After I wrote the draft of this article, I went to the station in a big hurry. I opened the Gett app on my smartphone and ordered a taxi, which, according to the app, should arrive within four minutes. I took a taxi to the station by the shortest route, which was chosen by Yandex Navigator.

To board the Aeroexpress, I showed the conductor the electronic ticket that I bought using the app on the way to the station. When I arrived at the airport, I checked in my e-ticket and sat in the seat on the plane that I had reserved in advance using the online application.

This is all very different from my memories of when I first came to Russia in the 1990s, and even from what it was like just 10 years ago - no smartphones, no online apps for buying tickets or ordering a taxi, no online payments.

Advertising on Forbes

All of these technological innovations were the result of the work of entrepreneurs whose goal was to create products and services that made our lives more convenient, predictable, faster, cheaper and more controllable. But in order to realize their ideas and turn them into finished products and services, entrepreneurs needed money. This is how the era of venture capital financing began.

Basic principles of venture and business angel financing

Business angel and venture financing are related concepts: in business practice they use common terminology, methods and methods of work. The principle of such financing is investing capital in a company that has growth potential in exchange for a significant (above 10-15%) share with the aim of obtaining high profits by selling this share after a certain time.

The required rate of return is tens of percent per annum. Typically, investors invest in an innovative company with an interesting business idea, intangible assets, and intellectual property.

The peculiarity of such investments is that the investor’s profit is generated due to the growth of capitalization with the investor. There is a term “smart money”, and this fully applies to business angels. They not only invest money, but also develop the company.

Pros and cons of venture capital investments

To decide whether or not it is worth investing in venture projects, it is necessary to consider the advantages and disadvantages of this type of investment.

The advantages include the following points:

- high profitability;

- the ability to start investing with relatively small amounts;

- a feeling of deep emotional satisfaction if the business begins to develop rapidly.

And now about the sad thing:

- vague, difficult to predict prospects;

- high risks of losing invested funds;

- There is a possibility of running into scammers. Often, financial pyramids are hidden under the guise of a young and ambitious startup. Be careful and careful!

Differences between business angels and venture investors

Business angels are:

- People, private investors.

- Their contribution to the company usually does not exceed $500 thousand.

- They actively develop the company (not only by financing it).

- Transfer useful contacts and management skills.

In cooperation with business angels, the psychological compatibility of the company's owners and the investor plays a significant role. All this is very close to venture investing, but there are differences:

- Venture investing is the provision of funds to young companies in the early stages of development for a long period of time in exchange for a stake in these companies.

- Venture capital is a financial link in the innovation infrastructure, uniting capital carriers and technology carriers. It solves the problem of lack of money in the sector of start-up innovative projects.

A venture fund and a venture company are not the same thing.

Venture fund management company

A venture fund and a venture company are two different concepts, although in Russia they are usually used as synonyms. But from the point of view of terminology, this is incorrect, since a company (or firm) is a legal structure and the individuals who are part of it and manage funds. And a fund is precisely the assets managed by a venture capital company.

In Russia they often say “Pantera Caüital venture fund,” but this is incorrect, since Pantera Caüital has many different funds that differ in the type of assets, industry focus, geographic policy, etc.

several funds under management

, therefore, it is more correct to use either simply the name of the company, or use the expression “management”, “venture firm”.

Features of venture investment

A venture investor usually does not seek to acquire a controlling stake in a company, at least not in an initial investment.

This is its main difference from a strategic investor or partner who wants to establish control over the company. The goal of a venture capitalist is different: by acquiring a block of shares or a share less than a controlling stake (Minority Position), the investor expects that the company's management will use his money as financial leverage (Financial Leverage) for the rapid growth and development of their business. As soon as an investor takes a controlling stake, he becomes a majority shareholder and loses interest in the development of the company.

What is venture investment in plain English?

Venture investment is a relatively new phenomenon for our country. This type of investment represents investing in promising startups, that is, in projects that are at the initial stage of their development. A venture investor invests his money in a project and in return receives a stake in the enterprise. If you are lucky and it “shoots”, the profit can reach several thousand percent.

Why can’t the owners of such a business get a loan from a bank? Perhaps you ask. It’s all very simple - financial institutions, as a rule, refuse such potential borrowers due to the high riskiness of their ideas, because the only assets they have are intellectual ones, and many undertakings go bankrupt.

Of course, those who decide to invest in venture enterprises take a lot of risks, but if the project works as it should, the profits can be very high and more than compensate for the money and nerves spent.

The venture investment market in Russia is not yet very well developed, which cannot be said about Western countries. For example, in the USA, giant world-famous corporations have entire divisions that specialize specifically in financing young and ambitious projects.

The main object of interest of a venture investor is innovative areas of activity that have the prospect of explosive growth. These include:

- information Technology;

- biopharmaceuticals;

- biotechnology;

- software;

- cloud computing.

Giants who grew from venture business

- Microsoft. Turnover $90 billion, 130,000 employees, capitalization $400 billion.

- Apple. Turnover $233 billion, 115,000 employees, capitalization $570 billion.

- Google, Facebook.

- Uber. Founded in 2009. Capitalization $65 billion

- ExxonMobil. The largest company in the world. Capitalization is $350 billion. And this is less than that of Internet companies.

- Gazprom. Capitalization $45 billion

- The founders of Yandex, VK, Mail.ru became billionaires. These people, often middle managers, invested a million rubles each in the project. They believed in small business and earned 10,000%.

Other well-known venture projects: LaModa, Intel, Ozon, RBC, Rambler, Avito. It always seems that the idea is on the surface, but the investor’s task is to consider it and support it.

Successful venture investors in the Russian Federation

Before we talk about what venture investors do, I suggest you familiarize yourself with those who have made money doing exactly this.

So, the top 5 most successful investors in Russia:

- Yuri Milner is recognized as the most successful venture investor. He earned capital through successful investments in Zygna, Facebook and other projects. It is believed that Milner's luckiest investments were in Alibaba Group and Twitter's IPO. He's not going to stop there.

- Victor Remsha is known in Russia as the founder of a brokerage. He received the title of a successful venture investor after selling the joint product of Afisha and Rambler - the Begun service. Until 2012, he owned 49.9% of the shares of this company. He actively invests in the Banki.ru resource and the production of PC games.

- Leonid Boguslavsky. Owns 20% of shares of Ozon.ru, co-owner of venture funds ru-Net Ventures (Russia), RTP Ventures (USA). Actively participates in more than 20 projects, mainly related to the Internet.

- Alexander Galitsky founded the Almaz Capital Partners fund. Today it is one of the sponsors of the Foundation B612 project, the goal of which is to create a powerful telescope capable of tracking asteroids.

- The head of the Russian venture fund Bright Capital, Mikhail Chuchkevich, closes our rating, with $220 million under management. In recent years, he has made a number of major transactions, for example, selling the hotel selection service DealAngel.

I’ll tell you now what exactly they do.

Hurry up to take advantage of the doubling of the tax deduction until December 31, 2022.

Difference between venture and regular business

Venture business

- Goal: high value and liquidity of the company.

- Objective: quickly increase the value of the company.

- Means of achievement: reputation in the investment market.

- Product: the company as a whole.

- Consumer of the product: investor in the next stage.

Business as usual

- Goal: profit for the founders.

- Objective: to ensure profitability.

- Means of achievement: selling products.

- Product: technology, products, services for the market.

- Product consumer: consumer of a product, service.

The difference between business angels and venture funds

Business angels working with seeding campaigns

- Formation of a company as a legal entity: in the formation stage.

- Team: being formed, only a part of the intended members are known.

- Market: being studied, there is a common vision, individual developments.

- Intellectual property: developments are not completed, registration is missing.

- Production: pilot production is being established.

- Future cash flow: cannot be predicted, there are only estimates.

- A business plan as a document: there is a general vision of the business and individual elements of the plan.

- Nature of the relationship: frequent informal meetings.

Venture funds working with startups

- Formation of the company as a legal entity: formation work has been completed.

- Team: formed.

- Market: marketing research has been completed, consumers have been identified.

- Intellectual property: the initial package is formed and protected.

- Production: pilot production has been established, work is underway to establish mass production.

- Future Cash Flow: Forecasted with a high degree of confidence.

- Business plan as a document: there is a clear business plan that contains the economic justification for the project.

- Nature of the relationship: meetings within the established procedures within the agreed time frame.

As a rule, business angels are those who have retired from business, saved up money from a managerial job, do not want to actively work, but also do not want to leave the business. They invest money and do not monitor the company operationally. They don't move from industry to industry, they work with what they know.

Where is it popular?

The success of Silicon Valley companies is built on this model, where startups are surrounded by venture capital funds, entrepreneurs and the business community, providing support and funding during their formation period.

For example, Andreessen Horowitz, a venture capital fund founded by Marc Andreessen, the founder of Netscape, has more than 100 employees actively involved in working with entrepreneurs and helping them with marketing, hiring and business development. Because they are so deeply immersed in the technology ecosystem, they know who is best suited for developing technologies, who is suitable for the role of head of technology development and who is suitable for the position of CFO, and what markets and marketing strategies are most attractive.

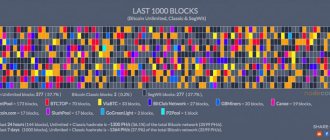

The US is undoubtedly the leader in venture capital investment, given the size and number of US venture capital funds. There are thousands of them in the US market, and in 2016 they invested a total of $69 billion in 8,136 companies, representing 54% of all venture capital invested in the world.

However, Europe is also a fairly developed venture capital market. In 2016, the region's venture capital stock was roughly a quarter of that of the United States.

If we talk about promising regions, then in addition to Silicon Valley, it is worth mentioning Israel, where there are very active technology and venture communities. They have close ties with Russia for historical reasons, which is why many Russian venture capital funds are involved in the Israeli venture business.

Advertising on Forbes

From a macroeconomic point of view, the Russian economy is more stable in 2022 than in the last two years, which is a big plus for companies and investment decisions. However, we still face a significant restriction in investment appetite.

There are a number of reasons for this. High real interest rates on loans, the level of which exceeds inflation, makes raising funds for investment expensive for companies, which is why everyone is waiting for the Central Bank to reduce the rate.

Sanctions also remain an unfavorable factor for Russia in terms of attracting investments, including venture capital. Businesses and investors will adapt to the new situation, but this still needs to be worked on. We are already seeing some progress in this regard, for example, the recent IPO of Detsky Mir.

Every market has its own difficulties and nuances. If we talk about the global trend, then in 2015 and in the first half of 2016, venture investments reached record levels. But the main enemy of investment is uncertainty. It makes the planning process difficult for both companies and investors. The results of the US presidential election and the UK's exit from the European Union have shaken the market and created a high level of uncertainty in the US, UK and EU.

As a result of these events, investment activity has slowed significantly and fell by 29% year-on-year in the second half of 2016, despite large-scale investments in major startups such as Uber, Magic Leap and Snapchat.

Advertising on Forbes