The Binance Futures service went live in the fall of 2022. It attracted the attention of the exchange’s clients and opened up new questions that did not exist during normal cryptocurrency trading. Our Mining-Bitcoin magazine will cover the main topics in this article.

The term “Futures contract” came to the crypto market, in particular to Binance Futures, from traditional commodity exchanges, where futures are represented by deliverable and settlement assets. Delivery means a real transaction for the purchase/sale of goods - the buyer receives the quantity of the product specified in the contract. In the case of settlement contracts, we are talking about speculative type operations. Traders do not trade an asset, but the right to buy or sell that asset.

What is a futures?

Futures (from the English futures - future) is a contract for the purchase of an asset in the future at a price fixed at the time of the transaction. The underlying asset of a futures contract can be anything - goods, services, shares.

In the cryptocurrency market, investors use futures to hedge risks and make speculative profits. In today's realities, in the cryptocurrency market, futures are used not only to guarantee the price of a product in the future, but also to obtain speculative profit.

The main part of the directives market consists of settlement futures, which do not involve the direct transfer of goods. Those. The buyer is not given the product at a set price, but a monetary calculation of the difference in price. Traders record profits or losses depending on which direction the quotes have changed.

Small conclusion

With the introduction of COIN-margined perpetual futures, users can benefit from the synergy of two markets (perpetual and quarterly). Innovative features such as shared margin and customizable margin modes (cross and isolated) allow arbitrageurs and experienced traders to effectively manage margins, profits and losses. Thus, COIN-margined perpetual futures are an ideal product for long-term traders, arbitrageurs and users interested in hedging risks.

With an industry-leading matcher and a wide range of hedging tools, Binance Futures is now the hedging platform of choice for traders.

Cryptocurrency futures contracts are used for speculation and risk hedging

1. Obtaining speculative profit from playing on the difference in cost.

2. Risk hedging.

In the first case, a trader can buy, for example, Bitcoin futures in the hope that BTC quotes will increase in price in the future. If his predictions turn out to be correct, he will be able to benefit from the difference in cost.

The second option is used less frequently. For example, a miner can open a futures contract to sell a coin if he fears a sharp decline in the value of this coin. Those. he hedged the risk. If the value of the coin falls, mining will bring less profit, but the futures for the sale of the coin will compensate for the shortfall in profit due to speculative profits.

Or a trader can open two positions in the opposite direction, thereby minimizing his risks and losses in case his forecasts turn out to be incorrect.

A hedging strategy helps investors protect their capital from potentially adverse changes in the prices of the underlying asset. For example, if an investor owns ETH and expects its price to decline, but does not want to get rid of the asset, he can open a short position and then the profit from the future will cover the drawdown in the value of ETH.

Traders make profit from the difference in exchange rate. It is very important to be able to analyze the market and correctly guess the direction. The aerobatics is to combine speculative actions with a hedging strategy, opening positions in different directions.

Futures trading is not the purchase of cryptocurrency as in spot trading, but the purchase of futures with the aim of changing the price and making a profit on the price difference, or hedging the underlying asset. Here I think everything is clear.

Perpetual Contract Specification

You can trade Bitcoin using the BTC/USDT futures contract in the same way as on the spot market; the price is calculated in the same way. Binance Futures uses traditional contracts, not inverse contracts. The table shows the specifications of futures supported on the exchange:

Settlement and delivery of cryptocurrency futures

A deliverable futures contract involves the transfer of an asset at the time of execution. If the futures contract was for 10 ETH, then at the time of expiration the seller sent 10 ETH to the buyer, and the buyer will pay the agreed price.

A settled futures contract does not involve the transfer of an asset. At the time of expiration of the settlement futures, the buyer and seller make a cash settlement without transferring the asset.

Leveraged futures are a separate category of futures. They represent quite a risky trade, because... Using leverage increases risks. If you don't get the direction right, you can very quickly lose your deposit and all other positions if you run out of collateral (so-called liquidation), more on that later.

To reduce the risk of loss on cryptocurrency futures trading to a minimum, we will give you the rules of risk management and money management.

Recommendations and tips

When setting up the grid, be sure to set stop triggers; they will more than once save you from complete bankruptcy. This is the main rule of any serious trader. Having a small capital, you should not choose trading pairs with Bitcoin; work on cheaper coins.

Never set your leverage to the maximum and carefully calculate the degree of risk. Remember, the market can suddenly turn in the other direction. It is better to lose potential profit than real capital, especially if this is your last money.

Maybe spot trading is better?

If you are a complete beginner, we recommend entering the crypto market through spot trading. We have material describing spot trading in detail. How to buy cryptocurrency, how to sell it, what orders are available and everything else.

In a nutshell, spot trading is the exchange of one currency for another, followed by holding it for any period without swaps and other hidden fees, and subsequently selling it at a higher rate.

Example: you deposit $100 on the exchange, buy (exchange) them for 50 Cardana coins (ADA) at a rate of $2 per coin. Those. you have exchanged fiat (classical money) for Cardana (cryptocurrency). You now own 50 Cardana (ADA) coins.

If the price of Cardana rises to $4 per coin, you will still own the same 50 coins, but when you sell (exchange) them for USDT (dollar tether), you will already receive $200 for selling 50 coins. If the coin price drops to $1, you will receive $50 when selling. Which would be a loss of $50. In any case, at any price, you own cryptocurrency and can exchange it for a dollar or another coin.

Spot trading is an ideal option for medium- and long-term holding of cryptocurrency and investing in cryptocurrency. Read in this section about the most promising cryptocurrencies for investment.

Definition of PNL

PNL (Profit and Loss) is a value that shows the difference between income and loss during trading. To calculate it, various initial information is used. This can be one transaction or an open position, a series of completed transactions, transactions over a certain time period, transactions that were opened according to one strategy.

With such calculations, a P&L report is compiled, and thanks to it, traders can then determine how effective their trading strategy is and what kind of profit they can expect.

Calculating profits using such a tool allows you to get a very accurate result in the end. On the Binance exchange, PNL has its own calculation method.

How to Reduce Trading Fees on Binance Futures

Firstly, by clicking and registering through our link, you will receive a 10% discount on commissions. But that is not all.

You can save additional fees on fees by going to your Dashboard and enabling fee payout via BNB.

Toolbar

In the “Toolbar” we look for a block with a commission, the block is called “Your trading commission level”. It's at the bottom right.

Trading commission level

In this block, you can immediately turn on the switch “Use BNB for commissions (25% discount).” If you enable this checkbox, you will receive a 25% discount on spot trading, 10% on futures trading, in addition to what you will receive by registering through our link, i.e. 20% on futures and 35% on spot trading.

You can also follow the link on the right “Trading commissions” and enable this checkbox there. Here you can see your commission status.

Please note that you need to have BNB in your account to receive the 25% discount.

Let's move on to the Binance Futures interface.

How does technical analysis work?

This area of market research includes a variety of patterns - figures that form on charts, as well as support and resistance levels, based on which an upward or downward trend is built.

Based on all this data, traders often try to catch the moment of a market reversal in order to conclude a profitable deal.

Such a market analysis tool is convenient because it does not require additional indicators to use it. Next, we’ll look at the basic patterns that even beginners can use.

Binance Futures Interface

Binance Futures Interface

To get to Binance Futures, go to “Derivatives” - “Binance Futures Review”. This will take you to the Binance Futures home page.

Binance Futures Interface

Let's look at the main types of futures on Binance. Currently, there are two types of futures in Binance Futures: USDⓈ -M (Margin), COINⓈ-M (Margin).

USDⓈ-M

Standard futures with margin in Tether (USDT, BUSD). You can record profits or losses either in USDT or BUSD (Binance Tether dollar).

Contracts in USD-M are perpetual and delivery.

- Perpetual contract USDⓈ-M is a contract that does not have an expiration date. You can hold these contracts as long as you need. What is used most often.

- Delivery contract USDⓈ-M (quarterly) - the supply contract has a delivery date. Those. closing or changing it. You know the term at the time of the contract transaction.

COINⓈ-M

Standard futures with a margin in the cryptocurrency in which the futures were purchased, and not in Tether, this is the main difference from USDⓈ-M. There is also an open-ended and delivery contract.

Binance Futures has two other tools: Binance Leveraged Tokens and Binance Options, but that's a different story and separate tutorials.

Why do users trade futures?

- Hedging and Risk Management: This is one of the main reasons for the development of this financial instrument.

- Short Exposure: Traders can bet against the price movement of an asset without owning it.

- Financial Leverage: Traders can open trading positions that exceed their available balance. On Binance, perpetual contracts can be traded with x20 leverage.

Registering a Binance Futures account

Binance Futures account

To open an account, where it says Hello HairBugSweet! on my screenshot, there will be an “Open account” button, when opening an account, be sure to enter the promo code “InsidePC” and get a 10% discount on trading commissions.

You can also register an account by switching to USDⓈ-M or COINⓈ-M. After selecting the contract type, you will enter the trading terminal where you will be asked to register. Don't forget about the promo code.

Testnet and its use

Binance also launched a test platform, a kind of futures trading simulator where you can practice without risking real money. It is located at https://testnet.binancefuture.com/ru/futures/BTCUSDT.

To work, you need to create a separate account. Click the "Register" button in the upper right corner.

Enter your email, password that meets the given conditions, and confirm that you are over 18 years old. Click "Create an account."

Solve the captcha and confirm your email.

Enter the username and password you created earlier. Once you log into your account, you will see 100,000 USDT in your account, which you can fully “manage” to simulate trading.

Transferring money to a futures account and withdrawing money from a futures account

Having selected the type and type of futures contract, we go to the trading terminal, we need to fund our account for trading.

To do this, you will see a “Transfer” button at the bottom of the trading terminal.

Transfer funds within the Binance exchange

By clicking on it, you will see the following window:

Transfer funds within the Binance exchange

You need to transfer money from other Binance exchange accounts to an account for futures trading.

From - choose where we are transferring money from.

- Fiat and spot

- Cross margin

- Isolated Margin

For — choose what we will trade:

- USDⓈ-M futures

- Futures COINⓈ-M

Select a coin. Most often this will be USDT ThetherUS if you chose USDⓈ-M.

Having selected what you need, click confirm. All internal transfers within Binance are commission-free. This is a big plus, especially when you mine on Binance.

How to deposit money on Binance and buy cryptocurrency or USDT ThetherUS, read the article on spot trading, all possible options are described there.

This was a deposit of money into a futures account; to withdraw money, use the same “Transfer” button, just select the change direction icon:

Transfer funds within the Binance exchange

Binance Margin Calculator

To simplify the work of traders, the Binance exchange has created a special calculator that allows you to calculate profit and loss (P/L) values, as well as the profitability of the transaction in % (ROE) even before opening orders. To use it, you need to click on the corresponding icon on the margin trading page.

In the window that opens, you need to enter the following data:

- Starting price;

- The final price;

- Original amount;

- Borrow an amount (loan amount).

After this, you can click the “Calculate” button to find out the values of PNL and ROE.

Futures Binance Trading Interface Review

Binance Futures Trading Interface

- Window for selecting a crypto currency pair, type and type of futures

- Basic data window for the selected cryptocurrency pair

- Percentage changes for other pairs (Featured pairs)

- Price movement chart

- Stock cup and print ribbon

- Windows with order history

- Window for placing orders. Trading window.

- Settings window and your account

- Betting odds window and asset balance

More details on each window.

Window for selecting a crypto currency pair, type and type of futures.

Cryptocurrency pairs

Select the desired pair for futures trading. Here you can select the type of futures contract (perpetual, with delivery), as well as USDⓈ-M or COINⓈ-M. The difference between USDⓈ-M and COINⓈ-M is described above.

Other Binance financial products are also available in this window, but we won’t talk about them now.

Basic data window for the selected cryptocurrency pair

Information window

- Marking - The last marking price for this contract. This price is used to calculate PnL and margin. It may differ from the last price to avoid price manipulation. The marking price is calculated based on the price index.

- Price Index - is a collection of prices of the major spot exchanges, calculated by their relative volume. Average price for the 6 largest crypto exchanges.

- Rate/Remaining – Change in the financing rate between buyers and sellers. During the funding rate cycle (every 8 hours), the premium index will be calculated every minute and a time-weighted average will be used to calculate the funding rate. In simple terms, these are periodic payments to long or short traders, which are calculated based on the difference in prices in the perpetual futures market and the spot market. In a bull market, the funding rate is positive, i.e. if you and I buy a futures long, then we plan to make money on the upward price movement, and every 8 hours we will pay the funding rate to other traders who buy the same futures but short. Conversely, if the market is bearish, then the funding rate is negative, and those who are short will pay those who are long.

- Change over 24H - changes in the asset over 24 hours.

- Max 24h - the maximum value of an asset in 24 hours.

- Min for 24 hours - the minimum value of the asset for 24 hours.

- Volume 24h (BTC) — volume for 24 hours in BTC.

- 24h volume (USDT) — 24-hour volume in USDT.

Featured Couples

List of Favorite Coins

This window displays the crypto currency pairs that you have added to your favorites. A kind of watchlist, if you are familiar with the terminology of the stock market.

If you want to add any coin to your favorites, simply click on the star in the list of currency pairs, and remove from favorites in the same way.

Window for selecting a cryptocurrency pair for futures trading

Price chart

Price chart

The chart shows the history of price changes. If you need information on chart reading and candlestick or graphical analysis, write in the comments.

I recommend choosing TradingView on the chart, since limit orders are visible on it, you can draw and set a large number of indicators.

Depth chart is a graphical representation of the volume for buying and selling. Indicator.

Exchange glass

Exchange order book

The order book displays all limit orders for purchase (Bid) and for sale (Ask). About the types of orders below in the section about the window for sending orders. This is the market liquidity of the pair you have chosen. Market orders are not displayed in this order book.

Trade windows and order history

The transaction and order history window is divided into four tabs:

- Open orders are active limit or stop orders. Market orders will not be shown here, because they are executed instantly. You can see which order is at what price.

- Order history —the history of all orders. Not to be confused with deals. Here is the whole story based on what orders you sent, canceled, and executed.

- Transaction history - the history of your transactions for all types of orders.

- Transaction history - All activity (transfers, profits and losses received, commissions, funding fees and insurance fund payments) on your futures account for a certain period is available.

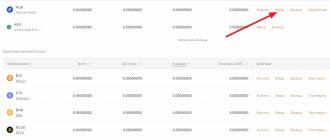

- Assets are all your cryptocurrencies on the exchange.

- PAI Key -

In these tabs you will find the following columns that require explanation:

- Liquidation price is the price of the underlying asset at which your position or positions will be liquidated. Those. the price at which your collateral is no longer enough to hold a losing position.

- Margin ratio - shows how far your order is from being liquidated.

- Margin - how much money is involved in a given transaction.

- PNL (ROE%) - shows the profit or loss for the position in monetary and percentage terms.

- Close all positions - you can close a position immediately on the market or place a limit order from this window, indicating in % the volume of the position that will be closed. We'll talk about orders below.

Window for sending orders

Margin mode

First, to trade you need to select a margin mode:

- Cross Margin - We will use your entire deposit on the trade. If in one transaction we lose money, and we have other positions or orders hanging, then we will lose all remaining positions, because the margin will be used to cover the negative position.

- Isolated margin - we allocate a fixed amount of the deposit for each transaction. We recommend using this option. Then a loss in one trade will not lead to the closure of other trades.

Leverage

Leverage is the amount you borrow from Binance Futures for your trading. The lower the leverage, the less risky the trade. Those. if you fail, you don't lose money as quickly. But earnings are not that fast. Those. This is your deposit multiplier. 2x leverage on a $100 deposit means you can buy futures for $200. And the risk will always be limited either by your deposit, if there is a cross margin, or by the selected amount of isolated margin.

For beginners, we recommend using no more than 10x, or better yet, less than 1-2x. Having also selected the leverage, you will see the maximum position amount that is allowed to be made with the selected leverage.

VERY IMPORTANT INFORMATION!!!

If you take leverage and mispredict the price, once your leverage runs out, the position will be liquidated.

Unlike the spot market, if the price falls, you still own the cryptocurrency. And here you can lose all your money.

Warrants

There are three order types in cryptocurrency futures trading:

- Limit order (transaction either at a specified price or not at all) - executes an order at a specified price. For example, the price of BTC is $62,000, you want to sell your 1 BTC at a price of $70,000. Until the price reaches this figure, the sell order will not be executed, but it will be in the order book in the (Ask) section, i.e. as a sell order at a given price. Those. you add liquidity to the market. This reduces your commission by 2 times, we will talk about this in the section on trading commissions. BUT if you send a limit order with a price worse than the current one, it will be executed as a market order. Those. if you want to sell 1BTC at $62,000 and the price is $62,500, the order will be executed at $62,500, i.e. this price is better than the one you quoted. With this execution, the commission will be the same as for a market order.

- Market order (instant execution of a transaction at the market price) - an order that is executed at the current market price. Those. if you want to sell 1 BTC, you no longer have to choose a price, you simply send an order and it will be executed instantly at the current market price. With such order execution, there may be so-called “slippage”, when at the moment the price is the same, and at the time of execution it may be worse than what it was at the time the order was sent.

- Stop orders: Stop limit is an order for a delayed exit or entry into a position. In this order you indicate the activation price of the limit order, i.e. at $62,000, you want to activate a sell limit order at $62,100.

- Stop market is a pending order to activate a market order. Those. you set the price at which the market order will be activated and sent to the market.

- Trailing stop is a trailing stop order that allows you to set a stop order at a certain percentage of the maximum or minimum price, without being tied to specific prices.

- Placement only - will be added to the order book, but will not be executed instantly even if there are suitable orders. (YOU DON'T NEED THIS)

- TWAP is a strategy aimed at ensuring that the average execution price is close to the weighted average price over a period of time specified by the user. (YOU DON'T NEED THIS AT THE INITIAL STAGE).

For basic trading, limit and market orders will be sufficient.

We will not delve into the topic of orders, because... These are topics for training in professional trading on the stock exchange. If you want to know more about orders, write in the comments.

One more moment.

For a trailing stop, the deviation percentage (from 0.1% to 5%), activation price, and trigger types must be specified.

Trailing stop operation scheme

Additional settings

Go to the switches icon and select Settings.

Settings mode

Order confirmation is a must-have feature for beginners. Before sending an order, it allows you to make sure that everything is set correctly and get a lot of additional information.

Order confirmation

You will see the price, number of orders, marking price, estimated liquidation price (in my example, I have a very low entry price, the platform did not calculate liquidation for it).

Position mode - You can select the hedging mode for simultaneous long and short trading.

Liquidation price

Calculator

The price at which our position will be liquidated by the exchange. It can be calculated by going to the calculator, which is located opposite the available balance in the orders window.

Liquidation price

TP/SL (take profit/stop loss)

TP/SL (take profit/stop loss) - by checking this box, you set a take profit for the position (i.e. where you will fix your profit, and a stop loss, i.e. where you will exit the position if the price moves against you). When choosing this mechanism, the Binance Future platform itself will set an exit limit for you in case of profit and a stop order for exit in case of loss. It is better to do this with a limit order and a stop order. This is what professionals do.

Reducing position

This option allows you to choose what percentage of the current position you want to cover. If you suddenly made a mistake when entering and entered with a larger volume than you wanted, or want to fix part of the position.

Deals (ribbon prints)

Transactions (tape)

The “Transactions” window displays all transactions for a cryptocurrency pair. By the words “all transactions” we mean the execution of all types of orders on the market.

- The “Price(USDT)” field displays the transaction price. The red price means that the transaction was initiated by the seller (in a transaction, someone always sells, someone buys, but only one person initiates the transaction), a green price means that the transaction was initiated by the buyer (someone bought).

- The “Quantity (BTC)” field displays the number of BTC coins in the transaction.

- The “Time” field displays the time of the transaction.

Last Trade always displays the last price of the pair. It is based on transactions that the price chart is drawn.

Your account settings window

In your account settings you can change:

- Topic

- Color spectrum

- View - we always use the pro mode.

- Remove or add windows

We won’t dwell on this, display it as you like.

In the “Wallet” menu, you can view the balances of the following wallets:

- USDⓈ-M

- COINⓈ-M

- Fiat and spot

- Margin wallet

Betting odds window and asset balance.

This window shows:

- Margin ratio - how much is left before the position is liquidated, if it is, or positions if it is cross margin.

- Maintenance margin is the minimum amount required to support a position or positions.

- Margin balance - margin balance, taking into account current open positions, takes into account PNL.

Advantages and disadvantages

pros

- The product belongs to the Binance exchange, a leader in its industry.

- Lots of contracts to trade.

- High liquidity.

- Leverage up to 125x.

- Instant replenishment of the balance from the main account.

- There is a test network (demo account).

- Low commissions, discounts as your account level increases.

- There is a special fund for the safety of user funds.

- Detailed help and competent support.

Minuses

- You can only fund your futures account in USDT and BNB.

Commission on Binance Futures

The commission level can be viewed under the Buy/Sell buttons. The link is called "Commission Level".

Commission level

- A taker is the one who takes liquidity from the market. These are market orders or limit orders that are executed as a market. We wrote about this in the description of the limit order.

- A maker is someone who adds liquidity to the market. Those. limit orders that appear in the order window.

Trading with limit orders is 2 times more profitable. The commission for limit orders is 2 times less.

In fact, the commission on Binance Futures for the VIP0 level is:

- Taker - 0.0400%

- Maker - 0.0200%

Margin

Another important element of futures trading is the maintenance margin - the minimum amount of equity in the account that ensures the maintenance of an open position. It is calculated regardless of the leverage, but the higher the value of the position, the larger the margin will be. This instrument has a direct impact on the liquidation price - in order to avoid a decrease in credit funds, it is necessary to ensure that the level of collateral does not fall below the maintenance margin, and if it decreases, contracts should be closed immediately.

How profit and loss are calculated

If the price from the entry price is 0.6% and you trade with your own money, you will gain or lose 0.6% of your asset, but if you trade with 10 leverage, you will earn or lose 6%.

How to calculate profit?

Go to the calculator, PNL. Enter entry price, leverage, quantity. Before entering a trade, you need to use a calculator.

PNL calculation

Earnings from listing new tokens

When a token of a new project gets listed on such a popular and highly liquid exchange as Binance, there is a high probability of rapid growth in the rate. To this end, many traders try to acquire new tokens in advance (by purchasing them on Launchpad during the initial sale, receiving them on Launchpool as a staking bonus) in order to then sell them for a good profit.

Examples of tokens that showed sharp growth after listing:

- Litentry (LIT) rose 7430% in a minute.

- My Neighbor Alice (ALICE) increased in price by 60,000% in a minute.

- SafePal (SFP) is up 1,800% since listing.

- WazirX (WRX) increased in price by 160% in the first second after entering the market.

Of course, not all tokens show such growth. But in the case of Binance, the situation is observed more and more often. This is due to both the popularity of the exchange itself and the high-quality selection of projects for listing.

Differences between mark price and final price

To avoid unexpected liquidations during periods of high volatility, Binance Futures uses the latest price and mark price.

Last Price is the value of the last contract sold from the order book. In other words, the last trade in the trading history of the platform determines the last price. This price is used to calculate your realized PnL (profit and loss).

Price marking is intended to prevent various price manipulations. It is calculated using a combination of trade finance and asset price data from multiple spot exchanges. This price determines the time of liquidation of the transaction and calculates the unrealized PnL.

Please note that the marked price and the latest price may differ from each other.

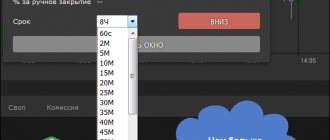

When you create a stop order, you are given the option of choosing the price you want to use as a trigger, the last price or the mark price. To do this, indicate the price you need in the drop-down menu in the order creation field.

Auto deleveraging and its consequences

Auto-deleveraging for an order is activated if a situation arises that by the time liquidation is due, there may not be enough funds in the exchange’s insurance fund to cover the margin collateral. The situation happens infrequently and is associated with the inefficiency of the exchange system, which incorrectly distributed the insurance fund or failed to carry out the transfer from expiring futures contracts to new ones:

- In this case, traders’ positions are liquidated, and both profitable and unprofitable transactions are closed.

- Auto-deleveraging priority - orders with the highest profit/loss and the highest leverage are closed first, then the next ones.

- Typically, the exchange has an indicator window with green cells, which shows the risk of being subject to the auto deleveraging procedure.

- On the Binance Futures exchange, the likelihood of such an event is reduced, since there are no futures contracts yet.

As a result, the investor may either receive less profit or take a loss, which in a normal situation might not lead to the position being liquidated. As a rule, exchanges cooperate with clients, help them reopen positions or otherwise compensate for force majeure.

Trading on Binance Futures (futures trading on Binacne)

We are gradually moving on to trading. Trading futures on cryptocurrency requires that you know how to use graphical analysis, candlestick analysis or other types of price chart analysis.

We will soon have materials on graphical analysis of the cryptocurrency market on our website.

Rules for safe trading on the futures market!!!:

- Take the test before trading on Binance Futures.

- Always use a stop order (insure yourself against unexpected losses).

- Be sure to enable order confirmation (settings - order confirmation)

- The transaction amount should not exceed 1-5% of your deposit.

- When making transactions, always adhere to the risk reword rule of at least 1k3. If you risk $100 on a trade, the profit or gain on the trade must be at least $300. This is the only way to make money over the long haul.

- Your deposit must be spread over several trading days. Don't put everything into trades at once.

- Keep records of trading transactions.

- Trade using any system so that you can predict the result.

Happy trading on Binance Futures!

How to top up your balance

To start trading on the Binance Futures platform, you will need to transfer funds from the main exchange wallet to the futures wallet. For this:

- Click on the "Transfer" button next to the fields for creating orders.

- And enter the desired amount in USDT or BNB, then click “Confirm Transfer”. In exactly the same way, you can subsequently transfer funds back by swapping the spot and futures wallet. No commission is charged.

- The available balance is immediately displayed in the orders section and can be used for trading.

If the spot wallet does not have the required coins, then instead of Transfer you should click Deposit. On the new page, select the cryptocurrency to enter. Next, exchange them for USDT or BNB and transfer them to a futures wallet.

You can buy cryptocurrency for fiat at exchangers, crypto exchanges or p2p exchangers.

Basic forms of financial statements

To understand the real financial situation, in addition to PNL, other types of financial statements are needed:

- Balance sheet. The company's balance sheet shows assets (current, non-current), short-term and long-term liabilities and capital (profit, authorized capital, other funds). The balance sheet describes in detail all the items and the structure of assets and liabilities, and their changes in different periods of the reporting year.

- Report on the flow of cash resources (Cash Flow). This report is needed to understand balances and cash receipts in different months. For example, when selling with deferred payment when completing a transaction, the company receives income, but real money will only come to the cash register after some time. The same situation can arise with regard to costs.

The balance sheet, cash flow statement and PNL together provide a complete picture of your company's financial health.

Friends, I run a telegram channel where I publish announcements of fresh materials, plus I post interesting hacks and cases that are not on the site. Subscribe if you like it. Let's continue reading...

Advantages and disadvantages

Trading futures in multi-asset mode seems very attractive at first glance. Margin requirements are reduced, because if one pair goes down, the second one can save the situation. However, if there is a sharp jump in the price of one of the pairs, the level of unrealized PnL may become too high and then your positions will still be liquidated. Trading in the multi-asset mode requires a thorough analysis of the state of affairs in the market; you cannot trade relying only on luck.

Your account's margin ratio in multi-asset mode

When working in this mode, you must control the margin ratio. If this indicator reaches 100%, the system will automatically close all positions for him. It’s easy to follow; the widget is located in the lower right corner, immediately below the order filling form. When working in multi-asset mode, a notification will appear to the right of the margin ratio.

The margin ratio when enabling the multi-asset option is calculated by dividing the maintenance margin by the total equity balance of the margin account. Maintenance margin is calculated by adding up the indicators for all positions. Assets are converted into US dollars at the current exchange rate.