From the author: the year is already coming to an end, but this does not mean that the time for predictions is over. Cryptocurrencies surprise us with changes in value every hour, not to mention every day. For Ripple, the forecast for 2022 was very optimistic, but time has shown almost the opposite. Therefore, today we will talk about the events of the last year and their impact both on the XRP rate and on the position of the project as a whole.

What did the market expect?

Anyone interested in the crypto market remembers the price boom at the beginning of the year. All projects, without exception, showed record growth. Not only the crypto community, but the whole world was shocked by those events. No one could have imagined that a well-protected digital code would be valued so highly.

In this regard, many expected further development and even greater growth. The news background constantly announced new investments, recognition of cryptocurrencies by some company or country. It seemed that digital money would become a complete alternative to the banking system any day now. Several analysts have predicted a move away from fiat in some countries.

Ripple also rose against this background. By that time, the project already had a good reputation, so there was considerable demand for XRP. As a result, its rate rose to unprecedented heights for this token. At a certain point, it took second place in capitalization, overtaking the virtually indestructible ETH.

How to invest in Ripple?

Many people are scared of investing in cryptocurrency because no one understands how the blockchain works and what the rates depend on. In this regard, Ripp wins, because the company tries to work with banks, and this is a serious niche.

It is obvious that the project has development prospects and the more banks use the development, the higher the rate becomes.

Ripple retained 61% of the tokens, locking 55 million coins through 55 different smart contracts. Every month one contract expires, which adds to the issue. Gradually, Ripp is sold and the company's expenses are covered.

Anyone can invest in development; to do this, you just need to open a Ripple wallet and find a service where it is currently profitable to buy tokens. There are many options, below we will talk about them and provide instructions.

Having received the currency on your electronic balance, all you have to do is wait for the rate to rise. Even with the slightest change in quotes, you can sell coins and make money from it.

How Ripple came to the top

Each project is special in its own way. Therefore, you can expect revolutionary products and ideas from any start-up. Especially when it comes to cryptocurrency. But what is important here is not so much the idea as its implementation and perspective.

For a long time, Ripple was a platform that was feared by banks and investors, as well as ordinary users. There was no guarantee that the developers did not want simple profit. This is due to the fact that most of the tokens were in their possession. Many were afraid that at one moment the entire volume would be thrown onto the market, which would cause the exchange rate to completely collapse and the project would eventually be closed.

But two factors changed the situation. Firstly, more and more organizations signed an agreement with Ripple Labs, and the company itself opened new offices. Secondly, in the spring of 2022, 55 billion tokens were frozen in an escrow account. Thus, the Ripple team showed that they are focused on the implementation of the idea, and not on profit.

These arguments were more than enough to at least believe in the honesty of the project. The rate then increased greatly, Ripple began to be in great demand. All this gradually brought the platform to its current position.

Users view Ripple in terms of two possible functions:

1. as an investment vehicle available to private individuals; 2. as a means of payment that can be easily used in bank payments.

This feature has a very positive effect on the growth prospects of Ripple among other representatives of the world of cryptocurrencies.

We recommend the Yobit and Binance exchanges (Registration on Binance is temporarily closed due to the large flow of applicants). New tokens/cryptocurrencies are constantly appearing on these exchanges, which are pumped up very quickly and heavily. You can increase your deposit very quickly.

You can also pay attention to EXMO - this is an exchange where you can purchase veterans among crypto coins. Reliable and promising, such as Ripple, BTC, LTC, Ethereum, etc.

Why did they wait for the explosion?

As already said, by the time all the graphs grew, Ripple had become a reputable project. Many financial institutions have begun testing its network. Exchanges have added XRP to the list of trading pairs. In general, the platform and its token had everything to start a new era.

Global idea and financing. The main goal of the developers is to completely change the understanding of international bank transfers. It is caused by the fact that the popular Swift can no longer cope with the current pace of humanity.

The project itself was developed back in 2004, but then there was not enough budget for a full-scale launch. In 2012, the idea was picked up by such personalities as Jed McCaleb and Chris Larsen. Thanks to their past experience, they had enough savings to get the platform off the ground and put it on the market.

Speed and cost. The previously unattainable transaction indicators belong to Ripple. The transfer (from the moment the user requests until the funds are received) takes about 2 minutes, and the online operation itself takes about 5 seconds. The commission is only 0.00001 XRP.

Unique opportunities. Today, XRP is the only cryptocurrency that can be used to buy precious metals. This is due to the fact that the project is focused on cooperation with banks. Of course, this opportunity does not exist everywhere, but its presence and successful use speaks of positive ambitions.

Scalability. What was Bitcoin, or even Ether, capable of? 10-15 transactions per second. This is simply ridiculous at the current pace of life. Ripple easily processes 1,500. Of course, this is far from Visa’s 50,000. But according to statistics, more than 2,000 transactions per second have never entered the Visa network.

No mining. The entire volume was released at once in the amount of 100 billion coins. There will be no more emissions. Accordingly, there is nothing to reward miners with. And the concept of transfers here is completely different, so mining would not be useful. But its absence has a positive impact, which is manifested in the above network performance indicators.

Low power consumption. One of the reasons lies precisely in the previous paragraph. Since there is no need to use power, there is no need to spend money on energy-intensive equipment. The platform concept has greatly reduced resource consumption. Thanks to this, by the way, the commission is such a trifle.

High security. Many thought that if there is no mining, then part of the protection is lost. On the contrary, it eliminates one of the attacks (51%). Of course, there are small losses. However, the structure of the platform overlaps them. Despite the different code, not a single attack today has been successful.

All of the above factors indicate how promising the platform is. At the time of the “cryptocurrency boom,” everyone knew about it, and therefore they predicted great achievements. Few suspected what would happen next.

Ripple forecast based on historical data

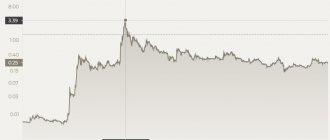

Before buying a cryptocurrency, a trader or investor always studies the history of changes in its price, analyzes the reaction of the exchange rate to events and draws conclusions about the future prospects of the asset. It is known that Ripple appeared in 2012 and was in its “infancy” for a long time. In the period from 2012 to 2014, its rate did not exceed $0.06 per XRP. In 2015, there was a “drawdown” in value, which most of the time remained at the level of $0.006–0.007 per coin. In 2016, there were short-term spikes to $0.008, but otherwise the rate remained almost unchanged. The main changes occurred in 2017, when cryptocurrency showed rapid growth. Hundreds of Ripple predictions have emerged regarding the virtual coin's future prospects.

The first growth occurred at the end of March - beginning of April, when the cost of XRP rose to 20 cents per coin. The bullish trend continued until May 17, 2017, when the rate reached 40 cents, after which there was a slight decline. Another jump occurred in December, when Ripple reached new heights almost every day, and on January 7, 2022, the price reached incredible heights for this coin - 3.4 XRP per dollar.

Of course, changes did not happen out of the blue. One of the reasons was the growth of the Bitcoin cryptocurrency, which pulled with it other virtual coins, including Ripple. It is worth noting a number of positive events that preceded the growth - the launch of an exchanger, the holding of a conference in Toronto, the placement of cryptocurrency on new exchanges (CoinRail, Huobi Pro and others). There were also meetings in South Korea and Tokyo, after which investors’ faith in cryptocurrency strengthened.

During the period of growth of Ripple, on December 15, 2017, the tranche between Korea and Japan was tested, which only consolidated the success. But rapid growth cannot continue indefinitely. Experienced traders know that an active bullish trend is followed by a correction, which implies a decrease in price. This happened this time too. Already on January 16, the cost of Ripple was $1.2 per coin. The rate fell three times in a week, which caused panic among investors who managed to invest in cryptocurrency. At this stage, the most negative forecasts for XRP arose.

Despite small spikes, Ripple's value continues to fall today. As of March 23, 2022, the rate is $0.64. But the bearish trend may change direction. All that is required is an appropriate news background indicating the future prospects of the virtual coin.

By the way, even during the period of depreciation, there were events that led to a short-term increase in prices. For example, joining the LianLian International network (February 9, 2022), partnerships with UAE Exchange (February 13), cooperation with Western Union (February 16). All this led to the exchange rate again exceeding one dollar and continuing to grow. But soon the price went down again, despite a number of positive news, such as the connection of new banking institutions to the partnership and the entry into the Abra exchange (March 15).

Correction

Three weeks - that’s exactly how long the courage lasted at the beginning of 2022. And the news, it seemed, did not foreshadow anything, but traders (more precisely, major players of the exchange) moved to active action. If you have ever been involved with stock exchanges, then you know its basic laws, one of which is correction.

It involves the targeted purchase and sale of tokens at a rate below the market rate. Thus, in the order book, all bets are sooner or later reduced to the lowest value, which is why the chart goes down.

XRP Cryptocurrency Forecast - Current and Future Prospects

Foreign and domestic analysts carefully analyzed the growth of the Ripple cryptocurrency at the end of 2022. Despite existing stereotypes, the company's main business is not yet related to XRP. The goal is to compete with SWIFT, as mentioned above. But how realistic is the competition against the backdrop of the “fever” that has gripped the cryptocurrency system?

Despite the phenomenal growth of the rate and positive forecasts for the Ripple cryptocurrency, few banks have decided to cooperate. Moreover, even financial institutions working with Ripple are unlikely to trust the system of corporate clients. At the current stage, such an event is risky and bank representatives express clear skepticism in this matter.

It is known that the Ripple company issued almost 100 billion coins immediately after the start of its activities. Today, the creators have about 60 billion coins in their hands, and the rest is on free sale. The bulk of the cryptocurrency is in escrow accounts and is sold in a limited volume to protect the network from collapse. From the fall of 2016 to 2018, more than 185 million coins were sold.

As noted, the Ripple system was created in 2012, and from the very start the company planned to develop cryptocurrency and increase its role in interbank transfers. XRP coins were planned to be used as a replacement for currencies of different countries, which would avoid additional fees and speed up the transaction process. At the same time, the Ripple team counted not only on banking institutions, but also on companies.

Subsequently, the developers focused their attention on RippleNet, a system whose parameters have much in common with the SWIFT service. It is based on an algorithm that helps financial institutions conduct transactions. Today, many banks work with the company, and influential people sit on the board of directors.

The situation with Ripple’s promotion is complicated by the fact that other organizations have also set their sights on optimizing payments. In particular, Earthport, a UK company that operates a network in many countries around the world, is gaining momentum. SWIFT itself is not going to give up, regularly releasing updates to existing and new products. In this way, management tries to prove superiority over competitors.

It is worth considering that the owners of SWIFT are an association of global banking institutions, so it is in their hands that the “trump cards” are located. As for Ripple, its functionality is used by a limited number of companies. One of them is Quallix. Since October 2022, the coin has been used to facilitate more than ten transfers between the United States and Mexico. In addition, testing of XRP by the MoneyGrem payment system began at the beginning of 2018. Despite the low activity in 2017, from the beginning of 2022 the activity of organizations has increased and the list of partners is growing.

When evaluating Ripple, one cannot ignore the current situation. The outlook for the XRP cryptocurrency has worsened after a sharp decline in early 2018. Experts argue that such volatility negatively affects confidence in the cryptocurrency and scares off potential customers. This also applies to investors who were interested in buying coins, but are still wondering whether it is worth investing in Ripple or not. Frequent fluctuations in one direction or the other are of interest only to traders, while they cause problems for other market participants.

Blockchain technology and cryptocurrencies. Fast start

Get the book and learn all the basics of blockchain technology and cryptocurrency in one evening.

The main task is to stabilize the exchange rate. After all, in fact, situations like the winter one are, roughly speaking, inadequate for the financial system. Try to remember at least one fact from history, when the shares of a company on the stock exchange soared by more than 6000% in less than a month.

Along with this, naturally, a flurry of news began about the collapse of the cryptocurrency market. This provoked a wave of sales of their tokens by both large investors and ordinary users. In turn, such negative activity further reduced the value of both XRP and all other cryptocurrencies.

This trend continues to this day, although there have been shifts several times. Thus, the initial exchange rate forecast failed miserably. Instead of the predicted 10 dollars per token, today you can see half a dollar. There are many reasons for this, not only related to the correction and the general market trend.

Principle of operation

The functioning of the token is based on the creation of an internal exchange gateway. When making a transaction, the user sends personal savings from a bank card to this point. Then the system automatically converts the money into cryptocurrency at the most favorable rate and sends it to the final recipient. The translation process takes a few seconds. As a result, thanks to Ripple, banks receive:

- increasing the speed of processing transactions;

- reduction of commission costs;

- no risks.

People are also opening up new horizons. It is known that today's international transactions leave much to be desired. To transfer funds to another country, you must use the SWIFT system. The procedure will take 3-5 days, and the commission will be several tens of dollars. In this case, the operation during the sending process may encounter a number of problems and simply be cancelled. Essentially, a person does not receive guarantees that his recipient will ultimately receive the money. Ripple is an alternative option that provides reliable and fast transfers.

By the way, Visa’s throughput is 1,500 operations/sec; for Ripple, this value is 70,000 operations/sec. This feature leaves popular cryptocurrencies far behind.

Negative Ripple

So, user behavior is far from the only reason for the rate collapse. Of course, it played a big role in this phenomenon. But any economic process begins with the presence of a set of certain features. Despite all the positive things, Ripple also has several disadvantages that are pointless to deny.

Regulation. This is a problem with any cryptocurrency. Many countries are very skeptical about this market. Some completely prohibit its use to any extent. Accordingly, the integration of Ripple into banks is no longer possible, because they act in accordance with the law. This platform needs a positive attitude from the government.

Control. Ripple is partially centralized. This makes it very different from other cryptocurrencies. In addition, it allows you to track the transaction. This opportunity is good for government agencies, because it will help avoid crimes. But at the same time, it scares many users who want complete anonymity.

Probability of collapse. It sounds obvious, because this feature is inherent in any project. However, Ripple is very dependent on the decisions of the banks. Of course, today many organizations have already integrated the network. Some have even started using it for almost all transactions.

But in general, the platform is not yet recognized by most financial institutions. In addition, the slightest shortcomings (including constant exchange rate fluctuations) can provoke a refusal to work with Ripple. On some level, this will be to the detriment of banks, since they will return to lengthy and expensive transactions. But they will be confident in the conversion.

If this happens, then the idea of Ripple will be a failure. Accordingly, the project will lose further prospects, the exchange rate will fall to zero. Eventually, the platform and its token will simply disappear from the market.

Recommendations for buying Ripple

Do you want to become an investor in the Ripple cryptocurrency?

Then you need to figure out how to buy coins. This is a great way to increase money. The fact is that coins of this type are not anti-banking, that is, they deny the possibility of cooperation with other financial institutions. They complement the capabilities of banks by allowing them to take advantage of innovative technologies. So, given the current cryptocurrency rate, investing in coins is profitable, since this investment can pay off in a short time. The three dollar mark has already been passed, and perhaps in a few months Ripple will cross the line of 5 or even 6 dollars. Having found out how profitable it is, it’s time to find out how to buy this cryptocurrency:

- At the current market price. Since the cryptocurrency is currently falling slightly in price, the coin needs to be purchased at the best price. Over the course of even one day, a coin can fall by several cents (from 5 to 20 cents) to a dollar or more. Considering the prospects for the cost of ripple in 2022, you should buy when the cost is as low as possible.

- In the event of an upper correction, it is possible to sell the currency at the most favorable price. In addition, in this case, you can average the price for your benefit.

- For a short-term investment, the best level to sell XRP/USD is the price of 4-5 dollars and above.

- For long-term investments, users may be suitable for the level of 6-7 dollars, which Ripple will reach in a few months, and perhaps faster. And by the end of 2022, according to competent experts, it will definitely reach $10.

And we must not forget about the reliability of our trading and investment work. For successful activities with cryptocurrencies, it is best to use proven exchanges.

But remember, you cannot completely trust technical data and recommendations. The situation on the cryptocurrency market changes frequently, especially when it comes to Ripple. To be successful in cryptocurrency trading, you need to be able to not only take into account statistics and forecasts, but also have a flair, even some kind of intuition, in order to take successful steps. And choose the right exchange for trading.

Which exchanges trade cryptocurrency:

| EXCHANGE | PAIR | WELL | XRP VOLUME | VOLUME % |

| Bithumb | XRP/KRW | 4280 KRW | 484229528,180 | 23.2% |

| Binance | XRP/BTC | 0.0001673 BTC | 227085707,000 | 10.88% |

| Bittrex | XRP/BTC | 0.00016763 BTC | 206978762,295 | 9.92% |

| Bitfinex | XRP/USD | $2,656 | 201612924,722 | 9.66% |

| Poloniex | XRP/BTC | 0.00016495 BTC | 188370080,303 | 9.03% |

| Bitstamp | XRP/USD | 2.68573 USD | 94100994,422 | 4.51% |

| Coinone | XRP/KRW | 4269 KRW | 93531341,621 | 4.48% |

| Bitfinex | XRP/BTC | 0.0001657 BTC | 65213843,184 | 3.12% |

| Binance | XRP/ETH | 0.00275264 ETH | 61360840,000 | 2.94% |

| Korbit | XRP/KRW | 4259 KRW | 54365441,158 | 2.6% |

| Hitbtc | XRP/BTC | 0.000165 BTC | 46657740,000 | 2.24% |

| Poloniex | XRP/USDT | 2.65764389 USDT | 41369141,004 | 1.98% |

| Bitstamp | XRP/EUR | 2.22 EUR | 40303698,875 | 1.93% |

| Bitstamp | XRP/BTC | 0.00016598 BTC | 39637081,395 | 1.9% |

| Kraken | XRP/EUR | 2.2 EUR | 36608144,805 | 1.75% |

| Huobi | XRP/USDT | 2.7 USDT | 29703120,379 | 1.42% |

| Kraken | XRP/USD | 2.63846 USD | 29320632,607 | 1.4% |

| Kraken | XRP/XBT | 0.000163 XBT | 25833577,468 | 1.24% |

| Bittrex | XRP/USDT | 2.67 USDT | 25214232,908 | 1.21% |

| sex | XRP/USD | 2.9321 USD | 16256614,628 | 0.78% |

| Huobi | XRP/BTC | 0.00016699 BTC | 15773934,301 | 0.76% |

| Exmo | XRP/USD | $2,856 | 15337625,279 | 0.73% |

| Bittrex | XRP/ETH | 0.00275014 ETH | 13261574,371 | 0.64% |

| Exmo | XRP/BTC | 0.00017 BTC | 7417482,762 | 0.36% |

| bx thailand | XRP/THB | 97 THB | 7310622,895 | 0.35% |

| Bitcoin indonesia | XRP/IDR | 40750 IDR | 6791627,654 | 0.33% |

| Bitcoin indonesia | XRP/BTC | 0.00016555 BTC | 3907140,516 | 0.19% |

| Exmo | XRP/RUB | 166.2 RUB | 3244375,253 | 0.16% |

| sex | XRP/BTC | 0.00017222 BTC | 2922531,219 | 0.14% |

| sex | XRP/EUR | 2.34 EUR | 1091563,947 | 0.05% |

| Hitbtc | XRP/ETH | 0.00273 ETH | 949378,000 | 0.05% |

| Gate | XRP/USDT | 3.2301 USDT | 481166,147 | 0.02% |

| Qryptos | XRP/BTC | 0.000167 BTC | 287792,357 | 0.01% |

| Anx | XRP/BTC | 0.000172 BTC | 242895,924 | 0.01% |

| Abucoins | XRP/BTC | 0.0001788 BTC | 191738,806 | 0.01% |

End of year forecast

There are a couple of months left until the end of 2022. But, as already said, in the world of cryptocurrencies this is a very long gap, so making predictions is natural, and maybe even necessary. It is likely that some kind of revolution will occur and the community will be able to see something completely new.

Among other things, today there is more and more news that Bitcoin is ready for a new explosion, or cryptocurrencies are preparing another revolution. At the same time, such information is published not only by ordinary publications, but also by some reputable sites. This only increases the likelihood of Ripple’s price growth.

The most convenient Ripple wallet online

Most beginners try to find a Ripple wallet on the official website. Some download software versions, but all this is not convenient or simply does not work.

Not long ago, the largest exchange Exmo added Ripp to the list of supported cryptocurrencies and here it is easy to buy them for rubles, dollars or even other cryptocurrencies.

This is a registration form on the site that you will definitely need to fill out. After logging into your personal account, go to the “Wallet” section and there will be XRP . The Ripple wallet has already been created:

Opposite the balance there are 2 buttons. The first is needed for replenishment, the second for withdrawal. When you click on the first one, a page opens where you are asked to generate an address:

The conditions are presented above, the minimum deposit is 10 XRP (about $20), there is no commission. After clicking the button to create an address, you will receive a unique number that you can indicate on different sites or send to other people so that they send you Ripp:

To buy Ripple for rubles or other national currencies, first top up your balance on the exchange, and then buy coins. This is not difficult to do, but we will also clearly show how it is done.

Limits of potential

Among other things, today there is more and more news that Bitcoin is ready for a new explosion, or cryptocurrencies are preparing another revolution. At the same time, such information is published not only by ordinary publications, but also by some reputable sites. This only increases the likelihood of Ripple’s price growth.

Now we can confidently say that Ripple’s potential is almost limitless. To be precise, it will end only when the last bank fully integrates the platform into its system. Even so, there will still be room for network improvement. In other words, in the field of payments, Ripple can do everything. But what is needed for this?

- Even more partnerships with banks and companies in other areas.

- More interest from the media (although, it would seem, much more).

- Increase in trading volume (both overall and on each exchange separately).

- Using xRapid and xVia in areas other than financial (xCurrent is created only for banks).

- Expansion of payment corridors.

- Mostly positive news.

If we analyze the existing achievements, we can confidently say that Ripple has very great potential. One of the factors is that for the first three years the project was in the shadows, but after several changes it entered the top 3 of the market. XRP is in huge demand and this provides new opportunities to expand boundaries.

The media are talking about the project more and more often. Information about cryptocurrency often appears in publications such as The Guardian, Forbes, and Wall Street Journal. In addition, Brad Garlinghouse gives interviews to companies such as Bloomberg. More importantly, the official website of the project constantly updates its news background. At the same time, they present real data, and not a look with rose-colored glasses.

What is known about the corridors? Almost nothing, because the team tries to hide such information until the last moment. All that is known today are offices in America, India, England, Singapore, Luxembourg, Japan and Australia. And of course, partnerships with organizations like American Express and MoneyGram.

Many people understand that the developers are actively working to improve the project. But the CEO lifted the curtain a little. In an interview, she said that the company wants to focus on expanding the possibilities of using XRP tokens. You can rest assured in his words and wait for the next updates. One of these was the full-scale launch of xRapid. But many are sure that this is not all.

What is the reason for Ripple's positive outlook?

Despite temporary problems and a bearish trend in the XRP market, investors believe in the future of the Ripple cryptocurrency. According to many experts, the exchange rate forecast can be called positive. Real numbers for December 2022 are 2–3 dollars per 1 XRP. As for long-term goals, much depends on the activity of the company and the implementation of the system in the banking network.

In general, experts highlight a number of reasons why Ripple will develop and the exchange rate will grow:

- Profitable operations.

The company has already managed to conclude contracts with dozens of large financial institutions, which not only believed in the idea, but were also convinced of the capabilities of the cryptocurrency network. The ultimate goal of the developers is to unite the financial sector by enabling instant transactions. The technology is based on a blockchain-based system, thanks to which financial transactions between countries take seconds. It is planned that the new technology will be used by all banks and will eventually replace SWIFT. Today it is too early to say that Ripple is ready to completely or even partially change SWIFT, but work in this direction is underway. It is unlikely that a new network will be able to break a monopoly that has existed for years, but in the long term it is possible. - Unique technology.

Many experts, when making Ripple forecasts taking into account the intricacies and advantages of the platform, focus on the advantages and features of the new system. One of the main advantages of Ripple is the large number of transactions per second (about 1500), which is significantly more than that of Bitcoin (up to 15 operations per second). The power of XRP technology is enough to take the place of existing payment systems in the future. After implementing Ripple, transaction costs are reduced to a minimum, and transactions themselves are carried out almost instantly. - Increased level of trust.

Only a blind person would not notice that Ripple technology is steadily gaining popularity. It is trusted by large companies, banks and exchangers. Experts agree that investing in cryptocurrency is profitable. Moreover, leading experts one after another are giving out positive forecasts for Ripple (XRP). A temporary depreciation is a plus for investors, because you can take advantage of the “pause” to buy cryptocurrency at a low price and then sell it in case of a sharp increase. - High level of protection.

One of the success factors for cryptocurrency is network security. There is no mining here, which eliminates the “capture” of power. Most of the coins are in the hands of developers who are gradually introducing XRP into the market, which guarantees additional security. In addition, the network provides a commission equal to 0.00001XRP, which was created to protect against spam. It is charged each time an application is submitted and makes attacks on the network a costly endeavor.

Results

Cryptocurrency has experienced a lot in 2022. One of the main shocks, as described above, is the unfulfilled forecasts for the entire year. And the reason lies not only in general market trends. This means Ripple still has room to grow.

Today, many facts play into the hands of the project, which occupies a solid third place in the rating and is gradually approaching second. Full competition with BTC and ETH is excluded in 2022, but you can definitely expect an increase in the rate. It is likely that by the New Year the quotes will reach one and a half to two dollars per token.

Most experts are confident that today Ripple needs new deposits of about 250 billion. If this goal is achieved, the value of the cryptocurrency may rise to $5. Of course, this is very difficult to believe now. But if all the above circumstances coincide, then 5 dollars, or at least something close to that price, is quite realistic.

Content

- Ripple forecast based on historical data

- What determines the positive prognosis?

- XRP Cryptocurrency Forecast - Current and Future Prospects

- Prospects for Ripple cryptocurrency after being added to Coinbase

- What are the long-term prospects of a currency based on?

- What is Ripple's forecast for the near future?

In 2022, the Ripple cryptocurrency managed to surprise and interest millions of investors.

Needless to say, if at the beginning of 2017 the cost of a coin was 0.0065 USD per dollar, and by the end of the year the price jumped to 2.28 dollars per coin. It turns out that the cryptocurrency rate has increased 350 times in just a year. Before investors had time to enjoy the moment and purchase XRP, a rapid downward correction occurred. Almost the entire first quarter of 2022, the value of the coin fell (except for a few periods). As of March 23, 2022, the price of Ripple is $0.64. If we compare with last year’s figures, the growth still remains phenomenal – 100 times. It is not surprising that the topic of Ripple cryptocurrency forecasts is in high demand. What does the future hold for XRP? Will there be growth in 2022, 2022 and beyond? Is it worth investing or is it better to wait on this issue? We will consider these and other points below.