Often in our reviews we refer to certain proprietary strategies that are publicly available on Tradingview. What is it and how to use such a tool? Today we decided to tell you in detail what strategies for binary options are using Tradingview.

We all know the Live Chart, which is an indispensable assistant for any trader to achieve accurate market analysis. If many sites (including ours) have a limited version (without public access), then on its official website Tradingview there is this most interesting section, which includes an excellent selection of ready-made strategies. And on a free basis.

The Tradingview community, represented by experienced professionals, create their own indicators based on classic ones. And they post them publicly on the website. To receive competent criticism and feedback from other more experienced colleagues. This is a kind of social network where the same likes and subscribers exist.

But first things first. First you need to go to the official Live Chart website, where our Tradingview strategies are located. It is located at ru.tradingview.com .

In addition to the Chart itself, news, signals, recommendations, articles from other users and their transactions, and much more are regularly published here. This is a full-fledged financial portal. Remember, we previously described all the sites that provide online analytics. So, the Tradingview portal also cooperates with one of these services - Prime.

But let's not get distracted, let's get straight to the point. Open the Chart itself by clicking on the corresponding button.

This panel opens, which is slightly different from the Live Graph we are used to. In the right panel, quotes are updated online and news is published. In the bottom panel, you can test any built-in Tradingview strategy on quote history, create your own scripts and indicators in the Pine editor.

Actually, we won’t talk about the basics of programming. We will talk about the best proprietary tactics and indicators that are publicly available and created by exactly the same users as us.

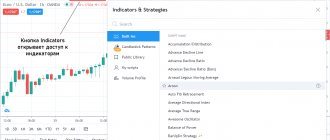

Finding them is easy. Click on the “Indicators” tab, then on “Public”. You will see a list of ready-made tactics that are daily rated by users and built into a kind of rating. You can also read information about its author.

Linear Regression

Many binary options strategies using Tradingview are channel based. Experienced pros have been using this technique for a long time, which has allowed them to make a fortune. This tactic is based on support and resistance levels. But the advantage is that you don't have to build them! They are applied automatically using a special linear regression indicator.

It is best to use an hourly timeframe, since there are many false signals on shorter ones.

The indicator represents the range within which the price moves. Accordingly, when it approaches the upper limit, we open the Lower option, and when it approaches the lower limit, then Open the Upper option.

In both cases, we conclude a deal for 45-50 minutes with a time frame in H1.

It will not be amiss to know candlestick reversal patterns, which will make sure that the price will actually rebound from the level.

Action instructions

Go, as stated, to the official Tradingview website.

Please note that in addition to the chart, there is a section with news, signals, recommendations, material from other users, their transactions and other information. In general, this is a well-equipped financial portal. It should be noted that this website cooperates with the Prime analytical service.

So, now let’s start looking at the chart, namely, open it, and you will see the following picture:

As you can see, the panel differs from the Live Chart that a speculator is used to. For example, on the right side there is a window with quotes:

The data is updated online, and news is also presented below. In the bottom panel, the investor can check any built-in method on the history of quotes; if desired, you can create your own scripts and algorithms in Pine.

We won’t dwell on the work processes in detail; we’d rather spend time on proprietary trading strategies and indicators that are publicly available.

To open the available list of methods, you just need to click on the “Indicators” tab, and then select the “Public” folder:

Please note that next to each position there is information regarding user ratings, this is a kind of rating. Now let's start looking at trading strategies.

Modified Guppy

Everything about our next binary options strategy tool using Tradingview is great. It combines not only a beautiful appearance, but also high profitability of signals.

You may remember the famous Guppy strategy. This one is based on it, but with the flaws corrected.

Sets the timeframe to 15 minutes, then through a search we find the following indicators in the panel:

- Percentage price oscillator (PPO), the settings do not change, we leave them as standard.

- TRIX, we don’t change the settings,

- CM_Guppy_EMA is our main indicator, on which the strategy is based.

At first glance, you may be intimidated by the number of moving averages that are included in Guppy. In fact, it is very simple to use. The indicator includes 12 moving average moving averages with periods from 3 to 60.

If in classical tactics you have to plot them on the chart yourself, then thanks to a ready-made strategy for binary options using Tradingview you get rid of this.

We buy the Higher option at the moment when fast moving averages intersect with slow moving ones from bottom to top. In this case, PPO intersects with the zero level, TRIX does the same.

We set expiration dates for 2-3 subsequent candles, which for the M15 timeframe is 30-45 minutes.

Strategy “Trading on MAshki”

This indicator strategy will be understandable even to a novice trader, since it is based on the same techniques as the “Long-term Trading Strategy”. However, it has its own settings.

Work schedule:

H1.

- EMA with period (120) with added additional levels (+100) and (-100);

- EMA with period (10).

How to trade?

BUY type transactions

, you need to wait until:

- Candles should form above the EMA 120 indicator (red moving average).

- We wait for the price to reach (touch) EMA 120.

- We place an order for BUY or place a limit order of the Buy Limit type in advance.

- The Take Profit order must be at the level of the nearest maximum.

- The Stop Loss order is two times smaller than the Take Profit.

To consider SELL transactions, you need to wait until:

- Candles should form below the EMA 120 indicator (red moving average).

- We wait for the price to reach (touch) EMA 120.

- We place an order for SELL or place a limit order of the Sell Limit type in advance.

- The Take Profit order must be at the nearest minimum.

- The Stop Loss order is two times smaller than the Take Profit. You can also use trailing stops.

Important:

we do not conclude trades if the price at the close of the day is in the channel between the gray levels.

Minimum Stop Loss = 15 p., and minimum Take Profit = 20 p. The body of the candle that approaches EMA 120 should not exceed 60 points. If the price with an open order crosses EMA 10, we immediately transfer the transaction to breakeven. When the candle takes us out of the market, we need to wait for the next rebound candle to conclude the next deal.

Money wave

Tradingview custom strategies like these are universally praised by users online. And positive reviews are already a kind of guarantee of the suitability of the tactics. The following tactic, like a wave, can overwhelm you with huge profits. At least that's what its author promises.

We need only one indicator - WaveTrend Oscillator.

We don’t change the settings, since the author created the candy anyway! The only thing we recommend changing is the MA parameter to 50.

What we need to pay attention to is the green signal line of the WaveTrend Oscillator. It is she who will generate the main signals.

We wait for the oscillator line to cross the zero level. Next, we wait for confirmation from the candle - it should intersect with MA 50. In this case, it does not matter at all in which direction.

A distinctive feature of WaveTrend’s public tactics is its good filtering of false signals, which eliminates almost all market noise.

The trade should be opened for a long period of time, since the strategy involves catching entire market trends. With a time frame of 1 minute, it is worth opening a trade for 15 minutes.

Strategy “Attack on trend”

From the name of this strategy, it is obvious that cryptocurrency trading will be carried out only according to the trend. Using some tools, it will be possible to weed out flat areas. Despite the rather rare stops, the trader will cover losses and make money due to prolonged trend movements.

Work schedule:

H1.

Indicators used:

EMA 96.

You can download the “Attack on Trend” strategy template from this link.

How to trade?

To consider transactions to purchase an asset, that is, open orders of the BUY

, it is necessary that the following conditions coincide on the work schedule:

- The candles for the previous trading day were trading higher and did not touch the EMA indicator (96).

- We wait for the next trading day and at 10:00 we open three orders for BUY with the same volume. The total risk for three orders should not be more than 5% of your deposit. Take profit for the first order

is 100 pips. Stop Loss is 50 pips.

For the second order, the Take Profit should be set at the highs of the previous day, the Stop Loss should be 50 pips. The third order

should be closed manually at the end of the trading day.

To be able to open SELL

, you need to wait for the following moments in the market:

- The candles for the previous trading day were trading lower and did not touch the EMA indicator (96).

- We wait for the next trading day and at 10:00 we open three orders for SELL with the same volume. The total risk for three orders should not be more than 5% of your deposit. Take profit for the first order

is 100 pips. Stop Loss is 50 pips.

For the second order, the Take Profit should be set at the highs of the previous day, the Stop Loss should be 50 pips. The third order

should be closed manually at the end of the trading day.

Important:

if at 10:00 Moscow time the take profit for the second order is less than 10 points or there is no target at all, then you should not open any of the three orders not only on that day, but also on the next.

Double confirmation

Strategies for binary options using Tradingview in the public library are quite unique. You need to be careful when using the indicators that are included in them. Therefore, we recommend that you first thoroughly study them on a demo account and find out all the features.

Our next tactic is designed specifically for short-term trading. Therefore, feel free to set time frames for work from 1 to 5 minutes. Next, in the search, we find the following instruments and plot them on the chart:

- MACD_VXI - the algorithm is based on the classic MACD, but with minor changes,

- DeMarker - allows you to determine not only the strength of the trend, but also its direction.

The main signal will come from MACD, and as confirmation we will use an additional one from DeMark. Two signals are generated from MACD. The first is the intersection of both moving averages with level 0 from bottom to top. In this case, the histogram should turn green and move into the positive zone.

The DeMarker indicator should be located in the shaded area and move from bottom to top. In this case, we confidently conclude a deal for an increase.

There is a little secret. The red MACD moving average intersects the zero level first. This is a kind of signal to prepare. And the control one is the intersection of the blue moving average. The signal candle will be the one that formed at the moment of crossing the blue moving average. Don't confuse this!

For bearish trading, the signals are completely mirrored. We set the expiration dates for 3-4 candles immediately after the signal closes.

Are there any advantages to using it?

But first, I would like to note that in my approach I do not use horizontal volumes, because... my trading system practically does not depend on these parameters, and with experience you begin to understand that horizontal volumes for the most part are just a kind of assistant for making a decision, but not the primary reason. In almost any part of the market, I can myself determine the area where these same horizontal volumes have accumulated, without this indicator. But it’s also worth recognizing that there are some advantages to horizontal volumes, especially for beginners, but first things first.

Buy/Sell

Why do binary options strategies using Tradingview deserve special attention? The fact is that experienced professionals who have been in binary trading for several years are working on their development. They know exactly what indicator settings need to be changed in order to achieve a better result.

The next tactic is based on two unique tools that you can only find in the Tradingview public library - BuySellSignal (the main trend) and CM_RSI Plus EMA (generates many signals, which we will filter using the first one).

From the BuySellSignal indicator we only need its central line. The main Cloud, which looks like Bollinger, can be ignored.

First of all, we wait until the gray signal line of CM_RSI Plus intersects with the dotted one from bottom to top. At this moment, the green candle should intersect with the central moving average on the chart from bottom to top. At this moment we make a purchase of the option Above.

To trade downwards, we wait for the same intersections to occur from top to bottom.

We used 1 minute as the working timeframe. In this case, we conclude trades 5-10 minutes after the signal candle closes.

It is worth noting that this strategy for binary options using Tradingview does not generate many signals. Therefore, if you want to enter into more signals, we recommend simultaneously analyzing 1-2 more currency pairs. But don't be greedy, as confusion may arise and you may miss the right moment.

Advice for Newbies

For a convenient and well-perceived display, it is recommended to download the MetaTrader terminal; most of the necessary indicators are already in the download version, it is easy to use for analysis and is quite ergonomic. If this is not ultra-urgent trading for 15 seconds, then there should be enough time to switch between the terminal and the trading platform with options; the best option is if the size of the monitor allows - both terminals are in front of your eyes. In addition, this will eliminate any possible fraud with the chart and indicators on the part of the options broker.

As a reliable broker who doesn’t play tricks with quotes and excludes any manipulations with charts, I can recommend ]Intrade Bar[/anchor]. The broker has been operating honestly since 2016. Known as the fastest paying broker. The administration withdraws money on average in 10-15 minutes after submitting an application - these are the highest withdrawal speeds among competitors. You can also get acquainted with other reliable companies by reading the rating of binary options brokers by reliability.

Moon Trader

The following tactics are based on unusual tools that not all traders, even experienced ones, can master. On the one hand, why complicate your life and master complex unknown tools? The answer is simple - sometimes they are able to avoid many of the shortcomings that exist in classical indicators.

Let us immediately note that the Moon Trader strategy belongs to the category of long-term ones, so signals appear here very rarely. Let's check their effectiveness.

It is based on two tools that you can only find in the public collection of Live Graph:

- Moon Phases - reflects the phases of the moon. You may have a completely logical question - what is the relationship between the moon and financial markets? In fact, a long time ago Larry Williams himself said that he noticed a direct relationship between them. Fans of wave market analysis immediately began testing this theory and were convinced of its effectiveness!

- Linear Regression - we already talked about it in the very first Tradingview strategy. It is a channel that is drawn by automatically built support and resistance lines.

This is what our graph will look like. Since this is a long-term tactic, we will use D1 as the base timeframe, that is, one candle will be equal to a day.

Linear regression is built only on the latest trend, so, unfortunately, it will not be possible to analyze the history of quotes here.

It will take a very long time to wait for signals, but this tactic is suitable for those people who are busy with their main job. To analyze the chart you will only need a couple of minutes a day.

We conclude a bullish trade at the moment when the channel is directed upward, the price breaks through the lower level and goes beyond the channel. At this moment, Moon Phases draws a dark gray dot, which signals the full moon.

Immediately after the signal candle closes (with which the level was broken), we enter into a deal Higher.

We set expiration dates for long periods – 7-10 days. Not all brokers provide this opportunity, so choose a company based on this parameter if you will be trading using this tactic.

Overall, she shows very good performance. The only negative is that you have to wait a long time for the signal itself.

Timeframe

Now let's look at the contributions from above. You can select a time period for chart analysis there, and do it as follows:

By the way, just recently, TradingView became able to watch the movement of the chart in online time. Added the ability to analyze charts in second periods (1, 5, 15, 30 seconds).

Shot System

Let's continue our acquaintance with interesting Tradingview chart indicators. The following tactics are based on monitoring the main trend in the market, as well as identifying oversold and overbought zones.

In the public indicators section we are looking for the following:

- CM Sling Shot System,

- Squeeze Momentum Indicator.

At first glance they will seem completely incomprehensible. We will now tell you in detail how to work on them.

To begin, set the working timeframe to 15 minutes.

CM Sling Shot System can also be classified as a shooter. It significantly simplifies the process of market analysis by generating signals independently in the form of green and red arrows.

Since almost all arrow tools suffer from redrawing, we will use the second tool to filter out false signals. Therefore, when a green arrow appears, it is necessary for the oscillator histogram to turn green and move to a zone above 0.

Pay attention to the color of the histogram - it should be bright green. If the color turns dark, it means the current trend is declining.

A downward trade is concluded at the moment when a red arrow appears, and the histogram turns red and begins to fall.

With a 15-minute timeframe, we conclude a deal for 30 minutes. Well, in all other cases, focus on the 2 subsequent candles immediately after the signal closes.

Very accurate strategy for cryptocurrencies

This trading indicator system involves the additional use of the TradingView service.

Indicators used:

WaveTrend Strategy v 1.0.

Working timeframe:

D1.

This exact strategy for cryptocurrencies will only work on the crypto market, since adjustments to past candlestick movements are completely excluded.

Enter the name of the indicator into the search window (just type “ WaveTrend s

” and select it:

In the settings of the WaveTrend Oscilaror indicator, you need to uncheck the “ Pyramiding”

” and put

the value 100% % of capital

In the settings, uncheck the “Pyramiding” checkbox and set it to 100% of the share capital. Try it on crypto pairs with a daily timeframe.

Let's figure out why this works? Crypto investors almost never use software like MetaTrader 4.5 or Kwik. Often, TradingView is closer to them, as well as a selection of indicators with a larger number of likes. The most popular indicator according to this criterion is “WaveTrend Oscilaror” from the author of LazyBear. It does not work on Forex, stocks and indices, or other markets. After all, he was chosen because the market simply “loves” him, and not because he is so profitable. Based on its signals, you can predict the behavior of the crowd and manipulate it in time.

Another important setting for a very accurate strategy for cryptocurrencies is to disable the argument for trading long only (you need to uncheck the box in the indicator settings):

How to trade a very precise strategy for cryptocurrencies

The screenshot above shows everything clearly. If an up arrow appears, it means we are looking for entry points into BUY

, if we observe the formation of a down arrow, then

SELL

.

How to close positions?

Alternatively, you can use the opposite signal of the WaveTrend Strategy v 1.0 indicator on the H4 chart. Stop Loss is set 10 points from the bottom of the indicator arrow. If everything is done correctly using this trading system, up to 85% of all transactions will be closed in money.

Rate of Change

15-minute strategies are a kind of middle ground. There is no longer a lot of market noise that confuses the signals. In addition, the number of signals is much greater than when analyzing the hourly timeframe.

The strategy for binary options using Tradingview is quite suitable for novice traders, allowing them to increase their initial capital with less risk.

The Rate of Change indicator scale is divided into two parts by the zero level. Above zero, the price rises, below zero, the price falls. It would seem that everything is simple! Let's see how things work in practice.

As you can see from the screenshot above, indeed, the tactic generates many profitable signals. Its main advantage is absolute versatility! Work with any currency pairs, stock indices or pairs.

Money springboard

The following tactics belong to the scalping category, so we set a one-minute timeframe. We find the True Strength Indicator in the Tradingview chart directory, and as an additional filter we will use the classic Alligator.

Any scalping tactic requires increased attentiveness and concentration, since you need to react quickly.

We conclude a bullish trade at the moment when the black line intersects with the red line of the TSI from bottom to top; the green moving average in the same direction intersects with the red one of the Alligator.

We set the expiration time to 5 minutes. With such high-frequency trading, it is better to play it safe and set the transaction amount to more than 3% of your deposit.

If you don’t like M1, then you can increase the timeframe to M5, but no more.

“BTER” strategy

The “BTER” strategy is quite significant from the point of view of generating income on the crypto market. Its profitability is close to 100%. You can make a decent profit on an ongoing basis by using proven trading tactics:

- Asset selection

. First of all, look at indicators such as coin value and trading volume. As for the value, the price of the coin should not be expensive, and the volumes at which the pair is traded should be large. - Researching an asset's chart

. We advise you to carefully analyze the 30-minute chart. If there is a stable decline in the rate, this asset fits perfectly into the rules of the “BTER” strategy. - The rate reduction per day should be no more than 10%

. If a drop of more than 25 percent is observed in 24 hours, then traders’ faith in this crypto coin has decreased excessively. It is better not to consider such assets for purchases. - Place a pending order or buy at the current price

. You should not purchase a coin with all or half of your free funds. - Place trades taking into account 5% profit

. For example, we bought for $1 per coin and sold for $1.05.

With careful development of this trading strategy, you can get about 20 profitable trades per month. This will double your initial investment.

Losing trades will definitely slip through, but there will be few of them. This is quite normal, so be prepared for it.

Iron levels

Well, at the end of our review, we would like to present you with a unique tactic based on the Donchian Channels indicator. It is also not present in all terminals. Therefore, it is better to look for it in the Tradingview terminal.

Experienced traders always use support/resistance levels to determine when the price will turn. But what should we, beginners who have not yet learned how to build them correctly, do? Donchian Channels come to your aid and will do all the work for you. All that remains is to have time to conclude deals.

As soon as the price approaches the upper limit, we open the Lower option, and if it approaches the lower limit, then Open the Upper option. The most important thing is not to run into a breakdown, and this will help you determine candlestick analysis.

Graph scale

In order to change the scale of the graph (expand, narrow) you need to use the bottom line and the line on the right (you can also use the mouse wheel):

Life hack: by double-clicking the left mouse button on the line on the right, you can fix the graph, and when you change the scale, it will be fully visible in the graph window.