Even the longest trend ends someday. On the chart it looks like a stop followed by a reversal. But how to determine a trend reversal? And the most important thing is to find the place and time of this event. Perhaps this will not be a reversal at all, and not a large pullback or correction of the current trend.

This article presents trading strategies that contain high-quality and high-probability reversal signals (candlestick patterns, models, etc.). With their help, you can make the most of trading trend reversals.

Everyone knows that it is most profitable to trade with the trend. However, what could be more profitable than catching a trend at the very beginning of its emergence?

Characteristics of a trending market

An uptrend is a market with higher highs and higher lows. A downtrend is a market with lower lows and lower highs.

Let's visualize the highs and lows over a certain period and see how they relate to each other over time.

The daily chart below is a great example of how simply observing how market highs and lows interact with each other can signal a change in trend:

The first lower high was a clear sign that the uptrend was starting to run out of steam. But it was only after the first lower low that we could say that the current trend had reversed.

Keep in mind that a trend reversal will not always be so obvious. But you can always find certain signs of a trend change, it's just sometimes harder to see them.

Triple top or triple bottom

Figure 7. “Triple top or triple bottom” figure schematically.

As you may have guessed, in addition to the “Double Top and Double Bottom” patterns, there are graphic patterns called “Triple Top or Triple Bottom”. This is a modified formation of the head and shoulders chart pattern, as well as the double top.

On a chart in MT4 it might look like this:

Figure 8. Triple Top pattern.

By the way, trading on trend reversals will be carried out according to the following strategy. First, we see that the top reaches the same price value several times and then rolls back, which means we draw a resistance line at their peaks. We do the same with downward price pullbacks - we draw a support line. Then we wait for one of these lines to be broken. After some time, we see that it was the support zone that was broken. Thus, we dare to assume that this was a “triple top” pattern. This gives a strong signal for a price reversal from upward to downward. In addition, when the neckline is broken, increased volumes should be observed.

Identifying weakness in trend movement

We know that any trend consists of the trend movement itself and a period of rollbacks.

A trend move is a strong phase of the market when the price moves in one direction and consists predominantly of bullish candles. Bullish candles are larger than bearish ones and close near their highs. When bullish candles become smaller, it indicates that buying power is weakening, or there is equal selling pressure.

The size of the candles will not give you a guarantee that the market will reverse. But this is definitely a signal that indicates the weakness of buyers.

A pullback is the opposite of a trend move, where the price moves against the underlying trend. Retracement periods are dominated by bearish candles, which are relatively small and usually close near the middle or low of their range.

When bearish candles become larger, it indicates that selling pressure is increasing as buyers are unwilling to buy at higher prices.

Again, this does not guarantee that the market will definitely reverse. But this is a sure sign that buyers are becoming weaker.

Parabolic SAR

Among technical indicators, Parabolic SAR stands out for its clarity in determining the direction and change of trend. It is in many ways similar to the widely used moving average, with the difference that it has greater acceleration and less lag relative to the price chart. Parabolic points are placed below or above the price chart, which serves as a clear demonstration of the current trend.

Parabolic SAR shows itself even more clearly when the trend direction changes - this is one of its main advantages. In such a situation, the relative position of the indicator and the price chart changes to the opposite: when the “bearish” trend changes to a “bullish” one, the indicator points will begin to be located under the price, similarly, but vice versa, will happen after a reversal of the upward trend. The parabolic has no equal in determining the moment to close a long position.

When does a trend reversal occur?

As a trend exhausts its potential, it enters the distribution phase. The forces of buyers and sellers are balanced, and the price begins to move in a range. At this point, it becomes apparent that the support area is an important level, as it is the last line of defense for buyers. If the support does not hold, then the market will come under the complete control of sellers.

There are situations when the market moves along the trend line for a long time. And if the trend line breaks through, this is a sign that buyers have finally lost their initiative.

You should also always pay attention to higher timeframes. If you suddenly see that the market has suddenly changed its direction, most likely it has come close to a significant support or resistance level on a higher timeframe.

This can be useful for two reasons:

- You can find high probability trend reversal areas based on a higher time frame.

- You can avoid bad entry points by checking your trading setup against a higher time frame.

A strong trend move usually occurs when the market is in a long-term uptrend and the price suddenly begins to move vertically upward. The range of candles becomes much larger compared to the previous candles. When this happens, it is a sure sign that the smart money is rushing to get out of the market, with most traders opening new trades as volatility increases. All this suggests that the trend is close to its end.

Divergence and convergence of the oscillator with price

If you are not familiar with divergences and convergences, you can learn about them in the article: “How to use the MACD indicator. Trading settings and strategies." They are written about in the final part of the article.

In short, divergence/convergence is the discrepancy between the price chart and the oscillator chart. For example, when the indicator shows new highs, but they are absent on the price chart (divergence). Or vice versa (convergence), if we are talking about downward movement. It looks like this:

Bullish divergence (convergence)

The example shows convergence, or as it is also called, the bullish divergence of the price chart and indicator data (in this case, the MACD histogram). This tells the trader about a possible change in direction of the previous movement.

If the market is growing and the oscillator readings diverge from the price chart, then we are talking about bearish divergence.

Bearish divergence (divergence)

Another good sign of a reversal is an acceleration of the trend. It is known that the trend is divided into phases:

- initial

- development

- completion

Using the linear figure "folding meter" you can determine these stages.

Accelerating trend. Folding meter figure

Determining the trend reversal

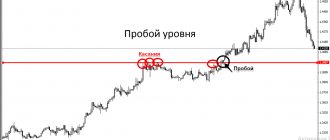

There is a common misconception among most traders. From somewhere came the statement that support and resistance levels become stronger with each additional testing. However, this is a grave mistake. Repeated testing of a level makes the level more noticeable, but does not make it stronger. Visible and strong levels are not synonymous.

If this were true, then the levels would become stronger with each additional test, and their breakdown would never take place. If the level breakdown does not occur on the third test, why then does it occur on the sixth test, when this level should have been twice as strong?

If we can agree that repeatedly testing a level does not make it stronger, then we can conclude that the level is getting weaker? Not certainly in that way. Of course, sooner or later there will be a breakdown, but we must have enough data that would confirm to us the likelihood of a breakdown.

Let's look at the connection between price highs and lows with the key level.

The illustration below shows a trending market that bounces off a trend line, but the distance between each retest gets shorter over time:

Note that the price has tested this level as support four times since its formation. The intervals between retests decrease as the trend develops.

Subsequently, a breakdown of the level occurs:

Why is it happening?

The price shows you that demand in the market is gradually drying up. When prices rise, demand decreases as traders become less willing to buy at higher prices. At the same time, supply increases as market participants close their positions, taking profits.

In the image above, demand decreased each time after the trend line was retested. Thus, the market tries to maintain this level and the price can no longer reach higher highs.

This concept also applies to a bearish trend, when demand increases and supply decreases along with the price.

Let's look at the real graph:

Notice how the trend reaches the support level faster and faster. A further breakdown served as the starting point for a rapid price drop.

The last sign of a potential breakout is price movement near a key level. That is, the market begins to exert constant pressure on a key level over a short period of time. This is a sure sign that a breakout will soon occur and the trend will reverse.

Real example:

This technique can be used on a 1-hour chart:

The price began to group around the level, which is a sure sign that the bullish momentum will soon end.

Another example on a 4-hour chart:

We can also combine these methods with graphical patterns of price movement. For example, the line of defense for buyers was the long-term trend line and support area. Also, the price forms a head and shoulders figure.

How to gain positions and place stops during trend trading

Traders trading with a relatively calm strategy usually open 1-2 trades following the trend and simply accompany them, either placing or moving stops. Their more aggressive counterparts enter a second trade as soon as the next level is broken. And the stop on both positions is moved beyond the last wave - this protects the achieved potential profit in the first trade and introduces a small risk in the second. Increasing positions in this way is acceptable and justified if you have well-developed skills and experience. It is this strategy that makes trend trading as profitable as possible. As you move, additions occur at each new level. And the feet are positioned in exactly the same way. The only drawback of the method is that moving stops does not allow you to catch the top of the trend or its end at the very bottom. The range for trading will be relatively small, which is why you will not receive any potential profit. But you will be able to protect the actual profit you already have. Here it is appropriate to remember the popular saying that you can’t earn all the money .

You can't predict how far or how long a trend will grow. Just try to move with it for as long as possible, remembering to protect the dividends already received, rather than trying to catch the trend before the reversal. This is more effective than taking unnecessary risks . Exiting a trade in this way is the best option, which is confirmed by the experience of numerous students of Alexander Gerchik and other experienced traders. There is another way to exit - when the trend line is broken . Exit the trade when a candle appears if it closes lower than the uptrend line or higher than the downtrend line. In theory, the moment of exit is determined by the market. In practice, cautious traders can close transactions an order of magnitude earlier than the end of the movement, thereby missing out on the “fat” part of the moving trend and making less profit. But on the other hand, it’s better than missing everything out of greed and running into losses, including losing your deposit.

Trading setups for entering the market

There are 3 ways to enter the market:

- At the level of support or resistance.

- At the breakdown.

- On a rollback.

At support or resistance level

The minimum of the accumulation phase is an area of support, which also relies on the support of a higher time frame.

The advantages of this method:

This trading setup offers a very favorable risk/reward ratio because you are entering the market at the earliest stage of a reversal move. The size of your potential profit can be very large.

Minuses:

The price does not always retest the support level.

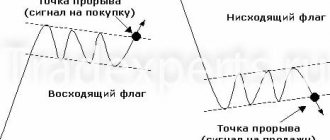

On a breakout

You can wait for the breakout and then enter the trade.

The advantages of this method:

You will be able to catch every movement of the market as it moves from the accumulation stage to the movement stage.

Minuses:

Any breakout may turn out to be a false breakout.

On a pullback

You can wait for a pullback before entering a trade.

The advantages of this method:

We have a logical place to place a stop loss and a good risk to reward ratio.

Minuses:

The pullback may not happen, and you risk missing the entire subsequent movement.

Economic fundamentals

Of all the fundamental analysis, only the actions of the regulator in each individual country can be called truly useful. Monetary policy determines the behavior of long-term large investors. An increase in the interest rate leads to the fact that the country’s currency becomes attractive and one can expect its growth in those pairs where the second currency has a lower rate.

But this applies only to the currencies of developed countries, because the rate on the hryvnia is more than 10%, and it is completely unattractive. Cycles of rising and falling rates can be seen as driving trends, and their endings as potential reversal points. During periods of unchanged rates, anything can happen and this method cannot be used, so it can only act as an auxiliary one.

Entry points for trend reversals

We have two ways:

- Using a limit order.

- Using a reversal candlestick pattern.

Limit order

You can set a limit order and enter without confirmation. In this case, you get a favorable risk-to-reward ratio, since your entry point will be near the highs or lows.

The downside is that it will be psychologically difficult for you to buy when the market is down.

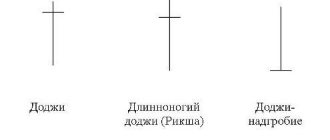

Reversal candlestick pattern

You can use reversal candlestick patterns for your entry point. This way, you will only enter the market once there are signs of a reversal. However, you risk entering at a much higher price.

Absorption pattern at support level:

Three black crows and three advancing soldiers

Unusual names, aren't they?

In fact, these are three candles that form at the top/bottom of the market. The closing of each of them is at the maximum (minimum), and there are practically no shadows:

In this example, the trend set the market bottom three times. All three falls were impulsive: with each new blow, the sellers expended their strength.

Then, literally from the bottom, three white candles appeared - harbingers of good news for buyers. Each of the candles had a closing high, with small or no upper shadows.

Here is a mirror example with “three black crows”:

Despite the fact that the candles were large, the signal of three black crows gave a very good profit.

Note: both patterns are signals of a long-term trend reversal. They always form at the top/bottom of the market.

Let's sum it up

Identifying trend reversals doesn't have to be complicated. The techniques I've described are all you need to know to understand whether the current trend will continue or end. Keep in mind that these methods are useful in both bear and bull markets and can be used on any instrument or time frame.

The best thing a trader can do when trying to assess the strength of a trend is to try to understand the history of price movement. We cannot know what will happen in the market in the future. Our job as a trader is to pick up the clues that price leaves and thus accumulate our statistical advantage.

Completion

Every trader should use certain signals in their trading that indicate a trend reversal. After all, only in this case can you consciously and consistently take profits in the market. We have examined the main, one might say, fundamental tools, but there are others. By carefully studying the charts, each trader can find his own unique patterns that only he will know.

In general, in addition to the above tools and reversal patterns, trend reversal indicators can also be used in trading. In addition, there are some very good options. Their use is mainly due to the fact that it is possible to partially automate the trading process by connecting alerts (sound or SMS notifications) to the indicators.

By the way, if you have a working indicator, but it does not have an alert, then you can create a new one based on this indicator using indicator designers and advisors . All this can be done without knowledge of a programming language.

Good luck and great trades to everyone!