Traders choose foreign companies for unimpeded access to the markets of their respective countries. There are other advantages, for example, deposit insurance for a substantial amount. Many foreign brokers accept clients from countries all over the world without any problems, which means that Russians and residents of other post-Soviet countries can open accounts and trade with them.

Below we describe the best foreign brokers for Russians and not only, and also indicate the features of working directly with foreign companies. From this article you will learn:

- Types of foreign brokers

- TOP 6 best foreign brokers

- Features of working with foreign brokers

- Conclusion

So, foreign/foreign brokers who remotely open accounts for Russians are as follows:

- Interactive Brokers (there is a website in Russian. One of the best and largest brokers with a long history.

Effective July 1, 2022, Interactive Brokers has waived the monthly inactivity fee.

- Captrader (min. deposit - 2,000 EUR or USD, no commission for inactivity!)

- Lightspeed (min. deposit - $25,000)

- Place Trade (min. deposit - $5,000)

- Just2Trade (min. deposit - $2,500) - American “daughter” of Finam-a

- Venom by Cobra Trading (min. deposit - $5,000)

- Saxobank (min. deposit - $10,000)

- KIT-Finance Europe (min. deposit - $5,000)

- FFINRU Investments Ltd (min. deposit - $500)

- Exante (min. deposit - €10,000)

- TradeStation Global (min. deposit - $1,000)

On topic: The best and most reliable American online brokers. Rating.

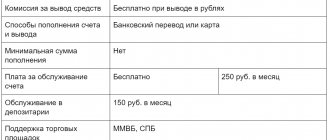

Each broker must confirm the size of the deposit to open an account and the commission. The deposit can range from several hundred to several thousand dollars. Fees can also vary significantly.

For example, Interactive Brokers had it at $10,000, but in 2018 it was canceled and now it is zero. But, they have a fee for inactivity/inactivity. Read more here: What you need to know about Interactive Brokers.

A valuable PDF guide to Interactive Brokers with answers to the main questions: ✔ how to open an account, ✔ how to fund your account and withdraw money, ✔ what fees are charged, ✔ which tariff is right for you, ✔ how to pay taxes, ✔ and other important questions. Download the Interactive Brokers PDF Guide for free here .

What are the advantages and disadvantages of foreign brokerage accounts?

pros

+ Brokerage account is insured! + Assets are located abroad + Opportunities for tax optimization + Direct access to foreign exchanges and their instruments (without sub-brokers) + High market liquidity + Laws and conditions are stable and transparent

Minuses

— To minimize commissions, large sums in accounts are needed — Citizens of the Russian Federation must report to the tax service about the presence of accounts and the movement of money abroad — Foreign brokers are not tax agents, you will have to calculate the tax yourself — You need to know the language and understand the legal nuances — There is a risk of refusal US brokers from servicing Russian clients.

What are the pros and cons of foreign brokerage accounts?

Procedure for opening a foreign account

Important features. Currency control. Transfers via cryptocurrencies

News from foreign brokers:

11/16/2021 Interactive brokers The client’s account was frozen after he entered the application from the territory of Crimea.

The All Finance Links broker rating warned about such risks. Just a year ago, there were widespread episodes when, fulfilling the risk of the requirements of American regulators, Interactive Brokers blocked the accounts of Russian citizens.

11/09/2021 Freedom Finance Holding The American financial corporation Freedom Holding presented a financial report for the second quarter of the 2022 fiscal year, in which it reported a fourfold increase in quarterly revenue, to $312.8 million. This was reported on the website of the US Securities and Exchange Commission. The holding's net profit year-on-year increased by more than 8.5 times - from $23.7 million in the second quarter of the 2022 financial year to $204.5 million at the end of the reporting period. On a per-share basis, earnings rose to $3.44 from $3.04 in the same period last year. The holding's assets and liabilities increased by $373 thousand and $162 thousand, respectively. Read more…

08.11.2021 Bonus promotion from Just2Trade We hereby inform you that Just2Trade Online Ltd announces the extension of the period of validity of the “StartUp” promotion until November 30, 2022. You can find out more about the terms of the promotion in the Regulations

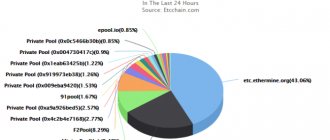

10/12/2021 Etoro Broker eToro is pleased to announce that it is launching a number of new tokens.

Now available on the eToro investment platform: Solana (SOL)

The SOL token is a scalable crypto platform built on the Solana blockchain that is capable of nearly 50,000 transactions per second.

In total, the following cryptocoins are available on Etoro: BTC, ETH, BCH, LTC, XRP, DASH, ETC, ADA, XLM, EOS, NEO, TRON, ZEC, BNB, XTZ, LINK, UNI, COMP, AAVE, YFI, MANA, ALGO , MATIC, BAT, MKR, ENJ, FIL, DOT, and MIOTA

10/01/2021 Conditions of the bonus promotion Just2Trade Online Ltd announces the extension of the validity period of the “StartUp” promotion until October 31, 2022 and the “MT5 Global special offer” promotion until December 31, 2022. You can find out more about the terms of the promotion in the StartUp Regulations and Regulations MT5 Global special offer

Frequently asked questions regarding foreign brokerage accounts:

1. Money and assets are located in foreign jurisdictions and are protected by international law (this point, of course, is purely beneficial individually. Of course, this is not important for legally earned fortunes, but there are different cases) 2. The number of intermediaries between your money and investment instruments is minimal (you have direct access : Broker - Exchange - Financial instrument with registered property rights from registrars and depositories without unnecessary intermediaries) 3. High regulation of the activities of investment markets (financial legislation, and most importantly its actual enforcement, has been worked out for years) 4. Brokerage accounts are insured by local and international supervisory regulators (if the broker has been issued a license from the financial market regulator, which means the legal entity has been verified, has high-quality supervision and liability insurance) 5. Opportunities for tax optimization, especially for brokers registered in jurisdictions with preferential tax regimes (Cyprus, Malta, British Virgin Islands, Cayman Islands, Estonia and others)

1. Low commissions are achieved due to large trading volumes and frequent transactions; long-term investors may have higher commissions, because they are less profitable for brokers 2. The obligation of Russian citizens to declare foreign accounts and movements on them to the tax service 3. The regulator is not the Central Bank of your country, so it will be more difficult for non-residents to complain and sue 4. Not all foreign brokers have Russian-speaking support 5. Large American and European brokers have a preconceived idea about the toxicity of clients and money from Russia and the countries of the former USSR

13% income tax. At the same time, starting from January 2022, the owner of a brokerage account is obliged to notify the Federal Tax Service about the opening of an account, change of details, and movement of funds. Additionally, every year the investor fills out a tax return 3-NDFL in which he declares profits or losses from transactions with assets in foreign brokerage accounts. A cash flow report is not needed under two conditions: - The broker is located in a country that exchanges financial information with Russia (full list on the tax website). — Changes in the amount for the year no more than 600 thousand rubles.

For non-compliance with the norms specified in Federal Law No. 173 “On Currency Regulation” the following fines are levied: - Failure to comply with deadlines for submitting information on opening or closing a brokerage account, as well as transfer of data in violation of the notification form. 1000–1500 rubles for individuals; — Lack of notification about the opening/closing of a foreign account or changes in its details. 4000–5000 rubles for individuals; — Failure to comply with tax reporting rules. 4000–5000 rubles for individuals;

1. Doesn’t know if there is no automatic exchange. For example, there is no such exchange with the UK (Tradestation), USA (Interactive brokers), Estonia (United Traders). 2. Even if the country of registration of the broker has an automatic exchange with the Federal Tax Service of the Russian Federation, it is not a fact that the exchange is carried out correctly. For example, Cypriot brokers do not always verify tax identifiers, and accordingly, data exchange with the Federal Tax Service of the Russian Federation may not be validated. (Example - Just2Trade broker, which has a representative office in the USA) 3. It should be noted that the Federal Tax Service of the Russian Federation will see your money transfers from a Russian bank to the current account of a foreign broker. Of course, there are ways to anonymously transfer funds, for example through cryptocurrencies (digital financial assets), but the presence of cryptocurrencies also needs to be notified to the Federal Tax Service of the Russian Federation.

The basis for refusing to withdraw funds from a brokerage account may be questions or doubts regarding the information provided by the client. In this case, the broker may request additional information or documents, including the origin of funds received into the brokerage account. During the verification process, the client's account may be blocked legally. But this does not mean that the account will be automatically closed or the funds on it will be seized. The broker only temporarily restricts the client from withdrawing funds from the account and performing trading operations. If the check does not reveal any violations, the account will be unblocked. If there are violations, the case will be sent to court for further consideration. There have been cases of temporary freezing of operations to withdraw client funds. But this applied only in cases of suspicion from law enforcement agencies and concerned large sums of hundreds of thousands of dollars and more.

Taxation issues for foreign brokerage accounts:

Residents of the Russian Federation interact with the tax service regarding foreign brokerage accounts in 3 directions (3 different documents): Citizens are required to notify the tax service of the presence of foreign brokerage accounts within a month from the date of opening (part 2 of article 12 and part 10 of article 28 No. 173-FZ “On Currency Regulation and Currency Control”). Citizens are required to submit to the Federal Tax Service reports on cash flows in a foreign broker no later than June 1 of the following year. (Resolution of the Government of the Russian Federation dated December 12, 2015 No. 1365) Citizens of the Russian Federation are required to declare income from foreign investments when filing a tax return 3-NDFL no later than April 30 following the reporting year. (Clause 1, Clause 1, Article 227 of the Tax Code of the Russian Federation)

1. The notification form and formats are approved by Order of the Federal Tax Service of Russia dated April 24, 2020 No. ED-7-14 / [email protected] “On approval of forms, formats of notifications about the opening (closing) of an account (deposit), about changing the details of the account (deposit) in bank and other financial market organization located outside the territory of the Russian Federation. https://www.nalog.gov.ru/rn77/fl/interest/account_opening 2. The form of the Report is established by Decree of the Government of the Russian Federation of December 12, 2015 No. 1365 “On the procedure for the submission by resident individuals to the tax authorities of reports on the movement of funds in accounts ( deposits) in banks outside the territory of the Russian Federation.” https://www.nalog.gov.ru/rn77/fl/interest/otfl_dvsredstv

1. In person or through a representative 2. By registered mail 3. Through the taxpayer’s personal account. Individuals must send documents to the tax office at their place of residence or stay.

There are 2 cases in which it is not necessary to submit a report on the flow of funds: 1. The broker (financial organization) is located on the territory of a foreign state - a member of the OECD or FATF and automatically exchanges financial information with Russia 2. During the year, changes in the account - deposits or debits - are not exceed 600,000 rubles. or funds were not credited or debited, and the account balance does not exceed RUB 600,000. in foreign currency at the exchange rate as of December 31 of the reporting year.

In case of failure to submit notifications and reports to the tax authority, penalties in the form of fines are provided for individuals: 1. for notification of opening/closing an account, changing details - from 4,000 to 5,000 rubles (clause 2.1 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation); 2. for a cash flow statement - from 2,500 to 3,000 rubles for a primary violation and up to 20,000 rubles for a repeated violation (clauses 6.3 and 6.5 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation)

In accordance with the Order of the Federal Tax Service dated November 21, 2019 No. ММВ-7-17/ [email protected] “On approval of the List of states (territories) with which the automatic exchange of financial information is carried out, a list of countries with which the tax office has an automated exchange of tax data is published. For example, the UK, USA, and Lithuania are not included in this List. Cyprus, Malta, Estonia, the British Isles and other offshore companies familiar to Russian-speaking investors are on the List. But it is unknown how the exchange is actually carried out, and most importantly, what information brokers from these jurisdictions disclose about their clients.

"1. Dividends 2. Coupons and bond transactions 3. Stock transactions 4. Futures transactions 5. Options transactions 6. Currency transactions 7. Interest charged by the broker on the account balance 8. Long-term or short-term distribution of profits (for example, ETF funds) 9. Other types of income

1. Data on transactions and income must be entered into the declaration manually. Accordingly, for those who make many transactions, this is a significant problem. 2. All transactions on foreign brokerage accounts must be converted into national currency at the Central Bank exchange rate. 3. All transactions within one instrument must be accounted for according to the FIFO (first in, first out) accounting rule. The first to be deregistered are the assets that were registered first. 4. It is necessary to correctly apply tax deductions and balance losses in other tax periods with other sources of income. 5. To correctly calculate the tax base and tax rate for certain types of income, such as dividends, it is necessary to use double taxation agreements with issuers of securities depending on their jurisdictions. Bottom line: filing a declaration with income from foreign brokerage accounts yourself is very problematic. If there are not many transactions and sources of income, you can waste time. But if you are actively trading large amounts, then it is easier and safer to contact a tax and reporting specialist or a tax consulting company.

According to the law, on dividends on US shares received by Russian residents, the higher depository withholds tax to the US budget. Due to the existence of a Double Taxation Avoidance Agreement between Russia and the United States, the tax rate of 30% can be reduced to 10% if the client provides a current tax form W8BEN, confirming that the client does not belong to the United States and entitles him to these benefits. However, according to the rules of FATCA (Foreign Account Tax Reporting Act aimed at combating tax evasion by American citizens and residents), in order to apply the preferential rate of 10%, all financial intermediaries in the chain of custody must submit tax form W8BEN before the “record date” (cut-off dates for dividends on securities), often this does not happen and financial institutions immediately apply a penalty rate of 30% for clients for whom the IRS - the US Tax Service - does not have information about which country they are a resident of. To ensure that you are charged only 10% and not 30% of dividends, fill out Tax Form W8BEN with your broker. Most brokers allow you to fill out information in your brokers' personal accounts.

*We urge you to comply with the requirements of tax legislation, but if you want to check the efficiency of the tax system, and then share with readers the results of fines and additional charges received, then as an option you can: 1. Open brokerage accounts in jurisdictions with a preferential tax regime, minimizing the package of services provided documents. (Cyprus, British Isles, Malta, Estonia, Belize and others) 2. Open brokerage accounts in jurisdictions of those countries that do not have automatic exchange with the tax service (USA, UK, Lithuania) 3. Use of irrevocable discretionary trusts (for large capitals) 4 Initiation and withdrawal of funds from foreign brokerage accounts using cryptocurrencies and crypto exchange brokers.

Advantages of investing through an American broker:

- The investor gains access to American and world exchanges, excluding sub-brokers from the chain.

- The investor gets access to a selection of assets that is tens to hundreds of times greater than that of any Russian broker.

- The investor buys securities that are tens or hundreds of times cheaper in terms of commissions than Russian ones.

- The investor buys securities that are managed much more accurately and efficiently than domestic ones.

- The second advantage is that the account insurance amount is $500,000 (including up to $250,000 cash insurance). Some brokers additionally insure themselves with insurance companies, in which case the compensation may be higher.

I don't recommend going to a broker who doesn't have SIPC!

- Investors are transferring part of their assets to a more reliable country and economy, where there is a completely different attitude towards private capital and the highest possible protection of investor interests.

- The reliability of a Western broker may be higher than that of a domestic one.

Read: Manipapa's Investment Strategy! Or how I earn over 10% in dollars per year by doubling my investments every 6-8 years.

Conclusions from the comparison table

Just2Trade and United Traders* had the most profitable commissions Moreover, only with them you can have assets in your account of less than $10,000 without additional fees. These brokers, having jurisdiction in Cyprus and BVI respectively, have shown their reliability, customer focus and ease of service over a long period of time. + they have the best services on the market for participation in foreign IPOs. * Unfortunately, the Bank of Russia has included United Traders in the list of organizations with signs of an illegal professional market participant. The broker continues to operate, but the opening of accounts for citizens of the Russian Federation is temporarily suspended.

Interactive Brokers , a large American discount broker, is also gaining popularity among Russian clients, but the profitability of its tariffs for traders (more than 3 transactions within 5 days) starts from assets worth more than $25,000. Accounts under $10,000 are subject to additional fees with limitations. In addition, after fines from American regulators amounting to tens of millions of dollars, Interactive Brokers began cleaning up client accounts. And in case of suspicious, non-standard activity on accounts, they begin to block accounts or suspend withdrawals of funds until they receive evidence of the origin of the client’s money!

Exante strictly has a minimum threshold of $10,000. Moreover, in terms of exchanges, he is a sub-broker, i.e. gives access to trading through another broker, which increases risks. At the same time, the company successfully passed all checks and proved the legitimacy of all processes before the US Securities and Exchange Commission (SEC)

Etoro is essentially not a stock broker, but a dealer who executes transactions internally and you do not receive the purchased assets as your own, you trade contracts. There is an advantage to this: you can use short positions and buy expensive shares in fractional parts. At the same time, it is possible to acquire shares into ownership. In addition, Etoro has an excellent social network and an auto-following service for the transactions of the best traders.

Freedom Finance Europe is the only brokerage holding company with Russian roots to be listed on the American Nasdaq exchange. They are major experts in the field of analysis and service for participation in IPOs for wealthy investors. They have 75 offices in 7 countries: USA, Germany, Cyprus, Russia, Kazakhstan, Uzbekistan and Ukraine. One of the most dynamically growing brokers for Russian-speaking clients in the post-Soviet space.

Step-by-step algorithm for choosing a foreign broker

The best brokers for participation in IPO

Foreign brokers with the most favorable rates

Documents, deadlines, responsibility, optimization.

Declaration as property, taxation, liability.

How to choose the most favorable tariff?

Flaws

Among the disadvantages is that you will have to communicate with most brokers in English. Perhaps some brokers will stop opening accounts for Russians.

Some may be afraid of sanctions risks.

It is also necessary to notify the tax authorities about opening an account with a foreign broker and about the movement of funds and other assets through such accounts.

On topic: If you do not notify the tax authorities about your account with a foreign broker. New cash flow report from 2022. Fines 50-75-100% of capital! The tax office will find out anyway! LAWYER'S ADVICE!

Types of foreign brokers

Highlight:

- American brokers , the most famous representative is Interactive Broker. They work in accordance with American legislation, their activities are regulated by the most stringent regulators in the world.

- European companies (CapTrader, Exante and others). There are also no problems with regulation, traders’ deposits are insured.

- Subsidiaries of Russian companies.

- Offshore brokers . They are characterized by relatively low requirements for the starting deposit.

Working with foreign brokers has both strengths and weaknesses.

| Advantages | Flaws |

| Tight regulation, maximum operational reliability . There are no fly-by-night companies among these brokers | Possible increased requirements for start-up capital compared to Russian companies |

| Deposit insurance | Knowledge of a foreign language is desirable |

| Assets are held in foreign currency | Foreign companies are not tax agents. This means that you will have to pay taxes yourself. |

| For some, the important thing is that foreign non-bank accounts do not need to be reported to tax authorities. We emphasize that you need to pay taxes on income, but you do not need to report brokerage accounts. | Commissions may be higher than those of Russian companies |

| Availability of more trading platforms | The deterioration of relations with the EU and the USA may lead to the abandonment of clients from Russia |

| Everything is done remotely, there is no need to go abroad and visit the broker’s branch |

Interesting!

Remember that one of the best investment tools in Western markets are ETFs. It is ETFs that allow the “ordinary person” to earn more than the world’s coolest managers.

In 2007, legendary investor Warren Buffett made a $1,000,000 bet with a hedge fund manager that hedge funds (managed by some of the toughest investors in the world) would not outperform the S&P 500 index (to which some ETFs are linked). -s) over a period of 10 years! And he won this argument!!!

Learn more about ETFs here.

Mini-course “How to choose the best American ETFs.” Get step-by-step instructions with dozens of screenshots of how I choose ETFs for myself (!!!) and for clients. ETF is exactly the tool that allows you to earn from 10-20% (and more) in dollars per year! Price - only 1,800 rubles! Find out more here.

What amounts can you start with?

The minimum investment amount depends on the broker. For example, to open an account with the Danish Saxo Bank you need a deposit of $10,000, with the German CapTrader - $2000 (or in euros), and with the American Choice Trade - $100. Some brokers have no limits on the amount, including the American Firstrade.

The larger the deposit amount, the less you lose on commission. It’s worth opening an account with a foreign broker if you have a capital of more than $10,000. And then you can deposit 15-20 thousand rubles into the account every month, then the commissions will be minimal.

It will be useful!

——————-

Where and how the MoneyPap family invests (successfully) (PDF) . In this document, I honestly tell you what profitable instruments my family invests in. Download the PDF for free - here.

——————-