An Initial Exchange Offering or IEO is an evolution of the Initial Coin Offering or ICO. While anyone in the world can start participating in an ICO, IEOs are more limited. In an IEO, a centralized exchange serves as the platform for the initial sale of project tokens.

ICO has been the king of fundraising for crypto projects for many years. But his days are numbered. Thanks to regulators, especially in the United States, who saw that a method of financing (ICO) bypassed the usual requirements for the sale of securities, after which they came down hard on ICOs.

However, while one financing mechanism dies, many others appear in its place. One of them is the Initial Exchange Offering (IEO).

In this review, we explore what IEOs are, who uses them, and the pros and cons of this newest funding tool.

What is an Initial Exchange Offering (IEO)?

An Initial Exchange Offering or IEO is an evolution (one might even say a fork) of an Initial Coin Offering or ICO. While anyone in the world can start participating in an ICO, an IEO is more limited. In IEO

Centralized exchanges (such as Binance) narrow the platform for the initial sale of project tokens.

This small but significant difference between ICO and IEO means that exchanges act as gatekeepers for projects that want to sell their tokens to the general public.

The exchange should serve as an intermediary between the token buyer and the token seller, ideally reducing the rampant fraud that has plagued ICOs in the past.

There are other forms of crypto finance that have also begun to replace ICOs, such as security token offerings or STOs, but for the sake of simplicity, we will focus on comparing IEOs to ICOs in this article.

You can read a comparison of ICO with STO on our website!

What all of these initial offerings have in common is that they create a certain amount of cryptoassets in the form of a token or coin to sell to the consumer, usually at a fixed price.

The IEO is unique because the sale of these tokens is managed by the existing exchange and not directly by the project team.

Ethereum has by far been the most commonly used platform for launching ICOs in the past. The vast majority of ICOs were created on the Ethereum network.

What is an Initial Exchange Offering (IEO) and how is it different from an ICO?

At the beginning of 2017, there was a boom in ICOs in which a lot of people were scammed. Now ICOs have been replaced by IEOs, which should reduce the number of scam projects. I have already written about IEO from Huobi, I advise you to take a look.

What is IEO?

An initial exchange offering, as its name suggests, is conducted on an exchange platform. Unlike Initial Coin Offerings (ICOs)

,

IEOs

are managed by an exchange on behalf of a startup that is trying to raise funds using its newly issued tokens. Since the token sale takes place on the exchange platform, token issuers must pay a listing fee along with a percentage of the tokens sold during the IEO. In turn, tokens of crypto startups are sold on exchange platforms, and their coins are transferred after the end of the IEO.

IEO participants do not send money to a smart contract, such as the one governed by the ICO. Instead, they must create an account on the exchange platform where the IEO is being held. Participants then deposit funds into their exchange wallets using coins, and use those funds to purchase fundraising company tokens.

IEO on exchange platforms

More and more exchanges have begun to create IEOs.

One of the first in the line was Binance, which released its IEO platform Binance Launchpad. In January, BitTorrent, bought by TRON, initiated a token sale on Binance Launchpad and raised $7.2 million in less than 15 minutes. The next IEO on the platform broke this record, and closed in just 22 seconds. Following the success of Binance Launchpad, other famous exchanges announced the launch of their own IEO platforms. IEO platforms include Bitmax Launchpad, Bittrex IEO, OK Jumpstart (OKEx), KuCoin Spotlight and Huobi Prime.

IEO vs ICO - what are the differences?

We have created a table to show you the main differences between IEO and ICO. Here:

Advantages and disadvantages of IEO. Confidence

One of the main advantages of IEO is trust.

Since the crowdsale is held on the exchange platform, the counterparty reviews each project that wants to launch an IEO on its website. Exchanges do this to maintain a good reputation by carefully vetting token issuers. In this way, IEOs can exclude fraudulent and dubious projects due to raising funds through exchange platforms.

IEO RAID is a great example. Bittrex recently announced that it canceled the IEO for the RAID project just hours before the crowdsale began. The reason for the cancellation was the discontinued partnership between RAID and OP.GG.

According to Bittrex, the partnership between the two companies was a vital part of the project, and when the cryptocurrency exchange became aware of this event, it decided to cancel the token sale as it did not believe it was in the best interests of Bittrex customers.

Safety

Token issuers do not need to worry about the security of the crowdsale since the exchange manages the smart contract IEO. The KYC/AML process is also handled by the exchange as most service providers do KYC/AML for their clients after creating their accounts.

Easier for projects

Token issuing startups benefit from a more seamless process for launching IEOs on exchange platforms compared to launching their own ICOs. While fundraising organizations must pay listing fees and a percentage of their tokens. Thus, startups launching their IEOs require a smaller marketing budget than if they decided to go with an ICO. In addition, token issuers can take advantage of the exchange's stable client base to receive more input into their projects.

Listing

Since the token listing is also “included in the deal,” it is a natural process for the exchange hosting the IEO to list the startup’s token after the crowdsale ends.

Although IEOs appear to be a safer and more efficient alternative to ICOs, the costs associated with token sales can be high for startups. Listing fees can go up to 20 BTC, while exchanges can even get a 10% discount on fundraising company tokens.

How to participate in IEO?

Since IEOs are relatively rare in the crypto community these days, it's not that hard to find one you like.

Once you have found your IEO, you need to find out which exchanges host the crowdsale. The next step is to register an account with the cryptocurrency exchange and complete the KYC and AML verification process.

Once you're done with that, check out the cryptocurrencies you can use to participate in the IEO and binge on them. The last step is to wait for the IEO to start.

Will IEOs create the next fundraising boom?

ICOs have created a fundraising boom in 2022 and 2022.

However, a significant percentage of cryptographic projects were scams. Because of this, as well as the ICO bans, we can say that this is not an effective fundraising model for cryptocurrency startups. On the other hand, IEOs provide an increased level of trust in cryptocurrency projects because the exchanges on which crowdsales are hosted actively participate in the fundraising process, which increases the effectiveness of the crowdsale. Consequently, IEOs could become the standard model for fundraising in the crypto space, and perhaps even create the next fundraising boom.

Translation

Who invented the initial stock exchange offering?

The first major exchange to offer IEO and popularize the practice was Binance through their IEO platform called Binance Launchpad.

However, even the founder of Binance, Changpeng Zhao (CZ), admits that they did not come up with the concept or term and were inspired by the “centralized ICO websites” that were popular in 2022.

Short story

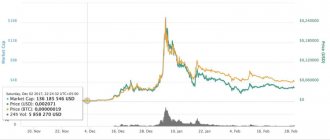

- In June 2022, the amount of funds raised by ICOs reached its peak for the first time.

- February 2022 The US Securities and Exchange Commission (SEC) begins issuing summonses for ICOs deemed fraudulent or illegal, signaling the end of the ICO.

- January 2022, Binance launches its first IEO, the BitTorrent Tokens (BTT) sale, which sold out in less than 15 minutes and raised over $7.1 million.

Of the most funded crowdfunding projects in history, ICOs dominate, occupying 17 of the top 20 positions, including the top three funded projects.

What's so special about this?

The IEO is an attempt to recapture the success of the highly efficient ICO funding mechanism, but with more restrictions and higher standards.

Benefits of IEO for startups

Token sale speed. The fact that the exchange conducts Due Diligence and distributes the collected funds greatly increases the level of investor confidence. This is why many IEOs end in record time - from 20 seconds to one day (ICOs raised money over several months or a year).

Speed of getting listed. After an IEO, new tokens are included in trading listings on exchanges much faster, usually within a day, sometimes a week. With a regular ICO, this process took months, since the project had to undergo Due Diligence, which had already been completed with an IEO. And there were no guarantees that the project would undergo an IEO after the ICO.

Client base. When launching a regular ICO, a startup must independently attract potential investors to fundraising platform That is, you need to create and implement a marketing strategy, which costs time and requires skills. In the case of an IEO, a startup immediately gains access to a large number of potential investors who are ready to invest money in the startup project.

How can you participate in IEO?

All exchanges offering IEOs require you to register or create an account on their platform.

Exchanges will also require users to complete Know-Your-Customer (KYC) account verification before participating in the IEO.

Finally, many exchanges require you to use their own tokens to participate. For example, Binance requires users to use Binance coin (BNB), and Huobi requires users to use Huobi Token (HT) to purchase tokens during the IEO.

Operating principles of IEO platforms

The exchange is launching a special platform for conducting crowdsales. Then he selects a promising project, tells his users about it and names the token sale date. To buy new coins, exchange clients must own a certain cryptocurrency (usually tokens created by the exchange itself).

One of the popular token sale schemes in IEO is “first come, first served”. Users who submitted applications for new coins the fastest will receive them first.

Crowdsales are sometimes held in several rounds, and the cost of coins can become more expensive from round to round. However, exchange developers have the right to come up with new rules for issuing initial exchange offerings. Thus, recently the creators of the Binance exchange decided to conduct a token sale in a lottery format.

What can you do with the coins you bought on IEO?

Once you are registered, completed KYC and have platform tokens, you are ready to purchase crypto assets through the IEO Initial Offering.

Binance allows users to purchase tokens on a first come, first served basis until the initial supply of coins expires.

Huobi requires users to hold their Huobi Token (HT) for a certain period of time so that the more HT coins you have, the more IEO tokens you can buy.

Once the sale is over, you can freely trade your newly purchased tokens on the same exchange.

How to make money on IDO

- What is IDO on Launchpads. How to make money on this Read more

- Launchpad with a low entry threshold and high-quality projects! More details

- How to make $1000 on the Huobi exchange using Primelist from $50 More details

As already written above, the main task of the project and the exchange on which the project is hosted is to provide liquidity thanks to the liquidity pool.

To fill the liquidity pool, projects send a portion of the proceeds from token sales to the liquidity pool.

Using the TruePNL launchpad as an example, we show how everything works!

Exchange for you: pros and cons

Any exchange will ensure a scrupulous verification of the project, since it risks its reputation by releasing it in IEO. Since there is no second chance in sight, the materials: “White Paper”, “Pitch Deck”, “One Pager”, website and everything that will be shown to users and exchanges must be well polished and as clear and attractive as possible for investment.

In addition to the technical justification, when working on a White Paper, you should pay attention to the following criteria:

- Tokenomics;

- Financial model;

- Options for using a product or service, as well as the advantages and usefulness of the created technology (product);

- Potential market project;

- Competitiveness;

- Your team and its development trends;

- Company partners;

- Legal design of the token and organizational structure of companies for a given period of time;

Main differences from IFO

| IEO | IFO | |

| Means of payment | any cryptocurrency | liquidity tokens that are received in advance for placing funds in the exchange's exchange pool |

| Payment method | from a personal account on the site | from an account in a DeFi wallet (for example MetaMask) |

| Distribution of coins among those interested | lottery (the more the user staked the base currency of the exchange, the more tickets he received and the chances of getting a location)/subscription/live queue | divided in accordance with the amount of investment between all participants; if more money is collected than needed, then all participants receive proportionally fewer coins |

| Entry threshold | average | short |

| Regulator | stock exchange | smart contract; the only danger of losing investments (besides the market one) is hacking through vulnerabilities in the protocol |

| Identity verification | most often required | need not |

By mid-2022, the popularity of IEOs is gradually declining, and there is a strong excitement around DeFi projects, including IFOs.

Marketing and advertising

Some exchanges state that they do not consider pre-marketing to be a key phrase for deciding which IEO to launch on. However, experts point out that with strong competition between projects, the project that is better prepared wins. At the very least, he will be more likely to agree to sell more tokens. Our recommendation is a simple formula:

- SMM + Community Management

You should gradually launch social networks, revealing the entire essence of the project with the active participation of the team involved in the development of technical solutions to create the product.

Don't ignore the feedback from potential clients. It is necessary to provide feedback by promptly answering questions and building communication chains.

conclusions

Today IEO is actively developing. Many exchanges are preparing their solutions and counting on this method of attracting investments for their projects.

Attention! IEO has both its advantages and disadvantages. It is quite realistic to believe that, like any other phenomenon that demonstrates strong results at the initial stage, IEO can experience both recession and decline. At the same time, exchanges that build relationships with users on a basis of trust will actively use this method. And we will monitor the situation, providing you with IEO legal support and advice on all issues.

And what happened then

Following the fundamental success of Binance Launchpad, other cryptocurrency exchange participants responded to market trends and announced the launch of their own IEO platforms. Today, some of them include KuCoin Spotlight, Huobi Prime, Bittrex IEO, OKEX Jumpstart and others, which are associated with both large and small exchanges. This data means that the method will be available for most different, in-demand projects.

So, let's move from theory to practice and consider what is needed in order to come to one of the platforms and process an IEO to promote your project.

Structure of project preparation for joining EIO

So, the preparatory structure largely coincides with preparation for the ICO. In addition, we see general trends in projects that ended in success:

- Progressive business model leading to high profits;

- Breakthrough, ultra-modern technologies;

- An excellent team of trained specialists;

- Reputation of project advisors.

Please note that the above markers must be in the project even before attracting investments. Let's look in detail at all the points of working with this tool.

An MVP is essentially a prototype of your product. During the emergence and development of the crypto industry, few people believe in unconfirmed ideas and concepts. Any project needs an MVP, which speaks more eloquently than the White Paper for its self-sufficiency.

Medium hard cap

Modern projects differ from those that were practiced several decades ago and were aimed at attracting ten to fifty million dollars, which in general was very unreasonable. Today, the capitalization of projects that go to IEO almost never exceeds $5,000,000 million. It is natural that with an increase in the number of people wishing to create new projects, that is, to attract investments in a similar way, this constant will decrease.

It is important to understand that soft cap and hard cap require clear justification. And this would not be so difficult if bytokens were not sold in combination rounds. Only a certain part is allocated for IEO, while the rest is sold in private and public rounds, calculated and reflected in the tokenomics of the project.

White Paper and tokenomics.

As a rule, a significant part of the White Paper is written by the team and organizers of the project. This is explained by the fact that no one knows this project better than its founders. However, as practice shows, this is a mistake, since, at least, it is unjustified not to give professionals the opportunity to correct previously made mistakes. Almost always we are talking about the technical side, but it tends to be reflected in tokenomics, justifications for calculations, positioning and disclosure of the project.

What do we offer to clients

When planning to launch an IEO, our potential clients contact us for an initial consultation. At the first stage, we make adjustments or write a White Paper and a number of necessary basic materials. Our goal is to create a legal model in which the demand for tokens may not be satisfied even by selling all the tokens.

Attention! This is the key strategy of each token! Over time, interest in the project will not disappear after entering the exchange and will even force everyone who did not manage to do so earlier to buy tokens.

Examples of successful ICOs

At the beginning of 2022, research was carried out, based on the results of which it was possible to establish which of the ICO projects were the most successful. It is worth noting that it was the volumes of collected amounts that were considered, and not the further success of the projects. There are cases when project organizers managed to collect huge amounts of investment, however, this did not save the project from collapse.

So, the largest and most successful ICOs were:

- EOS, the purpose of which was to raise funds for the implementation of a project to automate business processes in the financial sector, create services and applications for assessing the scale of the transaction and other things important for business. The implementation of goals became possible thanks to innovative blockchain architectures. It should enable horizontal and vertical scaling of decentralized applications. As the head of the block.one company said, the main task of EOS is to solve the most important problems and problems of the blockchain. The developers managed to collect an amount of 883.4 million US dollars;

- the Tezos project has collected an amount of $232 million US dollars. This took only two weeks. This happened in July 2017. The goal of this project is to create an alternative to Ethereum. This is a smart contract platform on its own blockchain. Thanks to the existing built-in consensus system of the parties, it will be able to develop independently, automatically, and there will be no hard forks. It becomes possible to control at the protocol level. For this purpose, a special smart contract language was created. This was necessary in order to simplify formal verification. It's worth noting that Tezos developers still have the authority to make changes to the system, but they charge a fee for doing so;

- The Filecoin project, which raised an impressive amount of 205.8 million US dollars, was launched by Protocol Labs back in 2014. It is based on the decentralized network protocol IPFS. The developers claim that thanks to it, the hypermedia peer-to-peer communication protocol can become a replacement for HTTP;

- the Status project raised 108 million US dollars. This ICO was carried out by a company that is the developer of a decentralized application of the same name. In fact, it can be called an analogue of Telegram. At the same time, in order to interact with the blockchain, you do not have to be a programmer - the graphical system, as well as software modules, help with everything;

- Bancor is a project that raised $140 million in just 3 hours. Later, the amount continued to grow until it reached a value of 153 million US dollars. The benefit of Bancor for users is the ability to link an account in any token to their own bank card. In addition, each participant in the system has the opportunity to issue their own tokens, which are quoted immediately after issue.

Community participation

By community participation, we mean attracting users who come to us from thematic platforms. You should be interested in any buzz around your project on forums like Telegram, Reddit threads, medium blogs, Bitcointalk threads, and the like. If you work correctly with these platforms, you will get good results from user demand for your project. This will be an excellent platform for promoting IEO. Yes, it will take at least 2 months to promote this company. Only after this period will you get the first tangible results. Don't forget about the necessary criteria:

- Project audit.

- Working on the foundation of White Paper and tokenomics.

As time passes and you confirm your listing on the exchange , the marketing strategy will work on its own and you will have a huge number of interested investors attracted by the hype due to the IEO.

Formation of public opinion

Trust is an important component. Tell us about the benefits of your project and its prospects. It's likely that your revolutionary technology will actually help the user solve important problems. And the main thing is that at the time of submitting an IEO application to the exchange, representatives will see a serious sensation around this project, and during the announcement of the IEO, interesting publications will appear and an interested community will gather.

If you submit publications to well-known media, success will be guaranteed. Especially if we are talking about potential market technologies related to the crypto topic that is of interest to certain users. To do this, you will probably need a turnkey IEO.