Spot rate and forward rate are two types of foreign exchange rates that every new trader should know about. The Forex market is the largest and most liquid market in the world.

It operates all over the world. Every self-respecting trader should have a full understanding of all the processes occurring on the Forex exchange. To understand these processes, you should know all the exchange terms used by leading experts in the field of currency trading. And for profitable trading it is necessary to use technical indicators. One such Forex indicator is the CCI indicator. It will make your trading on the foreign exchange market profitable, if used wisely, of course.

What is spot Forex?

Forex spot is a negotiated price to buy or sell a commodity, security or currency for immediate delivery and payment on the spot date. The spot date is usually two business days after the date of the transaction or transaction. On charts this is expressed by the symbol T+2 (today + 2 days).

Deliveries for most currency pairs have a T+2 spot date, but some countries require earlier settlement. Thus, the settlement date for USD-CAD (Canadian dollar) and USD-TRY (Turkish lira) falls one day after the transaction date or T+1. Chinese Yuan can be settled on the day of trade or T+0.

Spot trading days exclude Saturdays, Sundays and official holidays. Therefore, during the Christmas and Easter holidays, spot trades may take up to six days to clear.

Forward transactions in the foreign exchange market

Over the past 10-15 years the derivatives segment of the foreign exchange market , represented by forward transactions, futures, swaps, currency options and their varieties and combinations, has gained widespread development. The common feature for all of them is that the delivery time for currency (if it occurs at all) exceeds two business days, and their characteristic feature is that they are drawn up in standardized documents (contracts) that have legal force for a certain period (from signing to payment) and themselves become objects of purchase and sale on the foreign exchange markets. These documents are called currency derivatives. These primarily include forward and futures contracts and options.

Forwards or forward contracts are concluded between the parties to a transaction with the condition of exchanging a certain amount of currency at previously agreed upon quotes on a predetermined day (value date). The transaction will be executed regardless of what the current prices are on the spot market.

Futures differ from regular forwards in that they have standard maturities (value dates) and fixed contract sizes, allowing them to be traded on the futures market like regular securities.

Options have weak (relative to futures) obligations of one of the parties to the contract, that is, the owner of the option can refuse to redeem the contract, losing only the amount paid for the option or the so-called premium. This type of derivatives is also traded on a separate options market.

Futures transactions are relatively “new” in the foreign exchange markets (appeared in the 70-80s of the twentieth century), but they are developing quite rapidly. This is primarily due to significant fluctuations in exchange rates, and, accordingly, with significant currency risk. Urgent conversion transactions not only allow you to hedge currency risk, but can also be a source of very significant speculative profits. A peculiar “hybrid” of the above-mentioned current and forward currency transactions are “swap” transactions. Currency swap is a currency transaction that combines the purchase or sale of a currency on spot terms with the simultaneous sale (or purchase) of the same currency for a certain period on forward terms, that is, a combination of two opposite conversion transactions is carried out on identical amounts, but with different value dates. Just like forward transactions, futures and options, they allow, firstly, to insure risks, and secondly, to receive additional income by taking on a risk corresponding to the expected profit.

Spot or Forward?

Spot transactions are not immune to currency risk and exchange rates are based on direct quotations. On the contrary, Forward is one of the ways to reduce currency risk . The exchange rate in this case is hedged on the date of conclusion of the contract in accordance with the current quote and cannot change regardless of the situation on the foreign exchange market. Forward transactions are most often concluded for specific periods of time : a week, 2 weeks, a month, a quarter, a year. However, most banks allow these transactions to be concluded within an individually agreed upon time frame.

When deciding on foreign exchange transactions, you should familiarize yourself with the types of them in advance. Currency risk protection can significantly reduce transaction costs, which is why it is so important.

Types of spot rates

Forex participants make money on the difference between the buying and selling rates of a currency: these rates are known as “Bid” and “Offer” respectively. The exchange rate on a spot Forex transaction will be higher or lower than the average rate between the purchase and sale of a currency pair, depending on whether it is made at the bid or offer rate.

A spot contract does not have an expiration date, and the spot rate may change by the time the trade is executed. Postponement of the currency delivery date is possible and is a matter of market agreement.

Forwards

Forward foreign exchange contracts are an alternative to rolled-over spot contracts and can provide better protection against sudden fluctuations in exchange rates. A forward contract is settled on a specific date.

The forward rate is calculated using a formula that takes into account the difference in interest rates and the spot exchange rate. The formula is based on the principle of “covered interest parity”.

Swaps

Spot transactions in the foreign exchange market involve physical settlement of the transaction, but it does not actually occur. Traders want to profit from exchange rate differences on transactions, and not just buy large volumes of currency. Many traders simply roll transactions over to the settlement date. They close the trade at the closing price and reopen it at the next day's opening price, effectively extending the settlement date. The difference between the closing price and the opening price is taken as profit or loss. Many brokers do this automatically for clients. This type of exchange rate is called “swap”. The swap rate is calculated as for a forward contract

The ratio of transactions on the spot Forex market:

Spot

Spot is a method of settlement of a transaction in which money is transferred immediately. The opposite of spot transactions are forward transactions (for example, forwards), in which settlement is made some time after the conclusion of the contract. Spot transactions can be concluded both on stock and currency exchanges, and on the over-the-counter market.

TO

counterparties are able to purchase and sell currency, requiring the transfer of funds for the transaction no later than on the second day after its conclusion. The price at which the purchase occurs is called the spot price. In this case, spot foreign exchange transactions can be one of three types:

- TOD (short for today) - money is transferred on the same day the transaction was completed.

- TOM (tomorrow) – transfer occurs the next day.

- T+2 or spot transactions - money arrives in the seller’s account two days after the conclusion of the contract.

The date when the seller receives money is called the value date.

The spot exchange rate is the main attribute of the spot market. A rate is the price of one currency expressed in another currency. The spot rate is influenced by factors such as:

- The state of the state balance of payments.

- Inflation rate and degree of business activity in the country.

- Politics and military factors.

- The size of accepted bank rates.

- The degree of development of telecommunications in the state.

- Government regulation.

The spot rate reflects the relationship between the levels of supply and demand for a financial asset. Technically, the spot rate can be broken down into many renewable quotes called ticks. In the interbank market, the spot rate changes on average 50-60 times per minute.

The key participants in the spot market are commercial banks, which enter into transactions with different counterparties and in different ways:

- With public and private companies through direct negotiations.

- With other commercial banks through brokers.

- With central banks of other countries (usually developing ones).

- With other commercial banks, acting directly (in the interbank market).

At the same time, the spot market serves both private requests and speculative requests from banks and enterprises.

For the untrained trader, many of the terms used in the spot market can be confusing. Let's look at some of them - almost all of them are related to quotes:

- Big figure is that part of the price that traditionally remains unchanged. Let's explain with an example:

The big figure of this quote can be called the unit or part of 1.41. Since this part rarely changes, dealers indicate it only if the market is extremely volatile. In American markets this part may be called Handle.

- Pips. The most moving part of the quote. Traders refer to the final two digits of the price as pips. Using pips as an example, this is 23/33.

- Bid price is the price at which a trader is able to sell a currency. In the example it is 1.4123.

- Offer price – the price at which a trader can buy a currency (1.4133). The offer price is always higher than the bid price - due to this, market makers benefit.

- Spread is the difference between the bid and offer prices. The size of the spread depends primarily on the liquidity of the asset being traded.

It is important to understand that spot quotes on the interbank market and quotes that can be seen on the screens of dealing centers are not the same thing. An ordinary trader sees so-called indicative prices - such prices do not indicate that this or that bank is ready to conclude a deal at this particular price.

The spot market has the following advantages over derivatives:

- No centralization. A trader is able to choose which broker to entrust his finances to. This can lead to manipulation, however, it is more beneficial for the client due to the presence of competition.

- Big levers. For the spot market, leverage of 400:1 does not seem surprising. Therefore, you can start trading standard lots with a minimum amount in your account.

- Minimal regulation. Almost anyone can have access to trading on the spot market, however, if a dispute arises with a broker, the trader simply has nowhere to turn for support, because there is no regulatory body.

Features of Forex spots

While large players in the interbank foreign exchange market can influence market supply and demand, individual investors can only take bets. Businesses and individuals purchasing currency through a bank or broker may find that the quoted spread between bid and ask rates exceeds the market spread.

MT4 and MT5 Forex platforms can help businesses get the best spot currency exchange rates. They time trades to take advantage of temporary differences in rates between different Forex service providers.

What goals are being pursued, conclusions

It is worth understanding that the spot market is one of the parts of the Forex currency market. To achieve success in this field, a trader needs to learn not to focus only on this direction. You need to be able to combine various operations that are performed on the spot market with trading work on the derivatives market. Proper use of all the opportunities provided will bring you prosperity and prosperity. The main thing is to have certain qualifications, the necessary basic knowledge, skills and self-confidence. Today there are a sufficient number of training courses, seminars on Forex and specialized literature to expand knowledge. The training will provide you with the necessary theoretical material, and practical skills can be acquired by using the opportunities of the spot market.

Study new principles, methods and methods of pricing in the derivatives market as well. This recommendation will help beginners expand their horizons and gain experience for further successful activities in the desired field. When the process of trading in banknotes occurs, participants and banking institutions can present counterclaims, some obligations in any banknotes. A currency position is formed through the correlation of these claims and, accordingly, obligations for a certain currency. There are important goals that are pursued when conducting spot financial transactions.

- To meet the needs of clientele who need foreign currency.

- Provide financial flow from one foreign currency unit to another.

- Conduct operations related to speculation.

The use of spot currency transactions by banking institutions occurs to maintain the required minimized operating balances in other countries. This is necessary to reduce the surplus of one currency sign and cover the needs of another. This is how the working currency position is adjusted to avoid overdraft. Despite the short deadlines for foreign exchange deliveries within the framework of floating rates, counterparties are able to bear some risk in this operation. The spot rate is used to serve all clients of banking institutions. Spot market payment means are electronic transfers through special system channels that can provide participants with round-the-clock access to the network to transmit the necessary information. There is the necessary control and protective functions against unauthorized entries. If you want to learn more, visit our website tradernew.pro, discover new opportunities for earning money and increasing capital today.

Conclusion

Individual investors seeking to profit from movements in foreign exchange rates prefer a currency management strategy that includes spot foreign exchange contracts and swaps.

Forward foreign exchange contracts are an alternative to rolled-over spot contracts and can provide better protection against sudden fluctuations in exchange rates.

Are spot trades suitable for beginners?

Spot currency transactions are considered more dangerous than Forex index transactions in the derivatives market, where there is time to think and develop a strategy. What is spot Forex for a beginner? It is unpredictability and strong price fluctuations that can completely change the outcome, especially in short-term trading. Before placing spot trades, a beginner should learn to read charts (candlesticks) and develop a strategy.

Do you want to know how to make money on Forex without investment? Read the article about what a Forex affiliate program is.

Differences between derivatives and spot markets

Although both markets are regulated according to the same rules, the spot market has its own differences from the futures market.

The spot market is characterized by the following:

- In the spot market, assets are sold (in particular, in Forex - currency), and in the forward market, rather, obligations and rights to assets are sold.

- Both markets trade different assets using different trading methods (spot - only the real "commodity", in the future - derivatives such as options and futures).

- In the spot market, settlement is made immediately at the current price, and in the forward market, only part of the cost is paid immediately (the so-called “guarantee collateral”).

How do spot forex trades differ from spot trades in the stock market?

Although a spot transaction implies the availability of goods, in the case of Forex, the currency is often immediately sold after its acquisition, and it actually does not have time to be “in the hands” of the first buyer.

Note that spot transactions in the foreign exchange market are conducted on a global scale. And mutual settlements are often simply delayed (for example, in one country it may be one day, and in the second night banks may not be open, or there may be public holidays in one of the countries). Therefore, it is necessary to distinguish between the dates of the transaction and the receipt of funds (the latter is called the “value date”).

Classification of spot transactions by value date

This date must be no later than two business days from the date of conclusion of the contract.

Based on this, transactions are divided into:

- "Tod" (TOD, short for English "today", that is, "today"). With it, payment is made on the day the transaction is concluded.

- “Tom” (TOM, short for English “tomorrow”, that is, “tomorrow”). In this case, payment is made on the next business day.

- "SPT" (from English SPOT). Payment is made on the second working day.

In fact, the entire forex market is spot. And this is true even for pending orders, because when the price reaches a certain level, the order is immediately closed. It is also not surprising that it was on the spot Forex market that the market really flourished.

After all, for this purpose Forex provides a number of advantages:

- it is relatively simple;

- You can trade on it around the clock;

- it has a huge selection of financial instruments (currency pairs);

- it is highly liquid;

- It allows you to trade online without intermediaries.

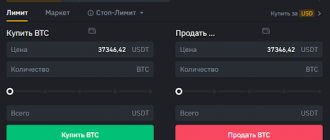

Trading futures contracts

The main difference between futures trading for a trader is the opportunity to earn more through the use of leverage. By purchasing a contract, a market participant does not physically own the asset. Instead, you have an agreement to buy or sell a specific coin in the future. You also cannot participate in voting or staking.

These are the very “short/higher games” that we often hear about in films about traders, investors and stock speculators. Earnings here depend primarily not on the leverage you set, but on your ability to predict the future value of an asset.

* Leverage is a loan that a trader takes from an exchange to complete a transaction for a larger amount than his deposit can afford.

Concluding transactions on the futures market is practically no different from the spot market. To open an order, you must set the expected transaction price and the number of coins or portfolio share. You can also set Stop Loss

and

Take Profit

, which is very convenient for traders.

Stop Loss

— this is the price at which the transaction will be closed if the trader’s expectations are not met and the value of the coin goes into a reversal.

Take Profit

is the price at which the trader wants to sell the contract.

“Buy/Long” button

involves holding a coin for a long period of time in anticipation of its rise in price.

“Sell/Short” button

assumes that the trader expects the value of the asset to decline and plans to take advantage of this.

The Binance cryptocurrency exchange also has a useful tool such as a calculator that allows you to calculate the cost of a transaction and possible profit depending on the entry and exit of a position, taking into account the leverage used. The tool is very easy to use and will help you correctly assess all risks before opening a transaction.

Planwrld.ru

What orders are there on Binance and how do I use them in trading. Stops, limits, profits, CCA. Everything you need for good trading on the stock exchange. I’ll tell you not only how and where to click to place orders, but also how to navigate the chart. Look for good entry points into a position.

- What are pending orders for?

- Orders on Binance

- Limit order

- Stop loss and take profit order

- OCO warrant

- Trailing stop

20% refund on all Binance trading commissions. When you register on Binance using the link: https://accounts.binance.com/ru/register?ref=NZTLJOHA you will receive 20% of all commissions on your trades (this is the maximum possible return). And this is better than just registering without a partner. Be sure to check the referral code: NZTLJOHA

I recommend reading my post on how to trade on the stock exchange and where to start learning trading. In it you will find good advice on choosing reference books, and we will also discuss how important discipline is and what rules of behavior on the stock exchange you need to learn for yourself.

If you are interested in cryptocurrency, be sure to visit my Telegram channel. There I publish interesting scenarios of market behavior. Where and where is the best place to go, when to leave. Very useful, and most importantly free!

What are pending orders for?

Pending orders are the main tool on the exchange. They are needed to automatically take profits or reduce your losses. To buy or sell coins at the price you want, etc. If you don’t use pending orders, then you don’t need an exchange. Change cryptocurrency in exchangers