In Russia, the history of mining is quite complex. Ilya Massukh (President of the FID) indicated in 2022 that coin mining on the territory of the Russian Federation should be prohibited. But, considering the legality of this decree regarding 2022, we can conclude that the arguments presented by it are completely incorrect.

Indeed, mining farms seriously load the electrical network and require constant cooling. But until the owners of mining farms regularly pay all their bills, no one has the right to ban their activities. Moreover, the production of most cryptocurrencies (except Bitcoin) is quite accessible in terms of technology and resources. Cryptocurrencies are not prohibited on the territory of the Russian Federation. Although the issue of the legality of their production has been raised more than once, there are no official prohibitions. Therefore, anyone can mine cryptocurrencies at home.

It is completely pointless to run away from innovations in the field of Internet technologies, since such a concept as virtual money is gaining more and more supporters every day. It follows from this that declaring mining illegal is at least stupid. Mining is one of the main parts of the development of cryptocurrencies.

So, until cryptocurrency mining is completely legalized, it is too early to discuss legal mining in Russia.

What is mining?

The essence of mining is the process of creating new crypto coins; in other words, mining is mathematical calculations that create a new cryptocurrency (coin). Previously, bitcoins could only be obtained by mining them, but now, given the high complexity of this process, bitcoins are easier to buy than to mine. But other coins are still quite easy to mine, of course, if you use special mining equipment.

The equipment is selected depending on what kind of coin we are talking about. But there are still general rules for choosing equipment for mining cryptomoney:

Video card. If you want the mining process to be more active, it is better to buy several video cards suitable for mining the cryptocurrency you are interested in. The more video cards and the higher their power, the more active the calculation process will be and the coins will appear in your account.

ASIC miners. This is the name given to special chips that have great computing power. They are expensive, which is why it is extremely rare to create home mining farms with their help. Rather, they are useful for professional farms.

FPGA. Another equipment option. But it is rarely used due to a number of disadvantages. In particular, this equipment does not synchronize well with each other, malfunctions often occur and, of course, the cost is too high. Using this equipment, the miner performs computational operations, solving problems that are based on a cryptographic algorithm, and receives cryptocurrency as a reward for this. Today it is profitable to mine money as follows:

Solo mining. The miner works on creating blocks himself, without the help of other users. This is the most expensive way to make money, as it requires expensive equipment that needs to be maintained and ensured to work. But this option was highly profitable only in the first years after the advent of bitcoins, and now other cryptocurrencies, but not bitcoins, can be mined in this way.

Cryptocurrency mining through pools. In this case, a group of people comes together to mine crypto money more efficiently. When the problem is solved, the crypto coins are divided among the miners depending on their participation in the work process. That is, the more powerful your equipment, the higher the share you receive.

Cloud mining. In this case, the miner rents equipment and buys computing power. But the lease is only for a certain period, although it is possible to buy out in full.

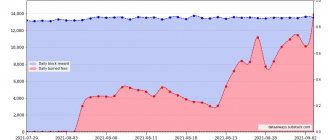

Cloud mining has become the best option for Bitcoin mining

Cloud mining is a model for earning cryptocurrency that creates groups (mining pools) with one goal: obtaining more income, compared to conventional distributed mining, through the management of equipment by a contractor who resolves all issues regarding technical and software components.

The user pays for the operation of the rented equipment for a certain period of time. For the payment received, the cloud mining provider must ensure round-the-clock operation of its equipment with the specified capacity, ensuring that the earned cryptocurrency is credited to the wallet of the tenant who paid for the cloud mining services.

Setting up cloud mining does not require a powerful computer or knowledge in the field of blockchain and cryptocurrencies in general. The setup in this case consists of going through the standard registration procedure at the pool, depositing money (usually regular money or bitcoins) and choosing a tariff plan. Then the user specifies the address (personal wallet) where the mined cryptocurrency will be withdrawn.

Rating of TOP 5 cloud mining services (with current ratings as of December 2022)

| Service | Grade | Detailed review |

| IQ Mining (editor's choice!) | 9.5 | Read review |

| ECOS | 7.2 | Read review |

| YoBit VMining | 7.0 | Read review |

| BitDeer | 6.4 | Read review |

| HashFlare | 6.3 | Read review |

The criteria by which the rating is given in our rating:

- Profitability and profitability – we calculate payback periods, clarify the reality of mining.

- Prices and commissions – we take into account the validity of tariff plans and compare them with competitors.

- Deposit/withdrawal, discounts, reliability - we analyze reviews, test the correctness of accruals and withdrawals.

- Convenience of the platform and website – we evaluate functionality, errors and failures when working with the service.

- Features of the company are unique services and useful services, duration of work on the market.

- The final score is the average number of points for all indicators, determines the place in the ranking.

What is a mining farm?

While they don’t intend to imprison anyone for mining, you need to open a mining farm and make money on cryptocurrencies until the legality of this action is terminated. And this may well happen, given the attitude of the authorities. In the meantime, the process of assembling a farm for mining coins is as follows:

The first step is to assemble a kind of frame. This is something like a server rack where you need to mount a farm. This includes the motherboard, which is something like the heart of our “horse”. The more powerful the board, the more video cards it can handle. Next you need to start assembling the frame for the farm. Moreover, it is recommended to assemble it on your own, because standardized designs are not designed for many video cards and other equipment. Make sure you have enough RAM, because it is responsible for the functioning of the OS. The processor is also an important component, and it must be compatible with the motherboard. The power supply must be of maximum power and meet the system parameters for energy consumption. Choosing a hard drive is also an important step. It should not only be reliable, but also have a lot of free space. And, of course, for our workhorse to gallop, we need a device focused on mining bitcoins, etc., for example, it could be an ASIC controller.

The second step is to assemble and connect all the listed equipment. Having made the frame, the motherboard is installed on it. It is placed on the bottom shelf of the frame. But make a special elevation to protect the motherboard from contact with various surfaces. This is one of the main laws of collecting a mining farm.

After installing the motherboard, install the processor.

Next, the power supply is installed and securely fastened, otherwise safety rules will be violated and the system will work intermittently. It was this point that became a stumbling block when discussing criminal liability for mining in 2022. Since the “experts” in power believe that such farms will put a heavy load on electrical networks. But while the whole world understands the importance and prospects of cryptocurrencies, in Russia they want to create a law banning mining and are even trying to promote bills on criminal liability.

- After the power supply there is an on/off button.

- The next step is to install the hard drive by connecting it to the power supply.

- Video cards must be connected.

After connecting to power and the Internet, you can start working while answering the question “Is it legal to mine cryptocurrencies?” you can give an affirmative answer.

Will it be possible to ban cryptocurrency?

In Russia, 17.3 million people currently have crypto wallets, according to RACIB estimates. The actual investment volumes may be higher, since these statistics do not include traders who use VPNs and their IP addresses are not identified as Russian.

According to Mikhailyshyn from Joy, the Central Bank is unlikely to be able to seriously limit investments in cryptocurrency. The options that the Central Bank is considering may make it difficult to buy cryptocurrency, but investors will be able to find a legal workaround without any problems, he said. For example, open a bank account in Belarus or Kazakhstan and buy cryptocurrency through it - in these countries, investments in cryptocurrency are allowed.

“If transfers to cryptocurrency are prohibited through officially declared exchanges, then honest exchanges will be the first to leave the market. There will remain gray crypto exchange sites that will, for example, offer to buy a certificate and then exchange it for cryptocurrency. In addition, crypto exchanges can use so-called miscoding, using other codes for transactions,” said Viktor Dostov, chairman of the Association of Electronic Money and Money Transfer Market Participants.

Is mining legal in the world?

The topic of the legality of cryptocurrency mining is relevant all over the world. But if some states accept the new financial system as a natural development of technology, others look at cryptocurrencies as a threat, trying in every possible way to remove or discredit it. Let's look at cryptocurrency mining using the example of the very first and most popular cryptocurrency - bitcoins.

So, is it legal to mine Bitcoin? In most countries, yes. In particular, Japan was one of the first to recognize Bitcoin as an official means of payment, and it is used quite actively there. In addition, Japan has its own national cryptocurrency - monacoin, the popularity of which in this country is even higher than bitcoin.

Let's look at whether mining is legal, using the example of some countries:

- The European Union excluded cryptocurrencies from the list of currencies subject to taxation back in 2015. As for transactions with bitcoins, they were equated with payment transactions with fiat currencies. That is, there is no law banning mining.

- Germany recognized bitcoins back in 2013, but classified them as private money used for multilateral clearing operations.

- Croatia was one of the first to recognize the legality of cryptocurrency, even at the level of the National Bank. But there are nuances. In particular, it is up to the receiving party to accept or not accept payments in cryptocurrency, even if this money is legal tender.

- As already mentioned, Japan is working with bitcoins, studying the system and developing tax rules. In March 2016, Bitcoin became legal tender in Japan.

- Cryptocurrencies are not entirely legal in Thailand. There is a confusing story about where you can exchange bitcoins, but only for national currency.

- Looking at Chinese mining news, the situation in this market becomes clearer. There, all official transactions with virtual money are prohibited at the state level, but individuals can own bitcoins. Thus, home-based money making is permitted. But there is simply nowhere to buy and sell bitcoins, since in 2014 a law was passed that closed 15 websites selling cryptocurrencies.

- The United States recognizes Bitcoin as a decentralized virtual currency. Since 2013, transactions with bitcoins are controlled in the same way as with fiat money. All exchanges and others must be registered as financial service providers. And if suspicious transactions are carried out, they are reported to law enforcement agencies. That is, cryptocurrencies are not prohibited, they are simply trying to regulate them. Including profits from mining and other operations are taxed. And in the fall of 2022, a criminal case was opened for fraud with cryptocurrencies.

- In Switzerland, back in 2013-14, Bitcoin was equated with foreign currency and endowed with the same rights.

In other countries the situation is also ambiguous. Thanks to news sites, it is quite easy to find out the latest news about mining. This topic is very popular today and is on everyone’s lips.

Law governing ICOs

In developed countries, such laws have existed for a long time; for example, France adopted such a law back in 2014. The law regulates the procedure for conducting ICOs and has the following features:

- the terms crowdfunding and investment project tokens are introduced;

- the procedure for organizing crowdfunding, the requirements for the rules of the investment platform, and investment methods are determined, including the acquisition of tokens;

- the property rights of the owner of the tokens of the investment project and the investment limits have been determined;

- the requirements for operators of investment platforms and the scope of responsibility are regulated, it is indicated that the operator of the investment platform is not responsible for the obligations of the person attracting investments;

- the requirements for regulation and supervision have been determined, according to which control over compliance with the requirements of the law is assigned to the Bank of Russia;

- The Bank of Russia will maintain an open register of investment platform operators on the Internet.

Is mining legal in Russia?

The topic of whether it is legal to mine cryptocurrencies in Russia is more relevant than ever. So, in Russia, mining is still completely legal, but given the ambiguous attitude of the authorities, in 2018 you can expect anything from complete legalization to a complete ban on mining and cryptocurrencies. At least, the word “mining” and “cryptocurrencies” do not appear anywhere in Russian legislation, which means that no one faces liability for mining in Russia yet.

But the topic of the legality of mining in Russia may change from 2022. In October 2022, Russian cryptocurrency specialists tried to make their contribution to the current situation. They presented a draft federal law “On the regulation of decentralized virtual property.” This is a reasonable decision, given that prosecutors and courts still view cryptocurrency transactions as illegal transactions.

In particular, here is a statement on behalf of the prosecutor's office of the Sverdlovsk region:

“The district prosecutor’s office explains that the use of “virtual currency” when making transactions is the basis for considering the issue of classifying such transactions as transactions aimed at laundering proceeds from crime and financing terrorism.”

And in 2022, a criminal case was opened in Russia for mining, although, more precisely, the punishment followed the exchange of bitcoins worth more than 500 million rubles. The authorities referred to the article on illegal banking activities (Part 2 of Article 172 of the Criminal Code of the Russian Federation). The ruble millionaires turned out to be three people who, instead of rejoicing at the money they received, will fight with the outdated Themis. So much for the mining law.

As for the bank’s position, at the beginning of October 2022, at the Sochi “Finopolis” forum, Elvira Nabiullina, in response to the question of whether to legalize mining in Russia, indicated that this was unacceptable. The Bank of Russia is against the legalization of cryptocurrencies and will not work with them as means of payment. There is no place for private money in Russia, be it virtual or material. So, if mining is now legal in the Russian Federation, it is unlikely to last long. At least, given the current situation.

Drawing conclusions

It is extremely difficult to give an accurate forecast of whether or not mining will be legal in the future, even the near future. The situation in Russia is ambiguous. If official structures prefer to turn a blind eye to the new financial situation and live by outdated principles, then ordinary people have managed to appreciate the benefits of using cryptocurrencies and have learned to mine them, which they are actively doing. A conflict of interest arises.

But the latest news is keeping miners on edge. They fear that mining will become illegal and their activities will no longer be legal. Considering all of the above, the fears are quite reasonable. But people are trying to try themselves in this area, and given the number of cryptocurrencies, many achieve success. This is what worries financiers.

But there is no need to take the path of least resistance – ban the mining of cryptocurrencies altogether. It is better to develop adequate measures to control this industry. In addition, there is a risk that access to mining in Russia will be open only to wealthy individuals, and everyone else will be outlawed, as has already happened to three people who dared to exchange bitcoins and become millionaires.

I am glad that it will not be possible to completely ban the extraction of virtual money physically. This is an anonymous system. But the exchange of funds can become shady. For example, it will be possible to change money from hand to hand. This will increase the risk of fraud and most self-taught miners will leave the industry on their own, while professionals will go deep underground.

Therefore, it is much more reasonable to legalize the mining and trading of virtual coins, taking them under control, than to transfer miners to the level of criminals and put them in prison. Nothing good will come of this.

Does everyone support the Central Bank?

On Monday, December 20, the State Duma held the first meeting of the working group on the regulation of cryptocurrencies, chaired by Vice Speaker Alexei Gordeev, two meeting participants - an employee of a large bank and an official - told Forbes. Speakers at it were Deputy Minister of Finance Alexey Moiseev, First Deputy Chairman of the Central Bank Olga Skorobogatova, Head of the Duma Committee on the Financial Market Anatoly Aksakov and others.

At this meeting, Skorobogatova explained that the Central Bank is not going to develop an additional bill banning cryptocurrencies, but the regulator considers their circulation unacceptable and plans to ban investments in them, an interlocutor from the bank and an official (both were at the meeting) told Forbes.

However, the Central Bank, with its tough position at this meeting, was in the minority, say both participants. “There is the position of the Central Bank, and there is the position of everyone else,” the official added.

Material on the topic

For example, Deputy Director of Rosfinmonitoring German Neglyada proposed allowing the circulation of cryptocurrency, but putting under strict control all financial flows from crypto to traditional finance and de-anonymizing all cryptocurrency transfers to the traditional financial system, one of the meeting participants recounts the Forbes discussion. Moiseev from the Ministry of Finance proposed limiting the purchase of cryptocurrencies only to unqualified investors, saying that it was too late to completely ban cryptocurrencies, given how many Russians had already invested, a meeting participant said.

The Ministry of Finance relies on an estimate that more than 10 million people in Russia bought this asset. The Central Bank previously estimated the annual volume of Russians’ transactions with digital assets at $5 billion. Aksakov estimated that Russian residents invested 5 trillion rubles in cryptocurrency. At the same time, the Ministry of Finance agrees with the Central Bank that cryptocurrency is “absolute speculation”, in addition, it is used to evade supervision, says a Ministry of Finance official.

“A large number of Russians own cryptocurrency. At the same time, cryptocurrencies are volatile, not backed by anything and are not transparent to regulators. However, banning them now could create problems for millions of compatriots, since it would make illegal what they already own. In this regard, various regulatory options are currently being explored. It is planned to develop a consolidated position on this issue in 2022,” the press service of the Ministry of Finance commented to Forbes.