- Tariffs, limits and incentives

Seeking global adoption remains a central theme in the cryptocurrency space, and a crypto debit card is a good way to bridge the gap between traditional finance and digital currencies.

Bitcoin debit cards allow you to integrate both crypto and fiat currencies, and cardholders can transfer their funds to them and make payments and purchases at restaurants, movie theaters, stores, and more.

It is much easier to spend cryptocurrencies using cards and you do not need special knowledge in crypto trading.

But since card providers rely on the services of VISA and MasterCard, any problems (conflicts) with the credit card giants can lead to serious delays, and an issue between VISA and Gibraltar-based bank WaveCrest in 2022 led to VISA payment system WaveCrest Holdings banning the use of Visa® cards both within and outside the European Economic Area.

Since WaveCrest has dealt with many crypto debit card companies, this has become a major embarrassment for the sector, however, a number of projects have already been launched and are allowing people to spend their funds through physical and/or virtual debit cards.

Choosing a Crypto Debit Card

When choosing a Bitcoin debit card, you need to consider a number of factors:

- Jurisdiction : Due to the way the cryptocurrency industry is regulated, some Bitcoin debit card services will be available in certain locations. Users should double check that their region is supported by their debit card provider and also remain compliant and aware of any changes to your country's legislation.

- Ease of use : Bitcoin debit cards should be easy to use; however, financing options, fees, and spending limits can complicate the process. Virtual cards help greatly simplify the spending process.

- Security : With increased security comes greater peace of mind, and protocols like site encryption, two-factor authentication, and email/SMS notifications keep user accounts safe. Integration with major credit card providers allows customers to use verification protocols like MasterCard 3D Secure.

- Reliability : Bitcoin is twelve years old, the sector is still young. And it is worth trying to choose the most reputable service providers. Cards delivered through projects that are transparent and integrated with the traditional banking system, as well as with Visa and MasterCard, have a good chance of surviving in the long term, as well as the sudden disappearance or termination of their service.

- Fees : While the world of digital assets is volatile, Bitcoin debit card users are still interested in finding the best rates, and spending on the card shouldn't be hampered by excessive fees. Projects that support transparent and simple payment structures are also well positioned to retain their user base.

- Features : All Bitcoin debit cards have the same basic features: simplify online/offline spending, and cardholders can withdraw money from ATMs. Additional features: Altcoin support, banking services, payment/transfer services, and foreign currency exchange features will also be useful.

- Incentives : New projects aim to attract new users by offering discounts, cashback programs and referral programs that make their services more interesting.

Features of Bitcoin cards

Today, having a card linked to Bitcoin greatly simplifies the life of cryptocurrency owners. With a Bitcoin debit card, you can withdraw cryptocurrency almost as easily as you can withdraw any other currency from the first ATM you come across. Isn’t this what all owners of savings in digital coins dream of?

Previously, they had to go through all the “circles of hell” to withdraw money, and also risk not getting anything at all. Simply put, there are not many safe and effective translation methods. But with the advent of cards, you can manage Bitcoins as easily as money from a regular credit card.

Although, before using one or another Bitcoin card, you need to understand their features:

- The cards in question work in tandem with MasterCard and Visa payment systems. Simply put, the owner of such an accessory can pay with a card anywhere and anytime;

- These cards contain not only cryptocurrencies, but also fiat money (dollars, rubles, euros, etc.). Thanks to this, the exchange occurs quickly and at the internal rate, without markups and commissions. This is an automatic process;

- The card will be linked to an account opened in this service. Thanks to this, you can get fiat money quite quickly;

- You can work with some cards without verification, absolutely anonymously;

- Thanks to the card, you have 24/7 access to funds;

- There are no intermediaries, which simplifies and reduces the cost of transactions with cryptocurrency.

In general, using cards is quite profitable. But for some reason they are not very popular in our country. Apparently, the lack of awareness of the population is taking its toll.

Using a Bitcoin bank card

An ordinary Bitcoin card holder can pay with cryptocurrency in stores that do not support crypto technologies, buy mineral water, or pay for dinner in a restaurant through a regular bank terminal.

Depositing not only with bitcoins and withdrawing in any currency solves the problem of conversion in the absence of a computer and access to the Internet. This requires binding to several currencies. This allows you to quickly and profitably exchange and withdraw “cryptocurrency” into real money.

Some users are interested in the anonymous Bitcoin debit card that the services provide. No bank provides this opportunity, except issuers of Bitcoin cards. Dealing with confidential or anonymous cards has withdrawal and transaction limits, and transaction fees are usually higher. But scans of documents are not needed and the fundamental principle of cryptocurrency payments is respected - confidentiality.

Bitcoin card holders have constant access to their funds and use them regardless of Internet connection.

But automatic cryptocurrency conversion has its drawbacks. Cryptocurrencies have high volatility and it is possible that at the time of settlement in the store the exchange rate will be unfavorable for the holder. Therefore, many people change and withdraw bitcoins to regular cards at the moment of the maximum rise in the rate.

Bitcoin cards are also disliked for their high fees for withdrawals and payments.

Exchange Visa/MasterCard RUB to Bitcoin (BTC) in the Telegram messenger

To increase its potential, the online exchanger Nicechange launched a Telegram bot, which makes it possible to carry out exchange operations without leaving your favorite Telegram messenger. This way your application will be completed even faster, you can test it.

Using a bot assistant allows customers who are concerned about their privacy to no longer worry about this issue.

The Nicechange online exchange resource is the best solution if you are looking for an operator for exchanging Visa/MasterCard RUB for Bitcoin!

Coinbase Card

The Coinbase card allows its customers in the UK, Spain, Germany, France, Italy, Ireland and the Netherlands to instantly spend the funds they have in their accounts.

The Visa bitcoin debit card is linked to the user's crypto account balances at Coinbase, and when the card is used, Coinbase instantly converts the cryptocurrency into fiat currency, which is then used for purchases.

| Characteristics | Coinbase Bitcoin |

| Supported currency | EUR, GBP, BTC |

| Map options | physical |

| Card type | Visa |

| Commission | Average |

| Native token | No |

| Bonuses | No |

As expected, the card can be used anywhere Visa payments are accepted, and customers can use the card for contactless, chip and PIN purchases and to withdraw cash from ATMs.

Users can spend any balances they hold in their accounts (BTC, BCH, ETH and LTC). The card supports fixed currencies GBP and EUR.

The mobile app is available in i0S and Android versions and provides instant receipts, transaction summaries and expense categories.

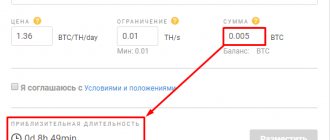

Tariffs, limits and incentives

Coinbase has a transparent fee structure. There is a £4.95 fee to issue the card, however domestic transactions are free and intra-EEA transactions incur a fee of 0.20% of the POS value. Transaction fees and international purchases accumulate at 3% of the POS transaction value.

Domestic cash withdrawals (both ATM and OTC) up to £200 per month are free, but above this amount there is a 1% fee. International cash withdrawals are also free up to £200 per month, and above this amount there is a 2% fee of the withdrawal amount.

It's also worth noting that Coinbase charges a crypto liquidation fee of 2.49% per transaction, as the charges trigger the sale or "liquidation" of digital assets held in a customer's account to fund a fictitious transaction.

This makes the card a little more expensive, and it has a daily ATM withdrawal limit of £500 and a daily spending limit of £10,000.

There is a monthly purchase limit of £20,000 and an annual purchase limit of £50,000.

The Coinbase card does not contain any incentives, however, when the card launched, the exchange waived the £4.95 card issuance fee for the first 1,000 people who ordered it.

As expected, the Coinbase card is good for those who are already using the Coinbase exchange. Coinbase is an established operator and transparent project in the industry, however, to use the card you need to have a Coinbase account and the fees are slightly higher.

Wirex

Based in London, Wirex provides a full range of personal and business solutions focused on cryptocurrency, and also has offices in Kyiv (Ukraine) and Tokyo (Japan).

Wirex is an established project with a transaction volume of $2 billion and a user base approaching 2 million.

Wirex provides a contactless Visa card and lets you connect your credit and debit cards, store cryptocurrencies and buy Bitcoin and select altcoins with competitive exchange rates and high limits.

| Characteristics | Wirex Bitcoin |

| Supported currency | USD, EUR, GBP, BTC |

| Availability | EEA |

| Map options | Physical / Virtual |

| Card type | Visa |

| Commission | Low |

| Native token | WXT |

| Bonuses | 0.5% cryptoback (like cashback) |

You can exchange between crypto and fiat, as well as make direct money transfers with low fees. Supported cryptocurrencies include: BTC, LTC, ETH, XRP, XLM, DAI, NANO and WAVES, while GBP, EUR and USD are the supported fiat currencies.

It is possible to instantly exchange between these supported currencies using transparent live prices and exchange rates. To do this, you need to create a Wirex account, fund it, and then add funds to your Wirex Visa card. You can fund your account by making a bank transfer using a credit or debit card.

Wirex provides different wallets for each cryptocurrency and you can order the card in GBP, EUR or USD.

Tariffs, limits and incentives

Wirex operates a low-fee service, but some features remain free. There are no commissions or transaction fees, and top-ups, regardless of method, are also free. Many transactions are free: online card purchases, in-store purchases and cashback, as well as crypto or fiat exchanges and Wirex crypto/fiat transfers.

Card issuance and delivery are free and there is no charge to use the mobile app, however there is a small fee to manage the card which is around £1.00 / €1.20 / $1.50 per month.

When using a card, you usually only pay the price of each service, product or type of exchange, although there is a fee for using an ATM, which is around £1.75/€2.25/$2.50 in Europe and £2.25/ €2.75 / $3.50 outside Europe plus 1% monthly service charge.

Wirex also imposes a purchase limit of £7,500/€8,000/$10,000 for online and in-store purchases, while the in-store cash back limit is £50 per day.

ATM withdrawals are limited to £250/€250/$250 per day, with a transfer limit of 10 Bitcoin per day, and Bitcoin credit and debit card top-ups up to £5,000/€5,000/$5,000 per day day. Users are required to maintain a maximum card balance of £15k/€16k/$20k.

Wirex has a “Cryptoback” rewards program that allows you to earn cryptocurrencies when you use your Visa debit card. You can earn 0.5% of your spending back in Bitcoin when you make payments and/or purchases.

The Bitcoin you earn with this program is automatically credited whenever you spend on the card and can be instantly exchanged and spent and/or converted. The team also released their WXT token, which provides additional discounts on fees and a 1.5% crypto security level.

Wirex is a worthy choice for tourists to spend their money at any merchant that accepts VISA, with a range of currencies available as well as competitive exchange rates. Service not available in the US. The company is focused on the European market, but plans to expand in the US and Asia in the future.

The most popular cards for cryptocurrencies

There are many useful products among the major players in the Bitcoin card market. If you need to acquire a convenient payment instrument, then you need to approach its choice with special responsibility. The assortment is quite large, and debates about which card is better are ongoing. Everyone praises their product, so to find the best offer, you need to consider each one individually:

- Bitwa.la Bitcoin debit card. It is chosen by European Bitcoiners. She uses euros for payments. This card is issued by Wavecrest Holdings Ltd and Mychoice. There are not only physical, but also virtual options. These Bitcoin cards are used wherever Visa is accepted. The transaction fee is 0.5%. To withdraw money from an ATM, you need to pay 2.25 euros. If you make purchases through POS terminals, these transactions take place without commissions. You can buy a plastic card for 8 euros, and a virtual one for 2 euros.

- Spectrocoin Visa. They are produced by Mychoice. The balance of this card can be topped up in EUR, GBP and USD. Replenishment is free. You can buy a physical Bitcoin card for €8.00, and virtual cards are sold for €0.50. Card maintenance costs €1.00 per month. You can withdraw money from an ATM, but the fee is $3.50.

- Bitpay Visa. This card is primarily intended for residents of Europe and the USA. It costs 10 dollars. You can get it from Metropolitan Commercial Bank for US residents, and Europeans can get this Bitcoin card from Wavecrest Holdings. There is no fee for making a payment, except in cases of foreign currency. The price of Bitcoins in the system is based immediately on a pair of value indices. It will cost two dollars to withdraw money from an ATM, although POS transactions are free. Once the card expires, it can be reissued for a fee of $25.

- Xapo. Today, Xapo is one of the most popular debit cards that supports a balance in BTC. However, these payment instruments are not available in the USA. This Bitcoin card supports the following currencies: BTC, EUR, GBP, USD. The physical card costs 18 euros. If you need to withdraw money from an ATM, you will have to pay 2.25 euros. There are no fees for POS transactions. Transactions on Xapo are inexpensive and there are no service fees at all. You need to pay for Bitcoins that are on the card balance.

- Coinsbank. The peculiarity of this tool is that you can store not only Bitcoins, but also Litecoin on a bank card. There are two types of Bitcoin cards: physical and virtual. You can order an anonymous card, which will allow you not to reveal your identity. To withdraw money from an ATM, you need to pay $4.95, and transactions within the system are free. You have to pay $0.95 monthly for the service.

- ANX. Cooperates with the Visa payment system. Uses USD, BTC. Withdrawal of funds to the card is free, as is maintenance, POS transactions, card issue and reissue. Withdrawing money from an ATM costs $3, and for currency conversion you have to pay 3% of the transaction.

- CryptoPay. The card works with USD, EUR, GBP. Only POS transactions are free, you have to pay for the rest. For example, withdrawing money will cost 1% of the amount. You have to pay $1/€1/£1 for maintenance per month. ATM withdrawals will cost different amounts for different currencies: $3.50/€2.75/£2.25. Conversion within the system costs 3% of the amount. And of course, the card itself costs $/€/£15.

- BitPlastic. You can withdraw money from this card at MasterCard ATMs. You can store USD, BTC on the card. At the same time, withdrawal of money is free, as is the service. To withdraw money from an ATM, the fee is $2, and currency conversion costs 6-8%.

- E-Coin. Collaborates with MasterCard. Can be used to store USD, EUR, GBP. To withdraw funds to a card, the fee is 1%, currency conversion will cost 3% of the amount. The monthly card maintenance fee is $1/€1.5/£1.08, ATM withdrawals are $1/€1/£1. But there are no fees for POS transactions.

But it’s worth considering that services that issue cryptocurrency cards have a cunning conversion system. Many cards cooperate with Visa, but to avoid surprises, it is better to carefully read the agreement with both the service and the bank.

You can buy, sell and safely store Bitcoin in the Matbi multicurrency crypto exchanger. On average, the entire purchasing process is quite simple and takes no more than 10-15 minutes. For convenience, there is a detailed video review. In addition to Bitcoin, Matby supports Litecoin, Dash and Zcash. 24-hour support service, purchase of cryptocurrencies via Visa/Mastercard, fast processing of applications, attractive exchange rates, instant exchange of rubles for cryptocurrencies without commissions, built-in “cold” online wallet for secure storage of cryptocurrencies - this is just a small list of the advantages of the Matbi service.

Revolut

Revolut was a FinTech success story and began disrupting the financial industry with its mobile banking app. Revolut's services are available in the EEA, Switzerland and Australia. In addition to mobile banking services, the British company allows its clients to buy cryptocurrencies.

You need to sign up for one of the paid monthly subscription plans, and a Premium subscription costs £6.99 / €7.99 per month.

Paid subscriptions give you access to digital assets integrated into the platform and purchase Bitcoin, Ethereum, Bitcoin Cash, Litecoin and Ripple. Revolut maintains the standard rate and adds a 1.5% premium to the final purchase price.

But Revolut may not be suitable for everyone. Here you do not have your private keys and cannot transfer your cryptocurrencies outside the Revolut system; the mobile bank retains the right to store your digital assets. Therefore, many cryptocurrency proponents may not view this as a “real” way to buy Bitcoin.

BitPay

BitPay is a recognized operator and American provider of cryptocurrency payments. It has been operating since 2011 and has already connected more than 10,000 sellers. BitPay offers a prepaid Visa card for US citizens that can be loaded with funds through a Bitpay account.

The debit card is fully functional and available throughout the US and is accepted worldwide. BitPay users can make payments and purchases with their debit card at various Visa card acceptance locations.

| Characteristics | BitPay |

| Supported currency | USD, BTC |

| Availability | USA |

| Map options | Physical / Virtual |

| Card type | Visa |

| Commission | Low |

| Native token | No |

| Bonuses | No |

Since the service is only available to US citizens, you must provide KYC to use BitPay. The company provides a range of business services to integrate Bitcoin into everyday business operations.

Bitwala

Bitwala is a European cryptocurrency exchange that works together with the German company Solaris Bank to allow users to buy and sell Bitcoin, make cryptocurrency and fiat transfers. Bitwala customers can make payments via POS and online via MasterCard debit card.

The company's services are not available to US citizens. But whoever is in the EEA can open a Bitwala account if they are over 18 years of age, provide a valid ID and proof of address (KYC).

As expected, Bitwala has also focused on maintaining compliance and trust, with deposits up to €100,000 protected by the German Deposit Guarantee System (DGS).

| Characteristics | Bitwala |

| Supported currency | EUR, BTC |

| Availability | EEA |

| Map options | Physical |

| Card type | MasterCard |

| Commission | Low |

| Native token | No |

| Bonuses | No |

With the Bitwala contactless debit card, you can instantly exchange your cryptocurrency account balance into euros, shop online or in store, and withdraw funds from your nearest ATM.

VISA Mastercard RUB -> Bitcoin: where is it profitable to exchange

Do you need to exchange visa mastercard rubles -> Bitcoin?

Where can you do this with maximum benefit for yourself? How can this be done safely? There are many questions - few answers. Online exchange offices are rightfully considered a popular place for converting fiat funds into cryptocurrency. There are a huge number of offers on the Internet, from which it is difficult to choose the most suitable one.

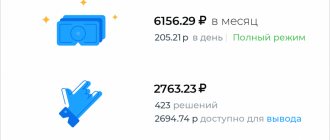

The ExNode website has selected a list of reliable exchangers. Their page contains a table of exchangers. On the left of the page you need to select the currency to be exchanged and the one you want to buy. As soon as the data is entered, a list of exchangers will appear on the right.

Cryptopay

Cryptopay is a fair and open Bitcoin debit card. Cryptopay was founded by a Russian development company in 2013, the services are already used by more than 167 thousand active users from all over the world, and more than 37 thousand cards have been issued in total. Cryptopay is one of the largest Bitcoin debit card platforms, handling approximately 100,000 transactions every month.

Like the other Bitcoin debit cards on this list, Cryptopay comes in physical and virtual versions, but unlike many other platforms, Cryptopay openly informs its customers about the fees and terms of use of the cards. The Cryptopay platform provides its services to unverified users, although there are restrictions on such accounts.

The Cryptopay plastic card belongs to the Visa system and is accepted wherever Visa is supported. The base currency of these plastic cards is EUR, GBP, USD, and the price of each of them is €15. Cryptopay cards are delivered by mail everywhere for free, but you will have to pay an additional €70 for express delivery.

A fee of $2.5 is charged for withdrawing cash from an ATM in your home country, and $3.5 for ATM services abroad. Verified Cryptopay users can make unlimited transactions online, however, there is a $1000 limit for unverified users. Unverified users can withdraw no more than $400 from an ATM per day, but only $1000. Verified - up to $2000 per day, and the total amount of cash withdrawal is not limited.

The commission for foreign currency transactions is 3%, and another 1% is charged for converting funds from Bitcoin to fiat and vice versa. Cryptopay commissions are slightly higher than the market average, but this platform is honest with its users and delivers their cards free of charge to all countries of the world.

Bitcoin cards for Russian users

Despite the fact that plastic cryptocurrency cards are no longer new in the world, in Russia things are much worse with Bitcoin cards.

But still, there is a good choice here for people who are really interested in finding a convenient tool. In particular, there are several services that work with a Russian interface and can be used throughout the country. So, let's consider several suitable options:

- Advcash. This is a relatively young project. Works with the MasterCard payment system and the currencies dollar and euro. Commissions vary when used - this is one of the main positive features of the service. For example, for withdrawal of money the commission is $/€ 0.99. And to withdraw money from an ATM you need to pay $/€ 1.99. When converting, you will have to pay 2% of the transaction. To buy a card, you need to pay $/€ 4.99, and re-issuing it will cost $/€ 9.99. Even changing the PIN code is a paid procedure, and it costs one dollar. And you don't need to pay for the service. There is verification, the passage of which significantly increases the limits on withdrawal and deposit of money. At the moment, the limits are up to 3,000 dollars/euro per day.

- EPayments. The service of this card was constantly adjusted to the needs of people who own cryptocurrency. As a result, it turned out that the card became one of the most popular in this direction. In April last year, they even canceled the single service fee and switched to monthly. This immediately made the Bitcoin card the clear leader. In addition, the price of the accessory has been reduced. Now it is almost 6 dollars. Conversion to local currency will cost 2.6%. The card can be topped up not only with Bitcoins, but also with Ethereum or Litecoins.

- Wirex. Many people have heard about this card. It is very popular in the world and in Russia they also began to use it, appreciating the advantages. Not least because it is multi-currency. Supports working with Bitcoin, Ethereum, Monero, Dash, Litecoin and other currencies. In addition, this Bitcoin card cooperates with the Visa and MasterCard systems.

So far the list is not that impressive. The Russian market is large and it has not been developed. Many companies are already interested in promoting their payment cards with cryptocurrency support here.

Wagecan

Wagecan is a MasterCard debit card issued by Transforex. This is a popular Bitcoin debit card among digital nomads and independent freelancers because it has a 1.5% foreign currency conversion fee, compared to 3% for many other cards.

Wagecan has a 1% fee for withdrawing cash from an ATM. Many BTC cards currently on the market charge a flat withdrawal fee of $2.5 to $3.5, so Wagecan's one percent fee is cheaper.

Wagecan was established in 2014 in Taiwan. There are both mobile and web wallets synced with this debit card. Each card has a wallet address printed on it: it’s convenient to both deposit bitcoins into your account and instantly convert them into fiat currency.

Wagecan operates in many countries and offers various bonuses on purchases. Popular with tourists, Wagecan is used in over 30 million ATMs worldwide to withdraw over 210 different currencies.

How to use Bitcoin plastic cards

Having a plastic debit card on which you can store BTC does not provide any benefits. If you don't know how to use this tool, it is useless. In principle, there should be no difficulties with this, since the operating procedure is the same as with ordinary cards. But as an example, let’s look at how to use, for example, the Xapo Bitcoin card.

- The first step is to register for HARO. Enter all the data and create a wallet.

- The second step is to top up your wallet on the service with cryptocurrency.

- The third step is to order a card and link it to the account created in the system. The order is made quickly, but you need to wait for the card, and also pay for it, as much as the developer requires, the fiat equivalents supported by the card. This is an automatic procedure if two accounts are opened on the service - with cryptocurrency and fiat money.

- The fourth step is to withdraw cash from any ATM in the country that supports Visa.

There is just one not very good point for residents of Russia - the Bitcoin card of this service is not available in our country. The developers have focused on working in EU countries, and it is there that it is much more convenient to use this payment tool.

Nevertheless, the instructions we have given are suitable for almost all Bitcoin cards. They operate on a similar principle, excluding minor features. For example, some have paid services, while others have free ones. In addition, there is a difference in the fees that the user pays for depositing, withdrawing and withdrawing money.

Monaco

Launched at the zenith of the cryptocurrency boom in 2022, the Monaco ICO project experienced a decline in investor interest, a crypto winter and a drop in the value of the internal token of the MCO platform, but coped with the difficulties and continued to exist. In 2022, the project rebranded and also acquired the Crypto.com service, under which it now issues cryptocurrency cards available to residents of the USA and Canada, Europe and the UK, as well as Singapore.

The Visa MCO card operates on the VISA payment system and can be used at VISA-connected points of sale and ATMs throughout the world.

The Crypto.com Card (MCO) has many pricing plans. There are five levels of cards available to holders depending on the number of internal CRO tokens the client owns. At the basic level, cardholders are provided with cashback in the amount of 1% of the transaction value, and the limit for commission-free cash withdrawals from ATMs will be $200 per month. For the fifth level, there is an 8% cashback, a limit on cash withdrawals from ATMs up to $1000 per month, as well as many other bonuses - a 10% discount on bookings through popular platforms, an affiliate program with a business jet booking service, access to business lounges airport.

To top up your Crypto.com MCO card, you need to register on the platform, top up your current account using cryptocurrencies or a bank transfer, and then send the required amount to your card account. When credited to the card account, the cryptocurrency is converted into US dollars.

Crypto.com (MCO) is issued only in plastic and is not available as a virtual card.

| Card issue | for free |

| Subscription fee | No |

| ATM withdrawal fee | No (up to $200 per month on the basic plan and up to $1000 on the platinum plan). Then - 2% |

| Transaction fees when paying in stores | No |

| Replenishment limit | Depends on the holder’s country of residence (for the USA - $25,000 per month, for the EU - €25,000 per month) |

| Maximum balance | No |

| Supported Cryptocurrencies | BTC, ETH, LTC, XRP, MCO, BAT, BNB, TUSD and ENJ |

| Referral program | Available for CRO token holders |

TTM Bank

In 2020, the virtual bank TTM Bank, registered in Estonia, launched the issuance of cryptocurrency cards that work on the VISA payment system and can be used wherever cards of this system are accepted. The TTM crypto card has two advantages that distinguish it from other analogues. Firstly, TTM crypto cards do not require storing digital assets on the service wallet. The owner can replenish the card account directly from his wallet, rather than first transferring coins to the current account, and then from it to the card account. This keeps control of cryptocurrency assets in the hands of their owners, who do not need to entrust coins to other services for safekeeping. Secondly, this is the only Bitcoin card that is available to residents of Russia for registration.

You can top up your TTM crypto card account using four digital assets (BTC, ETH, USDT and TRX) or with a regular bank card, from which the required amount will be debited in fiat. When credited to the card account, funds are converted into euros. The distribution, delivery and maintenance of card accounts is handled by the company's partner, financial services operator UAB Walletto, a member of the Visa payment network, registered in Lithuania. Deposited funds are kept in a licensed bank. You can issue both a plastic card and its virtual equivalent.

The TTM card allows you to make instant transfers to the accounts of other TTM Bank crypto card holders without commission. Transfers are made in euros. The sender must indicate the recipient's card number and the recipient's full username.

The number of active users of issued TTM crypto cards at the end of 2022 exceeded 40,000.

| Card issue | From €20, delivery within the Russian Federation is free |

| Subscription fee | €2 every month |

| ATM withdrawal fee | €2,5 +2% |

| Deposit fee | 1% |

| Trading commission | €0,25 |

| Commission for transfer between card accounts | €2 |

| Cross conversion fee | 1,5% |

| Replenishment limit | €5000 one time |

| Cash withdrawal limit at ATMs | €500 per day, no more than €2500 per month |

| Spending limit through POS terminals and online stores | €2500 per day/€5000 per month |

| Maximum balance | €5000 |

| Supported Cryptocurrencies | BTC, ETH, USDT and TRX |

| Referral program | Eat |

How to get a Bitcoin card

Rules for issuing different btc cards :

- registration of the user on the website of the service that issued the card;

- receiving a Bitcoin wallet or linking to an existing one;

- production and receipt of a plastic card;

- activation of the received card using a financial transaction. The virtual card can be used almost immediately after registration.

Is it safe to trade through the mastercard and visa exchanger, rubles to BTC?

A transaction made through an exchanger from the ExNode list is completely safe. Argument? All exchangers are thoroughly checked by the administration before being included in the rating table. Also here you can go to the item you have chosen and view reviews from other users and the rating of the exchanger.

When choosing an exchanger, you need to analyze the following parameters:

- Well

- Limits

- Reserve

- Options

The advantage of the exchangers presented on ExNode is the fact that we have technical support for users. If you have any difficulties, contact support and they will help you resolve the issue or dispute. Services that do not perform their work conscientiously are excluded from our rating.