In bright, loud advertising, everything is so easy and beautiful: novice traders get quick profits with minimal time spent, and get a permanent income. In reality, the situation looks somewhat different: the majority of beginners play by intuition and ruin the bank in a short time. Only a clear, proven strategy will allow users of the foreign exchange market to achieve their goal. We will tell you what trading strategies for beginners exist on the Forex platform today and how to use them correctly.

Read in the article:

1. Features of Forex market strategies for beginners and professionals 2. Forex moving average strategy 3. “Puria” strategy 4. “20 pips a day” strategy 5. Forex trading strategies suitable for those who have little time 6. Roaming from trend to trend with "Nomad" 7. We build a trend line and trade without indicators 8. MTS Forex - the future of trading 9. Breakout strategy 10. Breakout of trend lines 11. Breakout of the price level 12. Professional Forex strategies not only for experienced traders 13. False ones breakouts also bring profit 14. We trade according to “London” 15. Trading system “80-20” on D1

Trading with a period of 5 minutes

Taking trades for 4-5 minutes is the second most popular trading approach used by novice traders. Our website contains a description of new working schemes and vip strategies for trading binary options with a five-minute expiration.

Genesis Matrix

The strategy is based on a complex template that is used for Meta Trader 4. After installing the template, the chart will look like the screenshot below:

Genesis Matrix input

A downward signal occurs under the following conditions:

- The Genesis indicator showed 4 red dots.

- Both Stochastics are leaving the overbought zone.

- The candle closed below the moving average.

The template also has a dial indicator that emits a sound signal and draws an arrow when a signal occurs. Often it is delayed by 1-3 candles; if you trust only it, the effectiveness of the strategy may deteriorate.

You need to open a bullish trade provided that:

- Genesis showed 4 white dots.

- Stochastics are leaving the oversold zone.

- The candle closed above the moving average.

"Three Candles"

A simple approach based on candlestick analysis is to look for two patterns - Three Soldiers and Three Crows.

For a Call trade, the following situation is observed on the chart: during a downward trend, 3 bullish candles of approximately the same size appear, the “Three Soldiers” figure. This indicates a reversal and that you can enter into a trade, because a growing trend is likely to appear.

Three soldiers

For a Put trade, the opposite situation arises. The Three Crows pattern looks like 3 bearish candles that occurred during an uptrend. Their appearance indicates a downward trend reversal.

Figure in a bear market

Candles on the Three Soldiers and Three Crows patterns must comply with the following rules:

- The third candle, which comes last, should be slightly shorter than the previous ones.

- If all three formations of the pattern are too large, then this means that the price is moving very quickly, so strong pullbacks are possible. In this case, it is better to wait and not enter into a deal.

- The shorter the shadows of the candles, the stronger the signal.

- If the shadows are too long and follow the body of the formation, then this means that the patterns are not Three Soldiers or Ravens.

This strategy is best combined with additional indicator systems. To confirm the signal, you can use MACD, RSI and other indicators. The expiration period of transactions is 5-10 minutes.

Comparison of indicator and non-indicator strategies

| Systems with indicators | Systems without indicators |

| Simplicity and accessibility | Require experience |

| Delayed signals | Can be used on any trading asset |

| Many tools are redrawn | Difficult to automate |

Binary Gambit

This technique involves opening two opposite trades on the same trading asset and closing a losing position early.

If a trader bought an option and sees that the trend line is going in the opposite direction, he needs to open a trade in the other direction and complete the previous one.

Some of the money bet will be lost, but the second option will cover the losses.

Other free trading strategies for beginners on binary options that will allow you to open trades for 5 minutes are presented in this article.

Features of Forex market strategies for beginners and professionals

Most newbies who come to Forex think that making a profit is the main thing. But they are wrong.

The main thing is victory over greed and fear, and the key to this lies in a systematic approach to trading and understanding the processes occurring in the market. You need to start with simple Forex trading strategies.

They are based on technical analysis and their consistent implementation leads to an understanding of the patterns in the movement of the quote chart.

Create a personal account

Introduction

There are countless ways to profit from cryptocurrency trading. Trading strategies will help you organize these methods into a single structure that you can follow in the future. This way, you will be able to constantly monitor and optimize your strategy.

When building a trading strategy, you need to conduct a complete analysis of the market using: technical analysis (from the English technical analysis, abbreviated TA), as well as fundamental analysis (from the English technical analysis, abbreviated FA). We'll look at which one applies to each strategy, but before we go any further, make sure you understand the differences between these concepts.

Since the number of different trading strategies is so large that it is not possible to name their exact number, we will consider only some of the most common ones. This article mainly focuses on cryptocurrency trading strategies, but they can also be applied to other financial assets such as forex, stocks, options or precious metals such as gold.

So, would you like to develop your own trading strategy? This article will help you understand the topic and how you should approach cryptocurrency speculation. With a solid trading strategy, the likelihood of achieving your trading and investment goals will increase significantly.

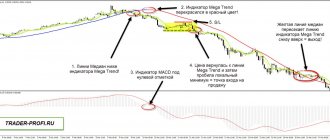

Puria strategy – two indicators and stable profit in the end

Forex strategy "Puria" is based on signals from the MA and MACD indicators. The first one is already familiar to us, and the second one represents a family of oscillators (leading indicators).

MACD was created by Gerald Appel and is one of the best. The indicator uses two exponential MAs, determining their difference.

The intersection of the zero level indicator curve signals a change in the price trend.

In MA we use three moving averages with periods:

- 5 – yellow.

- 75 – red.

- 85 - red.

We configure MACD as follows:

- SMA – 1.

- Fast – 15.

- Slow – 26.

We sell when the yellow moving average breaks through two red moving averages from above, and when the first bar in the MACD closes below the zero level.

We buy when the yellow moving average breaks through the red ones from bottom to top, and one bar in the MACD closes above zero.

Stop loss is set at 14 points. We exit the transaction using Take profit.

How to create your own effective options strategy

The best binary strategies take into account a wide range of market patterns. Each element of fundamental and technical analysis, when applied correctly, can shift the likelihood of correctly choosing an entry point towards profitable trading.

Trends

A TS for a beginner should carry out transactions in the direction of the trend. Even if price reversals are traded, they are chosen according to the global direction of the market. The system requires the presence of an element that determines the trend.

To do this, you can use the following tools:

- Fundamental analysis, which determines the general background of the economic and political situation for selected assets.

- Trend indicators: Bollinger Bands, moving averages, Average Directional Movement Index, Parabolic SAR, Alligator, Elder screens, etc. The parameters of technical tools are selected depending on the nature of the price movement.

- Changing the time frame - you can learn to fix a trend by observing the chart of an asset on higher time frames.

- Wave analysis of different types.

- Trend lines, channels.

Support and resistance

The best strategies for all forms of trading use levels to determine possible price rebounds, the market moving into a flat, or the end of a correction.

Levels are plotted manually on the chart or special indicators are used:

- Moving averages of older periods.

- Fibonacci levels.

- Zone.

- PowerDynamiteAreas.

- Lines algorithm.

- PZ levels.

- Pivot.

Volumes

For the Forex market, volumes are provided by analytical companies, such as IDC, or the number of currency futures contracts is analyzed.

For futures markets and stocks, you can use indicators, tape or order book.

It is believed that the more volume is traded, the stronger the movement will be. Indicators track divergence—the discrepancy between indicators of the quantity of an asset and the strength of price movement.

Volumes are often confirmed by patterns on the chart.

Time-tested “20 pips a day”

The “20 pips per day” Forex trading strategy is based on trading after news releases during the period of maximum volatility (after 14:00 Moscow time). In this trading system we are faced with the Monentum oscillator.

It measures fluctuations in quotes over a certain period of time. It is used as a trend and leading indicator to determine entry points.

In this trading system, the intersection of the center line indicator curve warns of a possible entry into the market.

Indicator settings:

- Monentum – 5.

- SMA – 20.

We trade on the 30 minute chart.

We buy when the candle closes above the SMA and Monentum crosses the middle line.

We sell when the candle closes below the SMA and Monentum moves below the middle line.

Stop loss is 20 points, and take profit is 20-40 points. When the price passes 20 points, move the stop to breakeven.

The considered Forex trading strategies can be used in the process of studying the peculiarities of market behavior. For beginners, the effectiveness of using the strategy lies in its simplicity.

Over time, having tried various Forex trading tactics, the trader finds and improves his own that suits his personal predisposition.

Trading system “Beginning” – a strategy for novice traders

What do Forex beginners like? That's right, be constantly in the market and spend less time on analysis. This strategy will allow you to open a trade every day at the beginning of the London session, and everything will take you no more than 5 minutes. The strategy is very simple, and trading is carried out on the M30 timeframe. You need to wait for the opening of the London session, which starts at 10 am Moscow time. After the first 30-minute candle is formed, you need to place two pending orders: one to buy a few points above the high, and the other to sell just below the low.

We place stop losses at the extreme points of the same candle opposite each other so that when a stop loss is triggered on one order, the opposite pending order is activated. We do not set take profits; instead, we close all positions at the end of the London session, regardless of whether they are profitable or unprofitable, and we also delete failed orders. The fact is that at the end of the London session - the beginning of the American session, price reversals very often occur, and if you do not close positions on time, you can go into a big minus. If important news is expected to come out, then we move our positions to breakeven within half an hour. For trading using this strategy, pairs with GBP, for example, GBPUSD, are best suited.

Forex trading strategies suitable for those who are short on time

The organization of a trading day depends on many factors, and the trader’s busy schedule plays an important role. Some people devote their whole day to trading, while others note the market situation periodically.

Forex strategies for those who are short on time are based on long-term trading. Following them, the trader moves from trend to trend, the direction of which rarely changes.

Both beginners and experienced speculators can trade this way. In this case, everything is determined by the size of the base capital. It must be significant, since daily price fluctuations can be significant.

Traders who practice long-term trend Forex strategies can hold a position for months, calmly controlling the growth of profits.

Capital is protected from trend reversals by a periodically moved stop loss. One such strategy is “Nomad”.

Strategy “Hama Scalping System”

From the name of the best Forex strategy, it becomes clear that it is intended for scalping. If you like to make a lot of trades and work with 5-15 minute charts, then “Hama Scalping System” is just for you.

- Working schedule:

M5-M15. - Currency pairs:

any. - Trading sessions:

any.

List of indicators used:

- daily_open_line;

- FTI_HamaSystem;

- Kijun Tekan+;

- MACD Histogram;

- MiniSinyal_v1_1;

- PivotsD_v5 (Black);

- X 3Semafor;

- EMA (200).

Important: the last indicator (EMA 200) serves as a filter for opening positions.

If the price is above this indicator, you only need to consider BUY orders . If it is lower - only on SELL .

How to use the “Hama Scalping System” strategy

To be able to consider purchases (BUY), you need to:

- The formation of candles occurs above EMA200 (exponential moving average line in turquoise).

- The appearance of a green or blue circle.

- The yellow moving average crosses the turquoise dotted line from bottom to top (KijunTekan+ and moving).

- The price is above the blue HAMA system.

- MACD changed color from red to blue.

To be able to consider concluding a transaction (SELL), the following conditions of the best Forex strategy must not be violated:

- The formation of candles occurs below EMA200 (exponential moving average line in turquoise).

- A red circle appears.

- The yellow moving average crosses the turquoise dotted line from top to bottom (KijunTekan+ and moving).

- The price is below the red HAMA system.

- MACD changed color from blue to red.

How to close positions?

Since the trading strategy involves scalping the market, you can close profits at your own discretion. For some, 5-10 points of profit from one currency pair is enough, while others wait for the intersection of two indicator lines (KijunTekan+ and moving). Also, this TS has in its arsenal automatically set support and resistance levels. Alternatively, to close positions, you can focus on them.

You can download the indicators and template here .

We wander from trend to trend with “Nomad”

The Forex trend strategy “Nomad” uses two indicators: MA and RSI. W. Wilder's RSI oscillator tracks price.

With standard settings (14, 30 and 70) it is used to predict the formation of price bottoms and tops. The emerging price top is indicated by crossing the level of 70, and the trough – by level 30.

In our case, the indicator settings are as follows:

- MA – two moving averages, with periods: 5 – red and 12 – yellow.

- Oscillator RSI period 20, levels 50 and 100.

We buy when the moving red one is above the yellow one, and the oscillator curve has crossed the level of 50 and risen above it.

We sell when the red moving average goes under the yellow one and the RSI curve drops below 50.

We check the graphs on D1, H4 and H1. We look for entry points into the position on the hourly timeframe. Stop loss is set at the level of the adjacent maximum or minimum, and take profit is three times higher than the stop.

Free Candle

Free Candle is another incredibly simple strategy. It has several advantages:

- Easy to understand and use. Just one indicator that does not require special knowledge to understand;

- Ability to make several transactions per day. The Free Candlestick strategy was developed for trading on the M15 chart. Compared to H1 and older, it is possible to trade much more often;

- Versatility. The strategy is equally effective on various currency pairs. This means that you will definitely not be left without a suitable signal. It is also worth noting that you can trade during any session, although it is better to limit yourself to the European and American ones, and leave the Asian one to others.

Description

When analyzing the market, an EMA moving average line with a period of 9 is superimposed on the chart. Its main task is to show the average price value. Have you ever used this indicator? If yes, then you have probably noticed that some candles are located below or above the line. At the same time, neither the body nor the shadow touches it. They are what are called free, which will serve as a signal for entry. But the candle must meet the following requirements:

- In a bullish trend, the opening price of the candle should be lower than the closing price;

- During a bearish trend, the opposite is true: the opening price is higher than the closing price.

Purchase

You should find an asset on the chart of which there is an upward trend (EMA is directed upward). Now you should wait for a free candle to appear that meets all the necessary requirements.

Next, you need to wait for the signal candle to close. If its final price is located above the maximum value of the previous pattern, then when opening the next one after a free candle, we open a trade for an increase.

Stop loss should be set at the low level of the signal candle. Count the number of points of a free candle and multiply them by 2. The resulting value is TakeProfit. You need to postpone it from the trade opening level upwards.

And at the end, a little advice: when the price has moved in the desired direction from 70% of the distance between the stop and the opening point, the transaction is transferred to breakeven.

Sale

If there is a downward trend, you should wait for a free candle to appear, and then for it to close. It is worth entering trades with a short trade and a reduction if the closing price of the signal candle is lower than the previous maximum.

Stop loss should correspond to the maximum of the free candle. Take profit is calculated in the same way as in the case of a purchase. Don’t forget about transferring to breakeven after completing 70% of the way.

Have questions? Probably not, because the strategy is really simple and even a beginner can handle it. But if you still haven’t learned something, re-read the section and try the method in practice. And then move on to the continuation, because this is not the last strategy that can bring income on Forex.

We build a trend line and trade without indicators

The Forex trend line strategy does not use indicators. On a downward trend, we connect two adjacent price highs and sell at point 3.

In an uptrend, we connect two adjacent price lows and buy at point 3.

A price reversal may not necessarily occur when it touches the trend line. We set the stop loss at 10 points, go to the 5-minute chart and monitor the price.

If it goes in the expected direction, then at the first sign of a reversal, we take profit. In addition to trend strategies, there are countertrend strategies that use price correction after a strong movement.

Beginners should not start with them. It is safer to trade according to the trend.

Along with manual trading, mechanical Forex trading systems are becoming increasingly popular. These are advisors or robots that carry out all or part of trading operations without the participation of the trader.

They are created on the basis of a trading algorithm corresponding to a particular strategy.

What is a profitable strategy and what should it be?

Profit is translated from English as “profit”. This is a system that will allow a trader to trade profitably. You can select it according to the following criteria:

- The percentage of profitable trades after testing is at least 60%-65%.

- Simplicity and a minimum number of tools for analysis.

- Accurate signals without redrawing.

Beginners are often looking for an effective, break-even system and are even willing to pay for it. Advertisements in which a supposedly successful trader says: “I’ll sell an ironclad strategy” are often found on the Internet. But buying such a “grail” is risky. You can run into a scammer, lose the money that was paid for the author’s vehicle and your deposit. Draining strategies under the guise of being profitable are very often sold on the Internet.

You don’t have to give money to get the guru’s secret; you can learn market analysis for free.

Subscribe

New telegram channel to help the novice trader! All the most useful things - every day!

Telegram

MTS Forex – the future of trading

The idea of replacing humans with robots is not new. The program is devoid of emotions and clearly follows the algorithm embedded in it.

Under ideal trading conditions, MTS Forex demonstrates fairly high efficiency, but in force majeure situations, human presence is still required.

The release of news and the participation of major market players causes sharp fluctuations in quotes, which robots cannot cope with. The trader’s task in this case is to stop the program and close unprofitable trades manually.

On the other hand, thanks to advisors, a multi-currency Forex strategy can be implemented. Its essence is to trade several (4-5) correlating currency pairs in order to diversify risks.

Even on an hourly chart, it is difficult for one trader to control the market situation for several instruments at the same time. If robots trade, and a person exercises overall control, then trading becomes much easier.

Trading strategies: let's summarize

In this lesson, we discussed a variety of trading strategies in financial markets. We covered scalping, day trading, swing trading, as well as position trading on macroeconomic indicators. Additionally, we discussed the use of discretionary and algorithmic trading systems.

With this knowledge, you can decide which trading style best suits your personality. For example, my trading style is focused on a discretionary swing trading style. This is what works best for me and I stick with it. Now it’s your turn to explore the various options available and choose the best trading strategy for yourself.

Breakout strategy - an organic combination of technical and fundamental analysis

Special mention should be made of Forex breakout strategies. They are based on the phenomenon of a breakdown of an important price level. This usually happens with the participation of large market players.

If the price adheres to the corridor for a long time, then at some point it will leave it. The Forex breakout strategy is based not only on technical analysis, but also on a deep understanding of the psychology of market tycoons aimed at super-profits.

For such a profit to appear, the majority of trading participants must generate it from their losses.

How to choose your own strategy

To choose the right trading system, you need to clarify for yourself the criteria that it must meet.

The break-even strategy has the following characteristics:

consistently brings results;- 80-90% of entries are profitable, the vehicle must have a positive mathematical expectation;

- simple, has unambiguous waveforms;

- trading style corresponds to the trader’s psychology;

- suitable for selected assets;

- the trading time suits the person’s schedule;

- based on clear market patterns.

Selected vehicles should be tested through a strategy tester, for example, in MetaTrader, and tested on training accounts.

It is of great importance how risk and money management are taken into account when trading binary options.

It is important that the system follows the following rules:

- do not risk more than 5% of the deposit;

- have sufficient reserves for profitable trading;

- manage lot size;

- after 3-4 unsuccessful trades, it is better to stop buying options and analyze the mistakes;

- don't act out;

- record the results of activities in the trader’s diary;

- do not use martingale at the initial stages of work;

- After a loss, you can regain confidence by trading on practice accounts.

Breakout of the price level

A simple breakdown of the price level occurs quite often. Important support/resistance levels stop the price movement, and their breakdown requires the intervention of influential players.

This is usually followed by a strong market movement. The difficulty lies in identifying levels and filtering false breakouts.

Until the price consolidates at the achieved level, you should not open a position. Excessive haste leads to losses and disappointments.

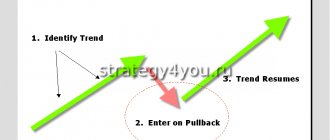

Trading with the trend

A trend trading strategy is based on the use of technical analysis to determine the direction of the market. This is generally considered a medium-term strategy, best suited for position traders or swing traders, since each position will remain open as long as the trend continues.

The price of an asset can move both up and down. If you are going long, you will do so if you are confident that the market will make higher highs. If you were going to go short, you would do so if you thought the market would make lower lows.

Trend traders pay little attention to market corrections, but it is important for them to confirm that this is a temporary price movement and not a complete reversal, which is a signal to close the trade.

Some of the most popular technical analysis indicators that are included in trend following strategies use moving averages, the RSI indicator, as well as the ADX indicator.

Professional Forex strategies are not only for experienced traders

You should not think that professional Forex strategies include many indicators and advisors. The situation on the market can be predicted, but it is impossible to predict the development of events 100%.

Of course, we are talking about ordinary traders. Central bankers are planning market interventions in advance.

Professional traders, realizing that excessive and not always correct information can only get in the way, often prefer indicator-free Forex trading.

Definition and construction of a trend channel

Identifying a trend is something every novice speculator should learn. Without this skill there is nothing to do in Forex. But once you master it, you can start making money without bothering with formulas and indicators. Still don't know how to spot a trend? Then read on, or better yet, pick up a pen and notepad.

The price is constantly rising or falling. This is one of the main misconceptions of beginners. In fact, the price almost always moves in a narrowed price corridor, which you need to be able to determine. This movement is called a trend, and there are three types:

- Rising (bullish) – the price during this time may fluctuate up or down, but in general there is an increase in price;

- Downward (bearish) – during this trend the price decreases, but this also does not mean that you will not see upward candles;

- Sideways (flat) – during this time the price does not suffer significant changes, and the market is in consolidation.

False breakouts also bring profit

It is no coincidence that there is an opinion among professionals: “The simpler the trading algorithm, the more reliable and profitable it is.” Every year, indicator-less Forex trading strategies based on breakouts of price levels are becoming more popular.

In addition to the usual, there is a false breakout when the quotes return to the previous price range and there is a strong movement that can generate profits over a long period.

Scalping

Scalping is a fast-paced trading style that can be very intense and often brings a lot of stress. Scalping involves constantly looking for trading opportunities. Scalpers can often trade 20, 30 or more than 50 positions during a single trading session. Most scalpers tend to be in and out of the market within a few minutes.

Scalping involves opening and holding a position for a very short period of time, ranging from a few seconds to a few minutes. The idea is to enter a trade and exit it as soon as the market moves in your favor - making small but frequent profits.

Scalping is often considered a faster and more intense form of day trading. This requires traders to focus on markets that are extremely liquid and have strong trends.

Scalping is an extremely labor-intensive and energy-consuming process. This style is not typically used by part-time traders as it requires constant market monitoring and analysis.

Scalpers typically use high leverage and look for small moves that they can take advantage of. For example, a scalper trading EURUSD might trade multiple positions on a smaller time frame, such as a 1-minute or 2-minute chart, based on a breakout on the daily chart.

Scalping is quite popular in the stock market, where price movement is clearer and less chaotic than in Forex.

As you can imagine, one of the biggest disadvantages of using scalping is the high cost of transaction fees associated with a large number of trades. In many cases, transaction costs in the form of commissions can amount to 60-70% of a trader's gross profit. Therefore, scalpers should aim for low commissions from their broker to increase their chances of success.

These days, scalpers are facing serious competition from high-frequency trading using robots that can make hundreds or even thousands of trades during a single trading session. Therefore, it is not surprising that it is computer algorithms that dominate scalping and largely determine price movements on lower time frames.