Financial technology, or fintech for short, is a catchall term for companies bringing modern technology to the financial world. According to various estimates, there are already about 10,000 fintech startups in the world, and their number is constantly growing. From 2010 to 2015, the volume of venture capital investments in fintech grew 10-fold, to almost $20 billion a year, and there are already several dozen startups in this area, whose valuation has exceeded a billion dollars. But despite all this, the penetration of new digital business models in the financial sector, even in the US, is less than 1%. So what is the fintech industry and where does investor money go?

1. Payments and transfers

This segment combines wallets, money transfer services, gateways for accepting online payments, etc. It accounts for up to a third of all investments in fintech, and the largest national fintech companies were created specifically in the field of payments (Russia with Qiwi is no exception). At the same time, the margin in this segment is rarely more than 2–3%, and you can only make money on a large scale. That's why major payments companies PayPal and Ant Financial ("financial ant" brand Alipay), which handle nearly $100 billion in transactions per month, have grown through close relationships with the world's largest marketplaces, eBay and Alibaba.

Another fast-growing subcategory of this segment is remittances. Investors are attracted by the size of this market (more than $500 billion per year) and the presence of huge inefficiencies in it (for example, the cost of international transfers in some cases reaches 10% or more).

Fintech organizations: types of service offerings

Fintech organizations are divided based on when exactly the organization offers its services. There is established fintech and new fintech.

EY research concludes that fintech organizations are facilitators who support infrastructure and technology issues. Most often these are global vendors of IT services. They already have a strong position in the financial sector.

On the other side are organizations that work according to new models.

The business models of these groups can be completely different. It is common for new companies to operate in several different niches. Such companies may have completely different sources of income. At the same time, traditional companies operate on the basis of simple, more understandable models. For example, payment per operation, per click, and so on.

Another important difference between companies is the replacement and application of infrastructure. New industry participants are striving to meet the demand for infrastructure on their own, using P2P networks and Bitcoin/Blockchain for this. Members with established views prefer to use existing infrastructure. Thus, PayPal developed a business based on existing capabilities, but at the same time other services were added that allow clients to solve certain problems.

2. Lending

This is perhaps the most understandable market segment for users, where almost 60% of the profits of modern banks are concentrated and where half of venture fintech investments go. Its active development began after the 2008 crisis, when, due to regulatory changes, it became less profitable for banks to lend to certain groups of borrowers. The first big stories in this segment were companies that do not compete directly with banks, but rather go after customers they have not reached (about 2 billion people in the world do not have access to banking services). One of the most prominent examples is Wonga, a microfinance organization in the UK that focuses on high-yield payday loans. Already in 2012, it showed more than $100 million in net profit - and this in the fintech market, which is still dominated by startups that rarely break even. Lending to small businesses has also developed greatly, in which the banks themselves see too many risks.

Startups that operate on a peer-to-peer (P2P) lending model deserve special mention, when the service provides a platform for connecting borrowers with lenders, which can be retail investors. This model is also successfully used for lending to enterprises. The largest player in this area, the British platform Funding Circle, promises investors investing through it more than 7% net annual return, while deposit rates in Europe rarely exceed 2%.

In the P2P segment, the largest scandal in the history of fintech occurred - the fall of the Ezubao pyramid operating in China. The company falsified 95% of loan applications, on investments in which almost a million Chinese investors lost $7.6 billion. The P2P lending boom in China is generally a unique phenomenon in the world: there are almost 4,000 P2P platforms operating in the country.

The reason for the emergence of fintech

Some companies cannot move away from outdated business models. In an organization of this type, it is not easy to launch and implement an innovation process. There is resistance to modification in such institutions, coupled with a host of financial service delivery challenges. This situation has provoked the emergence of a new niche – fintech projects.

Important! The penetration of new business models in the US financial industry is less than 1%.

Thus, the Kantox company deals with foreign exchange and international payments for its corporate clients. The company makes a profit due to the situation that has developed in the market - large organizations cannot agree on the terms of cooperation with the bank.

At the same time, small and medium-sized businesses are provided with the most favorable terms of cooperation from many companies. And the P2P marketplace (Kantox) provides large clients with the most attractive terms of cooperation, and the exchange rate is more favorable.

3. Asset management and investments

Existing asset management mechanisms and available investment methods are often tailored to a narrow circle of clients: these are either professional investors or people with large fortunes, who are served by professional financial advisors. But with the development of technology, it becomes possible to automate and reduce the cost of many processes, which is often what companies in this segment do. One example is robo-advising, when portfolio selection is carried out by algorithms that offer the client an investment structure that matches his investment preferences and risk profile, thus reducing annual maintenance costs from the industry standard 1–2% to 0.3–0. 5%. And it is cost reduction, ease of use of the product and democratization of access that are the basis of the offer of fintech startups.

This segment also includes numerous crowdsourcing platforms. And while many are already accustomed to investing in pre-orders of projects on sites like Indiegogo or Kickstarter (crowdfunding), investing in shares of private companies in the same way (crowdinvesting) is only gaining momentum.

From idea to development

Fintech is expanding. Large investments are being made in them, and new fintech organizations are emerging. But this industry needs improvement.

Groups of companies specializing in financial technologies:

- startups;

- established financial institutions;

- technology or retail organizations that have decided to change their focus;

- complex startups with mixed ownership structures.

However, there are no clear boundaries between these criteria. Since banks can be owners of shares in new projects. Startups can also be part of the ownership of an institution.

4. Digital banking and personal finance

In the world of fintech, a customer's current account is considered something of a holy grail, because it is often the face of the organization with which the user interacts. True, the current account itself is not monetized very well and only makes sense when linked to other products, including the same payments, loans and investments. This is exactly how most modern banks operate, and more and more so-called neobanks are appearing here - digital banks of the new generation. But if the first attempts to create a digital bank were focused around providing a convenient service based on the existing banking infrastructure (for example, Rocketbank in Russia), then new startups are creating infrastructure from scratch. Regulatory flexibility on digital banking models is also helping startups create full-fledged banks. Thus, in the UK, after changes in banking legislation in 2014–2015, five new banks have already received licenses, and London has become the de facto fintech capital of the world during this time.

Another important category in this segment is personal finance management startups. For example, US-based Credit Karma allows users to gain free access to their credit score and credit history (for which users previously had to pay up to $100), and also keeps a record of all financial products used by the client.

Implementation of fintech projects

Fintech organizations provide services using services. Some of the services:

- cloud computing;

- artificial intelligence;

- mobile;

- big data analytics;

- social media.

Services are also classified as enablers (helpers) and disruptors (destroyers).

Fintech projects are set to destroy or seriously squeeze out competitors. That is, helpers and destroyers are aimed at one thing - changing the market with the help of innovations. Innovation is based on business models, products, services, and organizational innovations.

5. Insurance

The insurance industry, valued at almost $5 trillion, has until now remained one of the most low-tech. This is primarily due to increased requirements imposed by regulators and the inertia of existing players (for example, the average age of a large insurance company in the United States is almost 100 years). Until now, the main innovations in the insurance industry have occurred in the distribution segment. This is not surprising, given that most insurance companies still distribute their products by relying on huge offline agent networks, which take up to 20% in commissions.

Recently, it has become a trend to create a digital insurer from scratch. True, such projects are not cheap. For example, the American startup Bright Health, whose official launch is scheduled only for 2022, has already raised more than $80 million to create a new generation insurance company.

conclusions

According to the data, it can be concluded that the fintech industry is on the rise. This segment is promoting more and more useful projects. But only those who understand the field can invest in this area. The trends in this area are somewhat similar to deep-tech. That is, investors believe that in order to close deals in areas such as data storage and security, an accurate understanding of these areas is necessary - and fintech is increasingly aimed at employees who have the required knowledge to competently evaluate new ideas.

You may also be interested.

Blockchain 0

6. Infrastructure and various support services

This category mainly focuses on B2B startups offering their technologies either to other fintech players, or more often to banks and insurance companies. These include both point solutions related to security, working with big data, borrower scoring mechanisms, and full-fledged platforms, for example, for organizing P2P lending or mobile payments.

As you can see, fintech includes a wide variety of business models and approaches. Some of them, like payments, are already at a fairly advanced level, while others are just in their infancy. At the same time, financial organizations, despite their sluggishness, have already begun to actively look at fintech, realizing that new technologies, together with their established client base, the ability to attract cheap borrowing and a well-developed regulatory framework, can lay the foundations for a new generation of digital financial institutions. Telecom operators are also looking in the same direction, having long ago become a “pipe” for data transmission and dreaming of learning how to make money from customer services. And of course, companies such as Google, Facebook and Apple are actively coming here.

Until now, fintech startups have been able to find a niche with relative ease. But the larger they become, the more overlap they have with traditional financial companies.

And in these conditions, closer integration of fintech startups with large offline players is only a matter of time. A time that is already coming and which many call a new stage in the development of the industry - fintech 2.0.

FinTech directions

Over several years of development of the fintech industry, more than a dozen categories have emerged in which companies operate:

Personal finance – mobile and desktop applications from startups that help an individual user manage their finances, analyze expenses, and receive forecasts of future expenses in the form of detailed reports.

Payments are fintech tools that solve the problem of 2 billion people by providing access to basic financial services. Mobile Internet, smartphones and progressive approaches to financial transactions make it possible to provide access to financial payments even where there are no banking institutions.

Lending is one of the most popular areas, based on the possibility of lending without the participation of banks. Startups work on the basis of distributed registries and help lenders and borrowers from the consumer and business sectors collaborate profitably.

Money transfers – startups in this area allow users to transfer money without the participation of banks. They use mobile platforms and simple authentication in their work. Prominent unicorn representatives of the area: neobank Revolut , TransferWise (platform for cheap international currency transfers), Klarna (internet payments).

Investment platforms – also called Wealthtech. These include robo-advisors, digital brokers, micro-investment platforms and personal finance management programs. They are working on automation and accessibility of the market for retail investors. They are especially valued by investors due to predictive analysis and robotization.

Security – companies in this area provide simpler and more reliable data processing to the banks themselves: from customer authentication to protection measures against fraudulent schemes.

B2B fintech is a direction designed to solve the problems of mutual settlements and data exchange in business. In the area of increased attention: smart contracts based on blockchain technologies.

Big Data Analysis – There are now about 100 fintech startups working on big data for the financial sector. Advertising and PR have been using personal data in their activities for a long time, but the financial sector needs a more systematic approach.

RegTech is one of the most useful areas for business. Allows you to automatically adapt your business to changes in legislation and market conditions.

InsureTech is an insurance offering automated products: mobile applications, payment automation, interaction in the Internet of Things. For example: US car insurance companies sell insurance based on “telematics”. This is when the client's driving style is monitored using his smartphone or a “black box” installed in the car itself. This information can be used to determine the payment amount for your next insurance policy.

Artificial intelligence is still a poorly developed area, but all financial companies are determined to use it to reduce staffing costs. Amazon launched an algorithm based on AI in 2014. As many as 500 computer models had to search and select resumes in open databases of recruiting companies based on matches. But in 2015, developers noticed that the algorithm discriminated against female candidates. They made adjustments, but could not guarantee that there would be no further errors, and were forced to abandon the HR algorithm.

Crowdfunding - the direction creates platforms for collective financing, allows product creators and investors to meet for further cooperation. The most popular: Kickstarter and Indiegogo.

Neobanks – solutions in the field of banking services. Most often they are created in the form of mobile applications that replace the services of classic banks. Customer-oriented, do not require physical branches (examples: Monobank, Rocketbank). Disadvantages of neobanks: low level of customer trust and lack of clear regulatory regulation.

Cryptocurrencies are a type of digital currency that works without a central payment system, completely automatically, and is mined by miners using powerful computing systems. Many startups, exchanges, exchangers and investment platforms have been built on cryptocurrency; millions of dollars are capitalized in them, but financial experts cannot clearly see the future of this industry.

Blockchain is a technology of distributed data registries. Each participant in its chain is his own server, confirming the legitimacy of the operations of other users. The technology is distinguished by its reliability; the Bitcoin cryptocurrency is built on it. This technology has spawned many solutions and startups. For example, it is used for concluding smart contracts, copyright proof, biometric security, trading and transactions, energy distribution, and even voting. At our academy, we use this technology to protect the authenticity of diplomas and certificates and record the history of their receipt.

Online banking

It sounds paradoxical, but in terms of digitalization, Russian banks are not only not inferior, but often even superior to foreign ones. The US and EU banking sectors continue to remain quite conservative. However, younger and more daring people are beginning to promote their influence and original developments around the world. AggregationChallenge.com is the first attempt to track and compare the effectiveness of financial services aggregation (48,000 interconnected companies, billions of possible moves, 99% of customers are satisfied with the service). Finn.ai connects third-party products such as Facebook Messenger and Alexa with digital retail banking experiences. When a user opens an account, Digital Onboarding sends a text message with a link to the banking application and a link to connect to their personal account. FI.SPAN opens a new business banking channel and allows the credit institution to use any third-party projects. Cyber Productivity provides assistance with invoicing, payments, cash management, and more. As you can see, the trend is not so much digitalization (this is already a prerequisite), but rather the integration and expansion of connections between available data bases and platforms.

Voice robot assistants

In a bank branch, a live person talks to a client. This option will soon become premium. The development of voice interfaces will give banks the opportunity to reduce the time it takes to provide the necessary information to clients.

Today, robots are already working in many call centers, eliminating the need for clients to wait for an operator’s response.

The phrase “Your call is very important to us” is a thing of the past. Today, robots can replace human operators by 70-80%. Only in some situations they cannot figure it out. And as data accumulates, voice assistants become more and more effective. In the next few years, they will dominate the first line of communication with customers.

Automatic voice assistants will be able to be active sellers of services in different communication channels: from telephone to instant messengers. With their help, clients will be able to solve their problems faster and in real time.

Artificial intelligence

All of the above are the realities of our day, which we can focus on in the next three to five years: digitalization, integration, personalization. With the advent of quantum computers and the development of machine learning, 99% of the functions of the financial sector will most likely become automated. But according to even the most respected economic gurus, this will not happen until 2025. Now we cannot predict what this will look like and what it will lead to in the end.

Alexander Ermakov , consulting expert on marketing and PR

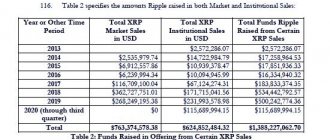

Subscribe to our Telegram channel to learn about all the most important changes affecting business!