- 2018

- price

- complexity

- well

- height

- perspective

- pessimism

- change

- legalization

- result

The passing year will be remembered by everyone for the truly breathtaking growth of Bitcoin. And although the financial quarter has not yet come to an end, platform investors are already looking for forecasts regarding future changes in its exchange rate in order to decide whether it is worth investing their own funds in the coin for the medium or long term. Various experts in the field of blockchain, as well as reputable economists and analysts, do not lag behind ordinary users. Studying in detail the asset's movement charts and relying on the latest stock market trends, they try to predict how the No. 1 cryptocurrency will behave. Let's look at what trends, according to economists, await Bitcoin in 2022.

Bitcoin 2022: what awaits us next year?

The total capitalization of the site as of November of this year is a whopping $136 billion. Moreover, it is growing every day, as the service continues to be financed by both private investors and large investment companies. According to experts, the trend for infusions of funds into digital currency will continue until the end of this year and, most likely, will be relevant next year, and therefore we should expect a further upward movement in the value of Bitcoin.

Renowned analyst Cliff High predicts that 2022 could mark a major crisis in the traditional economic paradigm, with many financial institutions simply closing down. In order to stabilize the situation, the central banks of countries will be forced to expend a lot of effort, thereby weakening their positions, allowing, against the backdrop of these circumstances, digital payment systems to strengthen their position in the established model. It is because of this that most predictions regarding Bitcoin in 2018 are extremely positive. Its value is expected to be 3 times the price of gold.

Bitcoin growth factors

One of the main factors in the growth of the price of Bitcoin was the very large number of ICOs being conducted; millions of dollars were collected in a matter of hours and even minutes. And this is a huge influx of funds into the cryptocurrency market. And due to the fact that ico projects gave a lot of X’s and very quickly, this further fueled the interest of people who were afraid to get into crypto. It’s hard to resist when there is news everywhere about projects that could multiply capital by 10-100, and sometimes thousands of times, in a month.

- Continued and self-fueling demand for digital currency. Most investors are interested in buying bitcoins, using all available assets;

- Exchanges launched futures on the Bitcoin trading market back in December 2022;

- Such large participants as, for example, JP Morgan have entered the bitcoin trading market. In general, it must be said that 50% of the BTC market is controlled by only 1% of players. Although many of the world's financial tycoons are cautious about digital currency;

- The endless interest in Bitcoin on the part of speculative capital is completely understandable;

- In many countries, there is a legal expansion of various uses of cryptocurrency.

Contrary to expectations, the division of Bitcoin into two currencies in August 2017 (classic Bitcoin BTC and Bitcoin Cash BCH) did not lead to a decrease in cryptocurrency quotes, but, on the contrary, happened quite painlessly for the main Bitcoin.

During 2022, given the current state of affairs, the trend towards further growth in quotations will continue and exceed the $40,000 mark. According to some experts, by 2022 this figure will reach $100,000.

But these are too optimistic views of experts. Everything will depend on the legislative bodies of the states; if there is no serious regulation of the crypto industry, we will probably see figures in the region of $20,000 again by the end of the year.

What influences the cost?

In matters of fluctuations in the exchange rate of fiat money, the demand indicator plays a significant role. This fully applies to digital coins. If there is a gradual increase or decrease in price, it means that investors have begun to actively purchase platform tokens. But the sharp form of this process already indicates the presence of a currency pump.

Both the first and second types of players have a sufficient amount of coins, which can influence the rate movements up or down. They respond fairly quickly to the actions of professional traders and ordinary buyers, if necessary creating the appearance of an increase in value. The result of such manipulations is an artificial excitement around the cue ball. As soon as the price reaches its maximum, pumpers sell the available currency, thereby reducing its rate to a minimum.

This phenomenon is easy to track, since it is most often preceded by an increase in the popularity of electronic currency. The history of Bitcoin is full of such anomalous jumps - bad news was often deliberately invented or disseminated in the media in order to bring down the rate and make money on it.

An experienced trader will immediately determine when a digital money pump occurs. But for a beginner in the world of cryptocurrency, this task may be overwhelming. Therefore, the best solution would be to enter the digital asset market when there is relative calm.

However, these are not the only factors influencing the growth of Bitcoin. When making forecasts, Cliff High and other experts take into account all aspects that can positively or negatively affect the movement of the exchange rate. Circumstances that may stimulate future growth in the price of electronic currency include:

- a significant influx of investment into the site;

- official adoption of cryptographic currency in a number of countries;

- implementation of truly innovative and technological solutions.

But the introduction of a ban on the use of electronic money in a state with a leading position in the geopolitical arena, or another scandal around Bitcoin can easily provoke a drop in its value. In addition, according to analysts, a sharp collapse in prices could be caused by a large-scale hacker attack on popular cryptocurrency exchanges.

Bitcoin price for 2022: analyst forecasts

Due to the special situation and active development of the cryptocurrency field, analysts are trying to find some support points for forecasts. Among investors, a comparison was made between cryptocurrency and the advent of the Internet - these areas really have a lot in common in their development path. Uniting points include:

- significant simplification and systematization of familiar processes, thanks to which ordinary citizens have the opportunity to use resources more efficiently;

- broad prospects for development and the virtual absence of negative aspects.

According to eminent analyst Ronnie Moas, the current position of cryptocurrency is equivalent to the period of development of the Internet in 1995. All further changes, according to him, will be exclusively positive. Analysis of data over the past year indicates the powerful potential of Bitcoin. The most significant moment was the resumption of active growth after the Chinese side decided to introduce a number of bans. Thus, having lost a significant segment of the market, cryptocurrency has not lost the interest of buyers. When making a forecast, it is also necessary to pay special attention to the automation of Bitcoin mining. If previously miners could receive coins using one video card, today even a mini-farm does not guarantee income. Due to the increase in the amount of information provided for processing to extract Bitcoin, the only solution is to expand capacity. Thus, the growth in the number of miners is dictated by the mining conditions themselves, which naturally maintains the level of demand.

Increasing difficulty or how miners' earnings change

In the Bitcoin system, the difficulty of mining a block is the main indicator. The resource is already configured and links in the chain are created every few minutes, which means the power increases. To limit the speed of mining digital currency, an artificial increase in difficulty is used. As a rule, its parameters change once every 14 days.

Only in recent years has the difficulty decreased slightly, as one of the largest pools, GHash, has disconnected from the general Bitcoin network. What will happen in the future is quite difficult to say. The higher the difficulty indicators, the correspondingly less electronic money is mined, but at the same time the price of coins increases. However, such a dependence does not always arise, because cryptographic assets are greatly influenced by demand.

The creator of ETH does not believe in the prospect of significant growth in Bitcoin and altcoins

Vitalik Buterin believes that 2022 marked the end of the speculative period in the history of digital currencies. Since many people are aware of BTC, ether, litecoin and other projects, you should not expect significant jumps. There will always be enough sellers in the market.

The blockchain space has almost reached the ceiling. If you ask the average educated person about the benefits of Bitcoin, they have most likely heard about them at least once.

Buterin believes that the bubble in 2022 and 2022 attracted the attention of the general public to cryptocurrency. To open up new perspectives, it is worth working on improving decentralized systems, applications and protocols. For further development, it is necessary to increase economic activity.

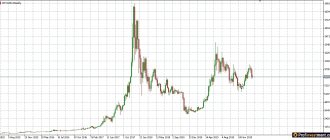

Exchange rate movements over the past 3 years

The digital currency does not last long by the standards of traditional payment instruments, but from the beginning of its existence to the present day, the value of Bitcoin has been steadily growing. Some experts suggest further development of the blockchain sphere, while others, on the contrary, predict the imminent collapse of the entire system.

In the first months and years of Bitcoin’s operation, there were no particularly significant price jumps. The rate reached the level of $30 per coin only in the summer of 2011, but a few months later it dropped again to $5. It was from this point that the gradual increase in price began, up to $14 in the fall of 2012. Such results were the first signal about the prospects of investing in Bitcoin.

November 2013 was remembered for the colossal growth of digital currency, which amazed many analysts and ordinary users. As of December, the price of 1 coin already exceeded a thousand US dollars, and many sincerely regretted that they could not find the courage to invest their capital in the early stages of the platform’s development. Although, of course, there were people who managed to get rich with the help of such a huge movement of value. It would seem that completely new horizons were opening up for investors, but a year later the decentralized platform began to rapidly lose ground, and the price for 1 of its tokens fell 3 times.

The main reason that caused the jump in the Bitcoin rate on trading platforms is the positive attitude of community members towards it. Due to the fact that users became interested in cryptographic currency and began to mine it, and in addition, use it as a full-fledged payment instrument (for example, when paying for purchases in an online store), large investors also noticed the digital service. And then the classical laws of market economics were activated, according to which, the more a product is purchased, the more its liquidity indicator grows.

The reason for the sharp drop in the value of Bitcoin in the period from 2013 to 2014 is a series of hacker attacks on major trading platforms, as a result of which the rate of the electronic coin was deliberately brought down by attackers.

As for the rather noticeable drop in price throughout 2015 and 2016, everything looks quite natural here. After all, it was followed by a natural increase in the Bitcoin rate. This year it continues its systematic upward movement, and many analysts consider this situation a good basis for entering the cryptocurrency market. She has not lost her potential and is ready to conquer new heights.

To zero and back. How opinions about Bitcoin have changed in 2022

For many investors, the digital money market has become a disappointment, as it did not bring the expected profit, but only losses and experience. If at the beginning of the year experts made the most daring forecasts, by December they became less optimistic

A market of unfulfilled predictions - this is how 2022 can be described in the field of digital money. A lot of expectations turned out to be unjustified, and many experts completely refused to make further assumptions about changes in the value of Bitcoin.

January February

One of the first to speak out about Bitcoin this year was PayPal CEO Dan Shulman. He has an extremely negative attitude towards cryptocurrencies, so he said that the payment system will never support them.

“I think what we're seeing now is how the volatility of cryptocurrency makes it effectively unsuitable as a real currency that can be accepted by retailers. Because sellers have very low margins, when you have Bitcoin bouncing up and down 15% over a couple of weeks, the difference between making money and losing money on each sale can be significant,” Shulman said.

He spoke specifically about the first cryptocurrency, without considering stablecoins (digital currencies whose value is tied to a specific asset). The president of PayPal said that Bitcoin could never become a real currency.

Analysts from the major investment bank Goldman Sachs did not agree with this opinion. Zach Pandl and Charles Himmelberg suggested that digital money could be an excellent replacement for local government currencies in emerging economies.

“In recent decades, the US dollar has served its purpose relatively well. But in those countries and corners of the financial system where traditional money services are underserved, Bitcoin (and cryptocurrencies in general) may offer viable alternatives,” the experts wrote.

In mid-January, analysts from the consulting company Quinlan & Associates published their forecast for 2022. At that time, the price of Bitcoin was at $14,000, so the assumption that the rate of the first cryptocurrency would drop to $1,800 seemed somewhat unfounded. When the coin price set a minimum of $3,200 on December 15, this forecast no longer looked so unrealistic.

“To evaluate Bitcoin as a currency, we assessed its use for both legal and retail transactions, as well as black market payments. After significant testing, we have calculated a BTC price of $1,780,” the company said in its report.

Then South Korean Finance Minister Kim Dong-yong, speaking on a local radio station, announced a possible ban on cryptocurrencies in the country. After this, most digital assets lost about 20% of their value, and Bitcoin set a minimum of $11,600.

Russian politicians also joined the general pressure on Bitcoin - Russian Prime Minister Dmitry Medvedev compared cryptocurrencies to the “dot-com bubble.” In his opinion, blockchain technology will remain, and the new type of assets will disappear in a few years.

“In the same way, in a few years, cryptocurrencies may disappear, and the technology on the basis of which these cryptocurrencies are developing, I mean blockchain, will become part of everyday reality. Such a scenario is also not excluded,” Medvedev said.

The head of Sberbank, German Gref, came to the defense of digital money. He proposed competently regulating the new industry, and not banning it, in order to give it the opportunity to develop.

“Before trying to regulate, there is no need to rush, but rather maintain a normal background around blockchain technology and cryptocurrencies. We need to explain to people that this is not a store of value, this is a very dangerous story, like a lottery or a casino - for now. But under no circumstances should this be prohibited; behind cryptocurrency, a gigantic new technology is being born, which no one is yet able to understand,” Gref said.

The opposite opinion was held by Nobel laureate in economics Robert Shiller, who compared the situation in the blockchain industry with “tulip fever,” when flower bulbs were more expensive than a plot of land. The expert emphasized that cryptocurrencies can remain for a long time and exist for another 100 years.

“It has no real value, but everyone thinks it has value. Other things, like gold, would at least have some value even if people didn't consider them as an investment," Shiller said.

Chairman of the board of the largest financial holding company in Switzerland, UBS Group AG, Axel Weber, also does not believe in cryptocurrencies. He explained that the bank cannot start working with digital money, as its value will collapse.

“Our fear is that in the future, when these investments blow up and the market corrects, then investors will try to figure out, 'Who sold it to us?'” Weber said.

The authorities of large countries were increasingly thinking about the importance of regulating the new industry. British Prime Minister Theresa May recalled that criminals are actively using Bitcoin.

“We need to watch it [digital money] very seriously precisely because it can be used by criminals,” May said.

Former broker Jordan Belfort, played by Leonardo DiCaprio in the biopic, also spoke out about what he understands best: fraud. “The Wolf of Wall Street” suggested that the Bitcoin rate could rise to $50,000, after which the asset would certainly depreciate.

“Governments don't like anything more than money laundering. And the biggest scam right now is that something created as a currency has become an investment vehicle. Bitcoin is practically not used in the world. While it is growing, you can make money if you exit the game in time. And then, when a certain point comes, Bitcoin will not go from $30,000 to $29,000, and then to $28,000, and so on. It will be $30,000 - $1,” Belfort is sure.

Then the head of the global analytical department of the investment bank Goldman Sachs, Steve Strongin, spoke. He is of the opinion that cryptocurrencies have no intrinsic value and many coins will not survive in the long term.

“People seem to be trading cryptocurrencies as if they will all survive or at least retain their value. What worries me is the high correlation between different cryptocurrencies. Contrary to what one would expect in a rational market, new currencies do not depreciate the value of old ones; they all move as one asset class,” Strongin wrote.

Large banks generally did not treat Bitcoin and the like very kindly, while many appreciated the new type of asset. JPMorgan Chase analysts acknowledged that digital money can be used to generate profits, but it will never replace traditional money.

“The enormous volatility in the price of digital money relative to traditional currencies or a basket of goods and services has made cryptocurrencies impractical. Cryptocurrencies are used as a means of payment only as a hobby, at least for ordinary transactions - for goods and services,” experts emphasize.

Tom Lee, always optimistic about cryptocurrencies, said that by the end of 2022 Bitcoin will rise in price to $25,000, and by March 2022 the value of the currency will reach $90,000.

March-May

Winter passed, but the opinions of some experts about Bitcoin remained just as cold. Former IMF chief economist Kenneth Rogoff suggested that the price of cryptocurrency will drop to $100 due to pressure from major governments. He noted that the new type of assets is mainly needed to launder money obtained from crime and evade taxes.

“I think the value of Bitcoin will be a tiny fraction of what it is now. In 10 years, a price of $100 will be much more likely than $100 thousand,” the specialist suggested.

Experts from the largest investment company in Europe, Allianz Global Investors, predicted an even tougher future for cryptocurrencies. They called Bitcoin a bubble that is about to burst.

“...What is the fair value of Bitcoin? In our opinion, its intrinsic value should be zero. Presumably the same argument could be made for gold, but gold was accepted as a value by humanity over two and a half thousand years ago. Compare this to Bitcoin's less than ten-year lifespan,” the company said in its report.

While the head of PayPal criticized cryptocurrencies, co-founder of the payment system Peter Thiel believed in the growth of the price of Bitcoin in the long term, although he was “neutral or skeptical” about altcoins.

“Bitcoin is like gold bars in a vault that never moves. This is a kind of hedge against a general collapse,” Thiel said.

Visa CFO Vasant Prahbu holds exactly the opposite opinion. He is sure that only “dirty politicians” and scammers use digital money.

“When the guy who shines your shoes tells you what stocks to buy, that’s the last indicator that it’s a bubble,” Prahbu recalled the famous parable.

Analysts from large banks continued to insist on their position; next in line were specialists from Merrill Lynch, which is part of the financial conglomerate Bank of America. They called Bitcoin the largest bubble in history, which began to collapse.

Investors continued to believe in Bitcoin no matter what, and Tim Draper urged not to listen to skeptics. In his opinion, the price of the first cryptocurrency will reach $250 thousand by 2022.

“I think Bitcoin will reach $250 thousand by 2022... Believe me, it will happen. They'll think you're crazy, but believe me, it's going to happen and it's going to be amazing!” Draper says.

The famous billionaire and unique symbol of cryptocurrency Warren Buffett did not agree with this statement. He has long said that he does not trust digital money, and this year is no exception. According to the entrepreneur, Bitcoin is anything but an investment.

“If you buy something like Bitcoin or some cryptocurrency, you really don't have anything that can produce anything. You just hope the next guy pays more. You are not investing when you do this. You are speculating. There is nothing wrong. If you want to gamble, someone else will come and pay more money tomorrow, this is one of the games. This is not investing,” Buffett said.

In May, Fundstrat Global Advisors analysts made a forecast for 2019. They suggested that Bitcoin would cost from $20 thousand to $64 thousand, and ultimately the cost of the cryptocurrency would consolidate at $36 thousand. Experts believed that miners will have a positive impact on the growth of the value of digital money.

The head of the BitMEX exchange, Arthur Hayes, supported this forecast and made a bolder statement that the price of the first cryptocurrency will rise to $50,000 before the end of 2022. Vanguard economist Joe Davis spoke out against this. He spoke positively about the blockchain, but predicted that the Bitcoin rate would fall to zero.

“I am enthusiastic about the blockchain technology that makes Bitcoin possible. In fact, Vanguard already uses such technology. As for Bitcoin as a currency, I believe that with a significant degree of probability its rate will fall to zero,” the expert said.

June August

In June, Apple co-founder Steve Wozniak joined the discussion of digital money. He said he agreed with Jack Dorsey, who previously said that in ten years there will be only one cryptocurrency left - Bitcoin, and all altcoins will be worthless.

“I’m ready to fall for what Jack Dorsey says. Not because I think it will definitely happen, but because I want it to happen,” Wozniak said.

Analysts continued to try to guess what the price of Bitcoin would be by the end of 2022. The Trefis company got involved in the matter, whose specialists first said that the cryptocurrency would rise in price to $15 thousand, and then lowered their forecast to $12.5 thousand. With the current price of the first cryptocurrency at $3,800, such figures seem unrealistic given that there is less than a week left until the New Year.

Tom Lee did not lower the bar and at the beginning of the summer confirmed his forecast of $25 thousand. The specialist recommended buying the coin at a price of $7,800 in order to make a profit in the long term. Now the asset price is 2.5 times less.

The most realistic opinion at that time was expressed by the founder of Onchain Capital, Ran Neu Ner, who spoke about the decline in interest in the industry and suggested that in the near future the price of cryptocurrency will continue to fall. He recommended not to panic (advice that became most relevant in December) and to continue to believe in the market's prospects.

“If the price of Bitcoin reaches $20 thousand, $40 thousand or $80 thousand within a few years, then no one will worry about whether Bitcoin was bought at $6 thousand or $6.5 thousand. Only day traders operating on a scale of less than a year should be concerned about the current drop in market price,” said Ran Neu Ner.

Barclays head of investment strategy Will Hobbs (oh those banks) was much less optimistic. He said that cryptocurrencies have no future.

“The arguments underlying the idea of a future “bitcoin standard” are still economically illiterate. The crypto debacle is not over yet,” says Hobbs.

The head of the Bank for International Settlements, Agustin Carstens, went even further. He suggested stopping mining as it was pointless.

“Cryptocurrencies do not fulfill any of the three functions of money. They are neither a good means of payment, nor a good unit of account, nor a decent store of value. They suffer a crushing defeat on each of these points,” said the head of the BIS.

The protracted correction of the digital money market forced Tom Lee to lower his forecast for Bitcoin to $22,000. Then he was wrong twice at once, because with the price of the cryptocurrency at $6,500, he said that it would not fall below this level.

The CEO of the website for private investors ADVFN, Clemb Chambers, expected a further fall in the value of Bitcoin, but believed in long-term growth to $100 thousand. He added that the new type of asset could have a positive impact on the global economy.

“Blockchain is the road to the future, just as the Internet was for the previous generation. Bitcoin may be part of this future in the long term. Will he return to his previous records? There is a chance that it will fall in price to $2 thousand before reaching $20 thousand. Will it reach $100 thousand? I think it's quite likely," Chambers said.

In response, Gary Barnett, senior analyst at research firm Global Data, published a 34-page report on the digital money market. He called all the arguments of supporters of the new type of assets lies.

“The main statements of cryptocurrency supporters are not true. We are told that cryptocurrencies speed up transactions, remove middlemen and are cost-free, but none of these things are true,” Barnett said.

The head of BitMEX, Arthur Hayes, meanwhile predicted a fall in the Bitcoin rate to $5,000. Only after this could the price of the coin reach $50 thousand, the expert believed.

“I would like to see the price of Bitcoin go down to $5,000 so we can see if we really hit the bottom. If this level holds up. We can rise to $50 thousand by the end of the year,” the specialist suggested.

In mid-August, the head of BitMEX again commented on the situation on the market and correctly predicted that the price of Ethereum would fall below $100, and the Bitcoin rate to $3,000-$4,000. Hayes also said that miners will begin to actively turn off equipment. And so it happened: since November, more than 1.3 million digital money mining devices have been turned off due to low business profitability.

September—November

In September, Mike Novogratz twice again stated that the cryptocurrency market had reached a low and was now ready for new growth. He added that over time, more and more people will start using digital money, which will lead to new growth for Bitcoin.

“This is the BGCI chart... I think we touched the low yesterday. We have again reached last year's acceleration point, which led to a massive rally/bubble. The market seems to be returning to a breakout,” Novogratz wrote on September 14, after Bitcoin set a local low of $6,200.

Tim Draper supported the billionaire and added that he still believes in Bitcoin’s growth to $250 thousand despite the market situation. He once again recommended purchasing digital money while its price is relatively low.

Allianz Chief Economic Advisor Mohamed El-Erian tried to temper the fervor of the crypto community and suggested that digital coins are here to stay and will play a role in the ecosystem, but things will be a little different.

“The distribution (of blockchain - editor's note) will not be as wide and fast as cryptocurrency supporters want. I think cryptocurrencies will be around for a long time and will play a role in the ecosystem, but they will not become the currency that many supporters want to see,” El-Erian emphasized.

Tom Lee continued to believe in Bitcoin and, at a price of $6,000, predicted that the cryptocurrency would definitely rise in price by the end of the year. Mike Novogratz was already much less optimistic and said that Bitcoin would no longer be able to overcome the $9,000 mark, although now the phrase put in this way looks quite positive.

The economist who predicted the 2008 crisis, Nouriel Roubini, was much more serious. He compared digital money to North Korea and called Ethereum creator Vitalik Buterin a dictator for life.

“Decentralization of cryptocurrencies is a myth. This system is more centralized than North Korea: mining is centralized, exchanges are centralized, developers are centralized dictators (Buterin is a “dictator for life”), and the Gini coefficient of Bitcoin is worse than North Korea. ", Roubini wrote.

The head of Sberbank, German Gref, also spoke more restrainedly about the imminent “death” of cryptocurrencies. He explained that the governments of large countries will not allow cryptocurrencies to develop, and this area will not become widespread in the near future.

“Do I see a great future for cryptocurrencies? Until it is reviewed, the state will not cede its centralized role and will not allow cryptocurrency,” Gref said.

European Central Bank board member Benoit Couré called Bitcoin “an evil product of the 2008 financial crisis.” He advised central banks not to get involved with this industry for the next ten years.

“Few people remember that Satoshi Nakamoto inserted into the first block of Bitcoin a headline from a Time article about the bailout of British banks, published in January 2009. In many ways, Bitcoin is an evil product of the financial crisis,” Kure said.

At the end of November, Tom Lee continued to believe that Bitcoin would rise to $15,000, despite the fact that the rate of the first cryptocurrency fell below $4,500. The analyst hoped that the launch of the Bakkt platform for institutional investors would give a new impetus to market growth, but the launch of the platform was postponed until January 24.

A less optimistic forecast was given by Civic project head Vinnie Lingham. He suggested that Bitcoin will be in the $3,000-$5,000 range in the next 3-6 months.

“Risks now in any case outweigh the chances of growth in the short term. There will be better opportunities in the future. You may have to pay a little more if you buy Bitcoin for $5,700 or $6,000, but you will take on less risk associated with the fact that the cryptocurrency can rise to these levels and fall again,” said the head of the startup Civic.

December

The situation on the cryptocurrency market deteriorated significantly in December 2018, and analysts' opinions became more harsh. At the beginning of the month, billionaire and venture capitalist Jim Brier said that users are losing interest in the blockchain, this is a normal dynamic, but in the near future the value of Bitcoin will fall much lower.

“Cryptocurrencies are now ready to enter the nuclear winter phase,” Brier said.

Saxo Bank analyst Steen Jacobsen does not believe that the cryptocurrency has prospects for further price growth. In his opinion, a prolonged correction will lead to Bitcoin depreciating next year.

“In 2022, the base mark for Bitcoin will be $1000, after which its price will begin to fall to zero. Cryptocurrencies have the right to exist, but only under the control of the authorities,” Jacobsen said.

Bobby Lee, the founder of the BTCC exchange, expressed a different opinion; he believes that the coin rate will drop to a minimum of $2,500 in January 2022, after which it will begin to rise again. The expert drew an analogy with the situation on the market in 2014.

“After an all-time high of $1,200 in December 2013, Bitcoin fell more than 87% over the next 13 months and bottomed at $150 in January 2015. Now, from a high of $20,000, an 87% drop would result in $2,500. Maybe the bottom will be in January 2019?,” Lee wrote.

In order not to be tormented by guesses about the future of digital money, the head of Allianz Global Investors, Andreas Utermann, said that cryptocurrencies should be banned. He noted that investments in a new type of asset often lead to large financial losses.

“They need to be declared illegal. I am surprised that regulators have not yet introduced stricter measures,” Utermann said.

Fundstat analyst Tom Lee was apparently upset that none of his predictions turned out to be correct, so the expert said he would no longer give future price levels for cryptocurrencies. However, he could not resist and still reported the “fair price” of Bitcoin at $13,800-$14,800.

“The fair value of Bitcoin is much higher than the current one. The number of e-wallets would have to drop from 50 million to 17 million for the current price to be true,” Lee said.

Then former chief risk officer of investment firm AQR Capital Aaron Brown gave it a B+ rating despite the protracted correction. The analyst suggested that Bitcoin could take much longer than three years to recover from its fall.

“A decline is often followed by a recovery, but cryptocurrencies can stay down for a very long time,” Brown said.

Russian Minister of Economic Development Maxim Oreshkin called digital money a burst bubble, but spoke about the prospects of blockchain technology.

“At the end of last year there was a lot of talk about cryptocurrencies. Bitcoin, if I'm not mistaken, reached a value of $20 thousand. Even then, I personally emphasized that this was a financial bubble that would burst. Now we see that this bubble has disappeared, Bitcoin prices have fallen several times. What well. This story attracted a lot of attention to new technologies, allowed companies to attract investments for the development of new technologies, and as a result, from this point of view, we can talk about a positive effect,” Oreshkin said.

During the year, Bitcoin was buried more than 90 times and called a bubble countless times. There were also optimistic opinions, but by the end of the year there were fewer and fewer of them, and the situation in the industry was heating up. Next year is expected to be a breakthrough year, the market should become more regulated, and institutional investors will come to the industry, which will have a positive impact on the cost of digital money and on the mood of the community.

Estimated range of Bitcoin price growth in 2018

Some experts predict a rapid rise in price that Bitcoin will show in 2022. Among them are experienced developers of top projects in the field of blockchain and decentralization, and therefore the degree of reliability of the information is very high. The stated price maximum is 10 thousand dollars per 1 token. In making such predictions, they rely on the imminent collapse of the entire traditional banking system and the emergence of serious complications in access to personal savings.

As soon as the current payment instruments show signs of weakness, digital money will immediately fill this niche. At the same time, the value of cryptocurrency will undoubtedly increase.

However, such an expert assessment is only one of many. So in the summer of 2022, a real cryptocurrency boom occurred in Japan. In addition to frantic demand, digital currency has been noted for being equal to traditional means of payment in certain areas of service provision. The news did not fail to recoup the value of Bitcoin, which reached unprecedented heights.

In the Celestial Empire, everything is exactly the opposite. The government of the country subjected the digital currency to severe control, and therefore most of the cryptocurrency investors were forced to turn to the markets of other countries. This decision had a negative impact on the rate of coin No. 1, and it dipped somewhat. Speaking about the long term, it can be noted that experts are divided into 2 camps. Some suggest a quick fall in the digital currency, while others, on the contrary, expect it to rise sharply.

Key catalysts for growth

2017 can well be called the year of cryptocurrency or even the year of Bitcoin, because the rate of this coin has risen almost exponentially. We had to wait for such rapid growth for several years, and last year it just happened. Taking all this into account, users are confident that in 2022, buying bitcoins is a mandatory task for all investors who want to earn as much as possible from the growth of the rate. But given that bitcoins are suitable for long-term investment, it is important to know the main factors that can positively affect the growth of the crypto coin in the just begun 2022:

- The first factor is the enormous potential of blockchain technology . The most logical and tangible reason for the growth of the coin price, which can be traced over the past few years, is the incredibly high potential of blockchain technology. This is what initially hooked the users who were mining tokens. For those who don’t know, blockchain is a digital decentralized registry where you can register transactions without using the services of an intermediary, which is a bank. This network uses open source code, which makes it almost impossible to change the information provided there. In addition, the Bitcoin blockchain provides maximum security, which opens up enormous prospects for the platform in question as a full-fledged, inherently unique payment system.

. Investors pay attention not only to the reliability of the cryptocurrency, but also to how many updates this system has gone through. Each of them periodically raised the Bitcoin rate, so this phenomenon guarantees the increased prospects of the cryptocurrency. The fact is that the update made it possible to increase the number of transactions that the system carries out per second. This has become the main problem of Bitcoin, holding back its more rapid growth. The developers have fixed this, although not completely. But even such changes allowed the system to become significantly more popular and significantly increase its price.

Bitcoin Blockchain Updates- Depreciation of the dollar . Since Bitcoin was created as an alternative to such powerful fiat currencies as the dollar, its fluctuations affect the value of the coin. Usually, when the dollar falls, investors try to protect their money by investing it in gold, which before the advent of cryptocurrencies was considered the most reliable way to preserve their assets. In principle, this is true, but now with the advent of Bitcoin there are much more alternatives. Bitcoin is called digital gold, which is why the bravest investors chose it to bolster their own capital and were right. Thanks to the popularization of Bitcoin and its use as a safe haven, it was possible to take this cryptocurrency to a completely different level.

- Interest from institutional investors . Due to the fact that not only individual investors, but also institutional investors, including Fidelity and Goldman Sachs (NYSE: GS), are showing interest in Bitcoin, the coin’s rate could not remain at the same level. Many companies that entered this trend in time can now make decent money from Bitcoin mining. For some, this is just a good addition to profit, while for others it is its main source. Additionally, given the growing liquidity of the cryptocurrency market, many firms are successfully experimenting with Bitcoin trading. Even a company like Goldman decided to get into cryptocurrencies, and despite the seeming absurdity of this decision, it is not something out of the ordinary. In general, there are more and more investors who are ready to work with cryptocurrency, which ensures the stability of the coin.

- Bitcoin has high potential as a means of payment . It was created as an alternative to fiat money, which allows for the safety, efficiency, and availability of money transfers. So the frequency of using Bitcoin as a means of payment makes this coin even more expensive. After Bitcoin was updated, several companies immediately indicated that they were ready to accept it as a means of payment. Although this applies to large organizations, smaller firms are just getting ready to take a risky step for themselves. If in 2022 a couple more companies open a Bitcoin account, then we can expect another jump in the rate.

- Lifting restrictions on the use of Bitcoin in China . It is Chinese cryptocurrency exchanges that today occupy the first places in popularity among people working with bitcoins. But this turned out to be a short-term phenomenon, because the news that China could change the approach to the use of cryptocurrency and thereby open up broad horizons for financial transactions turned out to be a fiction. Banning ICOs and restricting all existing cryptocurrencies on a huge number of Chinese exchanges could contribute to the collapse. This increased the number of Bitcoin transactions that users rushed to make before the exchanges closed, and contributed to the growth of this cryptocurrency.

- Another factor contributing to the growth of Bitcoin is the reluctance to miss out on profits . The emotionality of investors plays to the benefit of the Bitcoin rate (of course, not always, but quite often). Many users, seeing that the rate is rising, buy coins without thinking about why they are doing this, how they will store these bitcoins and whether they chose the right moment to make a financial transaction. But the general trend towards the growth of a cryptocurrency does not always indicate that it will continue to grow in the future, although it is precisely such actions that contribute to the growth of cryptocurrency.

- Bitcoin gaining brand status . People are known for their unaccountable trust in everything they know. Today everyone has heard about Bitcoin, because they want to own this coin.

- The final success of blockchain technology at the government level and increased confidence in the coin. Bitcoin's growth forecast for 2022 is quite positive, up to the full acceptance of the system. Several countries have already successfully officially recognized the coin, including Japan. Each such decision on the part of some country secures Bitcoin in the currency market, and not only digital money.

But, given the positive factors that contribute to the growth of the coin, we cannot forget about the high competition in this industry. Bitcoin, although the first cryptocurrency, is far from the only one. Many of the new products are more thoughtful, functional and accessible, although not yet so expensive. So it is quite possible that over time (not in 2022) Bitcoin will be replaced.

Medium term prospects

Ignoring electronic money when it is showing such tremendous growth is an unforgivable omission. Bitcoin has attracted the attention of not only professional analysts and traders, but also ordinary users who are looking for a stable source of income in these difficult times.

International market acceptance explains the gradual upward movement. The most significant changes are happening right now, because the price for 1 coin has soared to 8 thousand dollars. In addition, in the near future the platform may acquire official legal status, which will also immediately affect the cost of its tokens.

Most analysts believe that the Bitcoin cryptocurrency is not in danger of collapsing next year. As the previously mentioned Chris Haya states, the price of 1 BTC on trading platforms will surpass the cost of gold. Chris is also supported by the authoritative physicist at the Polish National University, Mariusz Tarnopolski. He created an application that simulates with a high degree of accuracy how Bitcoin will behave in 2022, and in accordance with it, it turns out that the price of the coin will double compared to the previous year.

When analyzing the fluctuations of the platform and the predictions of experts, you should also not ignore the words of experts from Goldman Sachs, the oldest and most influential company in the field of investments. Their forecasts are more than positive: they report that next year the value of the cryptographic currency will only increase. The rate can increase at least one and a half times. However, short-term price declines of 25% cannot be ruled out. There is no need to fear a complete collapse of cryptocurrency.

The head of the large financial company Standpoint Research, Ronnie Moas, also predicts a favorable future for Bitcoin. According to him, the currency is protected from possible inflation, and its capitalization indicators will grow rapidly.

What is Bitcoin and what is it used for?

Bitcoin has shown itself to be a unique and completely new currency, which is increasingly used in payments on the Internet. In fact, the need for it arose at the very moment when trade smoothly flowed from “contact” markets to interactive platforms. Bitcoin is just one type of cryptocurrency. Active users of the global network immediately appreciated the ease of use. This is precisely the reason for the sharp rise in the popularity of “interactive money”, which can only be stored in electronic wallets, although cryptocurrencies have a number of characteristic differences even from each other.

As mentioned above, they do not have a single control center; the database is duplicated for all users of the system. The totality of users constitutes a unified payment system that operates in all corners of the world around the clock. It is based on an algorithm on the operation of which the functionality of the system completely depends, and no one controls this algorithm.

In addition, when paying with cryptocurrencies, modern data encryption methods are used, which guarantee multi-level security. As a result, we have a system with a number of undeniable advantages:

- Independence from inflation.

- Instant payments.

- An innovative alternative to “real” money.

- Impossibility of falsification.

- International currency status.

- Security of transactions.

Most analysts agree that Bitcoin has a lot of prospects for the near future: from a colossal increase in its rate in a couple of years to the suppression of the development of a new currency in the territories of many countries. There are a number of factors on which the future of Bitcoin and the prospects for its development in the coming years will directly depend.

Share of pessimism

Despite the fact that most experts agree on the positive development of events next year, there are those who hold a different view. So Chris Berniske considers Bitcoin to be just another speculative instrument, and its high price is completely unreasonable. As Chris states, Bitcoin 2018 will lose over 75%, thereby causing a fall in the rate of other cryptocurrencies.

The reason for such a negative movement may be an excess of volumes in the market and too much hype around electronic coins. It is assumed that the situation, having reached its climax, will provoke a final drop in the value of the cryptocurrency.

How Bitcoin's prospects will change in 2018

The price increase from $6,190 to $6,450 happened so quickly that many traders were unable to get their bearings. After the massive collapse on September 5, not a single analyst predicted such a jump. For novice investors to enter the market, a long period of stability in the price range of 5 to 6 thousand is required.

In six months, the Bitcoin rate had to test the support level of $6,000 three times. If in the future BTC manages to gain a foothold above this level for a long time, we should wait for the trend to reverse. But this may not happen until December 2022. For the cryptocurrency to recover from the recent decline, the rate needs to rise to $6,500.

Changes in Bitcoin to the dollar and ruble

According to analysts, the BTC rate against the ruble or dollar will most likely increase next year. However, it is worth understanding that if the domestic currency strengthens its position on trading floors, the cue ball quotes against it may not increase as quickly as, for example, against the American dollar.

Large financial companies and manufacturers of mining equipment are more than optimistic. They intend to continue investing in promising types of electronic currency, including Bitcoin. And in many countries, the issue of legalizing cryptocurrency and assigning it official legal status is increasingly being discussed. If Bitcoin is recognized by a number of top ten countries, its value will increase many times over.

How Bitcoin rose from $6 thousand to $11 thousand

However, over the next two weeks, Bitcoin sensationally grew in price. None of the analysts predicted that Bitcoin would show crazy growth.

On February 7, the price of the cryptocurrency increased by 17%. From $6.3 thousand, Bitcoin jumped to $7.3 thousand. SEC Chairman Jay Clayton stated the importance of the safety of cryptocurrency owners. The head of the Commodity Futures Trading Commission, J. Christopher Giancarlo, noted the importance of blockchain technology. The system cannot exist without Bitcoin.

The next day, the price of Bitcoin exceeded another psychological mark – $8 thousand. On February 12, the Bitcoin exchange rate to the dollar was $8.5 thousand. The cost of Bitcoin increased amid reports of investors’ interest in cryptocurrency.

Ramzan Kadyrov acquired a share of bitcoins | news.crypto.pro

The head of Chechnya, Ramzan Kadyrov, announced that he had acquired a share of Bitcoin. There are big risks in this segment. However, Kadyrov is going to introduce blockchain technology into the Rosreestr of Chechnya. Implementation is necessary for registration and accounting of real estate transactions.

Bitcoin dynamics were positively influenced by statements from the authorities of South Korea and the United Arab Emirates. The Abu Dhabi Financial Services Authority, part of the Abu Dhabi Financial Centre, said it would create a regulatory framework to control the cryptocurrency market. The South Korean authorities will make cryptocurrency trading transparent - they do not intend to ban Bitcoin.

On February 16, the Bitcoin rate against the dollar rose above $10.1 thousand. Experts explained the growth of Bitcoin by the decision of the Japanese government to make cryptocurrency an official payment system.

Japan made Bitcoin an official payment system | promdevelop.ru

The authorities obliged companies to make a license fee of $300 thousand before starting to work with bitcoins. After receiving a license, the organization must store $100 thousand in reserve currency. Management will have to provide information about the legal use of Bitcoin. The bill is aimed at protecting traders. However, the Japanese were outraged by the size of the license fee. On February 20, the Bitcoin exchange rate to the ruble was 649 thousand rubles. ($11.5 thousand).

Is it possible to legalize Bitcoin in Russia?

Experts around the world predict large-scale integration of blockchain technology into many areas of human life. This means we should expect the growth of digital money. Russian analysts in the field of electronic currency have a similar opinion and suggest that Bitcoin quotes against the ruble will increase significantly in 2022. They also hope that the government will find a common language with both miners and ordinary network participants who want to pay for online purchases confidentially and without commissions by adopting digital money at the legislative level.

The Bitcoin lifetime graph shows that this innovative currency is strengthening its position in the global financial arena every day. And soon Russia will fall under its onslaught, intending to recognize and allow the circulation of cryptocurrency on its territory in the near future.

Say a good word for poor Bitcoin

Bitcoin is too unreliable. This is exactly what analysts from another camp think, who are of the opinion that the prospects for Bitcoin in 2017-2018 are extremely unenviable. According to them, the cryptocurrency will face a complete fiasco in the coming years, and it will begin to collapse at the end of 2022. The main argument: if the wallet is deleted or the funds in it are stolen by cybercriminals, the owner will be left with nothing. He has nowhere to go and no one to prove that he was made a victim. The system does not provide any compensation.

Despite the high level of security for payments with cryptocurrencies, the technologies of cybercriminals do not stand still. As they say, “there’s a hole for every old woman,” so the guarantees remain extremely vague, even though new wallets with increased levels of protection await us in the near future.

The downside for Bitcoin will be that it will receive the status of an “outlaw” currency if a number of countries decide not only not to legalize it, but also to ban it. This is exactly the scenario that led to the sad fate of Bitcoin in China. The official ban not only excluded the possibility of the use of cryptocurrency by the Chinese, but also collapsed its rate throughout the world. The Chinese market, of course, is one of the largest, but if a ban in just one country could deal such a crushing blow to the system as a whole, then what kind of stability can we talk about about Bitcoin?

Summarizing

The question of how the first electronic currency will manifest itself cannot be given a definite answer. On the one hand, it can continue to develop successfully and conquer new horizons. On the other hand, it is no less likely that it will fail and disappear completely. The main feature of any cryptocurrency is its enormous dependence on demand. As long as people believe in Bitcoin 2022 and buy it, it will continue to exist.

However, despite the obvious risks, the coin provides a unique opportunity to make money. Top fiat currencies, including the euro or dollar, do not have such potential.