Hello, dear friends. A trader's transaction log is unfairly ignored by many speculators. It is perceived as something optional and useless; sometimes it feels like there is zero benefit from manually maintaining statistics. In reality, everything is different; maintaining your own report can become basis for improving trade, that is, the transaction log can directly affect the trader’s income.

Below is a detailed analysis of this tool and a description of services that allow you to automate reporting.

Why keep a trader's diary

Above, I noted that a diary can become the basis for improving trading. Keeping your own records involves recording both the technical details of transactions and the emotional state at the time of entering the market. If the report is carried out impartially , statistics accumulate over time, from which weaknesses can be identified.

The diary allows you to identify not only the technical shortcomings of a trading strategy, but also gaps in psychology. For example, an overly emotional attitude towards trading or a tendency to overemphasize the opinions of third-party analysts.

The trader's journal also disciplines and teaches systematic work . If you get into the habit of describing each transaction according to a number of criteria, then over time emotional, random transactions will disappear.

All of the above is possible only if the trader does not try to flatter himself and keeps an honest diary. Impartiality is the most difficult thing in this matter.

The main value of a diary is recording, among other things, your emotional state . A trading report or information and analytical services, for example, myfxbook.com, allow you to evaluate only the technical component of trading. Manual logging is not suitable only for high-frequency scalpers. Such traders can only rely on monitoring services by connecting trading accounts to them.

Trader statistics services

If Excel or Windows diary doesn't satisfy your sophisticated tastes, consider using online statistics. In Forex, the most popular service on this topic is called myfxbook. But, alas, brokers do not allow it to be used in binary and financial markets. rates.

Therefore, alternatives such as Marketstat can be used. Such universal services allow you to track transactions anywhere, including the stock exchange or cryptocurrencies.

Visual statistics are perceived by many (and me too) much better than dry Excel columns.

The summary data will contain all the statistics, without any visual beauties. Such advanced statistical systems are a great way to identify patterns that affect your trading. You can also keep a psychological diary there, and for Forex and stock exchanges, data is generally “pulled” from your account automatically.

The funny thing is that you can do something similar in Excel, but you will have to dig into it for a couple of years before you get the hang of it, and I personally don’t have the time for that. So be sure to find yourself a simple and convenient assistant for maintaining statistics.

Hindsight error

This phenomenon became an object of interest for psychologists in the 70s of the last century. Hindsight is a kind of thinking trap, it is also called “ I knew it .”

The essence of hindsight is that after some event it seems to the trader that such an outcome was easily predicted in advance . For example, the chart shows a rebound from the support level, but the deal was not concluded at that moment for objective reasons (NFP exit, failure to fulfill a number of strategy filters). That's the right decision .

There is a rebound from the level, the trade is not opened, and due to Hindsight's error, it seems that not entering the market is the wrong decision. The assessment of past events is distorted; in the future this can play a cruel joke on the trader. In a similar situation, he can go against the rules of the system and enter into a deal, losing money on it.

The Stock Trader's Trading Diary solves this problem.

If information about concluded transactions is recorded immediately, it is much more difficult to distort it in the future .

Identify your weaknesses

You can later, in a calm atmosphere, take notes, look at your trading from the outside, and then all the weaknesses will be in full view. Suddenly you notice that:

- break the rules of strategy

- that you are too worried about an open position (are subject to trader’s fears)

- “chasing a deal” - this means entering when there is actually no signal to enter

- close a profitable position early or sit out losses

This list of typical sins of traders can be continued for a long time, but I think you understand the essence perfectly. A trader's journal gives you the opportunity to work on yourself and clearly identify those points that prevent you from achieving success personally .

What to write down in your diary

The document must contain all details about the transaction . Recorded:

- Date and time the signal occurred .

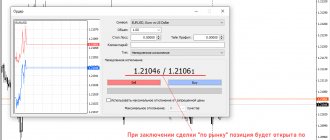

- The chart at the moment of entering the market , for clarity, you can make notes justifying the trader’s actions. If the work is carried out using graphical analysis, then marking is needed.

- You can take a screenshot using the built-in capabilities of Windows or through a third-party application.

- The result of the trade . Regardless of whether the trade is closed by take profit, stop, or early manually, it is advisable to attach a chart.

- A comment . Here we briefly indicate the trader's considerations regarding entry/exit from the market. It is advisable to write down emotions, for example, “the signal complies with the rules, but there is a feeling that it is not worth entering” or “the chart has not reached the Fibo level, the volume has been reduced.” If you are not familiar with Fibonacci tools, I recommend reading the post “How to Apply Fibonacci Levels.”

This is the required minimum . also add the following items :

- Maximum drawdown in percentage and in deposit currency.

- Volume.

- The state of capital after the position is closed.

- Duration of keeping the trade open.

- Losses due to swap, spread.

There is no strict standard for how to keep a trader's diary; you yourself determine its format and completeness. As for the management methods, any will do – from writing information in a notebook/notebook to using special services. Make your choice based on your own preferences.

Start trading with AMarkets

Timeline for when the deal is completed

This is the chart at the time the trade is completed. You need to specify the end result of the trade at R multiple of profit/loss.

Here's an example

Higher time frame

Trade entry schedule

Timeline for when the deal is completed

Next, I will discuss how to use a trader's diary to make consistent profits in the market.

Reporting services

Below I will give a short description of popular services through which you can collect maximum statistical information about trading. I recommend using at least one of them in everyday work.

Myfxbook

The service is convenient in that you can connect a trading account to it , and trading information will be transferred to myfxbook.com automatically. A lot of statistics are calculated, you get free information to optimize your trading.

You will need to register at myfxbook.com . A minimum of information is filled in, the captcha is entered, and the account is created. You will receive an email with an activation link, follow it.

Let's move on to connecting a trading account:

- On the main page in the drop-down menu of the tab "Briefcase» select the item «Add account" There will be a button with the same name in the new menu, click on it.

- In the next menu, select the terminal from which trading information will be downloaded. For MT4 there are 2 options – EA (Expert Advisor, copy using an advisor) and Auto update, this option corresponds to a simple transfer of information from the trading platform. Choose an option with auto-update, this is the simplest method, the data will be transferred to myfxbook.com constantly.

- At the next stage, account parameters are set - its name, investor password, a broker and the corresponding server are also selected. This information is provided to the trader at the time the deposit is created. If you don't remember, look for the corresponding letter in the mail. The investor password can be changed via MetaTrader 4, to do this go to Settings – Server – Change and set a new password. After entering the data, click on " Create Account».

- At this point, the connection of the account is completed, it is displayed in the list. By default, the results are visible only to its author, that is, the account is not public.

By clicking on the edit button, you will be taken to a menu with in-depth settings. Here you can configure the frequency of information transfer from MT4 to myfxbook.com, change the method of copying data (activate the “ through an advisor ” mode), and set a description of the trading system. Also, through the settings, the account is made public, however, this requires account verification on myfxbook.com.

As for reporting, detailed statistics on work are automatically calculated. A graph of deposit changes is constructed, the Sharpe ratio and a host of other statistical indicators are calculated. The change in deposit by month is also shown.

Monitoring is completely free , I recommend using it as an addition to a regular diary. As for what data to enter into the trader’s transaction log and which to look at myfxbook.com, with this approach you can manually record only descriptions of transactions. The rest will be monitored automatically.

Profitable trading in AMarkets

Marketstat

A complete trader's diary. Unlike myfxbook.com, on marketstat.ru you can connect not only a Forex broker account. The service can track trading on the stock market and work with binary options, and there are other features. Unlike myfxbook.com, you have to pay to use Marketstat.

Registration is standard , you only need to provide your email, password and account name.

After this, a separate account is created on Marketstat. Unlike myfxbook, the process of transferring information here is organized differently. Instead of choosing a broker, you need to select the exchange or market on which you operate, the deposit currency, the platform, and set the account name.

There are also advanced settings . They set parameters regarding trading commissions and merging transactions.

At the next stage, you will have to top up your account and activate your subscription. There is no free plan - this is the only drawback of the service in comparison with myfxbook.com.

Among the features of the service, I would like to note:

- Ability to download trading history from a standard brokerage report or manually. All transactions can be modified, duplicated, combined, and the required positions can be added manually.

- Ability to add comments and screenshots.

- Wide analytical capabilities. In addition to standard statistics, the service can classify results by type of entry points and trading style.

The efficiency of capital management, time statistics and other indicators are also analyzed. In terms of completeness of information, Marketstat is among the best.

Trader's Diary from Sergei Silantiev

Marketstat is the brainchild of Sergei Silantiev. But in addition to the online service, there is a trader’s diary in the form of an Excel table that is freely available. This is a ready-made document , all the necessary dependencies are already included in it, and the diagrams are updated automatically.

Notes on working with the journal:

- To work, you need to manually delete everything entered into cells with a white background. in the “ Data ” section.

- To update the table, just press Alt+F5 .

- Scatter and OHLC charts do not update automatically; you will have to manually set the data range for them.

- Double-clicking any field opens a window that explains the selected indicator in more detail.

- You can leave comments and rate transactions on a custom scale.

This journal is more labor-intensive due to the fact that data will have to be entered manually, but it is absolutely free .

PirateTrade

In terms of capabilities, the service resembles Marketstat, but there is a test version. The focus is on a comprehensive analysis of trading reports and support not only for Forex, but also for stock market instruments.

To receive a demo version, just leave your name and email. You will receive a link via email where you can download a trial version of the magazine. The diary is installed as a regular application.

The trial version of PirateTrade already includes trading statistics. To import your own reports or manually add transactions, you need to pay for access.

Key features of PirateTrade :

- Trades are imported from brokerage reports. Adjustment and manual addition of positions is supported.

- Lots of filters for trading analysis.

- Adding comments to each transaction.

- Support not only Forex, but also the stock market.

- Graphic display of trading results.

In terms of the completeness of the analysis of trading results, the service is slightly inferior to the analogues listed above. Due to the ability to comment on transactions, it can be considered as a full-fledged online diary.

Top Reasons Why You Need a Journal

The main reason is quite simple. When we are engaged in trading, we are in an open field, from where a sniper’s bullet can fly in at any moment. To survive, we must have a clear system in place that allows us to prepare for the worst and lay the foundations for future success.

How simple it would be if everyone had a personal trainer behind them, right? He would help us solve the main problems, guide us by the hand through key obstacles, and maybe even carry us through them. Yeah, there's no harm in dreaming, right? All we have is ourselves.

And if you want to truly learn something in this market, you need to continuously record your achievements. A detailed, loving journal is a great tool that practically replaces this hypothetical coach.

Many people consider keeping such diaries as an optional routine. Well, of course, this is not necessary: risk management is not required, money management is not required, time management, a trading plan... you don’t need anything, just press two “Buy/Sell” buttons for fun, right?

The only way to make money in this market is to be a clear-headed, cold and cynical professional. And for such a specialist, a diary is the first assistant. For everyone else, it really isn’t necessary. In the end, someone needs to replenish the brokerage cash desk.

What to write in your diary

Everything related to trading: before, during and after. Trading is a set of skills and specific abilities, regardless of what specific techniques or tools are chosen. And the final result depends on the systematization of your skills. It depends on how much you follow your own plan, how you implement it and track this implementation.

This is a very common... not even a mistake, but a misconception. That you can trade “out of your mind.” There is no need to formalize anything, it’s just that the stochastic crossed and I kind of entered into a deal, right?

Fantastic. Here’s a person on Skype showing me an unsuccessful deal and asking: “What didn’t work out”?

— How do I know what didn’t work out? It depends on your trading system. What is she like? Let's discuss it.

- What?

- System. Trading system. Trading plan. How do you trade? At random? Give us your entry criteria.

- Well, that’s me. Here, in general, the price approached the support line, I thought it would rebound and bet up.

- It's clear

This is a game with fate at random. Can you imagine an engineer constructing a building out of his mind, without any clear plan, estimate, or following building codes? Impossible. But in trading you will see such “houses” all the time. People simply don’t bother making trading a profession and are too lazy to even describe the criteria for entry from several points.

Meanwhile, the diary should contain:

- your motivations, why you came to this business;

- what the market is for you, how you evaluate and analyze it;

- how you analyze mistakes and missed opportunities;

- how you track your trades.

Everything must be written down. You can do it with a simple list, or you can do it with a complex program - whatever you like. Formalize your approach to trading. This is the only way to turn from an amateur into a professional.

In your diary you should find at any time:

- potential reason for opening a trade;

- description of the transaction;

- transaction size;

- your rules of risk, money and time management;

- analysis of an already completed transaction.

And remember - the diary is kept for you. Not for show. It should be your most important trading tool.

Trying to lead it reluctantly, without desire, just because Binguru or someone else insists on it, is a recipe for failure. You must feel its necessity and be soberly aware of it.

Reasons for opening a trade

Newcomers merge only because they do not understand what they are doing. Protecting themselves from the unpredictability of the market with an indicator or a “magic” signal, they simply play roulette. Meanwhile, you must have a clear, logical reason for entering. You are either a specialist or a little girl who got here, into this cruel market, by accident. What he will do to you can only be described in obscene words.

Therefore, in your trading plan, which we will talk about later, you must clearly describe exactly how you enter. Even if it is the intersection of moving averages, why not. Gradually you will add conditions for when to enter at the intersection, when not to, and so, smoothly and slowly, your system will be born.

As you know, technical analysis is not a strict science, but a struggle with the theory of probability, with mathematical expectation. Therefore, there are no 100% rules for opening a trade - but there are areas of increased probability.

How not to keep a journal

The key violation of the rules when keeping a diary is not taking it seriously. If you keep a journal just for the sake of formality, then it will not be useful. With this attitude, important information regarding psychology and emotions is guaranteed to be missed.

Another option for unwanted journaling is not including all the information. If a trader is lazy, does not accompany transactions with illustrations of the market state, or forgets to enter part of the transactions, the value of the report is reduced.

Both problems are solved by the trader taking the journal seriously. Keeping your own records should become a habit .

Why do we need it?

Your trading journal is a kind of diary that records your trading. Often, maintaining it can be the decisive factor that can make you a profitable trader. A trading journal will help you note your strengths and weaknesses. There is no perfect trader. Therefore, you must constantly improve your trading and not allow your weaknesses to put your trading account at risk.

If you are testing new trading strategies, you will have to constantly keep statistics, recording your results. You don't need to jump from one strategy to another when one strategy doesn't perform well in the short term. Thanks to a trading journal, you can analyze your statistics, noting the advantages and disadvantages of each strategy.

If you want to be a profitable trader, then you need to remain consistent in your actions. If you have a trade diary, you can study your past trades and determine which strategies and setups were losing money for you, and then stop trading them. Then you can focus on the strategies and setups that brought you profits. This way, you can gradually build up your statistical advantage in the market and earn even more.

Great Forex Broker for Trading

One of the best options for working on Forex is the AMarkets broker . In terms of trading conditions, it is in no way inferior to industry leaders. Working conditions:

- Regulation – membership in The FinaCom .

- The minimum deposit is $100 /€100/5000 RUB for standard accounts.

- Spread – from 0 for ECN , fixed from 3 points.

- Leverage – 1 to 1000, on ECN it decreases to 1 to 200. For beginners, I recommend reading the post “What is leverage”.

- Trading platforms – MT4 and MT5.

- The number of trading instruments is over 100.

- In-house developed indicators – Cayman and SOT. The first gives an understanding of market sentiment, the second provides data from CFTC reports.

Open a Forex account in AMarkets

I will also note additional opportunities - they offer welcome and regular bonuses, cashback, tournaments are held, and there are other customer incentives. Previously, a separate article “How to get a no deposit bonus” was published, in which you can learn more about promotions for clients.

The main thing when working with AMarkets is the confidence that the broker is guaranteed to withdraw your earnings.

Trader's journal in the form of a checklist

Certain criteria for trading must be written down in the checklist in advance. Then this document will be a kind of filter both for determining whether to open a deal or not, and for finding errors in trading. All traders need a trading plan to stay in the trade and not be controlled by unnecessary emotions. It is recommended to use such a plan each time before starting to analyze charts.

It is better for novice traders to print out a checklist and mark all the conditions with a pen each time before opening a trade until it becomes a habit.

View an example of a checklist

Analysis of transactions and your emotions upon entry

When analyzing trading, the most difficult thing is to give a sober assessment of your actions. If you placed, for example, a limit order in violation of the rules of the strategy, and this caused a loss, you do not need to explain your mistake by external factors. If you don’t know what a “limit order” is, take a short educational course on how to place a pending order in MT 4.

That is why it is extremely important at the time of entry to indicate not only the technical characteristics of the transaction, but also emotions. No one will control the correctness of keeping a diary; you need to learn this on your own .

As for the analysis, after accumulating an array of statistics, first of all look for emotional losing trades. This is one of the most common mistakes traders make. I recommend starting your trading optimization with this.

Screenshots of transactions

Your task is to take the maximum number of screenshots for zones where the odds are in your favor. I took more than a thousand screenshots of stochastics working with different candles, before the news, after, in different sessions, etc. All this extremely helped me filter where it should be used, where it is possible, and where it is absolutely impossible.

Take screenshots. A lot of. Different. With descriptions. In the live chart and the full version of Tradingview, they are done with one button - you don’t even have to install any separate program.

My old analysis of fundamental factors, saved in TV graphics

Save links to these screenshots with descriptions. It’s good to do this in your Excel diary or just in an online document, be it Google Docs, Evernote or iCloud notes.

Description of the transaction

You have opened a trade and are waiting for expiration. Great - you have a lot of free time. Don’t look at cats on VKontakte, but describe the reasons for entering. Did you enter just like that, by “intuition”? Great, you are on your way to “success”.

Or did you enter on a divergence? Just as soon as you saw her? Or there were other reasons, say, the price was near a significant support level on the 1-day chart, a price action pattern formed at the support, the price updated its lows. All of these are clear entry criteria that you write for yourself in order to eliminate the factor of random, blind entry.

Then, when you review already completed transactions, a screenshot and detailed description will be very helpful to you. After all, over time, you will forget about the deal. About these reasons, about the criteria, what you felt then. What does this lead to? To repeating the same mistakes. Every now and again. Round. What invaluable help a diary will provide you if you take the time to write down why this trade was opened!

Trade size

After the lesson about money management, you know everything about it. Indicate in your diary why you opened a trade with that particular volume.

- Were you confident in the accuracy of the input (why, reasons)?

- Suitable market conditions (which ones)?

- Good mood, have you decided on everything?

- You really needed money, so you decided to invest more?

You can learn a lot of interesting things about yourself by considering when and for what reason you opened certain transactions with different volumes. Don't be lazy to write this down.

Summary

A trader's diary is a tool that indirectly influences trading results. It teaches you to work measuredly with a clear assessment of each entry point. Keeping a diary allows you to eliminate the emotional component from trading over time, and thereby improve your results.

I recommend getting used to keeping a journal from the very beginning and entering information on all transactions into it. Regular analysis will show weaknesses in trading; all that remains is to eliminate them and continue trading. To make the task easier, you can use auxiliary services that collect an array of statistics automatically.

Share your own experience of keeping a diary in the comments. If you have questions, ask them, I will answer everyone. In order not to miss the release of new materials, I recommend subscribing to my blog updates in telegram . With it you are guaranteed not to miss the release of new articles. This is where I say goodbye to you, but not for long.

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Study your trading diary

The diary is a treasure. This is your trading life. On the weekends, when there's no trading, it's time to open it up and dive into your trading week. As you look through it, try to answer the following questions:

- Taking into account the risks, what was the correct size of the transaction?

- Was the entry really as successful as you thought?

- What tools could be used to improve it?

- Did you think through everything patiently or did you open a trade because you couldn’t wait?

- Was the trading plan followed when entering the trade?

- What happened to the support and resistance levels during the trade?

- Was there any important news?

By constantly asking yourself these and similar questions, you will learn to control your emotions and be able to treat the market as a normal, structured job, where no surprises can happen to you, because you have thought through everything in advance and know how to act in the event of profits and losses .

Improve yourself

A journal is a wonderful place to communicate with yourself. Ask yourself: what do I need to do to become a good trader? This is your opportunity to plan the path of self-improvement that you will follow.

And don’t write banal phrases like “don’t be stupid” or “I was too hasty.” We are always in a hurry, it's empty. What conclusions can be drawn from this? "Do not rush". Yes, brilliant.

Be very specific. What exactly are the steps you should take right now to improve your trading?

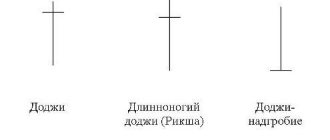

- Maybe it's better to study some candlestick combinations?

- Or analyze the performance of your trading system in the first hour of the Asian session?

- Perhaps it is necessary to filter false breakouts using ADX? It's time to analyze this in history.

Set yourself specific goals and achieve them. You are not taking an exam, there are no right or wrong answers. Be yourself, be honest with yourself. It is most important. Otherwise, any attempt to “deviate” from this process will lead to the fact that the diary will become formal and empty - just like your trades.

Take it seriously. A journal is your key tool. Along with risk and money management, it will become a tool of control and assistance if you allow it.

Study statistics

If the diary is kept in Excel, you have an excellent opportunity, using its built-in functions, to analyze your transactions in a wide variety of aspects.

This is how you can find out that you are much better at trading with the trend than against it or vice versa. That you absolutely cannot work during the Asian session, but you can work during the European one. That EUR/USD is not your pair at all, but AUD/CAD is yours.

The statistics always hide the reason why you have so many losses and not enough profits.

So look through it, look for patterns. Study the characteristics of negative transactions, look for the reasons why there are so many of them.

When you review trades several days after they occur, you may find things that shock and puzzle you. It turns out that sometimes you did not do what you should have done. That some AUD/CAD is your worst enemy, which only brings losses, and you enter it over and over again, absolutely thoughtlessly and senselessly.

It is not at all difficult to conduct it, because an experienced trader rarely makes more than 5-6 transactions a day. It is not difficult to describe them and view them from time to time.

What to do with statistics

When the journal accumulates sufficient transaction statistics, what should you do with it all? Nothing complicated. You actually need a diary for two things:

- finding what works;

- and what is obviously useless.

It is the diary that allows you to find answers to many questions regarding currencies, the best trading days of the week, special instruments and much more.

Try to use your diary to find answers to these and similar questions:

- which candlestick combinations, price action patterns or indicators are most useful in your trades and which are not;

- what you need to change in your indicators or your trading system to avoid entering too early or falling into traps like false breakouts;

- why do you miss expiration, overestimate the trend, incorrectly interpret the work of price with support and resistance;

- which expiration, statistically, suits you best;

- which trading plan, if there are several of them, is better;

- what good entries did you miss and why, is it a problem with your trading plan or emotional reasons;

- are there any problems with too many profitable trades in a row;

- which currency pair is more profitable for you and which is unprofitable;

- which news should you skip and which gives you the volatility you need;

- what trading session is best to trade;

- Are there any days of the week on which you have more profits or losses.

These and other questions allow you to quickly build a picture of when and how you should open trades.

The next step is to make the necessary changes to your trading plan and practice them continuously until the new rules become part of your nature. And don’t forget about the diary of emotions, write down how you are doing with the new plan, what has changed and what remains the same.