It would seem that the niche of payment systems has already been filled and no one will be able to compete with Webmoney, QIWI or Yandex money, but new payment systems continue to appear on the network.

We are talking about the Payeer system, which, although it was created back in 2010, began to gain momentum only in the last couple of years.

Today, more and more services are connecting to Payeer, which is not surprising; this system has certain advantages.

You can open a wallet in it in just one step (by entering your Email) and after that financial transactions are immediately available, without additional confirmation. But to use the wallet, you first need to top up your Payeer account.

How to top up your balance on Payeer?

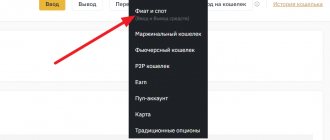

Another difference between this system and its analogues is the ability to deposit funds in a huge number of ways. To top up Payeer, you need to log into your profile and go to the appropriate section:

On the Payeer replenishment page there is a form where you need to select a currency and indicate the transfer amount. After filling out the fields, click “Top up” and you will be taken to a confirmation page:

Next comes confirmation through the official page of the service you decided to use. Pay attention to the message that the card must be confirmed (if you top up using this method). All that remains is to fill in the data, as when paying in any online store:

In addition to transferring from a card, there are several other methods. Every user will definitely find a convenient way to top up their Payeer account. Below we will consider each option separately.

System reliability

In general, the reliability of Payeer is ensured by the same methods as other payment systems - authorization using a login and password. Payeer recommends not storing passwords and wallet numbers in the mail, but immediately deleting all data. I often receive a question by email: “What should I do if I forgot the password for my Payeer wallet?” I didn’t figure it out right away either, because there’s no word anywhere on the site about password recovery. But everything is very simple.

On the main page of the site, in the top line, in the password line there is an image of a lock. Click on it and a password recovery form will appear. In order to recover your password, you need to enter your login and the secret word that you were asked to come up with when registering your wallet.

If you want to ensure additional security for your transactions, you can set up to receive a confirmation code via SMS (although sending messages to your phone is paid). You can also use the Master key - you will need to enter it in your personal account or when paying for services.

If you are interested in the reliability of the site and the risk of investing money, go to the trustevset.rf website and read the basic data from checking the payeer.com website, as well as reviews about the system.

Exchangers for replenishing Payeer from a Sbarbank card, Qiwi, phone and other methods

There is a universal method to transfer funds to your electronic wallet. It doesn’t matter whether you decide to top up your Payeer wallet from a Sberbank card, another payment system, or cryptocurrency (which is not listed on the official website). Exchange offices will help you carry out such an operation.

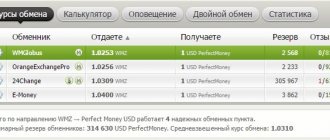

You need to look for them through BestChange monitoring:

This is a free service, it not only provides a list of verified exchangers, the table is also sorted by the profitability of the exchange rate. Therefore, you can make the conversion as profitable as possible.

Let’s imagine that you decide to top up Payeer with Qiwi, select these options in the “Give” and “Receive” columns, after which a list of sites opens:

Opposite each exchange office is indicated the rate, the minimum amount for the operation, how much money is in reserve. Plus, you can read user reviews about each exchanger.

Top up via Sberbank online

- You need to log into your account and select the “Top up” section.

- In the list that appears, you should mark the method that involves the use of bank cards.

- Click on the “Sberbank online” option.

- Activate the top-up option and follow the instructions provided.

- Log in to Sberbank online.

- Enter the payments tab and select the electronic money section.

- Check the box next to the W1 payment service.

- Indicate the wallet address as well as the payment amount.

The balance is credited within a few minutes, and the commission does not exceed 1% of the payment amount. There will be no difficulties with how to top up Payeer through Sberbank online if the user follows the instructions above.

How to top up your Payeer wallet through exchangers?

Any beginner will quickly figure out how to use exchange offices. By choosing one of the options on BestChange, the site opens. As a rule, in the first step you are asked to indicate details and amount:

The interface may be slightly different, but the steps are the same. After filling out the form, the user is directed to a page to verify the data. Once again, make sure that the account numbers are indicated correctly and look at the commission, it is constantly changing and each exchanger has its own:

After clicking the “Go to exchange” button, you are directed to the official page of the payment system with which the operation is planned. Likewise when using cards, mobile operators and other methods. With the exception of cryptocurrencies, they provide an address for transferring coins.

If you haven’t found a good exchanger or monitoring is not available, use a similar system – Course Expert.

Exchange offices significantly expand our capabilities. With their help, you can make a money transfer even if the required method is not provided on the official Payeer website.

Payeer Identification

User identification is needed to increase limits and be able to replenish your wallet from bank cards. The withdrawal limit for unverified wallets is 999 USD per day.

And for legal entities to remove restrictions on mass payments and payments via SWIFT.

There are 2 options for personal identification.

Identification using an internal passport:

- Upload a copy of the first page of your internal passport.

- Loading the registration page.

Identification using a foreign passport, driver's license or military ID:

- Upload a page with a photo and document number.

- A document with a stamp, your data and residential address. This could be a bank statement, a utility bill.

In my opinion, the first option is easier. Identification confirmation takes up to 2 business days.

Top up Payeer through the terminal

There are multi-cash desks on every corner, and through some of them you can top up e-wallets. Everything is simple here, a payment system is selected on the screen, the account number is entered, then the bills are inserted into the bill acceptor. You can see an example:

Anyone who has at least once in their life transferred money to their phone from a terminal will easily figure it out. The only caveat is that Payeer is not always on the list of supported payment systems. In this case, use an intermediate wallet, for example, transfer money to Qiwi first.

Sections of the Payeer payment system

In the “Balance” section you can see the status of your wallet. Each wallet has a button for depositing and withdrawing money.

The “Transfer” section exists for withdrawing funds to other payment systems. Here you can also send money to another user's account within Payeer.

You can conclude exchange transactions in the crypto-fiat position and in the opposite direction by clicking on the “Exchange” section.

The exchange can be made in the system between your wallets - the “Exchange” section. There is a minimum for exchange - 20 rubles or 0.5 dollars.

The “History” section will help you view your transactions for a certain period. You can also download the story to your gadget. All documentation and instructions for working with the service are located in the API section.

How to top up your Payeer wallet with cash?

In addition to the fact that the Payer administration suggests using an authorized exchange office, there is another company that accepts cash. The A-exchange exchanger is quite popular, old, proven and stable. Here, when choosing the direction of exchange, you can choose cash:

Offices are located only in Moscow and Simferopol, the addresses are listed on the website. There is no commission for such an operation, and the minimum replenishment amount is 3,000 rubles.

You can use this exchanger to carry out other transactions; Payeer can be exchanged for many other currencies here. We didn’t find any other decent exchange offices that accept cash.

Directly from your account

You can issue yourself an invoice or make a bank transfer using this deposit method. Not many banks work with Payer, but in every city you can find the bank you need. The commission is 1-2%, and you can use the following banks:

- Alpha click;

- Sberbank Online;

- Prosvyazbank;

- Svyaznoy Bank;

- Sepa;

- Wire Transfers.

After selecting a bank (for example, Sberbank), you will receive detailed instructions on the screen. If you do not want to enter your card details, then the option of using Alfa Bank or Sberbank will suit you.

Top up your Payeer wallet via phone

This can be done through exchangers, but it is better to use the official website. Why? Because it's more profitable. Not a single exchange office will carry out your operation at 4.99%, which is exactly what Payer charges:

An SMS with instructions is sent to the phone; the subscriber must perform several steps to confirm the operation.

Please note that mobile operators may charge additional fees, so check the amount in the message and if it does not suit you, then simply do nothing. Funds arrive within 10 minutes.

Conditions for transferring money to the Paer wallet from your phone

Another simple way to top up your Paer wallet is to use your mobile phone account for this purpose. This is very convenient when you are on the go or if for some reason you do not have a bank card at hand. And your mobile phone is almost always with you, so you can use it at any moment and anywhere.

However, not every mobile operator provides such a service. It is available only to subscribers of Russian companies:

- MTS;

- Megaphone;

- Beeline.

In this case, restrictions on financial transactions are more stringent than when transferring from a bank card. You can top up Payeer from your phone balance with an amount from 10 to 15,000 rubles. For this, the payment system is charged 2% of the amount of the money transfer. And the gateway commission ranges from 5.48 rubles to 3.2%.

More on the topic: How to transfer money from Payeer to Webmoney - step-by-step instructions for withdrawal.

Where and how to top up Payeer in Kazakhstan and Belarus?

Residents of the CIS countries also actively use payment systems common on the RuNet. It often happens that you cannot use a bank card or payment system, not to mention visiting an office.

In monitoring exchangers you can find not only popular directions in Russia, for example, there is Sberbank in tenge:

Directly from the KZT card are transferred to rubles or other Payeer currencies. If there is no suitable method, think about a multi-pass method. For example, first transfer money to Yandex or QIWI wallet, and then send money to Payeer from them without any problems. With Qiwi, when topping up from a card of 2,000 rubles or more, no commission is charged, so you won’t lose anything.

Deposit methods and fees

To top up your account, you must first create an application on the payment system website. Depending on the method you choose, you will be given data for the transfer. This could be an account number or bank details.

For 2022, the number of ways to deposit money on Payeer has decreased. There is no answer to what this is connected with. Replenishment via Sberbank Online has disappeared from the site. Transfers from Sberbank can only be made using a credit card from this bank. There was also no replenishment through the terminal and replenishment through Euroset.

For April 2022, the following methods are available:

- From a bank card. Visa, MasterCard, Maestro and Mir are available. The total commission, which includes the payment system service fee and payment for gateway services, is 6.4%. There is good news for Mir card holders - the replenishment fee has been reduced to 6.29%.

Important!

Only identified users can transfer from plastic. At the first request, you will need to send copies of documents, including a photo with a passport in hand. If you refuse identification, the money will be returned to your account within 30 days.

- From the balance of third-party payment systems. Supported: Qiwi (8.61%), Advcash (2.98%) and Yandex.Money (8.7%). Russian payment systems receive higher commissions due to the high cost of payment gateway services.

- By bank transfer from Alfa-Click. The final service fee will be 7.23% of the amount.

- From your mobile phone balance. Only the “big three” operators are supported: Megafon, MTS and Beeline. In all cases, the service fee is the same - 10.31% of the transfer amount.

- From other payment systems and banks, using exchangers certified by the service. It is impossible to predict the size of the service fee in this case, since it depends on the exchanger, the currency being transferred and from which system (bank) we are withdrawing money. The commission can be either 4% or 30%, so check in advance how much you will ultimately have to pay for processing the transaction.

It will not be possible to credit money to your Payeer balance without a commission. Even when it was possible to deposit cash through the terminal, the owner of the device still took a certain percentage for processing the transaction. The cheapest way to send funds is from the Advcash service. If you do not want to contact other payment systems, then it is better to top up from a Sberbank card, or from a credit card of another bank operating in the Mir system.

And the last way to profitably top up Payeer is to find an exchanger with a low interest rate. Most often these are currency services, but you can also find ruble ones.

Payer replenishment using Global24 wallet in Ukraine

Residents of Ukraine have access to another interesting method. You can top up your Global24 e-wallet in many ways and then transfer the money to your Payeer. To register, you only need a phone number or email. Over 250,000 users have already opened a virtual account here, and you can make a lot of different payments from it:

- transfer money to a card;

- top up your phone;

- pay for television;

- replenish your balance in games;

- pay for web services;

- repay loans.

In total, more than 1000 services are available to clients and no commission is charged for their use. There are 10,000 points on the territory of Ukraine for replenishing this wallet, all banks are connected. Download the mobile app, the interface is even more convenient:

First, you will top up your internal account, and only then you will be able to send money to Payeer or use it in other ways. This is a very convenient wallet that replaces any exchangers and offers favorable conditions.

Payeer exchange: features and nuances

The exchange was created specifically to easily and easily buy, sell, exchange cryptocurrency for digital money or fiat. Considering that the presented exchange is connected directly to the wallet, you can become a player on this exchange only if you have a payeer account.

Registration on the exchange is standard, via email confirmation. Trading can be carried out on the exchange without verification. In this case, get ready to face withdrawal limits. Do not limit yourself to only those

The exchange interface is quite laconic and contains such sections as a book of buy and sell orders, a chart of the rate of the selected currency pair, a section for creating orders, a chat for users, and order history.

To replenish your account, there is a “Replenishment” section. Select the required currency, payment option and complete your transaction. Conditions for commissions and limits for given directions are located on the right. The calculation is individual for each option. If you are satisfied with the conditions, click on the “Top up” button and follow the instructions.

Other articles

- — Exchange rules: how to exchange Bitcoin for rubles

- — The process of exchanging rubles for bitcoin, nuances

- — Features and nuances of exchanging bitcoin for qiwi

- — Features of exchanging Bitcoin (BTC) to Sberbank

- — What is an exchanger

- — How to buy cryptocurrency profitably

- — Cryptocurrencies: Ethereum price

- — Exchanger Shakhta

- — How to buy or sell Bitcoin through Tinkoff Bank

- — How to sell Bitcoin for cash

- — Bitcoin to dollar rate

How to activate the function?

To ensure that contactless information exchange is not blocked, the NFS module is activated. To enable the NFC function on Samsung J1 or another model, use the following instructions:

- launch a smartphone;

- in the main menu go to the “settings” section;

- find the “NFS” item;

- move the slider to the “on” position.

Now we know how to enable the NFC function on the J6 smartphone or on another model of this brand that can support the option.

Buy Payeer (dollars)

You can buy Payeer dollars profitably by exchanging Advanced Cash (USD/RUB/UAH/KZT/EUR), Capitalist (RUB/USD), EPay (EUR/USD), FasaPay (USD), Idram (AMD), Neteller (USD/EUR) , Payeer (USD/RUB/EUR), Paymer (USD/RUB), PayPal (USD/RUB), PaySera (RUB/USD/EUR/PLN/CZK/BGN/GBP), PerfectMoney (USD/BTC/EUR), Qiwi (RUB/USD/EUR/KZT), Skrill (USD/EUR), WebMoney (WMR/WMZ/WME), WeChat (CNY), Yandex.Money (RUB), MIR card (RUB), 0x (ZRX), Basic Attention Token (BAT), Bitcoin (BTC), Bitcoin Cash (BCH), Bitcoin Gold (BTG), Bitcoin SV (BSV), BitTorrent (BTT), Cardano (ADA), ChainLink (LINK), Cosmos (ATOM), Dash (DASH), Dogecoin (DOGE), E-Dinar (EDR), EOS (EOS), Ethereum (ETH), ICON (ICX), Lisk (LSK), Litecoin (LTC), Monero (XMR), NEM (XEM ), Neo (NEO), OmiseGO (OMG), Paxos (PAX), Peercoin (PPC), QTUM (QTUM), Ripple (XRP), Stellar (XLM), Tether (ERC20/TRC20/USDT), Tezos (XTZ) , Tron (TRX), True USD (TUSD), USD Coin (USDC), ZCash (ZEC), Alfa-Bank (RUB/UAH), Alipay (CNY), Avangard (RUB), Belarusbank (BYR), Eurasian Bank ( KZT), ForteBank (KZT), Gazprombank (RUB), Halyk Bank (KZT), Kaspi Bank (KZT), Kazkommertsbank (KZT), Monobank (UAH), Otkritie (RUB), Oschadbank (UAH), Privat24 (UAH/USD ), Promsvyazbank (RUB), FUIB (UAH), Raiffeisen Aval (RUB/UAH), RNKB (RUB), Rocketbank (RUB), Rosselkhozbank (RUB), Russian Standard (RUB), Sberbank (RUB/UAH/KZT), Tinkoff Bank (RUB), UkrSibbank (UAH), Visa/MasterCard (RUB/USD/EUR/UAH/BYR/KZT/AMD/TRY/MDL), VTB24 (RUB), Contaсt (USD), Zolotaya Korona (USD), MoneyGram (USD/EUR), Ria (EUR/USD), Unistream (USD), Western Union (USD/EUR), Wire (SEPA) (EUR/BGN), Wire (SWIFT) (RUB/BYR/UAH/USD/ EUR/KZT/PLN/INR/THB/GEL/KGS), Cash (RUB/USD/EUR/UAH), Binance Coin (BNB), Exmo (RUB/USD/EUR/UAH/BTC), Livecoin (RUB/USD /BTC/ETH), NIX Money (BTC/EUR/USD), Waves (WAVES), Corn (RUB) or PM voucher (USD).

Recent exchanges

| Exchanger | Exchange |

| 1 | 100 Payeer USD 90 Cash USD |

| 2 | 100 QIWI RUB 1.19 Skrill USD |

| 3 | 100 Neteller USD 0.01 Bitcoin BTC |

| 4 | 20 Skrill USD Bitcoin BTC |

| 5 | 0.0026 Ethereum ETH 0.9 Payeer USD |

| 6 | 100 PayPal USD 84.93 Payeer USD |

| 7 | 100 Neteller USD 615.03 WeChat CNY |

| 8 | 100 Neteller USD 91.32 WebMoney WMZ |

| 9 | 100 Payeer USD 100 PayPal USD |

| 10 | 100 PayPal USD 84.93 Payeer USD |

Popular exchanges

| Exchange directions |

| Skrill USD Payeer USD |

| Visa/MasterCard USD Bitcoin BTC |

| Skrill USD Bitcoin BTC |

| PerfectMoney USD Tron TRX |

| Tether USDT WebMoney WMZ |

| Payeer USD PayPal USD |

| Bitcoin BTC Wire (SWIFT) USD |

| Tether USDT PayPal USD |

| PerfectMoney USD Bitcoin BTC |

| PerfectMoney USD Cash USD |

Popular operators

| Operator | Courses | |

| 1 | Kiwi | 3692 |

| 2 | Ethereum | 3134 |

| 3 | Litecoin | 3094 |

| 4 | Sberbank | 2718 |

| 5 | Yandex money | 2412 |

| 6 | Wire (SWIFT) | 3708 |

| 7 | Alfa Bank | 2386 |

| 8 | Bitcoin | 4080 |

| 9 | Dash | 2440 |

| 10 | Privat24 | 1801 |

registration on the site

Becoming the owner of a wallet on this site and paying for the necessary services is quite simple. To get started you need:

- go to the payment service website;

- fill out the registration form (only email is needed);

- indicate the verification code.

Registration takes a few minutes, after which the user receives the Registered status. This is a universal account that can be used without identification. If you need Personal or Business, you need to confirm your identity. A business account provides the owner with the opportunity to use all the functionality of the system.

But if there is no need to make mass payments and use other features, then the owner of the wallet may not undergo identification. Regular payment of bills or receipt of funds is possible without this. The only drawback of such anonymity is the presence of certain limits. For example, only 2 financial transactions on a plastic card, with the maximum amount being $400.

To identify you, you need to fill out a short form with your personal information. You also need to attach scans of two documents. One is to confirm your identity, the second is to confirm your residential address. After checking the provided documents, the user has the opportunity to increase the limits for depositing and withdrawing funds.

Registering an electronic wallet on the service is carried out without any problems, since you only need an email. In addition, the site is Russified, so knowledge of English is not required. As for replenishing your balance, this can be done in any suitable way. But if the transfer is carried out online, then it is better to use proven exchangers for this. It's fast and safe.