So, McCaleb took his first creation, cleaned it up of all the flaws that served as a reason for criticism from the crypto community, and also added an improved protocol. That’s how “Healthy Person’s Ripple” came about.

The creator of the platform did not initially pursue the goal of making financial profit - the project is non-commercial in nature. It is managed by the Stellar Development Foundation, which is independent from developers. The founders of the fund, members of its board and consultants do not receive financial benefits from its activities. The organization only develops and supports the project.

To finance the work of the Stellar Development Foundation, they initially set aside 5% of all Stellar tokens, of which 2% was previously purchased by Stripe. As a result of this transaction, the fund received $3 million - a rather modest amount to provide for a development team. It clearly cannot be compared with how much the creators of Ripple earned.

Cryptocurrency Stellar Lumen (XLM) - what is it

Stellar is an open-source distributed transaction infrastructure; suitable for creating publicly available financial instruments. Using the Stellar network, developers can create mobile wallets, banking tools, smart automatic payment systems, and a host of other distributed applications.

The main advantage of the Stellar Lumen blockchain is the possibility of issuing new tokens for ICOs. By the way, writing code on Stellar is much easier than on Ethereum, since you can use any programming language rather than master a specialized one.

The main function of XLM tokens is to serve as an auxiliary means for exchanging one monetary unit for another. Operations are performed through the system interface.

Characteristics

Indicators of the Stellar cryptocurrency as of April 3, 2019:

| Cryptocurrency | Stellar Lumen |

| Ticker | XLM or STR |

| Capitalization | 2 395 836 557 $ |

| Stellar course (04/03/2019) | 0,12 $ |

| Current issue | 19,261,660,426 XLM |

| Maximum emission | 103 966 327 161 XLM |

| Project website | https://www.stellar.org/ |

| Reviewer | https://dashboard.stellar.org/ |

| Exchanges | Binance, EXMO, BitForex, FatBTC, DCoin, BW etc. |

| Mining algorithm | — |

| Wallets | stellar.org/lumens/wallets/ |

| Transactions per second | 1000+ |

| Transaction fee | 0.00001 XLM |

| Transaction confirmation time | 3-5 sec |

| Project launch year | 2014 |

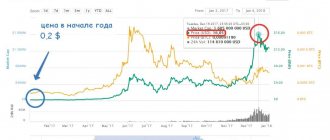

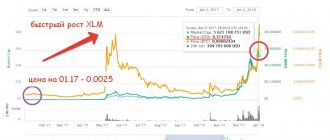

Online chart XLM/USD

How to buy or sell

Let's look at the main ways to buy or sell Stellar cryptocurrency :

- Cryptocurrency exchanges. List of liquid platforms where Stellar is traded and you can work with fiat currencies: Exmo; Binance.

- Crypto exchangers. For example, Baksman, Nicechange, Xchange and others.

- p2p platforms.

Detailed article: how to buy Stellar Lumem XML.

Description of the project, history of creation

Stellar cryptocurrency was founded by Joyce Kim and Jed McCaleb five years ago. The project became a fork of the Ripple cryptocurrency. The reason for its creation was numerous indignations from the crypto community regarding the principles of operation of the Ripple network. The fact is that at the time of the founding of XRP, the project had a closed source code, most of the coins belonged to the developers themselves, and the servers were owned by Ripple Labs. All this contradicts the principles of decentralization, which should underlie cryptocurrency structures.

In 2013, the Ripple team opened its source code, due to which the outrage decreased somewhat, but a certain part of the creators still insisted that a fork was necessary, without it it was impossible to solve other problems. cryptocurrency Stellar Lumen appeared .

At first, the project used the old Ripple protocol, but since 2015 it has been working on a separate Stellar protocol. From that moment on, the popularity of the new currency in the market began to grow confidently.

Decentralized network

A decentralized network consists of peer-to-peer nodes that operate independently of each other. This means that the Stellar network is not dependent on any one organization (legal entity).

The idea is to have as many independent nodes on the Stellar network as possible, so the network will continue to operate successfully even if some servers fail.

Ripple's consensus mechanism, of which Stellar Lumens was originally a fork, uses Byzantine Fault Tolerance (BFT). Its meaning is to maintain the functionality of the network, even if some of its nodes are disabled or captured by hackers. Ripple solves this problem by having full control of validators by the master node, which goes against Satoshi Nakamoto’s idea of decentralizing blockchain networks.

Having switched to their own platform, the developers of the XLM cryptocurrency changed the consensus mechanism from BFT to SCP ( Stellar Consensus protocol ).

At its most basic level, Stellar is an ownership tracking system. Like accountants for centuries, it uses a ledger to do this, but what's new about Stellar is that there's no real accountant. But there is a network of independent nodes, each of which checks and double-checks the work of others. Stellar is a decentralized system, meaning no one can stop the network or secretly tweak it to their liking, but even without a central authority, the ledgers are checked and updated every five seconds.

A unique algorithm called the Stellar Consensus Protocol ( SCP ) keeps everything in sync. There are many ways to reach consensus in a decentralized system—the visionary proof-of-work method used in the Bitcoin network was the first to be invented and remains the most famous. But like many early projects, PoW left room for improvement. SCP strives to be better by being customizable, fast and highly energy efficient.

Right above this base layer is a powerful API, so you don't need to understand the intricacies of distributed consensus to build on Stellar. Simple, well-documented functions allow you to move new digital money in a familiar way. It is very easy to trade tokens between accounts, create markets and issue assets.

To avoid loss of decentralization, certain measures were taken when launching the Stellar blockchain ecosystem.

- To develop the system, a non-profit fund, the Stellar Development Foundation, was founded. Its founders do not have the opportunity to receive dividends for participation in activities, or sell its shares.

- Open source. At the time of launch, XLM operated using the Ripple protocol, and then the team developed its own protocol, Stellar. The SDF (Stellar Development Foundation) is the guarantor of free access to the source code.

- Information about the activities of the project team is published on the official website and social network pages.

- At the first stage, it was immediately planned how many tokens would be generated when the network was launched (100 billion), and how many would be issued to create artificial inflation (1% per year). A budget for the development of the fund has also been drawn up (5% of the total issue). It is envisaged that 25% of all coins will be sent to non-profit structures.

According to the restrictive covenant, holders of large volumes of Lumens are not allowed to sell coins for 5 years.

Ledger (accounting book)

Like a traditional ledger, the Stellar ledger maintains a list of all balances and transactions belonging to every account on the network. A complete copy of the Stellar global ledger is stored on every server that runs the Stellar software. Any organization can run a Stellar server.

These servers form the decentralized Stellar network, allowing the ledger to be as widely distributed as possible. They synchronize and validate the ledger through a mechanism known as consensus.

The entire process of reaching consensus on the Stellar network occurs approximately every 2-5 seconds.

A technical description of the consensus process is provided by Professor David Mazieres in the white paper Stellar Consensus Protocol (SCP). You can also study other sources that explain how SCP works.

Anchors, trust and credits

Anchors are simply entities that people trust to hold their deposits and issue loans on the Stellar network according to these deposits. They act as a bridge between various currencies and the Stellar network. All monetary transactions on the Stellar network are carried out in the form of loans issued by anchors (the exception is its own digital currency, lumens).

Anchors do two simple things:

- Accepts your deposits and issues corresponding credits to your Stellar ledger account address.

- Allow you to withdraw funds by providing a loan issued by them.

Anchors now exist in a pre-Stellar world. For example, to use Venmo, you make a cash deposit from your bank account. Venmo then gives you a credit to your Venmo account. You can now send this Venmo credit to anyone who trusts Venmo (anyone with a Venmo account). Whoever receives your Venmo credit can convert it into real money by moving it to their bank.

Anchors perform the same function in Stellar. The difference is that Venmo and other anchors all operate on the same network, so now they can all communicate with each other - this makes the system much more powerful. People can easily send and exchange a wide variety of anchor credits to each other.

Distributed Exchange

Stellar's ledger is capable of storing bids made by people to sell or buy currencies. Offers are public commitments to exchange one loan for another at a predetermined rate. The ledger becomes a global marketplace for assets.

All offers form what is called an order book. An order book exists for each currency/issuer pair. So if you are looking to exchange Virgin Bank/EUR for bitstamp/BTC, you can look up the corresponding order book in the ledger to see what people are buying and selling them for.

This allows you not only to buy and sell all currencies in almost the same way as foreign ones, but also to easily convert currencies during transactions.

Multi-currency transactions

Stellar allows you to transfer any currency you hold to anyone in another currency through its built-in distributed exchange. Also, people can receive any currency through the anchor they added.

For example, Amy wants to send Bob Euros using her BTC balance. Stellar will automatically convert her BTC to EUR. The network will select the best exchange rates for transactions.

Stellar Development Fund

Stellar.org (Stellar Development Foundation) is a non-profit organization that promotes the development of the Stellar network and ensures that it is open and accessible to everyone.

Our mission is to attract people to low-cost financial services to fight poverty. We envision a prosperous world where everyone can improve their lives by accessing affordable payments, credit, and savings accounts.

Community

The main Stellar community space is slack.stellar.org, a real-time chat group with over a thousand members. You can also join the local Stellar community.

Features of cryptocurrency, technical implementation

Most applications interact with Stellar through the Horizon API server. It provides an easy way to submit transactions, check balances, and subscribe to certain events. Because it's based on simple HTTP, Horizon can be accessed through a web browser and command line using your favorite programming language.

To communicate with Horizon, Stellar supports JavaScript and Java, as well as a number of SDKs for different programming languages. Each Horizon server connects to the Stellar Core network backbone, and this software verifies and reconciles every transaction through the Stellar Consensus protocol. The Stellar Network itself is a collection of interconnected Stellar Cores that are operated by organizations and individuals around the world. Some are available for interaction, and some serve only to support the network.

Distributed technology makes the network reliable and secure.

Each transaction of the Stellar cryptocurrency costs 0.00001 XLM - this is protection against network spam.

Consensus instead of mining

Network nodes confirm transactions of participants, establishing consensus through voting. The node selection algorithm is based on the SCP protocol - Stellar Consensus Protocol, which is used to select a group of nodes to vote for transactions and the process of making a collective decision of the group for each of them. In many ways, it copies the principle of consensus implemented in Ripple, but with the difference that anyone can own a node - you just need to install ready-made software packages on a dedicated server of a certain configuration.

If we briefly consider the process of block formation in the Stellar network, it includes several simple steps:

- Preliminary determination of the pool of nodes that will participate in the consensus search process. It is implemented as a separate thread and does not have an explicit control center, representing a mutual and cyclic polling of the state of all network nodes.

- Users send transactions directly to those nodes that are selected to search for consensus, which reduces delays in processing incoming data and eliminates the presence of a bullet of unconfirmed transactions, as is implemented in Bitcoin.

- Consensus itself is the nodes voting on whether a transaction is valid. In other words, when checking its own copy of the blockchain, the node searches it for the account status of the transfer sender, and if the distributed registry contains information about a sufficient amount of funds in this account, the node confirms its legitimacy and transfers it to another node. The voting process must be completed in less than 5 seconds with a result of at least 80% successful confirmations.

- Next, a successful transaction ends up in the ledger (ledger, distributed registry) of the node that forms the next block. The changes made are propagated among other nodes and the search for consensus operation is repeated for new transactions received for processing.

Finding consensus allows you to effectively solve the problem of communication between nodes that cannot trust each other. The already classic problem of the Byzantine generals, the effective solution of which is the basis for finding consensus in many other cryptocurrency payment systems, requires the presence of an absolute majority of “loyal” nodes to eliminate errors. In Stellar, Ripple and other cryptocurrencies that operate on similar principles, the required majority of the majority is deliberately increased to 70-80% in order to eliminate even the slightest chance of fraudsters being included in the block of transactions.

Consensus in Stellar is also necessary because it solves the problem of forks. The high speed of processing data received from users and the short time required to form one block should lead to the formation of parallel blockchain chains.

The consensus logic allows only the longest and most complete of them to be automatically stored, since only the version of the blockchain that meets these requirements will be guaranteed to reflect the current state of the entire network. As a result, this will lead to confirmation of a larger number of transactions initiated by network participants and sent to the holder of the most current copy, which will lead to continued growth of the chain, which means that no additional actions need to be taken to compare parallel chains.

Advantages and disadvantages

As a result of attempts to correct the shortcomings of her ancestor, Stellar acquired the following advantages:

- Equality of all participants in the system.

- Very fast transactions (up to 1000 in one second).

- Open source, maximum decentralization.

- Security, which is achieved through cryptographic encryption and the use of autonomous nodes.

- Support for integration with other projects and financial systems.

One of the inconveniences is the entry threshold - to make transactions, you must have at least 0.5 XLM in your account. Given the low cost of the coin, this is not yet a serious obstacle and does not discourage those who want to use the system.

Currency distribution

To manage the project, a Development Fund was created, which is responsible for the popularization and fair distribution of STR among everyone, for supporting the network and its participants, for which appropriate tools and services are being developed (free, it should be noted), as well as for ensuring that everyone can get free access to the network.

The Foundation left 5% of the 100 billion coins created for its needs. 2% was exchanged for $3 million from Stripe, and 3% was retained by the Fund for operating expenses.

It is not difficult to calculate that there are still 95% of coins left to distribute. For their effective distribution, 3 programs were created:

- The first is aimed at distributing 50% of the asset and involves the possibility of anyone receiving coins through simply registering an account on the official resource of the project and passing authorization through FB. Authorization was chosen as the simplest tool for user identification, and also because of the vastness of the database of this social network. True, to weed out untrustworthy pages, we had to add a special verification mechanism. For those users who are not associated with Facebook in any way, other distribution methods are provided.

- The second program involves the distribution of coins through various organizations that are far from commerce. This is done in order to involve more people in the system, even those who, due to the inaccessibility of Internet resources, cannot register an account themselves.

- And finally, the remaining 20% of the asset will be distributed between the lucky owners of BTC and Ripple, taking into account the number of these currencies on their balance sheets. Bitcoin holders will receive 19% of the coins, while Ripple holders will receive only 1%. If a user has a certain percentage of all BTC on his balance, then he receives the same percentage of STR.

Wallets

The most reliable and popular way to store Stellar is the cold desktop wallet Stellar Lumens. It is downloaded from the project page on GitHub; Versions are available for different operating systems.

The list of wallets for Stellar is located in the “Lumens” - “Wallets” section on the official website. A list of different types of wallets is available:

- Desktop Wallets: Stellarport, Ledger, BlockEQ, Foxlet, Stargazer.

- Mobile applications (Mobile Wallets): Blockchain, Lobstr, InterStellar, Papaya and others.

- Online services (Web Wallets): Astral, Saza, StellarTerm, Ledger, Blockchain, etc.

The list provided on the site is not complete, since many multi-currency wallets have appeared that support Stellar Lumen, for example, Exodus.

Addition. If you click on the “Account Viewer” link, you will be taken to the official, lightweight online wallet. To create a new private key, click “Generate”. Get a Secret Key - this is a private key, keep it in a safe place and a Public Key - a public key (address) for receiving cryptocurrency.

Prospects and forecast

The Stellar Lumens (XLM) cryptocurrency is a fairly serious project and in terms of market coverage it has almost caught up with Ripple Labs, from which it originally originated. However, experts still do not recommend counting on growth as active as Ripple’s. Despite the fact that the project is more honest and improved, Ripple now has various banks and large corporations on its side, the number of which is only growing every day.

However, analysts predict strong growth for the Stellar Lumens (XLM) cryptocurrency over the next few years. It already has a large capitalization (included in the top 10 cryptocurrency ratings) at a fairly low exchange rate. This can be considered a reason to invest, but only with the expectation of HODL, since no short-term profit should be expected from the currency.

It will be possible to draw more definite conclusions when a general positive trend is established in the market. Another factor is the signing of contracts with large global corporations. Although there are not very many giants interested in the Stellar currency yet, it is clear to the naked eye that the development is promising and in demand.

If this happens, then XLM will at least rise to a price of $1, as it was at the beginning of last year. Experts consider the next step to be reaching a price of $5, although no one can name the exact timing of such an event.

In conclusion...

A few words about the prospects for crypto growth. The jump in the XLM rate in the first quarter of 2022 is due to Stellar’s announcement that it has entered into an agreement with Tempo Money Transfer, ICICI Bank, Flutterwave and Coins.ph corporations, which made money transfers cheaper. The authority of the digital architecture and confidence in the future is added by a number of companies from the Middle Kingdom that are partners of the EPS and carry out financial transactions with impressive amounts in XLM. This fact, in turn, affects the daily growth of XLM quotes. In general, if everything develops in such a positive perspective, XLM is a fairly promising coin for investments of any type (long-term, short-term).

You may also be interested

.

Blockchain 0