Bitcoin rate - Bitcoin (BTC) for today

BTC is currently the first most popular cryptocurrency, the release of which dates back to 2009.

Initially, the coin did not attract public attention as a potential tool for paying for goods and services, but nevertheless, this method of obtaining Bitcoin as mining has become widely developed. At the dawn of the mining era, it was easy to get 1 token; it was mined in a matter of minutes. Now this is more difficult to do. To obtain a single coin, large organizations install serious crypto farms with powerful video cards. In 2022, the price of 1 bitcoin fluctuates in the range of ~ 30-40 thousand dollars. The coin has already peaked at $60+ thousand, so there is a possibility that at any moment the price of the cryptocurrency could jump again (as well as fall). Because of this, BTC is receiving attention from traders, digital asset investors, and people who are simply passionate about cryptocurrencies.

- Bitcoin to dollar exchange rate today

- How much is Bitcoin worth in dollars?

- Bitcoin to ruble exchange rate today

- Bitcoin to euro exchange rate today

- Bitcoin trading chart online

- Where can I find out the current Bitcoin exchange rate?

- Where can you buy Bitcoin at a favorable rate?

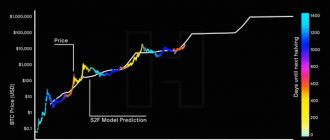

- Bitcoin exchange rate dynamics

How much is Bitcoin worth in dollars?

Our widget will show you the current bitcoin to dollar exchange rate. A number of other indicators of the currency pair in question:

- At the beginning of July 27, 2021, the starting rate was $38,072.3.

- Over the past 24 hours, trading volumes reached $3,160,440,000. For a common cryptocurrency, this is a relatively small indicator. At the peak of exchange rate fluctuations, this amount increases significantly.

- As of July 2022, the total number of Bitcoins circulating in the markets is 18,767,675. These are all those BTC that are present on exchanges, exchangers, in the hands of users, in other services (for example, buxes that pay their clients and employees money in satoshi).

- The price has fallen from the set rate over the last 24 hours. Now it is -996.1$. Against the backdrop of the fall, many traders are actively buying tokens, which causes a rate correction.

The volatility of Bitcoin (price in dollars) is also affected by fiat currency inflation. Over the past 2 months, America has experienced a serious period of inflation, as a result of which many stocks, bonds and other digital assets in dollars have fallen. The same goes for BTK. Now there is active growth of this cryptocurrency. 1 bitcoin in dollars has recently been 30-31 thousand dollars. But in a short time it grew by 12%, which added euphoria to traders. However, professionals argue that the exchange rate will continue to adjust, and the cost of Bitcoin in dollars will level out and decrease.

Average prices table

- by month

- by days

- on years

| Month | Price, USD |

| January 2022 | 43 382.455 |

| December 2021 | 48 802.47 |

| November 2021 | 60 940.55 |

| October 2021 | 59 887.82000000001 |

| September 2021 | 45 765.7625 |

| August 2021 | 46 075.585 |

| July 2021 | 33 659.42 |

| June 2021 | 35 756.145 |

| May 2021 | 46 863.76 |

| April 2021 | 57 270.72 |

| March 2021 | 55 298.89 |

| February 2021 | 46 972.322499999995 |

| January 2021 | 34 287.41 |

| date | Price, USD |

| 13.01.2022 | 43 754.125 |

| 12.01.2022 | 43 382.455 |

| 11.01.2022 | 42 200.884999999995 |

| 10.01.2022 | 40 959.335 |

| 09.01.2022 | 42 018.895000000004 |

| 08.01.2022 | 41 420.57 |

| 07.01.2022 | 41 944.604999999996 |

| 06.01.2022 | 43 123.995 |

| 05.01.2022 | 44 789.020000000004 |

| 04.01.2022 | 46 558.69500000001 |

| 03.01.2022 | 46 639.89 |

| 02.01.2022 | 47 322.72 |

| 01.01.2022 | 47 073.16 |

| 31.12.2021 | 47 119.33 |

| 30.12.2021 | 46 941.085 |

| 29.12.2021 | 47 126.565 |

| 28.12.2021 | 49 018.155 |

| 27.12.2021 | 51 280.36 |

| 26.12.2021 | 50 384.66 |

| 25.12.2021 | 50 679.06 |

| 24.12.2021 | 51 156.46 |

| 23.12.2021 | 49 722.565 |

| 22.12.2021 | 49 020.92 |

| 21.12.2021 | 47 997.96 |

| 20.12.2021 | 46 541.104999999996 |

| 19.12.2021 | 47 372.975000000006 |

| 18.12.2021 | 46 439.795 |

| 17.12.2021 | 46 754.695 |

| 16.12.2021 | 48 498.775 |

| 15.12.2021 | 48 031.005000000005 |

| 14.12.2021 | 47 493.015 |

| 13.12.2021 | 48 007.97 |

| 12.12.2021 | 49 748.5 |

| 11.12.2021 | 48 166.96 |

| 10.12.2021 | 48 518.634999999995 |

| 09.12.2021 | 49 088.57000000001 |

| 08.12.2021 | 49 963.725 |

| 07.12.2021 | 51 018.3 |

| 06.12.2021 | 49 123.11 |

| 05.12.2021 | 48 802.47 |

| 04.12.2021 | 48 717.134999999995 |

| 03.12.2021 | 55 066.19 |

| 02.12.2021 | 56 629.94 |

| 01.12.2021 | 57 801.259999999995 |

| 30.11.2021 | 57 578.83 |

| 29.11.2021 | 57 825.47 |

| 28.11.2021 | 55 455.655 |

| 27.11.2021 | 54 492.8 |

| 26.11.2021 | 56 388.744999999995 |

| 25.11.2021 | 58 246.84 |

| 24.11.2021 | 56 820.11 |

| 23.11.2021 | 56 679.67999999999 |

| 22.11.2021 | 57 532.495 |

| 21.11.2021 | 59 317.125 |

| 20.11.2021 | 58 676.265 |

| 19.11.2021 | 57 029.475 |

| 18.11.2021 | 58 749.990000000005 |

| 17.11.2021 | 59 701.57 |

| 16.11.2021 | 61 180.119999999995 |

| 15.11.2021 | 64 889.0 |

| 14.11.2021 | 64 562.695 |

| 13.11.2021 | 64 187.16 |

| 12.11.2021 | 63 890.509999999995 |

| 11.11.2021 | 64 858.024999999994 |

| 10.11.2021 | 66 087.445 |

| 09.11.2021 | 67 413.34 |

| 08.11.2021 | 65 529.12 |

| 07.11.2021 | 62 358.065 |

| 06.11.2021 | 60 862.505000000005 |

| 05.11.2021 | 61 705.565 |

| 04.11.2021 | 61 924.35 |

| 03.11.2021 | 62 305.705 |

| 02.11.2021 | 62 480.525 |

| 01.11.2021 | 61 018.595 |

| 31.10.2021 | 61 221.315 |

| 30.10.2021 | 61 572.95 |

| 29.10.2021 | 61 618.71 |

| 28.10.2021 | 60 198.755000000005 |

| 27.10.2021 | 59 800.59 |

| 26.10.2021 | 61 579.36 |

| 25.10.2021 | 62 184.16 |

| 24.10.2021 | 60 505.295 |

| 23.10.2021 | 60 719.270000000004 |

| 22.10.2021 | 61 874.2 |

| 21.10.2021 | 64 360.945 |

| 20.10.2021 | 65 262.18 |

| 19.10.2021 | 62 939.405 |

| 18.10.2021 | 61 294.325 |

| 17.10.2021 | 60 374.2 |

| 16.10.2021 | 61 247.625 |

| 15.10.2021 | 59 887.82000000001 |

| 14.10.2021 | 57 684.57 |

| 13.10.2021 | 56 024.295 |

| 12.10.2021 | 55 872.575 |

| 11.10.2021 | 56 137.33 |

| 10.10.2021 | 55 302.575 |

| 09.10.2021 | 54 590.759999999995 |

| 08.10.2021 | 54 857.0 |

| 07.10.2021 | 54 375.85 |

| 06.10.2021 | 53 047.994999999995 |

| 05.10.2021 | 50 486.375 |

| 04.10.2021 | 48 222.744999999995 |

| 03.10.2021 | 48 161.205 |

| 02.10.2021 | 47 908.09 |

| 01.10.2021 | 45 887.475 |

| 30.09.2021 | 42 771.695 |

| 29.09.2021 | 41 696.925 |

| 28.09.2021 | 41 852.685 |

| 27.09.2021 | 43 249.825 |

| 26.09.2021 | 42 376.945 |

| 25.09.2021 | 42 351.51 |

| 24.09.2021 | 42 975.19 |

| 23.09.2021 | 44 051.295 |

| 22.09.2021 | 42 300.645000000004 |

| 21.09.2021 | 41 696.55 |

| 20.09.2021 | 44 946.56 |

| 19.09.2021 | 47 620.4 |

| 18.09.2021 | 47 937.235 |

| 17.09.2021 | 47 471.335 |

| 16.09.2021 | 47 774.53 |

| 15.09.2021 | 47 591.225000000006 |

| 14.09.2021 | 46 019.965 |

| 13.09.2021 | 45 166.57 |

| 12.09.2021 | 45 584.66 |

| 11.09.2021 | 45 364.805 |

| 10.09.2021 | 45 612.47 |

| 09.09.2021 | 46 453.795 |

| 08.09.2021 | 45 919.055 |

| 07.09.2021 | 48 411.83 |

| 06.09.2021 | 51 900.92 |

| 05.09.2021 | 50 694.729999999996 |

| 04.09.2021 | 50 025.235 |

| 03.09.2021 | 49 709.354999999996 |

| 02.09.2021 | 49 503.795 |

| 01.09.2021 | 47 803.395000000004 |

| 31.08.2021 | 47 483.229999999996 |

| 30.08.2021 | 47 875.29 |

| 29.08.2021 | 48 747.49 |

| 28.08.2021 | 48 846.685 |

| 27.08.2021 | 47 771.56 |

| 26.08.2021 | 47 907.44 |

| 25.08.2021 | 48 196.405 |

| 24.08.2021 | 48 720.315 |

| 23.08.2021 | 49 781.04 |

| 22.08.2021 | 48 816.08500000001 |

| 21.08.2021 | 49 069.925 |

| 20.08.2021 | 48 014.75 |

| 19.08.2021 | 45 513.134999999995 |

| 18.08.2021 | 45 132.935 |

| 17.08.2021 | 45 769.880000000005 |

| Data is provided for the dates on which the auction took place. Therefore, there is no data for weekends and holidays. | |

| The table is too large to display on the screen. | |

| Year | Price, USD |

| 2022 | 43 382.455 |

| 2021 | 47 908.09 |

| 2020 | 9 701.64 |

| 2019 | 7 783.71 |

| 2018 | 6 945.665 |

| 2017 | 2 576.355 |

| 2016 | 581.2925 |

| 2015 | 248.315 |

| 2014 | 492.075 |

| 2013 | 115.455 |

| 2012 | 6.69 |

| 2011 | 3.3 |

| 2010 | 0.0 |

| 2009 | 0.0 |

Bitcoin to ruble exchange rate today

BTCRUB rate from TradingView

1 bitcoin in rubles as of July 27, 2021 is 2,738,710. Other ruble characteristics of the cryptocurrency in question:

- Initial course marks: 2.796.580.

- Within a few hours the cost dropped significantly. Unlike the dollar, the fall is not 12%, but more, which is caused by the less stability of fiat money in the currency pair in question.

- Over the past 24 hours, the price of Bitcoin in rubles has fallen, but this has had almost no effect on the total daily trading volume. Today it is 606.466.000. But this is far from the highest (or even average) trading indicator.

- The total capitalization of all BTC, taking into account the exchange rate of Bitcoin to the ruble now, is 51,399,218,198,612. This figure literally 1-1.5 years ago was ~2 times higher.

- Fluctuations in the value of Bitcoin in rubles online over the past 24 hours amounted to -57876.9. By the morning of July 27, 2021, market activity increased due to this indicator. Some decided that the rate was good enough to buy, while others preferred to sell their existing coins in order to prevent the value of their cryptocurrency portfolio from falling.

If you look at the Bitcoin exchange rate to the ruble on the chart, you can see the dynamics of first a smooth growth, and then a sharp fall. The cost reached its peak in April 21, when it almost approached 5 million rubles. But over the past week, the rate has been actively growing again, so many consider this time as a good time to buy the corresponding digital asset.

Bitcoin to euro exchange rate today

BTCEUR rate from TradingView

Speaking about what the Bitcoin rate is today in the currency pair with the euro, we can assume that this is the most stable combination as possible for the cryptocurrency market. Recently, it is the euro that has been demonstrating minimal inflation, since European countries are taking a responsible approach to shaping their economies. The value of BTC in euros is currently 31288.9€. Other indicators of the corresponding currency pair are highlighted:

- At the beginning of July 27, 2021, the coin rate was 32341.5 €. Then, over the next 5-7 hours, it sank significantly.

- Over the past 24 hours, the trading volume amounted to €711,648,000. Most of this volume occurs during periods of active price fluctuations. Many investors in cryptocurrency assets considered the sharp drop in the price of Bitcoin as a reason to purchase tokens in a decent amount.

- As of today, the total capitalization of BTC is 587.221.251.561€. This is a fairly high figure, but compared to the peak rate, the cost has dropped by almost 2 times.

- Over the past 24 hours, the price of the cryptocurrency has fallen, now it is -1052.61€. The indicator is higher than in dollars, which is due to the fact that the US fiat currency is now experiencing a rate correction after a constant 2-month fall due to inflation.

- The cost of the course has decreased by more than 3% over the past 24 hours. It should be noted that against the background of this, other cryptocurrencies also experienced a fall in relation to the euro. EOS and Ethereum suffered the most, falling almost 6%. The fluctuations were less painful for Monero; its rate fell about the same as Bitcoin.

To make money from trading, you need to monitor the price of Bitcoin online on an ongoing basis. A strong jump in the exchange rate can occur in a minute. Therefore, it is better to use proven services like the unistex.com exchange. Here, there is a rapid update of exchange rate indicators, as well as user support is carried out on powerful server hardware to eliminate delays in the execution of operations and transactions.

Is bitcoin anonymous?

Most people believe that Bitcoin is a completely anonymous cryptocurrency. However, this is not quite true. Intelligence agencies can reveal your identity if they try hard enough. The fact is that, in general, the Bitcoin blockchain provides for partial anonymity of coin owners. In order to install a bitcoin wallet, store and use coins, you do not need to disclose or indicate your personal data anywhere. However, information about transactions, the amount of funds transferred, the date and time of any transactions with coins is completely open. Those. The BTC blockchain itself is completely public, since its code is in the public domain and can be viewed and analyzed by anyone.

The question arises: how can one identify a particular user, having only data on transactions performed?

In general, this is quite difficult to do. In theory, it is possible to group individual transactions and determine whether they relate to the same person. After a group of transactions has led to one user, all that remains is to reveal his identity, which is sometimes impossible to do if the user knows how to achieve maximum anonymity and does everything to achieve this. However, the situation is catastrophically aggravated when you use third-party sites and services. That is, let’s say you bought bitcoins at some exchanger, on a cryptocurrency exchange, or somewhere else. If to carry out this operation you had to disclose your personal data, or you made a purchase with a bank card, or on an exchange that is regulated by various regulatory authorities, then the level of your anonymity is sharply reduced. Immediately there is an opportunity to easily follow your trail.

Of course, the Bitcoin protocol includes some tricks that confuse its tracks, such as the constant change of Bitcoin addresses. That is, for each subsequent transaction, the bitcoin wallet generates a new address. Thus, it becomes more difficult to de-anonymize you, but still in most cases this will not save you.

Recently, coins have begun to appear on the cryptocurrency market that have much better privacy than bitcoin, and which were originally created to provide complete anonymity for users. Such coins include, for example, ZCash, Monero, Dash, SmartCoin and some others.

Bitcoin trading chart online

BTCUSD chart from TradingView

If you plan to make money on cryptocurrency, then you need to track the Bitcoin exchange rate online in real time. This opportunity is offered on the unistex.com exchange. For the convenience of users, it is suggested to choose a standard graphic change, or switch to candlesticks.

Charts are used to predict prices. This is the skill of any trader. But if the situation with stocks, bonds or other more traditional digital assets is more or less clear, then with cryptocurrency everything is much more complicated.

For convenience, the trader uses 3 types of charts:

- Line chart. This is a basic system that is mastered by a trader in the cryptocurrency market first. It shows how the price of Bitcoin has changed during its time on the market. In accordance with it, you can track events in the world in order to understand which of them may have an impact on exchange rate fluctuations.

- Bar chart. Primarily used by long-term investors, or traders who prefer to trade over long periods rather than enter into many trades within 24 hours.

- Bitcoin chart on Japanese candlesticks. This is a convenient format that began to be actively used on exchanges in 1991. And when the first BTC coins went on sale, exchanges immediately implemented such a system. Using candles, you can conveniently make a forecast, track the progress of a token over a day or another time period.

Knowing how to analyze prices and read charts to successfully trade Bitcoin is part of the deal. It is also recommended to follow news and mentions of tokens in the global community. Big news can affect the exchange rate. For example, when Musk announced that he would not sell Tesla cars for BTC, the rate fell sharply, and to this day it cannot level off.

What is Bitcoin in simple words?

Bitcoin (English Bitcoin, abbreviated as “BTC”) is the world’s first digital currency (cryptocurrency), created in 2009, which exists exclusively on the Internet in the form of program code, does not have an emission center, and is not subject to regulators represented by government agencies . In simple words, Bitcoin is a modern analogue of paper money, only existing on the Internet, and creating the prerequisites for the formation of the modern financial future of the whole world.

In simple terms, Bitcoin is designed to ensure freedom of financial relations between people around the world. It is a completely decentralized digital currency that cannot be blocked, seized, or otherwise controlled like regular fiat money. This impossibility is explained by the fact that no one controls Bitcoin, just as states and banks manage conventional fiat currency (dollars, euros, etc.). As you probably guess, the same dollars or rubles can disappear even tomorrow, if only the authorities want it, and the result will be the loss of all your savings. This will not happen in the case of Bitcoin.

Every person, even a child, can own Bitcoin, and to purchase it you do not need to disclose your data (full name, residential address, etc.), as required by popular payment systems such as WebMoney, Yandex-Money, AdvCash, etc. When transacting with BTC, you do it yourself. In order to send bitcoins to another country, you do not need any intermediaries in the form of banks, exchangers, etc. All operations are carried out directly between bitcoin users, and all this thanks to the decentralization that is provided by the blockchain system, which we will talk about later. It is also worth noting that any transactions carried out on the Bitcoin network are irreversible, i.e. they cannot be undone.

Bitcoin is not the only cryptocurrency. Currently, a huge number of other digital coins have been created and launched and are being used successfully, such as Ethereum, Litecoin, Dash, ZCash, Ripple, etc.

Where can I find out the current Bitcoin exchange rate?

Information about the current exchange rate of the BTC coin is important. Exchangers or other similar structures may use the old rates when concluding transactions. Because of this, buyers are forced to overpay. And given the constant jumps, keeping track of the current price is important for concluding profitable deals.

The unistex.com platform is considered as an example. Here:

- Current price information on the coin is presented;

- Abundance of charts, you can choose a graphic format for the trader;

- Rate fluctuations are quickly displayed;

- Trades are made quickly to make money at the peak;

- Requests are processed quickly;

- You can set limits.

There are official sources that offer information on the current token rate. But if you load resources in one browser, inaccuracies are observed. Therefore, it is better to trust a trusted organization.

Where can you buy Bitcoin at a favorable rate?

To buy Bitcoin, they use various resources on the Internet. But not everyone offers profitable courses.

If we consider exchangers, then the cost of a coin can fluctuate in the range of +5%. Transfer fees are also taken into account. Some organizations charge a commission twice, for example, when money enters the site and when it leaves the site. Thus, both parties to the transaction lose money, and the benefit is observed only for the exchanger itself.

Advice: if an investor plans to buy a large amount at once, it is recommended to check any virtual exchange office on a small amount. The answer to the question of whether it is possible to buy part of a bitcoin is positive, so first you should take 4-5 thousand satoshi. And if the transaction goes through quickly, then the verification has been passed, and large amounts can be connected.

As for exchanges, the rates here are much more profitable. On unistex.com, the price of Bitcoin is adjusted in accordance with global rising and falling trends. Therefore, a profitable and realistic rate can be found here. The exchange also works with different methods for withdrawing and depositing money, almost all of them are accompanied by minimal commissions. Therefore, most traders and investors decide to buy cryptocurrency on unistex.com.

Is Bitcoin a financial pyramid?

The answer to this question is “no, no and no again.”

As you probably know, financial pyramids are investment programs in which income is paid to existing investors using the money of new investors. Also, in such projects there is a management that makes profit from this activity, which in turn goes to them fraudulently (after all, they attract new investors with fairy tales about a profitable business, but in fact their goal is banal enrichment at the expense of these same investors). Financial pyramids do not conduct any business and do not produce any goods, services or other valuables. Thus, their activities are carried out in vain.

Pyramids are also often called hype projects. An example of a pyramid: which was organized by the well-known Mavrodi, and where a huge number of investors lost their money.

When analyzing Bitcoin for a possible pyramid scheme of operation, you should pay attention to several factors that completely exclude such a development of events:

- Bitcoin is a development that has clear value. People invest in it for a reason. BTC is the world's first digital currency, which has introduced a new round of development into the digital economy, and indeed into the development of society and the state as a whole. A financial pyramid does not represent anything valuable, and is just a simple transfer of money back and forth.

- One of the signs of a financial pyramid is the presence of “fraudulent managers” who make profit from all this and can close the project at any time. In the case of Bitcoin, such leaders do not exist. The payment network cannot be closed, and no one controls it. Users conduct transactions among themselves, without the participation of any intermediaries.

- It is also necessary to understand that bitcoin itself is not programmed to carry out any obligations to users, as happens in financial pyramids. When buying coins, you must be aware of the risks and understand that bitcoin does not owe anyone anything, and its price depends on the users themselves, its scarcity, and also on the overall perception of the technology by the global community.

Thus, you have convinced yourself that Bitcoin does not correspond to the signs of a hype or financial pyramid.

The price of Bitcoin is formed, as I already said, based on many factors, the main one of which is supply and demand between market participants.