What is a dividend gap

So, the dividend gap – what is it in simple words and should you be afraid of it?

Some shareholders purchase securities solely for the purpose of profiting from dividends. Not everyone does this (in the article “Dividend Stocks” we discussed that in order to profit from dividends you need very solid capital). Most investors have two goals: to receive dividends and to sell securities at the peak of their value.

The amount of dividends is determined at a meeting of shareholders after summing up the results of the year. The financial reporting results are approved by the company's management and published in official sources. Some advanced investors calculate their potential profits themselves as soon as the reporting data becomes publicly available. But we already know that this should not be done, unless, of course, you are the owner of a large stake. At a meeting of participants, a majority vote may decide to use the net profit not for payments to shareholders, but for something else, for example, to a new line of business.

But when the size and date of payment of dividends become known to everyone, then a dividend gap occurs. To be precise, the registrar (a professional participant in the securities market) compiles a register of shareholders as of the agreed date. To receive upcoming dividends, you must be on this register. The closing date of the register coincides with the cut-off day. While the register is still open, the shares are growing; after the cut-off day, the quotes fall sharply. This is the dividend gap.

There is no need to be afraid of this phenomenon - after the payment of income to shareholders, the securities will begin to grow again, if before the announcement of dividends there was an upward trend and no cataclysms occurred in the market. Thus, the dividend gap is a temporary phenomenon; it is created artificially. Next we will look into the reasons.

Useful materials on the topic

Subscribe to my newsletter. There will be many new articles on finance, trading and investing in the coming months. When you subscribe, I can send you links to these articles directly to your email. This way you are guaranteed not to miss anything.

If you are interested in speculation in the financial market, here is my selection of trading courses. I collected it myself. At the beginning of the collection, I list many free courses - start your training with them.

If you are too lazy to read the entire article, here is an example of a five-lesson trading course. Eduard Sungatullin teaches - he speculated in the market with almost all types of financial instruments. All classes are available in recordings on YouTube, you can watch the first one right here, from the article:

Today I don’t believe that you can really make money from trading. Because traders don’t earn them at all, but try to take them away from each other. In the short term, some of them succeed, but in the long term, no one succeeds.

If you want to get rich and increase your capital, it’s better to delve into investments rather than speculation. You can start with free materials, for example, with these three books from the City of Investors:

- How to gain financial independence in 1 year.

- 5 ways to effectively invest 1000 or more rubles.

- 6 steps to financial security.

Download them and read them. The project also has free webinars for future investors:

- Investment portfolio for $100 per month - about how investment portfolios are created in principle, what needs to be done for this. The teacher will teach you how to choose the right brokers for investing, and will teach you how to choose financial assets for investment.

- Investments without a million in your pocket - about how to start making investments from very small amounts - from 500 or 1,000 rubles. You will understand that investments do not need to be shelved; you can start investing today.

I hope some of these materials (especially the free ones) will hook you and help you achieve financial freedom and independence in the future.

Causes

A dividend gap occurs because news of an earnings payment has come out. Before the release of this news, demand for securities was at its peak - investors want to have time to receive income during this period. And the supply is also growing, judge for yourself: those who entered the register can sell shares at an inflated price and receive dividends, i.e. earn both on dividends and on the exchange rate.

After the registry is closed, demand drops sharply, because... the next payments will not come soon, and whether they will happen at all is still unknown. But the supply remains high for a number of reasons:

- some paper holders did not have time to react in time, mistakenly mistaking the rise in stock prices before the payment of dividends as a market trend;

- others, not having time to get on the register, lose interest in the shares of this company and want to sell them at a high rate.

Thus, the discrepancy between supply and demand is the main reason for the dividend gap.

Dividend payment mechanism

- At the end of the reporting period, financial statements are prepared, which are approved by the company's management, submitted to the tax authorities and published in official sources.

- The board of directors decides on the distribution of profits. Net profit can be used in whole or in part to pay income to holders of the enterprise's securities. Thus, the amount of dividends per share is established.

- The amount of payments on securities is submitted to the general meeting of shareholders. If a positive decision is made by a majority vote, a date for closing the register is set.

- The decision of the general meeting is published in the public domain - on the company’s official website, in the media.

- On the established date, the register is closed, income is paid to all participants in the register.

How do dividend gaps begin?

After the announcement of the payment of dividends, a rush begins: securities skyrocket in price due to increased demand. After the cut-off day, some shareholders who were included in the register and received a guaranteed right to dividends want to sell the securities at an inflated price. However, there are fewer and fewer people willing to buy shares.

A dividend gap occurs because the market has adjusted the balance between a company's earnings and shareholder returns. According to most financiers, making money on a dividend gap is impossible, since a rapid drop in price does not allow for speculative income.

How do dividend gaps close?

Closing a dividend gap is a return of the price to the level that was before the announcement of dividend payment. This can happen very quickly - within a week or a month, but in some cases dividend gaps can close for a year.

The length of the period depends on the liquidity of the shares, capital expenditures and profitability of the company. There is also a direct relationship between the size of the dividend and the share price.

For example, dividend gaps on Tinkoff Bank securities are practically not felt and are closed quickly, since the dividend yield is small - approximately 0.4–0.8% in 2020–2021. But on average, closing takes from 1 to 3 months.

This is what the dividend gap looks like on the chart of Sberbank shares in June 2018:

So how can you make money from this? The main question is how to calculate how long the closing will take. Internet services will help you here, where you can create a history of closing the dividend gap and the optimal purchase for a certain period. Such a service, for example, is offered by Tinkoff. True, most functions are available only to site subscribers.

The fundamental criterion influencing the speed of closing the dividend gap is the level of demand for securities. Other criteria are the size of the gap, the profitability of the securities, the financial position of the company, news and the general situation on the stock market.

And let's move directly to the question - how a dividend gap can be useful.

Origin

The term comes from English.

gap, literally translated as “gap”. A gap is a significant difference between the closing price of the previous trading session and the opening price. Market liquidity is lower. The frequency of gaps appears is affected by the volatility of the instrument. More often, gaps are formed in commodity markets due to non-round-the-clock work (important factors are triggered before the start of trading, price jumps occur). In the stock market, gaps appear less frequently; in Forex they are rare (maximum 2 times a month without force majeure). On the NASDAQ (which specializes in international high-tech companies), price gaps do not occur as often as on the NYSE.

In Forex, gaps over 20 points are considered full. On stock and commodity exchange platforms, a gap is considered full when it appears on a daily or wider time frame.

How to use them

As we already know, for a long-term investor it will be profitable to purchase securities at the time of the dividend gap at a reduced price and hold them for a long period, receiving dividends. However, when they talk about making money on gaps, they most often mean speculative profit. But there are other points.

For example, you are the owner of large capital and are interested in acquiring a controlling stake. Then the simplest solution would be to buy shares at a low price in as many quantities as possible.

In this case, the investor does not pursue the goal of receiving dividends and does not count on quick profits - his goals are more global in nature.

Other ways to make money are to buy securities at a low price and sell them at the close of the dividend gap. Let's look at a few strategies.

About us: Admiral Markets

Admiral Markets is a global, award-winning, regulated Forex and CFD broker offering trading in over 8,000 financial instruments on the most popular trading platforms in the world: MetaTrader 4 and MetaTrader 5. Start trading today!

This material does not contain, and should not be construed as containing, investment advice, recommendations or an offer or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future trading as circumstances may change over time. Before making any investment decisions, you should seek the advice of independent financial experts to ensure you understand the risks.

Strategies for making money on the dividend gap

First of all, I would like to note that for any methods of making money on the dividend gap, you should choose the most liquid shares. From Russian securities, choose blue chips; from American securities, choose stocks included in the S&P 500, NASDAQ and other popular indices.

Method 1

Buying securities before the shareholders meeting and selling at the peak of the price before paying income. But then you will not receive dividends.

Method 2

Buying shares in the same way - before the meeting (before the hype arises), receiving dividends and selling after closing the gap. In this case, your profit will be equal to the dividends received.

Method 3

Buying at a low price and selling at the close of the dividend gap or after inclusion in the register for the next dividend. But this method, in my opinion, is the most reasonable and safe - you will earn both on the difference in quotes and on dividends.

Next, let's talk about the riskiest way to make money.

Adviсe

Gaps don't happen every week, but you can profit from them.

For profitable trading, it is advisable to determine the type of gap.

- Ordinary gaps can be ignored; they pass without serious consequences for price movement. This is a signal of insufficient interest among traders in the instrument. Not recommended for intraday trading.

- Breakout gaps are a powerful trading signal, especially if confirming patterns are visible on the charts (it is useful to use Autochartist). Indicates continuation of movement in a given direction.

- The acceleration gap reports the strength of the emerging trend and further price changes while maintaining the direction.

- The departure gap clearly indicates a price reversal against the backdrop of large trading volumes.

- It's easy to confuse exhaustion and acceleration gaps.

Gaps tend to be filled, but this does not happen immediately and not every time. Online gap statistics for currencies (average sizes, duration, probability of overlap) are useful.

It is not recommended to bet on closing the gap in the absence of serious confirmation. After an overlap, opportunities always open up to enter trades in the direction of the previous trend.

It is important to recognize the reasons for the appearance of gaps, correlate them with other data on the charts, and take into account the market mood. And after a balanced analysis, make a decision to open a position. Gaps often provoke strong market panic without a clear trend, price movements are chaotic.

It is useful to test a strategy with gaps in a demo, rather than immediately start real trading.

Is it possible to short a dividend gap?

First, let's remember what a short is.

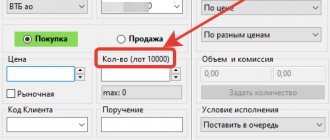

Short is a short position, i.e. a transaction with the aim of making a quick profit from the difference in quotes. There is another important nuance here: for shorting, the asset is always borrowed from the broker. That is, your broker provides you with a security or currency, you sell it. After 1-2 days the price drops, you buy the position back and return it to the broker, paying a commission for this short period.

So, you borrow a share whose market price is 200 rubles. at the current moment, and sell it at this price. The next day after the cutoff, the price drops by the amount of the dividend (20 rubles), and you buy it back for 180 rubles. Let's say you pay 1 ruble to the broker, and your profit will be 19 rubles. (200 – 180 – 1).

But under no circumstances should you do this, and if your broker values his reputation, he will warn you about this. Using the same example, we will analyze why you cannot short the dividend gap. More precisely, it’s not that it’s impossible, but you won’t be able to make money from it.

So, the broker lent you a security for a short period. We must assume that the share is not his personal property - he provided it to you by borrowing from another client. This client holds the papers and wants to receive dividends. Thus, the promotion will not be available on the client’s account for some time.

Kinds

This word in English means “gap” or “gap”. In other words, the gap between the price of the previous and next candle, which arises due to a sharp jump in asset prices in any direction.

If you look at the charts, this appears as a visual gap between two candles that stand next to each other.

GEP is divided into 4 types:

- gap breakout;

- general;

- on the way out;

- escaping.

A breakout gap occurs when there is a large trading volume. If the price breaks away from the triangle with the formation of a gap, this means a strong change in sentiment, and therefore the forward movement will be intense.

In this case, it is necessary to control the volume (high volume after the gap gives an excellent chance that the market will not return to fill the gap).

If the price moves away from the previous candle at a low level, then the gap will be filled before the chart fills the gap.

A common gap is a gap that occurs during active trading between resistance and support levels in a very short time, and the market price moves sideways.

This type can also be seen with large trading volumes. If the gap is filled, the schedule becomes almost unpredictable.

The gap at the end has another name - the gap of exhaustion. Basically it talks about the end of a trend.

Gaps in the chart are associated with intense linear movement or decline in the value of the asset.

When this type of gap occurs at a top with a large trading volume, then most likely the current trend will fade and there will be a change in the movement of quotes in the opposite direction.

But this does not mean that trends will change dramatically; it may show a fading of trading at current levels.

A runaway occurs approximately in the middle of a rapid advance or decline in prices and is rarely seen in areas with a narrow trading range.

Running gaps in most cases are not filled even after a long period of time. A running gap is needed to measure how far an asset's price will move.

Simple

A simple gap is not as simple as it seems. Until this gap has outlived its usefulness, in most market situations it will be interpreted by everyone as a gap at the end, a gap at the gap, a gap at the break.

Why do you think?

Yes, because every single trader is impatient. But the deal log helps shake things up. And I want to quickly go to the market to earn money for an apartment, a car, or a vacation. Everyone wants a beautiful life, and give it quickly.

All this beautiful Instagram life just blows the minds of ordinary people. And after reading books and advice about entry points, they begin to see them in everything. At the slightest hint, the rest of the picture is conjectured. After all, you want to make millions quickly.

And then it turns out that this is an ordinary gap. And there are no other prerequisites for its appearance. The usual price gap on old news. But there is no trend, and important levels have not been overcome, and the volatility is very low. And the volumes are worse than on New Year's days.

Simple gap

For me, a simple gap is the first thing I think of any gap that arises. And I put this interpretation on a par with other strong arguments. If the probability of this gap degenerating into others is high, then I look for the optimal entry point. Often you have to wait for several hours. And of course we set a stop loss.

Take this idea and implement it in your trading!

Monthly

These gaps occur between the closing price of one month and the opening price of the next. It is important to note that a monthly gap only forms if a new month begins on a weekend. Gaps can occur if a new month starts on a weekday, but they rarely result in a significant gap in price.

Annual

As the name suggests, these gaps form at the beginning of the new year. With retail closed until January 1st and most major players opting to unload their positions before the end of the year, you can often find a significant price gap when retail trading resumes on January 2nd. This is the most important gap that can have a big impact on the market.

Full

Full gap up: Long

If the stock's opening price is above yesterday's High, refer to the one-minute chart after 10:30 a.m. and place a buy stop order three cents above the High formed in the first hour of trading.

Full gap up: Short

If a stock gaps up but there is not enough buying pressure to support the rally, the stock price will remain at that level or fall below the opening price. Similarly, signals for entering short can be set as follows:

If the opening price is higher than yesterday's High, refer to the minute chart after 10:30 and place a short stop order three cents below the Low formed in the first hour of trading.

Full Gap Down: Long

A bad report, unfavorable news, organizational changes in the company and market influences can cause the price to drop uncharacteristically. A full gap down occurs when the price is not only below the previous day's close, but also below the previous day's Low. A stock that completely gaps down at the open will immediately begin to rise in price. This phenomenon is known as the “dead cat jump.”

If the opening price is below yesterday's Low, place a buy stop order three cents above yesterday's Low.

Full Gap Down: Short

If the opening price is lower than yesterday's Low, refer to the one-minute chart after 10:30 and place a short stop order three cents below the Low formed in the first hour of trading.

Examples

Let me remind you that on the chart the dividend gap looks like this:

Let us give illustrative examples of dividend gaps for preferred shares of OJSC “Surgutneftegas”.

So, the dividend payment date is 08/03/20, the register closing date is 07/20/20. Dividend – 0.97 rub. per share.

Quotes:

| date | Cost of securities, rub. | Change |

| 30.07 | 37,490 | |

| 31.07 | 37,555 | +0,065 |

| 03.08 | 36,900 | -0,655 |

| 04.08 | 36,785 | -0,115 |

| 05.08 | 36,540 | -0,245 |

| 06.08 | 36,655 | +0,115 |

| 07.08 | 36,735 | +0,080 |

| 10.08 | 36,925 | +0,19 |

| 11.08 | 37,255 | +0,330 |

| 12.08 | 37,900 | +0,645 |

| 13.08 | 38,145 | +0,245 |

And let’s calculate how much the shares fell in price during the dividend gap period:

37.555 – 36.540 = 1.015 rubles. This even exceeds the amount of dividends.

And earlier gaps did not close so quickly, for example, the 2016 dividend gap closed only in January 2022:

At that time, the prerequisites for a long period of dividend gap were the following factors:

- strengthening of the national currency;

- The Central Bank rate and bond yields are higher than in 2020.

Since Surgutneftegaz is an oil company, the strong ruble had a negative impact on the stock price.