At the end of last year, cryptocurrency futures trading was launched on well-known financial exchanges and several additional trading platforms. In particular, the Chicago Mercantile Exchange CME, the Man Group investment fund and Vontobel Bank began trading in cryptocurrency financial assets. Let's consider what prospects this step opens up for the cryptocurrency market and what consequences the start of trading in CME Bitcoin futures entails. You can learn more about Bitcoin in this article.

What are cryptocurrency futures

Futures in the general sense of the word are a long-known and relatively popular financial instrument used by financiers all over the world. In essence, it is an agreement between two parties, according to which one undertakes to buy a product from the other in the future at a price fixed at the time of purchase. The exact validity period of the futures contract is agreed upon when concluding the transaction.

Futures are in free circulation and can be purchased and sold before the expiration of the period specified in them. To complete purchase/sale transactions, it is not necessary to pay the full price indicated in the document. As collateral for the fulfillment of obligations, a part of the amount is transferred, which is called the guarantee security.

Bitcoin futures, which CME began trading, are a type of derivative in which the commodity is the cryptocurrency BTC. Similar contracts can be introduced for other cryptocurrencies by decision of the management of financial institutions and regulatory authorities of specific states.

Total: on which platforms can you buy and sell BTC?

- Still on more than 300 crypto exchanges, the largest of which are Binance, Huobi, OKEx, ZB.COM, Bitfinex, etc.:

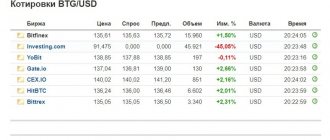

Fig 1. Cryptocurrency exchanges - New: on American exchanges through the listing of CME Group Inc.

- New: Forex brokers (NordFX, Alpari, Fibo Group, etc.) have added cryptocurrencies to the list of trading instruments on their trading platforms.

Features of Bitcoin futures

A futures contract for Bitcoin or other crypto is not much different from a derivative for a regular commodity. One party to the transaction undertakes to buy or sell the required number of BTC tokens after the expiration of the contract.

The guarantee obligations for such transactions amount to 10-15% of the amount, which allows small market participants to buy or sell futures for little money, receiving a good income from exchange rate fluctuations. Everything a novice cryptocurrency trader needs to know is here.

History: how futures appeared

Traces of futures trading can be seen as early as 1750 BC in Mesopotamia. King Hammurabi's legal code stated that goods and assets must be delivered at an agreed price at a future date, based on a written contract.

If we talk specifically about financial exchange futures, they have been actively used since the 1970s. Previously, their trade was mainly associated with agricultural products, but in 1971 there was a turning point in the industry - the abolition of the gold standard for currencies. Market leaders immediately realized that the principles of trading currencies were now no different from trading commodities. Therefore, futures can also be used here.

The concept received support from economists, and they were not mistaken - currency futures soon became an integral part of international finance.

Impact of CME futures on cryptocurrency

The introduction of futures contracts is of great importance for the cryptocurrency market. Analysts are confident that this entails an increase in the value of the asset itself. The bottom line is that futures contracts stimulate interest in this asset from large investors who could not invest in BTC and crypto before due to the lack of legislative regulation of these processes.

The beginning of futures trading in some way legalizes Bitcoin and provides access to this asset to participants in large international traditional exchanges that exist within the framework of local legislation. Bitcoin is being transformed from an obscure digital asset into a commodity whose value is calculated alongside precious metals, strategic foodstuffs, oil, government bonds, etc.

The introduction of BTC futures increases the investment attractiveness of the asset. As a result, the demand for Bitcoin will increase, which in turn leads to an increase in its price. Moreover, due to the limited number of Bitcoins being issued (a technology limitation), the price of BTC will further increase and volatility will decrease. That is, tokens can be used as a means of storing investments and as a tool for long-term investment.

However, there are also negative aspects of the process:

- A futures contract is a derivative financial instrument, so its rate can change artificially under the influence of major players. This opens up scope for manipulations that will cause reputational damage to the asset itself.

- Due to the lack of a tangible representation of Bitcoin as a commodity, it has no minimum price. Therefore, under the influence of large players, the price may collapse uncontrollably, which will cause significant harm to the economy.

- Futures do not guarantee constant price growth, since stock speculators with significant financial resources can reduce the price by selling assets, albeit for a short period. This will lead to loss of funds for small traders.

What has changed in the BTC trend since professional trading entered the market?

The main change is the end of the 1st A wave of the bullish (upward) trend of Bitcoin, spontaneously formed by millions of small, medium and large BTC owners during 2011-2017. on crypto exchanges.

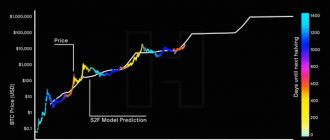

Fig 2. The end of the 1st A wave of the bullish (upward) trend of Bitcoin

The nature of the movement of cryptocurrencies has become significantly more complicated and changed . If previously every trader on the stock exchange bought Bitcoin whenever it fell down and knew that in a day or week a profit would appear in his account, which he could lock in immediately or hold the deal for a month or two (feel like an investor) and earn up to 100% in a month , presenting himself as “smarter than Soros and Buffett” combined (“they earn some 20% a year, when I can get a higher percentage on a cue ball in a week”).

Bitcoin ETF: Definition and Purpose

Bitcoin ETF

Exchange-traded funds will allow traders to access BTC through traditional markets, without the participation of cryptocurrency exchanges or other means of purchasing digital assets. In this case, you can only trade in accordance with the rules of stock exchanges - on weekdays, at certain hours.

Bitcoin ETF tracks the price of Bitcoin and forms its value based on it. Final settlements can be carried out in both cryptocurrency and fiat currency.

For trading an exchange-traded fund, apps aimed at retail investors, such as Robinhood or Fidelity . Typically, they track key stock indexes, such as the Standard & Poor's 500, or other traditional assets and commodities (oil, gold).

Bitcoin ETFs have been actively discussed since 2013, when the Winklevoss brothers filed their first application with the SEC. That application was rejected. At the moment, nine years have passed, and the SEC has still not approved Bitcoin ETF, although applications are received with enviable regularity - there was another application from the Winklevoss brothers, as well as requests from BlockFi, Bitwise, Direxion (five pieces), GraniteShares (two pieces) ) and many others.

It's worth noting that there are several Bitcoin ETNs - this means that there is potential counterparty risk (if the fund goes bust, holders will lose money). An example ETN is GBTC (Grayscale).

In the following chapters:

- Technical analysis of MF or how to understand every movement of the BTC trend

- Author's indicators for BTC, unknown to the market

- Money management MF: how to guarantee not to lose a deposit when trading crypto

- Successful Trading System: How to Test It for Bitcoin

- 1st MF point for opening transactions on cryptocurrencies

- 2nd MF point for opening transactions on cryptocurrencies

- 3rd MF point for opening transactions on cryptocurrencies

- 4th MF point for opening transactions on cryptocurrencies

- 5-12 points of the MF for opening transactions on cryptocurrencies (given during training)

<<<Read previous chapter Read next chapter>>>

What has changed after Yandex shares were listed on the NASDAQ stock exchange: trends and earnings of intermediaries?

To understand how COMPLEX the movement of the BTC price will now be , I will give an analogy with the entry of Yandex shares on the same American exchanges (NASDAQ). Compare with what happened with Bitcoin and you will find many analogies. So:

Figure 3. Yandex shares entering the American exchanges (NASDAQ)

Circle No. 1 . In May 2011, Yandex entered the IPO (initial public offering) of the NASDAQ exchange at first $20, then $25 per share, selling them for $1.3 billion to three large global banks - Morgan Stanley, Deutsche Bank and Goldman Sachs, which offered them trading on NASDAQ at an initial price of... $35 per share, and then raised it to $35.95 per share by July 11th. In total, the profit of the banks that conducted the IPO amounted to at least 43.8-79.8% in 1.5 months (they earned at least $0.5 billion).

Explanation: why did market maker banks play short? This is logical, because in 1.5 months they SOLD shares purchased at a discount at the IPO (analogous to ICO crypto exchanges). Now their task was to LOWER the price to a minimum and BUY shares cheaper. This is what they achieved by pushing the price BELOW $25 and even $20 per share (the media told everyone the price of the pre-exchange IPO, do you think by chance? No matter how it is, large capital does not have accidents, after all, you need to tell all small players where to put stop-loss on market?).

Circles No. 1 and 3. The next year (!!) the Yandex share price fell and fell (July 2011 - June 2012), dropping to a price of $17.55 per share on June 15, 2012. Let's assume that the same three largest world banks used shorting only the profit earned previously in 1.5 months ($0.5 billion), then their income doubled and amounted to $1 billion.

Analogy question: if Yandex shares were in a bearish trend for a year, how long do you think the CME will push Bitcoin down so that large players can buy up, if not all, then almost all of it? A week? Two weeks? A month or two or longer?

Circle No. 2. A bullish wave of a senior level up, which could have become a reversal as the beginning of a bullish upward trend, but did not. I draw your attention to circle No. 3, which collected the stops of those small players who hastened to open buy transactions in the hope of a trend change.

An analogy question for Bitcoin traders: are you sure that the first powerful upward wave is necessarily a change in trend?

Circles No. 3 and 4. The next 1.5 years (!!) - bullish trend (June 2012 - January 2014), when the price of Yandex shares was raised to $44 on January 10, 2014. This is 250%, or $1 billion turned into $2.5 billion.

Circles No. 4 and 5. The next 1.5 years - a bearish trend (January 2014 - October 2015), down to the local minimum of $10.69 on October 26, 2015. I draw your attention to:

- technical analysis figure “Head and Shoulders”;

- breaking through the support at $17.55 (usually stops are placed there), after which the bullish trend began again;

- the bearish play on shares amounted to 411% in 1.5 years;

- $2.5 billion turned into $10.2 billion.

Circle No. 5 and up: a 2.5-year (ending) bullish trend that has already raised the price from $10.69 to $42, i.e. by 392%. So $10.2 billion turned into $40 billion.

Prospects for SEC approval of Bitcoin ETF

The first Bitcoin exchange-traded fund in the US could be approved by the end of the year, analysts say. In any case, the commission has already postponed the deadline several times, and according to the law, it cannot do this anymore. Thus, in November-December we will learn the final decision on at least one application. There are a lot of requests, including recent ones: ProShares, VanEck, WisdomTree, Direxion, First Trust, GraniteShares .

President Joe Biden, upon taking office, appointed Gary Gensler as head of the SEC, a man who views crypto assets more favorably than the previous chairman. Gensler even taught a course on “Blockchain and Money” at the Massachusetts Institute of Technology. This gives hope to investors.

The most promising applications

Bloomberg published a report in October 2022 that identified several exchange-traded funds that best meet SEC requirements (particularly those identified by Gary Gensler shortly after his appointment) and therefore are likely to be approved:

- Invesco Bitcoin Strategy ETF

- VanEck Bitcoin Strategy ETF

- ProShares Bitcoin Strategy ETF

- Valkyrie Bitcoin Strategy ETF

Within a few weeks, requests will be reviewed and a positive or negative response will be given. Please understand that approved ETFs will be futures contracts and not spot assets. They will be registered in accordance with the conditions specified in the Investment Company Act of 1940. This ensures a high level of investor protection.

Recently, the crypto lending platform BlockFi also filed an application with the SEC to launch a Bitcoin futures exchange-traded fund.

Bitcoin ETF from BlockFi