Investor's Dictionary

Brokerage account

- an account in which all transactions, operations and assets of the client under a brokerage service agreement are recorded, and the transactions themselves are carried out on behalf of the client on the stock exchange or on the over-the-counter market.

IIS

— individual investment account. A type of brokerage account for long-term investments with preferential tax treatment. The main limitation is that money cannot be withdrawn from the account for three years. If you withdraw money during this period, the account will be closed, and there will be no tax deductions (and those previously received will have to be returned).

Qualified investor

- an investor who has confirmed that he understands how the financial market works and knows how to manage capital, or has sufficient capital and is willing to take on increased risks associated with complex financial products. This status gives access to tools that are not available to other investors.

What's new for investors in 2022

Investment has been one of the most dynamic areas in Russia over the past few years. This market has been growing at a particularly rapid pace in the last 2-3 years. 2022 turned out to be rich in events and the development of new trends that affect the work of Russian exchanges and investors. The most significant events:

- most brokers waive depository fees;

- More and more Russian banks are moving into the brokerage services market, which makes it easier for new participants to access the stock market;

- brokers are abandoning complex tariff plans, creating simple and convenient formats that are understandable to any user - without hidden commissions or overpayments;

- The Bank of Russia has introduced mandatory testing for unqualified investors if they want to conduct transactions associated with an increased level of risk;

- The Moscow Exchange announced the launch of trading in assets of foreign issuers, and will launch a morning trading session in December 2022;

- The St. Petersburg Exchange added more than 300 new companies, including expanding the list of European issuers.

Leading Russian brokers prove that today's investor and the investor of ten years ago have completely different needs and levels of preparation. In 2011, only private individuals with a high level of professional training were investing in Russia. After 2015-2017, millions of new participants entered the market with different needs.

For example, today an accessible mobile application, access to the stock market without cumbersome software products and learning a complex trading mechanism are more important to the client. If a broker does not take this into account, he will certainly be pushed aside by more successful client-oriented competitors.

Where to invest money?

On the stock exchange, an investor can trade the following instruments:

- stock;

- bonds;

- derivatives;

- currency;

Shares are securities that give the investor the right to a share in the property of the company. An investor will be able to purchase shares in order to receive dividends (if they are paid by the issuing company) or for subsequent resale.

Bonds are debt securities that are used by governments and private companies to raise funds. By buying bonds, an investor is essentially lending money. Securities of reliable issuers like OFZ can be classified as risk-free investments with stable income.

Derivatives are derivative financial instruments. Their main goal is to hedge risks. For example, a futures contract for the delivery of a certain asset allows you to purchase it at a fixed price at a specified point in the future. Derivatives are complex instruments for experienced investors who know how to properly assess risks.

Trading currency on the exchange allows you to purchase it at a better price than in commercial banks. This advantage will be especially noticeable for large volumes of currency.

Basic criteria for choosing the best broker

When choosing a broker, investors and traders are guided by different criteria, but from dozens of parameters, we can single out those that are important for most clients:

- a license from the Bank of Russia, which ensures the legality of cooperation with the broker;

- company rating awarded by rating agencies, which guarantees the reliability of the broker;

- limit on the entry amount to start investing, if we are talking about a small investor’s capital;

- access to exchanges and trading instruments - to diversify a portfolio, an investor should have the opportunity to buy assets that are issued not only in different currencies, but also in different countries;

- broker commissions – the lower the costs for intermediary services, the greater the benefit for the investor;

- remote account opening, high quality service, technical support and general customer service - today the winners are those who resolve customer issues the fastest, and are not just polite in chat;

- software – the more opportunities an investor has, the higher the chance of successfully conducting transactions at the right time and in the right place.

The Brobank service rating compares brokers who are among the top of the Moscow Exchange in terms of these indicators, so they will be given maximum attention in the article.

According to Russian legislation, private investors have no limit on the number of brokerage accounts. Therefore, you can try to submit applications to 2-3 companies, see whose service you like more at this stage, and then compare other criteria.

Most Russian brokers do not charge a fee for maintaining a brokerage account if no transactions are carried out on it. Therefore, you will not lose much money if you open 2-3 accounts with different brokers. But it is better to clarify this issue in advance so that commissions do not accumulate. In addition, there are situations when a broker changes tariffs, and you did not have time to control this. If you have time and opportunity, start with one brokerage account. As you gain investment experience, compare the conditions of your broker with your closest competitors or new successful players.

License of the Bank of Russia

According to the Bank of Russia, at the end of the first half of 2022, 451 professional securities market participants were registered in the Russian Federation, including:

- 194 – commercial organizations;

- 241 – non-profit financial organization;

- 16 – investment advisers – individual entrepreneurs.

The total number of companies with a brokerage license for the same period is 253. Their number is constantly decreasing. For example, in the first quarter of 2021 there were 260 companies with a license, and according to data for 2022 - 425. Therefore, when choosing a broker, it is so important to check the availability of a valid license for brokerage services.

Of the total number of Russian brokers:

- 60% are banks with a brokerage license and depository functions;

- 40% are specialized brokers who focus on investment activities.

To obtain a license from the Bank of Russia, a company must meet all regulatory requirements. A complete list of Russian brokers is available on the website of the Central Bank of the Russian Federation. There you can also find a list of all suspended and revoked licenses.

When signing an agreement for brokerage services, be sure to check that the company name is the same as on the website of the Central Bank of the Russian Federation. It happens that a broker works in partnership or enters into contracts on behalf of a foreign company that is located in the legal framework of another state. If difficulties arise when cooperating with such a broker, you will have to defend your interests in a foreign court. The Bank of Russia will not be able to help in the settlement. Be aware of this risk.

Company rating

When choosing the best broker, check the rating in several ways. Use:

- stock exchange websites;

- official websites of brokers;

- rating agency websites;

- special ratings of third-party organizations.

Websites of Russian exchanges . In this case, see if the company is included in the list of 10 or 20 leading participants with the largest number of customers and turnover.

Rating agency websites . Most brokers independently publish the rating or level of reliability that rating agencies assign to them. This can be an international rating from Standard & Poors, Moody's, Fitch Ratings or Russian agencies - Expert RA, National Rating Agency, ACRA and NKR.

Broker websites. Most often, Russian brokers are rated only by Russian rating agencies. It is advisable to double-check information about the level of reliability on the broker company’s website. Sometimes it happens that the agency lowers the status to “average” or from “moderately high” to “moderate”, and the broker deliberately remains silent about the changes that have occurred.

Individual ratings . Lists of the best brokers are also compiled by specialized aggregator sites based on several criteria. If you use such ratings, make sure that this is an independent study and not a commissioned one. All comparison criteria should be given in advance so that it is clear that there is no bias in order to “highlight” the obvious strengths of any one broker.

Limit on entry amount to start investing

Most often, restrictions on the amount are found among those brokers that are focused on large investors or offer trust management services. Lately the trend has been changing. Now most brokers are seeking to remove any restrictions that prevent private clients from entering the stock market. Therefore, you can start investing even with a couple of hundred rubles in your account or in cash.

The following can also be considered as a limitation for the investor on the entry amount:

- high commission for opening an account,

- fee for maintaining an empty account,

- fee for access to a trading terminal or mobile application, without which it is impossible to conduct transactions on the market.

Check these parameters when comparing brokers to avoid making a rash choice.

Access to exchanges

There are two stock exchanges in Russia - Moscow and St. Petersburg. Exchanges differ in the list of available instruments. The Moscow one is more focused on the assets of Russian companies, the St. Petersburg one - foreign ones. At the same time, both platforms regularly add new securities and issuers.

In 2022, transactions with securities of foreign issuers traded in rubles started on the Moscow Exchange. And the St. Petersburg Exchange added new European assets. However, the difference in the list of trading instruments is still significant. It is important for an investor to have access to both exchanges in order to diversify the portfolio across countries and currencies.

Not all Russian brokers provide access to the St. Petersburg Stock Exchange. Out of 251 brokers, only 46 provide access to trading on the St. Petersburg Exchange. But the list of partners of the St. Petersburg Exchange is expanding. So in 2021, 5 more Russian brokers entered into agreements with this exchange, so see the link for the current list.

In addition to Russian exchanges, some Russian brokers provide access to trading on foreign exchanges in London, Frankfurt, the USA or China. If you want to trade through the LSE, NYSE, NASDAQ or other stock markets, check this option with your broker in advance.

Broker commissions

Any broker charges commissions for their services - this is the main goal of the brokerage business. But the final maintenance costs can vary significantly. All payments and interest rates are fixed in tariff plans. These documents are necessarily published on the broker’s official website and are freely available. Before you sign a brokerage agreement, pull up this data and make a comparison.

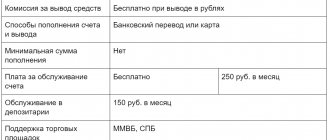

The costs of brokerage services consist of several payments:

- Transaction fees. Most often this is a percentage of the transaction amount or trade turnover. The commission may vary depending on the exchange and currency or be the same for all transactions. Some brokers have floating interest rates. They depend on the amount of transactions or the number of transactions during the trading day - the more transactions, the lower the commission.

- Depository service fee . Fee for storing and recording investor securities in a depository. Most often, a commission is charged when opening a securities account or when moving securities - purchase and sale transactions and transfers to another depository. Not all brokers allocate this payment separately. Some companies do not specify a depository commission at all; they combine it with the trading commission.

- Commission for opening, servicing, maintaining, closing an account . The broker may charge a fee for any of these activities, but most companies charge these transactions free of charge. In any case, check this information in the tariff description or check with your broker. Check to see if there is a subscription fee if you are inactive on the market.

- Software usage fee. Most well-known Russian brokers provide free access to mobile applications for conducting transactions on the stock exchange. But for trading terminals that are installed separately on a computer or tablet, they may charge a fixed fee. Professional software is most often required by traders who conduct a lot of transactions on the stock exchange; if you do not belong to this category, then this type of service and commissions for it may not be taken into account.

- Fees for depositing and withdrawing funds from brokerage accounts. Most often, the broker offers free top-ups from their cards and accounts, but charges a fee if the money comes from other banks, companies or electronic wallets. But there are exceptions when any replenishment methods are free. The same applies to withdrawals - amounts are withdrawn within the company free of charge, outside - for a fee. Most brokers charge a fee for withdrawing currency, regardless of where the money will be credited. Some brokers restrict the withdrawal of funds directly from a brokerage account to the accounts of other companies.

In addition to the main commissions, the investor pays the broker for margin trading and execution of offer transactions. He may also charge fees for consulting, trust management, filing an application for participation in an IPO, voice orders over the phone, currency conversion, SMS notifications, online broadcast of quotes and rates.

Remote account opening, maintenance, technical support and customer service

Online application and registration of a brokerage account is a relative advantage that will not be significant for everyone. Some clients, on the contrary, prefer to communicate with a broker’s representative only in person or by phone. It is more important for such investors to check the number of offices and the level of service in the nearest ones.

However, the reality is that more and more clients are trying to minimize personal contacts and are looking for a broker with whom they can resolve all issues remotely. And it's not just about opening an account. Most often, the remote format is more convenient in the long term - when re-issuing papers, changing personal data or any other circumstances.

If the broker is poorly represented in the regions or has a minimum number of offices, the remote format of service is even more important. If, when changing his registration or surname, an investor has to go to another city, losing time and money, he will probably change his broker to a more mobile one.

Most brokers develop several channels for remote communication between clients and their specialists:

- online chats;

- social network;

- feedback forms;

- chatbots;

- hotlines;

- messengers.

Customer support is no longer a luxury that only large brokers can afford. Without quality service and feedback, companies lose customers. The trends are such that those brokers who cannot compete in this area will certainly give way to other players. The standard of customer service, when an investor or trader can get an answer to his question non-stop 24/7.

Transaction platforms

To conduct transactions on the stock exchange, investors and traders require special software. For novice investors, in most cases, a mobile application or a personal account on the broker’s website is sufficient. Such services are most often free. Special programs for transactions on the stock exchange and trading terminals are most interesting to active traders and experienced investors who conduct many transactions.

The best Russian brokers offer several software options:

- mobile app;

- Personal Area;

- QUIK or any other trading terminal;

- WebQuik – a lightweight version of the trading terminal for mobile devices;

- any other professional software, for example, for automatic transactions on the stock exchange and robotic trading - most brokers have this as a paid service.

Some brokers provide free demo versions of the trading terminal with unlimited or time-limited access. This option is convenient if you want to test the usability of the software of your favorite broker.

Where to open a brokerage account: online or offline?

Each option has its own advantages. If you contact the company’s office, you need to prepare the necessary package of documents. It includes:

- application for opening an account;

- investor questionnaire;

- TIN;

- passport;

- SNILS.

The advantage of registering a BS in the office is full support of the procedure by a company employee. The investor only needs to provide all the documents and select the appropriate tariff plan.

You can also open a BS online on the company’s website or app. In this case, you will need to fill out a form with personal information, provide a copy of your passport in electronic form and sign the agreement using a digital signature. Identification can be done using the State Services portal.

The advantage of an online application is time savings. On the other hand, the presence of errors will lead to a refusal to issue a BS and the need to repeat the entire procedure again. Also, when registering online, you should pay special attention to the reliability of the broker.

Additional criteria for choosing a broker

You can select a company to open a brokerage account based on some other parameters:

- number of clients the broker has;

- the length of time the company has been in the market;

- availability of offices to resolve complex issues and receive personal advice;

- Availability of analytics for beginners and more experienced clients;

- services of a robo-advisor or qualified expert;

- choice between independent and trust management;

- speed of replenishment and withdrawal of funds from brokerage accounts;

- availability of margin trading and the size of the commission for it;

- access to IPO;

- user reviews on third-party sites;

- The broker has awards and other accolades that confirm the company’s success.

If you have little experience in investing, it is not necessary to check all the brokers on the market at once. Even the Bank of Russia publishes only a list of the 25 or 30 best brokers, depending on the selection parameters. To make things easier for yourself, you can open a brokerage account:

- at your servicing bank if it provides brokerage services;

- any company from the top 7 discussed in the article, or from the Moscow Exchange website;

- any other that seems promising to you and has a valid license from the Central Bank.

Please note that different brokers may have different benefits. Experienced investors take this into account and sometimes split their capital between several brokers. They buy shares from one for long-term ownership, from another they maintain an individual investment account, and through a third they participate in IPOs and conduct margin transactions.

Is it possible to transfer an IIS to another broker?

Such a need arises if the company was chosen unsuccessfully in terms of tariffs ; there may be other reasons.

The procedure is as follows:

- You open an IIS from the company you are going to move to . Request account details.

- Notify your current broker that you want to transfer your IIS and request the same details.

- need to obtain the depository agreement number from both companies , as well as documents on brokerage services and agreements of both brokers with NSD .

- A non-trading order is submitted to transfer and receive assets to both companies.

a month is given for the transfer , the “experience” of the IIS is preserved, and the 3-year period does not have to be counted again. You can do it simpler - close your IIS with one broker and re-register it, but the 3 years will start counting again. I note that the broker is not obliged to accept IIS from another company. The operation is not entirely standard, so I recommend checking it out on a case-by-case basis.

I came across reviews in which traders complained that the transfer of assets was not entirely correct . But within 1-3 months everything returned to normal, the main thing is that the IIS period was not reset .

How to avoid mistakes when choosing the best broker

When choosing a broker, novice investors can make mistakes. To prevent this from happening, follow a few tips.

Consider more than just the rating. It may happen that you have studied some kind of review, analysis or material that was created by order of a brokerage company. Or they went to a website where advertising text was posted, in which the company was presented in a favorable light. In any of these situations, the information will be biased. Once again, we emphasize that when writing an article about the best brokers in Russia, Brobank did not cooperate with any of the companies that were in the top 7.

Pay attention to several criteria at once. If you focus too much on one plus, you may not notice many other minuses. For example, a broker has a high-quality remote service, but the commission is too high or the selection of securities is limited. Either the broker has been working on the market for many years, but recently it has become inferior to its competitors in the level of service or its software is outdated.

Avoid the perceived lack of choice. It may turn out that you opened the IIS “by accident”. For example, you receive a salary on a card and want to open a deposit, and a bank employee opens a combined product for you, which includes an IIS. Over time, you figured it out and even want to change the broker, but you think or are convinced that it is too difficult or it is better not to do it. Remember, the number of brokerage accounts one person has in the Russian Federation is not limited, so decide with whom to cooperate, this is your right. Moreover, there can really only be one IIS.

Filter the advice of friends, bloggers and any financial advisors. Everyone has their own goals and investment opportunities. The timing, amount of capital and strategies also differ. Therefore, one investor is more profitable with a broker that provides access to margin trading. For others, access to international exchanges is more important. And the third one wants to pay as few commissions as possible and invest money only in Russian stocks and bonds, because he works for a government agency and has his own legal restrictions.

Be critical of broker advertising and promotions. Attracting customers through marketing is a common practice. Some brokers give a month of premium service, others give shares, and still others give away real money to investors. Gifts and prizes attract a lot of attention, but most newcomers do not read the terms and conditions or fail to meet the requirements to become a part of the promotion. Or the final benefit becomes significantly less than promised. This leads to disappointment. A broker is your partner for more than just a day, so analyze it comprehensively, and not for immediate gain.

How to submit documents to receive a tax deduction

Personal income tax compensation from the state is not received automatically every year. To receive this money you will have to send a request . The procedure is as follows:

- We are preparing documents . You will need : a salary certificate 2-NDFL, a document from a broker confirming the opening of an IIS (check, it must contain the date of registration of the IIS and the amount deposited), account details, a completed declaration in form 3-NDFL. There is no need to pay for this service; you can do everything yourself. For beginners, I recommend reading the post with step-by-step instructions for filling out 3-NDFL.

- We submit documents to the tax authorities . This can be done either during a personal visit to the Federal Tax Service, or remotely if you have an account on the Federal Tax Service website.

- We are waiting for the money to arrive . There are no instant deposits; according to the law, verification by the Federal Tax Service can take up to 3 months. If there are no errors, compensation for the personal income tax paid will be sent to your details.

Tips for submitting documents for a tax deduction:

- There are no strict deadlines , but I recommend submitting a package of documents at the beginning of the year , at this time the Federal Tax Service is not yet so busy with work. Instead of waiting 3 months, it is quite possible to receive money in 3-4 weeks.

- The right to receive a deduction expires after 3 years . That is, for 2022 you can receive it in 2022, 2022 and 2021.

- It is impossible to receive a deduction for several years at once in one application to the Federal Tax Service . If, for example, in 2022 you want to receive money for 2022 and 2022, then prepare 2 separate packages of documents.

- the scanned documents so that the Federal Tax Service inspector immediately understands what kind of paper it is.

- When filling out documents manually, do not put dates . It must coincide with the day the papers are submitted.

- A tax deduction preserves a person's right to benefit from other compensation from the state . For example, when buying a home, you first receive money through an IIS, then compensation for part of the tax paid for the purchase of an apartment/house.

I do not recommend using the services of companies that promise to fill out documents for you. Even a beginner can leisurely collect the entire package of papers .

Rating of the best brokers on the Moscow Exchange

The Moscow Exchange was created in 2011 as a result of the merger of the Moscow Non-Bank Currency Exchange (MVVB) and the Russian Trading System (RTS). This is the largest Russian trading platform for conducting transactions between investors and traders.

To enter the stock exchange, an investor needs a brokerage or individual investment account, as well as the services of a broker who becomes an intermediary between the stock exchange and the individual.

By number of registered clients

According to the number of registered clients, the top 5 Russian brokers according to the Moscow Exchange are:

| Place in the ranking | Broker name | Number of clients as of 11/01/2021 |

| 1 | JSC Tinkoff Bank | 7 641 286 |

| 2 | Sberbank | 5 264 310 |

| 3 | VTB | 1 947 212 |

| 4 | JSC Alfa-Bank | 1 384 001 |

| 5 | FG BKS | 814 956 |

The composition of the top three has not changed for three years, but in 2020 Sberbank lost first place to Tinkoff Bank.

The positions of Sberbank and VTB as the two largest Russian banks with state participation are due to the large number of clients who are gradually being involved in brokerage services. Some individuals are initially set up for this format of cooperation: a bank, a broker, a personal account and an office – all in one place. This makes it more convenient to receive a full range of services.

As of January 2012, Sberbank occupied the first place, it served 189 thousand private investors, VTB was second - more than 170 thousand investors opened brokerage accounts with it.

Tinkoff, as a broker, entered the top 25 of the Moscow Exchange only in May 2018 and immediately took 13th place. And in April 2022, the company took first place and since then has only been increasing its lead over its closest competitors. As of November 2022, Tinkoff surpassed Sberbank by almost 2.4 million accounts, and VTB by 5.7 million.

Such success of the Tinkoff broker is associated with large-scale advertising campaigns to attract new clients, encourage the transfer of existing brokerage accounts and high quality services.

By number of active clients

The top 5 Russian brokers by the number of active clients according to the Moscow Exchange looks different. Active are those investors or traders who carry out at least one transaction per month on a brokerage account or individual investment account:

| Place in the ranking | Broker name | Number of clients as of October 2022 |

| 1 | JSC Tinkoff Bank | 1 635 071 |

| 2 | VTB | 340 818 |

| 3 | Sberbank | 219 332 |

| 4 | LLC Management Company "Alfa Capital" | 85 438 |

| 5 | JSC Alfa-Bank | 78 381 |

Here the top three are the same as in the previous section, but Sberbank lost second place to VTB. This suggests that the country's leading bank has a much larger share of inactive accounts than VTB. At the same time, BCS did not make it into the top five at all. He placed only in 6th place.

Tinkoff Bank has 21% of active clients, VTB has 17%, Alfa Bank has almost 6%, and Sberbank has only 4%. BCS has 67,426 active clients – which is almost 83% of all open brokerage accounts. No other bank that is in the top 5 in terms of the total number of open accounts has such a high indicator, so 6th place is a fairly conditional lag.

By number of IIS

The rating of Moscow Exchange trading participants by the number of registered individual investment accounts is also different, although the composition of the top three is the same:

| Position in the list | Participant name | Number of IIS as of 11/01/2021 |

| 1 | Bank Group "PJSC Sberbank" | 2 087 050 |

| 2 | JSC Tinkoff Bank | 932 700 |

| 3 | VTB | 777 281 |

| 4 | LLC "Company BKS" | 225 620 |

| 5 | FC Otkritie Bank Group | 114 127 |

In this list, Tinkoff Bank is inferior to Sber. Also in the top 5 was the broker FC Otkritie, whose positions in other ratings were lower. In terms of the total number of registered clients, the company ranks 6th, serving more than 390 thousand brokerage accounts. Therefore, it deserves attention and will be included in the top 7 best Russian brokers, according to Brobank.

The top 5 management companies that open IIS, according to the Moscow Exchange as of November 2022, include:

| Position in the list | Participant name | Number of IIS as of 11/01/2021 |

| 1 | JSC "Sberbank Asset Management" | 286 377 |

| 2 | LLC Management Company "Alfa Capital" | 84 204 |

| 3 | Management Company MKB Investments | 55 028 |

| 4 | Otkrytie Management Company LLC | 27 352 |

| 5 | JSC "GPB - UA" | 10 865 |

There is no Tinkoff broker in the rating of management companies, since until October 2022 it did not have a license for the trust management of securities.

Additionally, we present the top 5 Moscow Exchange in terms of the volume of client transactions on individual investment accounts:

| Position in the list | Company name | Trade turnover, million rubles. |

| 1 | VTB | 38 029 |

| 2 | Sberbank | 37 869 |

| 3 | FINAM | 27 529 |

| 4 | FG BKS | 26 561 |

| 5 | JSC Tinkoff Bank | 19 116 |

According to this indicator, Tinkoff Bank is in 5th place.

Alfa-Bank is not in the top at all. But FINAM appeared, which is also widely represented on the Russian brokerage market. This company serves more than 300 thousand clients. The broker is in the top 10 of the Moscow Exchange in terms of the number of registered clients, where it ranks 7th. In the final comparison of the best brokers according to Brobank, the company will also take its place.

By volume of client transactions

The success of a broker is evidenced not only by the number of registered brokerage accounts and IIS. If you analyze the rating of the best Moscow Exchange brokers by the volume of client transactions, other companies will be in the top 5:

| Place in the ranking | Broker name | Trade turnover according to data for October 2022, billion rubles |

| 1 | LLC "BC Region" | 5 810 |

| 2 | FG BKS | 3 852 |

| 3 | Renaissance Broker LLC | 1 749 |

| 4 | VTB | 1 614 |

| 5 | Aton LLC | 1 275 |

Positions of leaders from other Moscow Exchange ratings:

- Sberbank is in 7th place with a turnover of 1,153 billion rubles;

- Tinkoff is in 12th place with a turnover of 827 billion rubles.

JSC Alfa-Bank is not represented at all in this Moscow Exchange rating. Only the manager got into it. It is in 20th place with a turnover of 373 billion rubles.

The composition of the Moscow Exchange ranking in terms of turnover is associated with differences in the client base. Legal entities do not have dozens of brokerage accounts, but they have much larger amounts of money concentrated in them than private investors.

Since 2022, the leading position in the Moscow Exchange ranking in terms of turnover has been occupied by the broker BC Region. This group has been in the brokerage services market for 26 years. It provides services to institutional, corporate and private clients. The broker cooperates with Sberbank NPF, Moscow Industrial Bank, Gazprom and many other large companies, funds and municipalities. Thanks to such clients, BC Region occupies a leading position in terms of trading turnover of the Moscow Exchange.

VTB and Sberbank managed to enter the top ten in terms of trade turnover. But Tinkoff Bank does not, because the overwhelming majority of its client base are individuals, among whom there are many investors with small capital and experience in investing. However, this broker's position is steadily growing. At the end of 2022, Tinkoff Bank was not included in this rating at all. For the first time, the company entered the top 25 in terms of trade turnover on the Moscow Exchange in May 2022 and in 18 months managed to rise to 12th place.

Brobank's final rating does not include companies that are focused on serving large institutional investors or corporations.

How to open an IIS

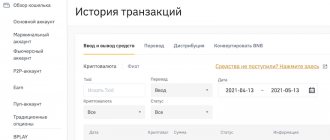

Although the conditions are different, the sequence of actions when opening an individual investment account is the same . Below are instructions for the BCS broker (I assume that you already have a regular account):

- In your personal account, in the “ Products ” section, select “ Open IIS ”. There is a nuance - transfers between a regular account and an IIS are not possible . If you mistakenly fund a brokerage account and then open an IIS, you will not be able to transfer money . You will have to withdraw funds to your bank details and then send them to your IIS.

- We are warned that we are about to open an individual investment account.

- Let's move on to filling out the questionnaire . Personal data automatically transferred from the information provided when registering a brokerage account.

- At the next stage, we indicate how we will submit client orders . Check QUIK, MT5 - that's enough.

- At the end of the page, click on the “ Go to next step ” button.

- It is not necessary to specify investment products . For now, we are skipping Depositing funds” item .

- All that remains is to send an application to open an account to the broker . By clicking on the “ Confirm the entire set of documents ” button, you will receive an SMS with a code. We sign the application with them, it is sent for consideration to the BCS.

- An information window will appear , informing you that the application has been sent and we will receive a response in 1 day. also give you an agreement and brokerage account number be sure to save them .

- In about a day, a new general agreement corresponding to your IIS will appear in your personal account.

The IIS is open , all that remains is to replenish it.

Open an IIS account with BCS

How to deposit money into an IIS

Unlike offshore brokers, BCS does not have such an abundance of options for depositing funds ; you will have to work with a standard bank transfer. An example of details is in the figure below. Don't forget to correctly indicate the purpose of the payment .

As for which broker opening an IIS is best to work with, when choosing a company, account replenishment methods are not taken into account as a decisive factor . Everyone has the same picture - bank transfer, cash through a broker’s branch, option with a card (but most often this option comes with a commission, I don’t recommend it).

For me, the sequence of actions when replenishing an IIS looks like this:

- In your personal account you need to provide bank account details . While in the client’s profile, click on the “ Change ” button and then “ Add details ”.

- appears for filling out the details .

- Indicate the name of your bank . In my case it is Tinkoff .

- If you wrote it without errors, the system automatically finds a suitable bank; from the drop-down list, select the optimal one by geographic location .

- We continue to fill out the form . The only things that may confuse you here are the “ Main ” and “ Central Bank Income Account ” items. The second point refers to income in the form of coupon payments on bonds and dividends on shares. If you are coming across these concepts for the first time, I recommend reading the post on how to get dividends on stocks. You can check both boxes for the same account or create 2 different ones. On one you will receive income through coupons and dividends, and on the second you will receive profit through speculative transactions with securities.

- All that remains is to check once again that the details have been entered correctly and sign the form using the SMS code.

All that remains is to transfer money to IIS using bank details. BCS does not charge a commission for either depositing or withdrawing funds , according to your bank - check with technical support.

Rating of brokers St. Petersburg Exchange

The rating of the St. Petersburg Exchange differs from the data for the Moscow Exchange. This is due to the fact that not all Russian brokers give clients access to the St. Petersburg exchange. In particular, one of the largest brokers, Sberbank, still does not cooperate with this trading platform.

As of October 2022, the top 10 brokers of the St. Petersburg Exchange by trading turnover include:

| Place in the ranking | Broker's company name |

| 1 | JSC Tinkoff Bank |

| 2 | PJSC "Best Efforts Bank" |

| 3 | LLC "Company BKS" |

| 4 | JSC Alfa-Bank |

| 5 | PJSC VTB Bank |

| 6 | LLC "IK Freedom Finance" |

| 7 | JSC "FINAM" |

| 8 | Otkritie Broker JSC |

| 9 | ALOR+ LLC |

| 10 | Renaissance Broker LLC |

In terms of the number of registered and active clients, Tinkoff Bank and VTB have leading positions. The list also includes BCS, Alfa-Bank JSC and Otkritie Broker JSC.

Since the St. Petersburg Exchange is still losing its leading position to the Moscow Exchange, the final comparison placed greater emphasis on Moscow Exchange data.

When a brokerage account is unprofitable

The main disadvantage of a brokerage account is that there are no tax deductions like on an individual investment account.

The brokerage account has a three-year tax benefit for investors. It differs from the Type B deduction in terms: the securities must be owned for at least three years and the benefit cannot exceed a certain amount.

Criteria for comparing the best brokers in Russia

A comparison of the best Russian brokers was carried out by the Brobank service according to 5 criteria:

- access to exchanges and trading instruments;

- broker commissions;

- remote account opening;

- trading platforms;

- customer service.

All brokers who are in Brobank's top 7 have a license from the Bank of Russia at the time of writing the review. As of November 2022, there are no prerequisites for them to leave the market, so they can be called one of the most reliable Russian brokers.

Broker commissions are given for the tariff that is most suitable for novice investors or those who do not conduct very many transactions in the markets. If you are pursuing a more aggressive strategy, the top brokers that will suit you will be different.

Reliability of the broker Otkritie

Of course, the broker is very reliable. The Otkritie holding has a lot of money, and this makes the company very resistant to any financial adversity.

The reliability of the broker is also evidenced by the following facts:

- There are all necessary licenses (information about licenses is available at the link - open-broker.ru/documents/raskrytie-informacii/licenzii)

- 25 years on the market

- The National Rating Agency estimates the broker's reliability rating at the AAA level (stable forecast), which is the highest reliability rating

In general, there are no questions about the broker’s reliability. And, in general, all the largest brokers in the country are quite reliable.

Top 7 best brokers in 2022

The comparison table included 7 companies that were most often found in the ratings of Russian exchanges for several years. Only those brokers who offer the most favorable conditions for private rather than corporate clients are selected for the top.

| Place, name | Access to exchanges and instruments | Commissions | Remote account opening | Trading platforms | Customer service |

| 1, FG BKS | Moscow Exchange, St. Petersburg and global platforms | “Investor” 0.1% (no broker commission until December 31, 2021) + exchange commission from 0.01% | Yes | Mobile application, personal account, trading terminal, standard software, professional software for trading | Online chat on the website and in the app, hotline |

| 2, Finam | Moscow Exchange, St. Petersburg and global platforms | “Strategist” from 0.05% to 0.1% depending on the instrument and exchange | Yes | Mobile application, personal account, trading terminal, standard software, professional software for trading | Contact form by phone number |

| 3, FC Otkritie Bank Group | Moscow Exchange, St. Petersburg and global platforms | “All inclusive” from 0.05% to 0.15% depending on the site | Yes | Mobile application, personal account, trading terminal, standard software, professional software for trading | Hotline |

| 4, Tinkoff Bank | Moscow Exchange, St. Petersburg and global exchanges (limitations on instruments) | "Investor" 0.3% | Yes | Mobile application, personal account, standard software, trading terminal | Online chat on the website, in the mobile application and any messengers 24/7, hotline |

| 5, VTB | Moscow Exchange, St. Petersburg and global exchanges (limitations on instruments) | “My online” 0.05% + exchange commission for transactions 0.1% | If there is identification | Mobile application, personal account, standard software | Online chat in the application, hotline |

| 6, Sberbank | Only Moscow Exchange | “Independent” 0.06% + exchange commissions 0.01% | If there is identification | Mobile application, personal account, standard software | Online chat in the application, hotline |

| 7, Alfa-Bank | Moscow Exchange, St. Petersburg and global exchanges (limitations on instruments) | "Investor" 0.3% | If there is identification | Mobile application and personal account, standard software | Phone line |

The color of the cells in the table comparing the best brokers informs about the level of the broker's criterion:

- green – maximum or high;

- yellow – medium or neutral;

- red – critical or low level.

Brokerage account and IIS: a visual comparison

It is not necessary to open only an IIS or only a brokerage account - they can be used simultaneously. For example, keep a brokerage account for short-term investments, and an IIS for savings. The capabilities of both accounts are in the comparative table:

In the Gazprombank Investments application, the tariffs for servicing a brokerage account and IIS are the same. Before you start real investing, you can practice for free on a demo account - it already has a virtual amount that can be spent on buying securities. Collect your first portfolio, trade financial instruments and watch how the price changes. In the mobile and web versions of the application, you need to select the “Portfolio” and “Demo Account” tabs. Transactions have no legal force, and the money on the demo account is virtual - it cannot be withdrawn, but the risk is zero.

To understand which real account to open, take a two-step mini-test.

Whatever account you choose, you need to remember the basic rules of investing - regularly replenish your portfolio, look at the financial performance of companies, monitor news and market analytics, and diversify your investment portfolio.

Summary

The rating of the best brokers in Russia for 2022, which was prepared by Brobank, will not be universal for everyone. The selection criteria may be different for you. The above top 7 is a list for investors who are just starting to look for a suitable intermediary to enter the stock exchange. The rating is also suitable for determining your own parameters by which you can choose your best broker.

If the most important parameter for you is remote application submission and high-quality online support, study this information. If you need special applications for trading, pay attention to this criterion. For example, some government employees do not need access to foreign and St. Petersburg stock exchanges, so they can ignore this criterion. If it is more important for you to resolve all issues in the broker’s office rather than by phone or chat, check that the broker’s representative offices are within walking distance.

Please note that terms of service, pricing plans, software and customer service are constantly changing, so please ensure they are up to date when applying for a brokerage account. Perhaps in six months or a year the leadership will belong to another Russian broker. The article does not constitute investment advice. Any investment activity is associated with risks, take them into account when conducting transactions on exchanges .

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

What type of brokerage account should I choose?

There are two types of BS for individuals: standard and individual investment (IIS). In the first case, the investor gets access to trading on the exchange, and his profit is subject to personal income tax of 13%. In this case, the intermediary company acts as a tax agent. The investor receives profit in “pure” form after taxes have been deducted.

IIS has a number of advantages over standard BS. It allows you to receive a tax deduction of up to 52,000 rubles or not pay personal income tax on profits from operations on the stock exchange. This option also has a number of disadvantages. IIS is opened only in national currency and you can deposit up to 1 million rubles per year into the account. You can withdraw money or close your bank account without losing benefits and tax deductions only after three years

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

Rates

All broker rates are described in a 195-page pdf document. In the content we see 17 standard tariffs and 13 tariffs for accounts on foreign trading platforms. But if you look through this entire document, you will find that 3 standard tariffs and 8 tariffs for foreign exchanges are no longer valid. In total, we have 14 standard tariffs and 5 tariffs for foreign exchanges.

Of course, we will not consider all these tariffs. Let's go through only the most popular ones presented directly on the site.

All tariffs include a depository fee - 175 rubles per month ($3 for the St. Petersburg Exchange), if there were movements on the “Universal” account. The most popular broker tariff for independent trading on Russian exchanges. The turnover commission is 0.057% (but not less than 4 kopecks) on the Moscow Exchange and 0.05% (but not less than $0.02) on the St. Petersburg Exchange. If the value of the assets in the account does not exceed 50,000 rubles, then there is an account maintenance fee - 295 rubles for a simple brokerage account or 200 rubles for an individual investment account. This fee is reduced by the amount of turnover commissions paid.

Before the depositary fee was increased from 10 rubles to 175 rubles per month, this tariff was called the most profitable among Moscow Exchange brokers. "Professional". Another tariff for independent trading. The turnover commission ranges from 0.015% to 0.086% (but not less than 4 kopecks). The turnover commission becomes more profitable than the previous tariff, with daily turnover of 3 million rubles. In addition, this tariff has a lower cost of leverage. The commission on the St. Petersburg Exchange is the same - 0.05% (but not less than $0.02). If the value of the assets in the account does not exceed 50,000 rubles, then there is an account maintenance fee - 295 rubles for a simple brokerage account or 200 rubles for an individual investment account. This fee is reduced by the amount of turnover commissions paid. "Model Portfolio". Tariff for accounts using the broker's service of the same name. Account maintenance costs 0.167% per month, but not less than 177 rubles. The turnover commission is 0.057% (but not less than 4 kopecks). The commission on the St. Petersburg Exchange is standard - 0.05% (but not less than $0.02). “Your financial analyst. Universal". Tariff for accounts using the broker's service of the same name. Account maintenance costs 0.17% per month, but not less than 400 rubles. The turnover commission is 0.057% (but not less than 4 kopecks). The commission on the St. Petersburg Exchange is standard - 0.05% (but not less than $0.02).

The name of the tariff is similar to “Universal”, but this is a completely different tariff. It is distinguished by the presence of a fee for maintaining the account. These rates are often confused. Be careful and pay attention to this point when choosing a tariff. Some believe that by creating tariffs with similar names, the broker is trying to confuse the client. “Your financial analyst. Investor." Another tariff for accounts using the “Your Financial Analyst” service. Account maintenance is free, but if the value of assets in the account does not exceed 50,000 rubles, then there is an account maintenance fee - 295 rubles for a simple brokerage account or 200 rubles for an individual investment account. This fee is reduced by the amount of turnover commissions paid. The turnover commission is 0.24% (but not less than 4 kopecks). The commission on the St. Petersburg Exchange is standard - 0.05% (but not less than $0.02). UPDATE 02/24/21

At the end of last year, the broker rolled out a new line of tariffs (the depository fee was removed, but some tariffs have a subscription fee). You can find it at the link - open-broker.ru/invest/tariffs

Reviews Opening broker

As with any broker, you can find both positive and negative reviews about Otkritie.

Let's start with the negative. People often complain about unjustifiably high tariffs and about the depositary commission that has increased by 17.5 times. How loud it sounds - 17.5 times! But if you say 165 rubles, that’s not so impressive, is it?!