Types of mergers

Depending on the motives, mergers and acquisitions can be classified into the following types:

- Horizontal integration

- Vertical integration

- Conglomerate integration

Horizontal integration

- A merger of two companies in the same industry whose operations are very similar

- Main motives: economies of scale, increased market power, improved product mix

- Disadvantages: may be subject to review by antimonopoly authorities

Vertical integration

- Merger of two companies in the same industry, but engaged in different stages of product processing

- A good example of such a merger would be the merger of a pig farm and a meat processing plant.

- Main motives: increasing the predictability of raw material supplies and product sales, introducing a just-in-time inventory management system leading to a significant reduction in inventory levels

Conglomerate integration

- A combination of businesses independent of each other, which is usually not accompanied by synergistic effects other than brands and management talent

- Main motives: reducing risk through diversification, optimizing management costs, improving sales through the brand

Oracle → PeopleSoft (2005), $12.6 billion

In 2003, PeopleSoft ranked second in the enterprise management systems market after SAP. The company completed its merger with JD Edwards, which allowed them to do business not only with corporations, but also with mid-sized organizations.

Third place in the ERP systems market was taken by Oracle, which planned to change its position. This took a year and a half and $12.6 billion at today’s exchange rates. Since July 2003, Oracle has been attacking PeopleSoft with takeover bids, first raising the price relative to the market price and then reducing the size of the offer. PeopleSoft's board of directors defended the company's independence, marveling at aggressive pressure from Oracle.

The US Department of Justice and the European Commission became involved in the case, considering the potential deal illegal. But Oracle, led by Larry Ellison, was able to achieve its goal - in September 2004, the United States recognized that there was no violation of antitrust laws in this operation. Later, the same decision was made in Europe. By 2005, Oracle completed its acquisition, firing more than half of PeopleSoft's employees.

Many PeopleSoft clients feared that its purchase was made only for the sake of elimination, and most of the developments of the former competitor Oracle would be curtailed. However, after the merger, Oracle continued to develop and release PeopleSoft and JD Edwards systems, making them part of its application suite. A year after the deal, the corporation's profits increased, and Oracle moved closer to its main competitor, SAP.

Key arguments in favor of mergers and acquisitions

Organic growth or development through mergers and acquisitions

Organic growth is the development of a company through internal resources, created by the efforts of internal specialists.

Advantages of organic growth (disadvantages of growth through mergers and acquisitions)

- Organic growth allows you to plan a business development strategy in accordance with the objectives of shareholders

- Less risky development path compared to mergers

- Costs are typically higher in mergers and acquisitions (significant premiums for share buybacks)

- Allows you to avoid problems during the integration of acquired companies. The integration process is usually very complex due to significant differences in policies, business practices, accounting systems, cultural and other differences

- A merger or acquisition puts a lot of pressure on existing management, as it is necessary to train new management and build management of the new business.

Advantages of development through mergers and acquisitions

- The fastest way to enter a new market or launch a new product

- The risk of overproduction in the market and increased competition is reduced

- The number of competitors is decreasing

- Increasing a company's market power to influence the price of a product, for example through a monopoly on a product or collusion with other producers

- In the event of an acquisition, highly qualified personnel of the “target of the transaction” can become a competitive advantage

As a result, the path along which to develop will depend on the specific situation. In one case or another, a decision must be made based on all prerequisites.

HP → EDS (2008), $15.4 billion

In 2008, Hewlett-Packard acquired Texas-based EDS (Electronic Data Systems). EDS was one of the largest international companies providing services and supplying equipment to the corporate sector. The company, a respected company before the merger with HP, lost ground - many employees were laid off to save money, others left due to disagreement with the policies of HP management.

The cost estimate for EDS was greatly overestimated, and Hewlett-Packard admitted this 4 years later. Concentration on short-term relationships with clients, the desire to make quick money, lack of understanding of all processes within the company and the wrong choice of priorities - these were the main problems with the integration of EDS and HP Enterprise Services, according to experts.

Synergistic effect

As in other areas of financial management, ultimately all activities should lead to increased business value, i.e. to improve the welfare of shareholders. As, for example, in capital investment planning, any project should be approved only if NPV>0. In turn, mergers and acquisitions should only be carried out if they lead to an increase in share capital.

There are several types of synergy:

Revenue synergy

Revenue synergies include:

- Market power and reduced competition. Companies may merge to increase market power and gain the ability to influence the price of products. Horizontal lights can allow a company to gain some degree of monopoly power, which in turn can increase the profitability of the business by increasing the price.

- Economics of vertical integration. Some mergers involve vertical integration, i.e. buyout of companies within the same production chain. For example, a supplier of raw materials buys out the consumer of its main products, which can increase profitability by eliminating any intermediaries, improving control of materials and avoiding supplier-buyer disputes.

- Additional resources. Sometimes the combination of the strengths of two companies can lead to synergies. What is meant? A merger between a product innovation company and a marketing agency can result in profits that are significantly greater than those of either company individually.

Cost synergies

Cost synergies include:

- Economics of scale. Horizontal mergers (within similar businesses) are often designed to reduce costs and therefore increase profitability due to economies of scale. Economies of scale can be in production, marketing, and finance. Economies of scale arise from spreading overhead costs over large production volumes, consolidating production, using spare capacity, increasing buyer power and volume discounts, and reducing the cost of duplicative expenses such as accounting or management expenses.

- Savings from combining . It can arise in marketing from combining advertising of several products.

Financial synergy

Financial synergy includes:

- Reduce inefficiency. If the takeover target is poorly managed, its effectiveness and cost could be improved by more professional management. Improvements can be made in the areas of production, marketing or finance.

- Tax shield. Another form of financial synergy can be exploited through accumulated tax losses.

- Excess cash. It happens that a company accumulates excess cash that needs to be used somehow. Increasing dividends is not always a solution, since shareholders may not need such an amount of money, and the payment of dividends is associated with tax obligations. As a result, acquiring new companies is the only option.

- Diversification of corporate risks . One of the main reasons for mergers and acquisitions, especially conglomerate ones, is the fact that flows from several companies will always be more stable than from one. In this case, the merger is a factor in reducing the overall risk, but not the systemic one.

- Diversification and financing . If the cash flow forecasts of two separate companies do not look good in the eyes of creditors, then an effective solution may be to merge the two companies to demonstrate more consistent cash flows and make the business more attractive to creditors.

Other types of synergies

Other types of synergies include:

- Merging management talent. Companies with highly qualified management can use their resources only when there are problems and tasks to solve. Taking over a troubled company is sometimes the only way to attract qualified management

- Seed investments. It happens that organic business growth is a very labor-intensive activity, then an acquisition can be a good alternative for the development of new products and markets

Google → Motorola (2011), $13.2 billion

In the summer of 2011, Google announced the acquisition of Motorola Mobility, having received more than 20 thousand patents for various mobile developments along with a research laboratory. Next, Google introduced the Motorola X and Motorola G smartphones, running on a version of Android that has been cleared of most third-party modifications.

This move attracted attention and alarmed many smartphone manufacturers, especially Samsung. The Korean giant felt that even its power would not be enough to overtake Google in the event of direct competition.

Google's version of Android was perceived better by users than Samsung's overloaded design. Therefore, the Korean company had to postpone plans to use its Tizen OS.

In early 2014, Google and Samsung entered into a ten-year agreement that contains restrictions on possible changes to Android on smartphones they produce. Google was able to keep the largest device manufacturer on its OS from confrontation, while gaining greater control over the product.

As a result, after selling Motorola to Lenovo at a much lower price, Google retained all patents and research capabilities, increasing its influence on Android device manufacturers.

Reasons for mergers in the “real world”

While potential synergies are a key reason for mergers and acquisitions, there are other reasons:

- Entering new markets and launching new products

- In order to obtain highly qualified personnel, know-how, technologies

- Managerial motives and personal interests of management

- Hubris hypothesis

- Diversification

- Defense mechanism to protect against hostile takeover

- In order to improve liquidity

- Attracting additional funding

- Reducing risk by absorbing less risky assets

- Stimulating business growth

Facebook → WhatsApp (2014), $22 billion

Compared to the price Facebook paid for WhatsApp, the messenger's profitability is very low. But as Bloomberg reported, what's important to WhatsApp at the moment is continued growth. They will begin experimenting with monetization methods after reaching a billion users. The company believes that Facebook Messenger and WhatsApp do not compete with each other due to their different focus on use.

Many experts positively assessed this deal, considering it beneficial for Facebook. It is not yet completely certain that such an expensive acquisition will bring commensurate profits, but in the long term this is quite possible.

Why do so many mergers fail?

A number of studies show that many acquisitions turn out to be mistakes and only harm shareholder value. The main reasons cited in these studies are:

- Overestimation of economies of scale.

- As soon as the company is purchased, management starts looking for a new object and forgets to make sure that the integration is carried out correctly and the expected synergistic effects are achieved.

- Insufficient preliminary analysis of the acquired business combined with the inability to correctly integrate the business

- Underestimation of problems with personnel.

- The prevalence of subjective factors in decision making. Pushing through decisions on the authority of the company's top officials.

- Difficulty of assessment

- Management is too lazy to look for alternatives

- The desire to win! When two companies compete for one object, the winner will pay a significant premium for the object of the transaction. In other words, the buyer simply overpays.

Share the link:

- Click here to share content on Facebook. (Opens in a new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Skype (Opens in new window)

- Click to share posts on Pocket (Opens in new window)

- More

- Click to print (Opens in new window)

- Send this to a friend (Opens in new window)

- Click to share on Pinterest (Opens in new window)

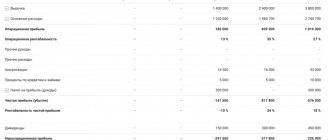

Microsoft → Skype (2011), $9 billion

Microsoft absorbed Skype in 2011, beating out Google, Facebook and Cisco with its offering. Experts were skeptical about the deal, noting that Microsoft clearly overpaid for a company that could not reach profitability.

In addition, previous major acquisitions turned out to be failures for the IT giant. Despite the fact that this merger has not yet brought a very noticeable effect, Microsoft was able to reap some benefits.

The acquisition of Skype allowed Microsoft to gain a foothold in the field of IP telephony and video communications, gaining paid subscribers among its huge user base. The company was able to integrate Skype with its products - Windows, Office, Xbox, Bing, Microsoft Messenger and Lync. This is how Microsoft influenced its services for both ordinary users and corporate clients at the same time.

Skype still does not bring in serious profits, but it serves as a link for other projects of the corporation, and, with the right approach, will be able to hold back competitors due to greater popularity.