Beefy Finance is a profitability optimizer on the Binance Smart Chain. There are already a number of similar solutions for Ethereum DeFi protocols, but BSC has slightly different problems. While on Ethereum it makes sense to focus on saving gas to avoid high fee costs, fees are already low, so the focus is on automation to provide the highest returns with the least amount of interaction.

BIFI is a token for decentralized project management. Has a maximum emission of 80,000 BIFI. Of these, 74,000 have already been distributed among community members, and the remaining 6,000 remain for the founding team, but access to them is blocked for time.

The editors of Profinvestment.com offer an overview of the main features of the project and its token, which is currently traded only on decentralized platforms, but may soon appear on the Binance exchange.

On March 16, 2021, Binance (binance.com) listed the Beefy Finance (BIFI) token. Trading is available in BIFI/BNB, BIFI/BUSD pairs.

general information

| Name | Beefy Finance |

| Ticker | BIFI |

| Token standard | BEP-20 |

| Blockchain | Binance Smart Chain |

| Current issue as of 02/06/21 | 74,000 BIFI |

| Total emissions | 80,000 BIFI |

| Rate as of 02/06/21 | 726 $ |

| Market capitalization as of 02/06/21 | 58 636 570 $ |

| Official site | https://beefy.finance/ |

| Documentation | https://docs.beefy.finance/ |

| Blog | https://medium.com/beefyfinance |

| Social network | https://twitter.com/beefyfinance; https://t.me/beefyfinance |

| Code | https://github.com/beefyfinance |

| Exchanges | PancakeSwap, StreetSwap, trade.bscswap.com/#/swap; https://classic.openocean.finance/exchange/bifi |

Comparison of PancakeSwap mining with Beefy.Finance

Let's take farming Cake coins as an example.

| Coin Cake | PancakeSwap | Beefy.Finance |

| Entrance | 1.5 Cake - at the current rate as of April 14, 2021 - $36.36 | 0 |

| Annual percentage | 210.27% per annum | 103,36% |

| Total confirmation amount in Binance Smart Chain when mining starts (commission) | About 7-10$ | About 4-5$ |

| Reinvestment fee, every time | About 0.2-0.4 dollars | Automatic |

Conclusion

From this table, we see that farming monte on Beefy.Finance is much more profitable than on PancakeSwap, since we save one-time funds for entering 1.5 cake, + we do not need to constantly confirm transactions when we bet on reinvestment and withdraw coins.

How the protocol works. Storage

Work with the protocol is carried out through the section https://app.beefy.finance/#/. You can connect through Binance Chain Wallet, MathWallet, Trust Wallet, SafePal App, Wallet Connect.

Welcome to Beefy Finance - yield farming optimizer on #BSC .

Put your digital assets to work for you and earn passive income 24/7, while spending your time on things that matter most.#beefylearn $BIFI pic.twitter.com/4O4WcoPD12

— beefy.finance (@beefyfinance) January 22, 2021

The essence of the interaction is the creation and use of storage facilities – Vaults, similar to the usual DeFi pools. A vault is an investment vehicle that uses a specific set of strategies to automate the best available yield farming opportunities. Any community member can create strategies and then bring them to the public for a vote.

Vaults liquidity can be expressed in any asset. Some assets are provided as security for others. Earned profits can be reinvested.

Working with storage facilities allows you to save on fees, maintain a normal collateral-to-debt ratio, automatically reinvest profits and optimize for optimal returns.

Two main types of storage:

- Money Market: Uses stablecoin lending platforms such as Fortube to maximize profits on various coins (BUSD, DOT, DAI, USDT, LINK, ETH or BTCB).

- Native Token Farming: Allows you to invest various assets to earn profits in the form of the BIFI Native Token.

When a user deposits any coins, they receive what are called mooTokens, which symbolize the user's stake in a particular vault. You can always withdraw from Vault only the type of asset you deposited. There are risks here - for example, you invested 10 BNB and withdrew 10 BNB, but BNB itself could fall in price during this time. There is also a 0.1% commission for withdrawals.

Beefy Finance video review (more videos here) :

home

Launched in 2022, Beefy.Finance (BIFI) is a yield optimization tool that helps maximize returns while growing crops on the Binance smart chain. Yield farming is the practice of staking or lending your crypto assets to a liquidity pool based on smart contracts to generate a profit or reward. The lender is known as the liquidity provider and the fund in which the money is held is known as the liquidity pool. Yield protocols encourage liquidity providers (LPs) to lock up their crypto assets in a liquidity pool.

Beefy.Finance optimizes returns through the cash register system. These repositories serve as investment vehicles and can implement strategies using smart contracts.

Vaults can automate yield-maximizing capabilities and leverage crypto assets for liquidity, offer assets as collateral, manage collateral, reduce the likelihood of liquidation, and leverage assets for profit and total returns. This combination of features allows users to automate DeFi farming and optimize profits. There are box upgrades that eliminate the need to make crop growing decisions yourself.

Beefy.Finance has no deposit fees. However, there is a withdrawal fee of 0.01% of the withdrawal amount.

Additional bandwidth charges vary and are determined on a case-by-case basis. There is also a 0.55% commission for each harvest. It supports many popular wallets including Beefy.Finance, Metamask, WalletConnect, TrustWallet and others.

Beefy.Finance uses its own governance token, BIFI, which allows users to receive a portion of the storage performance fee. BIFI holders can stake their tokens in the governance pool. It then distributes WBNB to players daily based on their share of the pool. Users do not need to redeem their tokens to participate in voting.

Additionally, the core team consists of anonymous developers known as @superbeefyboy, @sirbeefalot_bnb, @roastyb1 and @0xbeefy. Other people contributed to the community by writing and testing strategies, tracking statistics, creating marketing materials, and developing new initiatives.

Since the BIFI coin and the platform behind it are relatively new at the moment, investors seem to be treading a little cautiously, although they bring great benefits. However, there are also analysts who state that the price of BIFI coin will increase as the number of users increases.

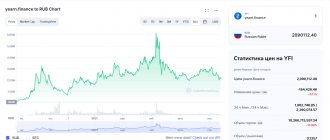

According to CoinMarketCap, Beefy.Finance coin ranks 379th in market capitalization with $76,814,174. Additionally, it can be seen that the 24-hour trading volume of Beefy.Finance Coin, which is trading at $1.066 at the time of publication, is $3,431,108. Additionally, on March 16, 2022, Beefy.Finance Coin broke an all-time record by raising $3,620.

Additionally, there are currently 72,000 BIFI coins in circulation and the total supply of BIFI coins is 80,000 coins.

Beefy Finance offers simple and intuitive complex strategies for any trader to participate through offer boxes on the platform. The first set of vaults went live on Binance Smart Chain (BSC) on October 8, 2022, making Beefy Finance the first yield optimizer on BSC. With Binance Smart Chain's inherent advantage of speed and low fees, the team continues to explore new ways to optimize automation to ensure the highest profits available. Beefy Finance has also expanded to other blockchains such as Huobi Eco Chain (HECO) and Avalanche after initially setting up on Binance Smart Chain.

Beefy Finance uses its native BIFI token across all the vaults distributed on each blockchain. The platform's revenue comes from a small percentage of the company's total profits and is redistributed to those who own $BIFI shares. As a decentralized project with a deep-rooted crypto mindset, BIFI also has a robust governance system that ensures those investing in the project retain decision-making power.

There are several key reasons why Beefy Finance is different from many of the yield optimizers available on the market today:

Beefy Finance distributes the platform's income mainly to those who own shares in BIFI. With BIFI, you essentially own shares in the company, which is eligible to receive dividends. — Beefy Finance repositories employ over 10 smart contract developers who thoroughly test and validate their investment strategies, new platforms and smart contracts before publishing them. Beefy also encourages developers to participate and collaborate to make the Beefy Finance product even better. — Beefy Finance is flexible and works on several blockchains. — Beefy is in open source development. The more source code is available for public testing, review, and experimentation, the faster bugs will be discovered. This is an important principle of Beefy. — Beefy offers unique strategies that other profitability optimizers do not have. This includes liquidity pool pairs that you can only find on the Beefy platform. “To optimize yield, mooVaults has large APYs that outperform most of our competitors in yield.

- Beefy Finance is a supported partner of Binance's official decentralized wallet, Trust Wallet. This increases project credibility and overall confidence.

BIFI, also known as BIFI, is our project's local government token. Users who own this token can be part of the governance mechanisms. By placing bets, users can directly participate in the decision-making process. To purchase a token, you can use one of the many liquidity pools or exchanges such as 1inch or PancakeSwap on Binance Smart Chain.

The platform has mechanisms built into the token that allow it to be deflationary. This rewards early backers and was created with the goal of creating highly motivated token holders to contribute to the project. After an initial distribution period of about two months, the founding team received 8,000 tokens and the community received 72,000. BIFI token holders have the right to create and vote on proposals for the platform as part of the governance system. Tokens can also be staked in a governance pool to earn rewards on wBNB. A portion of the fees paid by users from the harvest treasury is then distributed among the holders of BIFI tokens deposited into the pool.

Users do not need to return their tokens to participate in the voting process. This encourages much higher voter turnout because it means users don't have to be rewarded for voting by default. If desired, users can also be placed into a BIFI maxi-vault, which pays out their BIFI rewards to BIFI. Since the token is non-inflationary and will no longer print tokens, wBNB from storage fees is used to purchase BIFI on the open market. These purchased tokens are then distributed to everyone who has stakes in the BIFI maxi vault.

BIFI Maxi Vault allows users to stake their BIFI like prize pools but receive rewards in BIFI. By staking their BIFI, each participant converts and consolidates their share of the protocol's revenue into more BIFI tokens. Since BIFI tokens will no longer be minted, they are distributed to users who stake by purchasing BIFI with wBNB on the open market.

This vault is intended for users who want to convert and consolidate their share of protocol revenues into more BIFI tokens. Since BIFI does not have inflation, the strategy market buys BIFI for wBNB rewards.

BIFI Coin can be purchased quickly and securely through Binance, the world's largest cryptocurrency trading platform by trading volume.

To buy BIFI Coin, you must first be a member of Binance and then send fiat money. After sending fiat currency such as rubles or dollars, purchases can be made on the trading pair BIFI BUSD and Binance Coin (BNB), where BIFI Coin is traded.

Additionally, by placing a buy order on Binance not only at the market value but also at a lower value, users can make purchases at their desired price. To do this, all you have to do is use the “Limit” tab and enter the amount you want to buy and the price you want to buy.

Strategies in Beefy Finance

Beefy's strategies are modular smart contracts that tell vaults what assets to process and where to sell them. Rewards received are regularly collected, exchanged for the original vault asset, and deposited again for complex farming. Every connection between Vault and strategy is hard coded and the code is completely immutable, so once they are created they cannot be stopped. No one can technically change the repositories and strategies.

To release a new strategy for any asset, a new vault and smart contract must be created. There are currently several lending strategies available through Fortube and FRIES. As the number of strategies gradually increases, the developers are planning to create a dashboard and filter tools for the convenience of users.

Participants can post and discuss their own strategies on Discord https://discord.gg/yq8wfHd on the #strategies channel. There will be a template to help you get started.

Facts about Beefy.Finance and price forecast from Ghost In The Block

The first aggregator on BSC, operating since September 2022, there is simply no more reliable team on BSC.

- The only aggregator that works on 5 networks

- After entering Polygon, deposits = more than 300 million USD (for AUTOFARM = 40 million at the polygon)

- 400+ vaults on all networks

- There are rumors that it is planned to enter Arbitrum (a new sidechain of Ether)

- The BIFI token can be transferred to any of the 5 networks via a bridge, but the quantity - as it was 80 thousand coins - remains the same.

- Demand is increasing in each of the networks. Price will inevitably follow demand

- A month ago we started actively working with the Chinese audience

- As of June 1, a new marketing director was hired. And he's so cool that you can't say his last place of work

- A new secret project based on Beefy storages is being prepared, release date - June-July

Price forecast – 10,000 USD

BIFI token

The goal of BIFI tokenomics is to create incentives for the growth and sustainability of the Beefy protocol. The inflation-free model aims to reward early adopters and effectively incentivize token holders who contribute to the future of the protocol. Many modern economic models in DeFi take advantage of token inflation to provide high annual rates. This sometimes works great in the short term, but in the long run it hurts most holders and only benefits those who use various active mechanisms to squeeze out as much profit as possible.

Beefy takes a simpler approach. Token holders have the right to participate in all past, present and future cash flows within the protocol, which is achieved through a reward pool. Currently, protocol fees charged to storage users and other forms of income are distributed among BIFI stakers. Also, token holders are positioned as partners who provide capital for the development of the company in exchange for high profitability with minimal risks.

The BIFI rate increased by 770% in January 2022 and at the beginning of February is $726.

Beefy.Finance (BIFI) price forecast from GovCapital

As of 2022 June 18, the current price of BIFI is $1,706,330 and our data shows that the asset's price has been in an uptrend over the past year.

The estimated price forecast is powered by a proprietary algorithm powered by Deep Learning, which helps our users decide whether BIFI could be a good portfolio addition in the future. These forecasts take into account several variables such as volume change, price change, market cycles, similar coins.

According to our forecasting system, the future price of the asset in a year will be $4818.

This means that if you invested $100 now, your current investment could be worth $282,405 in 2022 on Saturday, June 18th.