Hello! In this article we will talk about such an investment tool as PAMM accounts. This is not a call to run and invest your hard-earned money, but a review of the tool.

Today you will learn:

- What are PAMM accounts;

- Is it worth investing in them?

- How to start investing in PAMM;

- And what kind of profit can you expect?

Content

- What are PAMM accounts

- Example of working with PAMM accounts

- Is investing in PAMM accounts profitable?

- Step-by-step instructions for making money on PAMM accounts

- Step 1. Choosing a broker

- Step 2: Making a deposit

- Step 3. Selecting a PAMM account

- Step 4. Watch and analyze

- Step 5. Take profit or minimize losses

- Choosing a broker for a PAMM account

- Rating of TOP 5 PAMM brokers

- PAMM accounts at Alpari

- PAMM in Insta Forex

- PAMM accounts in Forex Trend

- PAMM broker Alfa-Forex

- PAMM account broker Forex4You

- How to choose a PAMM account for investing

- Forums and collecting additional information about the trader

- Monitoring PAMM accounts

- All about the risks of investing in PAMM

- Tips for beginners

- Conclusion

Signs of “draining” PAMM accounts

Draining a PAMM account is a sharp drop in profitability, down to -100%, which essentially leads to the loss of deposits of all participants in the process. This is what it looks like:

Of course, losing money in trading happens, but -100% per day is clearly too much. Every time something like this happens on a popular PAMM account, dozens of angry comments appear on the forum, which clearly shows that people simply did not understand where they invested their money and fell for the beautiful chart.

Identifying a “draining” PAMM account is actually not that difficult. In 2017-2018, I studied merged accounts in search of patterns; 50 Alpari PAMM accounts that were closed with negative returns were selected for analysis. They were quite popular among investors - the investment mark reached a minimum of $15,000. I collected all the information in an Excel file, which you can download from this link.

First of all, it is important to pay attention to the age of the PAMM account :

The left columns are the number of merged accounts, the right columns are the number of accounts in general in the age segment. And this is what we see:

- half of the merged PAMM accounts did not last even six months;

- in the period from 7 to 18 months, the % of drains is ahead of the % of PAMM accounts in the age category;

- only 1 out of 10 PAMM accounts with an age of 18+ are lost, although their share reaches 20%.

Overall, nothing unexpected. Old PAMM accounts are not merged because they use less risky trading strategies that allow them to stay afloat for a long time.

If you are committed to long-term investments, I recommend considering managers with at least 3 years of experience.

Go ahead. In 80% of cases, merged PAMM accounts have a noticeable imbalance in the graph of the used leverage , jumps occur from 10-20% to 100% and higher:

PAMM account AL conservative RUB

In many cases, such jumps arise due to the use of the Martingale strategy, which itself leads to a loss in 100% of cases.

With a slightly less high probability of 76%, a similar sign is observed - the leverage used at least once exceeds 100% . Essentially, this means that the manager brought the volume of transactions to the maximum and was already at risk of losing the account, although he was ultimately lucky with the direction of prices on the market.

PAMM account Synergy_Factor

A regular profitability chart gives quite a bit of information about the potential risks of a loss, but there is one case when the sad end is obvious - the chart looks like a straight line (may curve up a little at a profitability of 1000%+). This sign was found in 40% of PAMM accounts:

PAMM account Full afterburner_RUB

Another rather obvious sign: in the archive of the manager’s PAMM accounts there are merged ones . Probably, the TOPMASTER manager distinguished himself most of all at Alpari - 9 merged accounts with investor capital of $15,000+ and as many as 490 in the archive! Just look at this and the desire to invest will quickly disappear:

Ideally, to understand the risks of investing in a PAMM account, a more in-depth analysis is needed. In the next section of the article I will tell you what you should pay attention to first.

What are PAMM accounts

In short: PAMM accounts to which investors transfer money so that they can trade on Forex at their expense.

This is a kind of analogue of investment funds - companies that trade on the stock market at the expense of their clients’ funds, and bring them profit. In Forex, the principle is the same, only the role of the management company is played by one person or a team that is engaged in independent trading, without forming a legal entity.

PAMM accounts (in scientific literature) are a financial instrument that allows you to use a trading account to transfer funds in trust to a trader for the purpose of making a profit.

Depending on the Forex broker, a different trading system using PAMM accounts is provided. In one case, this will be a simple transfer of funds to the managing trader, who will trade with them.

This method accumulates funds from one trader, relieving the investor of all operations. The disadvantages are obvious - the investor does not have any mechanisms to influence trading, except for one thing - he can withdraw his money.

But the second method deserves much more attention: scaling deals. The trader trades his small capital on his account (often 5-10 thousand dollars), and investors, wanting to invest funds in him, enter into an agreement with a system that carries out the same transactions on their accounts (with the same percentage of the main capital) that and main trader.

Participants and types

PAMM investment participants:

- An investor is one who entrusts his money to a professional manager in the hope of greater profits.

- A manager is a trader who trades on the foreign exchange market with his own capital and the capital of investors who have invested money into his account.

- A broker is a controlling and regulating platform that resolves technical issues with registration and verification of participants, deposit and withdrawal of funds, payment of remuneration to the manager, and audit.

The operating mechanism is designed in such a way that the manager cannot withdraw the investor’s money, but can only carry out trading operations on his behalf. An investor can at any time fully or partially withdraw his capital, withdraw it from the site altogether, or transfer it to the management of another trader.

Let's look at the types of PAMM accounts.

More than 100 cool lessons, tests and exercises for brain development

Start developing

By strategy:

- Aggressive. Profitability can reach several hundred percent per annum. Transactions are made frequently, sometimes dozens per hour. High probability of losing all your money.

- Moderate. Managers focus on more modest results (10–20% per month), smaller drawdowns and less risk.

- Conservative. As a rule, the dynamics of profitability is a smoothly increasing line without big ups and downs. The yield is small, up to 10% per month. Transactions – no more than 2 per day.

By currencies: rubles, dollars and euros.

Example of working with PAMM accounts

You have 10,000 USD. You have found a good trader whose account yield is 150-200% per year. You enter into an agreement with the broker, according to which the same transactions take place on your account as the trader.

Example. You have 10,000 in your account, and he has 5,000. Having bought dollars with a leverage of 10 in the amount of 50,000 cu, and receiving a return of 2% on the transaction, he has a profit of about $1,000. An operation to purchase dollars in the amount of 10,000 USD took place on your trading account. with a leverage of 10, and in the end you received a profit of about $2,000 from the trading operation.

The advantage of this method of maintaining PAMM accounts is obvious - with current trading instruments you can increase or decrease risks when trading. You adjust the leverage that the trader uses, increasing it up to 5 times, or decreasing it by 2 times. This allows you to get less risk when working with aggressive accounts, and more profit when trading conservatively with a minimum of drawdowns.

Regardless of the trading method, there are three types of participants:

- traders – investors’ funds are accumulated in their accounts;

- investors - investors in traders;

- brokers are those who provide access to trading.

The interaction of the first two brings profit to the entire system - the broker receives new potential clients who think that trading Forex is quite simple, as well as an additional commission from all transactions.

It should be remembered that profit is the difference between the price of entering a transaction and its closing, minus the broker's commission.

Profit is distributed between the trader and investor depending on the agreement. Most large traders share profits with their investors in half, bringing them returns in the region of 50-60% per annum. More aggressive traders can receive up to 300-500% profitability, but also give investors about 200% per annum.

Mechanism of operation

The service offers two investment methods: PAMM account and PAMM portfolio. Let's look at the features of each.

PAMM account

How it works:

- The manager opens a PAMM account and deposits his own capital into it, which will participate in trading along with other investors. He will be able to return the originally invested money (or a smaller part of it in case of unsuccessful transactions) only upon liquidation of the account. Has the right to increase capital by adding funds.

- The manager develops an offer, where he prescribes the terms of cooperation: minimum entry threshold, percentage of remuneration. The latter often depends on the investment amount and can reach 50%, i.e. the investor will give half of the earnings to the trader.

For example, this is what the conditions look like for trader No. 1 in the Alpari rating:

- The account receives public status and is monitored on the brokerage site’s website. Any investor can monitor the manager’s transactions and communicate with him on the forum.

- The investor, based on certain criteria, which we will talk about later, selects a manager and a PAMM account, and invests money in it. After receiving the profit, part of it goes to remunerate the manager, the rest can be left on the account, or can be withdrawn.

The profit distribution mechanism is presented in the diagram:

PAMM portfolio

The first rule of an investor is diversification. This is especially true for risky investments, such as PAMM accounts. To reduce risks, the manager creates a portfolio that includes several accounts. Determines everyone's share, contributes their capital and attracts investors with their trading. Can change the structure, delete and add new accounts if he sees that the strategy is not profitable.

The main advantage for an investor is risk diversification. A drawdown on one account is offset by a profit on another. It seems unlikely to lose all the capital invested in the portfolio.

The profit distribution mechanism is similar to that described above:

Is investing in PAMM accounts profitable?

PAMM is a financial instrument, the use of which gives profitability 6-50 times higher than the average banking one. And it is also a passive method of earning money - almost nothing is required from a potential investor other than monitoring the trading account. It is precisely because of such profitability, coupled with a passive type of income, that PAMM accounts are one of the most profitable investments today.

PAMM accounts are a highly profitable and therefore extremely risky financial instrument.

Everything related to finance is directly dependent - the greater the risk, the greater the profitability. If a trader conducts his business aggressively, he may lose his entire trading account in one moment, but if he behaves passively, he will miss out on potential profits.

It is the balance between aggression and passivity that is the key to making money on Forex and PAMM accounts.

Alpari PAMM offers

Since she was one of the first creators of PAMM investing, cooperation with such a famous broker provides the account manager with a chance to personally customize the minimum investment format and the required salary level.

When the depositor's balance reaches the next level, the financial balance will change automatically. At first, their offers were too complex, but an attempt to gradually simplify the agreements led to this form: you can safely withdraw money at any time, without worrying about restrictions or fines.

Step-by-step instructions for making money on PAMM accounts

You can start making money on PAMM accounts in literally 5 steps:

Step 1. Choosing a broker

This is the most important step that you need to approach wisely. Many people underestimate the procedure for choosing a broker, believing that profits depend more on accounts, traders, and trading policies in general. But it is not so.

A fraudulent broker is the first obstacle to making a profit from a PAMM account. But even if a broker plays a fair game, he can indirectly reduce the investor’s or trader’s chances of success - not giving any trading signals, having poor optimization for trading, etc.

It depends on the choice of broker whether you will make a profit at all when investing in PAMM accounts. Some successful traders and investors insure themselves against unfair performance of their obligations on the part of brokers by dividing their assets into several companies. This allows you to minimize the risk of loss in the event of a scam (bankruptcy) of a legal entity.

Step 2: Making a deposit

After choosing a broker, there is a fairly simple technical procedure - replenishing your account. But before that, you need to study the trading terminal, “poke” different buttons - learn everything about the functionality.

This is done in order to avoid purely technical errors, which can result from inexperience and first acquaintance with the trading program. If you have any questions, it is best to ask them in tech. support. There are people there who are paid to answer customer questions.

Step 3. Selecting a PAMM account

This is also a rather important stage that needs to be approached by studying many materials, looking at reviews and blogs of successful investors. For beginners, the ideal option would be about a week of analyzing popular traders, and searching for reviews on independent forums, and after that forming a portfolio that will have enough investment.

If you don’t know which trader to invest your money in, you can also use the services of technical experts. support. Some Forex brokers advise novice investors to use more conservative players who are guaranteed to be able to make a profit.

Over time, you will be able to gain experience and choose suitable traders yourself based on the dynamics of their trading account and other independently found signals.

Step 4. Watch and analyze

After the money has been transferred to the trader’s trading account, you can begin the most important procedure - analyzing transactions. You don’t have to sit for days on end and watch when deals open and how. It is enough to come in once or twice a day, monitor drawdowns, avoid strong falls and keep an eye out for sharp rises.

By analyzing a trader's game, you can understand a lot - whether he will be profitable for you, or whether it is worth withdrawing your earned money. A good analysis will be able to provide information in advance about impending losses due to aggressive trading or indicate a loss of profit due to excessive passivity.

Nowadays, many terminals allow you to adjust risks by increasing or decreasing the leverage rate. This will allow you to optimize your partner’s trading strategy to the level that you, as an investor, need.

Step 5. Take profit or minimize losses

As with regular trading, the main task of the investor is to get maximum profit.

To do this, you can go in two ways: expansion and additional diversification of risks - making profit and distributing it among different brokers; invest additional funds in those already in your portfolio. Each method has its pros and cons, and which one to choose is up to you.

Now about something more important – minimizing risks. As soon as you see that the trader has “floated” - that is, he makes transactions emotionally, chaotically, or has lost his usual rhythm, then immediately take the money. Those who give in to emotions in Forex immediately go down the drain.

Also, if you see that the trader is regularly losing his account instead of making a profit, you need to withdraw your money as quickly as possible. A very rare number of traders make deliberate account drawdowns without taking profits at one of the obvious points, hoping to get more after a while.

If you trust your trader, it is better to talk to him and ask about his plans, because if you withdraw your funds, you will sharply provoke a decrease in the account, and, possibly, everything will snowball down on someone who just wanted to get a little more profit.

How it works?

We have come to a basic understanding of what a PAMM account means – now let’s figure out how it works:

- The trader creates a special deposit, which is available for investment by investors, and begins trading. Moreover, its share of contribution is about 60%.

- The offer to Finam, BCS or another broker is determined by the manager independently (threshold amount for entry, commission, etc.).

- Investors who want to earn income in the financial market, but do not have sufficient experience and professionalism, transfer their money to the trader. As the value of the portfolio increases, they receive a portion of their profits minus the manager's commission.

Earnings received on PAMM accounts are distributed in proportion to the participants’ investments. The manager, along with investors, invests his own funds and has a corresponding share with additional remuneration (10-50%).

Let's give a specific example. Investors (let's say Peter, Paul and Phil) are interested in making a profit from Forex trading, but they either do not have the time to dedicate themselves to trading activities, or they do not have sufficient knowledge to trade. Professional managers Marcus and Matthew have experience in trading and managing other people's money (eg mutual fund manager).

A Forex brokerage firm signs Marcus and Matthew to serve as portfolio managers to manage other investors' money. The investors (Peter, Paul and Phil) also sign a trust agreement with the brokerage firm. The essence of the signed agreement is that investors agree to take on the risk of trading the Forex market by committing their capital to a manager of their choice, who will use the pooled money to trade the Forex market according to their trading style and strategy. It also states how much money (or percentage) the manager will charge as his share for offering this service.

For the sake of simplicity of the example, let's assume that all three investors chose Marcus to manage their share of the money for trading the forex market. In this case, the manager takes 10% of the profit.

In terms of the percentage contribution to the total pooled PAMM fund of $15,000, each investor has the following share:

| Investor | Share |

| Floor | 26,67% |

| Peter | 23,33% |

| Phil | 16,67% |

| Marcus | 33,33% |

(The total of all shares in the pool always remains 1 or 100%.

Let's say one trading period (e.g. a month) passes and Marcus manages to make a profit of 30% on the entire portfolio, which is now $19,500 ($15,000 + 30% profit or $4,500).

He takes his 10% commission or $450. The remaining profit of $4,050 is distributed among all investors based on what percentage they have in the total pool:

- Gender = $4,050 * 26.67% = $1,080

- Peter = $4,050 * 23.33% = $945

- Phil = $4,050 * 16.67% = $675

- Marcus = $4,050 * 33.33% = $1,350.

Choosing a broker for a PAMM account

Now let's take a closer look at choosing a broker. But before listing the best brokers, you need to understand one thing. Most investors look at the conditions that the company provides to them. That is, brokers, wanting to attract money, increase the opportunities of investors, sometimes not even in favor of traders.

Such companies should be avoided, because they do not have good players who can bring excellent profits. Such sites attract mediocre people who receive an average income with an average investment.

Rating of TOP 5 PAMM brokers

Below we present 5 brokers that are most often requested on the Internet.

There are many more platforms, but these are the best, according to reviews and opinions of participants, in order to start investing in PAMM. With experience, you will be able to use less popular and reliable companies in order to maximize profits and avoid scams in time. But at the initial stage of investment, these will be the simplest, most reliable and stable brokers with the most interesting traders.

Each broker has its own rating of PAMM accounts, and below we will talk in more detail about how to choose the best ones.

PAMM accounts at Alpari

The largest and oldest forex platform in Russia and the CIS. It has existed since 1998, and is not going to give up its leading position. Does this mean they are the best? No. This site is characterized by what we talked about above - the best conditions are created for investors, but not for traders. Therefore, there are very few high-quality managers in Alpari, and the entry threshold for them starts from $1,000.

An analogy can be drawn with the banking sector and Sberbanks in particular. The most reliable bank? Undoubtedly. What's the easiest way to open a deposit? Without a doubt. Good interest rates? No. Same with Alpari. Reliability and simplicity come before profitability.

The site is ideal for beginners - you can be guaranteed to gain experience and not lose your account. Alpari PAMM accounts are the best option for those who do not want to take risks.

PAMM in Insta Forex

Quite an interesting site, which is characterized by a huge number of training manuals. This is where many top Asian traders started, and this is what is good for both a trader and an investor to start on the CIS market.

But for beginners, it will probably be in second place after Alpari, simply because the first exchange is more reliable, older and simpler.

The site is ideal for those who love statistics and know how to use large amounts of data. Here you will find everything: from the number and currency of transactions, to the expected maximum drawdown. This amount of data allows already sophisticated investors to analyze trader accounts down to the smallest detail. If you have experience and analytical thirst, this is the place for you.

PAMM accounts in Forex Trend

A platform ideally suited for PAMM investing. It was she who introduced a new approach with transferring transactions to the investor’s trading account. Their main feature is that they are the first in the development and application of new technologies. Working with this broker, you get a variety of trading and analytical tools, the number of which is updated almost every week.

PAMM broker Alfa-Forex

A platform that focuses specifically on investors. Managers receive a commission only if they win back their trades.

The main feature is complete transparency. You see in real time where your money is going and you can stop it in time.

PAMM account broker Forex4You

A platform that is ideal for investors who want to create completely passive income. The broker allows you to automatically record and withdraw profits, and unique trading tools make it attractive for traders. In general, this is the European style - stability, reliability, honesty.

Formation of a PAMM portfolio from 3 parts

PAMM accounts vary in terms of profitability. The amount of profit depends on the degree of investment risk and varies on average from 3 to 40% per month. Each of these variations should represent a certain percentage of your financial portfolio.

The overall “bank” should be diversified across different currencies and between several managers. The recommended minimum number of selected portfolios is from 7 to 12.

Profitable

The main share of any PAMM portfolio is represented by the income part - at least 60% of all funds. The riskiness of investments is at the level of 3-4, but the profitability is relatively reliable.

A well-developed strategy will allow the investor to receive a stable profit without drawdowns.

Conservative

The conservative part in the PAMM account portfolio is about 20-30%. Designed to preserve the investor's invested funds, in particular in cases of possible market instability (crisis, drawdowns, etc.). Peculiarities:

- have the highest level of reliability and stability;

- reduced aggressiveness;

- low profitability.

How to choose a PAMM account for investing

Now to an even more difficult task - finding a manager. All the information you need can be found in the broker’s trading terminal and on special forums.

The first thing we look at is the dynamics of the trading account. If it gradually goes up, then this trader is trading profitably and cautiously. Its profitability will be about 100% per annum, the possibility of completely draining the deposit is minimal. You can call this conservative trading.

There are aggressive accounts. They are characterized by the use of large leverage and, as a result, large drawdowns and equally large winnings. The profitability on some aggressive accounts goes beyond 300% per annum, but the risks are considerable.

Due to their attractive profitability, most investors prefer to have 2-3 aggressive accounts in their portfolio, or even create a separate “aggressive” portfolio with high profitability, which contains traders who, with their high profits, interrupt each other’s drawdowns.

A balance between conservative and aggressive traders must be maintained. Advantage should be given to conservatives, because they are almost guaranteed to bring in income without losing money.

There is also another category of traders whose accounts SHOULD NOT be in your investment portfolio. We are talking about martingale and those using its strategy in trading.

For those who don't know, the Martingale theory is based on doubling your bets after losing. This theory is dangerous because during a long streak of failures, it brings the trading account to 0 extremely quickly. And with a long series of victories, we do not see a significant increase. That is, at one point, every martingale operator will come to the point where his trading account will be equal to 0, regardless of his trading style. This is why such traders should be avoided.

It is quite easy to distinguish them if you have some experience. Martingale is characterized by gradual gains over a distance, one-time large drawdowns, and one-time quick profits.

Conclusion: the best PAMM accounts are those that bring profit to their investors.

Small tricks

Considering the rating of PAMM accounts, with a detailed study of the information, you can see what trading instrument the trader uses in his work.

The ideal option is one or two trading pairs. We can conclude that a person is perfectly familiar with the specifics of the movement of a certain currency and, thanks to experience, perfectly sees the situation on the market.

One should be wary of the fact that a variety of instruments are used in trading, from 5 or more currency pairs. This already indicates the fragmentation of the trader’s knowledge and his orientation towards a happy occasion. No, there are unique managers, but they are rare.

Take into account every little detail when studying a PAMM account. Information on how many investors trust the latter will tell you how to choose a suitable manager. This data is usually contained on the broker's website under the manager's offer. If there is no such information, you need to note for yourself the amount of capital under management. If it amounts to hundreds of thousands, then appropriate conclusions can be drawn. It is quite obvious that the manager is trusted.

Forums and collecting additional information about the trader

In addition to the trading account, special PAMM forums must be used to collect data. On them you can find a lot of interesting information about certain traders.

For example, in 2014, on Alpari the second largest trader in terms of capital showed a return of around 200-250% per annum over the past 2 years. His trading account experienced only a few drawdowns, while investors' profits steadily climbed upward.

But the old-timers of the forum remembered that the same trader drained his accounts about 5 times in order to achieve such amazing dynamics. This was done in order to attract a large number of investments and maximize profits in a short time. And they warned most newbies that this trader could also drain his account.

Of course, it didn’t come to this, but thanks to one large-scale drawdown, about 30% of the funds were withdrawn from his assets, significantly shaking his profitability, and soon reducing the entire trade balance to almost 0.

Looking for such information is the task of someone who wants to invest in a truly profitable trader. After all, the investor and the manager must be full-fledged partners, and about those with whom you deal, especially in the financial sector, you need to collect as much information as possible. The more additional information, the better.

Myths about Forex trust management

1 If the manager has a lot of money in his account, then this is a sign of a guarantee. In fact, this is not the case, because:

- Everyone's attitude to risk is different. Perhaps a maniac who is willing to risk everything on one deal. Any adequate trader would never do this. Moreover, a super risky approach can bring super returns before the first mistake;

- We don't know how big this amount is for the manager. Maybe $1000 is only 1/1000 of his capital. If he loses them, he will have many more opportunities to start again;

2 Managers are professionals. Nobody knows this. Even if he answers questions about his actions and strategy, this does not mean anything. It’s one thing to talk about what a sustainable and profitable trading strategy is, but in fact, then he will make trades not according to the strategy.

3 PAMM will allow you to get very rich. If you're lucky, you can make good money. But most accounts are lost. Will you be able to find the one who will work steadily for several years? .

4 I will invest in the top 10 PAMM accounts. After all, the best must continue to show high results. However, this is also a myth. Accounts at the top usually don't grow as quickly as at the beginning. In general, you can note that the top changes significantly every month.

Monitoring PAMM accounts

PAMM account monitoring – procedures for monitoring a trader’s trading and responding to unfavorable signals. In simple words, the investor’s task is to monitor the account and, in the event of an uncontrolled drawdown, withdraw the money.

But it's easier said than done. Experienced investors even have their own signals that allow them to recognize an imminent loss in trading.

The first and main indicator that a trader may soon begin to play at a loss is a sharp increase in the number of transactions. This shows that a person either switches to a new trading model (in most cases more aggressive) or starts trading whenever he wants. If the first transition is deliberate, and it only speaks of a change in the type of trading, then the second is the first call in order to soon take profit and exit the game.

The second indicator is poor closing. Withdrawing profits too early, or, conversely, recording losses too late, is a sure sign that the strategy is no longer working. This means that the trader begins to “lose his grip.” This can depend on many factors, and you need to look at how much time the game is not playing at full capacity. If everything returns to normal within a few days, it means the player has experienced tilt and unnecessary emotions. If not, take a closer look, maybe you should quit the game.

The third indicator is chaos. If you previously tracked trading in strictly designated periods of time, but now trading is scattered, then this indicates either a change in the schedule or uncertainty in your previous strategy. Both should make you think very hard about the feasibility of a partnership.

Remember that a good trader follows his trading strategy, does not change it, and makes a certain volume of transactions per day, without going beyond it.

It is important to know that some traders take a short break after a string of unsuccessful trades. This is done in order to calm down and not go on tilt by becoming too emotional. Self-control is the most important quality of a trader. Treat such moments with understanding, and do not assume that the trader has simply decided to quit the game. He's taking a break to rethink his game and re-enter the market with renewed vigor.

But despite the fact that a PAMM account investor should care primarily about his profit, in some cases it is better to talk with a trader and understand whether a change in trading or a deliberate drawdown is part of his idea.

Risks and mistakes of novice investors

When deciding to invest money in PAMM, you should understand that in any case, this is a risk. In order for money to bring in new money, it is necessary to choose competent strategies in choosing the broker himself. At the same time, I recommend following a number of rules that will help minimize risks:

- Choose different brokers with a reliable reputation. Even if one makes a mistake, summing up the totals for a certain period, you can come out with a profit.

- Do not invest all your money, especially the money you borrowed.

- Distribute your portfolio evenly into different PAMM accounts.

I often observe the picture that newcomers to investing, having bought into too high a percentage, invest everything they have into the pool with their heads and a sense of greed. This is not only wrong, it significantly increases the risk of complete loss. Even the fat percentage of profitability indicator does not guarantee profit.

When choosing a PAMM account as a strategic investment instrument, I recommend assessing all the nuances in detail and making balanced decisions, assessing the reputation, period of operation, average profitability, and the size of drawdowns. Plus, it’s worth remembering about diversification, which has never let anyone down. The reputation and stability in the market, for example, of the Finam broker, also plays an important role and guarantees a trouble-free withdrawal of profits.

I wish that you do not make a mistake in your choice, having determined exactly the PAMM account, and that the selected managers correctly set the direction of the transaction to obtain a profit.

Author Ganesa K.

A professional investor with 5 years of experience working with various financial instruments, runs his own blog and advises investors. Own effective methods and information support for investments.

All about the risks of investing in PAMM

PAMM accounts are a highly profitable financial instrument and this is an indisputable fact. But we must remember one rule of finance:

The higher the profit, the higher the risk.

It has been working for several centuries in all areas of business. PAMM accounts are no exception. They are associated with a huge risk, as is the entire Forex kitchen.

The profitability of a PAMM account directly depends on the aggressiveness of the trader’s game. The more aggressive the transactions are, the more profit you can get. But even more deeply you can sink at a certain moment.

Also, despite all the European efforts to “whiten” the forex market, there are still many dishonest brokers who deliberately play against their players, and from time to time fictitiously go bankrupt. Nowadays there are fewer and fewer such cases, but nevertheless they exist. Broker scams are not uncommon, so you should be careful about who you are dealing with.

The same goes for traders. Forex trading, at first glance, is extremely simple. But it is very difficult to make a profit over a long distance. A lot of inexperienced managers, martingale followers and simply dishonest traders who want to get a one-time income from investors do not add peace of mind.

But as in stock trading, over the years it is possible to distinguish professional brokers from scammers, experienced traders from lucky beginners, and martingale traders from simply risky and lucky players. Over time, with years of analysis, risks are minimized, but, nevertheless, the reliability of bank deposits remains undeniable.

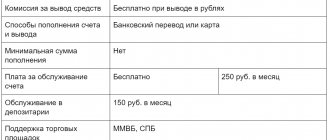

Autofollowing from FINAM

Since 2015, it has been approved: all forex dealers in Russia are required to have the appropriate license so that trust management does not contradict the law. The first company to receive such permission was Finam-Forex (license No. 045-13961-020000 dated December 14, 2015).

This is the largest retail broker in the Russian Federation, founded in 2000 and specializing in providing investment and trading services. Previously, this company offered investors PAMM accounts, but then abandoned this tool.

In 2010, the Autofollow platform was launched to simplify asset management. Unlike PAMM accounts, securities are accounted for in the investor's brokerage account, and he has the right to dispose of them at his own discretion. Operating principle: a list of various strategies is presented, from which the investor selects the appropriate one. Next, the algorithm automatically connects to your account.

| Algorithm | Profitability | Minimum investment, rub. |

| Technologies.USA | 149,63% | 350000 |

| Atlant signals | 166,84% | 135000 |

| USA middle | 116,65% | 600000 |

| USA+: moderate multi-strategy | 80,18% | 1000000 |

| Betelgeuse | 105,11% | 75000 |

| Enhanced Investments | 116,65% | 366 000 |

Profit making scheme

After getting acquainted with the theoretical aspects and how this system works, let's delve into the practical issues of how to make money by transferring amounts to trust management.

For those who want to make money on this financial instrument, it is necessary to take into account several important points. First, the main steps on how to open a new account:

- Portfolio formation . You should not invest all your money in one strategy you like. Investments in a certain PAMM account may fail, while in another they may fail. Therefore, try to diversify by distributing funds not only among managers, but also among products.

- Selection of a broker . Pay attention to how profitable and safe the investment conditions are. In particular, the broker’s rating, its payment and bonus policies, the presence of regulation, and the minimum deposit.

- Consideration of traders and strategies . Investments in certain schemes do not happen blindly. The reliability of managers is determined by the duration of the strategy (from six months), stability, current balance and annual profitability (preferably no more than 100%).

- Registration. To get started, first register a personal account (you will need your email, full name, and other data).

- Start earning money. Create and top up your balance with the required amount for trust management.

How to make money: important rules for a beginner

For beginners, when opening an account with Finam or another brokerage platform, there are several basic aspects to consider. Any trading instrument requires careful study. First of all, you should understand that this is not only a way to increase profitability, but also the risk of losing a large amount.

Remember six simple truths related to PAMM accounts:

- Choose an adequate annual return of up to 100%. If earnings exceed 150% on a PAMM account, the trader’s trading is quite aggressive and risky.

- Place funds with several of the most reliable brokerage companies. This way, in the event of bankruptcy, you will not lose 100% of your investment.

- Don't forget about diversification. It is better to gradually make money on 3-4 portfolios than to suddenly lose everything on one.

- The main criterion for a trader is experience. Some participants are ready to make high profits only at the beginning of activity. Therefore, look for experienced traders (6 months or more), whose trading takes place without sudden jumps.

- Manager's share. It is preferable to choose those Finam portfolios in which the owner has invested an impressive amount. Thus, he demonstrates confidence in making a profit.

- User reviews. In addition to technical indicators, it is important to study the attitude of real individuals towards a particular product/company.

Tips for beginners

And in the end, we have collected for you 5 of the most relevant tips for beginners who want to try themselves as PAMM investors.

Tip 1. Diversify risks.

Creating an investment portfolio is the best way to spread risk. It’s even better to divide portfolios into several, according to brokers and areas of investment. This will allow you to more intelligently distribute your funds and cover potential drawdowns with potential income.

But make sure that there are more conservative traders (those who bring in a stable income) than those who risk a lot of their money.

Tip 2. Collect complete information about your managers.

The more you know about your manager, the better it will be for you. As you can understand from the example in the article, even reading a couple of messages on the PAMM forum can be quite profitable, or at least less unprofitable.

Tip 3. Regulate trading with all available instruments.

Most brokers allow managers to influence trading. The most popular tool is the multiplier. It increases or decreases the amount of leverage that the trader (and, accordingly, the broker) will use. Its regulation in one direction or another can make a risky trader more conservative and vice versa.

It is worth doing this in cases where:

- Drawdowns cause trouble for your trading account and it is better to remove them;

- A conservative trader very rarely makes losing trades, and it is possible to increase leverage, increasing profits and slightly increasing losses.

But for beginners, this advice will only be useful after the first month as an investor. First, take a closer look at the trading mechanisms and gain experience.

Tip 4. Take money from a losing trader.

As we said earlier, the best manager is the one who brings profit to his investors. This is the golden rule that you should always remember.

If your trader is only losing his account, then it is better not to trust him with funds. But if you have done this, you need to withdraw the funds without delay. A slight delay will result in you losing money. The trader doesn’t care about the finances with which he trades.

Tip 5. Study Forex on your own.

This is one of the least obvious tips of all. But, nevertheless, studying Forex on your own is a great way to understand what a trader does. The better you understand what trades your manager makes, what trading model he follows, and how he makes profits in general, the better you will notice various changes.

Anyone who does not understand anything about Forex may not notice excessive nervousness and a change in strategy, thereby losing a significant part of their funds. But a person experienced in currency trading will quickly suspect something is wrong, draw the appropriate conclusions and react in a timely manner.

It is not necessary to read a lot of educational manuals yourself or study technical analysis thoroughly. It is enough to understand the psychology of a trader and how he should trade. Everything else will come with experience.

The best book is Basics of Stock Trading. It was written by a professional stock market player and part-time psychotherapist. It is this book that makes it possible to fully understand the entire psychology of traders.

Investing in PAMM accounts is a great way to make money, but you shouldn’t forget about the pitfalls.

Advantages and disadvantages

Each party that is part of an investment system may find certain advantages and disadvantages in it.

Pros:

- For a trader, this is an opportunity to earn extra money on trust management thanks to rewards, the amount of which he determines independently. The higher the rating, the more participants and the size of the commission.

- For the investor - safe and professional management of funds (the manager, among other things, risks his own money). The ability to invest in several portfolios, thereby diversifying risks.

Minuses:

- For a broker, it is necessary to prepare a legal and technical basis for trust management.

- For an investor, the probability of losing investments due to unsuccessful management strategies. You can transfer funds only on licensed platforms.

- For the manager, if the strategy is unsuccessful, he will lose not only investors’ money, but also his own investments.