Bitcoin price forecast for tomorrow and the next few days of the month.

Updated 01/13/2022 12:40

Next week the Bitcoin rate will rise to 45560, and in two weeks the rate will be 40644 dollars. Bitcoin rate forecast for tomorrow is 44,797 dollars, for the day after tomorrow 45,955. The rate over the next month will trade in the range of 37,463 - 45,955 dollars, with a slight downward trend towards 40,803 dollars. from the current level of 43786 .

By the end of this January, the Bitcoin rate is expected to be at the level of 41,002 dollars, by the end of February 38,437, and on the last day of March 31,123 dollars. In the next six months, the Bitcoin rate will decrease - in July 2022 we expect $37,129. In the future, the exchange rate will rise and therefore in a year the target will be 46,655 dollars.

We expect the exchange rate to rise in the next two years. Within two years, the minimum rate will drop to 29231, and the highest rate will touch 132466 dollars. In two years, in January 2024, the predicted exchange rate will be $96,033.

What is the Bitcoin price forecast for tomorrow?

The Bitcoin exchange rate forecast for tomorrow is 44,797 , the minimum rate is $43,901, and the maximum is $45,693. The current Bitcoin rate is 43786. Today the rate is down by 0.31% compared to yesterday's close of the day at 43920.

Will the Bitcoin price rise or fall in a week?

Bitcoin price forecast in a week : 45560 dollars, minimum 44649, maximum 46471 dollars. Thus, within a week the Bitcoin rate will increase by 1,774 . relative to the current exchange rate of 43,786 dollars. For more detailed forecast by day for the week, see the table below.

What is the Bitcoin price forecast for January?

Bitcoin exchange rate forecast for January 39343-47770, at the end of January 41002 dollars. At the beginning of January, the Bitcoin rate was 46658, i.e. the change for the month will be -12.1%.

What Bitcoin rate is predicted for February?

Bitcoin exchange rate forecast for February - 38,437 . at the end of February, the minimum rate during the month was 36714, the maximum was 41789. The change over the month was -6.3%.

Ethereum price forecast for January, February and March 2022.

Bitcoin rate online and chart.

Bitcoin rate chart throughout history from 2008 to 2022

In 2008, Bitcoin cost $0 because that year the domain bitcoin.org was only registered and articles were sent to cryptography specialists.

From 2009 until today, almost the entire BTC market is valued in US dollars ($).

As the market valuation of the total supply of Bitcoin approached $1 billion, some analysts called Bitcoin prices a bubble.

The maximum price of Bitcoin is 64,863.10 USD (the peak was reached on April 14, 2022).

READ:

The history of Bitcoin from the very beginning: The creation of cryptocurrencies [2008-2021] and what influenced prices historically

A fairly simple method that is suitable for everyone, and especially for beginners, is to use the Matbi exchanger. To do this, you need to register using your phone number or email.

To sell bitcoin and withdraw money to an account in Sberbank, you must first transfer bitcoins to a wallet in “Matbi”. To find out the wallet address, you need to go to the “Accept cryptocurrency” tab.

There it is shown both in symbolic form and as a QR code.

When Bitcoin coins arrive in your account, you can sell them for rubles, dollars or euros on the “Exchange” tab.

There are no fees for this. Identity confirmation may be required by sending a passport photo and selfie.

The money will go to your account at Matbi. You can withdraw them to your Sberbank card from the “Withdraw” tab.

All operations in “Matbi” are carried out as quickly as possible, around the clock and automatically. If you have any questions, the support service is ready to promptly answer them from 08:00 to 24:00.

If the user has any questions, the Matbi team has prepared detailed video instructions.

Bitcoin price history (compared to US dollars) all time

| date | USD: 1 BTC | Notes |

| August 18, 2008 – January 2009 | 0$ | During this period, no one knew about Bitcoin. The domain bitcoin.org was only registered and the blockchain was being developed. |

| January 2009 - October 2009 | Had virtually no value | There were no exchanges or exchangers, the users were mostly crypto enthusiasts who sent bitcoins as a hobby. The coins had little or no value. In March 2010, user "SmokeTooMuch" auctioned 10,000 BTC for $50 (cumulative), but no buyer was found. |

| October 5, 2009 | 1 dollar = 1,309.03 BTC | The first Bitcoin to dollar rate has been published : 1 dollar = 1,309.03 BTC. Public sales have begun on the New Liberty Standard Stock Exchange. |

| March 2010 | $ 0,003 | On March 17, 2010, the now defunct BitcoinMarket.com exchange ceased to operate. |

| May 2010 | less than $0.01 | On May 22, 2010, Laszlo Haniec made his first real-world transaction, buying two pizzas in Jacksonville, Florida for 10,000 BTC. |

| July 2010 | $ 0,08 | In five days, the price increased by 1000%, increasing from $0.008 to $0.08 per coin. |

| February 2011 - April 2011 | $ 1,00 | Bitcoin is reaching parity with the dollar. |

| July 8, 2011 | $ 31,00 | The top of the first bubble is reached, followed by the first drop in price. |

| December 2011 | $ 2,00 | Bitcoin reached its low at that time. |

| December 2012 | $ 13,00 | Slowly grows throughout the year. |

| 11 April 2013 | $ 266 | The top of a price rally, during which the price grew by 5-10% daily. |

| May, 2013 | $ 130 | The price is mostly stable and BTC is slowly rising again. |

| June 2013 | $ 100 | In June it slowly drops to $70, but rises in July to $110. |

| November 2013 | $ 350 — $ 1242 | From October - 150-200 dollars in November the price reaches 1242 dollars (November 29, 2013.) |

| December 2013 | 600 — 1000 $ | The price fell to $600, recovered to $1,000, fell back to the $500 range. Stabilizing to the ~$650–$800 range. |

| January 2014 | 750 — 1000 $ | The price rose sharply to $1,000 and then remained at $800–$900 for the rest of the month. |

| February 2014 | 550 — 750 $ | The price fell after the Mt. exchange shutdown. Gox before recovering to the $600 to $700 range. |

| March 2014 | 450 — 700 $ | The price continued to fall due to a false report of a bitcoin ban in China and uncertainty that the Chinese government would seek to ban banks from dealing with digital currency exchanges. |

| April 2014 | 340 — 530 $ | Lowest price since the Cypriot financial crisis of 2012–2013. It was reached at 3:25 am on April 11th. |

| May 2014 | 440 — 630 $ | The downtrend first slows and then reverses, increasing by more than 30% in the last days of May. |

| March 2015 | 200-300 $ | The price fell until early 2015. |

| Early November 2015 | 395 — 504 | A big surge in value from 225-250 in early October to the 2015 all-time high of $504. |

| May – June 2016 | 450 — 750 $ | A big surge in value starting at $450 and peaking at $750. |

| July – September 2016 | 600 — 630 $ | The price has stabilized in the $600 range. |

| October – November 2016 | 600 — 780 $ | As the Chinese yuan depreciated against the dollar, Bitcoin rose to $700. |

| January 2017 | 800 — 1150 $ | There were no significant events. |

| January 5-12, 2022 | 750 — 920 $ | The price fell 30% in a week, hitting a multi-month low of $750. |

| March 2-3, 2022 | $ 1290 + | The price remained above the November 2013 high of $1,242 before rising above $1,290. |

| April 2017 | $ 1210 — $ 1250 | Short period of low volatility. |

| May 2017 | $ 2000 | The price reached a new high, reaching $1,402.03 on May 1, 2017, and over $1,800 on May 11, 2022. On May 20, 2022, the price of one bitcoin exceeded $2,000 for the first time. |

| May – June 2017 | 2000 – 3200+ $ | The price hit an all-time high of $3,000 on June 12 and has hovered around $2,500 since then. As of August 6, 2017, the price is $3,270. |

| August 2017 | $ 4,400 | On August 5, 2022, the price of one BTC exceeded $3,000 for the first time. On August 12, 2022, the price of one BTC exceeded $4,000 for the first time. Two days later, the price of one BTC exceeded $4,400 for the first time. |

| September 2017 | $ 5000 | On September 1, 2022, Bitcoin was worth $5,000 for the first time, peaking at $5,013.91. |

| September 12, 2017 | $ 2 900 | The price dropped sharply due to the Chinese Bitcoin ICO and the currency crackdown (ICO ban in China). |

| October 13, 2017 | $ 5,600 | The price skyrocketed as the ICO ban in China began to be forgotten. |

| October 21, 2017 | $ 6180 | The price reached a new high as a fork with a 1:1 distribution of new coins (Bitcoin Cash) was approaching. |

| November 6, 2017 | $ 7300 | The growth continued. |

| November 12, 2017 | $ 5,519-6,295 | This is due to the rise in prices for Bitcoin Cash, which exceeded $2,477.65, or this amounted to 2.2-2.5 times the cost of Bitcoin Cash from the cost of one bitcoin. The developments push Ethereum as the second most popular cryptocurrency into third place relative to the overall market capitalization of the listed cryptocurrency by dollar value, at least temporarily, before Ethereum regains its place in second place. |

| November 17-20, 2022 | $ 7,600-8,100 | At 01:14:11 UTC, the price rose to $8,004.59/BTC before retreating from the highs. According to CoinDesk, at 05:35 UTC on November 20, 2022, the price was $7,988.23 per BTC. This surge may be related to events in the 2017 Zimbabwean coup. The market reaction on one exchange is alarming as 1 BTC has crossed almost $13,500, which is 2 times higher than the international BTC market. |

| November 25, 2017 | $ 9000 | Bitcoin surpasses $9,000 for the first time. |

| November 28, 2022 | $ 10000 | Bitcoin surpasses $10,000 for the first time. |

| November 29, 2017 | $ 11 000 | Bitcoin surpasses $11,000 for the first time. |

| December 5, 2017 | $ 12 000 | Bitcoin surpasses $12,000 for the first time. |

| December 6, 2017 | $ 13 000 | Bitcoin surpasses $13,000 for the first time. |

| December 7, 2017 | $ 17 000 | Bitcoin surpasses $17,000 for the first time at 11:03 p.m. |

| December 8, 2017 | $ 18 000 | Bitcoin surpasses $18,000 for the first time at 12:28 a.m. |

| December 8, 2017 | $ 14277 | Bitcoin price fell to $14,000, but it rebounded to $16,250 on the same day |

| December 15, 2017 | $ 17900 | Bitcoin price reached $17,900 |

| December 22, 2017 | $ 13800 | Bitcoin price loses a third of its value in 24 hours, falling below $14,000. |

| February 5, 2018 | $ 6200 | Bitcoin price falls 50 percent in 16 days, falling below $7,000. |

| October 31, 2018 | $ 6,300 | On Bitcoin's 10th anniversary, the price remains stable above $6,000 during a period of historically low volatility. |

| November 14, 2018 | $ 5590 | Drop below $6,000. |

| November 24, 2018 | $ 3778 | Drop below $4,000. |

| November 29, 2018 | $ 4333 | Bitcoin price reached $4,300. |

| January 4, 2019 | $ 3820 | Since the beginning of 2022, Bitcoin has continued to fall. |

| February 7, 2019 | $ 3399 | The lowest price for the first quarter of 2019. |

| February 24, 2019 | $ 4199 | Bitcoin is starting to rise. |

| April 4, 2019 | $ 5256 | A sudden jump in awareness. |

| May 29, 2019 | $ 8721 | The price of Bitcoin is still rising. Experts predict a future rise in Bitcoin prices similar to 2022. |

| June 4, 2019 | $ 7750 | Bitcoin price fell more than 10%. |

| June 15, 2019 | $ 8700 | BTC price rose above $8,000. Experts say the 2015 pattern is repeating itself. |

| June 16, 2019 | $ 9311 | The cryptocurrency reached a new yearly high of around $9,000. |

| June 22, 2019 | $ 10738 | Bitcoin has broken through the $10,000 mark. |

| June 26, 2019 | $ 12637 | Bitcoin is approaching $13,000. Experts attribute this to the development of cryptocurrency and the blockchain industry in the form of the release of the Libra cryptocurrency. |

| December 31, 2019 | $ 7240 | Bitcoin ended 2022 with a price just above $7,200. |

| February 15, 2020 | $ 10320 | The price reached $10,000, it is estimated that at this time $300 million was laundered using Bitcoin |

| March 12, 2020 | $ 8000-4600 | "Black Thursday" in the cryptocurrency market. Bitcoin price fell below $5K for the first time since May 8, 2022. There were also whales dumping BTC as large amounts were transferred to exchanges prior to this sell-off. The $2.9 billion PlusToken pyramid scheme, which still holds 61,229 coins, transferred 13,000 BTC from its wallets to exchanges through mixer services. |

| March 13, 2020 | 4600-3800 $ | “Friday the 13th” was marked by the strongest fall in Bitcoin over the past few years. On this day, 3 global events occurred in the world: COVID-19 was declared a pandemic; All three major US stock indexes fell sharply; President Trump announced the closure of US borders due to the pandemic. |

| March 26, 2020 | 6700 $ | The first wave of economic crisis begins all over the world. Bitcoin went flat. It seems that BTC cannot yet decide whether it is a salvation from the crisis or not. |

| July 27, 2020 | 10 944 $ | The price rose to its highest level in almost a year. |

| November 18, 2020 | 18 000 $ | The rate rises above $18,000 and is trading near the all-time highs of late 2022. |

| January 3, 2021 | 34 800 $ | The digital asset reached a new high of over $34,800. |

| January 7, 2021 | 40000 $ | The price exceeded $40,000 for the first time. |

| January 8, 2021 | 41973 $ | The ATH (All Time High, absolute maximum) was fixed at $41,973. |

| January 11, 2021 | 33 400 $ | The price briefly fell 26%, resulting in a price of $33,400 per coin. |

| February 01, 2021 | 33 500 $ | Bitcoin price remains stable at $33,500. |

| March 13, 2021 | 60,021 $ | The price of Bitcoin increased by 25% in just 7 days. |

| June 1, 2021 | 37,265 $ | El Salvador's President Nayib Bukele has announced his plans to accept Bitcoin as legal tender, making El Salvador the first country in the world to do so. |

| November 7, 2021 | 67, 549 $ | On November 7, 2022, BTC again reached a record high of $67,549.14. |

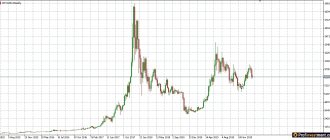

Bitcoin price history chart from 2009 to 2022.

The price chart shows the historical value of the BTC cryptocurrency, the logarithm of the Bitcoin market capitalization, and the most significant historical dates.

Bitcoin price from 2010 to 2013

Factors that may have contributed to the growth included:

- european sovereign debt crisis,

- especially the financial crisis in Cyprus in 2012–2013, FinCEN statements about improving the legal position of cryptocurrency

- and the growing interest of the media and the Internet in the first cryptocurrency.

All-time chart

Add us to your bookmarks to always be aware of what is happening in the world of cryptocurrencies!

The charts and information on this page will be updated as the story progresses.

Price table with average exchange rate by year

The impact of Halving on the price by year is presented in the image below.

Halving is the process of dividing the number of generated rewards for mining a block by half. After this event, miners begin to sell the mined currency for half as much because it is physically mined in half. Consequently, demand becomes high and supply is low. This always moved the price up.

Bitcoin has already had 3 halvings. The last Bitcoin halving took place on May 11, 2022. And the next Halving is scheduled for May 2022.

Bitcoin exchange rate forecast for each day in the table

| date | Day | Min | Well | Max |

| 14.01 | heels | 43901 | 44797 | 45693 |

| 17.01 | Mon | 45036 | 45955 | 46874 |

| 18.01 | WTO | 45007 | 45925 | 46844 |

| 19.01 | Wednesday | 44887 | 45803 | 46719 |

| 20.01 | even | 44649 | 45560 | 46471 |

| 21.01 | heels | 43833 | 44728 | 45623 |

| 24.01 | Mon | 42935 | 43811 | 44687 |

| 25.01 | WTO | 40518 | 41345 | 42172 |

| 26.01 | Wednesday | 40553 | 41381 | 42209 |

| 27.01 | even | 39831 | 40644 | 41457 |

| 28.01 | heels | 39343 | 40146 | 40949 |

| 31.01 | Mon | 40182 | 41002 | 41822 |

| 01.02 | WTO | 39814 | 40627 | 41440 |

| 02.02 | Wednesday | 40151 | 40970 | 41789 |

| 03.02 | even | 39249 | 40050 | 40851 |

| 04.02 | heels | 37218 | 37978 | 38738 |

| 07.02 | Mon | 37023 | 37779 | 38535 |

| 08.02 | WTO | 37178 | 37937 | 38696 |

| 09.02 | Wednesday | 36714 | 37463 | 38212 |

| 10.02 | even | 36812 | 37563 | 38314 |

| 11.02 | heels | 38819 | 39611 | 40403 |

| 14.02 | Mon | 38523 | 39309 | 40095 |

| 15.02 | WTO | 40061 | 40879 | 41697 |

| 16.02 | Wednesday | 39987 | 40803 | 41619 |

What is the Bitcoin forecast for March?

The Bitcoin exchange rate forecast for March is in the range of 30501-38437, at the end of March 31123 dollars. Monthly change -19.0%.

What Bitcoin price is predicted until the end of 2022?

Bitcoin price forecast for 2022 : the rate will trade in the range of 28646-44732. Forecast for the exchange rate at the end of December 2022 38879 dollars.

What will the Bitcoin price be in 2023?

Bitcoin exchange rate forecast for 2023 : rate at the end of December 2023 - 105,112 . And throughout the year the rate will fluctuate in the range of 38879-134018.

The price of $100 thousand is just the beginning

Some domestic and foreign experts are more optimistic in their forecasts and assure that the price of Bitcoin will not only break through the $100 thousand mark, but also set a new record at $150 thousand.

“I have no doubt that Bitcoin will exceed $100 thousand this winter. According to my forecasts, the price of the cryptocurrency can reach $150 – $180 thousand. Technical analysis indicators indicate this. I am confident that the first half of the year will be a breakthrough for the crypto market,” says Yuri Gusev, founder of Zam.io.

A similar point of view was voiced by Leonid Litvinenko, CEO and Co-founder of Lot.Trade . The expert has no doubt that already in the first quarter of 2022, the price of Bitcoin will reach $100 thousand.

Dmitry Sheludko, CEO of the Biconomy crypto exchange, is also confident that the main cryptocurrency will grow to its maximum levels at the beginning of the year.

“Bitcoin will continue to grow in 2022. We see that the situation with the global Covid19 pandemic continues and this means that online business and investing will continue to develop. Consequently, we will see even greater interest in cryptocurrencies and an influx of investors. Bitcoin can be safely expected to reach $100,000 and this will no longer be a surprise to anyone,” he said.

In general, experts agree that Bitcoin will continue to grow against the backdrop of a strengthening crypto market and increasing interest from institutional and private investors in crypto assets.

Bitcoin price forecast for 2022, 2023 and 2024

| Month | Min-Max | Closing | Total,% | |

| 2022 | ||||

| Jan | 39343-47770 | 41002 | -12.1% | |

| Feb | 36714-41789 | 38437 | -17.6% | |

| Mar | 30501-38437 | 31123 | -33.3% | |

| Apr | 28646-31123 | 29231 | -37.4% | |

| May | 29231-35779 | 35077 | -24.8% | |

| Jun | 31948-35077 | 32600 | -30.1% | |

| Jul | 32600-37872 | 37129 | -20.4% | |

| Aug | 37129-44732 | 43855 | -6.0% | |

| Sep | 40401-43855 | 41225 | -11.6% | |

| Oct | 32320-41225 | 32980 | -29.3% | |

| But I | 31751-33047 | 32399 | -30.6% | |

| Dec | 32399-39657 | 38879 | -16.7% | |

| 2023 | ||||

| Jan | 38879-47588 | 46655 | 0.0% | |

| Feb | 46655-53381 | 52334 | +12.2% | |

| Mar | 52334-64057 | 62801 | +34.6% | |

| Apr | 62801-76868 | 75361 | +61.5% | |

| May | 75361-92242 | 90433 | +93.8% | |

| Jun | 81115-90433 | 82770 | +77.4% | |

| Jul | 82770-87999 | 86274 | +84.9% | |

| Aug | 86274-105600 | 103529 | +122% | |

| Sep | 98074-103529 | 100076 | +115% | |

| Oct | 100076-111682 | 109492 | +135% | |

| But I | 109492-134018 | 131390 | +182% | |

| Dec | 103010-131390 | 105112 | +125% | |

| 2024 | ||||

| Jan | 94112-105112 | 96033 | +106% | |

The forecast is updated daily.

Apple stock forecast 2022, 2023.

Dollar exchange rate forecast for January, February and March 2022.

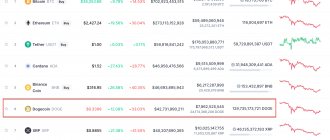

What's happening in the crypto market

Since November 10, the capitalization of the entire crypto market has decreased by 12.08% - from $2.97 trillion to $2.65 trillion.

After rising to a historical high of $69,000, which was reached on November 10, the price of Bitcoin has been constantly declining - for three weeks in a row, BTC quotes have been predominantly in a downward movement. At the same time, on November 27, the price of BTC fell by 10% in just one day and briefly dropped to $53,500 - these are the minimum values since mid-October.

BTC price chart for the last month. Source

Traditionally, ETH behaves in a similar way. After the altcoin reached a maximum of $4,850 on November 10, it went into a correction and was trading in a corridor from $4,000 to $4,500 until November 30. However, now Ether has managed to recover and rise to $4,700. Most altcoins also traded in a downward trend throughout November .

ETH price chart for the last month. Source

On November 26, a real Black Friday occurred on the crypto market - most digital assets fell by an average of 15–20%. Even metaverse tokens fell in price, although they withstood the correction better than most other assets.

The fall of the crypto market on November 26. Source.

Over the weekend, the crypto market grew by 8%, almost recouping Friday’s drop. For the last three days, BTC has been trading at $56,000–$59,000. Most crypto assets are also in the green zone compared to the end of last week.

What does PayPal have to do with it?

The catalyst for the explosive growth in the price of Bitcoin was PayPal’s announcement that it would integrate into its service the ability to buy and sell four types of cryptocurrencies – Bitcoin and Ethereum. Bitcoin Cash and Litecoin. At the same time, users of the payment system were able to store them in a wallet linked to their account.

PayPal Announces the Launch of Cryptocurrency Support

To attract additional attention to the innovation, PayPal has completely removed the fee for storing cryptocurrency, without any hidden restrictions. In addition, any transactions with crypto through this system will not be subject to commissions, but this promotion is already temporary and will end on December 31, 2022.

PayPal plans to develop support for cryptocurrencies in its system. So, in mid-2022 (no exact date yet), its proprietary mobile application Venmo will allow you to pay with virtual money at 26 million merchants. Before payment, crypto money will be converted into dollars, and PayPal received this opportunity thanks to the Bitlicense license, which was granted to it by the New York State Department of Financial Services (NYDFS). PayPal is set to provide cryptocurrency support to users around the world, but US residents are the first to try it out.

The cryptocurrency service itself was developed by PayPal together with the blockchain startup Paxos.

What should investors pay attention to?

If you did not buy cryptocurrencies at the maximum and did not use credit money, then you should not worry about the crypto market drawdown - most likely, it will soon fully recover. But for short-term investors, a busy time has begun - uncertainty remains in the market and there are no guarantees that a new wave of correction will not collapse cryptocurrency quotes.

Now the attention of investors should be focused on macroeconomic factors: the development of the situation with the Omicron strain and the introduction of new lockdowns, raising interest rates by the Federal Reserve and the ECB, and regulation of cryptocurrencies in the United States. It is this kind of news that will affect all markets, including the cryptocurrency one.

Reasons for the recent collapse of the crypto market

Let's look at the main reasons for the fall of the crypto market over the past three weeks.

Changes in US tax laws. On November 15, US President Joe Biden signed a bill to finance infrastructure projects for $1.2 trillion.

$28 billion of this amount should come from crypto companies, which are now also considered taxable brokers. In addition, the country has introduced new reporting requirements for crypto brokers and digital asset operators - they must now report transactions worth $10,000 or more to the tax authorities. On the day the law was signed, BTC fell by $6,000, falling below $60,000 for the first time since October. At the same time, the entire crypto market lost 10% of its capitalization.

Also on November 15, Senators Ron Wyden and Cynthia Lummis introduced an amendment to the law that would eliminate the tax reporting requirement for blockchain developers and crypto wallet teams. However, politicians proposed similar amendments back in the summer, but they were rejected - they are unlikely to receive approval this time.

New strain of COVID-19. On November 25, a new, much more contagious and vaccine-resistant strain of coronavirus, called Omicron, was discovered in South Africa. Later, the strain was discovered in Hong Kong, Botswana, Australia and a number of other countries. The world froze in anticipation of a new lockdown: Great Britain and several EU countries suspended flights from six African countries, and Israel closed its borders to foreigners for 14 days.

The Omicron strain provoked a collapse in traditional markets: oil fell by 10% - from $80 to $72, the S&P 500 index fell by 2.7%, and the Moscow Stock Exchange index - by 3.5%. Under these conditions, it is not surprising that traders have also been dumping risky assets such as cryptocurrencies.

Blocking of mining pools in China . On November 26, a major Chinese crypto information portal, ChainNews, announced its closure. At the same time, local Internet providers blocked the publication’s website, as well as the resources of its competitors ODaily and BlockBeats. At the same time, mining pool domains became unavailable.

It is obvious that Chinese providers have learned to find and block miners’ connections to the ten largest BTC and ETH mining pools, including F2Pool, BTC.com, ViaBTC and BinancePool. As a result, miners from China can no longer connect to these pools.

This was reflected in the hashrate of the Bitcoin network: since November 18, it has decreased from 167 EH/s to 155.7 EH/s. In October, it became known that Chinese authorities were considering the possibility of prosecuting those involved in mining. In November, the National Development and Reform Commission (NDRC) said it would continue to crack down on mining in the country.