Ripple or Ripple (translation into Russian - pulsation) is a peer-to-peer ecosystem with a differentiated registry (a system of gateways or gates), which, unlike Bitcoin, does not use Blockchain technology. At the same time, the Ripple cryptocurrency is in many ways reminiscent of Bitcoin - it is the absolute decentralization of the virtual architecture, the presence of an intra-system coin.

We recommend watching: exchanges for trading cryptocurrency.

According to the developers themselves, the project was created as a kind of addition to the “cue ball”, but in no case as a competitor to Bitcoin. The fundamental goal of the project is to create a global “web” within which ecosystem clients can actively exchange digitized assets. At the same time, the task of increasing the processing speed and throughput capabilities of transactions with a radical reduction in commission fees for each financial transaction in the interbank sphere is a priority. Let’s take a closer look at this digital “miracle”: let’s look at the main parameters of the Ripple project, get acquainted with the history of its creation, pay attention to mining, and also talk about investment prospects.

Trading of the Ripple cryptocurrency (XRP), as well as storage, is available on crypto exchanges: Binance, Currency, EXMO, Bybit, CEX IO, Crex24, BTC-alpha and others.

basic information

Information about the XRP cryptocurrency as of July 17, 2019:

| Name | Ripple (Russian ripple) |

| Ticker | XRP |

| Type | Cryptocurrency |

| Capitalization | $13 638 547 980 |

| Number of transactions per second | 1500 |

| Confirmation time for one block | 0.06 s |

| Cost | $0.3196 |

| Current issue | 42,811,861,267 XRP |

| Maximum emission | 100,000,000,000 XRP |

| Consensus algorithm | Ripple Protocol consensus algorithm |

| Mining algorithm | XRP Ledger Consensus Protocol |

| Website | https://ripple.com/ |

| Launch year | 2012 |

| A country | USA |

| CEO | Brad Garlinghouse |

| Blockchain Explorer | https://xrpcharts.ripple.com/#/graph/ |

| https://twitter.com/Ripple | |

| Exchanges for buying/selling cryptocurrency | EXMO, Binance, Bitmex, Bybit, Crex24, BTC-alpha, Livecoin, Currency, Bitforex, Kucoin, Okex, Cex io, Huobi, BitMax, Gate, etc. |

Differences between XRP and Bitcoin

Coin generation mechanism

New bitcoins appear as a result of mining, and this process will continue until the total number of BTC in the world reaches 21 million. With XRP, the situation is completely different: all 100 billion coins were created (or, as they say, minted) at the time the network launched. Additional issuance is not possible, meaning neither Ripple nor anyone else will be able to create new XRP in the future.

Currently, 45 billion XRP . The remaining 55 billion are still kept by the Ripple company, which periodically releases new portions of coins into circulation. Therefore, some argue that the turnover of this cryptocurrency is controlled by the company, and therefore XRP cannot be considered a truly decentralized asset.

Consensus algorithm

Bitcoin uses an extremely energy-intensive, but reliable and decentralized Proof-of-Work mechanism, in which miners collect transactions into blocks and receive rewards in the form of new BTC. XRP has its own algorithm, which is called Consensus. A limited number of validators (candidates approved by Ripple) confirm transactions and update the ledger without receiving any reward for doing so. The XRP mechanism is much faster and more cost-effective, but is quite centralized, which does not please zealous blockchain evangelists.

Transaction costs

The commission on the Bitcoin network depends on the load on the network: at the end of April 2022, it averaged $35, regardless of the transaction volume. Transactions with XRP are almost a thousand times cheaper - only $0.004.

Speed

The average time of one block in the Bitcoin network is 10 minutes, and that is how long you need to wait for the first confirmation. Many services (in particular, crypto exchanges) require several confirmations to deposit or withdraw funds, so in practice you have to wait up to an hour. But on the XRP network, payments are processed in 3-5 seconds.

History of Ripple

Historical background of Ripple . Despite the fact that the year 2012 is considered to be the founding date of the Ripple cryptocurrency, in fairness it should be noted: at the beginning of the 2000s (2004), Ryan Fugger (a Canadian programmer from Vancouver) announced a new project for its development, which in 2005 took the form of an electronic payment system called "RipplePay". The project developed “sluggishly” due to almost zero public interest.

After 7 years, the project was noticed by Jed McCaleb (founder of the MtGox exchange) and other investors. After a financial injection and modification of the existing platform, an updated ecosystem emerged that literally burst into the top three cryptocurrencies by capitalization.

Features of Ripple

The Ripple cryptocurrency is a P2P design in its classic form, allowing the exchange of values within its borders without the presence of funds or third parties. For example, 2 ecosystem participants want to exchange, but do not have the funds. But one has a pear worth 5 bucks, and the other is the owner of a theater ticket, the price of which is $10. One is interested in the pear, the other is ready to get rid of it for a ticket. The lack of funds eliminates such an exchange in the traditional EPS (electronic payment system). However, in Ripple, this operation is as easy as pie: the ticket owner gives the countermark to the owner of the pear, and in return receives a piece of fruit and a promissory note for 5 “bucks.”

In fact, the example given is a simplified algorithm, the Ripple cryptocurrency carries out multi-stage exchanges from one user to another until the last one in the chain (ring) receives the desired asset from the previous client and gives the necessary “value” to the first user. At the same time, the entire multi-stage transaction is carried out at lightning speed; there is no need to look for candidates for exchange, since the system does this automatically. As a result, all participants in the “ring” receive the necessary assets without the intervention of intermediaries, that is, without commission fees.

In addition, within the boundaries of the XPR cryptocurrency there is a virtual structure called RippleNet, which unites transaction providers, banking structures, and corporations. Finances sent on this network are tracked from anywhere on the planet, and an individual interface has been developed for each category of users, allowing them to solve specific problems:

- This software was created for interbank relationships.

- The resource provides liquidity for transaction providers.

- XVia is a service for all ecosystem clients that makes payments with the ability to subsequently track the financial transaction and confirm the transaction. To make using the resource more comfortable, you can add an invoice or other payment transaction documents to its interface.

The final feature of the XRP cryptocurrency is its open API, through which decentralized application (DApp) developers can connect to the ecosystem, receiving all the virtual architecture information. Magento (a service that monitors the activities of virtual trading platforms) and Ripple Wallet, an electronic wallet for paying for goods and services with XRP, were among the first to use this option.

Important! Mining of the XRP cryptocurrency is not included in the concept of the ecosystem; it does not need “miners” to maintain the effective functionality of the digital architecture and the security of the virtual structure as a whole. You can purchase a coin on any cryptocurrency exchange: Gate, Bitmax, Bibox, BitForex, ABCC and other platforms. The Bitmex exchange is perfect for margin trading.

home

The cryptocurrency industry took a huge leap forward in 2021 after a tough year in 2022. We have seen a massive recovery as Bitcoin and many other cryptocurrencies hit all-time highs. The adoption of digital assets in the DeFi, NFT or Metaverse market has increased dramatically. Unlike previous years, when institutional participation was lacking in 2022, large companies were found to be in tune with the thriving cryptocurrency ecosystem.

Especially Ripple, it was the biggest hit to the cryptocurrency market last year, but it unexpectedly rose and recorded incredible progress. While the price of XRP managed to rise impressively in the first half of 2021, the growth rate began to wane in the second half. However, 2022 could be a great year for Ripple and XRP.

On December 22, 2022, the US Securities and Exchange Commission (SEC) sued Ripple for allegedly selling unregistered securities domestically. The $1.3 billion lawsuit came as a shock to XRP holders and the community, given the behind-the-scenes meetings the blockchain startup has had with several local regulators over the years.

More importantly, it has set a precedent in the ecosystem due to the lack of regulatory clarity.

Almost a year has passed since the lawsuit was filed, but no conclusion has been reached. The lawsuit is stuck at the point where Ripple asks the SEC to provide documents detailing the regulator's deliberations or rationale for classifying Bitcoin and Ethereum as commodities. Ripple argues that these documents reveal the controversial nature of the SEC's decision-making process. Moreover, the documents may help prove that the SEC did not notify Ripple of its acceptance of XRP as a security. However, the plaintiff argues that such important documents are protected by the negotiating process privilege (DPP).

Judge Sarah Netburn

reviewed these documents to confirm the authorities' claims, but the process was inconclusive, and both the SEC and Ripple requested a second briefing. The case will likely extend into next year, so here are the events you can expect in the future.

— If the SEC wins the case against Ripple, this will set a precedent for many years and will give the regulator the opportunity to monitor and regulate cryptocurrency projects. “It can also create a sense of clarity and create a set of guidelines for future projects to follow to avoid regulatory scrutiny.

“In this case, Ripple will have to pay a huge fine and concentrate its business elsewhere outside the West. This scenario could lead to other European countries following the same path, causing problems for the company. — The XRP price could take a big hit, but it will likely be short-lived. — The SEC cannot relax after the victory and focus on Ethereum, as many speculators believe.

— If Ripple wins its case against the SEC, the regulator will likely back down, which could mean a paradigm shift in securities laws for cryptocurrencies. “While the potential benefit may put Ripple in a safe place, current and future projects may still lack clarity. “Regulators will have to think twice before taking on other major projects like Ripple. — The price of XRP may jump sharply and set a new record.

Additionally, while 2022 may seem like a year of litigation and bureaucracy for Ripple, the company has made notable strides not only in sales but also in partnerships.

With bullish momentum growing in the cryptocurrency industry, the price of XRP could surpass its previous all-time high in 2022. But everything will depend on the outcome of Ripple’s case with the SEC.

A win in this case could serve as a headwind to the bullish argument and push XRP into double-digit territory above its all-time high of $3.31. Ripple has an important foundation to realize its upward potential as it makes important moves in the eastern hemisphere and signs new partnerships in Europe and the Middle East.

But if Ripple loses the case, at best it will lose its position in the United States. The news could temporarily lower the price of XRP before the market realizes its strong fundamentals.

Ripple cryptocurrency rate

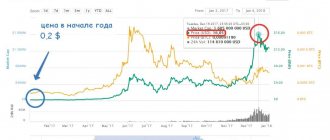

Today (September 27, 2018) the Ripple cryptocurrency is trading at 0.52 USD. Over the 5 years since the start of trading, the value has increased 88 times or 8783%. The initial price of XRP was $0.0059. Let us remind you that the first coin trading took place in August 2013.

The maximum price for the Ripple cryptocurrency was observed in January 2018. The token price reached $3.65. During the period January-September, Ripple quotes “fell” by more than 85% from their maximum values.

The largest price increase (806%) was recorded in December 2017, the maximum drawdown (-68%) was in January 2022.

On December 13, 2022, the rate increased by a record 78% in one day. Maximum drop (-26%) - January 16, 2022.

In continuation: Ripple to dollar exchange rate and chart online.

Ripple Storage Wallet

There is no official wallet for the Ripple cryptocurrency. The developers didn't bother to create it. To store cryptocoins, the Ripple Trade platform was previously used, on which it was possible to hold cryptocurrencies. Since 2016, the trading service has been closed, and officials have suggested using other storage facilities.

The official Ripple website provided an answer to the question “where to store XRP and which wallet to use”:

The developers are not responsible for the operation of third-party storage services and recommend conducting reliability checks before commencing operations.

Let's make a list of Ripple wallets:

- Local: Toast Wallet is an open source wallet for Windows, Mac, Linux.

- Online: Exarpy, Guarda, Toast (Chrome only), Bitpanda.

- Android, iOS applications: Toast Wallet, Zebpay, CoolWallet.

- Hardware wallets: Ledger, Trezor, Keepkey, CoolWallet S.

In continuation: Review of cryptocurrency wallets.

What is XRP?

XRP was specifically created for businesses to provide liquidity in cross-border payments. Banks can use XRP to obtain real-time liquidity on demand, without having to pre-fund nostro accounts.

Payment providers use it to expand into other markets, improve settlement speeds, or reduce the cost of foreign exchanges. You can buy or trade XRP on many popular cryptocurrency markets.

Compared to other cryptocurrencies, XRP installs incredibly quickly, taking just four seconds. In comparison, ETH takes two minutes to settle, while BTC takes over an hour. Traditional systems are even worse, three to five days.

XRP is also highly scalable, processing 1,500 transactions every second. XRP can even be scaled up to handle the same throughput as Visa. In comparison, ETH only has 15 transactions per second, and BTC only handles three to six.

Ripple exchanges for trading

Today, the main volume of trading in the Ripple cryptocurrency falls on the following exchanges:

- Binance. XRP/USDT pair – 12.52% of total trading volume.

- Bitbank. XRP/JPY - 11.65%.

- Upbit. XRP/KRW - 10.94%.

The most popular Ripple exchanges for fiat (you can make deposits/withdrawals in US dollars, rubles, etc.):

- Exmo.

- Cex.io.

- Livecoin.

- Yobit.

On crypto exchanges you can get a free wallet to store XRP without paying 20 XRP. Choose a reliable site that has been operating for more than one year and has a good reputation.

How to buy and sell cryptocurrency Ripple (XRP)

There are two main ways to buy or sell Ripple cryptocurrency:

- Crypto exchanges.

- Exchangers.

Before starting the operation, you should analyze the commissions and rates in order to understand where to buy Ripple or sell the coin more profitably. The cryptocurrency rate will be better on exchanges, but do not forget that you need to pay a commission for input/withdrawal. When exchanging for fiat, its value can be significant. Another nuance: not all crypto exchanges work with ordinary money: rubles, dollars, etc.

You can sell Ripple in an exchanger much faster, and the number of payment systems and directions is wider: bank cards, Yandex.Money, Qiwi and others. Now cryptocurrency exchangers create real competition for exchanges and exchanges with them are profitable. The downside is that to purchase you must already have a wallet address to receive Ripple.

You can get Ripple for free on faucet sites, but the payouts are very small and should not be considered as a way to earn money.

What is RippleNet?

RippleNet is Ripple's network of payment providers, banks, corporations and digital asset exchanges. It provides a seamless, frictionless experience that lets you send and receive money around the world. RippleNet provides connectivity across various payment networks with instant settlement on demand. It is secure as you can track funds in real time. To top it all off, it has low operating costs and low liquidity costs.

RippleNet gives users additional access to the fastest as well as most scalable digital asset used for payments in the world, XRP.

RippleNet is constantly growing around the world. At the moment you will find digital asset exchanges, payment providers, banks and more. All of these entities process and provide liquidity payments through RippleNet, expanding their cross-border payment services. There are over 100 clients and 75 commercial deployments.

The list of organizations using RippleNet includes numerous financial institutions that you have no doubt heard of and most likely interact with regularly. Just a few of them include Bank of Tokyo-Mitsubishi UFJ, RBC, Santander, Standard Chartered, Credit Agricole, Westpac, Axis Bank, UBS, SEB, SBI Remit, UniCredit and BMO.

xCurrent for payment processing

xCurrent allows banks to process payments worldwide for their customers. With this solution, banks instantly record payments across borders, including end-to-end tracking. Banks send messages to each other, confirming payments in real time before the transaction begins and confirming its delivery.

xRapid for liquidity

xRapid allows payment providers to set their liquidity on demand. Liquidity costs tend to be high because payments in markets that are still emerging require local currency accounts to be prepaid. Using XRP, xRapid provides on-demand liquidity, reducing costs while still enabling emerging markets to leverage real-time payments.

xVia for sending payments

xVia – This is what companies use to connect to RippleNet and send payments. It is a standard payment interface with a simple API and does not require software installation. With xVia, users can seamlessly send payments around the world in a completely transparent manner. They can even attach rich information such as invoices. xVia allows you to track and confirm their delivery, including in wallets and other non-traditional networks. With real-time global payments, xVia frees up capital by simply sitting in foreign currency accounts.