Summing up the results of the past 2022, experts unanimously agree that it was the best year for the cryptocurrency market. Investors have finally realized the full value of the HODL strategy, which focuses on buying and holding cryptocurrency no matter what the circumstances. The volatility was also quite good, as follows from the review by United Traders analyst Fedor Anashchenkov.

Over the past three years, there have been many more professional players on the crypto market. Pricing, in turn, is much more fair and balanced. Analysts today do not predict protracted crises like the one the market faced in 2022.

Binance analyst Gleb Kostarev focused on the fact that in the past year, explosive growth was expected from crypto payments, however, this did not happen. According to the expert, the strongest impetus for this trend in 2022 will be the entry of the giant Paypal into the global arena.

Expert forecasts for Bitcoin exchange rate in 2022

In the coming year, the cryptocurrency market will continue to attract both private and institutional investors. At the same time, not only Bitcoin, but also many altcoins will be in their field of vision in 2021, predicts a Binance analyst.

At the beginning of 2021, the global cryptocurrency market risks falling by 25-30 percent, stated Bestchange.ru analyst Nikita Zubarev. He recalled that historically Bitcoin lost 20-40 percent in 2017 and 2022. However, if the predicted decline occurs, it will most likely be short-lived. The expert explained his opinion by the presence of demand from institutional investors, as well as by the fact that the falling price will attract a large number of participants to the market.

Experts estimate the forecast for the growth of Bitcoin to $300 thousand in 2022

From the forecasts of former analyst at the investment bank Bear Stearns Tone Weiss, it follows that in 2022 Bitcoin could rise to $300 thousand. According to financial analyst at the Currency.com crypto exchange Mikhail Karkhalev, this is indeed quite possible.

Risky assets are being pushed to growth by the stimulus measures of the European Union and the United States, and therefore investors will begin to actively and to the maximum “squeeze” the loose monetary policy. The upward trend in the markets will continue until some compelling argument appears to start selling assets, summed up Mikhail Karkhalev.

EXANTE Managing Partner Alexey Kiriyenko stated that there are a number of factors indicating that Bitcoin can really grow actively in the coming year. During the crisis year of 2020, Bitcoin successfully quadrupled in price, and there are currently no signs of a “bubble,” the expert concluded.

Bitcoin price predictions: true and false

There are several Bitcoin price predictions made for the medium to long term or without a timeline at all that are still relevant today. Here are some of the most interesting predictions from Bitcoin's most legendary evangelists.

Correct: Tim Draper – $10,000 (by 2022)

Tim Draper, a venture capital billionaire, predicted that Bitcoin would reach $10,000 by 2018. Draper has had great success as an early backer of Skype and Baidu. He is also an early proponent of Bitcoin and its blockchain technology. In July 2014, Draper purchased approximately 30,000 bitcoins (about $19 million at the time), which were seized by the US Marshals Service.

Correct: Mike Novogratz – $10,000 (by April 2022)

Mike Novogratz is a former hedge fund manager who has long invested in blockchain and Bitcoin technologies. Due to strong investor interest in cryptocurrency, Mike believed that the price of Bitcoin could rise to $10,000 by April 2022.

Novogratz has already invested $150 million in cryptocurrency, raising more funds from outside sources, mostly high net worth individuals/families and hedge fund managers.

Incorrect: Ran Neuner – $50,000 (by 2022)

Ran Neuner, host of CNBC's Cryptotrader show and the 28th most influential blockchain technology insider according to Richtopia, stated that Bitcoin will trade at $50,000 by the end of 2022.

Interestingly, CNBC has become increasingly involved in cryptocurrency reporting over the past few months. On January 8, the cable network unveiled a step-by-step guide on how to buy Ripple using the Poloniex exchange as its platform for purchasing the cryptocurrency.

Incorrect: Trace Mayer – $27,395 (by February 2022)

Trace Mayer, who, according to his website, is an entrepreneur, investor, journalist, monetary scholar, and outspoken cryptocurrency advocate, predicted that the price of Bitcoin will reach $27,000 by February 2022. Mayer has been involved with Bitcoin since its early days, initially investing in the cryptocurrency when it was worth $0.25.

Incorrect: Masterluc – from 40,000 to 110,000 (by 2022)

Masterluc is an anonymous Bitcoin trader known for his impressive Bitcoin price predictions. Most notable was his prediction of the end of the 2013 Bitcoin bubble, which was followed by a bearish trend for several years.

Masterluc expected Bitcoin to reach between $40,000 and $110,000 by the end of 2022, publicly sharing his thoughts on the TradingView platform. In a May 26, 2022 post, the legendary trader said he expected that price to be reached sometime before 2022.

Incorrect: Mike Novogratz – $40,000 (by 2022)

After correctly predicting the $10,000 milestone, hedge fund manager Michael Novogratz came up with another prediction: Bitcoin's price could quadruple by the end of 2022 to surpass $40,000. According to him, high demand in Asia and limited supply of cryptocurrencies have led to the rapid growth of cryptocurrencies.

Forecasting Bitcoin Prices Long Term

In the long term, Bitcoin could replace all the gold that is currently in the hands of private investors - in other words, the gold bars that people keep in safe deposit boxes or bury in their backyards (simply as a way to store their money in convertible funds, much more more reliable than paper or fiat money).

Mark Yusko – $400,000 (undated)

Mark Yusko is a billionaire investor and founder of Morgan Creek Capital. His prediction for Bitcoin is that it will be worth over $400,000 in the long term.

He also noted that this asset strikes fear into the hearts of bankers precisely because Bitcoin eliminates the need for banks. When transactions are verified on the blockchain, banks are considered obsolete.

Roger Ver – $250,000 (undated)

Roger Ver is one of the first investors in Bitcoin and related startups. Ver was born in the USA and now has citizenship in St. Kitts and Nevis, and began his business career in the computer parts business MemoryDealers.com. By early 2011, Ver began investing in Bitcoin and now has startups such as Bitinstant, Ripple, Blockchain, Bitpay and Kraken in his portfolio.

In an interview with Jeff Berwick for the Dollar Vigilante blog, Roger Ver said in October 2015 that Bitcoin "could very easily be worth $2,500, or $25,000 a Bitcoin, or even $250,000 a Bitcoin." Ver's assessment is based on the principles of supply and demand, which he believes create great potential for Bitcoin as a store of value.

Kay VanPetersen – $100,000 (by 2027)

Kay Van-Petersen is an analyst at Saxo Bank, a Danish investment bank that specializes in online trading and investing. Van-Petersen, who holds a master's degree in applied economics and finance from Copenhagen, is an active Twitter user and is not afraid to debate difficult topics such as cryptocurrency prices. Van Petersen believes that the value of 1 Bitcoin will rise to $100,000 by 2027, according to CNBC data published in May 2022.

Tai Lopez – $60,000 (medium term)

Tai Lopez is a well-known investor and internet marketing expert who became famous for a viral video he made in his garage. He believes that if a small portion (1%) of the assets of millionaires worldwide were invested in Bitcoin in the coming months, the price of Bitcoin could rightfully rise to around $60,000.

With Bitcoin's acceptance as a store of value and medium of exchange in the global financial market growing exponentially, $60,000 remains a viable medium-term price target even for conservative investors. Only time will tell when/if this forecast will be achieved.

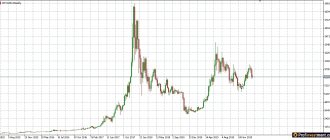

Bitcoin technical analysis

Well, in fact, technical analysis of Bitcoin can be called a stretch. That said, here is the aggregate ranking of BTC from several traders and analysts on TradingView.

Bitcoin (BTC) market forecasts on TradingView; the screenshot was taken on 10/17/19

Bitcoin up and down trend

Undoubtedly, financial giants like Warren and Joseph Stiglitz are making very dire predictions for Bitcoin prices. However, many influential and successful opinion leaders are 100% confident in the future success of Bitcoin.

Bitcoin block reward with possible halving by 2022

The halving of rewards and stuffing affects the number of miners who receive bitcoins for mining blocks. Historically, this process has had a positive impact on the price of the underlying cryptocurrency over the long term. The Bitcoin supply is 21 million coins. Half is intended to prevent coin inflation. Unlike central banks, which can print cash at their discretion, the supply of Bitcoin is limited. Thus, cryptocurrency becomes increasingly scarce and valuable.

After two previous cuts of almost half, Bitcoin recovered in about a year. After the first half in 2012, Bitcoin reached a record high of $1,000 by November 2013. After halving in 2016, Bitcoin rose again on December 18, 2022, reaching its all-time high of $20,089, after which its price fell again.

Previously, the block reward was 50 bitcoins, and these coins were then worth very little. However, two previous cuts have already halved the reward, and it is now 12.5 bitcoins per block. In 2022, the reward will drop to 6.25 bitcoins.

The halving entirely affects the income of miners. Many users come to the conclusion that mining costs, namely electricity and computing power, cost no less than the amount of the reward. However, another part of miners takes into account the fact that demand is growing, since the supply of coins in the world is already approaching their final number, and they do not give up mining.

Bitcoin market capitalization dominance

Just by looking at the market capitalization indicator you can understand a lot about cryptocurrency. The first and main conclusion: Bitcoin continues to be a major player in the cryptocurrency market. Its market share is around 55%, which is about three times that of its closest competitor, Ethereum.

Since its creation, Bitcoin has maintained its leadership in capitalization thanks to the many positive aspects that prevail in working with cryptocurrency. The developers are making important updates that reduce transaction fees, increase network scalability, etc. The market capitalization indicator is not just a tool that allows you to quickly assess the value of a cryptocurrency. Capitalization indicates the viability of the coin.

Bitcoin (BTC) price forecast for 2022, 2022, 2025, 2030

- Price forecast from WalletInvestor for 2019-2025.

- CoinPredictor.io BTC price forecast for the end of 2022

- Bitcoin price forecast from LongForecast for the period 2019-2023.

- Forecast from DigitalCoinPrice for 2019-2025.

- Bitcoin price forecast from Bitcoin Jack

- Bitcoin price forecast from Roger Ver

- BTC price forecast from the Winklevoss brothers

- Bitcoin Price Forecast by Vinny Lingham

- Tim Draper's Bitcoin Price Prediction for 2022

WalletInvestor's source suggests that BTC is a good long-term investment. Soon the price of the coin may rise to $11,177.9. Long-term earning potential is +12.3% per year. According to WI, the BTC rate will not fall. Now let's look at the BTC forecast year by year. • In 2022: $15,921.7 • In 2022: $19,902.14 • In 2022: $29,853.21 • In 2023: $39,804.28 • In 2024: $49,755.35 • In 2025: $79,608.56

According to the source, by the end of 2022, the BTC cryptocurrency will increase to $11,335.05 by +9.9%.

By the end of this year, the price of Bitcoin will fall to $8,687. The decrease is 9.7%. Next year, the price of Bitcoin will drop again, by just $8,139. • In 2022: $12,250 • In 2022: $25,627 • In 2023: $39,282

In December 2022, the price of Bitcoin will rise to $17,239.27. This price is almost impossible given the current price of Bitcoin. So let's look at some forecast numbers: • In 2022: $22,882.85 • In 2022: $20,680.83 • In 2022: $30,460.11 • In 2023: $30,133.5 • In 2024: $20,531.23 • In 2025: $ 20,929.93

An analyst with the nickname Bitcoin Jack believes that the price of BTC may fall to $7,400, but the fall will not last long. As soon as the largest digital currency touches a new “bottom”, the breakout will begin almost immediately. I think this is the most likely scenario for USD BTC Reach $7,400 by the end of November From there we move towards a breakout and gain full strength, returning to over $10,000 in late November or December and setting the rate around ATH to the downside twice. — Bitcoin Jack (@BTC_JackSparrow) September 7, 2022

In October 2015, Roger Ver stated that Bitcoins could be worth $2,500, $25,000, or even $250,000 per Bitcoin. According to him, this cryptocurrency has great potential.

Tyler Winklevoss claims that Bitcoin is a version of gold bullion 2.0. He also says that Bitcoin is better than gold only because it is portable and convenient.

Vinnie Lingham, co-founder of Civic, claims that by 2030 the price of Bitcoin could be between 100,000 and 1 million.

Tim Draper says Bitcoin will reach $250,000 by 2022. According to him, people will be able to buy coffee with bitcoins in 2022.