Next, we will try to answer this question, and also get acquainted with the opinions of experts regarding Ethereum quotes in 2019.

Ethereum price forecast in 2022. Main Factors

As mentioned earlier, 2022 was a very difficult year for the coins described. This is due to the fact that at the end of the last code, Ethereum quotes reached their lowest value in the last 17 months. Another serious problem faced by the described digital coins is a significant decrease in the level of capitalization, as a result of which Ethereum lost second place in this indicator to Ripple digital tokens.

Despite the difficulties of the past code, the prospects for Ethereum in 2019 look quite rosy. There are a number of factors that, according to many experts, could cause a significant increase in the prices of the described decentralized coins in 2019. Among the factors that will contribute to the increase in the value of the described coins, it is important to mention the following:

- The Blockchain Phone Exodus 1 smartphone goes on sale, which has a built-in cold wallet for storing Bitcoin and Ethereum coins.

- Hard fork of Constantinople, which is planned for early 2019.

- According to expert calculations, the difficulty bomb integrated into the Ethereum platform should reach a 30-second block time around May 2022.

- In 2022, the Ethereum 2.0 platform should be launched, into which the Casper add-on is integrated, which is a PoS algorithm, which in the future should replace the currently used PoW.

Next, we will look at analysts' forecasts about what the price of Ethereum will be in 2022.

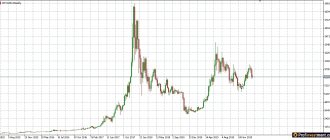

How the difficulty of obtaining Ether has changed

The platform appeared in 2015, and the mining difficulty level was low. The increase turned out to be gradual – until 2022. A sharp acceleration occurred in the spring of 2022 - from that time on, mining this cryptocurrency became a difficult task. By the way, this situation creates difficulties not only for miners, but also for the creators of the platform themselves.

If many miners stop working on the network before the right time comes, its security will be at risk. As a temporary solution, the Byzantium hardflock was produced, which became the Metropolis stage. The consequences of this were:

- reducing the level of mining complexity;

- delaying the firing of the “complexity bomb” that was present in the technology for one and a half years.

Forecast by B. Ullery

Well-known analyst B. Ullery uses his own model to forecast changes in Ethereum quotes, which takes into account the peculiarities of the development of the global economy and the assumption that the role of blockchain technologies in international trade will grow over time.

This analyst claims that by 2022 the cryptocurrency market capitalization level will exceed four trillion dollars, with about 25% of this amount coming from Ethereum. According to his forecast, quotes for the digital tokens in question will reach $11,000 by the end of this year. This prediction is quite bold, since in order to reach the stated level, the coins in question need to exceed their maximum quotes by more than seven times.

Possible threats to investing in ETH

Any investment in the form of an investment with the aim of generating future income is always risky, regardless of the area in which the money is invested. No one ever gives one hundred percent guarantees of return on investments, except that scammers can give such guarantees, but their goal is completely different - to lure money in order to get their hands on it.

However, if you take a close look at the crypto market, you will notice its speculative rather than investment nature, which is fraught with:

- prohibitive measures by states in order to protect the interests of both ordinary users and investors from speculators. This is what is happening now in the USA, when lawsuits have been filed against some crypto exchanges;

- rampant fraudulent schemes to defraud bona fide users of crypto assets;

- both ordinary users and investors from speculators. This is what is happening now in the USA, when lawsuits have been filed against some crypto exchanges; rampant fraudulent schemes to defraud bona fide users of crypto assets; encouraging the development of more advanced digital coin ecosystems.

If in the latter case, there is still an opportunity to switch to new, more advanced crypto assets in time, then in the first two, there is a high probability of losing funds, despite the fact that the judicial authorities, as in the first case, will make decisions in favor of the victims.

Our ether forecast for 2019 is 1.5 thousand American money with the rate fluctuating by 10-20 percent in one direction or another, which will allow both investors to receive a good margin and speculators to receive decent income. As they say, the predators (speculators) will be fed and the sheep (investors) will be happy.

CoinKir Forecast

Employees of the popular Internet portal CoinKir have prepared their own forecast for changes in the value of Ethereum coins. To make their own forecast, they used a variety of technical analysis techniques. After analyzing the behavior of the described decentralized tokens in 2022, analysts of the CoinKir portal came to the conclusion that they will be able to reach their maximum values only in 2022. According to their forecast, by the end of 2019 the cost of Ethereum tokens will be approximately seven hundred dollars. At the same time, throughout 2022, the quotes of these coins will gradually increase, due to which they will overcome the $1,500 mark.

Tom Lee's forecast

A well-known expert on the cryptocurrency market, T. Lee, in an interview with the popular Bloomberg publication, said that after the failures that Ethereum experienced in 2022, we can expect an upward trend, as a result of which Ethereum will be able to reach the $1,900 mark by the end of 2022.

This expert claims that Ethereum quotes are currently undervalued. This state of affairs is caused by the negative sentiment that currently dominates the cryptocurrency market. He states that in 2022, negative sentiment will be replaced by positive ones, which will cause a recovery of the entire cryptocurrency market, as well as an increase in Ethereum quotes.

How did Ethereum affect miners' income?

Ethereum difficulty metrics are important for calculating how profitable mining will be. The concept is used to characterize the time it will take to validate a block. The value can be determined by the Nonce parameter, the only way to find out which is to search through the available values. How much time is expected to be spent on searching becomes a characteristic of the difficulty of mining. The hashing action for Ethereum is Ethash, which specifies the latest block metadata for the blockchain using Nonce encoding.

It is impossible to randomly determine the code, and therefore in order to decrypt the block and receive a reward, you need to use computing power. The selection of indicators occurs automatically - they must correspond to each other. The period it takes to validate a block can be set to determine the difficulty. If it is less than expected, the system will lower the Block difficulty parameter.

Forecast from Finder.com

This portal is known among the cryptocurrency community for publishing analyst forecasts regarding changes in quotes for various digital tokens. The fact that the forecasts published on this portal quite often come true deserves special mention.

According to the employees of the mentioned portal, in January of this year the quotes for the cryptocurrency in question will be approximately $250. Throughout 2022, there will be an increase in Ethereum coin prices, resulting in the price of these tokens being over $1,500 at the end of the year.

A little history

A new cryptocurrency called ethereum (eth) appeared at the end of 2013, and the launch of the main network took place on July 30, 2015. The five years that have passed since its creation have been full of exciting events, sometimes quite dramatic. Suffice it to recall two cases of massive hacker attacks undertaken with an interval of just over a year.

Just as the new platform began to gain momentum, a critical bug was discovered in the system. On June 16, 2016, the loudest theft in the history of the cryptocurrency industry occurred and, as a result, the collapse of the newly launched The DAO project. Hackers managed to exploit a critical vulnerability in the platform and pocket the equivalent of $50 million in ether.

The security service was able to strike back at the cybercriminals and roll back transactions. This measure made it possible to return the stolen property, but many platform users were unhappy with this decision, believing that it violated the ethical laws of cryptocurrencies. As a result, a hard fork of the network occurred, and a new coin was born - Ethereum Classic. Today, both cryptocurrencies are successfully traded on exchanges and have a fairly high level of security.

A year later, in July 2017, two more attacks were carried out on Ethereum within a few days of each other; the losses amounted to $32 million. Once again, the attackers took advantage of the developers’ mistake: this time it was a flaw in the client for managing Parity electronic wallets, through which clients’ money leaked.

Oddly enough, major troubles could not hinder the development of the new platform, and to some extent even helped, making it more popular. And there are three reasons for this:

- the attention of potential users was attracted. Thanks to the kidnapping stories, even those who were far from the world of cryptocurrencies learned about Ethereum;

- the network was divided, resulting in a new coin;

- vulnerabilities were identified and subsequently fixed, making the ETH system more secure.

Thus, the company suffered not so much reputational as financial losses and continued its progressive development.

Forecast from D. Rachinski

D. Rachinski, who is the director of the company Joe-Technologist, has formed his own forecast for Ethereum quotes for 2022. He claims that Ethereum will be able to overcome the important level of $1,200 by the end of this year. The expert explains his rather optimistic forecast by the fact that the platform will expect a serious influx of institutional investments.

According to D. Rachinski, over the years of its existence, the Ethereum platform has managed to prove its performance, thanks to which many large organizations are beginning to use it for their own purposes. It is the growth of interest in the platform in question on the part of large companies that, according to D. Rachinski, should cause a serious influx of institutional investment.

Should you keep your savings in ether?

No one can answer. It’s quite easy to give all the arguments “against” and “for” - everyone will have to decide for themselves. You can purchase one or two ETH, putting them aside “for later,” and then wait and hope for a price increase. The main problem with Ether is this: unlike Bitcoin, it is not used for buying and selling goods. That is, the price is formed during trading on the exchange, and not during actual use. Smart contacts are a plus, although how to use them is a very interesting question. But large companies are interested, and this is not bad for cryptocurrency.

Forecast from N. Green

The founder of deVere CEO N. Green recently expressed his opinion regarding the prospects for Ethereum coins in 2022. He stated that by the end of 2022 the price of the digital tokens in question will be able to overcome the important level of $2,500 thousand. Among the factors that will contribute to the growth of Ethereum quotes, N. Green highlights the following:

- The growing popularity of digital tokens as means of payment.

- Wider adoption of smart contracts.

- Decentralization of the cloud computing process.

These factors, according to Green, will lead to an increase in the value of the digital tokens in question, but also to an increase in the level of capitalization of the entire cryptocurrency market in 2022.