Profit is the key goal of every organization, so all departments of the company are focused on analyzing this indicator. Increasing profits takes up about 80% of all the work of specialists related to production, analytics, and advertising activities.

Profit

The result of the enterprise's activities, usually for the year, in monetary terms, which remains in the hands of the owners after paying all expenses.

General Profit Formula

P = D − R \text{P} =\text{D}-\text{R} P = D−R,

where D\text{D} D – income from all types of activities,

Р \text{Р} Р – all expenses of the enterprise for these types of activities.

Prerequisites for making a profit

- revenue is greater than production costs;

- rational investment of funds;

- financing of external projects.

Net profit indicator: who, where and why calculates it

Net profit and commercial activity are inextricably linked concepts.

For the sake of profit, new production facilities are created, material and labor resources are intensively used, and effective ways are sought to increase the profitability of commercial activities. Net profit is one of the important final performance indicators of any company. Not only the management and owners of companies are interested in obtaining net profit. Good net profit indicators attract new investors, contribute to making positive decisions on issuing loans to the company, as well as strengthening the company’s authority in market conditions.

It is net profit that allows firms to develop their material base, invest in expanding production, improving technology and mastering advanced techniques and methods of work. All this leads to the company entering new markets, expanding sales volumes and, as a result, an increase in net profit.

Find out how to analyze net profit from the article “Procedure for analyzing net profit of an enterprise.”

Many financial indicators take part in calculating net profit, and the formula for calculating it is not as simple as it seems at first glance. In the accounting records of any company, net profit is reflected in line 2400 of the financial results statement (OFR), and all indicators in column 2 of this report are involved in determining net profit .

Learn about the structure and purpose of the ODF from this publication.

A detailed algorithm for calculating net profit is given in the next section.

Ways to increase enterprise profits

The calculations carried out have a specific practical orientation. Their job is to show. How can the company increase profits?

There are quite a few ways to solve this problem. For example, you can [1] optimize inventories of goods and balances in warehouses.

[2]. Analyze the range of manufactured goods and identify products that are less in demand among consumers in order to remove them from production.

[3]. Develop an effective enterprise management system that will help increase sales volumes.

The main task in this regard is the logistics of the consumer market in various regions to identify the region in which the products will be in greater demand.

[4]. To promote in every possible way the introduction of new technologies that will minimize employee labor and, accordingly, save on wages.

The impact of the company's main performance indicators on net profit

Net profit is a multi-component indicator - this can be seen from the composition of its calculation formula. Moreover, each parameter involved in the calculation is also complex. For example, a company's revenue may be divided into different lines of business or geographic segments, but its entire volume must be reflected in the formula for calculating net profit.

For information on how revenue and gross income of a company are related, see the article “How to correctly calculate gross income?” .

An indicator such as cost may have a different structure in certain companies and have a different impact on net profit. Thus, you should not expect a large net profit if amounts equal to or exceeding the amount of revenue received are spent on the products manufactured by the company (this is possible in case of material-intensive or labor-intensive production or the use of outdated technologies).

The impact on net profit of selling and administrative expenses is obvious: they reduce it. The magnitude of such a reduction directly depends on the ability of the company’s management to rationally approach the structure and volume of this type of costs.

However, even with zero or negative sales profit, which is influenced by the indicators listed above, it is possible to obtain a net profit . This is due to the fact that, in addition to profits from its core activities, the company can earn additional income. This will be discussed in the next section.

Calculation example

The following data is available for the company for the month.

| Name | Sum |

| Fixed costs | 34,000 rubles |

| Variable costs | 120,000 rubles |

| Implementation costs | 20,000 rubles |

| Revenue | 360,000 rubles |

You need to calculate:

- gross profit;

- the size of the net financial result of activities;

- profitability threshold;

- limit of financial strength.

Using the above formulas for profit, profitability and financial strength, we obtain the following results:

| Index | Calculation result |

| Gross profit | 240,000 rub. |

| Gross Margin | RUB 326,000 |

| Gross Margin Ratio | 326 000 / 360 000 = 90,5 % |

| Taxable base (tax 20%) | 360,000 – 120,000 – 34,000 – 20,000 = 186,000 rubles. |

| Net profit | 186,000 - 37,200 = 148,800 rubles. |

| Profitability threshold | 34,000 / 90% = 30,600 rub. |

| Financial strength margin | 360,000 – 30,600 = 329,400 rub. |

The projected profit with the existing safety margin will be 296,460 rubles.

The role of other income and expenses in the formation of net profit

Often, the company's core activities do not bring it the desired net profit. This happens especially often at the initial stage of a company’s formation. In this case, the additional income received by the company can be of great help.

For example, you can make a profit from participating in other companies or successfully invest free funds in securities. The income received will help increase net profit. Even a regular agreement with a bank on using the balance of money in the company’s current accounts for a certain percentage will allow the company to receive additional income, which will certainly affect its net profit.

But if a company uses borrowed funds in its work, the interest accrued for using the loan can significantly reduce the net profit - one should not forget about the impact of the fact of borrowing on net profit. The amount of interest on borrowed obligations (even calculated at the market rate) can seriously reduce net income, and in certain cases lead to losses and bankruptcy.

Whether the company's debts can be collected from the chief accountant in the event of bankruptcy, find out by following the link.

A variety of income and expenses not related to the company's core activities have a significant impact on net profit. For example, renting out unused space or equipment can bring good additional income and have a positive impact on your net profit. Net profit will increase if the company's assets that are not used in its activities are sold.

At the same time, we should not forget about the need for constant monitoring of the composition and amount of other expenses - as they increase, net profit decreases. For example, net income may decrease as a result of excessive spending on charity and other similar situations.

We will tell you in this material how to reflect charity expenses in accounting.

Other types of enterprise profit

The operating profit of an enterprise can be the result of different types of activities. Each of them depends on certain conditions. Such profit indicators are formed from the following criteria:

[1]. The type of calculation used in the company. The profit of a trading enterprise can be marginal, net or gross.

[2]. By type of application. The use of profits in an enterprise is carried out through capitalization, where funds are accumulated in the company’s accounts, and through distribution, where the proceeds are used to develop the business itself.

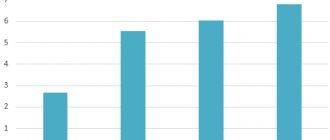

[3]. On the analysis of economic activity. Profit and loss statements are prepared for each specified period. A comparative analysis of past years shows the growth or decline of the company's overall efficiency.

[4]. By type of tax deductions. The profit of a manufacturing enterprise is divided into taxable based on the regime established in the company and non-taxable, which is included in the list in accordance with current legislation.

Enterprise profit planning methods allow, based on these criteria, to generate the volume of funds subject to further distribution or accumulation, as well as to compare the efficiency of production and accounting policies for past periods.

The net profit of an enterprise is an indicator calculated in different ways

Net profit, the calculation formula for which was described in the previous sections, can be determined in another way. For example:

Page 2400 = page 2300 – page 2410

Net profit, the calculation formula for which is given above , is equal to profit before tax minus income tax.

This algorithm for calculating net profit is simplified and can be used, for example, by small enterprises that have the right not to apply PBU 18/02 “Accounting for income tax calculations.”

IMPORTANT! The criteria for small enterprises are given in Federal Law No. 209-FZ dated July 24, 2007 “On the development of small and medium-sized enterprises in the Russian Federation.”

For more information on the criteria for small businesses, see this article.

Information about deferred tax assets and liabilities is generated in accounting and is required to reflect differences arising between tax and accounting accounting.

In what cases is it prohibited to distribute profits?

Profits are distributed in accordance with the decision made at the meeting of the LLC. However, in some cases, profits cannot be spent at your own discretion. Consider these cases:

- The authorized capital has not been fully paid.

- The participant who leaves the LLC is not transferred funds in the amount of his share.

- There are signs of bankruptcy. This is relevant even if bankruptcy proceedings are not carried out against the enterprise.

- If the money is spent, the company will show signs of bankruptcy.

- The amount of net assets (that is, the funds remaining after paying all taxes and other obligatory payments) should not be less than 10,000 rubles. This is the minimum limit specified by law.

ATTENTION! The general director is responsible for ensuring compliance with all these rules. In case of violations, responsibility will fall on him.

Results

Net profit is a complex indicator that includes all types of income received by the company, taking into account expenses incurred. If the company's costs exceed the total of sales revenue and additional other income, then we can talk about the absence of net profit and the company's activities are unprofitable.

Net profit allows merchants to expand their business, master new technologies and markets, which, in turn, has a positive effect on the increase in net profit.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Various controversial issues

When distributing funds, a number of controversial issues may arise:

- New LLC members have appeared . How to make payments if new participants appeared right before the distribution of funds? They should receive the funds in the standard manner. That is, in accordance with the size of the share. The procedure for dividing funds is established by the LLC Charter.

- Increase in capital volume . Increasing the authorized capital is relevant if it is necessary to increase the company’s attractiveness to investors and other external parties. A given amount of capital is needed to engage in a certain activity. It can be increased due to profit. However, before sending funds to the management company, you must pay taxes, various fees, and fines. The decision to change capital is made at a meeting of participants.

- Cancellation of a decision made at a meeting . Issues regarding the direction of money are resolved at the general meeting. The decision that is supported by the majority of participants will be made. However, it may be revised at an extraordinary meeting. If you need to reconsider a decision, you need to contact a judicial authority. The statement of claim is filed by those participants whose rights have been violated.

If controversial issues arise, one should focus on external and internal sources of law. That is, this is legislation, as well as company regulations.