The past year has played a huge role in the development of the cryptocurrency market. If 2013 was the year of the global triumph of Bitcoin, then 2022 can be called the year of triumph of the digital asset market as a single phenomenon with many currencies and other elements. It was in 2022 that many people learned that Bitcoin is not only not the only, but perhaps not even the most promising cryptocurrency: altcoins can be its real competition. In total, in 2022, the Bitcoin exchange rate and capitalization increased approximately 20 times (as of the end of the year), and the capitalization of the entire crypto market increased 34 times.

Update of the three-year record and Chinese demarche

The last days of 2016 were marked by a rapid rise in the Bitcoin rate. But its price still remained lower than on the record days of December 2013. Therefore, 2022 began with intrigue: will the record be broken in January? The answer turned out to be positive: the cherished $1,000 barrier was surpassed for the second time in history. On January 6, the new record Bitcoin rate was $1,100.

But investors did not rejoice for long. On January 7, the People's Bank of China announced plans for inspections at the largest cryptocurrency exchanges. By January 12, the Bitcoin rate rolled back to $770, losing 30%. The exchanges actively cooperated with the authorities and for several more months made life difficult for investors - regularly suspending trading, introducing new commissions, complicating the withdrawal of funds, and even prohibiting it for a long time under the pretext of updating equipment.

Advertising on Forbes

Bitcoin withstood the blow, gradually regaining its position by the end of February. But China, which until recently was considered the absolute market leader, has radically worsened its position. In 2016, China sometimes accounted for more than 90% of all Bitcoin transactions, and after the January events, this share almost stopped rising above 20%.

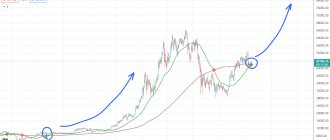

Growth of the Bitcoin (BTC) rate and capitalization in 2022 (hereinafter data from coinmarketcap.com)

March. ETF registration failure and continued Bitcoin growth

For several years now, the relationship between states and cryptocurrencies has been uncertain. Some of the idealists of the crypto market like its “protest” non-state position, but realists understand that bridges need to be built between crypto-economics and traditional economics. Including to protect yourself from events like those that happened in China in winter. And if the cryptocurrencies themselves are not recognized by the state, then you can try to create classical financial instruments that depend on their rates and trade them according to the current laws of the stock market. Such instruments have existed on the over-the-counter market since 2012, when Exante launched a Bitcoin-tracking fund (the price of a share of which is equal to the price of Bitcoin). But Bitcoin activists also wanted official exchange recognition. To this end, the Winklevoss brothers developed a Bitcoin ETF project - the same tracking fund, but traded on the exchange like an ordinary share. This would attract many classic investors to Bitcoin, boost its rate and mean partial official recognition.

Unfortunately, on March 10, the US Securities and Exchange Commission denied the brothers registration of an ETF. Moreover, she refused to use wording that left no doubt: the problem is not a specific ETF project, but Bitcoin itself with its derivation. The American government is not ready to help its development and does not consider it a tool worth dealing with.

However, Bitcoin reacted surprisingly mildly to this. On March 10, its rate fell from $1,250 to $1,100, but by March 15 it had regained its position. From March 16 to March 25, there was a deeper decline to $900, but it was also won back by April 11.

April. Japanese legalization of cryptocurrencies

If the American leadership officially refused to trust Bitcoin in March, then in April, as if playing the role of a “good cop,” Japan unexpectedly took a liberal position on this issue. On April 1, a law came into force, equating all cryptocurrencies to ordinary money and legalizing their circulation.

The adoption of the law became the most important precedent for investors: a large state, in one act, legalized a phenomenon that previously was usually considered “requiring a very careful legal approach”, and even a direct “enemy of the state.” Japan has shown that everything can be simpler. And perhaps other countries will follow her example.

Oddly enough, just like in March, the market reacted sluggishly to the news. A new serious growth in Bitcoin and other cryptocurrencies began only at the end of the month. Therefore, there is still no consensus among experts on how large the role of Japan was in subsequent events that changed the crypto market forever.

May. The triumph of altcoins and the Bitcoin reform project

Whether thanks to Japanese law, or simply from the accumulation of a critical mass of investor confidence, perhaps the main cryptocurrency event of the year took place in May: the unprecedented growth of many currencies.

On April 24, Bitcoin cost the same $1,250 as on March 10. But by May 24, it had risen in price to $2,700—more than doubling. These rates were reminiscent of 2013 and earlier years. Bitcoin's capitalization increased from $20 to $44 billion. But altcoins shot even stronger. Their total capitalization over the same days increased from $10 to $46 billion! The rates of individual altcoins increased by an order of magnitude: Stellar Lumens - 8 times, LuckChain - 10 times, Bytecoin and Reddcoin - 11 times. For the first time in history, the total capitalization of altcoins exceeded the capitalization of Bitcoin. The general public has realized that altcoins are not just a shadow of Bitcoin, but its real competitors.

Bitcoin itself, although it grew during the days of hype, clearly showed one of its technical problems: low network throughput. In May, some of his transactions took several days. The rather conservative Bitcoin community was forced to decide to change the protocol (hard fork) of the currency in order to increase network capacity. After much debate, on May 23, a number of key community authorities signed the New York Agreement on a two-phase reform of BTC: in August, SegWit technology is introduced into BTC, allowing many transactions to bypass the currency’s blockchain, and in November, the size of blockchain blocks is doubled - from 1 MB up to 2 MB. The reform was called SegWit2x, and its implementation seriously influenced the events of the second half of 2022.

- It's hard to be a Bitcoin: why the cryptocurrency rate is in a fever

Growth in the total capitalization of altcoins in 2022

What is Bitcoin

Bitcoin (from the English bit - unit of information “bit” and coin - coin) is a decentralized payment system for carrying out transactions with the monetary unit of the same name, also called virtual currency or cryptocurrency. The concept of the system was published in November 2008 on the Internet by its author (possibly a team of authors) under the pseudonym Satoshi Nakamoto. Currently, one of the main programmers responsible for the operation of the system is the American Gavin Andersen. In May 2016, Australian Craig Wright stated that he was the creator of the system, but did not provide any significant evidence of this.

June July. Ethereum vs Bitcoin

If in May, for the first time in history, Bitcoin was “beaten” by the total mass of altcoins, then in June among the altcoins there was a “hero” who almost repeated the feat alone: the cryptocurrency ether (Ethereum, ETH). The growth of most altcoins after May 25 gave way to a drawdown and balancing just below the May record, but Ethereum continued to break records. In a month and a half from April 24 to June 13, it rose in price from $50 to $400, and its capitalization increased from $4.5 billion to $37.1 billion. Bitcoin’s capitalization on that day rolled back to $38.9 billion. Thus, two blue chips digital asset markets have almost touched each other in value.

Advertising on Forbes

Ethereum lacked only 5% to beat Bitcoin's capitalization. In the following days, its rate sank, and the Bitcoin rate rose again. But in any case, this became a fundamental event for the reputation of the currency. Ether loudly declared itself as the main competitor of Bitcoin - and having more advanced technical characteristics. In particular, much greater network capacity, which allowed us to avoid the troubles that Bitcoin had in May.

Interestingly, shortly before the record, on June 2, the creator of the broadcast, Vitalik Buterin, met with President Vladimir Putin in St. Petersburg, talking with him about the prospects for using his developments in Russia.

Growth of the rate and capitalization of ether (ETH) in 2022

The whole world is on air

In May, the cryptocurrency fever intensified and swept the whole world. The Bitcoin rate set another record on the 21st, breaking the $2,000 mark. However, the main organizer of the “hype” in the second quarter was not Bitcoin, but Ethereum, or simply “ether” - a cryptocurrency based on the blockchain platform of the same name. Its founder, Russian-Canadian programmer Vitalik Buterin, positioned his system as a force capable of displacing Bitcoin from its pedestal. Ethereum is a platform for almost everything that can be transferred to the blockchain, while Bitcoin is nothing more than a payment system.

August. Hard fork of Bitcoin and the emergence of Bitcoin Cash

In August, the first part of the BTC reform took place - the introduction of SegWit support. And although the reform was supported by the majority of miners, there were still some dissenters in the Bitcoin community who advocated other methods of speeding up transactions. They believed that SegWit was a departure from the original principles of Bitcoin, described by its author Satoshi Nakamoto in 2008. In their opinion, all information about payments should continue to be recorded in the currency blockchain, but its block should be radically increased: not 2, but 8 times - from 1 MB to 8 MB. They embodied these ideas in their new version of Bitcoin, which was called Bitcoin Cash (BCH).

Advertising on Forbes

The loud hard fork of Bitcoin, and even with the division into two currencies - the updated BTC and the completely new BCH - frightened non-professionals. Many assumed that the Bitcoin rate could collapse. But that did not happen. The BTC rate continued to grow, setting a new record on September 2 – $4850. Its capitalization reached $80 billion, once again leaving Ether and other altcoins far behind. The BCH rate also showed a positive trend. Its initial price was about $300, and by August 19 it exceeded $900. The capitalization of the new currency at that moment amounted to $15 billion - third place in the world ranking of cryptocurrencies.

Story

In January 2009, the first version of software for working with the payment system appeared on the Internet. Initially, the currency was used only by computer enthusiasts. On May 22, 2010, Florida programmer Laszlo Hanich made the first documented exchange of bitcoins for a real item, transferring 10 thousand units of cryptocurrency to a user under the pseudonym Jerocs and receiving two pizzas from him.

In 2010-2011 The first exchanges appeared on the Internet where it was possible to exchange bitcoins for real currency. In the spring of 2011, Bitcoin reached parity with the US dollar.

Since 2011, the payment system, due to the anonymity of transfers, has attracted the attention of people involved in drug trafficking and other illegal businesses. Since 2013, bitcoins can be used to pay for services and goods in some online stores and hotel booking services. In 2013, the University of Nicosia (Cyprus) became the first university to accept Bitcoin as tuition fees. Currently, Bitcoin remains a rather exotic currency, but its scope of application continues to expand. As of August 2, 2022, the capitalization (total value of all available on the market) of bitcoins is $44.7 billion, and bitcoin cash, which separated from it, is $7.2 billion.

September October. New blow from China. Who saved Bitcoin?

Of all the months of 2022, September turned out to be perhaps the most unfavorable for the crypto market. China has long been its informal leader. But the relationship between the leadership of this country and cryptocurrencies is complex and opaque. In winter, as we have already said, the People’s Bank of China, through its actions, brought down the BTC rate by 30% and China’s share in global trade in this currency by almost 80%. At the end of May, the situation on Chinese exchanges softened, and the bans on withdrawals of funds ceased. In the summer, high-ranking officials of the Ministry of Finance and the Central Bank of the People's Republic of China allowed themselves very liberal statements, and it seemed that now the policy of this country would become more friendly to the crypto market. But in September, the Chinese leadership was able to collapse it even more than in January.

On September 4, it completely banned the attraction of investment funds through the ICO method, which had gained so much popularity in the first half of 2022 and became an important part of the cryptocurrency market. It was through ICO in 2014 that funds were raised, for example, to create the ether currency, and in the summer of 2022, the ICO market even overtook the traditional venture capital market. Cryptocurrency rates began to fall after the ban, but China did not wait for the bottom. On September 11, he dealt a second blow to the market, declaring his intention to close cryptocurrency exchanges on his territory, including the world's largest OKCoin and Huobi.

By September 15, the Bitcoin rate fell below $3,000, and capitalization to $50 billion. The total drop over 2 weeks was almost 40%. Over the same period, the capitalization of altcoins fell from $97 billion to approximately the same $50 billion, that is, almost doubling. The overall drop in the cryptocurrency market was 45%. For comparison, the US stock market fell by about the same amount in 2008 during the mortgage crisis.

However, the crypto market has its own laws, and crises here sometimes end as quickly as they begin. On September 12-15, the administrations of the Chinese exchanges met with the Chinese leadership and “found out” that there was a misunderstanding. China “did not at all intend” to close the exchanges, but only wanted to ban trading in cryptocurrency-yuan pairs. Not all the details of the negotiations were announced publicly, but the market breathed a sigh of relief, and already on September 16, Bitcoin rose in price to $3,800. And in October, he completely restored his position, starting to set new records. Altcoins reacted in approximately the same way, although more sluggishly.

Advertising on Forbes

Bitcoin price chart for all time

Bitcoin rate at the time of its appearance

Bitcoin price history for 10 years and 10 minutes.

Bitcoin exchange rate history and its initial value.

Cryptocurrency lovers have always been interested in the Bitcoin exchange rate. This narrative will examine the entire chronology of events that happened to Bitcoin from the time of its creation to the present day. How a coin with an initial value of $0.0007 could become titanium with a value of $17,500. Next, it will be stated what changes the Bitcoin exchange rate has undergone since its creation and how has the price of Bitcoin changed during this time?

Bitcoin development and its price in 2008

August

Three programmers, Neil King, Vladimir Oksman and Charles Bry, have applied for a patent on encryption technology. In the future, this technology will be called Blockchain. In the same month, the Bitcoin.org domain structure was registered. For this purpose SARDI was used. (Anonymous Domain Name Registration Service).

October

Shortly after this, Satoshi Nakamoto published a report explaining the concept of working with electronic netting, agreed entirely on P2P technology. This was supposed to solve the problem of counterfeiting and give Bitcoin a de jure foothold. The first block, called "Genesis", was launched at the end of October and started the entire mining process. Later that month, the first transaction was carried out. It is not possible to say exactly how much 1 bitcoin was worth in 2008 due to the lack of a qualified assessment at that time in relation to traditional currencies.

Bitcoin rate from the very beginning - chart

Bitcoin development and its price in 2009

On October 5, 2009, the Bitcoin coin received its first exchange rate against traditional currencies. The New Liberty Standard company set the Bitcoin rate and chart at 1 dollar in 2009, for more than 1,309.03 BTC. That is, $0.0007 was offered for 1 bitcoin. This price already included payment for electricity, due to the need to always keep the mining equipment turned on.

Bitcoin development and its value in 2010

February

This month, the world's first Bitcoin exchange, Dwdollar, was founded, which made it possible to work with Bitcoin and its dollar pair. Now the exchange no longer exists.

May

A historical event by Bitcoin standards occurred on May 22, 2010. It was then that 2 pizzas were purchased for 10,000 bitcoins, which at that time cost $25. If you look at how much Bitcoin costs in 2010 and how much it is now, then today for these 10 thousand bitcoins you can get 75 million dollars or 25 million pizzas.

July

July was memorable for the rise of Bitcoin to $0.08 per coin. This rate remained at this level until October 7, after which it continued to grow.

November

A month later, on November 6, the capitalization of the Bitcoin cryptocurrency had already reached $1 million, and the value of the coin on the MtGox exchange reached 50 cents each.

Bitcoin exchange rate dynamics in 2008-2010

The dynamics of the value of Bitcoin from 2008 to 2010 was a series of rises and falls. From $0.0003 per coin in 2008 to $0.20, Bitcoin has grown more than 1,500 times, which indicates its wealth at this time.

Bitcoin rate chart for the year

Bitcoin development and its value in 2011

February

If you ask how much Bitcoin cost in 2011, you can find out that already in February 2011 its cost was 1 dollar.

March

At the end of March, on the 23rd-24th, BTC established parity with the euro, surpassing its value and the value of the dollar pair.

June

At the beginning of June, the cost of 1 Bitcoin coin was more than $10, and a week later it increased to $32. On June 12, an unpleasant incident occurred, later called the “Big Bubble.” Then the rate fell almost 3 times, reaching the level of $10 per coin.

July

The largest Bitcoin theft occurred on July 13th. More than 25 thousand BTC were stolen from the electronic wallet of one of the active users of Bitcoin Forum.

Bitcoin development and its value in 2012

Bitcoin rate in 2012 chart

This year in the history of Bitcoin development marked the act of embodiment of Bitcoin in the form of physical value, on a par with precious metals and fiat currency.

This was done at the will and efforts of Bitcoin Central Bank, which was able to obtain a license and gain recognition from European regulators. This action had an insignificant effect on the value of the coin.

Bitcoin development and its rate in 2013

February

From the beginning of the year until the end of February, the BTC rate remained approximately at the same level. On February 22, quotes rose to $30 per coin. A subsequent increase on February 28 only strengthened this rate at $31.91.

March

On March 11, quote levels reached $37, and on March 22, an unprecedented $74.90 per coin.

April

On April 1, 2013, the cost of bitcoins increased to $100, and in the next 10 days it doubled. As of April 20, the price of Bitcoin was already $266. This was due to an unprecedented increase in the number of miners and the capacity of mining farms.

October

October 2 is called the day of the Bitcoin crash, when overnight the rate dropped to $109.71. This fall was due to the fault of the Silk Road trading platform, whose accounts were frozen and its owner was arrested for drug trafficking.

November

This month the price of Bitcoin reached a phenomenal $1,300. This happened in 3 stages, which is called the “Trinitrian revival”.

- The rise on November 6 to $269 due to the partial acquittal of Silk Road and the unfreezing of the site’s accounts.

- The increase on November 17 to the level of $503.10 was due to the partial dismissal of charges against the owner of Silk Road, William Ross Ulbricht.

At the end of November, the rate was already $1242, the potential of this currency.

December

By December, when rates had already begun to stabilize, the value of the currency fell slightly and reached the level of $1,000 per coin. As a result, the Bitcoin exchange rate in 2013 reached a maximum of $1,318.

By December 17, the rate of the coin fell almost 2 times, reaching $600 per coin. The drop was due to a ban on Chinese financial institutions working with crypto-currency assets. The ban was accompanied by a statement from the head of the Chinese Central Bank, saying that Bitcoin has nothing to do with the legally backed yuan and its foreign equivalent, the dollar, and is also a direct threat to China’s financial stability. In fairness, it is worth noting that today, China retains the title of the largest bitcoin trader in the world, and more than 85% of transactions are made in China and related countries.

Bitcoin development and its rate in 2014

January

January 2014 is rich in events, one of which is the beginning of the release of special cryptocurrency charts by Coindesk. From them it can be determined that the Bitcoin exchange rate in 2014 was first 770 and then 950 dollars.

February

After a sharp increase to $950, the price decreased and stabilized at $700. Since that time, the Bitcoin rate began a pendulum cycle with a series of decreases and increases. In the same month, it was announced that the Bitcoin service Elliptic began operating and that it launched a platform for insuring and storing Bitcoin assets. As conceived by the creators, all deposits were insured by a Fortune 100 company and kept in full.

Another highlight was that the online platform Overstock.com received the title of “the world’s first major online trading platform that supports Bitcoin.”

June

In June 2014, the US Government put up for auction 29 thousand BTC, which were seized from the illegal trading platform Silk Road. Closing this incident with a successful outcome helped Bitcoin clear itself of the shameful title of “Tool for Criminals.”

This incident made it clear to everyone that, if urgently needed, it is possible to identify any participant in Bitcoin transactions.

October

In October, TeraExchange announced that it would soon host its first transaction using a regulated exchange. There will also be automated Bitcoin hedging to improve transaction security.

Bitcoin development and rate in 2015

October

This month was marked by the emergence of a number of rumors and myths related to Bitcoin and its alleged connections with the scammer Mavrodi and his new pyramid, an analogue of MMM. In October, the price was reduced to $500 to revalue the currency and begin regulation in China.

December

Subsequently, before Christmas, Bitcoin decreased its position to a stable $390 - $410.

Bitcoin exchange rate dynamics in 2011-2015.

According to the exchanger bestchange.ru, the dynamics of the exchange rate in the period 2011 - 2015 ranged from 1 dollar to 520 dollars at the peak of sales, which indicated its trading liquidity and ability to replace traditional currency, if necessary.

Bitcoin development and rate in 2016

January

At the beginning of the month, one of the core developers of the Bitcoin Core platform, Mike Hern, quit. Before his departure, he published the “Hearn Report,” which predicted the collapse of the cryptocurrency system and the collapse of the Bitcoin exchange rate due to the reluctance of the company’s management to increase the necessary volumes of currency and concentrate assets on Asian markets.

March

The month of March began with good news, namely, with the acceptance by the Japanese Cabinet of Ministers of a memorandum recognizing Bitcoin as one of the options for electronic currency, possible for paying for goods and services, as an analogue of traditional currencies.

At the end of March, payment with cryptocurrency became possible in South Africa, namely on the Bidorbuy trading platform.

April

The exchange rate in April was $452 - $455 per bitcoin.

May

In May, the value of the currency increased and finally reached $600. By this time, the total capitalization of Bitcoin had already exceeded $30 billion.

June

Until about the end of the month, the price of the coin remained unchanged and by June 13 it reached $725.

August

August began with another criticism from the US Congress and the head of the US Central Bank against Bitcoin, about its unreliability and uselessness for the economy. And Chinese regulators closed 3 large exchanges operating in China, Taiwan and Singapore, which caused a drop in the Bitcoin rate by 15%.

December

On December 5, the “Black Sale” occurred, during which more than $4 billion in transactions were made in just one day, which became the most active day for trading in the past year.

Bitcoin exchange rate in 2014-2017.

An analysis of the three-year Bitcoin rate conducted by www.fxclub.org showed that the maximum cost of Bitcoin ranged from $960 at the peak of 2014 to $1015 in 2022.

Bitcoin rate in 2016 chart

Bitcoin development and rate in 2022

A boom in the activity of crypto traders, miners and all those who wanted to feel in the trend of news about Bitcoin occurred in 2022. The Bitcoin chart over 5 years showed an incredible increase in its price.

Bitcoin price chart for 5 years

From 2012 to 2022, the rate increased from $6.18 to $1200 per 1 bitcoin.

This year, Bitcoin began not only to be loved and revered, but also to strive to obtain it at any cost. Huge sums invested in the creation of crypto farms, empty shelves of stores selling video cards, criminal schemes of hundreds of motley fraudulent bubbles, these are the characteristic signs of this year.

The increase in the rate since the summer of 2022 was due to traders who announced that the cost of Bitcoin could soon reach 50 thousand dollars, Russian and foreign regulators who gave positive comments on this matter, as well as the media that circulated this type of news. Studying Bitcoin and the history of its rate growth over the years, one can understand that all this activity could not but affect the value of the currency and the current rate soon amounted to more than $3,200 per 1 bitcoin.

On the Internet, it could be used everywhere: From currency transactions to purchasing cars and real estate, from purchasing toys to life insurance in specialized clinics. Rapid growth was observed throughout the year and in just 11 months it reached $7,550 per bitcoin, at the exchange rate as of November 11.

Simple mathematics and nothing more. All those who bought currency at a price of 1 thousand dollars were able to receive a margin of 7 times. On November 20, Bitcoin broke its own ceiling and reached $8,100. December 1 - $10,100 - December 7 - $15,800. December 22 - $17,000 - December 24 - $17,585.

Thus, in just 1 year, Bitcoin went from $800 to more than $17,500, which is the highest Bitcoin price in history in dollars. In Russia, during the sales boom, the cost was also an impressive amount and the maximum price of Bitcoin in history in rubles reached 1,150,000 rubles per 1 Bitcoin. And in some regions of Russia, the highest Bitcoin rate in history was offered at a price of more than 1.5 million rubles per coin, which was significantly higher than the exchange rate.

Bitcoin rate chart for 2022

Bitcoin development and rate in 2022

2018 was not as eventful as the previous one. The year began with the exposure of a number of fraudulent and scam projects in the field of cryptocurrencies and blockchain. According to https://tehnoobzor.com, a third of all companies that require payment for work in this area are engaged in market speculation, scams on social networks and stock exchange fraud.

On August 2, the maximum Bitcoin rate was $7,600.

The nine-year rate, Bitcoin chart from 2009 to 2022, was $0.0007 and $9600. Which shows an increase of 13.7 million times. At the same time, the Bitcoin rate over 2 years showed a 2-fold decrease, from 19.5 thousand to 9.5 thousand.

Bitcoin price chart for all time

The Bitcoin price has increased more than 25 million times over the past 10 years and has reached $7,500. Although only 12 million coins have been mined, the mining capabilities due to its complexity, according to the calculations of experienced miners, will be enough for 1.5 - 2 centuries. This news gives hope to many people who want to make money from it.

The dynamics of the Bitcoin exchange rate over the entire period have shown promising growth, but, according to experts, this is not the limit. Over the past 10 years, the Bitcoin exchange rate has become much slower to rise due to the emergence of a significant number of miners and the complication of the mining process, coupled with pressure from government regulators on the cryptocurrency industry itself. The graph of Bitcoin's all-time price and the maximum price of Bitcoin in history showed that the cost of 17,500 is still a fraction of its potential.

Predictions for the future of Bitcoin

Monitoring the Bitcoin rate chart over its entire history gives us a chance to guess how prices will change in the near future. To do this, we can use the website https://apecon.ru.

November. Bitcoin's reputation crisis and Bitcoin Cash's shot

Amid the Chinese cataclysms, many ordinary investors forgot that the August BTC hard fork was only the first phase of the SegWit2x reform. BTC introduced SegWit support, but the blockchain block size remained the same as 1 MB. The second phase - increasing the block to 2 MB - was scheduled for November. But it turns out that a significant part of the Bitcoin community, including some of the “signatories” of the New York Agreement, now considers this unnecessary. An idea has emerged for a new division of BTC into two currencies - with 1 MB and 2 MB blocks. And until the end it was unclear which branch to designate as BTC, and which - BT1 or BT2.

A split in the community and confusion with designations could have hit Bitcoin's reputation hard and even paralyzed the work of payment systems. In theory, the escalation of the scandal could collapse the currency no worse than China did. Therefore, on November 8, the developers and a number of other key players canceled the hard fork. The official August BTC remained single and unchanged - with a block size of 1 MB.

The cancellation of the hard fork was the lesser evil in that situation, but still not a good thing. The community's reputation was somewhat preserved, but several reputable cryptocurrency activists said that failure to increase the block doomed BTC to repeat problems with transaction speed. In their opinion, the BTC community has discredited itself, is mired in intrigue and has forgotten how to make important decisions. At the same time, there is already a replacement for the official Bitcoin (BTC) - Bitcoin Cash (BCH), which has an excellent supply of network bandwidth and is technically even closer to the original Bitcoin.

As a result, BCH, which had dropped to $300 by the end of October, experienced unprecedented growth and reached $2,400 by November 12. The graphs showed that this was not just growth, but a flow of capital from BTC. However, the excitement soon died down, the BTC rate began to rise again, and the BCH rate rolled back to $1200-1300. But by the end of the month it began to grow again and never returned to the levels of August-October.

November events showed that BTC now has not one, but two serious competitors - ETH and BCH. Moreover, if on the ETH side there are only technical advantages, then on the BCH side there is also a high similarity of the code with the original BTC. All other things being equal, if someone decides to add support for other currencies to the Bitcoin payment service, then it will be especially easy for BCH to do this. After which its high technical characteristics (fast payments, low commissions) will become obvious to a wide audience.

Advertising on Forbes

Growth of the Bitcoin Cash (BCH) rate and capitalization in 2022

Principle of operation

Bitcoins have no physical form and are stored in an electronic wallet. Data about user accounts and bitcoin exchange transactions between them is stored in the system in encrypted form based on blockchain distributed database technology. The system is supported by users and volunteers who run its application on their computers.

The Bitcoin system operates without a regulatory body. The only source of emission of virtual currency is its “mining” (mining) by users who run applications: for using the resources of their computers, a small amount of bitcoins is transferred to them. The money supply in the system is limited - currently there are about 16.5 million bitcoins in circulation, the system’s operating algorithm states that their number will not exceed 21 million by 2040. In this case, fractional units can be used for operations: for example, 0.0001 bitcoin .

The main website of the payment system, which distributes software for working with it, is bitcoin.org.

December. Bitcoin futures and record market growth

On December 10 and 18, events took place that opened a new page in the history of the cryptocurrency market and overshadowed the November scandals. The Chicago Board Options Exchange (CBOE), and then the Chicago Mercantile Exchange (CME, the largest in the world), introduced Bitcoin futures. They managed to do what the Winklevoss failed to do in March: make Bitcoin trading accessible to classic stock investors.

Bitcoin never received recognition as a currency in the United States, but this turned out to be not necessary for trading futures on it. There are futures for oil, grain, and other commodities, as well as for abstract market values such as the Dow Jones index. Likewise, for the Chicago exchanges it was not so important what Bitcoin actually is: the main thing is that it has a market rate, the value of which can be the subject of bets.

This time, the American government swallowed the “pill” and did not ban the initiative. Exchange recognition of Bitcoin has had a very positive impact on the entire cryptocurrency market. Firstly, because now large financial players who are accustomed to the regulated rules of classic exchanges and were afraid of the unregulated crypto-currency market can trade Bitcoin. The introduction of futures for other cryptocurrencies is probably now only a matter of time. Secondly, because after such a precedent it will be much more difficult for Western states to take steps in the opposite direction. On the side of cryptocurrencies are now not only armchair traders and ideological anarchists, but also the world's largest financial players. Which the state is forced to reckon with.

Advertising on Forbes

Perhaps realizing this, CBOE has drafted several new Bitcoin-based ETFs. And perhaps, less than a year after the March rejection of the Winklevoss ETF, the American government will be forced to change its position and allow similar ETFs.

At the time of writing (December 19), the Bitcoin exchange rate is about $19,000, and its capitalization is about $320 billion. Thus, over the year, these values have increased approximately 20 times. And the capitalization of the entire cryptocurrency market is more than 34 times. And this growth continues.

Bottom line

2022 saw many interesting developments in the world of cryptocurrencies. But perhaps the most important of them is practical proof of the new market’s high resistance to disasters. Both good and bad news attracted the attention of new people to crypto-assets, on average being a plus for them. And while the vast minority of the world’s population is involved in the cryptocurrency market, it has room for growth. This global factor turned out to be much more important than the scandals surrounding individual cryptocurrencies.

Perhaps the only player who can now collapse the crypto market in the long term is the state. And not just any, but only very large ones - such as the USA or China. If the leadership of the leading powers seriously united against the inconvenient market and declared a real war on it - not only with the closure of exchanges, but also with reprisals against ordinary users - only then would a significant part of investors be forced to transfer funds to other assets and temporarily forget about progressive, but prohibited technology. However, after the Chicago events, such a turn seems less and less likely. More and more representatives of large classical businesses, often associated with the state, are becoming involved in the cryptocurrency market. And if once officials saw only a threat in cryptocurrencies, now many themselves make money from them.