Discounting from the English “discounting” is the reduction of economic values for different periods of time to a given period of time.

If you do not have an economic or financial education behind you, then this term is most likely unfamiliar to you and this definition is unlikely to explain the essence of “discounting”; rather, it will confuse it even more.

However, it makes sense for a prudent owner of his budget to understand this issue, since every person finds himself in a situation of “discounting” much more often than it seems at first glance.

Description of discounting in simple words

What Russian is not familiar with the phrase “know the value of money”? This phrase comes to mind as soon as the checkout line approaches and the buyer takes another look at his grocery cart to remove “unnecessary” items from it. Of course, because in our time we have to be prudent and economical.

Discounting is often understood as an economic indicator that determines the purchasing power of money and its value after a certain period of time. Discounting allows you to calculate the amount that will need to be invested today in order to receive an expected return over time.

Discounting, as a tool for predicting future profits, is in demand among business representatives at the stage of planning results (profits) from investment projects. Future results can be announced at the start of the project or during the implementation of its subsequent stages. To do this, the specified indicators are multiplied by the discount factor.

Discounting also “works” for the benefit of the average person who is not involved in the world of big investments.

For example, all parents strive to give their child a good education, and, as you know, it can cost a lot of money. Not everyone has the financial capabilities (cash reserve) at the time of admission, so many parents think about a “nest egg” (a certain amount of money spent past the family budget cash desk), which can help out in an hour.

Let's say that in five years your child graduates from school and decides to enroll in a prestigious European university. Preparatory courses at this university cost $2,500. You are not sure that you will be able to carve out this money from the family budget without infringing on the interests of all family members. There is a way out - you need to open a deposit in a bank, for a start it would be good to calculate the amount of the deposit that you should open in the bank now, so that at hour X (that is, five years later) you receive 2500, provided that the maximum favorable interest rate that can offer the bank, say -10%. To determine how much a future expenditure (cash flow) is worth today, we do a simple calculation: divide $2,500 by (1.10)2 and get $2,066 . This is discounting.

Simply put, if you want to know what the value of a sum of money you will receive or plan to spend in the future is, then you should “discount” that future sum (income) at the interest rate offered by the bank. This rate is also called the “discount rate”.

In our example, the discount rate is 10%, $2,500 is the payment amount (or cash outflow) in 5 years, and $2,066 is the discounted value of the future cash flow.

Stage 1. Grouping of source data

So, let the financial and economic indicators of some be characterized in a FORECAST period of seven years by the following initial data (thousands of dollars):

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| Net profit | 100 | 105 | 111 | 118 | 138 | 155 | 161 |

| Depreciation | 10 | 11 | 11 | 12 | 14 | 16 | 16 |

| Working capital | -20 | -22 | -30 | -25 | -35 | -40 | 5 |

| Investments | -20 | -21 | -21 | -24 | -28 | -31 | -50 |

| Credit debt | -29 | -18 | -7 | 4 | 6 | 3 | 1 |

| Cash flow | 41 | 55 | 63 | 85 | 95 | 103 | 133 |

The minus signs on individual lines require some explanation.

Thus, the column “Investments” contains numerical data reflecting, among other things, capital costs associated with maintaining or developing the business.

They must be given with a minus sign.

The values in the “Working capital” column have both a minus sign (this means that the working capital has INCREASED, for example, due to changes in prices for materials or raw materials) and a plus sign (this means that the working capital has DECREASED in the corresponding amount ).

Discount formulas

All over the world it is customary to use special English terms to denote current (discounted) and future value: future value (FV) and present value (PV) . It turns out that $2,500 is FV, that is, the value of money in the future, and $2,066 is PV, that is, the value at this point in time.

The formula for calculating the discounted value for our example is: 2500 * 1/(1+R)n = 2066.

General discounting formula: PV = FV * 1/(1+R)n

- The coefficient by which the future value 1/(1+R)n is called the “discount factor”,

- R – interest rate,

- N is the number of years from a date in the future to the present.

As you can see, these mathematical calculations are not that complicated and not only bankers can do it. In principle, you can give up on all these numbers and calculations, the main thing is to grasp the essence of the process.

Discounting is the path of cash flow from the future to today - that is, we go from the amount we want to receive in a certain amount of time to the amount we must spend (invest) today.

How to calculate the discounted payback period of a DPP project: features of the method

Many entrepreneurs, when planning business ideas, use a simplified method for determining the time period during which they can return the invested funds. Their choice is explained quite simply:

- PP parameters reflect the situation more clearly. A finance specialist immediately sees how much money is required for implementation and makes forecasts for the return on investment.

- A simple technique gives results that are relevant for short-term enterprises. Discounting, in turn, implies an analysis of long-term patterns.

When conducting a study of “long-term” investments, all significant factors are taken into account: the cost of raw materials, energy and labor resources, the nuances of taxation, the economic and political situation in the country, etc. Among the main criteria influencing investors’ preferences regarding cash injections, VSA certainly plays a significant role, but not the most important one.

Therefore, having considered all the available advantages and disadvantages of the method, we should recommend the definition of discount CO:

- For those whose occupation involves high-risk investments.

- Organizations actively exploring new markets (especially relevant for countries with unstable economies).

- Specialists who carry out analysis in planning commercial work. Indeed, in a business plan, this parameter determines exactly the period of time when costs and profits must be calculated with great care.

Formula of life: time + money

Let's imagine another situation familiar to everyone: you have “free” money, and you come to the bank to make a deposit of, say, $2,000. Today, $2,000 deposited in the bank at a bank rate of 10% will cost $2,200 tomorrow, that is, $2,000 + interest on the deposit of 200 (=2,000*10%) . It turns out that in a year you can get $2,200.

If we present this result in the form of a mathematical formula, then we have: $2000*(1+10%) or $2000*(1.10) = $2200 .

If you deposit $2,000 for two years, that amount converts to $2,420. We calculate: $2000 + interest accrued in the first year $200 + interest in the second year $220 = 2200*10%.

The general formula for increasing the deposit (without additional contributions) over two years looks like this: (2000*1,10)*1,10 = 2420

If you want to extend the deposit term, your deposit income will increase even more. To find out the amount that the bank will pay you in a year, two or, say, five years, you need to multiply the deposit amount with the multiplier: (1+R)N .

Wherein:

- R is the interest rate expressed as a fraction of a unit (10% = 0.1),

- N - denotes the number of years.

Definition of PSO

PP (pay-back period) is a measurable value that is used to conduct investment analysis and study the expected profitability of a future project. The indicator can be calculated in weeks (relevant for small enterprises), months, years and even tens of years. As a rule, the latter include particularly large, long-term business projects. The results of the calculations consistently depend on the total investment volume, the direction of the activity and the corresponding rates of return in a given area.

The PP value obtained as a result of computational manipulations makes it possible to determine the period after which the initial investments made will fully pay off. Omitting complex terminology, we can say that this indicator clearly demonstrates the time period after which the enterprise will cease to be unprofitable and begin to receive net profit. Obtaining income that completely covers investment investments is the main condition for the successful functioning of any project.

This value is of great importance not only for carrying out analytical activities that allow assessing the flow of invested funds, but also for drawing up a business plan. To organize work without loss of efficiency, you should use ready-made samples of schemes created for a specific field of activity.

Discounting and accretion operations

In this way, you can determine the value of the contribution at any time point in the future.

Calculating the future value of money is called "accretion."

The essence of this process can be explained using the example of the well-known expression “time is money”, that is, over time, the monetary deposit grows due to an increase in annual interest. The entire modern banking system operates on this principle, where time is money.

When we discount, we move from the future to today, and when we “increase,” the trajectory of money movement is directed from today to the future.

Both “calculation chains” (discounting and building up) make it possible to analyze possible changes in the value of money over time.

Discounted payback period DPP: what is it in simple words

Its calculation is carried out in order to imagine in detail how profitable the implemented idea will be. This parameter makes it possible to estimate the time period during which it will be possible to return the invested money, taking into account the cost of the invested unit. Simply put, it characterizes the time required for finance to complete its turnover.

On the Internet and in printed publications, the indicator is denoted by the short abbreviation DPP (Discounted payback period). This value is most often used to determine the effectiveness of funds invested in a business project through cash flow.

The discount period, like other quantitatively measurable parameters, has its own characteristics and comparative errors. Accordingly, when developing a new business project, you should take into account possible risks. Unforeseen circumstances that threaten to reduce profitability are a common occurrence in business.

Discounted Cash Flow Method (DCF)

We have already mentioned that discounting - as a tool for predicting future profits - is necessary to calculate an assessment of the effectiveness of the project.

Thus, when assessing the market value of a business, it is customary to take into account only that part of the capital that is capable of generating income in the future. At the same time, many points are important for a business owner, for example, the time of receipt of income (monthly, quarterly, at the end of the year, etc.); what risks may arise in connection with profitability, etc. These and other features that affect business valuation are taken into account by the DCF method.

Practical significance

Why is a thousand dollars now better than the same amount in the future? Everything is due to the fact that the money received at the moment could be invested in other assets. Therefore, the operation of postponing debt payment is inextricably linked with such a financial mechanism as the discounting operation. The concept is associated with the concept of opportunity cost. Late payment means that a person cannot use their money for a certain period. The debtor effectively compensates for this opportunity cost.

Discount coefficient

The discounted cash flow method is based on the law of the “falling” value of money. This means that over time money “gets cheaper”, that is, it loses value compared to its current value.

It follows from this that it is necessary to build on the current assessment, and correlate all subsequent cash flows or outflows with today. This will require a discount factor (Df), which is necessary to reduce future income to the present value by multiplying Kd by the payment streams. The calculation formula looks like this:

where: r – discount rate, i – number of the time period.

DCF calculation formula

The discount rate is the main component of the DCF formula. It shows what size (rate) of profit a business partner can expect when investing in a project. The discount rate takes into account various factors, depending on the object of evaluation, and may include: the inflation component, valuation of capital shares, return on risk-free assets, refinancing rate, interest on bank deposits and more.

It is generally accepted that a potential investor will not invest in a project whose cost will be higher than the present value of the future income from the project. Likewise, an owner will not sell his business for less than the estimated value of future earnings. Following the negotiations, the parties will agree on a market price that is equivalent to the today's value of the projected income.

The ideal situation for an investor is when the internal rate of return (discount rate) of the project is higher than the costs associated with finding financing for the business idea. In this case, the investor will be able to “earn” the way banks do, that is, accumulate money at a reduced interest rate and invest it in a project at a higher rate.

Discount rate

Market pricing is a complex process that depends on many factors. One of them is the discount rate. It is believed that it should be chosen in such a way as to correspond to the cost of capital. The last concept is inseparable from the rate of return. Of course, it must be adjusted taking into account the risks. The discount rates that apply to companies can vary significantly:

- Startups looking for investment – 50-100%.

- They are in the period of early formation - 40-60%.

- Startups established in the market – 30-50%.

- Mature companies – 10-25%.

Higher discount rates for startups reflect the problems associated with them:

- Less suitable for selling property rights than mature sales because their shares are not traded on an exchange.

- Limited number of investors.

- High risks.

- Overly optimistic forecasts from enthusiastic founders.

DEFINED BENEFITS PENSION PLANS

Under IAS 19 Employee Benefits, the rate used to discount post-employment benefit obligations is determined by reference to the market yield of high quality corporate bonds at the end of the reporting period.

In Russia, the market yield (at the end of the reporting period) of government bonds is also often used. The currency and terms (primarily the terms) of the bonds must correspond to the currency and settlement terms of the corresponding obligations that are subject to discounting. The rate in this case will reflect solely the time value of money, and not actuarial or investment risk. Moreover, the discount rate will not reflect the inherent credit risk borne by the entity's creditors, nor the risk that actual results may differ from actuarial assumptions.

The most popular method in Russia

The cumulative construction method is based on the fact that the discount rate is a risky function. It is taken as the totality of all existing risks possible for each property individually. The rate is equal to the sum of the risk-free rate and the risk premium. The last component is calculated by summing the values of the available factors for the analyzed property.

Specialists in Russia, as a rule, calculate the discount rate using a cumulative structure. This is explained by the ease of calculating the rate of return using this method in the current conditions of the domestic real estate market.

FINANCE LEASE

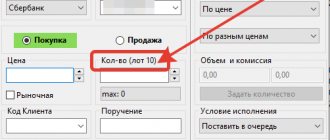

IAS 17 Leases requires that the present value of the minimum lease payments (MLP) be calculated to classify a lease (and, in the case of a finance lease, to calculate the assets and liabilities to be recognised).

The calculation is made on the date of commencement of the lease relationship (date of conclusion of the agreement), accordingly, all estimates are made on the same date. In this case, the standard defines two types of rates. 1. The interest rate implied in the lease agreement is the discount rate at which the sum of the discounted MAP and the discounted unguaranteed residual value equals the sum of the fair value of the asset that is the subject of the lease and the lessor's initial direct costs. This rate is used:

Based on the definition, the rate can be reliably calculated if there is information about the fair value of the asset that is the subject of the lease (its remaining characteristics are determined from the terms of the lease agreement).

If this rate cannot be reliably determined, the next rate applies.

2. Estimated interest rate under a lease - the rate of interest that the tenant would have to pay under a similar lease. Or, if such a rate is also impossible to determine, the rate at which the lessee could attract borrowed funds on similar terms to purchase the relevant asset is used. In this case, similar conditions mean the loan term, collateral (since during a lease, ownership of the asset remains with the lessor, a potential loan by the lessee is actually made against the security of this asset), currency, and other characteristics.

The requirements are therefore very similar to those for calculating the discount rate for financial instruments. In practice, rates are calculated based on the requirements of IAS 39, taking into account the specifics of lease relationships (for example, when renting, the payment scheme is usually uniform monthly).

IAS 17 does not contain any special requirements for disclosing information about interest rates. At the same time, as a financial instrument, assets and liabilities to receive (pay) lease payments fall within the scope of IFRS 7, which means that, in terms of disclosure, the same rules apply to them as for other financial instruments.

Example 3

Company A measures the fair value of assets at present value. For the calculation, the company has data on the real return on assets in the amount of 10% per annum. The expected inflation rate is 5% per year, so the company reports cash flows taking into account the inflation rate. To determine the present value of cash flows, a company must use a nominal interest rate to discount. To do this, you can apply the Fisher formula:

1 + Nominal interest rate = = (1 + Real interest rate) × (1 + Inflation percentage).

Thus, company A will discount cash flows at a nominal rate:

[(1 + 0,1) × (1 + 0,05)] − 1 = 15,5 %.

Example 6

Company A calculates the fair value of the equipment. The company's cost of capital is 10%. The following information is available about the probability distribution of cash flows:

Let's calculate the discounted value of cash flows.

In this case, the fair value of the asset will be RUB 24,693 thousand.

It should be noted that in practice there may be many possible outcomes. However, in order to apply the expected present value method, it is not always necessary to consider the distribution of all possible cash flows using complex models and methods. Instead, a limited number of discrete scenarios and probabilities can be developed that cover a variety of possible cash flows.