Working capital management is an issue that every manager deals with every day. An effectively organized process means stable profits for the company.

Manufacturing enterprises have the largest composition of current assets used. This is due to the complexity of the production cycle, during which raw materials produce a product with completely different parameters. This is how it differs, for example, from the product cycle of trading companies or the service sector.

In this section we will talk about production, since managing current assets in it is much more difficult. Our task is to understand how to correctly take them into account, normalize, and analyze them.

According to experts in the field of financial management, the amount of savings that can be obtained through effective working capital management is distributed as follows:

- 50% is inventory management;

- 40% — management of finished product inventories and accounts receivable;

- 10% - management of the technological cycle itself.

We will not dwell on the issue of technology efficiency and the optimality of the technological cycle - this is more related to the engineering field. Let's focus on the first two points, which make up 90% of existing financial management capabilities.

We will cover the following questions in this chapter:

- What are working capital and how important is it to manage it effectively?

- What does the company risk if there is a shortage or excess of working capital?

- What is the optimal amount of working capital?

- What is the main indicator of the effectiveness of working capital management?

- What cycles do finance and materials go through?

- how to determine the most optimal financial cycle?

- In relation to which areas will a manager's decision be required to optimize the company's working capital?

Turnover of funds in production

DEFINITION AND STRUCTURE

Working capital - those funds of the company that are involved in one cycle of production and are included in current assets. This definition is rather economic.

In accounting, current assets are the second section of the balance sheet. These are resources that are used to convert into cash for no longer than one year, while ensuring the continuous production activities of the company.

In the balance sheet, items of current assets will be designated as:

- Inventories - raw materials and supplies, work in progress, finished products, goods;

- Accounts receivable;

- Financial investments;

- Cash

The production process can be roughly divided into three steps:

- Replenishment of raw materials and supplies;

- Carrying out work on the manufacture of goods;

- Receiving funds from the sale of goods

The volume of working capital (current assets) depends on the type of production, stages of its development, cycle duration, etc.

The current assets of a manufacturing enterprise, as a rule, account for more than half of its total assets. Wholesale companies have significantly more.

After each turnover cycle, a profitably operating enterprise receives an increase in the funds put into circulation.

It is obvious that the main task of any manager is the effective organization of working capital management.

Calculation formula

To calculate the ROC, the formula is used:

- Pch – net profit;

- COA is the cost of asset turnover.

The indicator is calculated for a certain period of time - a year, a quarter, a month. The value of assets is taken as the average value over the required time.

The average value of assets is found using the formula:

- OANP – the value of current assets at the beginning of the period;

- OACP is the value of current assets at the end of the period.

Formula for calculation based on balance sheet data:

- p. 2400 – value of line 2400 from form 2;

- page 1200 – value of line 1200 from form 1.

Importance of Effective Working Capital Management

Effective management of working capital is the key to the financial stability of the company as a whole.

The task of working capital management is not only to minimize all risks associated with doing business.

Effective management is about skillfully balancing risks.

Thus, when the level of current assets is reduced to a minimum, a shortage of resources and problems in ensuring continuous operation may arise. At the same time, a situation with an excess amount of working capital leads to the “freezing” of money in current assets, which requires significant financial costs to maintain this level.

Let's look at an example of what costs and risks a company may face due to a suboptimal level of working capital:

| Lack of working capital is: | Excess working capital is: |

| Delays in the supply of raw materials and materials | Increased warehouse costs for storing surplus. In this case, the surplus may deteriorate or become obsolete. |

| Decline in sales due to lack of finished products | Reducing the real value of inventories and receivables due to inflation |

| Additional financing costs | Freezing money, lost profits |

Thus, working capital must be optimal for the successful and uninterrupted operation of the company.

Calculation of the indicator using an example

For clarity, it is better to use tables and the balance sheet of the enterprise.

Table 1. Example of an enterprise’s balance sheet for 2016 (amounts in thousand rubles)

| Assets | As of 01.01. 2016 | As of 12/31. 2016 | Passive | As of 01.01. 2016 | As of 12/31. 2016 |

| I. Non-current assets | 79 304 | 87 563 | III. Capital and reserves | 484 043 | 595 608 |

| II. Current assets | 567 495 | 678 905 | IV. long term duties | 300 | 500 |

| V. Current liabilities | 162 456 | 170 360 | |||

| Balance | 646 799 | 766 468 | Balance | 646 799 | 766 468 |

The value of the company's current assets at the beginning of 2016 amounted to 567,495 thousand rubles, at the end of the year - 678,905 thousand rubles.

Table 2. Profit and loss statement for 2016

| Indicator name | Value, thousand rubles, 2016 |

| Revenue | 593 689 |

| Cost of sales | 341 347 |

| Gross profit | 252 342 |

| Business expenses | 54 800 |

| Administrative expenses | 100 108 |

| Profit (loss) from sales | 97 434 |

| Other income | 27 061 |

| other expenses | 15 316 |

| Profit (loss) before tax (BP) | 109 179 |

| Current income tax | 21 835,8 |

| Net income (loss) | 87 343,2 |

Let's calculate the ROC:

In percentages:

Thus, the company’s return on working capital in 2016 was 7% (each ruble of working capital brought 7 kopecks of profit).

To evaluate the indicator over time, you need to compare it with data for other years of the company’s operation (download the table in Excel).

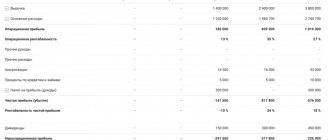

Table 3. Company profitability in the period from 2013-2016.

| Index | 2013 | 2014 | 2015 | 2016 | |

| Net profit, thousand rubles. | 43 872,6 | 526 588 | 563 087 | 873 432 | |

| Cost of asset turnover at the beginning of the period, thousand rubles. | 884 376 | 763 989,6 | 872 7 36,8 | 608 273 | |

| Cost of asset turnover at the end of the period, thousand rubles. | 763 989,6 | 872 7 36,8 | 608 273 | 678 905 | |

| Profitability, % | 3 | 6 | 6 | 7 | |

The graph of changes in the indicator is shown in the diagram below.

Rice. 2. Change in ROC over time

Thus, the company's profitability is gradually increasing. This means that every ruble of working capital provides more profit (in 2013 - only 5 kopecks, in 2016 - 6 kopecks).

How to ensure working capital availability

To maintain working capital in sufficient quantities for the company, both internal and external sources of financing are used.

Internal sources of financing are own and equivalent funds:

Statutory capital. It is especially important at the stage of creating an enterprise. Its value must be sufficient to ensure the establishment of the business before the start of contractual relations.

Profit is a constant source of business growth.

Other income from the sale of non-core assets, illiquid assets, various production waste, obsolete equipment, etc.

External sources of financing are debt and equity financing:

Equity financing for small businesses is an increase in the authorized capital by attracting investors to share.

Debt financing – attracting loans from banks and financial institutions, as well as borrowings from legal entities.

Working capital is in constant cyclical movement and flows from the monetary form into the commodity form - such is the circulation of funds in production.

Capital cycle

The circular movement of working capital - (Cash - Raw materials and supplies in the warehouse - Work in progress - Finished goods - Accounts receivable - Cash) is called the full operating cycle.

Based on certain characteristics, the operating cycle can be divided into:

- Production – movement of inventory items;

- Financial – movement of money.

The production cycle is a period of time that begins from the moment it is received at the warehouse and ends with the moment the finished product is shipped to the buyer.

The company has a need for cash between the periods when the supplier pays accounts payable and the moment it receives funds from customers. This period is called the financial cycle.

The financial cycle begins with the moment of payment for raw materials to the supplier and ends with the moment of receiving payment from the buyer. The “sign” of the financial cycle is cash.

Obviously, the shorter the duration of the financial cycle, the better for the company, and also the shorter the period of time the cash flow takes and the more often you can use it.

The duration of a full operating cycle is as follows:

- Financial cycle increased by the amount of accounts payable,

or

- Production cycle increased by the amount of accounts receivable.

Operational cycle – the period of time from the purchase of raw materials to payment for finished products, i.e. full cycle of circulation of raw materials, goods and money.

The company experiences the greatest need for cash when it issues advances to suppliers and sells products on a deferred payment basis. And the least need will be when the company receives a deferment from suppliers and an advance payment from buyers.

Standards

ROC speaks about the provision of an enterprise with working capital: it shows how much this asset item provides the company’s profit. There is no specific standard for this indicator that would be suitable for all companies in any industry. You need to analyze profitability over past periods.

Important! Profitability in different areas differs significantly. So, for example, in large industrial city-forming enterprises with high turnover it will be lower than in small companies offering services.

The resulting profitability indicator can be compared with the industry average. If the company is lagging behind, then this is a sure sign of ineffective management, and the enterprise development strategy needs to be adjusted. The most revealing comparison will be with its closest competitors.

The main difficulty in calculating the indicator is to separate working capital from assets. In addition, the indicators of return on equity and borrowed funds are of great value for analysis - they provide a detailed picture of the use of resources in the enterprise. Therefore, calculating ROC without dividing by methods of obtaining assets is not always rational. It is found to create an overall picture of the working capital supply.

How to shorten the operating cycle

Reducing both the production and financial cycles leads to a decrease in the duration of the full operating cycle, which is a positive thing.

We can reduce the production cycle by:

- Reducing the turnover period of raw materials and supplies;

- Reducing the turnover period of work in progress;

- Reducing the turnover period of finished products.

Using financial statements and special reference literature, you can calculate the company's financial cycles.

Financial cycle = inventory turnover period + accounts receivable turnover period – accounts payable turnover period.

The ratio of the duration of production and financial cycles is one of the criteria for the efficiency of using working capital.

Therefore, in order to reduce the duration of the operating cycle, it is necessary to optimize the duration of the components of the financial cycle.

Setting up optimal decision making

It is now clear that the final figure for the time period of the need for money is the result of effective management of inventories, accounts receivable, and cash.

You will be required to make decisions on the following issues:

- What should be the minimum required level of reserves and how to ensure their safety and rational use;

- What should be the acceptable level of accounts receivable;

- How to combine internal and external sources of financing;

By developing a comprehensive system of technical, economic and organizational measures, you will achieve the optimal duration of the financial cycle.

A management balance sheet will help you track the situation with working capital.

In operational mode, it is enough to provide information in the context of “Assets-liabilities” in the form of current assets and short-term liabilities.

This will be quite sufficient for making operational decisions.

Still have questions? Order a free consultation with our specialists!

Liquidity ratios

The effectiveness of asset management, including current assets, is assessed by liquidity ratios.

1 Current Ratio

Ktl = S/KO

Where:

- C – the amount of working capital;

- KO – short-term liabilities of the enterprise with a maturity of up to 1 year.

In practice, a coefficient in the range from 1.5 to 2.5 is normal. If this ratio falls below 1, then the company's solvency for short-term obligations is at risk.

2 Quick Ratio

This indicator is very similar to the first one, but from working capital I exclude its least liquid part - inventories.

Kbl = [Cash + Short-term investments + Accounts receivable + Other current assets] / KO

The optimal value of this coefficient is 1 or higher.

- Key financial indicators;