Candlestick analysis, despite its centuries-old history, continues to be one of the most profitable methods for predicting price movement on any financial asset, from currency pairs to options. However, like any technique, it also has advantages and disadvantages, which means there is room for improvement. One of the most successful modifications is Heiken Ashi candles.

The main problem with all technical analysis options is filtering out random and small price movements that make it difficult to determine the overall trend and the ability to trade along the trend line. A similar situation is observed in countertrend trading, where it is also necessary to understand from the data of technical indicators that the market is now experiencing the beginning of a correction or just another impulse after which the main movement will continue. In order to remove market noise, smoothing or averaging of historical data is used, which gives a clearer and more precise picture. The Heiken Ashi algorithm works in a similar way and we can say that we are dealing with a “candlestick moving average”.

Description of the Heiken Ashi strategy

The principle of Heiken Ashi strategy is based on the analysis of Japanese candlesticks. A Heiken candle is formed based on the following rules:

- The opening level of a candle is equivalent to the average of the opening or closing of previous candles.

- Completion level – is equivalent to the average value of the quotes of the previously placed candle.

- The top shadow rate is equivalent to the maximum open or close rate.

- The lower shadow is the smallest indicator of all the minimum previously placed candles.

When a candlestick is formed according to such principles, it makes the chart smooth. Moreover, market fluctuations are smoothed out. Additionally, you should double-check the signals of this instrument, since there is a risk of encountering a minor correction.

Introduction

In this lesson we will touch on the topic of candles. Which are called Heiken Ashi candles.

This is a special type of candles that are somewhat different from the Japanese candles we are used to. Literally, their name is translated from Japanese as “stripe in the middle” or “bar in the middle.” We will look at their advantages over Japanese candlesticks and their disadvantages. And in what cases, what timeframes, currency pairs, they are best used. Under what conditions their benefits are properly realized and serve us to improve our trading results.

I want you to understand very well from this lesson exactly how Heiken Ashi candles are built. If you pay attention, the closing-opening points of high and low Heiken Ashi candles do not always correspond to the same points on the chart of simple Japanese candles.

Conditions of the Heiken Ashi strategy

The Heiken Ashi strategy produces 5 types of candles:

- A blue candle without lower wicks is a bullish trend . It is best to hold the position as the trend movement will increase.

- A blue bar is most often formed at the start or end of a trend. Short positions should be completed.

- The base of the bar is small, and the wick is elongated - this is a likely change in the trend movement.

- A red bar is also a signal of a likely change in trend movement.

- A red candle without an upper wick is a continuation of a downward trend.

These candles allow you to assess the market situation, and only then can the investor make a final decision to purchase or sell an asset.

Opening a buy position

You need to buy only when blue bars with a small body and small shadows have formed on the chart. This signal indicates that the bullish trend will continue.

When blue-colored bars have changed shape to candles with little body and long shadows, it is advisable to hold off on buying as the trend movement weakens. In such a situation, you need to prepare to exit the position.

Opening a sell position

A powerful bearish trend movement is indicated by candles colored red with an impressive rectangle, with no lower shadows. This is the ideal time to enter into a selling operation. If the bar body is round, the shadows decrease - this is a signal of a decrease in the relevance of the trend.

Bars colored red with a small base and a long wick are a signal indicating a weakening trend. Concluding transactions at this moment is a loss. In such a situation, the speculator needs to prepare to exit the position.

Recommendations for use

- Heiken Ashi candles are not applicable for the scalping strategy and generally for small time frames less than M30, but even on it we only open intraday trades lasting at least 3-4 hours. Considering the delay, this is quite logical, but many beginners, seeing strong trends at first glance, try to apply them wherever possible and impossible.

- Despite the fact that you can use Heiken Ashi on any currency pairs, it is better to stay on the main ones (euro, dollar, yen) and not get too carried away with exotic ones (Mexican peso, Indian rupee and others). Although such currencies show a strong intraday movement, on which you can try to make money, you should not be deceived by a chart that has a lot of long candles. In fact, we have low liquidity and strong dependence on fundamental factors. In such conditions, all of the above strategies and signals practically do not work.

Click the button to go through a step-by-step guide to Heiken Ashi and master this instrument in a few simple steps Explore »

- Experienced traders on higher time frames can enter trades using only Heiken Ashi to monitor the “pulse of the market”, but this approach is more suitable for the stock market, where trends are calmer. However, in dynamic Forex, there is always a risk of a quick reversal of even a long-term trend, so take into account the data of other technical indicators.

- Working out graphic patterns poses a dilemma for traders: open a deal as required by the description, for example, on the next bar after breaking the triangle resistance line, or wait until three Heiken Ashi candles are the same color.

- In this case, it is better to enter the market based on the pattern signal. Still, graphical analysis sees the market situation more comprehensively and reacts more accurately to its changes. You can lose a significant portion of your profits by waiting for the candle to change color.

- Heiken Ashi candles clearly show the end of a local correction or rollback. The closer the trend resumption, the larger the shadows of the candles, even if the body size remains at the same level, it is recommended to fix the current profit/loss when the chart color changes to the opposite one.

- It is necessary to take into account not only the volatility of the trading instrument as a whole, but also its average values for Forex trading sessions. For example, pairs with the euro are the most dynamic, which means the Heiken chart is the most informative during the European session. And, on the contrary, in Asian volumes drop sharply, as do the sizes of candles. This is where many strategies stop working.

To summarize, we can say that Heiken Ashi is one of the best trend indicators and the lag is not a significant drawback, unless, of course, time frames M1-M15 are used. Opening 1-2 bars late, on the contrary, will allow you to enter on a really strong signal and close exactly at the end of the trend.

Heiken Ashi candles do not react to random market fluctuations and perfectly show medium- and long-term movements, but it is better to open positions only after additional confirmation in a comprehensive trading strategy, and not during a flat period.

Management

It is important for novice investors to adhere to the rules of risk management when working on the Parabolic Heiken Ashi strategy. In general, this applies to any tactics.

Let us remind you that it is not recommended to invest more than 2-3% of your balance in 1 transaction. For traders with experience, the percentage can be increased to 5. In this case, you need to set limits on the number of profitable and unprofitable operations. This allows you to control emotions and also work on mistakes.

HA+EMA strategy for BO

The idea is to use the timing of the Doji candle on the HA candlestick chart, and use the exponential moving average as a short-term trend filter. Recommended for currency assets prone to forming a short-term but confident trend - EUR/USD, EUR/JPY, GBP/JPY; working timeframe M5-M15

For a CALL option:

- in a downward trend, a “doji” HA bar is formed, or (as an option) a small “hammer” with a long “shadow” (up);

- the next regular candle closes above EMA(6).

For PUT option:

- in a bullish trend, an HA “doji” or “hammer” candle with a long “tail” (down) is formed;

- a regular candle closes below the moving average line.

Entrance is at the next bar.

Before entering, be sure to check the fundamental background: trading is expected in a stable market. We do not consider periods before, after and during the news period for entry; in such a situation, any “Doji” is likely to be false. .

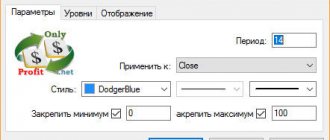

Settings in the terminal

In this regard, the TradingView live chart is somewhat simpler. When you select the type of quote display (bars, line, etc.), you will also see a button for setting Heiken Ashi. In MT4 everything is a little different. The fact is that the terminal regards this type of candles as a separate indicator. You can open it by clicking on the “Insert” button (see the screenshot below).

In custom indicators you will find the right tool. But after installation, you may encounter one problem. The fact is that Ashi is applied to candles. Because of this, keeping track of the schedule will not be very convenient.

Subscribe

New telegram channel to help the novice trader! All the most useful things - every day!

Telegram

What to do in this case? First of all, in the settings of the indicator itself, set wide display lines. For example, we have the thickness of the body set to 5, and the thickness of the shadow to 2. Also change the color of the rising candle if the terminal is set to a light background, since by default they are displayed white.

To avoid standard Japanese candlesticks from distracting you, set up a line chart (the color of the line can also be changed so that it blends into the background, or removed altogether). The end result will look something like the screenshot below.

Now let's compare charts with Heiken Ashi candlesticks for binary options and a standard instrument.

What immediately catches your eye? HAs do not perceive minor price fluctuations. The bars show a smoother price movement. If on a regular chart we see, say, 5 candles, 4 of which are directed downward, and one is slightly upward, then the chart with this indicator will most likely show 5 downward bars. Thus, HAs better show trends and do not distract from unnecessary minor fluctuations. This is due to the fact that during construction the price is smoothed out.

How to use the Heiken-Ashi candlestick chart for successful trading on crypto exchanges

Josh McGraff, an experienced trader, founder of IvoryMountain and author of several trading articles, shares tips on using the Heikin-Ashi (HA) candlestick chart and a simple but effective trading strategy. We bring to your attention a translation of an article published on the Hackernoon website.

Let's look at the difference between traditional candlestick charts and Heiken-Ashi candlestick charts.

Do you see the difference? The Heiken-Ashi chart is much smoother and clearly represents uptrends and downtrends. Wider time intervals when using Heiken-Ashi (one day or more) are useful for tracking the overall trend of a coin.

To access such charts in TradingView, you need to select the candlestick image at the top, then Heikin-Ashi.

Bullish candles without wicks below indicate strong buying pressure, while bearish candles without wicks indicate excess selling supply. Candles with wicks on both sides indicate indecision and struggle between bulls and bears.

It should also be noted that most types of candlesticks used in traditional candlestick charts are not applicable to Heiken-Ashi; however, dojis, spinning tops, and traditional technical analysis patterns (wedges and triangles) apply to it.

So, what is all this for? For example, you can get a clearer picture of the trend for a certain coin. Heiken-Ashi appears to be a powerful tool for identifying even a slight decline in activity or a reversal of an entire trend from bullish to bearish (and vice versa).

Of course, when you use any technical analysis knowledge, you do so at your own peril and risk.

Now that you've had a crash course in Heiken-Ashi by adding some moving averages to your chart, you can create a simplified but effective trend trading strategy for yourself. For example, this could be a 10- or 20-day moving average with the selected time frame in TradingView being one day.

If the 10-day moving average crosses above the 20-day moving average, then the candles will be bullish and you should buy coins, and at the first bearish candle you should exit trading. This is a conservative strategy, but it can save you.

If the candles turn bullish again and the 10-day moving average is still above the 20-day moving average, you can return to trading. If the 10-day moving average crosses below the 20-day, you should not trade until the 10-day crosses above the 20-day again.

Here's a checklist of questions, answers, and actions to help you stick to this strategy:

- Is the 10-day moving average crossing above the 20-day moving average? Yes. Get into trading and continue to stick to this checklist. No. Stop. Don't trade until this happens.

- Has a bearish candle appeared? No. Wait for this to happen. Yes. Exit the trade and continue to follow this checklist.

- Is the 10-day moving average crossing the 20-day moving average below it? No. Enter trading again with a bullish candle, return to step 2. Yes. The trade should be considered completed. Do not re-enter trading until the 10-day moving average crosses above the 20-day moving average again.

This checklist helps traders follow a simple rule and removes emotion from the trading process. You will have to follow the rules no matter how you feel. This is a fairly conservative algorithm, and you will enter trading later and exit earlier. However, by doing so you will protect your capital, because profit is not so easy to achieve!

Additionally, if you use a one-day chart, you will have plenty of time to monitor your trades. All you need to do is check your charts a couple of times a day and adjust your signals to identify critical moments.

The strategy can also be used to open long/short positions, and other time frames can be used. Some people prefer EMA or SMA indicators instead of the usual MA (moving average). They can show different signals with entry/exit points for the market.

However, you should always check your strategies against historical data and paper trade it before using real assets. It should also be noted that the Heiken-Ashi candlestick chart and strategies based on it are quite popular among traders.

The latest news on the cryptocurrency market and mining:

In the new 3D shooter “MASD GAMES” you can play and earn thanks to NFTs

Bitcoin price is growing amid the publication of the “consumer price index” in the United States

According to the inactivity flow indicator, the “bottom” for the price of Bitcoin has already been passed

Bitcoin is here to stay as 24% of US residents already own it

25% of companies are ready to accept cryptocurrency as a means of payment

The following two tabs change content below.

- Author of the material

- Latest news from the world of cryptocurrencies

Mining-Cryptocurrency.ru

The material was prepared by the editors of the website “Mining Cryptocurrency”, consisting of: Editor-in-Chief - Anton Sizov, Journalists - Igor Losev, Vitaly Voronov, Dmitry Markov, Elena Karpina. We provide the most up-to-date information about the cryptocurrency market, mining and blockchain technology. Disclaimer: all materials on the website Mining-Cryptocurrency.ru are for informational purposes only and do not constitute a trading recommendation or a public offer to purchase any cryptocurrencies or carry out any other investments and financial transactions.

News Mining-Cryptocurrency.ru (go to all news feed)

- In the new 3D shooter “MASD GAMES” you can play and earn thanks to NFTs - 01/13/2022

- Instructions: How can a beginner buy Bitcoin on a crypto exchange for rubles? — 01/13/2022

- NFA appealed to the Central Bank of the Russian Federation with a request to legalize investments in cryptocurrency - 01/12/2022

- Tinkoff bought a stake in the Swiss crypto exchange for international expansion - 01/12/2022

- The ex-head of Twitter created the “Bitcoin Legal Defense Fund” to develop the ecosystem - 01/12/2022

Cryptocurrency exchanges

HA+Stochastic strategy

The combination with standard Stochastic is also quite viable on major currency assets. We will consider a reversal from the critical zones of the oscillator as the first (warning) signal, and open a trade after the price confidently moves above/below the HA bar line.

For a CALL option (purchase):

- Stochastic lines intersect in the oversold zone (0-30) and turn upward;

- the price is above the blue line of HA bars.

For PUT option (sell):

- Stochastic lines intersect in the overbought zone (70-100) and turn down;

- the price is below the red line of HA bars.

The option closing period is at least 2-4 bars. The second signal - from Heiken Ashi - comes later, due to which part of the profitable trend is lost, but this is clearly visible only in history. Perhaps this is important for Forex transactions, but for binary options the main thing is the reliability of the entry and the correct expiration period, so we do not pay attention to this problem.

The nuances of using Heiken Ashi

In order to successfully use the Heiken Ashi indicator , you need to remember some points. They will help you apply it correctly, which will affect the overall effectiveness:

- Heiken Ashi works well on medium and large time frames . That is, you should focus on H1 and more; on small ones there will be too many conflicting signals, given how transient the trends are. In addition, filtering fluctuations and excessive volatility will greatly reduce the final result, even if you manage to somehow get used to trading, for example, on M5.

- The presence of an indicator on the chart does not mean that you need to stop looking at ordinary candles altogether . They can be used to search for patterns, that is, it makes sense to monitor the situation in two options at once. Heiken Ashi will not show absorption and the signal is quite strong.

- The indicator goes well with oscillators . This is convenient to use to search for reversals and enter the market upon confirmation of the formation of a trend according to Ashi. But it is better not to combine other indicators from the trend group, since they are intended for the same thing, but the readings of one may contradict the readings of the other. Heiken Ashi, of course, is not perfect, but it has a certain percentage of successful trades, as well as other indicators, so it is better to focus on one and work only on it. Only in this case will it be possible to objectively assess performance.

How do Heikin Ashi candles work?

Heiken Ashi smoothing is performed by averaging four parameters of Japanese candlesticks: open (bar opening), close (closing), max and min (maximum and minimum price values).

Each of these four parameters is constructed as follows:

- Open – the open and close of the previous Heikin Ashi candle are added and divided by two.

- Close – the opening and closing prices of the current bar, as well as its maximum and minimum, are added up. The resulting amount is then divided by four.

- Max (or High) – the highest value is selected among the highest point of the current Japanese Open and Close candlestick of the Heiken Ashi bar.

- Min (or Low) – the smallest value is selected among the highest point of the current Japanese Open and Close candlestick of the Heiken Ashi bar.

Now you know how Heiken Ashi bars are calculated. This means that we must understand that the extremum of HA bars can differ greatly both up and down compared to a Japanese candlestick in the same positions. This fact is often overlooked by beginners when placing stops at the extremes of Heikin Ashi bars.

The body value of HA candles completely coincides with that of Japanese candles and indicates the current balance of power in the market. In the case of a white or green bar, we assume a bullish market, and in the case of a black/red bar, we consider a bearish scenario.