- phenomenon

- experts

- opinion

- origins

- conclusion

Today our focus is on the Bitcoin exchange rate. However, the one who notices that this indicator has currently attracted not only our attention, but also the attention of many millions of people from all over the globe will be right. Because its record performance has recently exceeded all the wildest forecasts and predictions.

But let's talk about everything in order. We will try to provide you with a short overview of the entire development path of this digital currency with its ups, downs and periods of relative calm, and we will also try to understand the reasons for such unstable behavior.

By the way, despite the high volatility of BTC, every day about 300 thousand financial transactions (transactions) are carried out in this virtual currency and their number is constantly growing. What is the secret of the popularity of this crypt and what influences its behavior? Let's figure it out.

Phenomenon of the past year – Bitcoin

Let's start, as they say, from the end, that is, from this November, when Bitcoin broke all records for exchange rate growth, reaching a value of 8100 USD per 1 BTC.

This happened on November 20, 2022. This was preceded by several weeks, when the community's attention was focused on the events taking place around this currency. Back in early November, on the 8th, BTC reached a record high at that time of $7882 per coin. However, the cryptocurrency failed to hold on to this value for long. 4 subsequent trading sessions brought down the Bitcoin rate by a third, to $5,519. And again, not for long. Following the fall, a rapid upward movement began and by November 17, 7998 “green” were given for 1 BTC, and after another 3 days - a new record value of 8100 American “rubles” for 1 Bitcoin.

Where do quotes come from?

Bitcoin is today traded on several dozen cryptocurrency exchanges. Quotes on each specific exchange will differ slightly from the same indicator on another site. Therefore, for unification, the website BlockChainDesk.ru provides the weighted average BTC rate, that is, the average value calculated based on data collected on a number of major cryptocurrency exchanges, and its change over the last 24 hours.

In addition, data on Bitcoin capitalization at a given time and trading volume over the past 24 hours are displayed.

What do experts say about the Bitcoin rate?

Even people who are not particularly versed in the topic of cryptocurrencies understand that such exchange rate “swings” do not arise without a reason. And the rapid increase in the value of Bitcoin was caused by certain factors that experts in this field are now trying to understand. Most analysts agree that the main factor was that the significantly subsided interest in Segwit2x has recently begun to revive, and against this background, many investors chose to transfer their savings to Bitcoin.

Events developed as follows. The information that appeared about the cancellation of the hard fork immediately caused an increase in the price of BTC by more than 600 bucks (from 7200 to 7800 USD), which was soon followed by a drop to 5 and a half thousand dollars. In parallel with this, there was an increase in Bitcoin Cash, which in a short period of time jumped from $600 to $2,600. The situation provoked a significant outflow of miners from the BTC blockchain. They all chose to switch to BCH mining. As a result, the power of the Bitcoin network began to decline, which led to an increase in commissions and an increase in the time for confirming transactions.

It seemed like it was not the best of times for the cue ball. But then the rapid growth of Bitcoin Cash was followed by its equally rapid fall, the miners again turned their attention and power to the mining of the cue ball, thereby unloading its mempool, plus a number of positive news arrived in time and this leveled out the situation.

If we talk about the news, they consist, firstly, in the intention of the Man Group (an investment fund managing 100 billion bucks) to launch futures contracts for BTC, as the CME exchange has already done, and, secondly, in the fact that Cash The App has added tools for carrying out operations with cue ball to its functionality.

Quite authoritative analysts, such as Sh. Jafari, believe that the minimum for Bitcoin is now close to the mark of 10 thousand American “rubles,” but after reaching this value, you need to carefully monitor the situation. Since, most likely, a correction will follow, the beginning of which can be determined in advance by characteristic signs.

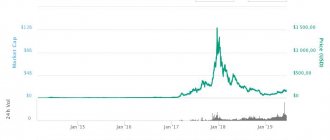

Bitcoin vs Dollar chart

Due to the fairly significant instability of the Bitcoin exchange rate, it is convenient to use the online Bitcoin to dollar exchange rate chart to present the general situation on the market. After all, in order to predict possible changes in the exchange rate, it is necessary to have information not only about current values, but also statistics about quotes for a certain past period of time.

The Bitcoin chart below shows the ratio of the price of Bitcoin online to the dollar. In addition, you can observe changes in the value of Bitcoin by day, week, month, quarter and year.

Why do the main quote values differ from those shown on the chart?

As mentioned above, the main quotes are an average value calculated based on trading data on several exchanges. The above chart is a live broadcast of trading from one specific exchange, in this case Coinbase.

The opinion of skeptics and the real Bitcoin rate

A skeptical attitude towards everything that does not fit into the usual framework is, in principle, characteristic of human nature. What can we say about the sphere of cryptocurrencies, there are more than enough skeptics here. They all consider digital money to be nothing more than an artificially inflated “bubble” or another “financial pyramid”. In fairness, it should be noted that there are not so many ardent opponents who are ready to vouch with their heads for the fallacy of such an opinion (after all, there is only one head, but you never know what can happen). But recent events are slowly pulling the rug out from under the feet of a critical audience.

But those who at the moment definitely do not care at all about the opinions of skeptical experts are those people who at the beginning of this year purchased Bitcoins for just over 900 dollars per coin, and 10 months later sold them with a gain of almost 800%. They simply rejoice at unexpected luck, without going into much detail about whether there is a “pyramid” or a “bubble” behind it.

Bitcoin calculator - how much is cryptocurrency worth?

To easily calculate the cost of one bitcoin, it is not at all necessary to peer into constantly changing stock quotes (see rating of cryptocurrency exchanges for 2022 ). You just need to use a calculator.

The built-in calculator can even be found in Yandex results if you enter the number of bitcoins and add another BTC (like this - “0.0011 BTC”):

I really like the calculator (aka converter) on the BestChange . To calculate, you need to indicate the amount in Bitcoins (or even in Satoshi, which is very convenient), or in rubles/dollars/euros. For example, let’s convert the Satoshi earned on Bitcoin faucets into rubles:

Or you can estimate how much and what you can get for 12,000 rubles in all the mentioned currencies. It is very convenient that the table below also provides calculations for other popular currencies and cryptocurrencies. This allows you to avoid having to select them from the converter drop-down list once again.

Even a child can use the calculator; there is absolutely nothing complicated here. the BestChange website itself is very useful in terms of not only calculations, but also finding the best exchange rate in the direction you need. I highly recommend it to save time and money.

To the origins of the phenomenon

Perhaps some information for understanding the current triumphant march of Bitcoin can be gleaned from the history of its emergence and development, to which we now turn. Fortunately, we will have to go back not centuries ago, or even decades, but only to 2008, when information about Bitcoin first appeared and the first transaction was carried out:

- year 2009. This year was marked by the fact that in October the first exchange rate of Bitcoin against fiat currencies was established. Now it’s hard to believe, but at that time 1 “green” could buy a little more than 1,300 bitcoins. No one even bothered to calculate the cost of a unit of BTC, since it was a ridiculous value. By the way, the present value even included the cost of electricity, because mining the crypt required round-the-clock computer operation.

- 2010 In February 2010, the now defunct Bitcoin exchange dwdollar was founded. And in May, a curious incident occurred when a certain person purchased pizza for 10 thousand bitcoins, which at that time was about 25 USD. However, it seems funny today when you realize that the eccentric paid a fortune for a piece of dough with cheese.

In July of the same year, the first noticeable jump in the price of BTC occurred; it grew 10 times to 8 cents per coin, and in November to 50 cents (the capitalization of the currency at that time reached a million dollars).

- 2011. At the end of winter, the price of the cue ball rises to $1, after which a long decline is observed. Then there was a rise again, and at the beginning of summer the Bitcoin rate was 10 USD per 1 BTC, and a few days later it was almost 32 bucks per unit. And then - a sharp drop by 3 times, again to 10 USD. It happened on June 12.

This year has generally not had the best impact on BTC, both from the financial side and from the image side. In July, the largest theft of cryptocurrency from an electronic wallet took place. The amount was 25,000 BTC. But this theft was not the only one; before the end of the year, a whole series of hacks and thefts took place, which sharply reduced user confidence in this currency.

- year 2012. The first Bitcoin bank appears, it is called Bitcoin Central. Everything here is legal and reputable, licensed and recognized by European regulators. True, the Bitcoin rate did not react particularly to this event.

- year 2013. This year cannot be called stable; it was probably payback for a long period of calm, when the price of the cue ball did not change for months. But in February of the thirteenth year, the rate first rose to 30 dollars, then crossed this mark and continued to grow. By the end of the first ten days of March it was 37 USD per 1 Bitcoin, and by the beginning of the third it was already almost $75.

April began with overcoming the hundred-dollar mark, and by the 10th the Bitcoin rate was, not much, not less, $266 per unit. But after 10 days there was another fall. The next wave of growth began in November - first 269 USD, then 503 and finally 1242 bucks. The potential of BTC has made itself known loudly.

But by mid-December, the rollback again more than doubled, to $600 due to the fact that the Chinese Central Bank banned its financial institutions from working with Bitcoin.

- year 2014. The beginning of the year was marked by a moderate increase in the value of the cue ball, but already in February the rate began to decline again and by the end of the year it amounted to 310 “green” per coin. This period can be considered a time of strengthening and maturation of this currency. Many events took place that brought crypto to a qualitatively new level, the area of its use expanded, the first operation was carried out through a regulated service, a storage and insurance system was created, etc.

Another significant event occurred - about 30 thousand Bitcoins were confiscated from the illegal trading resource Silk Road and put up for auction. On the one hand, this operation shook the attitude towards cryptocurrency as money for carrying out criminal operations, but, on the other hand, it became clear that the declared anonymity is in fact not so “anonymous”, and if necessary, it is quite possible to identify the participants in transactions.

- 2015 A year of hope. The sharp drop in the value of the cue ball ($177) that occurred in January was offset by a stable increase to 281 USD by the beginning of March and to 500 dollars in October. There was a feeling that global changes were coming in relation to digital currencies. But at the beginning of winter there was a rebound again and the Bitcoin rate stopped at $350-380 per 1 BTC.

- 2016 It’s no secret how sharply digital money (though not only digital money) reacts to various events in the financial and political sphere. And the sixteenth year was rich in such events, which was reflected in the exchange rate chart of the cue ball.

First, a drop of 50 points due to predictions of an imminent collapse by one of the developers, Mike Hern. Then a slight increase to $395-415 per coin, although the events that caused it were quite significant - the recognition of the currency by the Japanese Cabinet of Ministers, which allowed the use of BTC as a means of payment along with ordinary money, and a significant expansion of the possibilities of use in connection with the opening of trading in South Africa Bidorbuy sites.

April and May passed almost without changes, and only by the end of spring the cue ball gained almost $150 in value (up to 600 USD per 1 BTC). What caused this jump is still not really known. After this, moderate growth continued (up to $722), which ended in mid-June with a collapse of almost a hundred.

Until September there is a gradual decline. Then the restoration of lost positions began, which continued almost until the end of December and stopped at $950. Then a rollback of almost $100 and, finally, breaking the thousandth mark this year after the end of the New Year and Christmas holidays.

- And finally, the year 2022. The increase in the value of Bitcoin, which began in winter, continued throughout the subsequent months with rare minor decreases. Thus, having reached $2,900 in June, the cue ball experienced a minor pullback in July and by August was already worth $4,200. If you remember what we wrote about at the very beginning, then you cannot help but understand that the trend has continued, since at the end of November the Bitcoin rate is about $8,000 per 1 BTC.

What determines the price of Bitcoin today?

Unlike national currencies, the rate of which is set by the Central Bank for the entire current day, no one controls the Bitcoin rate. Neither the Central Bank nor any other organization sets a fixed price for Bitcoin.

The Bitcoin to dollar exchange rate depends solely on the natural relationship between supply and demand formed by market participants. Due to the high volatility of the Bitcoin rate, no one will dare to set a certain BTC rate for the whole day, because sometimes daily price changes can amount to tens of percent.

For many residents, for example, from Russia, it is more convenient to use the Bitcoin to ruble exchange rate, since this tool reflects the BTC exchange rate to the local currency. Therefore, the values of the Bitcoin to ruble exchange rate online are also given, recalculated taking into account the current dollar exchange rate.

How to buy Bitcoin at the best rate

You can buy bitcoins at a favorable rate:

- In exchangers (for example, Prostocash, Baksman, 60 cek, Xchange, 24paybank, Kassa).

- On crypto exchanges: Binance, Currency.com, OKEx, EXMO, FTX, Bybit, Huobi and others. You can exchange Bitcoin there for almost any payment system that you have.

In Bitcoin exchangers, the action algorithm is as follows:

- Register and receive a discount on each subsequent exchange.

- Select the direction of exchange and indicate the amount.

- Enter the required data, including the Bitcoin wallet address to receive. Click “Start exchange” and make payment according to the application.

- After confirming the transaction on the network, you receive bitcoins in your wallet.