What is long and short in trading?

Friends, perhaps these two concepts are the most important for trading after risk management.

Every trader definitely needs to understand what short and long are in trading! Now I cover this topic with a smile, but once upon a time I could not understand how “short” works. Everything was clear with the long, but the “short” was space!

And the funny thing is that it was important for me to figure out how this damn short works.

By the way, if we don’t know each other yet, you can read about me and the successes of my students here.

Important! But it was necessary to focus specifically on trading techniques, its endless tests and on preserving capital for trading.

There is no need to go deep and understand everything thoroughly. It is important to understand what and how it works, where the money comes from, and who these lucky people are who have learned to make money on the stock exchange. What do they think? How do they trade? How is money managed?

Well, for now we will analyze short and long positions and move on. At the same time, already understanding how to go long and short.

For financial markets, the formula for making a profit used in business is relevant - buy cheaper, sell more expensive.

Thus, it automatically gives trading status as a serious business!

In principle, we can end the article here and we can all go about our business, but we’ll figure it out.

1. How to increase your brokerage account from 50,000 to 100,000 rubles. Description in the VKontakte group

2. How to increase your brokerage account from 50,000 to 100,000 rubles. Description in the group In the telegram channel

The essence of short and long trading

Any participant interested in the stock market knows the simple scheme of trading relationships “buy low and sell high.”

To implement such a standard formula, several types of contracts and transactions are used. Some use shorting, while others use increasing bets. If you study the chart of any asset over a long period, you can see a trend: price increases occur slowly, in jumps and in steps. At the same time, it falls quickly, sometimes it takes hours or minutes. Therefore, upside contracts are designed for a long period, and downside contracts are designed for a short term.

To designate different types, the terms short and long are used, which in translation means short and long, respectively.

Experienced traders know what shorts and longs are on the exchange and how to manage them. The essence of short transactions is to increase profits by reducing the cost of stock exchange instruments, i.e. They use the market crash to make money. The purpose of long trades is to increase profits when prices rise.

To describe these terms in simple terms, shorting means first selling and then buying back when the price is lower, while receiving income. And to go long is to first buy, then wait until the price becomes higher, and then sell the asset.

Short commercial transactions, e.g. Short sales are sales of shares borrowed from a broker at interest. In practice, a trader takes a certain amount of securities or other trading instruments from a broker, sells them and waits for the price to fall. Then he buys the required amount and gives it to the broker along with his commission, and takes the rest for himself as profit.

When conducting short transactions, you need to take into account the exchange rate for previous periods, the liquidity of the asset itself and market behavior, the presence of a trend and a flat - a special time when the price stands in one place.

Market participants who operate in long-term periods use longs. If they believe that the price of securities will rise, they purchase them and then sell them at a higher price. Traders go long with their own money, purchasing an asset and then selling it, keeping the profit in the form of the difference.

What are bulls and bears on the stock exchange?

To make a profit, traders make transactions to sell and buy assets on the exchange. But there are a number of terms that are unique to trading.

Liquidity, long, short, futures trading on the Moscow Exchange are financial terms that are used in trading. Therefore, if you are looking to become a high-income investor, you should understand what exactly is happening on the stock market.

And, for this you need to master all the basic concepts that stock market participants use.

The trade terms discussed in this article come from English and are simply translated:

“Short” is short, and “long” is long.

When applied to stock trading, the term “short” takes on a slightly different meaning:

Indicates a short position (sell) that a trader enters on the exchange. He pursues the goal of making a profit from a fall in the stock price on the market. The transaction is often carried out on credit.

Again, I repeat that with a purchase everything is very similar to a regular purchase/sale from a trade.

What is its meaning?

Buy the product as cheaply as possible and sell it at a high price - the difference remains with you.

Selling is difficult to understand. Here the emphasis should be on the difference in price from sale to repurchase. This difference brings us profit if the price goes below the selling price.

And if the price goes above the selling price, then this is our loss.

They do the same thing: they make deals, focusing on the increase, i.e. long. And focusing on a decline in the asset, they begin to short.

And this is how participants in the securities market make money on the stock exchange!

Where did the terms bulls and bears come from?

Stock bulls are traders who buy securities in the hope that they will rise.

They assume that they bought low and will sell high. But what does the bull have to do with it? Yes, it’s just an association with a bull that has thrown its victim onto its horns and is throwing it up.

Bears on the stock exchange are traders who sell valuable assets, assuming that the price will go lower.

And they will be able to make money on the price difference. Why bears? Because the bear is considered a large animal, which pushes down prices on the market with a blow of one paw.

Definitions

To put it simply, you can make money from stocks in two ways:

- Buy and then sell at a higher price. Such operations are called long.

- Sell shares that the investor does not own. This is called shorting, or short selling.

Long in translation from English long means “long”, and short – short - “short”. These two terms came to us from the commodity market.

Let's look at the definitions.

Long, or long position , is an exchange transaction during which an investor buys an asset with the goal of selling it at a higher price. If, after opening a transaction, the asset begins to rise in price, the long becomes profitable; if the asset becomes cheaper, it becomes unprofitable.

Such operations are traditionally called bulling.

Most investors who buy securities for the long term can be called bull traders. Because they hope that their assets will increase in value in the future.

Traders also make money by going long, since it is not necessary to wait for asset growth for years.

Long example: Sberbank shares fell to 174 rubles per share in March 2022, but in August they rose to 242 rubles. As of April 29, 2022, one share of Sberbank already costs 295 rubles.

What is the essence: “short” or “long”?

Long is convenient for all traders - an easy profit scheme. But shorting means very often you need to sell assets taken from a broker at a high cost, wait for them to decline and buy them back again. Well, keep the profit for yourself.

With futures, of course, everything is simpler. There is no need to borrow. But that's another topic.

Of course, the broker is the party that will give these shares at interest. And if you transfer the stock overnight, you will already have to pay a commission to the broker. And in order not to lose your profit, you will need to close the deal with a profit. But this doesn't always happen!

I don’t know a single trader who would close all shorts with a profit.

In principle, such a trader does not exist.

If securities have reached a minimum value, then you can go long and purchase assets at a low price. After the purchase, the trader can only wait for the quotes to rise, and then sell the securities and receive income from the difference, using a simple profit-making scheme.

Short example:

The trader borrows 100 shares of the company from the broker at a price of 960 conventional units (cu) per share and sells them for 96,000 cu.

After some time, under the influence of external conditions, the value of the shares drops to 600 USD. a piece. A trader buys shares of that company on the stock exchange for 600 USD. (60,000 cu) and returns them to the broker. The difference between the courses was 360 USD. is the trader’s profit from one share. The total profit was 36,000 USD.

The term “long” refers to a trader opening a long position (buying). The trader calculated that the stock market expects stable growth in the future. He buys shares with the aim of selling them later at a higher price.

Long example:

A trader enters into an agreement with a broker to purchase 100 shares at a price of 60 USD (6000 USD). After some time, they show rapid growth. The trader believes that the shares have reached their peak and is selling them at a price of 126 USD. a piece. His profit will be 66 USD. from one share or total 6600 USD

It should be especially noted that these concepts are completely unrelated to the time of trading operations.

A “short” trade can last for weeks or months, while a “long” trade can close in one trading session or even a minute after opening.

How long trades occur

Everything is simple with them. A trader buys a certain financial instrument and waits until it rises in price. For example, if I bought dollars at 30 rubles and then sold them at 75, this would be a “long” transaction.

At first glance, it may seem that long trades are a gold mine. You just buy something and wait, wait, wait, so you can sell it later and make money.

In reality, everything is a little more complicated. If you buy a financial instrument on the exchange and do not sell it during the day, you will be charged commissions. For example, in the Forex currency market, swaps are charged for each “position transfer” from one day to another.

That is, it may turn out like this. You buy something, you will hold it for a very long time, the price will never increase. You will sell at the original price, but you will lose money on commissions.

What is a short position on the stock exchange?

Selling shares “short” is a rather complex algorithm of actions. You have no shares that you are going to sell. Therefore, shorting is suitable for experienced investors who know how to trade. For a beginner, it’s better to protect your own funds and trade from a long position.

What is the difference between long and short?

Yes, none! If you don’t imagine trading on the market, don’t have clear goals, don’t know what exactly you want from this type of activity, you will lose money everywhere. Whether long or short, you will lose money on both.

To open a short position, a trader needs to be able to:

- Select market

- Analyze possible price movements

- Calculate the risk of a given transaction

- Set profit goals

- Understand in what form the broker will give orders

- Etc.

But still, it is not recommended to open transactions of this type for a beginner in stocks.

The fact is that when opening a “short” position, the trader risks much more than with “long” positions.

If the stock price goes up, against the trader’s “short” position, there is a theoretically high risk that the borrowed shares will not be returned. A trader’s stock account may simply go to zero.

In practice, the broker will close a very unprofitable position at a price level at which there is already a risk that the trader will not be able to pay for borrowing these shares. This is called a margin call.

This is the advantage of long positions - there are always shares in hand, and the trader did not take out borrowed assets on the market. Shares can always be sold by waiting for the market to turn, even if it happens in a year.

Although you can’t do that either. But there will always be a newcomer trader who does not want to close a losing position and waits for the price to return to these prices.

How to open a long or short trade on Binance

It's easy to make money in futures trading, but it's also possible to lose everything. I do not recommend taking leverage greater than x10 of your balance.

A long trade is opened from a spot wallet in a standard interface. It does not require account verification. You just need to top up your account.

In this case, to short, you need to open futures (or margin) trading: verify your account and enable two-factor authentication. This is necessarily due to borrowing cryptocurrency from Binance.

How to take shorts

First you need to go through verification. To do this, go to Binance, hover your mouse over the profile icon and select “Verification” in the menu that opens:

How to Shor Cryptocurrency Using Binance: Registration

In the window that opens, click on the “Start” button:

First you need to go through basic verification. Multiple types of privacy

Now select the country and document you will upload. Click on “Continue”:

Confirm functions in this way when logging in and entering information

Take a photo of the document or scan the code to upload via the mobile app:

After uploading, your account will be approved within 24 hours.

If it is not possible to make out the data in the photograph, the application will be rejected.

After confirmation, go to the “Trading” section and select “Margin”:

Use in case of low quality earnings on stop loss for the year

A window will open with a link to video instructions on YouTube and a button to take the test. Without it, you will not be allowed to participate in margin trading. Go through it.

After that, click on the “Transfer” button:

It is located in the section with the choice of margin type.

A window will open in which you can transfer money between accounts. Select coin and amount:

How to work with coin volume in Binance futures

Then confirm the transaction.

The loan amount is tripled if there is money in the margin account. I advise you to read about the C98 token on Binance.

How to short cryptocurrency using Bitcoin as an example

Now, to borrow money, click on the “Borrow” button:

The English version has different names. See official support

It tells you how much you have already borrowed and how much you can still borrow. Below there are four bars for borrowing a percentage of the maximum amount:

We use a regular Bitcoin pair. Bidding on it is full and open all year

Now we use money to buy crypto at a high price:

How to Shor Bitcoin: Limit Tool

Then we wait for the moment of a sharp drawdown. My prediction: it will happen soon in the BTC/USDT pair. It's time to short to close the contract with a profit

Don't forget about the interest that accrues every hour. Calculate your strategy taking it into account.

How to open and trade long

Raise orders are created in the “Trading” section:

For beginners, I recommend using the classic interface. TradingView and deep analytics are disabled.

The page has a “Spot” section. It buys and sells cryptocurrencies for USD:

Crypto ratio: BTCUSDT

Enter the amount of crypto to buy and select the price at which the request will open.

After the purchase, expect growth. As soon as the currency rises significantly, sell.

Don’t get too carried away : if you miss the peak values, you will have to continue holding the asset.

Where does the broker source shares for clients' shorts?

We cannot always short a particular stock, because the broker may simply not have these shares. He would be glad to lend you money, but he doesn’t have any. The broker carefully monitors stocks for which short positions are available.

Each trader is provided with information about those shares that can be “shorted”. The broker can additionally specify account requirements.

The absence of some stocks for shorting is explained by their low liquidity, which makes potential “short” trading operations almost hopeless.

Blue chips are always available for shorting - shares of the largest companies with a large daily turnover.

The broker lends shares both from his own account and from the clients' accounts. That is, if there are shares or money in your account, the broker uses them in an overnight loan, and you receive your interest on an annual basis.

A broker borrows shares for his clients. For those clients who do not need them now or for other funds. Passed through Repo. There are even clauses about this in the agreement with the broker.

After all, large long-term investors can give their shares to a broker for a fee. But this is usually specified in the contract. You can also refuse this point. But this does not mean that you sold shares, and instantly someone found them and lent them to you, this is only the exchange transaction itself. And everything else is already delayed, but it’s definitely happening. And T+2 clearing makes it possible to make deliveries not on the day the short is made.

Conclusion:

The broker takes shares from his clients, or independently enters the repo market. In a repo, he acts as a borrower independently and receives shares from other stock market participants.

How does a short trade work?

The algorithm is mirrored in relation to the structure of the “long” trade, that is, it is built in reverse:

- A trader borrows shares from a broker when their value is high;

- Sells an asset and waits for the price to drop (Sell Short order);

- Buys back at a price less than the final sale;

- Returns shares that have fallen in price to the broker (Close Short order);

- He takes the difference into his account, minus the brokerage commission.

Essentially, the trader is selling securities that he does not have in stock. Therefore, such a transaction has another name - “short sale”. To prevent the trader from withdrawing funds from the sale of securities, they are blocked in the brokerage account until the borrowed shares are returned.

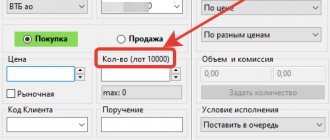

Technically, everything happens simply – a few clicks in the terminal. However, in order to make a profit on such an operation, the trader must predict the downward price movement, otherwise he will be at a loss. In addition to losses from an incorrectly taken position, the trader will also pay a commission for each day of using the borrowed asset, including weekends. There is no credit fee within one trading day, and the operation is sometimes carried out without rolling over an overnight short position.

If the broker can roll the position over to the next day, it will cost you money. The amount of the fee is calculated as a percentage per annum and is based on the current key rate. Often the profit from the difference in the purchase and sale price of a stock is comparable to the size of the commission. A standard turnover commission is added to these costs (depending on your tariff plan). That is, by being in a short position for too long, a trader risks giving the broker all the profit from the operation. It is for this reason that such positions are short, and they are closed as quickly as possible.

Example: you borrow shares of Rusal (RUAL) from your broker for 32 rubles. April 4, 2022, sell them and get real money into your account. After 10 days, you buy the same shares for 19.8 rubles. and give them to the broker. There is a difference left on the account, with which the intermediary will take a commission for 10 days of using credit shares (rate per annum/365*10).

I also recommend reading:

General Invest: analysis of reviews and independent review

Honest review of the General Invest broker

Now let’s take into account the nuances, without which the scheme of the “short” transaction will be incomplete. The broker gives a loan not only for a fee, but also with the security of the same shares, but in your portfolio. Let's say you have 10,000 Rusal shares, that is, your deposit is equal to 320,000 rubles. The broker gives a loan in the amount of 95% of the deposit - 9,500 shares for 304 thousand. You sell these virtual securities. You return the shares to the broker, the price of which on this day is already 188 thousand (198000 * 95%). The difference before commission deduction will be 116 thousand rubles. Of course, the ideal case is described here, at the maximum price amplitude.

In practice, things are more complicated. The difference in cost is rarely more than 10%, and the provided limit is not always fully used. In addition, the broker also has his own clearing limits on the exchange, beyond which he will not be able to provide the securities you need on credit. Then the position will not be transferred overnight, and the broker will be forced to close it or transfer it partially.

Another mandatory element of the transaction is stops, which the trader sets for himself in the terminal. They will work if the price, instead of falling, moves up and reaches the established percentages of the original. There is also always a margin call on the part of the broker, because he runs the risk of non-repayment of the loan. When the client’s own funds become less than the amount of debt, the broker first sends a request for additional collateral or cash. At the next set level, it forcibly closes the position (if the stop loss was not triggered before). This usually happens when the price goes against the position taken by more than a third. Then the broker himself buys back the growing shares you borrowed from the stock exchange and thereby covers his loss. Since your position is closed at this moment, you will not be able to do anything about your own losses. Margin calls are rarely used, only during periods of abnormally sharp and unpredictable movements in the market.

What stocks can be shorted on the Moscow Exchange

You can view the list of margin securities on your broker's website. This can usually be found in the “Margin Securities” section:

- Margin securities provided by the BCS broker

- Margin securities provided by Sberbank

- Margin securities provided by the broker Kit-Finance

We select a list of such securities for your risk level. Typically, ordinary private traders work with a standard level of risk.

Margin list on the website of the broker Kit-Finance. Other brokers are pretty much the same.

For a visual example, let's look at the list of margin securities from the BCS broker. That's 54 shares.

| broker | list of margin securities |

| BKS | PJSC MKB, United Company RUSAL PJSC IDGC of Center and Volga Region, PJSC Detsky Mir, PJSC AFK Sistema, PJSC Aeroflot, PJSC AK ALROSA, PJSC JSOC Bashneft, PJSC JSOC Bashneft , PJSC Severstal, PJSC Enel Russia, PJSC FGC UES X 5 RETAIL PJSC Gazprom, PJSC MMC Norilsk Nickel, PJSC RusHydro, PJSC INTER RAO UES, PJSC NK LUKOIL Lenta Ltd PJSC Lenenergo, PJSC LSR Group PJSC MMK PJSC Magnit, PJSC Moscow Exchange, PJSC Mosenergo, PJSC Mechel, PJSC Mobile TeleSystems, PJSC PJSC NOVATEK, PJSC OGK-2, PJSC PhosAgro, PJSC Polymetal International Raspadskaya Group, PJSC NK Rosneft, PJSC Rosseti, PJSC Rostelecom, PJSC Sberbank of Russia, PJSC Gazprom Neft, PJSC Surgutneftegaz, PJSC Tatneft, PJSC TGC-1, PJSC AK Transneft, PJSC Unipro, PJSC VTB Bank PLLC Yandex NV |

Broker Finam has 58 shares. Everything can be shortened without problems at any time.

Important! If you can't find a list of margin securities, ask your broker. They will tell you where to find it.

In general, you will always find a complete list of stocks available for short on the brokerage company’s website.

It should be noted that the list of margin instruments also includes depository receipts and bonds.

Extract from the list of margin instruments of the BCS broker

Examples of using short interest

There are several ways to use short interest. Traders interested in short squeezes need to find stocks that are seeing a significant increase in short interest or have a large number of days to cover. The stock should then "base" (in other words take a break) as it will likely be under a lot of selling pressure (though not always). Long trading can only be considered after the price starts to rise. This approach should use a tight stop loss to control risk, and trades should generally be viewed as short-term in nature, as there may be good reasons why investors are so bearish.

An investor who is long a stock may also want to monitor short interest. If short interest is rising, it could be a sign that investors are becoming more worried about the stock or the stock market in general. In either case, it alerts the investor to potential profit protection or exposure to some potential losses.

Some traders believe that extreme levels of short interest are a counter indicator. For example, extremely high short interest in a stock may indicate that investors have become too bearish and the price may actually turn higher.

Short and Dividend Gap

It is worth remembering such an interesting point as the dividend gap. It occurs after the registry is closed. The market reacts the next day by falling the share price exactly by the amount of dividends paid.

There is often a debate among traders about whether it is possible to make money on a dividend gap if you short before a stock declines in value. But to do this, you need to sell the paper before the cutoff, and this has nothing to do with the dividends themselves. This is an ordinary speculative transaction on such efficiency as a dividend gap, which always happens. And you can make money here.

But the short sellers will not be paid dividends. Dividends will be paid to those who bought shares before the cutoff or who have had them for a long time. It is not necessary to buy directly before the cutoff. You could have been long positionally with these shares for a long time.

In 2022, Sberbank paid record dividends of 16 rubles per share. And the last day when you could buy shares to receive dividends was June 10, 2022.

Let's see when this long could be closed so that these dividends would make sense. The closest point of closing a losing long is the closing of the gap in a few days.

It was possible to close a losing position at a comfortable price, albeit at a loss, understanding that perhaps from here the price would continue to fall further and it would be possible not to close the losing position for several months.

Many of the traders were able to close their unprofitable longs on Sberbank only in December 2022. But professional traders do not work with dividends this way; this outcome is more typical for beginners who have acquired knowledge of dividend gaps and want to make money easily.

To cover losses from such a long position, professionals can also short the futures for this stock. And thereby compensate for losses from the long position.

Now we can say that the dividend transaction turned out to be profitable.

After a stock gap, the futures will react neutrally. By the way, this condition is not observed in other trading situations. The normal state of a futures contract relative to a stock is contango. That is, futures quotes exceed the stock price.

Those traders who were able to buy these shares at one time much cheaper and, having already made a profit on growth, can immediately close their long position with a profit immediately after the cutoff, and even receive dividends. Cool situation!

Short and long in the cryptocurrency market

Cryptocurrency trading allows you to make a profit through speculative operations (short-term or long-term) on fluctuations in the prices of assets traded on the exchange. You can make money by buying a certain cryptocurrency and then selling it at an increased price. In addition, you can make a profit from a decrease in the price of cryptocurrency by opening a short trade.

The Buy and Hold strategy is the most successful and most common way to generate income during periods of rising cryptocurrency prices. By adhering to this strategy, traders have the opportunity to make money by increasing the price of financial instruments in any market: cryptocurrency, foreign exchange, stock, commodity.

The key features of this strategy are:

- The correct entry into a long position after a strong correction in the market.

- Holding an open transaction until the target is achieved, which is determined by technical analysis.

Is it possible to open longs and shorts at the same time?

From a technical point of view, a person can open “long” and “short” at the same time. For example, any trader can open a long position - purchase 50 shares of a company on the stock market. In addition, at the same time he can open a short position on another asset altogether.

But what's the end result?

Thus, with a competent approach, a trader can remain at zero. The long's losses are offset by the short's profits, and vice versa. But this doesn’t always happen, and especially not when you need it.))

True, such moves are used to cover risks: if there is a “short” on one market and a “long” on the other, the transactions will compensate for price risks.

This combination is also used by arbitrage traders. They buy an asset at a cheap price on one exchange and then sell it on another, thereby making a profit on the difference.

If a trader simply trades both stocks and futures and his trading strategy does not pursue the goals described above, then the following scenarios may occur:

- He can also offset the losses of one trade with the profits of another

- Receive losses both on the long side of one position and on the short side of another position

- Make a profit on both trades

- Receive colossal losses from these two transactions without calculating the risks of losses in advance.

Short and long in the Forex market

The terms Short and Long are most often used in the stock markets. In Forex, financial transactions are usually referred to as:

- purchase "Buy";

- “Sell” sale.

The designation of long positions “long” and short positions “short” are found on special platforms for communication between stock traders. Trading on the Forex market involves two actions: selling a currency pair or buying it.

Among stock traders, the sale of a financial instrument is called a short position (Short), and the purchase of a currency pair is called a long position (Long). However, these concepts have nothing to do with the duration of holding a position open. Buy or sell orders can be open for several minutes or several weeks.

How to short on the stock exchange?

In short, just like in long, the strategy and indicators that the trader uses are of great importance. Its goal is to find the optimal entry point into a position.

The subjective opinion that the price tends to be too high is not a reason to go short.

Many traders carefully study indicators that indicate stocks are overbought. Moving averages provide a specific signal to start studying a candlestick chart. Graphic analysis and search for formed figures, such as “head and shoulders”, gives more obvious signals.

Experienced traders advise entering a “short” trade only after cross-confirmation of signals that the stock price is ready to fall. In other words, many signals that coincide with the direction increase the chances of success.

How to write a business plan

The first thing you need to do before investing is to calculate the profits, risks and losses.

Profit from long

Calculate the profit from the contract using this formula:

(1/starting price – 1/ending price) * number of coins

In the formula, the difference in costs is multiplied by the number of tokens purchased. But this is a rough calculation. It does not take into account Binance's borrowing fees and withdrawal costs.

Income from short

For shorts there is a different formula:

(1 / closing cost - 1 / selling price) * (number of coins * -1)

Here we also find the difference in value between the two periods. Multiplying by minus one is necessary to take into account the fall: if in a long position we bet on an increase, then in a short position we bet on a decrease.

Expenses

It is impossible to calculate losses in advance. Enter the stock exchange only if you are ready to lose two-thirds of your capital.

Risk factor

To correctly assess the risk of a deposit, you need to be able to analyze the market. As a rule, to do this you need to conclude 50 transactions.

If you are a beginner, then study the forecasts of experts. For example, RBC produces a news digest every week. I also published an article in which I talked about new tokens.

Unrealized PNL

PNL is the difference between profit and loss.

To calculate the P&L for a long, use the formula:

(Marking price - purchase price) * amount of currency

Marking price is the exact contract price. Binance calculates it using algorithms to make it more objective. It is written to the right of the current price.

Screenshot of the mode with indicators, signals and listings

For a short, another algorithm:

(Purchase rate - marking cost) * number of tokens

P/L determines trading efficiency. Use it after every trade to measure success.