.

Below is a chart of Bitcoin halvings.

Behavior of the Bitcoin exchange rate against the backdrop of halvings

As already mentioned, Bitcoin has experienced two halvings. The first took place on November 29, 2012, and the second on July 10, 2016.

How many halvings will there be?

The third halving should take place on May 13, 2022, and the next one will most likely occur in 2024. The fifth could take place in another four years, in 2028, etc.

Bitcoin halvings will continue for decades. The rewards will become less and less, which means the project will never reach its last Satoshi (the minimum portion of Bitcoin).

Of course, mining will continue as long as there are people willing to mine coins, but at a certain stage the size of the reward will simply become unprofitable. However, this will not happen for several decades, and perhaps more than a century, if Bitcoin does not cease to exist at that time. According to some estimates, mining will continue until 2140. But by that time, the cryptocurrency industry will have completely transformed the world, and a solution to this problem will be found.

One of them is the use of transaction fees to pay miners. But, given the development of Bitcoin and the emergence of new ideas, it is likely that by that time a different solution will be found.

How many BTC were mined in their first year of existence?

The Blockchain network and Bitcoin itself appeared on January 3, 2009. At that time, the creators and a narrow circle of interested parties showed interest in the coin. The transaction processing fee reached several bitcoins. In 1 day you could become rich if you recalculate at today's exchange rate.

In the first year of BTC's existence, about 10% of the total issue was mined - 2.1 million coins. Satoshi Nakamoto owns most of them. The rest were distributed among network participants at that time. Let us remind you that the creator (a group of creators) has not yet used their tokens. Only trial transactions were carried out from his wallet to evaluate the capabilities of the new payment method. At that time, Bitcoin was worth $0.10. However, now it is difficult to believe.

How does halving affect the value of cryptocurrency?

We have already mentioned above that Bitcoin halvings ensure a gradual reduction in the influx of new coins. At the same time, the demand for military-technical cooperation continues to grow as this cryptocurrency continues to become popular. Accordingly, this is precisely the idea of halvings.

It should be noted that even the most brilliant ideas do not always work out in practice. However, until now this has not yet applied to Bitcoin. Over the 11 years of its existence, it has already experienced two halvings, and judging by the market reaction to these events, Satoshi’s plan turned out to be effective.

November 2012 - first Bitcoin halving

If we want to assess the true impact of the halving on the price of Bitcoin, we must honestly admit that the first halving is not the most reliable source of data. The reason is that at that time there were still very few cryptocurrency exchanges in the world, and many of them no longer exist.

At that time, buying and selling bitcoins was much more difficult due to the difficulties of depositing money into an account. There were few traders, and all this caused extremely low liquidity compared to today's volumes.

However, data from that period shows that the reduction in new block rewards did not have an immediate effect on the exchange rate. It took about 11 months before BTC entered a parabolic rally, gaining sustained bullish momentum. However, after these 11 months, one could talk about a tangible transformation of Bitcoin.

The BTC rate increased by an impressive 7.562%, strengthening from the $12 area at the time of halving to the $1,100 area 11 months later. This spectacular rally attracted many new traders to Bitcoin and generally led to an increase in interest in the crypto industry. In subsequent years, a large number of new altcoins appeared on the market, but despite this, for the vast majority, cryptocurrencies still remained something frightening and alien.

July 2016 - second halving

At this point, the price of BTC has already stabilized after the first halving. After reaching a high of $1,100, the market entered an extended period of correction, falling to $600. At these levels, the currency met the second halving, and 11 months later it began record growth.

In May 2022 (exactly 11 months after the halving), BTC staged the most ambitious rally in its history, leading it to an all-time high of around $20,000 in a matter of months.

This time, the whole world paid attention to cryptocurrency, and millions of new traders poured into such a promising industry. The example of Bitcoin inspired many enthusiasts, and the number of new altcoins launched began to number in the thousands.

The processes of development and formation of the cryptocurrency industry have significantly accelerated, and now only a few weeks separate us from the third halving.

If history repeats itself, then the next phase of growth in military-technical cooperation can be expected in April 2022. However, it is possible that Bitcoin will begin to strengthen much earlier and again reach historical highs.

If such expectations prevail in the market, we could see BTC purchases by investors hoping to strike it rich as the currency stages another breakneck rally. Accordingly, with such purchases they themselves can provoke the beginning of the strengthening of Bitcoin.

You can learn more about the third cryptocurrency halving from our material.

How many bitcoins are lost forever?

In the early years of cryptocurrency’s existence, no one in the world took it seriously. Because it’s not customary to value the change in your pocket in any way. The main advantage of Blockchain is decentralization. Users process transactions, so they do not need third party services. This means that the network operates independently. However, in case of a problem, writing to support service and recovering your password after loss will not work.

To access a cold wallet, you need to know a seed phrase consisting of 12 words. She is shown only once. It needs to be written down or remembered. Most newcomers did not attach any importance to this.

By 2022, about 20% of the coins of the current issue will be lost, worth about $125 billion. They cannot be used, since they are located on wallets whose passwords have been lost, or on destroyed hard drives.

In the summer of 2022, Mircea Popescu died in Costa Rica. The circumstances of this man's death are still unknown, so the event is considered mysterious. It is noteworthy that his wallet contained about 1 million BTC. According to some data, the owner did not share the password with anyone. As a result, the total cryptocurrency issue lost 4.76%.

These facts have a positive effect on the value of Bitcoin, for this reason the supply becomes even more limited, the demand increases, and with it the price.