Virtual money

Bitcoin

–

This

first cryptocurrency, electronic

facilities

, which were created by an unknown programmer (or group of programmers) under the pseudonym Satoshi Nakamoto. This happened in 2009. It was he who came up with the term “Bitcoin” and the specifics (the algorithm of Bitcoin’s operation).

If in real life, we have to use one or another currency, depending on the country of residence, then no one forced Internet users to pay with Bitcoin, and certainly not forced them. Virtual money is the free choice of free people. You can buy the most stable cryptocurrency for rubles here.

Concept and characteristics

In the broad sense of the word, we mean a cash subsystem or a settlement system using different monetary units using electronic technology. In the narrow sense of the word, electronic money refers to a subsystem of money that is issued by various banks. Their main difference is the optionality of making a payment to a bank account. This means that the transfer transaction is carried out between two parties without the participation of the bank.

Electronic money is a virtual currency that is equivalent to regular cash or non-cash funds and does not require opening a bank account.

In fact, this is money, the circulation of which occurs not in the form of paper bills, but through the introduction of computer technology and a modern communication system into the sphere of financial settlements.

At first glance, electronic money looks like non-cash payments, but this is not entirely true. Non-cash funds were originally familiar monetary units that a person, for example, deposited in a bank account. After which they turned into his working capital within the banking system.

Electronic money is initially a virtual currency, the storage of which is the Internet. They can be used by a person to pay for goods on the Internet or transferred to a bank card for cash withdrawal or non-cash payments. One electronic monetary unit is equal to a fiat monetary amount.

Receipt of money to an electronic wallet can occur as a transfer of funds from your own bank account or as payment for a service provided, a product, winnings in online games, etc. This procedure can be regarded as a monetary obligation of the issuer, which is available to the owner of the wallet only after completion of the transaction (receipt of goods, delivery of work, etc.)

The characteristics of electronic money are:

- Mobility. For such funds there is no concept of size. A person can always make calculations without using additional tools.

- Automation. When working with digital money, the human factor is completely absent. Operations are performed by computers and then recorded.

- Safety. Thanks to the use of special modern technologies, use in everyday life is not only convenient, but also safe.

There are other features, for example, in most countries to this day there are no laws that would clearly define the rules for working with digital money. In addition, prohibitions have been established that would limit the use of such currency in certain areas. However, they may be accepted as a means of payment by organizations other than the issuer.

Terminology

Digital money is a system for storing various currencies using modern technologies. In particular computers. In simple terms, electronic money refers to cash flows stored in so-called electronic wallets. We can say that this describes a currency that circulates not in the form of cash, but in electronic payment systems.

An electronic wallet is a storage of digital money. A set of data available to a financial organization that emphasizes a citizen’s right to use certain finances. Often, electronic wallets are simply called payment systems.

Blockchain

The reason for users' interest in electronic money is the underlying system. It's called Blockchain.

This system cannot be destroyed, changed, or disabled. Because this requires large computing capabilities with simultaneous access to the computers of millions of users. But no one has this.

Electronic money based on cards and networks

From a legal point of view, electronic money is divided into types that operate on the basis of bank cards or computer networks. The first type is monetary value expressed electronically, stored on a card, such as a smart card. The most common examples of this type are Mondex and Visa Cash. Banks act as issuers and payers, and bank deposits are the basis for moving money.

Electronic money based on computer networks operates on the basis of a software system, which is presented in the form of a program or network resource. These types actively use encryption and have an electronic digital signature. This type is popular for paying for goods in online stores or in games.

Examples are Qiwi, WebMoney, Yandex.Money and some others. Such systems are more popular and secure.

Electronic money networks also have several subtypes. These include:

- open;

- closed;

- two-slot;

- single-slot.

Other types of classifications

Currencies are also classified according to storage method. If we are talking about hardware, in this case the finances are on a chip, the carrier of which is a plastic card. If they are stored on a software basis, then we are talking about digital money that is stored on the computer’s hard drive. To transfer such funds, special computer software is required.

Based on the method of data processing, centralized and decentralized systems are divided. In the first case, information about transactions using such money is displayed in a centralized bank. When using decentralized tools, there is no control at all.

The most popular payment systems in Russia are:

- Yandex money;

- MoneyMail;

- QIWI;

- Skrill (formerly MoneyBookers);

- WebMoney;

- Rapida;

- RBK Money;

- PayPal;

- Mondex,

- "One Wallet";

- Z-Payment;

- Liqpay;

- NETELLER;

- PayCash.

Based on smart cards

This type of digital money is a plastic medium with a microprocessor on which is recorded the equivalent of the cost paid by the client to the original issuing organization in advance. Cards are issued by banks or non-banking organizations. Using plastic, the client can pay for purchases and services at all points of acceptance of such a payment instrument. Cards are issued multi-purpose or branded (telephone, for example). The tool is suitable for making a payment transaction or withdrawing funds through an ATM.

Among the variety of plastic cards, there are two types: debit (for storing one’s own funds, savings, payments) and credit (the owner of the plastic card spends money within a certain limit, which will then be required to be reimbursed to the issuing organization). A popular option for digital cash based on smart cards are products of the VisaCash and Mondex payment systems.

Fiat and non-fiat money

There is another classification of virtual money. They are divided into fiat and non-fiat. The first type includes the monetary units of a specific country, expressed in the national currency. The issue, circulation, cashing and conversion of fiat money is ensured by state legislation.

The second option is a currency issued by a non-state payment system. Government authorities of different countries control the issuance and circulation of non-fiat money to a certain extent. This option refers to a type of credit money.

Legal status

Since September 2011, electronic payment systems have been controlled by Federal Law No. 161. It reflects all the requirements for issuing organizations and the conduct of monetary transactions. Previously, this industry was controlled by different laws, but with the entry into force of the draft “On the National Payment System”, it became a single document regulating the relations of the parties.

From a legal point of view, electronic money is a perpetual obligation of the issuer to users of payment systems. The issue of funds is carried out as a credit limit or amount of obligations. The circulation of virtual money is carried out by assigning the right of claim to the issuer. Accounting is carried out using special software or electronic devices. As for the material form of virtual money, it represents information that is available to users around the clock.

The economic status of virtual money is a payment instrument that has the properties of traditional means or payment instruments, depending on the chosen method of implementation. What virtual currency has in common with cash is that users can make payments without using banking systems.

Electronic funds are similar to traditional payment instruments in that the client can transfer an amount or make a payment without opening an account with a financial institution.

What is virtual currency

To contents

Initially, this concept was associated with online communities. The history of virtual money began with the emergence of social networks and online games. They are used to pay for avatars, game artifacts, and additional features when using the forum.

Since 1993, electronic money has been officially recognized. The products began to be used much more widely. Numerous payment systems appeared, and by 2004, virtual money was already functioning in 37 countries around the world.

Electronic money and forms of its use

As a rule, electronic funds are used in online business. This payment instrument is considered as one of the forms of market economy. Using virtual money, you can make payments between clients and companies, while avoiding a large number of unnecessary expenses or loss of time. Due to the technical component, electronic payments are carried out instantly, which distinguishes this method from banking transactions.

Internet payments

One of the reasons why Russians are starting to use electronic money systems is the ability to instantly make payments via the Internet. The service is available around the clock. You can send money to any other accounts using the details of organizations, individuals, other wallets, in the form of payments for housing and communal services or cellular communications, etc. All transactions are saved by the system and tracked. Instead of the traditional client signature, an electronic digital signature is used - the most reliable way to protect user funds.

Credit cards

Another option for using virtual funds is credit cards. Using a physical plastic medium, the owner of an electronic wallet can spend virtual savings when paying for purchases in supermarkets, hotels and anywhere where bank cards are accepted. However, in this case, it is important not to transfer personal data to third parties so as not to lose money. It is especially dangerous to save details of such cards in online stores.

ATMs

Quick service terminals and ATMs are another convenient way to use your virtual savings. To receive cash, you need to issue an online card in the payment system with bank details, but without physical media. It is issued instantly and allows you not only to receive cash through ATMs, but also to pay for purchases online. Using bank terminals, users can not only withdraw money from virtual wallets, but also replenish online accounts.

Bank checks

To get cash from financial institutions, you can consider using electronic savings such as issuing bank checks. There are several ways in this case:

- Transfer of funds to a bank account with subsequent withdrawal.

- Transfer of virtual savings to a bank that will exchange them for cash.

- Sending electronic money using an international payment system with the possibility of receiving it at any bank.

Ways to earn cryptocurrency

Let's consider two options for earning virtual funds:

- with the investment of fiat money;

- without using fiat currency investing.

The second method is often used by those who cannot contribute money to a project that involves subsequent returns in virtual funds. In addition, this option is suitable for users who are just starting to get acquainted with the possibilities of earning virtual currency.

Risks are excluded. If there are no preliminary financial investments, then there are no monetary losses. The participant only loses personal time.

Electronic money exchangers

To transfer electronic funds between accounts of different payment systems, including withdrawal to bank card accounts with the possibility of subsequent receipt of cash, there are electronic money exchangers. They differ in exchange methods - automatic, semi-automatic or manual.

Each exchanger also sets its own rate for each currency and the percentage for exchange transactions between currency pairs. Each such service is limited by a certain limit - the electronic money reserve. Exchanges greater than this amount are not possible.

Electronic money transfer

Electronic money transfer is today’s fastest form of performing settlement transactions from your account in the EPS (electronic payment system) to the recipient’s account. The operation is completed almost instantly. You are only required to have a sufficient amount in the payment currency in your EPS account and indicate the exact details of the recipient of the electronic funds. A money transfer can be initiated from any electronic device with the appropriate software installed on it (personal computer or wearable gadget, payment terminal).

PayPal

Received less popularity in Russia, the service is convenient for users working with foreign employers.

The wallet of this system allows you to carry out transactions all over the world and has no restrictions. The payment service works with 203 countries; when opening an account, the account is opened in national currency; in the future, the user has the right to open another account in the selected foreign currency.

The benefits of using PayPal include:

- the ability to seamlessly pay for services and goods while traveling abroad - the payment system is known in almost all countries;

- when transferring money between users in the same country, no commission is charged;

- for international payments the system deducts from 0.4% - in alternative type money transfer systems the commission fee is several times higher.

Many freelance exchanges do not cooperate with PayPal; in order to receive payment for work performed, you will have to create an online wallet in another system.

How to use electronic money?

Let's figure out how you can use electronic money: withdraw it, transfer it to your card or top up your electronic wallet.

How to withdraw electronic money?

There are several ways to withdraw electronic money:

- Withdraw to a plastic card. The funds transfer usually arrives within a day.

- Use a money transfer system (Contact, Migom, RNKO, etc.). To do this, you will need to come to the point of issue of this system, fill out the transfer form and indicate your data, country, region, city and transfer point. The money will arrive within 1-3 days.

- Transfer to a ruble account in a Russian bank. You will need to take your bank details and fill out an application form. The transfer will arrive in 3-5 days.

You can choose any method. The differences between the options are the size of the commission for withdrawal of funds, which can be several percent of the withdrawn amount, and the speed of withdrawal of money.

How to top up an electronic wallet?

There are several ways:

- Through a terminal, ATM.

- Transfer from a bank card.

- From a mobile phone account (you need to send an SMS).

- In the office of the partner company.

Please note that there is usually a fee associated with funding your account. Its size depends on the selected replenishment method. To choose an option with a minimum commission, go to the payment system website. As a rule, the site has a section that lists all possible payment methods indicating the amount of the commission.

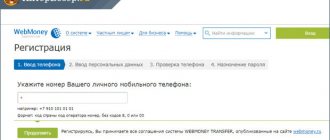

Webmoney

Opening an account in the system allows you to create wallets in Russian money, dollars, euros, Belarusian rubles and Ukrainian hryvnia.

The service began its work in 1998 and is recognized as the best platform for cooperation with foreign customers.

WebMoney offers several levels of certification for users, each with a certain framework of limits and transactions. The payment system has several applications for working on computers and mobile devices; account management can be done through a page on social networks.

The positive aspects of WebMoney are presented:

- multicurrency wallets – transactions are carried out in Russian rubles or foreign funds;

- widespread use of the system - allows transfers to users from different countries;

- high level of security - the risk of fraud and hacker attacks is minimized.

The disadvantages of WebMoney include the frequent blocking of Internet wallets when performing dubious transactions, blocking access to both the sender and the recipient of the transfer. Problems with replenishing your balance or withdrawing funds - if you are in a foreign country, difficulties may arise with them.

Individual payment platforms are practically not used in the Russian Federation. Less common systems include:

AliPay is the largest platform part of the Alibaba Group, created in 2004. In addition to paying for goods within the group, its services are used by about 460 thousand companies scattered around the world. The payment platform has its own program that allows you to make transactions from a mobile phone.

PAYEER – allows you to make transfers to all countries of the world, does not charge a commission for transactions. The system has 15 million users, operations are carried out anonymously. The platform does not block accounts and issues free cards, withdrawals from which are made without commission.

ADVCASH is a multifunctional payment system operating since 2014. Makes electronic money transfers all over the world, works with the main currencies for the Russian Federation. Users can use the service of receiving virtual and plastic cards. All transactions within the payment system are commission-free.

PERFECT MONEY – the official page of the web portal supports 23 languages, about 40 million transactions are processed per day. The service began operating in 2007 and is characterized by minimal commission deductions and a high level of protection for users’ personal pages. The wallet is replenished in several ways; account balances are paid monthly.

Epayments - since 2011, more than 500 thousand users have registered in the system, transactions worth 3.5 billion euros are made in it every year. Electronic money is withdrawn to Visa, MasterCard, bank accounts, and Yandex.Money wallet. The plastic card from the company is multi-purpose; you can use it to pay for purchases in stores and receive cash at Russian and foreign ATMs.

PAYONEER is a payment platform that deals with translations and is used by freelancers working with foreign employers. The service makes payments without territorial restrictions, in 200 countries, works with local currencies: 90 varieties. The specifics of the system include opening an Internet wallet in US dollars, a minimum transfer commission and transferring electronic money to cash.

Stripe – Americans consider it an alternative to PayPal. Accepts payments from 25 countries, in 100 types of currencies in different ways. The web page has a simple and intuitive interface.

Types of electronic money

All types of electronic money will not be considered here, otherwise it won’t be an article, but a whole book (there are too many of them). I will tell you only about the most popular ones, and, therefore, about those that are used by the majority.

Yandex money

Yandex.Money is the most popular online payment system in Russia. Instant payments, payment for goods and services on the Internet, transfer to a bank account or bank card.

Principle of operation. First you need to register. This is done in the same way as on other sites. After registration, you are immediately given a wallet number - this is a long set of numbers. It must be indicated for mutual settlements.

That's all - the wallet immediately starts working. You can top it up and pay for goods and services online. And also receive and send money transfers.

On a note. If you have mail on Yandex, then you don’t have to register at all. Just go to your inbox and click on the “Money” link at the top.

The wallet is managed through the system website money.yandex.ru or through a mobile application.

How to top up your account:

- Via a bank card;

- Via mobile;

- Cash at Sberbank, Euroset, Svyaznoy.

In addition, there are other ways to replenish: through Internet banking, bank transfer, other electronic money, through transfer systems (CONTACT, Unistream, City, Russian Post).

How to withdraw money:

- Withdraw to a bank card.

- Send to bank account.

- Receive cash through Western Union and Unistream.

Directly on the Yandex.Money website you can pay for telephone, Internet, any receipts, traffic police fines, taxes, utilities, repay a loan and much more.

You can also order a bank card. Then you will receive a real plastic card by mail, tied to your wallet. This makes it possible to withdraw Yandex.Money in cash from ATMs and pay with it in regular stores.

The system also allows you to open a virtual card for free. This is an analogue of a plastic card, but it can only be used on the Internet: pay for purchases on a site where cards are accepted for payment (eBay, App Store, Google Play and others).

On a note. When you register, you receive a Yandex account along with your wallet. This means also mail, Yandex.Disk (cloud storage) and access to other services.

Webmoney

Webmoney is the largest electronic payment system in Russia. Payment for services, transfers, loans. WebMoney is available not only in Russian rubles, but also in other currencies: dollars, euros, hryvnia, Belarusian rubles, Kazakh tenge.

Principle of operation. We register and immediately receive a number in the system, which is called WMID. Next, you will need to create a wallet in the desired currency. There can be several of them, both for one currency and for different ones. Each wallet will have its own unique number. This is what you need to send and receive money.

You can attach a bank card, bank account or e-wallet from another system to WMID. You can also issue a virtual card for making purchases on the Internet.

Account management occurs through the webmoney.ru website or mobile application. You can also use a special computer program called Keeper WinPro, but it is more difficult to work with.

Among the disadvantages, it should be noted that this system is not as simple as others. It seems that it is written in an accessible way, but in practice difficulties arise. All these certificates, restrictions, types of wallets. In general, it takes some time to figure it out.

PayPal

PayPal is the most popular electronic money system in the world. Suitable for payments between foreigners and purchases in foreign online stores (eBay and others).

Principle of operation. Register on the site. This procedure is more complicated than in other systems - you need to provide your full data (full name, address, phone number, etc.). After this, the system will open an account. It does not have a number; the email address specified during registration will be used instead.

To pay for purchases and services via PayPal, you need to link a plastic card to your account on the website. The money will be debited directly from her.

If you plan not to spend, but to receive money, then it will be credited to an internal account in the system. Then you can withdraw them to your bank account.

Management occurs through your personal account on paypal.com or through a mobile application.

Qiwi

Qiwi is another popular system in Russia. Very convenient for personal use. Simple, intuitive.

Registration takes place using a mobile phone number, which is an account in the system. This account can be easily topped up through a payment terminal, with a bank card or from your mobile balance.

You can issue a virtual or regular plastic card, pay directly on the website for a lot of services (telephone, Internet, games, credit, etc.), send a money transfer. In general, do almost everything the same as in the Yandex.Money system.

Account management occurs through your personal account on the website qiwi.com or through a mobile application.

QIWI

Linking an Internet wallet in this system occurs by mobile phone number.

The platform simplifies the management of your own funds and allows the use of:

- Russian rubles;

- Dollars;

- Euro;

- Kazakhstan tenge.

The advantages of working with the platform include:

- easy balance replenishment - payment terminals are located in all major retail chains;

- low commission for withdrawal: 1.6% when transferring to an account, 2% when withdrawing to a card;

- free transfer of funds to the accounts of other users of the QIWI system.

Ordering a special Visa card linked to a wallet allows you to make payments without commission. Despite all the advantages of this platform, not all online stores and services accept payments through it.

Which system to choose

For work. On the Russian-speaking Internet, Webmoney or Yandex.Money is most often used, on the English-speaking Internet – PayPal. If you have a choice, I recommend choosing Yandex.Money. They are easier to put on and take off. And the system itself is simpler.

For life. If electronic money is needed to pay for games, buy OKs on Odnoklassniki or Golosov on VKontakte, then it is better to choose QIWI or Yandex.Money.

Through these systems, you can instantly issue a virtual card and make payments throughout the Internet, including on foreign sites (ebay, aliexpress and others).

Safety

Despite the fact that electronic money systems are currently very reliable, users still manage to lose their money. The reason is either ignorance of the banal rules of safe work on the network, or laziness. Therefore, below I will give simple but effective methods of protection.

Antivirus. Such a program must be installed on the computer. And it is imperative that it be updated, that is, it always has up-to-date anti-virus databases. It is better, of course, to use paid products like Kaspersky Anti-Virus, but if this is not possible, use free Avast.

Strong password. Use a password of at least eight characters. It is better if these are both letters and numbers. Moreover, the letters are both uppercase and lowercase. Do not use your date of birth, phone number, or other personal information in your password.

Identification. This is a procedure that allows the payment service to see you as a respectable user. It concerns mainly Russian electronic money systems. Its meaning is that you need to indicate real passport data and show the document to an authorized person. Then your status will change and this will give certain advantages.

In addition, this will provide additional protection against scammers. After all, according to the law, if money is stolen from the account of an identified user, the system is obliged to return it (provided that he contacts the support service no later than 24 hours after the money is written off and the system confirms the fact of hacking).

In Yandex.Money and QIWI, the procedure for confirming your identity is called identification, and in Webmoney it is called certification.

By the way, many payment services greatly reduce the opportunities for “anonymous” users. For example, Yandex.Money prohibits such users from receiving and sending funds to other wallets, or making transfers to bank cards and accounts.

Address verification. Before entering your wallet number (login) and password to log in, check whether the site is open correctly.

Fraudsters often send fake emails purporting to be from the electronic money support service. For example, that a payment has been received into your account or, conversely, that the account has been blocked. Such messages may look very believable, but when you click on the link from the letter, a fraudulent site opens. Moreover, it usually looks the same as the real thing.

Only the site address is different. And if the user does not notice this and enters his data, the attacker will immediately receive it and be able to withdraw money. Therefore, before logging into your wallet, look at the address bar of your browser. The correct payment system address must be written there.

Additional protection. If the payment service has additional protection, you should enable it. This is done in the wallet settings. Usually this is login protection or confirmation of payments via SMS message. That is, until the code sent in the message is entered, the operation will not be performed. In this case, even if an attacker enters your password, he will not be able to withdraw anything from the account.

Reading documentation. Each system has a knowledge base. Usually this section is called “Help”, and it tells everything about the rules and features of the service. Of course, there is a lot of information, but I highly recommend that you study at least the basics. And also check out the tips for protecting your wallet from Yandex.

And most importantly: never give out your wallet password or card details!

How to earn cryptocurrency - Working on the stock exchange with the help of a manager

Not everyone can cope with working on the stock exchange. If you don’t want to gain new knowledge and waste time, you can use the services of a manager. They take on the work themselves, buying and selling crypto. The owner is informed about the manipulations being carried out and the increase in profits (losses).

Managers form crypto funds, which are an analogue of mutual funds, only in the absence of legislative regulation. The funds are used by both experienced and novice investors. The money of shareholders is manipulated by managers.

Profit is available for transfer every week, and the invested amount is not earlier than the period specified by the rules. As a rule, after a couple of months the user can withdraw the money.

Tips for using electronic money

Commissions. Almost every system has commissions. They charge some percentage for deposits, transfers, and withdrawals from the account. To avoid surprises, carefully read the information on the website - everything is written there.

Spend, don't save. Electronic money is not backed by government gold reserves. We can say that this is an idea of this or that organization, and only it is responsible for them. Therefore, they should be used only as a means of payment, and not as a savings account. You should also not make large payments with such money.

When using electronic money, remember: they are not yet insured by the state and have little regulation. We can say that you use them at your own peril and risk. Therefore, you should not transfer large sums using electronic money, much less accumulate them in your account.

Please note that electronic money has restrictions on the amount of payments: for example, the amount of payment without user identification should not exceed 15,000 rubles.

The lion's share of electronic money thefts occurs due to the carelessness of users. Remember that the password for your e-wallet must be complex. And it must be stored either in encrypted form on a computer (there are special programs for encrypting data), or on some non-digital media - for example, in a notepad that you always have at home. It is also important to follow computer security rules: first of all, install a good antivirus.

When registering a wallet, indicate your real email - this will help you recover your password if you forget or lose it.

Pros of electronic money

The main advantages are presented:

- convenience - most transfers and payments are made by pressing one button;

- reliability - transactions are confirmed by a code that comes via SMS: it is not communicated to anyone except the user;

- durability - money is stored in the wallet for as long as its owner needs;

- liquidity – virtual currency can be easily converted into real currency at any time;

- anonymity – if necessary, the sender and recipient of funds remains unknown;

- security - all electronic payment systems have modern protection, it is impossible to receive counterfeit money;

- universality - almost all websites, online stores and banks accept payments;

- no weekends or breaks – services operate 24 hours a day.

Comfort of use may be overshadowed by the commission. Popular types of virtual currency include Internet wallets and cards serviced by the e-money operator.