The Bitcoin rate has already soared by 20% since the beginning of October and costs more than $57,000, which corresponds to the levels of May of this year.

At the same time, capitalization has exceeded $1 trillion, and this is comparable to similar indicators of the largest American corporations. What is the reason for the current jump in the exchange rate and what does this mean for investors?

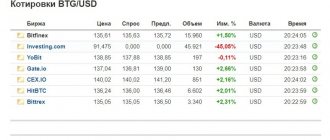

Bitcoin rate dynamics in October 2022:

What's up with Bitcoin as of May 20, 2021

Wednesday, May 19, 2022, became “black” for cryptocurrencies. It is known that on that day the rates of most top currencies in electronic form fell sharply by double-digit percentages. Bitcoin dropped below 32 thousand dollars per token; this rate has not been seen since the end of January 2022. The situation on May 20, 2022 has not changed, Bitcoin remained at the same level.

According to the data presented on the Coindesk portal, over the past 24 hours the Bitcoin exchange rate has fallen by 19 percent. At the time of the maximum fall, the rate was about $30,700, but later rose above $35,000. A month ago, Bitcoin was worth more than 60 thousand dollars. According to experts, such a drop is difficult to explain; many believe that it is “abnormal.”

The Ethereum cryptocurrency, which ranks second in the popularity rating, collapsed even more. Over the past 24 hours, the price has fallen by more than 27 percent. The peak low price settled at less than $1,950. The same indicators for “ether” could be observed in April 2022. A week ago, “ether” cost more than 4.3 thousand dollars.

Cryptocurrency rates suddenly began to decline. Not so long ago, the head of SpaceX and Tesla, Elon Musk, contributed to the decline. The inventor said that Tesla Corporation decided to suspend the sale of vehicles for cryptocurrency due to unforeseen circumstances.

Opinions in favor of Bitcoin growth

Experts in Russia and abroad build a Bitcoin exchange rate forecast for 2022 based on studying possible situations. A. Kosheleva believes that the value of the coin will increase from the middle of the year. The main factor for price growth will be increased investor demand for cryptocurrency.

V. Akelyev announces the continuation of the positive dynamics of the Bitcoin rate until the end of the year. According to the analyst, user discussions on the network will lead to an increase in demand and an increase in the value of the coin. Bitcoin has a chance of reaching $100,000 in December 2022.

Bitcoin forecasts for the near future

Experienced investors say Bitcoin has a good future ahead of it. Renowned PlanB analyst says the digital asset will be able to continue its growth. According to him, this is indicated by the signals of the developed S2F model, which deals with forecasting. Other community members say that Bitcoin may become the only cryptocurrency in the world that will show stability over a long period of time.

There were also those who predicted a bad future for Bitcoin. According to William Clemente, replenishing the balance of trading platforms with cryptocurrency may be a signal that many owners of digital assets are preparing to sell Bitcoin. Community representatives identified several important scenarios for the future behavior of Bitcoin. Many say that the cryptocurrency will continue to move within a narrowing triangle. A specialist with the nickname Trader XM reported this on Twitter.

There are experts who see no obstacles to the growth of Bitcoin in the future. According to experts who published their posts on Twitter, the cryptocurrency will inevitably grow in the next few months, until August 2022. After this, Bitcoin may decline, but will soon make a comeback again. This once again confirms the theory that Bitcoin has every chance of becoming the most stable cryptocurrency.

Subject:

- Bitcoin

- Cryptocurrency

Forecast for 2022, 2023 and 2024

Experts rarely predict the cryptocurrency rate for 2-3 years. Electronic coins are considered the most volatile funds in the world. The cost can change significantly from any event that occurs in the world.

The table shows the Bitcoin price values in the period 2022-2024. During these years, analysts will adjust the forecast based on the influence of new factors.

| Period | Price at the beginning of the year, thousand dollars | Price at the end of the year, thousand dollars | Deviation, % |

| 2022 | 55,5 | 62,5 | 12,61 |

| 2023 | 62,5 | 58,9 | -5,76 |

| 2024 | 58,9 | 54,5 | -7,47 |

According to experts from the Economic Forecasting Agency, the Bitcoin exchange rate will show a decline in 3 years. In 2024, the price of the coin will reach $41 thousand. However, over the year the price will decrease by 7.5%.

Attention! The values presented are estimates. They will be adjusted by analysts throughout the period under review.

Currency Resource experts presented a more optimistic forecast. In their opinion, by mid-2022 Bitcoin will break the long-awaited level of $100 thousand. But from August the rate will begin to decline and in 2023 it will remain at around 75-80 thousand dollars.

Bitcoin indicators show its weakness

The daily chart shows that despite the ongoing rebound that began on February 23rd, Bitcoin was rejected yesterday and is currently very close to the February 23rd lows. BTC is trading between the 0.382 and 0.5 Fibonacci retracement levels at $47,153 and $43,677, respectively. Technical indicators on the daily timeframe are very close to turning bearish. The MACD histogram has almost turned bearish, the RSI is close to falling below 50, and the stochastic oscillator has almost made a bearish cross (red arrow). If this happened it would confirm that the daily trend is bearish.

Bitcoin: analysts' forecast

Analysts daily express opinions about what will happen to BTC in the near future, which direction the exchange rate will go and what level the cryptocurrency will be at next year. We have collected both optimistic and pessimistic opinions regarding the Bitcoin rate for the week. Analysts' forecasts are as follows:

- You should not expect any noticeable drops in the Bitcoin rate in the near future. This opinion was expressed to RIA Novosti by Vladimir Panushkin, director of the Center for Social Matrix Technologies “Socioma”, head of the “RAKIB-Socioma” project. According to the expert, the psychological background of the crypto market continues to remain tense, despite the decrease in the volatility of the rate of the most popular cryptocurrency.

- The price of Bitcoin may return to $40 thousand. This opinion was voiced by financial analyst of the Currency.com crypto exchange Mikhail Karkhalev. The expert believes that after falling to $28.8 thousand, Bitcoin was able to quickly recover. Its value has returned to the corridor of $32-40 thousand. If the Bitcoin rate does not rush down again, then its value can return to $40 thousand. After that, it can rush higher, the analyst added.

- Maria Stankevich, Development Director of the EXMO crypto exchange, also gave a Bitcoin forecast for the week. She believes that the decline in the value of Bitcoin this week was no coincidence. It was all due to the negative news agenda. In particular, the Bitcoin exchange rate was affected by the news about the ban on Chinese financial institutions conducting transactions with cryptocurrency, writes RBC. Maria Stankevich is confident that Bitcoin may soon rise in price to $40-42 thousand.

- Summer is a holiday period and statistically there is no abnormal activity in the financial markets, explained Andrey Podolyan, CEO of Cryptorg.exchange. This is precisely the reason for the fact that nothing special happened on the crypto market over the weekend over the past few weeks.

“Bitcoin is currently trapped in the so-called “sticky zone” from $34 thousand to $31 thousand, and is unlikely to overcome these boundaries over the weekend,” the expert concluded.

- Experienced traders and network users also gave Bitcoin forecasts for the week. Popular author on TradingView Trade_lab I am sure that in the coming days we should not expect a fundamental change in the dynamics of Bitcoin. According to him, locally there is consolidation at the lower area of the range of $30-42 thousand, which has been relevant for two months now.

“It is the consolidation above or below the boundaries of this sideways trend that will be a signal for the development of a directed movement towards the breakdown, with the prospect of movement to an amplitude of $10-12 thousand,” the trader explained.

- The CEO of the cryptanalytic company ADVFN, Clem Chambers, warned that the Bitcoin rate could fall to $10 thousand and even $7 thousand before returning to growth. Chambers attributed his forecast to the repeating market cycles of the first cryptocurrency.

- Bitcoin continues to maintain a downward trend, the next levels being $27 thousand and $23 thousand, says Anton Kravchenko, CEO of Xena Financial Systems. According to him, the rate of decline has slowed down significantly and the market is waiting for a reversal point, but it is not yet known at what level this will happen.

- The opposite opinion is shared by Andrey Podolyan, CEO of the Cryptorg crypto exchange, who does not expect the local minimum for Bitcoin to be updated. Podolyan believes that some large players have already accumulated sufficient volume to buy in the area of $30-33 thousand and in July, with a breakout of $36 thousand upward, a powerful impulse movement should develop with the first target in the area of $40-41 thousand and the second target in the area of $45 -47 thousand

“At these levels, Bitcoin will slow down and there will probably be another attempt at a strong decline. For me, the cancellation of the scenario would be BTC going below $29 thousand,” the expert warned.

- There is another bitcoin forecast for the week. Without the receipt of favorable signals, the crypto market will remain volatile, with minor fluctuations both up and down possible, said Artem Deev, head of the analytical department at AMarkets. According to him, one of the drivers for short-term growth from the current $34.5 thousand to $37-38 thousand could be information from reports on the US labor market or interest in cryptocurrency from large investors. They remain silent for now, assessing the risks of tightening legislation in developed countries (for example, states could follow the example of China), Deev believes.

- Another expert gave a Bitcoin price forecast for the week. Summer is a period of reduced activity, so Vladimir Smetanin, director of the financial company Newcent, suggested that in July Bitcoin will remain in the $30-40 thousand corridor, since all the positive and negative news have already played out.

- You shouldn’t expect significant growth in Bitcoin in the coming weeks, says Nikita Soshnikov, director of the Alfacash cryptocurrency exchange service: the hashrate (the amount of computing power used for mining) of Bitcoin has decreased by more than 50% and in the near future this figure will only begin to recover. The crypto market may not return to growth until the fall, the expert believes - the move of miners from China, where several provinces have already introduced a ban on the mining of digital assets, will take more than one month.

In general, analysts predict the growth of Bitcoin to $100 thousand. The impetus for the growth of the main cryptocurrency was the decision of El Salvador to use cryptocurrency as a means of payment.

Which coins will “survive” the decline in value?

Despite the fact that according to forecasts, BTC will enter 2022 with a value of $53–54 thousand, this will not affect other tickers. For example, ETH and BNB are holding up well at their maximum values. Ethereum has been worth more than $4 thousand for a month now, and BinanceCoin is more than $600.

In addition, the Shiba Inu memecoin is growing again. In two days (from November 28 to 30) it rose in price by 55%. Luna, Matic, LiteCoin and Solana also rose.

If you have these coins in your portfolio, then it is worth considering keeping them. Additionally, analysts recommend increasing assets during drawdowns of 1–5%.

When does alt season start?

If Bitcoin does not make a profit this year, you can pay attention to promising coins. They may give "X" in the short term, but the risks are high.

Bestchange platform analyst Nikita Zuborev shared his opinion. To get more profit, he offered two types of assets: “meme” and GameFi tokens.

First of all, the expert recommended paying attention to the outsiders of “meme” coins. Here they are: Doge-Inu, Dogeswap, The Doge NFT, SafeMoon Inu. However, when investing in such instruments, remember that they have no value beyond their name. The value can fall to zero at any moment.

The analyst advised to leave part of the portfolio for native social tokens. For example, Hive, WAX, Steem and others. Additionally, you can choose a few popular blockchain games and invest in their coins.

Allocating no more than 10% of your budget for risky investments. Zuborev suggests investing them in the MANA coin. The token, which belongs to the Decentraland virtual platform, has already shown explosive growth.

Additionally, 2022 will see news buzz around Facebook and its metaverse. Virtual offices, augmented reality, etc. will be tested. This is also beneficial for other VR-related projects, including the MANA token.

The Bestchange platform specialist recommended AVAX and ETH as safe investments. The first is used in the DeFi sector, which is considered extremely promising. The second, according to many analysts, will reach $10,000 next year.

What will the price of BTC be according to popular valuation models?

Previously, we have already considered the most popular models for estimating the value of the first cryptocurrency. Let's see how some of them predict the peak price of BTC within the current rally.

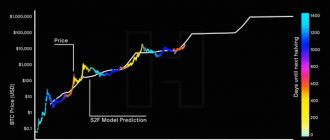

Chart . According to this model, in the second half of the year the price of military-technical cooperation will exceed $100,000, after which it will begin to decline.

The NVT (Network Value to Transactions Ratio) coefficient reflects the ratio of market capitalization to the volume of transactions on the network. The model was developed and promoted by analyst Willy Wu. It does not predict the exact price of an asset, but it can help determine if it is overbought. According to Wu, by the end of 2022, BTC could reach $200,000–$300,000.

Harold Burger's long-term exponential (power) model allows one to predict the direction of the price trend. Judging by the model, the current rally will last until the end of this year or until the spring of next year, and Bitcoin will surpass the $100,000 mark.

Hyperwave Theory , promoted by popular crypto trader Tone Weiss, is designed to predict BTC price peaks, after which an uptrend gives way to a downtrend. In December 2022, a trader predicted that the coin would reach a value of $300,000 before the end of this year.

The Trace Mayor Multiple model is an indicator that evaluates whether a market is overbought or underperforming. If the coefficient is above one, Bitcoin is in a bullish trend; if it is lower, it is in a bearish trend. On the day the article was published, the Mayer coefficient was 1.41. This means that the peak is still far away.