Electronic money

The content of the article

Electronic money is a new concept for the financial market, which is currently in its infancy. As a rule, “virtual currency” is usually understood as the monetary obligations of the issuer in electronic form, located on an electronic medium at the user’s disposal.

In Belarus, people have long disowned electronic money. Their legalization occurred only at the beginning of 2013, when the new edition of the Banking Code came into force.

In accordance with the letter of the law, electronic money is characterized as electronically stored units of value, issued into circulation in exchange for cash or non-cash funds and accepted as a means of payment when making settlements with the person who issued these units of value.

So it is with other legal entities and individuals, as well as the obligations of this person expressing the amount to return funds to any legal entity or individual upon presentation of these units of value.

The issuance of electronic money is carried out by the bank on the basis of a license to carry out banking activities.

The procedure for issuing electronic money is established by the National Bank. Today, about ten different types of electronic money operate in Belarus on an absolutely legal basis.

There are quite a lot of types of electronic money used in Belarus and related services. With the help of some, it is convenient to pay on the Internet, others will help you pay for services in the ERIP from your mobile phone account, and others can even “give” a virtual card from a Russian bank.

In addition to electronic money for individuals, we have found services that will help you pay with electronic money, for example, for fuel and other goods at gas stations, but they are mainly intended for legal entities: Berlio, Rosberlio-Card, Euroberlio.

It was not by chance that we wrote “mostly”, because Berlio told us in plain text that they have “unfavorable conditions” for individuals, and therefore they work only with legal entities.

Topping up your WebMoney wallet (WMZ, WMR) from Belarus

Recently I was puzzled by a blog reader: “How can I perform the reverse operation and top up my Webmoney wallet in Belarus?”

Naturally, we are not talking about wallets in Belarusian rubles (WMB), which are simply replenished at the issuing bank OJSC Technobank, but about currency wallets WMZ (US dollars), WME (euros), WMR (Russian rubles), which are not serviced in any way in our country.

I really thought about it.

Before this, I was used to the fact that electronic money is usually exchanged for paper money “from hand to hand.” To put it simply, you need WebMoney, but someone has a lot of them and needs real money. We met, exchanged, and separated.

There are even professional money changers who specialize in exchanges; they are ready to take your hard-earned dollars at any time and credit WMZ or WMR, whatever you need.

Plus, with such an exchange you can even get a small bonus, because cash is always valued more than any virtual money - that is, usually you give 98 WMZ and get, for example, $100.

The average percentage usually ranges from 1% to 5%. Well, if you really need WebMoney very urgently, then you change it one to one.

But the disadvantages of the change are obvious:

- They work mainly in large cities; in the periphery, buying WebMoney simply becomes an unsolvable problem.

- money changers often turn into scammers: how many cases are known when people gave $2,000 each and simply ran away with their money.

- Plainclothes employees can work under the guise of money changers.

- It’s tedious to search for money changers, since they were thoroughly squeezed and thrown out of the main sites: onliner.by, tut.by, etc. There you could see their rating, history, understand who was normal and who was a risky option. Now they live mainly on social networks, but I feel that they will be trampled from there too.

- you need to go to the money changers, wait for them somewhere near the metro, etc. - in short, waste time.

Therefore, in search of a civilized solution, I began to look towards all sorts of exchangers, other electronic systems such as Payeer, Okpay, etc.

But there is no ice there either. No one can guarantee that all these exchangers will not lose your money, they charge a large percentage and are generally troublesome, no one works in two clicks for three kopecks.

And then I thought: maybe the system itself can offer something, like prepaid cards that you can buy from us.

WebMoney – time-tested electronic money

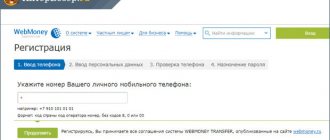

Only one bank works with the WebMoney system in Belarus - Technobank. First, you register on the WebMoney website itself, then you need to enter your passport data, take a photo of your passport and send it to the system for data verification. If everything is correct, you will be given a formal certificate free of charge.

To increase the level of your attestation, you leave an electronic application in the control panel, in other words, you select the attestator you want to contact. In our case, this is Technobank.

Then you need to come to the bank with your passport and a photocopy of it, name your WMID and write an application for a certificate at the bank branch. Technobank, by the way, will charge you 30 BYN for reviewing the documents.

According to the law, an initial certificate is issued to a WebMoney Transfer system participant who has received a formal certificate after verification of his personal data within 3 business days.

After this, you can receive a free co-branded WebMoney card in Belarusian rubles from Technobank, to which you can withdraw funds.

In November 2013, the largest and most widespread electronic payment system on the Internet, WebMoney Transfer, celebrates its 15th anniversary.

You can pay via WebMoney for everything your heart desires (or almost everything!). The services of telecom operators, providers, and online retail stores are just the tip of the iceberg.

The first step in working with WebMoney will be creating an electronic wallet. Subsequently, you can top it up in several ways, however, with any of them you will pay a commission of 3% of the amount:

- at Technobank cash desks;

- using “scratch cards” with a nominal value of Br 25,000, which can be purchased at bank branches and exchange offices, and Beltelecom public points;

- at the post office;

- at the cash desks of any Belarusian bank upon notification or by bank transfer;

- at ATMs, information kiosks, self-service terminals.

You can sell electronic money to Technobank, having a personal certificate, with a commission of 3% of the amount; with an initial certificate, the tariff increases to 5%, and for a client without a certificate it will result in 8% of the amount.

You can cash out WebMoney directly at the Technobank cash desks, or by transfer to a bank account, or to a bank payment card opened for an account in national currency, or to a Webmoney card.

How to withdraw

On the website https://wmtransfer.by/ you can withdraw Belarusian rubles through the ERIP system to any Technobank card with a commission from the WebMoney system of 0.8% (the commission must be left in the wallet before withdrawal). This is the most profitable way to cash out electronic currency.

In addition, through https://wmtransfer.by/ you can withdraw money to any card (not necessarily Technobank), which can be topped up through ERIP, but then, in addition to 0.8% of WebMoney, another bank may charge its own additional commission. This should be remembered!

You can also withdraw money using your card details or, for example, to accounts opened in any banks, but in this case the commission will be higher and limits will be set on the amounts withdrawn.

More information about tariffs and methods can be found on the Technobank website...

How to top up

Commission for replenishing a wallet is 3%. You can top up your wallet through the ERIP system of any bank, for example using Internet banking or an information kiosk.

You can also deposit money into your wallet at bank cash desks, but different banks may set their own additional fees.

More details about tariffs and replenishment methods can also be found on the Technobank website...

Advantages and disadvantages of WebMoney

Pros. Perhaps the greatest strength of WebMoney is its security. The system offers many options for ensuring wallet security - linking an identifier to an IP address and equipment, authentication using both a file with keys and via SMS, confirmation of each payment with a one-time code.

The biggest advantage of the service is the presence of a client. Which, by the way, also reminds us of account security problems.

WebMoney is one of the most popular systems in the CIS, so payment with WM currency is supported by most online stores.

At the same time, unlike most other electronic money operators, WebMoney provides the opportunity to have multiple wallets in different currencies within one account, as well as freely convert one amount into another.

In addition, WebMoney has an internal user rating system (BL), which shows the frequency of successful transactions and can serve as a certain guarantee of trust in the service or product provider.

Minuses. The first thing that catches your eye is the complex system of certificates confirming your identity. And this despite the fact that by and large there is no significant difference between them.

Certification of the highest level (initial, personal, seller) is paid. In Belarus, only one bank is responsible for issuing supporting documents - Technobank; it also services WebMoney in our country.

If for some reason you do not want to become a client of this bank, then you will have difficulties withdrawing money, because... the commission for this is very high - from 3% to 8%, depending on the certificate.

There is also a problem with crediting funds - the percentage here is also steep and amounts to 3%. For residents of Technobank, everything is somewhat simpler and the commission for the bank’s purchase of electronic money is only 1.99%, but the sales percentage still remains high.

The work of arbitration also raises criticism. Claims take a long time to be considered, and the outcome of the case is not always on the side of the injured party. Money lost as a result of fraud is rarely returned.

Withdrawal to card

For clarity, let’s look at how to transfer money from an electronic wallet to a Sberbank card.

The mechanism is similar for all online services:

- Log in to your personal account via e-mail or social networks.

- Click the “translate” tab (the name may vary slightly).

- We choose the “to bank card” method.

- We indicate the card number and amount.

- We confirm the operation using an SMS code (E-NUM for Webmoney).

The main difference between different platforms is the amount of commissions when transferring funds to third-party bank accounts:

- QIWI – 2% + 50 rub.;

- WebMoney – 2.5% + 40 rub. – additional conversion fees may apply;

- Yandex Money – 3% + 45 rub.

I hope my reviews and arguments help you decide which e-wallet is best to get for use in Russia, Belarus and the CIS countries. And the main thing is to take into account regional characteristics.

After all, flexibility in accepting payments is one of the most important qualities of a successful freelancer. Therefore, I recommend registering all three payment systems and using them according to the following scheme:

- Link WebMoney to Qiwi.

- Make plastic cards for QIWI and Yandex Money.

This gives you the opportunity to accept any payments and freely transfer funds between accounts. At the same time, losses are minimal. With Yandex you pay in stores, and with Qiwi you withdraw cash.

However, it's up to you to decide. Personally, I have been using Webmoney (mainly because of its multicurrency) for more than 6 years to work with customers from Russia and Belarus.

Read more about how to create an electronic wallet in each of the services on the blog.

Let all your financial transactions be profitable and safe!

An electronic wallet is produced on the basis of smart cards (usually in the form of bank plastic with a chip). The client transfers a certain amount to such a card, all operations are carried out within the limits of the credited funds. It can also be found in the form of a digital medium with a chip for reading data.

Virtual reality is increasingly absorbing human activity. We would like to direct your attention to the financial area, where we have set up our own corner today. Their use is precisely related to the term “electronic wallet”. What features does such a wallet have? In no, you can store digital money and transaction history, replenish funds, make various payments, transfer or withdraw amounts. And all this without cuts. Convenient, right?

Of course, both the national currency and any other can coexist within the same wallet. But here there is no need to rattle coins or rustle papers - all funds flow into digital format and are stored, say, on a server. Is their use popular? While Belarusians are wary of such wallets, they are trying, because they are easy to use and transfer money from abroad. They cannot, for example, be lost. However, it is worth protecting it from scammers so that it does not get stolen, although you have to try hard for this.

Belqi – QIWI in Belarusian

Belqi* (“squirrels”) is a fairly young electronic money system, the creators of which are Priorbank and the United Instant Payment System (USMP) payment system, known in Belarus under the QIWI brand. Working with belqi, similar to WebMoney, begins with registration on the project website and creating a virtual wallet.

In the future, you can replenish it without commission in several ways:

- from a Priorbank debit or credit card;

- through the e-PAY service (you can make no more than 3 operations per e-wallet per day, and no more than 10 per month!);

- through the purchase of electronic money cards in QIWI terminals, in Svyaznoy and Na Svyaz communication shops.

In other cases, the commission for depositing funds will be 1.5%.

The issuing bank offers clients the following main areas of use:

- instant payment for world of tanks, warface, point blank, aion and other online games, voices and new functions of the Odnoklassniki and VKontakte applications, replenishment of a Qiwi wallet and more than 50,000 different services;

- free transfers between belqi wallets;

- secure payments to other countries at a favorable rate - each payment is confirmed by a code sent to your personal phone;

- Scheduled payments - now you will never forget to pay for the Internet, cable TV or telephone.

You can cash out belqi using cash desks and the Central Bank of Priorbank. At the same time, one “squirrel” is equal to one Belarusian ruble, and the bank charges a 2% commission for issuing cash.

In October, Priorbank provided its clients with the opportunity to access “proteins” through the belqi wallet, an application for smartphones based on the Android and Apple iOS operating systems.

With its help, you can pay for any services without commissions, including cellular services, make utility payments, and transfer money between your accounts.

Wallet One - all your money in one wallet

Wallet One is the youngest player in the Belarusian banking market. The “provider” of this electronic money system is InterPayBank. To connect to the service you will need a mobile phone or computer with Internet access.

You can instantly top up your wallet balance:

- in PayNet terminals;

- at InterPayBank cash desks.

Despite its “young age,” Wallet 1 allows its users to make a wide range of payments, from mobile operator services to orders in online stores.

Most payments through the Wallet One service come with minimal or no fees. You can cash out electronic money from the Wallet One system using InterPayBank cards or by transferring them to a Visa card issued by this bank.

What is the classification?

What types of electronic money are there? They are divided into two large groups. Firstly, those that are issued on the basis of smart cards (this is bank plastic with a chip). Simply put, these are electronic wallets. The equivalent of money transferred in advance by the client to the card issuer is recorded on the chip. Operations are carried out within the credited amount.

Secondly, network money, which is based on networks. They operate on the basis of a software system or network resource. The latter are the most common, convenient and reliable. Their diversity is discussed in this publication.

EasyPay – spending money is easy

The creators of the EasyPay system were Belgazprombank together with. Communication with EasyPay traditionally begins with registration on the site, after which you have the opportunity to make micropayments via the Internet and SMS.

As a user of the system, the client can:

- purchase goods via the Internet both in Belarusian and foreign online stores specified in the list of sellers on the system website;

- payment of utility bills, services of Internet providers, telecom operators, television and many others;

- non-commercial transfers of funds to other individuals - participants in the EasyPay system.

You can top up your e-wallet in the EasyPay system:

- in cash at Belgazprombank branches;

- through payment cards issued by the bank;

- through the ERIP system at any banking service point (commission 2% of the amount).

You can cash out electronic money of this system at the offices of Belgazprombank. The commission will be 2% of the amount.

Advantages and disadvantages of EasyPay

Pros. Perhaps the most important advantage of the system is the ease of registration. Just an email address is enough to open an account. Personal data is used solely to return access to a wallet for which access details have been lost.

Another advantage is a very profitable account replenishment. In Belposhta branches, replenishing your wallet is interest-free, that is, for nothing. There is no such profitable deposit of money in any other Belarusian payment system.

In addition, you can top up EasyPay using a plastic card: free for Belgazprombank cardholders and with a 2% commission for other banks, which is also quite profitable. There are other ways to deposit money: terminals, SMS, etc.

This currency is also convenient in terms of popularity. If an online store accepts electronic money and has many customers from Belarus, you can be sure that EasyPay will be among the possible payment methods.

Also, using the system’s wallet, you can pay for most Belarusian services - telephone communications, provider services and many others.

Minuses. The main disadvantage of the system is the very low security of the service compared to others. Authentication is carried out only by login and password, and a four-digit control code is used to confirm payment. All. There is no option to use SMS identification or link a wallet to an IP or hardware.

In addition, EasyPay is not suitable for making purchases on foreign websites. In online stores, where Belarusians are infrequent guests, you most likely will not be able to pay using the currency of this system.

Another disadvantage of the operator is a fairly high commission for withdrawing money. At best, you will be charged 2% of the withdrawn amount. Other systems offer better rates.

Conclusion. EasyPay is perfect if you need an electronic wallet to pay rent, Internet, telephony and other services, as well as make small purchases in online stores in Belarus.

However, it is not worth using this system for the turnover of large amounts of money due to the insufficient security of the service. Easypay is also not suitable for you if you plan to make purchases abroad.

How to register an online wallet - complete instructions

Registration of a Yandex.Money wallet in Belarus is available from the yandex.by website if the user has an account on Yandex. When your mailbox is not registered in the search engine, you can create a wallet using the link: https://money.yandex.ru.

Before registering with Yandex.Money in Belarus, you need to prepare an e-mail for notifications from the service and a mobile phone. No other data will be required at the initial stage of registering an electronic payment instrument.

The process of registering a wallet in 2022 consists of four stages:

Using third-party accounts does not provide advantages when working with YaD, so for quick registration it is easier to create a mailbox on Yandex and use it to create a wallet.

Yandex.Money personal account

If you registered Yandex.Money using social networks and an email address, you will additionally need to confirm your email.

iPay – pay via mobile account

The issuer of the iPay electronic money system is Paritetbank.

Through iPay, a client can pay for goods and services on the Internet, purchase theater and concert tickets, repay loans, pay for utilities using the positive balance of a personal account on a mobile phone.

Working with iPay is easier than with most other Belarusian electronic money systems, if only because it does not require the creation of an electronic wallet, additional registration and separate account replenishment. Payment for services is made either by sending SMS or through your Personal Account on the payment system website.

When making payments in the iPay system, the following commissions apply:

- 4% – when making payments under loan agreements of Paritetbank;

- 4% (minimum 800 rubles) – when making payments using arbitrary bank details;

- 3% – when paying for services through the ERIP system;

- from 0% to 3% (depending on the paid service) – when paying for other services available in the iPay system

What are the wallet statuses?

When you first register, the wallet is assigned anonymous status. Only the phone number and email address are known about the user.

Online wallets with anonymous status have a number of limitations:

- The maximum amount of money in the account is 15,000 RUR;

- Payments can only be made to Russian companies;

- It is not possible to receive more than 5,000 RUR at a time from a plastic card;

- Transfers to other wallets and accounts of individuals cannot be made.

Personal wallet status allows you to expand the scope of use of Ya.Money; to obtain the status, you just need to fill out an online form.

Only citizens of the Russian Federation can obtain personalized e-wallet status.

An identified wallet allows you to perform all available operations, including transfers through Unistream and WesternUnion or using bank details. The limit on the total amount of funds on the balance is 500,000 RUR, the limit on one transaction from the account is 250,000 RUR, you can withdraw cash in the amount of 100,000 RUR at a time.

If you love skating, love Berlio

Using the Berlio electronic money system, you can make payments for automobile fuel in Belarus and abroad. The “provider” of the system is Belgazprombank.

You can become the owner of a Berlio electronic money card by visiting the Belgazprombank office at the address: st. Dombrovskaya, 9.

To activate the card, you will have to visit one of the Berlio company offices in Minsk on the street. Bykhovskaya, 55.

The purchase of electronic money is carried out by depositing cash at the RCC of the head office of Belgazprombank (commission - 0%), or by transfer to the account specified in the service agreement (commission - according to the tariffs of the sending bank).

MTS is not only an operator!

MTS Money is another “virtual currency” system created by Belgazprombank. MTS Money provides the opportunity for its subscribers to make payments using their personal mobile phone account (while being within the MTS coverage area). There is no need to open a bank account.

You can use MTS Money by registering on the website or through the mobile application. To manage funds, you only need your MTS number. The service allows you to make any one-time payments, adding them to your “Favorites” for repeated payments.

You can top up your mobile phone account using a bank payment card directly in the MTS Money service.

Prepaid cards

If we talk about the definition that the National Bank puts into the concept of electronic money, then we need to mention the prepaid electronic money cards that are issued by Belarusbank, Belinvestbank and Priorbank.

These card products can be used as a regular payment card, but, nevertheless, they are usually classified as electronic money.

Despite the fact that the average Belarusian will not soon receive a salary in electronic money, the further evolution of electronic money systems in Belarus is important and inevitable.

Sources: myfin.by, infobank.by, kv.by