The importance of cash is weakening every year, and paper cash and plastic cards are being replaced by electronic money and digital media. This simplifies commodity-market relations, both among the population and in the field of international business planning.

For example, cryptocurrency, which occupies a leading position on stock exchanges and the Forex market, although it does not have physical expression, continues to attract investors. Payment in an online store often occurs through payment systems, cards and electronic wallets, while in a neobank you can get a loan, diversify savings, open an account for a foreign company, or use it as an auxiliary means for payments with partners.

Let's try to figure out what the future holds for electronic payment systems, digital domestic currency and fiat money.

Services for selecting and opening an account in a neobank, an international payment system, as well as obtaining a financial license are available on the International Wealth portal. Write, call, leave your contacts for feedback: +372 5 489 53 37, +372 5 495 26 39, [email protected]

Electronic and digital money - what is it?

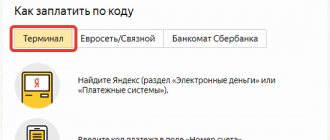

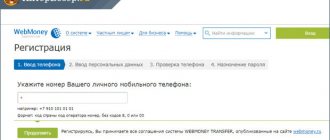

Electronic money in 2022 is present in all spheres of life and business industry. This can be payment for services and goods on the Internet with a bank card, transferring money via Internet banking, using the payment system Paypal, Yandex.Money, LiqPay and other providers.

Electronic money is divided by type of media:

- smart card (card-based);

- network-based.

Until recently, it was possible to use such financial instruments anonymously. However, due to stricter requirements of the EU, FATF and tax authorities, disclosure of information on the identity of the beneficiary is a mandatory requirement, including identification when opening an account in a neobank, payment system or electronic wallet.

Reference:

1

Electronic money is real monetary assets transferred to electronic media in the form of a payment system or card. They can be used for storage and payment, as well as cashed out into fiat.

2

Digital currency is a general term that defines electronic and virtual money. These currencies are intangible and are managed through electronic digital systems.

3

Cryptocurrency is a set of digital codes and designations that together represent electronic data that is recognized as a means of payment, but is not a monetary unit of any country in the world.

What do crypto and electronic money have in common? Both types of means of payment do not have a physical basis and can be used for settlements, storage, transfers and cashing into currency units of any state. Exceptions apply to the Russian Federation, where a new law came into force in 2022 prohibiting crypto-currency payments for commercial purposes, but does not exclude the ownership of such assets.

Tokenization

Asset Tokenization

The process of global tokenization has already begun. Manufacturers of cars, clothing and even food products use blockchain technologies to protect their products from counterfeiting and to be able to trace their path from manufacturer to seller and then to the buyer.

☝️

This idea is not new, since in the USA there has long been a database for cars, so that when buying a car second-hand, the new owner can check what repairs have been carried out, mileage, whether there have been accidents and other information.

But with the advent of blockchain, implementing such tasks has become much easier and soon tokenization will go further. The markets for real estate, securities, precious metals, and so on will soon also switch to tokens.

Today, in most cases, you do not receive the asset in your hands, and you don’t really need it if, for example, you trade oil futures. You are not going to store cans of black gold in the yard of your house, you are simply making money on the difference in the price of the asset, and your right to this is supported by an entry in the electronic register.

Or another example. When buying an apartment, you transfer money to the developer in the notary's office, and in return you are given a certificate of ownership. Just evidence - no one will give you the keys and when asked where they are, the developer and the notary will throw up their hands in surprise and say that you will pick up the keys from the administrator of the complex at the sales center. You received a certificate and this is the most important thing. And during the purchase you will receive a piece of paper and an electronic record with its number in the electronic register.

Blockchain technology

In the near future, paper certificates will also disappear and instead of them, you will receive a token in your email or directly in the messenger, which contains a cryptographic key, which makes it possible to make changes to the electronic record in the blockchain and thereby confirm your ownership.

This is our future, but we would caution anyone who is now looking at the various startups that are involved in asset tokenization. This is not financial advice, but this market is unlikely to provide us with the opportunity for the next Google or Amazon.

Most likely, existing corporations in the financial sector, such as Intercontinental Exchange, which has already launched the Bakkt crypto platform, or JPMorgan, which already has its own blockchain and stablecoin for international transactions. Such mega-companies will either absorb promising startups or launch their own analogues.

As for the ability of each of us to issue our own token today and make it personal money, this feature will remain in the future, but will not become widespread.

A simple example: Ivan and Peter each issued their own token and want to pay the second party to the transaction with it. But Ivan does not need Peter’s tokens and vice versa, because he does not trust this money and because it is more profitable for him to pay with his own tokens. And only some intermediary can try them on, who will act as a guarantor of the transaction and ensure the liquidity of this private money.

It turns out that such a system can only work if there is good liquidity of the guarantor’s money, and how are they secured? Do they have a free market or is it an exclusively closed ecosystem, interesting only to a narrow circle of people?

In fact, the idea of issuing private money has long been tested in computer games where there are internal currencies. They have value among players, but try to buy bread in a store with World of Tanks gold and you won't succeed unless you find an intermediary willing to take your gold and pay the seller your own cash instead.

☝️

Therefore, in the future we will see new private money, but each person will not issue their own currency, because no one simply needs it.

Only individual projects that can offer their own economy and find users for it will achieve success in this field. But all the same, these will be small closed ecosystems, but this is what will happen if some international corporation prints its money. We'll talk about this further.

Advantages of electronic money for life and business

In conditions of economic instability, as well as emerging concerns amid the aggravated situation with Coronavirus, the advantages of using electronic assets instead of fiat money are obvious:

+

An electronic wallet allows you to buy and sell goods/services via the Internet without geographical reference of the sender and recipient.

+

Neo banks do not have a real office, offer international service and allow you to use all the products of a financial institution on equal terms with a regular financial institution - deposits, transfers, corporate and personal accounts, loans, etc.

+

Cryptocurrency is not always stable, but if used correctly, you can profitably increase your savings, make money on currency differences, and save your savings from inflation.

+

Cards, including contactless devices (software for gadgets), protect against theft of personal property, and also provide bonus programs and wide geographic coverage.

+

For business, electronic money is indispensable, especially if the activity is carried out offshore or in several countries simultaneously. One account allows you to combine several currencies at once (multi-currency), and 24-hour banking makes it possible to conduct transactions without reference to a time zone.

In the 21st century, information technologies are improving annually and hourly, and many countries are actively revising internal regulations regarding currency control, taxation, development of telecommunications infrastructure and e-commerce.

Also, the era of digitalization has prompted the modernization of banking systems, including those linked to electronic systems. After all, the massive outflow of money to more stable payment systems and NEO banks will negatively affect the economy of the jurisdiction.

Thus, in 2022, China is already testing a “digital yuan”, and such major powers as the USA, Great Britain, France and Russia are actively developing similar programs. According to a World Bank study, 20% of 66 known Central Banks plan to introduce government digital assets in the next 5-6 years.

Payment system Free selection

an ideal payment system for HIGH-RISK business from an expert in foreign accounts with 5+ years of experience.

an ideal payment system for HIGH-RISK business from an expert in foreign accounts with 5+ years of experience.

We will contact you within 10 minutes

We will contact you within 10 minutes

The future is electronic money

Slowly but surely, paper money is becoming an atavism and is leaving the usual circulation. Based on the results of the research, it was found that many countries are planning to abandon physical banknotes at the state level in the near future.

- Between 2000 and 2015, the share of cash turnover in Scandinavia fell from 62 to 25%, and the government plans to completely eliminate cash payments by 2030.

- In Sweden and Norway, fiat turnover amounted to 3–5% of GDP. According to the Central Bank of the jurisdiction, cash transactions in the next 2 years will be reduced to a minimum (0.5% of the total volume).

- In South Korea, metal money will soon completely disappear.

- Countries in the European zone are gradually removing large denomination banknotes from circulation.

- In India, large banknotes have already been withdrawn from circulation.

If we talk about Russia, then here too digitalization has become popular in many financial institutions, and state authorities are calling for a transition to card and electronic payments, gradually reducing the role of fiat.

Thus, one of the large NEO banks, Tinkoff, has been offering exclusively remote customer service, issuing credit cards and using mobile applications since its creation. Sberbank, in turn, is going to introduce an unprecedented technology for non-cash payment for services and goods - through fingerprinting.

If a couple of years ago all this would have sounded fantastic, then in 2022 innovative payment systems, electronic money and cryptocurrency are taken for granted by consumers. The only thing left to do is to choose the most secure option that suits the functionality and available transactions with local/foreign currency.

Important! you open a personal and corporate account in an international payment system. Consultation is free!

Introduction

It is clear that if we talk about electronic money only from the perspective of future world currencies, then such an amount of electronic money seems fantastic and the question arises, why am I then talking about millions and why specifically about private money. Why, as they say, are you not satisfied with existing money? In order to understand where millions will come from and why we are talking about private money, we need to dive a little into the theory of socio-economic formation.

So, according to the hypothesis of the new formation, private credit emission in it will be the main method of production (according to Marx) or, in other words, the main source of income.

A method of production, a historically determined method of obtaining material goods that people need for production and personal consumption; represents the unity of productive forces and production relations. This is the main (predominant for the formation under consideration) method of exploitation of productive forces.

Let me remind you that under classical capitalism the main source of income was ownership of the means of production (instruments of production). And if under capitalism the ruling class were the owners of the means of production, then in the new formation this class is already the owners of the technology for issuing credit money, i.e. credit issue. In general, the transition to a new formation (based on exploitation) is always accompanied by a transformation of the source of income. It is also important to note here that the main source of income and well-being of the ruling class is always private ownership of the main and most in demand means of production for a given era. The means of production change and develop in the process of social development. And if three centuries ago land was a source of wealth, then later machines, factories, factories, etc.

So, having understood the logic of the development of means of production, we can make a forecast about future formations. According to history, we have a development in which the main source of income for the formation of wealth was first the person himself (slave), then the land, then the instruments of production (means of production) and now technology, namely private credit issue.

How to obtain a payment license

Electronic money affects one of the important areas of state activity - monetary circulation. It is quite logical that this direction cannot be started simply as a standard company registration. There will definitely be additional regulations, including licensing.

There are several types of licenses, which vary from country to country. This could be a general financial license, a brokerage license, a payment license, or permission to work exclusively with electronic assets. Many jurisdictions offer to obtain a license to issue electronic money, including the Czech Republic, Hong Kong, Singapore, the UK and EU countries.

The general requirements are as follows:

- payment of the minimum amount of authorized capital;

- availability of own funds;

- presence of an address and office in the country of incorporation;

- acceptance of tax residency;

- payment of mandatory payments for taxes and duties;

- reporting and so on.

The exact standards in a particular country for financial activities can be clarified with our experts, leaving your data for feedback.

Information: both local citizens and foreign citizens can obtain a payment license in the countries of the European zone, the Middle and Far East, as well as in offshore areas.

Services for obtaining a financial license

from £85,000

Financial license in the UK or Corporate Finance License

25,000 EUR

Ready-made company with an e-payments license in Singapore at a discount

from 150000 EUR

Banking license for Vanuatu

Where is it better to open an account: personal and for business?

There are three options for financial institutions to open a personal or corporate account. In this case, the choice should be made based on its purpose (storage, payments, transfers, accumulation, etc.), as well as the geography of coverage.

1

A bank account is a familiar option that has positive and negative sides. In such an institution you can store capital, accumulate, get a loan and invest. However, it is worth remembering that the verification of foreign clients and companies is carried out especially carefully. Also, all information will be transferred to the tax office, and in case of tax evasion, the violator will face serious sanctions.

2

Neobanks are similar to a regular bank, but without a physical office. The service provides a remote format, and all operations are controlled through an Internet application.

3

The payment system is a modern version of a financial institution that does not have an office and sometimes even a reference country. Such fintech corporations offer various services for personal and corporate use, open accounts in any currency, including Bitcoin, cover almost all countries of the world and have minimal requirements for clients.

The latter type is most relevant in the era of electronic money, which many entrepreneurs have actively mastered, seeking to register not just a bank, but a payment system or non-institution for financial services.

Single currency

In several novels, H.G. Wells predicted the creation of a single world state and the emergence of a common currency for all nations. The science fiction writer suggested such a scenario for the development of events in the works “War of the Worlds” and “The Invisible Man”. At the same time, society will be divided into 4 classes. The richest will own shares and live off dividends from securities.

I’m leaving gracefully and with compensation: according to Russians, you should quit your job

A digital ruble will appear in Russia: when will they start testing it?

Without a resume, everything is clear: at Datagroup, recruiting takes place at pub parties