The fall in bank rates, the instability of the financial sector and the tense anticipation of change - these events of the past and early this year forced Russians to pay attention to the stock markets, where, it seems, they can protect and increase their own funds. However, today it is wrong to rely only on this investment tool, says investment expert, organizer of the International Investment Congress, real estate specialist in Europe, investor Anna Stuckert.

What to invest in in 2022 to avoid losing money? Where can you invest profitably, and which offers should you definitely refuse? And how can a beginner, without knowledge and experience, approach investing correctly? Read the expert's answers to these questions in the FAN .

Photo from the personal archive of Anna Stukkert /

Where to invest in 2022 and is it worth it?

Investors perceive 2022 as the time of recovery from the Great Depression of our era. Right now, there are positive changes that indicate overcoming a major economic crisis, in which both investors and ordinary people who make decisions about buying and selling real estate have deeply realized the reality of the pandemic and its catastrophic consequences. But at the same time they realized the need for real estate transactions.

“Last year we did not acquire anything,” comments Anna Stukkert, organizer of the International Investment Congress. — Moreover, I dissuaded clients from buying and selling, since the price was unstable, there was practically no market. The only exception could be the need to move or benefit.”

But today there are noticeable changes. According to the expert, the peak of mass sales and purchases of real estate at inflated prices will occur at the end of 2022. For this reason, it is worth buying now, and a lot of real estate. But not just any one that catches your eye in your city or area. It must be liquid.

“If we talk about Germany, one- and two-room apartments are guaranteed and easily sold there in Munich and Berlin,” the expert notes. — An investor with any income can afford such a deal. It is, of course, more difficult for Russian citizens than for citizens of the European Union. But if you have equity capital of at least 50% of the property’s value, and in rare cases - 30% of the value, you can buy real estate in Germany, Bulgaria, and other European countries.”

Federal News Agency /

Comparison of Bitcoin and traditional currencies

| Bitcoin | Rubles, dollars and other fiat money | |

| Inflation | The number of coins is limited to exactly 21 million bitcoins. If demand continues to grow, and there is always a limited supply of coins, the rate will rise. The cost depends on the demand of system users who decide whether to invest in Bitcoin. | Fiat money is becoming cheaper every year. The exchange rate always reacts to government decisions, political events, and the general state of the economy. |

| Security | Own infrastructure, investments from private investors in the form of energy costs, computing power, investments from professional players: banks, large companies, investment funds. Now Sberbank, Intel, Microsoft, etc. are investing in Bitcoin. | Until the mid-20th century, the exchange rate was ensured by the real reserves of gold in the treasury. Next, a partial peg to the dollar was introduced. Since 1971, the value of the US currency has been completely decoupled from the gold reserve. The value of any national currency is dictated by politicians and has no connection to a real product. |

| Commissions and transaction speed | There may be no charge, but the more transactions there are on the network, the higher the fee will be in order to complete the transfer faster. | From 1.8%, but not less than a fixed amount. |

| Supporting infrastructure | Not only a digital currency, but also a payment system that does not require intermediaries. | Needs additional infrastructure: banks, payment systems, etc. |

| Confidentiality | Transactions are public and stored in clear format. Secrecy is achieved by the anonymity of address owners. | Ensured by restricting access to information. There is a possibility of data leakage and fraud. At the same time, financial transactions are under the supervision of Rosfinmonitoring. There is a tendency to tighten the rules for the turnover of large amounts. |

| Emission | The volume is limited and is mined by system users. | Regulated by the state, often does not depend on the real state of the economy. |

| No boundaries | The transfer can be made to anywhere in the world. Beyond politics and sanctions. | May be limited between states due to political or economic reasons. For example, it is now difficult to carry out a transfer from Moscow to Kyiv. |

As the number of users and transactions with cryptocurrencies in the system grows, there is a need to create new blocks. This task is performed by miners - people who use the resources of their computers, create new blocks and fill them with user transactions. Miners receive a commission for processing transfers.

We will not talk in more detail about blockchain technology. Participants in the system, in principle, do not need to know how cryptocurrency works in order to invest in it and use it. So, for example, we use payment cards every day, without understanding the Internet: how it works.

Where to start investing for a beginner

Even if you understand the right direction, investing without any experience or knowledge is risky and difficult. Of course, there are chances to make a profit, but there is a much higher chance of being left without anything at all. Therefore, Anna Stukkert first advises trying to understand the issue, and only then getting out your hard-earned savings. Then investing will feel less like roulette.

“I recommend, at a minimum, reading open sources and the works of investment specialists,” the expert comments. — Unlike educational theorists who teach at economic universities, experts are people who have bought and sold a lot in real life. They don't teach theory, they pass on experience. But I don’t recommend taking paid courses. I signed up for them several times, but did not receive anything valuable. Just general phrases, pure water.”

You can find useful information yourself. Yes, you will have to try: crawl through a lot of sites, read a large number of articles, and not just skim through them, but understand them, delve into them. It is important to gain experience and try to bring different proposals to a deal.

The best way to understand the intricacies of real estate transactions is to try working as an agent yourself. Communicate with sellers and buyers, listen to recommendations and arguments, participate in negotiations and transactions. And even if the deal doesn’t go through, you will still have invaluable practical experience, and you will a priori be head and shoulders above other novice investors.

pixabay.com/geralt

Where to invest for a novice investor

To answer this question, it is important to estimate your net worth. If you have 1000 euros on hand, you shouldn’t invest, it doesn’t make sense. You need to save the amount, and think about investing when you have at least 100 thousand euros in your hands.

“If you don’t own a home, that’s what you need to buy first,” notes Anna Stukkert. - But only liquid, which is easily sold. If you have housing, you can split your portfolio: invest 10% in Bitcoin, the stock market and give it a try.”

A beginner cannot handle this job alone. Here we need mentors, guides who will tell you what right steps to take. But it is impossible to give general recommendations on investments: despite the presence of hundreds of books on investing and accessible educational programs, including from leading Russian banks, such recommendations simply do not exist.

“Be prepared to lose this money,” the expert continues. — In the world of stocks, cryptocurrencies and the like, there are no guarantees. There is a chance of not losing, there is a chance of earning. But precisely because of the high risks, no more than 10% of your own funds should be invested in this type of investment.”

The remainder needs to be distributed. For example, to obtain a profitable loan in your country. The expert calls a loan with a rate of no more than 6% per annum profitable, and ideally 1-2%. If the rate is above 6%, it is not worth taking a loan; it is a priori unprofitable.

Part can be invested in gold, part in a proven business franchise. But buying stocks during a pandemic is risky. The exception is the titans of the market, for example, online retailers and large online stores, which are still on top today.

pixabay.com/Gerd Altmann

Case example. How much could you get from an investment of 2,000 rubles for 20 days?

Now in numbers. Let's consider a case about whether to invest small amounts in Bitcoin.

| How much could you earn on BTC in December 2017? | |

| Given: investment amount | 2000 rubles |

| Experiment start date | December 1, 2022 |

| Experiment end date | December 21, 2022 |

| The cost of 1 bitcoin at the beginning of the experiment | 582,730 rubles |

| Total investment | 343,212 satoshi |

| The dynamics look like this |

|

Let us remind you that on December 20, the Bitcoin exchange rate fell by 15%. Experts assessed the bearish trend as a market correction after rapid growth. Thus, for 20 days of December 2022, the return on an investment of 2,000 rubles amounted to 1,353.5 rubles. The answer to the question: “Why is it worth investing in Bitcoin?” We invite the reader to search for himself.

Where is the best place to invest money in 2022?

The only sure option for this year is real estate. But before investing, it’s worth taking a good look at those cities and countries where it has seriously fallen in price due to the pandemic, but before that there were no sharp fluctuations in value for 50 years.

This is complex analytical work that is carried out by real estate and investment specialists. You can also obtain such data yourself, but there is a possibility of making a mistake. Therefore, for advice, you should contact an expert who specializes in real estate in a particular country or region.

When choosing an investment object, countries and cities where prices have fallen more are especially attractive. But if there have been crisis periods there before, when prices rolled down, you should not focus on such an unstable market. An investor will not be able to enter it as a safe haven and gain confidence in preserving and increasing his own funds.

Mining

Mining BTC tokens can be considered as an indirect investment in Bitcoin . The investor does not buy the tokens themselves, but the equipment for their extraction, but the ultimate goal is to earn money by increasing the value of Bitcoin coins.

In the case of BTC, the entry threshold for mining is extremely high. This is the oldest coin; the days when BTC tokens could be mined on CPU and GPU are long gone. For more or less tangible results, you will have to buy an ASIC, and these devices cost a lot.

For example, the Bitmain Antminer S19 PRO model has a power of 110-115 Th/s. This means that with the cost of electricity being about 5 rubles. for kWh per month he can earn about $1395. With the device costing $17,830, this makes a quick payback in 2-3 months impossible. For businesses, this is an average figure, but it is calculated taking into account the fact that the crypt will remain at current levels. When the exchange rate declines, profitability will also drop, and the payback period will increase sharply.

Bitcoin mining is problematic for the average user . Problems are related to:

- High cost of equipment . Not everyone can spend 1.3-1.5 million to purchase even one ASIC, not to mention farms of dozens of such devices.

- High risks . Crypto growth is not guaranteed; payback may increase from the current 6-12 months to several years.

- Low liquidity of equipment . ASICs are more difficult to resell than, for example, video cards. ASIC is too “narrow” a device, suitable only for mining.

- The need to equip a separate room for “digging” the crypt . ASIC puts a high load on the power grid; it is better not to install a farm in an apartment.

In theory, it is possible to enter into Bitcoin mining, but the risks are too high; it is better to invest through the purchase of tokens on exchanges or exchangers.

I also recommend reading:

Interest Coverage (interest coverage ratio) - a method for assessing debt burden

Interest Coverage Ratio (ICR) refers to multiples that measure the debt burden of a business. This indicator allows you to understand whether the company […]

Cloud mining

The principle is the same as that of conventional mining - coins are mined using ASIC. The difference from the standard approach is that the investor does not need to spend money on purchasing equipment. Mining is called cloud mining because you pay to rent part of the computing power from the lessor. As a result, the income is somewhat less than with conventional military-technical production due to additional rental costs.

But, given the cost of equipment, cloud mining is the only option to try “digging” without investing a couple of million rubles. However, there are no guarantees that this approach will be more profitable than investing in Bitcoin through crypto exchanges.

Prices are provided on the relevant sites; they are comparable to the cost of an ASIC, but provide temporary access to the device. The cost is selected so that during the period while the ASIC is rented, the user has time to compensate for rental costs and gain profit. True, all this is relevant only if the value of military-technical cooperation remains at the current level.

Where is it profitable to invest money without risks?

The least risky investments are in real estate, as well as in stones - objects that are inextricably linked to the earth. The former are characterized by the capitalization of funds and their consolidation in a reliable segment. The latter are also reliable, proven over centuries. But Bitcoin and stock markets always create the risk of losing everything.

“Bitcoin has now, oddly enough, also strengthened its position,” notes Anna Stukkert. “But, even having extensive experience in making money on cryptocurrency, I cannot recommend such investments, much less call them classics, and guarantee that all this will not burst. Both Bitcoin and stock markets are always a transfer of money into an untested niche.”

Investing in cryptocurrency in 2022

As in previous years, you can try, but you need to be prepared for losses. According to the expert, in order to strengthen your positions, you can divide 10% of your portfolio into five or ten traders and work with each of them, allocating a little bit of the planned amount. But as soon as one of them starts saying “give me more money,” under no circumstances should you give it. Observe the situation for at least six months, and then quietly withdraw funds and draw conclusions for yourself which trader you liked working with more.

“You can repeat it with it,” advises Anna Stukkert, “but treat these investments like roulette. I know multimillionaires and billionaires who have made good money on cryptocurrency, but in most cases it was from commissions, not from the transactions themselves.”

pixabay.com/

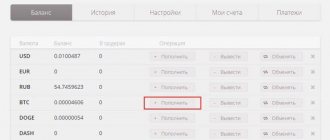

Rating of cryptocurrency exchangers

The reliability of an exchanger is determined by the time of its existence and its reputation. One of the oldest is “Matbi”. It has been successfully operating on the market since 2014 and has earned the trust of hundreds of thousands of users.

Rating of cryptocurrency exchangers:

| # | Exchanger | Website |

| 1 | Matby (editor's choice) | https://matbea.com |

| 2 | NewLine | https://newline.online |

| 3 | BetaTransfer | https://betatransfer.net |

| 4 | Baksman | https://baksman.org/ |

| 5 | Coinstart | https://coinstart.cc/ |

The criteria by which this rating was compiled:

- Reliability and user trust in the exchanger.

- Commission and rate : the exchanger should not charge hidden commissions from clients, everything should be as honest and transparent as possible.

- Simplicity and convenience of the interface : even a beginner should be able to figure out how to buy or sell cryptocurrency on an exchanger on the first try.

- Features of the platform : the presence of additional features, such as a cryptocurrency wallet with three-factor authentication on “Matbi” or the presence of a mobile application for Android and iOS there.

Investing in shares

You should only invest in the titans of the world market, but even in this case you cannot rely on your own “gut” if there is not enough investment experience. It’s better not to buy anything on your own, since a beginner simply won’t be able to figure it out on the official market.

We need a guide who will help and advise, and then, of course, take his commission. The approach to choosing a broker should be the same as with cryptocurrency: first a few, dividing the portfolio into parts and refusing to invest more, even if the broker strongly advises doing so “here and now.” It is important to understand that no matter what the broker says, and no matter how he convinces that he is no less interested in your earnings than you, in fact, he will receive his commission in any case, even if the transaction itself turns out to be unprofitable for you.

How to safely store bitcoins

Where is the best place to store bitcoins depends on your goals and investment strategy.

Initially, Bitcoin Core is considered the official wallet. This is a program that you need to install on your computer. It cannot be hacked, but attackers can gain access (login and password) to your computer, and then they will be able to transfer your funds to their account. In addition, this wallet weighs a lot (by the end of 2022 - about 100 GB, and its volume increases with the increase in the number of transactions).

For small or temporary accounts, online services like Blockchain.info or mobile applications are quite suitable. However, such services are the most unreliable - they have a high level of protection, but from time to time hackers still hack these applications and at their disposal it is not your personal account, but the funds of all the wallets of the hacked service.

If you trade on an exchange, you can store funds in your account directly on the exchange. However, firstly, exchanges are hacked from time to time, and secondly, there have been precedents when exchange owners simply disappeared with all user funds.

The safest way to store bitcoins is cold storage, namely a “flash drive” that is not connected to the Internet. The most popular option is the Ledger Nano S. It is unhackable, has many functions for conducting transactions with different cryptocurrencies, and is regularly developed.

Where to invest money for passive income

Investing and getting rich while “lying on the couch” is an attractive idea, but not feasible. One of the popular modern trends is that investing in an online business, according to the expert, will not help protect money, much less increase it.

“Promises that people will buy a product, and you will only receive money and do nothing, are not true,” notes Anna Stukkert.

Stable passive income can only be provided by renting real estate, but, unfortunately, it also depends on many factors. There must be a tenant, nothing should happen to the object, its technical condition must be maintained. But if we are talking about signing an agreement with a management company that will take on all the risks, then this option is profitable.

pixabay.com/Gerd Altmann

Long-term investments

Long-term investments are called investments with capitalization of funds. And this is investing in real estate. Giving 1000 euros to get 10 thousand in a year is risky. The bank may burst, the shares may fall in price, the company may go bankrupt...

Of course, something can also happen to real estate, but to minimize risks, there is insurance. You can also receive income - rent. Even if it is minimal, you will definitely not lose money, and stability is what every financial market professional strives for.

You need to invest in real estate for a long time, at least for 5-10 years. By buying and selling annually, the investor will spend more on notaries, taxes and other related costs than he will earn.

“Don’t fuss,” advises Anna Stukkert, “unless, of course, we are talking about a speculative price and when there is a ready buyer for the property. But this is rare. The reality is that stable investments are always long-term, and the best investment option is real estate.”